- Incredible long-term buying opportunity is coming

- Powell says “unconditional” commitment to squashing inflation

- Good signs we’re getting closer to ‘the’ bottom…

Chalk up another week of heavy selling for most major indices.

Investor fear remains high as the market tries to handicap such things as (not limited to):

- 8.6% year-on-year CPI;

- Increased likelihood of a recession / lower growth;

- Lower earnings for Q2/Q3;

- Pace of Fed rate hikes and QT; and

- The ongoing war in Ukraine (w/possible oil and food shortages)

A combination of the above saw the S&P 500 give up ~12% in just two weeks.

11 of the past 12 weeks have seen declines.

That’s not something you see too often… and the polar opposite of ‘easy gains’ the past two years.

For example, since 1949, the average bear market typically lasts around 193 days.

We are now 7 days past that average…

Now with the S&P 500 down 23.7% from its 4817 high – it’s worth asking:

- where is the bottom for stocks for 2022; and

- what zone(s) represent strong long-term risk/reward?

To be clear, this post isn’t for anyone looking to make money in the next few weeks or months.

That’s not how I work.

Markets are likely to swing as much as 20% in either direction.

You will need the “hands of surgeon” to precisely time these moves (which I don’t have). And I also don’t pretend to guess where the exact bottom will be… but I don’t think that’s critical.

However, if you’re a patient investor looking to make double-digit annual returns over the next 3+ years – then I bring welcomed news.

S&P 500 – Closer to ‘the’ Bottom

24% is a lot for the market to give up in just 6 months.

But it may not be all…

The good news is I think we’re closer to working towards a 2022 bottom. For example, if you consider that since WWII:

- the average bear market without a recession bottomed at ~24%; and

- in the event of a recession – the average decline is ~26% (according to Bloomberg)

But there is divided opinion on whether we see a recession at all; and if we do – how ‘deep’ it will be?

For what it’s worth – I think we will see a recession in 2023.

Now in favour of a “light” recession – unemployment levels are very low (below 4%); consumers sit on over $2 Trillion in savings; and corporate balance sheets remain strong.

That said, sharply higher interest rates (combined with sustained 6%+ inflation) is going to punish consumers (particularly low-to-middle income earners).

That’s likely to materially slow economic growth (where 70% of GDP is consumer spend).

Unfortunately, those who were coaxed into higher levels of debt (due to artificially low rates) are going to feel it most. Chairman Powell warned investors about taking on mortgage debt just this week.

Irrespective, the S&P 500 has now priced in a lot of the possible recession risks given the declines.

That said, I don’t think we are at the bottom just yet (neither technically or fundamentally).

Let’s start with the technicals using the weekly chart…

As I will explain, I believe we’re setting up for a great long-term buying opportunity – where CAGRs (Compound Annual Growth Rates) will likely exceed 12% over the next 3+ years (exceeding the long-term S&P 500 average of ~10.1%)

