- Did the market just issue a new near-term warning?

- Fed officials continue their hawkish rhetoric

- Earnings are subpar – however analysts price 10%+ growth in Q4

Too much too fast?

I think so.

Market participants have been extremely optimistic to start 2023…. sending stocks almost 7% higher in just 30 days.

And whilst things have improved in some areas… we are still not yet out of the woods.

For example, further to my most recent missive, I said there was a key technical signal I was watching.

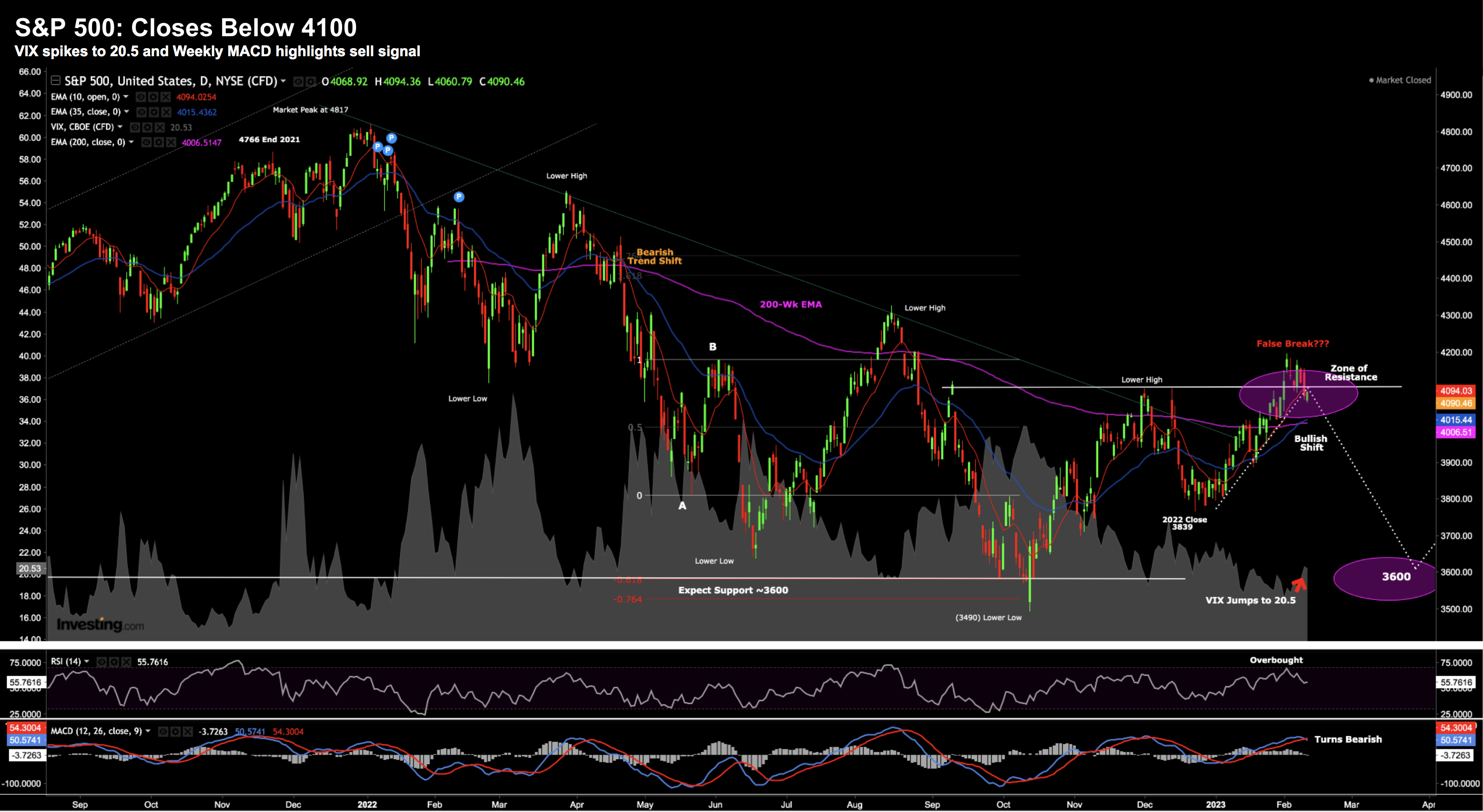

And that signal was a ‘false break’ of the previous (4100) high.

