- Market continues to trade at a rich premium

- Two valuation methods which suggest investors exercise caution

- But there are areas of the market which are not expensive

Markets are enjoying a much better 2023 than 2022.

Last year, the S&P 500 lost around 19%.

So far this year the Index is up ~14.5%

We still have a long way to re-capture the highs – however we are more than 20% off the lows.

New bull market?

But it begs the question – do you join the rally now or wait?

I will share some thoughts shortly.

First some general comments…

Always Have Some Exposure

My approach is to always have some exposure to the market.

And whether it was 2000, 2008 and 2020 – I had long exposure.

So far this year I’m up around 11.5%

But what I know to be true is over the long-run – the market rallies more often than not (see this post)

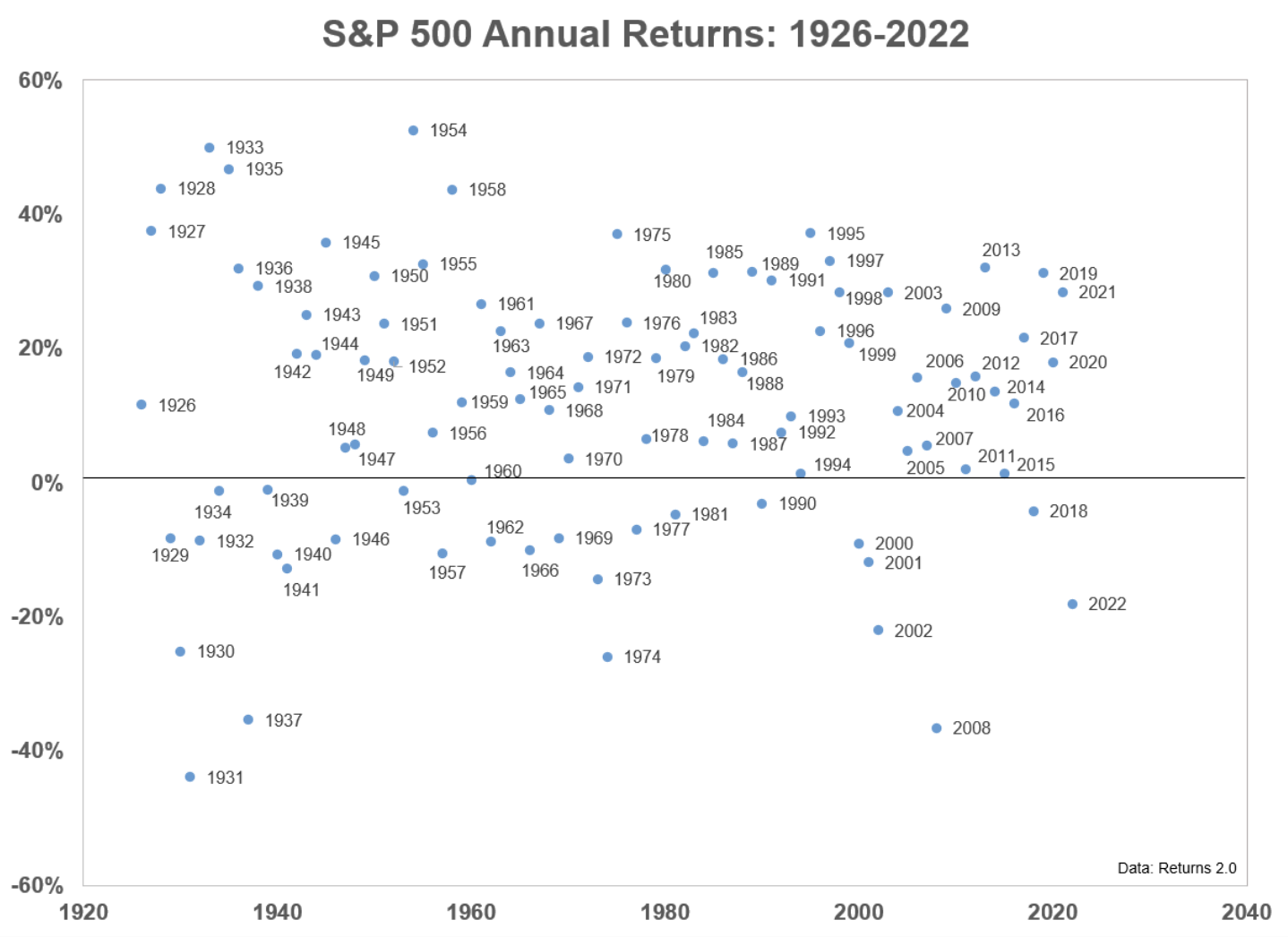

I referenced a great chart from Ben Carlson’s blog – ‘A Wealth of Common Sense’

The frequency of annual returns above 0% meaningfully outweigh negative years.

