Words: 1,853 Time: 7 Minutes

- Investors not overly impressed with tech earnings

- Are stocks losing their mojo?

- Just how much hinges on Magnificent Seven earnings?

Another month is now in the stock trader’s almanack.

October – synonymous for delivering market jolts – passed with barely a whimper.

However, it was the market’s first negative month since April.

Are stocks losing their mojo?

I will try and answer that question with a look at the long-term chart.

But first, large cap tech earnings from five of the ‘Mag 7’ were less than magnificent.

Meta, Apple and Microsoft all dropped post earnings.

Google managed a small 5% rise initially – but gave it all back. Amazon managed hold gains of ~3%

More on the specifics (and concerns) shortly…

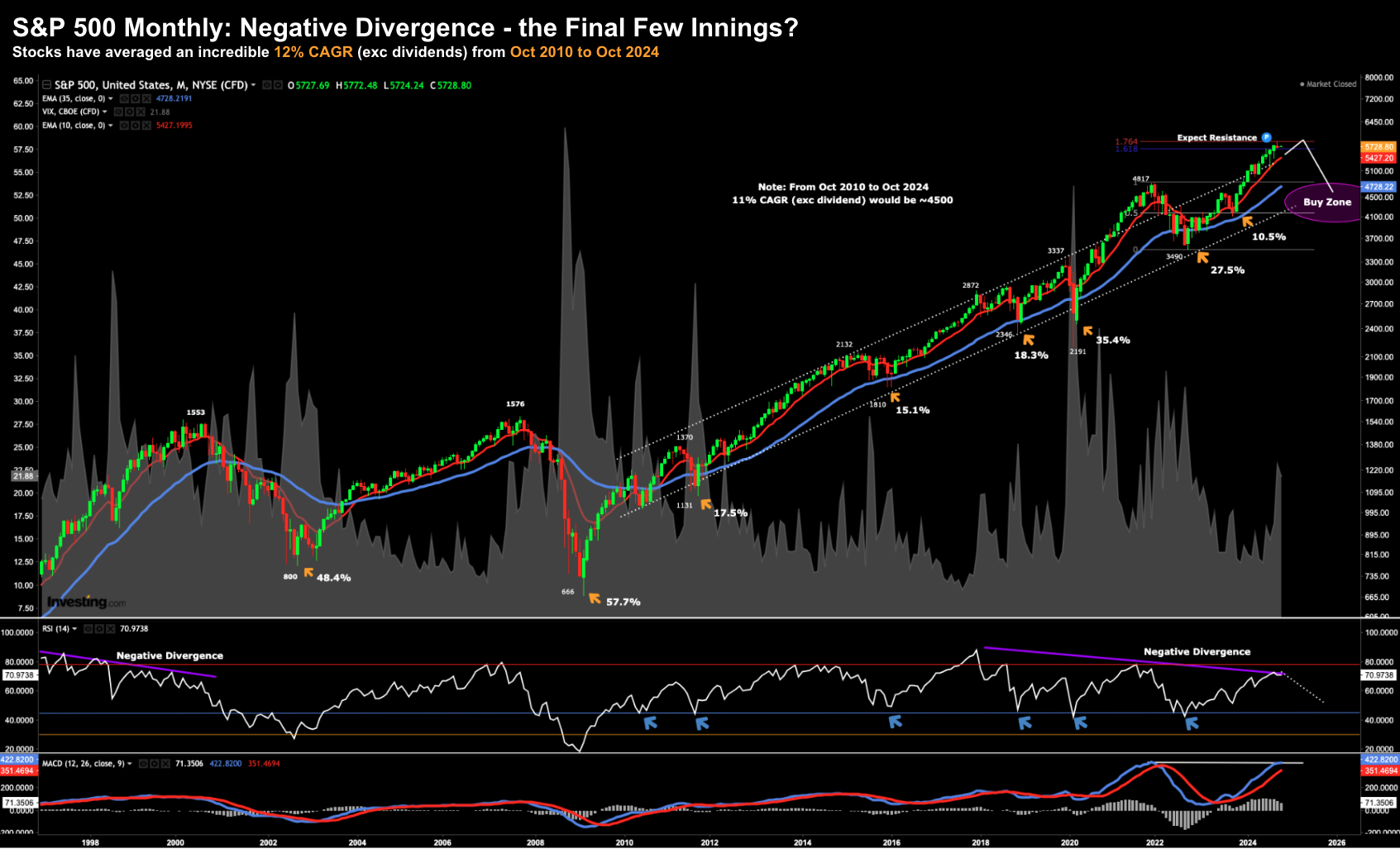

At the conclusion of each month – I review the S&P using this timeframe.