June 17 2022

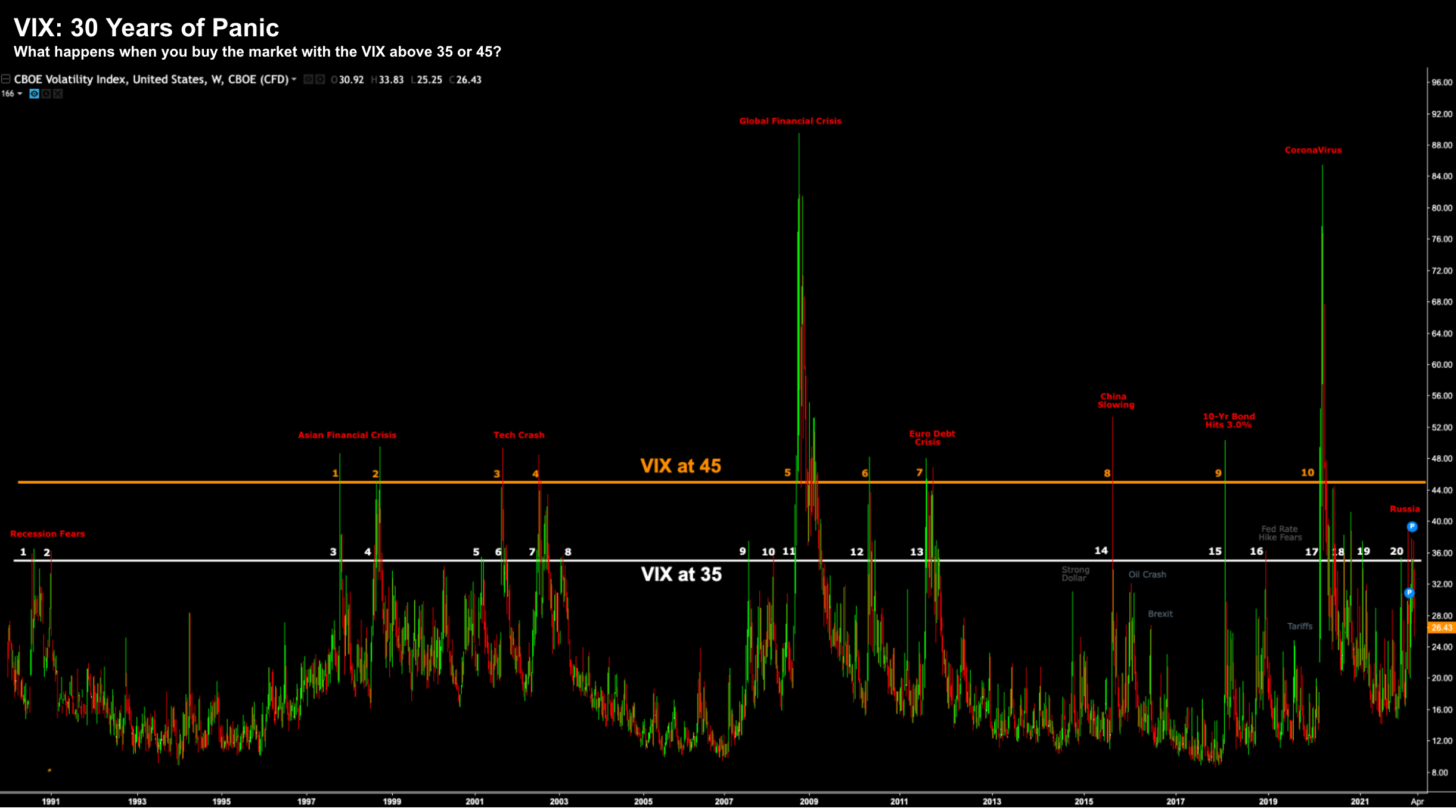

The first thing to highlight is what we saw the VIX or “fear index”

It hit a level of 35 this week… something we have not seen all year.

To digress – in March I share this point: “Why It Makes Sense to Buy at Peak Fear”

I annotated a long-term chart for the VIX where it traded above 35 and 45:

Repeating a portion of what I shared:

There have been 21 times when the VIX traded above 35 (this week being the 22nd)

If you bought the Index at this level of fear – the median 3-year CAGR is 10.3% exclusive of 2-3% average dividend

Now the VIX at 35 is more representative of the type of selling I’ve been patiently waiting for.

For example, Apple traded down to ~$130 this week.

Great news (even though I’m long the stock from $138)!

I say this because Apple is representative of stocks which are last to be sold.

Similar to the VIX at 35 – it’s what we need to see before we can consider calling for signs of a market bottom.

For example, the first group of stocks to be sold are typically “Cathie Wood” names (e.g., excessive high multiple / low-to-no earnings). On the other hand, investors are generally reluctant to let go of the highest quality companies.

In summary, don’t be surprised to see another 7-10% bear-market bounce soon (e.g. as shorts look to cover to lock in profits).

But as is the case with bear-markets – look for that strength to be sold.

From there (and as we learn more about H2 earnings guidance (e.g., Adobe guided lower today) – we are likely to make another leg lower.

Which sets us up for a terrific long-term (rare) buying opportunity.

This is how I am approaching it…

S&P 500: Two Zone(s) to Target

Assuming you maintained a healthy cash position this year – I want to nominate two zones to start thinking about increasing your exposure:

- 3500 to 3700; and

- Around 3200

#1. 3500 to 3700

With the S&P 500 in this zone – investors should consider adding to (or establishing) Index and/or quality positions (e.g., Apple, Google, Microsoft, Amazon, Adobe, Ely Lilly, Target etc).