That’s why the long-term chart is “up and to the right”

June 29 2023

- It removes the excess noise we get from weekly (or daily) charts;

- It shows how markets will often pull back in the realm of 20%+ (6 times in 14 years) but recover; and

- Why time in the market pays dividends.

Is the monthly chart a useful “timing” tool?

Potentially yes.

As a rough rule of thumb – if you see prices within 1% of the 35-month EMA (blue-line) – consider adding to positions.

It’s not fool-proof by any means – but over time this method has worked well.

At the time of writing, the S&P 500 trades at 4396 which is ~11.6% above the 35-month EMA.

Therefore, if we see the market correct ~10% – consider adding to quality positions (or the Index) and revisit your performance in a few years.

Could we see 10% Lower?

Recently I shared this post which suggested ~8% downside is possible in the next couple of months.

Here I was citing the price extension to the 35-week (not monthly) EMA.

In other words, for those who are actively trading with a very short timeframe (always hard to do successfully) we might see a pullback.

But that argument was made from a technical lens…

The other side of the coin is what we see fundamentally.

Those with a longer-term horizon probably don’t care too much about squiggly lines on a chart (which I understand) – but they care a lot about valuations.

Personally, I like to carefully assess both.

Fundamentally I think the market is expensive given what we see with multiples, interest rates and risk free yields.

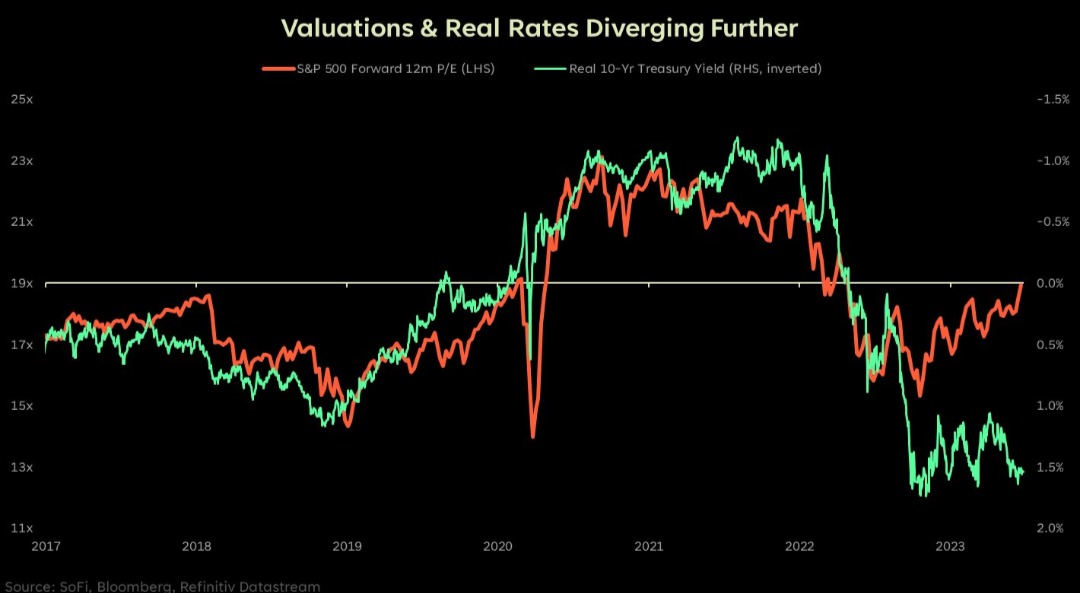

First a chart offered from Liz Young at SoFi:

June 29 2023

This chart shows how much valuations have risen this year (or what I’ve been calling multiple expansion)

Quoting Liz Young:

Valuations have risen over the last 6-9 months (red), while inflation-adjusted (real) interest rates stayed elevated at 1-1.5% (green, inverted). Higher rates typically decrease the present value of future cash flows & decrease valuations. Relationship is out of whack, watching for mean reversion in one or both.