A monthly chart gives us much needed perspective – generally lost when using a much shorter (volatile) weekly chart.

Let’s take a look…

🔭 S&P 500 Monthly Chart

The chart below highlights the incredible bull run from the depths of the 2008 crisis.

From October 2010 through to October this year – the S&P 500 has averaged a CAGR of ~12% (exclusive of dividends).

To put 12% into perspective – the long-term average CAGR for the S&P 500 (exc dividends) is ~8.0%.

However, if we assume dividends average ~2.5% – that puts the total return to ~10.5% per year

Nov 1 2024

That said, despite the strong bullish run (and wild enthusiasm for AI) – there are some troubling signs.

And whilst the market could easily rise the next few months (above 6,000) – below are four things I’m watching:

- Negative Divergence w/RSI and MACD. The middle and lower windows show these two momentum indicators are not making new highs in parallel with the price action. We saw something very similar in the lead up to the crash of 2000/01. And if we look back at previous market declines – you will find something similar

- Trading Well Above the Trend Channel. Using a dotted white line – I’ve sketched in a clear trend channel for the market from late 2009. It has typically faced resistance at the upper band; and support on the lower brand. Note – the 35-month EMA (blue) serves a similar purpose. At the time of writing, we’re trading well outside this band on the upside – which suggests we are extended. We saw something similar in 2021 (where I de-risked positions in Q4)

- Shrinking Candles. The size of the monthly candles are getting smaller. This suggests the bulls are starting to show signs of exhaustion. October was the first red candle since April of this year. Note – this overlaps with the failing momentum indicators

- Fibonacci Distribution. My final technical observation is the Fibonacci retracement to the 61.8% to 76.8% zone outside the peak to trough pullback of 2022. I use these retracement areas to indicate areas of possible support and resistance.

So where to?

Well forecasting is a fool’s errand.

At the risk of looking very foolish, my best guess is we test the area of 4400 to 4800 (highlighted by the “buy zone”).

4800 would represent a pullback of ~16%. A sharper pull back to 4400 would represent 23%

But with respect to when – my best guess is within the next 12-18 months.

However, I also believe it’s unlikely in the near term (e.g., next 6 months)

It’s possible… but less likely.

As an aside, note we’ve seen six double digit pullbacks since 2011 – ranging between 10.5% to 35% (COVID)

Therefore, a pullback between 16% to 23% is not unreasonable (and a buying opportunity for the longer-term)

👀 The Less than Magnificent Earnings

This week was a litmus test for the S&P 500.

With the Mag 7 comprising ~35% of the S&P 500 – their earnings (and forward guidance) – plays an outsized role with respect to the market’s momentum.

Can the market rally without the Mag 7?

Yes…

However, should the Mag 7 stumble in any meaningful way, it’s unlikely we see new highs.

Microsoft, Meta, Alphabet (Google), and Amazon are navigating the challenges of realizing value from their almost $1 Trillion in capex opposite artificial intelligence (AI).

Since OpenAI’s ChatGPT sparked intense interest in AI, we’re witnessing what can only be described as an “arms race” to unlock new revenue streams and boost productivity.

However, those bets are not without risk….

For example, as the latest quarterly earnings reports reveal, we’ve seen mixed results.

And based on the price action post July – investor patience with large-scale AI spending is starting to wane.

First, let’s consider Microsoft (MSFT):

- Revenue grew 16% in its fiscal first quarter, faster than analysts had anticipated.

- Revenue from Azure and other cloud services was up 33%, surpassing estimates.

- However, guidance for revenue growth fell short of expectations

As I said last week – Q3 was never the concern. That bar was going to be cleared.

However, it’s the guidance which matters more.

Why?

Investors have very high (short-term) expectations from these investments.

With respect to MSFT – investors are looking for acceleration with their ‘CoPilot‘ service at $30 p/mth per user (enabled via OpenAI).

However, its OpenAI investment is yet to yield significant financial returns.

Yes, there are signs of “product market fit” (as the tech industry describes it) – but the runs are not yet on the board.

The other notable point was the decline in Azure cloud revenue contrasted with Alphabet’s more optimistic cloud growth forecast.

Based on the growth numbers – it looks as though Google Cloud took 3% market share from Microsoft.

Again, from CNBC:

- Alphabet reported blowout cloud revenue at $11.35 billion, up nearly 35% from the $8.41 billion a year ago.

- Alphabet’s total revenue grew 15% year over year

- Google’s Search business generated $49.4 billion in revenue – up 12.3% from a year ago

It was a solid result which initially pleased the market – the stock rising ~5% – however the gains were short lived.