To be clear, this is not a zone to go all-in – but it is an area where you can start increasing your exposure.

Two thoughts here:

- 3500 to 3700 could prove a good risk/reward over the next 3 years (CAGRs 12%+); and

- I don’t pretend to know where the ‘ultimate’ 2022 bottom is.

And that’s the thing…

Given we can’t possibly know how low this market goes… it’s prudent to start adding to your long-term positions here.

However, you should have the expectation that the market is likely to move lower.

Which brings me to the second (high conviction) zone…

#2. 3200

This level represents a peak-to-decline of 34% (which exceeds average recessionary declines)

To be clear, there is every chance we go even lower (e.g. 3,000).

And that’s more than fine…

We are not investing with the expectation to be profitable within “12 months”.

For mine, the potential upside reward from the zone of ~3200 over the next 3+ years far exceeds any additional drawdowns (e.g. a fall to 3,000 or ~6.3%).

Should we see the S&P trading at this level – I will be buying with strong conviction – where I think CAGRs could exceed 15%.

For example, let’s assume you buy at 3200 and the market regains the level 4817 in 3 years.

That’s a CAGR of 14.61% (exc. ~2% dividends)

And if you bought some stock around 3500 (assuming a return to 4817 in 3 years) — that’s a CAGR of 11.2% plus dividends

In both cases, CAGRs of 11.2% and 14.6% exceed the 70-year total return average of 10.1% for the S&P 500

For example in 1950 the S&P 500 traded for just 16.6

At 3674 in 2022 – that represents a CAGR of 7.8% plus 2-3% dividends over 70 years.

Below are these two buying zones up-close:

June 17 2022

Bear markets often paralyze investors with outright fear…

And “24% declines” in 6 months can be hard to swallow.

However, there are others who realize the longer-term opportunity (assuming you’re positioned to take full advantage)

My personal portfolio has not been without pain in 2022… down ~8%.

But that’s to be expected – especially following a number of consecutive years with double-digit returns.

As I like to say – nothing rises or falls in a straight line.

So far this year I’ve done three key things:

- Focused my holdings on the highest quality stocks;

- Maintained a healthy cash position (currently 35%); and

- Writing covered call options over existing holdings (improving my total returns).

But with the S&P 500 now approaching a level of 3500 – I’m sharpening my blade.

That is, I will soon begin reducing my 35% cash position…

And should we see something in the realm of 3200 – I will be ‘gorging’ on risk assets.

Putting it All Together…

In closing, the biggest risks to the market will be what we see from the Fed (and interest rates)

Today, Federal Reserve officials rolled out more hawkish rhetoric when describing their approach to curbing inflation.

They promised Congress a full-fledged effort to restore price stability.

Put another way, sharply lower risk assets (such as stocks and houses) will be the intended consequence.

The Fed has every intent here of materially lowering the wealth-effect. Their goal with monetary policy is to see far less money (not more) chasing fewer goods. And that’s how inflation comes down.

Here’s Powell to Congress:

“The Committee’s commitment to restoring price stability — which is necessary for sustaining a strong labor market — is unconditional”

Unconditional means the Fed is not about to step in with “QE” or “interest rate cuts” should we see stock or house prices decline 30%+

That’s what we’ve seen with the recessions of 1994, 2000, 2008 and the 2020 pandemic.

It’s called the “Fed Put”.

Not this time.

On none of those occasions did we have crippling inflation levels of 8%+ YoY.

The Fed has run out of time in terms of being reactive to inflationary risks.

They now need a proactive (aggressive) stance.

This marks Powell’s strongest signal yet… they are on a war-path to restore credibility and reign in unwanted inflation.

The good news is this will present (patient) cashed-up investors a “once-in-a-decade” buying opportunity.

For example, I think the Fed are ‘happy’ to see stocks give back the “excesses” of the past 4+ years (opposite artificially low-rates and QE)

This will be a rare opportunity where you stand to reap as much as 12%-15%+ total CAGRs for decades to come (if you have the means and the resolve).

Buying is always hardest when no-one else wants to.