Could not agree more…

On this basis – things are now diverging (or “out-of-whack”)

That’s one fundamental measure…

Another popular metric to assess is the risk premium investors are being asked to pay to own stocks.

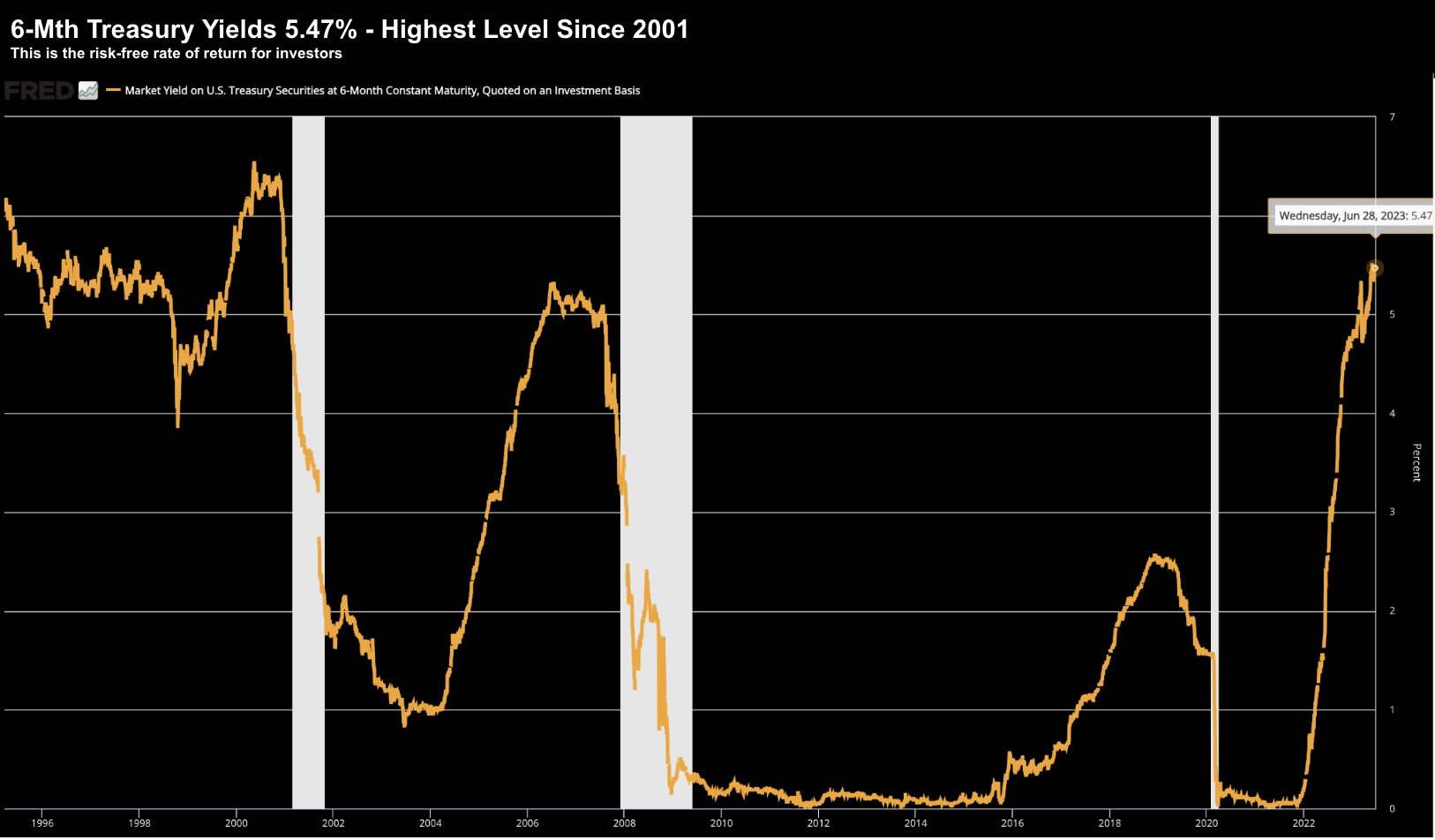

To start, consider what we see with (risk free) 6-month US treasury yield. They are trading ~5.47%

June 29 2023

A popular valuation check is to compare the risk free rate (5.47%) to the earnings yields of stocks.