Moving to Meta – it faced market backlash after reporting continued losses in its AI division.

- Meta reported weaker-than-expected user numbers in its third-quarter earnings report on Wednesday.

- The company reported 3.29 billion daily active people for the third quarter, which is up 5% year over year but came in below analysts’ expectations of 3.31 billion.

- Meta’s advertising revenue grew 18.7% year over year

- The company said it expects capital expenditures to continue to grow significantly in 2025.

And finally we had Apple and Amazon….

Amazon posted a strong result as it continues to scale its high margin advertising business with greater than expected growth in cloud services (AWS).

- Amazon Web Services revenue is growing faster than the same period last year.

- Sales grew 19% during the quarter compared to a year ago when sales accelerated by 12%.

- Advertising sales expanded 19% year over year to $14.3 billion during the quarter, outpacing growth in Amazon’s core retail business

- Among online ad companies, Amazon showed the strongest growth, although its ad business still remains a fraction the size of Meta and Google

With respect to Apple – sales were mostly inline – however posted a sharp miss with its high margin services division (the justification for its 32x multiple):

- iPhone sales rose (and total sales) rose by 6% for the quarter (inline with expectations)

- Services grew 12% on an annual basis to ~$25 billion (well below the 16% growth expected)

- Full year total revenue rose about 2% to $391.04 billion

What also disappointed investors was Apple advising that they expect “low to mid-single digit” sales growth during the December quarter.

No “Apple Intelligence” sales bump anytime soon…

The good news is Apple are not spending vast amounts of AI capex like their peers.

Instead, Apple has negotiated a deal with OpenAI – where they get the AI tech in exchange for distribution (e.g. OpenAI on more than 2B iPhones)

I think that’s a sensible decision until they start to see what use-cases can be effectively monetized (and where there might be strong product-market-fit)

The company’s cash pile now stands at $156.65 billion.

🤑 Show Me the Money!

Put together, these mixed outcomes have led investors to scrutinize earnings from stronger signs of tangible AI-driven productivity improvements.

But from mine, what these earnings stories suggest are the cost and product-market-fit challenges large-cap tech face with scaling AI operations.

For example, serving GenAI results from say “ChatGPT” or “Gemini” etc comes at a large cost (a loss in Meta’s case)

For investors, the emphasis is on whether these companies can quickly pivot to show returns on AI investments.

As it stands today, they are getting a “hall pass” but that tolerance will wane without strong measurable results over the next few quarters.

AJ Bell’s Russ Mould told Bloomberg that the trajectory of AI growth is more like a marathon than a sprint.

And I agree with that…

The advent of the internet was much the same way. We saw enormous amounts of investment through the late 90’s and early 2000s.

However, scalable and profitable business models would not emerge for almost ten years.

This will be similar.

During the mid-90s – we could see the potential for the internet was enormous. But that was not the debate…

AI is no different – its potential remains significant and will transform (and accelerate) human ingenuity.

However, investors are impatient.

They will want reassurance that funds are being allocated wisely and that returns will materialize sooner rather than later.

We can see this opposite the high valuations being placed on the tech sector.

Apple, Amazon and Microsoft all trade with forward multiples above 32x… which is ~30% higher than the 5-year average.

But let’s use another measure…

If we simply take the price-to-sales ratios – they remain historically elevated.

For example, Nvidia (yet to report) trades at more than 34x its sales revenue; and 56x its book value.

That said, it’s PEG Ratio at the expected 5-year growth rate is only 1.03x (not high)

💥 What Matters for Investors

So far we’ve received earnings from ~70% of the S&P 500 companies.

Here’s Factset (Nov 1):

- S&P 500 is continuing to report mixed results.

- On a YoY basis, the index is reporting earnings growth for the fifth-straight quarter.

- Of the 70% who have reported – 75% have reported actual EPS above estimates, which is below the 5-year average of 77%

- Companies are reporting earnings that are 4.6% above estimates, which is below the 5-year average of 8.5% and below the 10-year average of 6.8%.

UBS are projecting a 4.7% revenue growth and a 5.9% increase in earnings per share (EPS) for the quarter.

Good but not great.

Companies exceeding expectations on Q3 and revising their guidance higher have received positive market responses, outpacing the historical norm.

With respect to the Mag 7 – FactSet believe they’ll report an aggregate earnings growth of 18.1% YoY – dwarfing the 0.1% growth the other 493 companies

On that basis, momentum in the Index will depend a lot on these “magnificent” seven.

Tomorrow I will be back with a look at Real PCE and what the quarterly trend tells us.