Three steps to do this:

- You need to have a gauge of where you think earnings will be for 2023. My view is in the realm of $210 earnings per share (EPS). However current market consensus of $220 EPS.

2. With the S&P 500 trading at 4396 that gives us a forward PE of 20x (i.e., 4396 / 220 = 19.9x). Now if you think earnings will be lower (e.g. $210) – the implied forward PE is higher (4396 / 210 = 21x)

3. To convert the forward PE to an earnings yield – we simply take the inverse of the PE. That is, 1/19.9 = 5.0%

This allows us to compare this to the risk free rate of return (e.g., 5.47%)

Ideally stocks pay a higher rate of return – which compensates the investors higher level of risk being taken.

However, what we find is the opposite.

But it potentially gets worse….

If you are of the view we are unlikely to avoid a recession – it implies $220 is optimistic.

A recession will likely result in earnings contraction (e.g., $210 per share)

That would imply a PE of 21x – where the earnings yield falls to 4.8%

That’s almost 100 basis points less than the risk free rate!

As an aside, I noticed Liz Young’s chart assumes a forward PE of 19x (i.e., SoFi assume 2023 earnings of $230 per share – higher than consensus)

Whatever your assumption for earnings (e.g. $210 to $230) – valuations are rich.

But there is a caveat…

Where it Gets Interesting…

In aggregate, the market looks expensive.

Typically we will lump all stocks together and say the S&P 500 trades at “20x forward earnings”

But as we know, there are fewer than 10 stocks which have driven up the multiple.

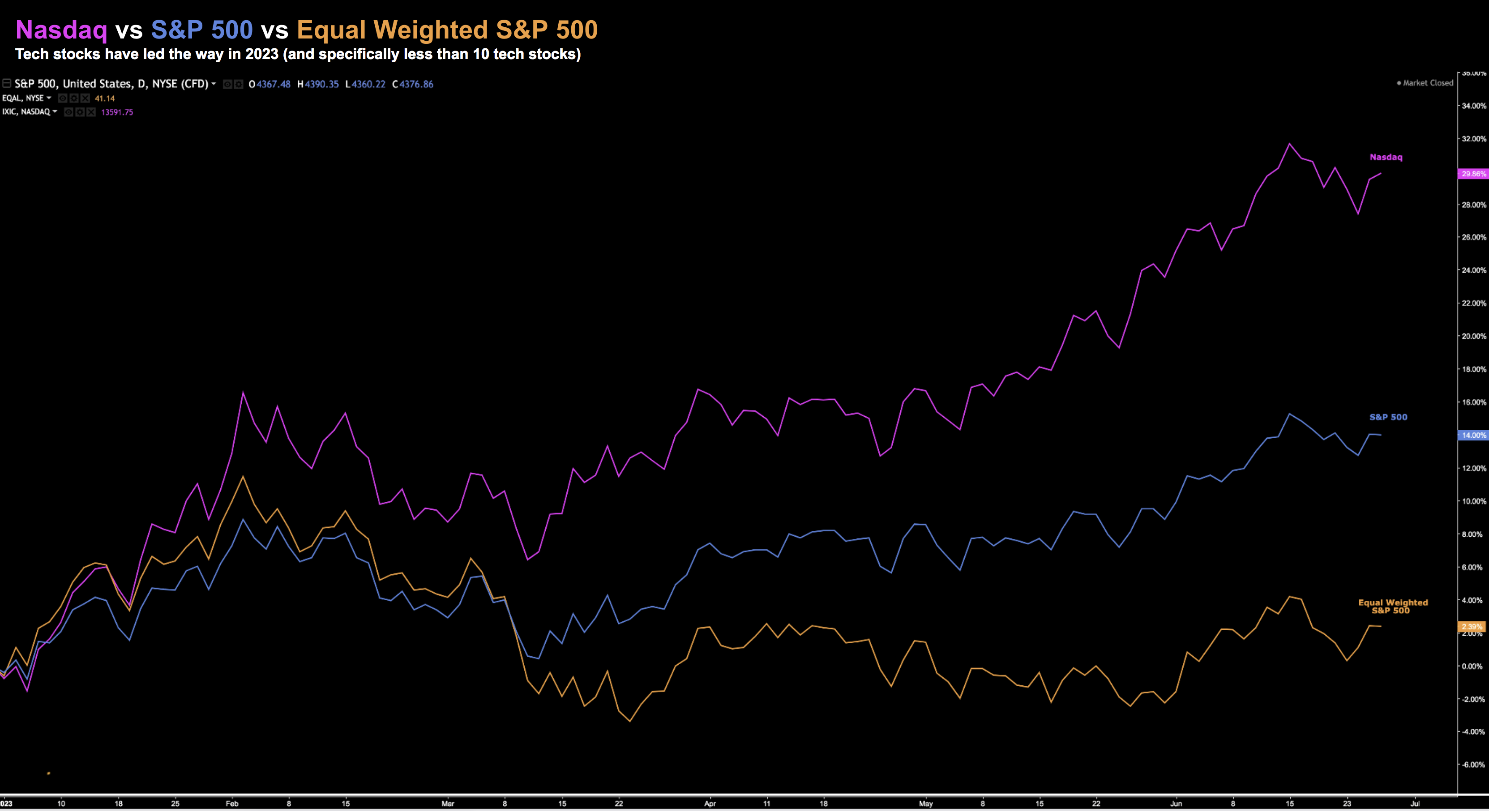

To demonstrate this very narrow concentration – I’ve shared this chart:

June 29 2023

The purple lines shows the incredible outperformance of the Nasdaq vs the S&P 500 (and the equal weighted S&P)

With respect to the latter – if all stocks had the same weight in the Index – the market is barely positive.

But as we know, 5 stocks comprise about 25% of the total market (eg Apple, Microsoft, Google, Amazon, Meta)

Apple alone is almost $3 Trillion

Now below are the forward earnings multiples for each of these tech heavyweights:

- Apple (29x)

- Microsoft (31x)

- Google (23x)

- Amazon (74x)

- NVIDIA (55x)

- Tesla (75x)

- Netflix (38x)

- Meta (24x)

If you were to remove these 8 names from the Index – the forward PE for the S&P 500 would be closer to 16x

If we invert 16x – we get a earnings yield of 6.25%

That’s attractive.

Another way of saying this is:

- Large cap tech is now very expensive opposite its earnings; however

- Defensive, cyclical names are more attractively priced.

And this is why I have paired my exposure to large cap tech (now only 20% of my portfolio) and increased my exposure to banks and energy (for example)

Is my timing right?

Clearly not.

Not in the short-term!

Tech has continued to run higher after I reduced my exposure (what I expected)

What’s more, banks and energy are about flat since I bought them.

But my timeframe on these trades is not the next “3 weeks or 3 months”… it’s 3+ years.

Here’s something else I know:

- When I sell (or trim) a position – it’s never the top. That position will almost always run higher after I take profits; and

- When I buy (or add) a position – it’s never the bottom. That position will always go lower after I buy.

True to my prediction – this happened when I reduced my tech exposure and when I added energy and banks.

I know I will never pick tops or bottoms (and that’s fine)

I am not that talented.

But what I can tell you is I never buy at the top; and nor will I sell at the bottom.

Putting it All Together

Getting the precise timing on buying and selling stocks is very hard to do consistently well.

For example, you need to nail it twice:

- First, timing the optimum sale of the asset; and

- Second, the timing of your re-entry

And of course you then need to consider any potential tax implications pending how long you held the asset.

For example, anything less than 12 months is a much higher tax rate.

Put together – it’s tricky.

But what we can do is ensure we try and tilt the odds in our favour over the long run.

That’s how I do it…

For me, this means identifying when the long-term risk reward is in your favour.

For example, when I look at risk premiums we’re being asked to pay for (some) equities – it’s not attractive.

What’s more, the tape looks stretched.

Now if yields were closer to 1% and not 5.5% – yes – I could make the case to buy stocks at a forward PE of 20x.

But interest rates change everything…

Finally, Jay Powell told us again today that they are likely to hike at least twice more this year.

Therefore, if you use a risk-free rate of closer to 6.0% (which would not be surprising to be given CorePCE is close to 5%), the risk reward looks worse again!

For now, I will sit tight with my 65% long exposure and bide my time.

And if that means the S&P 500 outperforms my portfolio by “5-8%” or so in the near-term – that’s fine.

However, my guess is I will be rewarded (again) for exercising patience.