For those less familiar, this is a technical formation where stocks first break through a previous area of resistance (or established high) — however then fail to hold that level and reverse.

Put another way, the breakout higher was likely a head fake.

And that’s what we are wrestling with after this week.

So was the 7% January the real deal? Or yet another bear market rally?

Let’s take a look…

Proceed with Caution

It was a sluggish week for major indices… failing to maintain the momentum we saw in January.

And it makes sense…

Earnings and guidance continue to disappoint – bond yields continue to rise – and central banks continue to warn of further tightening.

Put together, stocks remain under some pressure:

Feb 10 2023

Before I offer the near-term bear case… there are some bullish signs.

And in that sense, tactical (short-term) trading is very tricky business (and why I mostly avoid it)

Let me re-cap the bullish (technical) case:

We have both the short-term and longer-term moving averages suggest higher prices.

For example, the 10-week EMA (red) trading above the 35-week EMA (blue). In addition, we find the 35-week EMA trading above the 200-week EMA (pink).

Trend followers can easily argue for higher prices.

What’s more, we made a new interim ‘higher high’ – exceeding the 4100 level made December last year.

And finally, when markets post a strong January, they generally have a positive year.

There are all valid reasons to maintain a bullish stance.

However, what makes things difficult is we can just as easily outline reasons for near-term downside:

- The false break of the previous high warns of a move lower. The S&P 500 needs to trade well above 4100 and hold it there for several weeks. So far, it has not been able to do this.

2. The weekly MACD (lower window) warns of downside pressure – suggesting momentum has stalled; and

3. The VIX has jumped back above 20. Ideally we needed to see this stay below 17 for a lengthy period.

So what to make of it?

My feeling is we push lower in the near-term.

That said, I am not even considering selling my long positions.

My strategy in this market has been to sell out-of-the-money covered calls on existing long positions.

This strategy effectively helps me offset some of the downside.

And the reason I’m comfortable selling covered calls is I consider some of the stocks I own expensive with the market trading around 4200.

For example, I think stocks like Apple (25x) and Microsoft (28x) are overpriced.

Meta has also crept into what I consider ‘expensive’ territory when it traded above $190.

Therefore, if we are to trade meaningfully higher from here (e.g. 15%) – I will be “called away” at multiples where I would be happy selling!

Speaking of excessive multiples… let’s check in with earnings.

Subpar Earnings Season

If you want to stay up-to-date with company earnings (and relevant trends) – I highly recommend subscribing to Factset’s free (earnings) newsletter.

Here’s the opening paragraph from this week’s update:

The performance of S&P 500 companies during the Q4 earnings season continues to be subpar.

Although the percentage of S&P 500 companies reporting positive earnings surprises declined over the past week, the magnitude of these earnings surprises increased during this time.

However, both metrics are below their 5-year and 10-year averages. As a result, the earnings decline for the fourth quarter is smaller today compared to the end of last week, but still larger today compared to the end of the quarter….

… If -4.9% is the actual decline for the quarter, it will mark the first time the index has reported a year-over-year decrease in earnings since Q3 2020 (-5.7%).

… Four of the 11 sectors are reporting year-over-year earnings growth, led by the Energy and Industrials sectors.

… On the other hand, seven sectors are reporting a year-over-year decline in earnings, led by the Communication Services, Materials, and Consumer Discretionary sectors.

In terms of revenue growth:

If 4.6% is the actual growth rate for the quarter, it will mark the lowest revenue growth rate reported by the index since Q4 2020 (3.2%).

Eight sectors are reporting year-over-year growth in revenues, led by the Energy, Consumer Discretionary, and Industrials sectors. Three sectors are reporting a year-over-year decline in revenues, led by the Utilities sector.

And finally, looking ahead:

Analysts expect earnings declines for the first half of 2023, but earnings growth for the second half of 2023.

For Q1 2023 and Q2 2023, analysts are projecting earnings declines of -5.1% and -3.3%, respectively.

For Q3 2023 and Q4 2023, analysts are projecting earnings growth of 3.4% and 10.1%, respectively.

For all of CY 2023, analysts predict earnings growth of 2.5%.

The forward 12-month P/E ratio is 18.0, which is below the 5-year average (18.5) but above the 10-year average (17.2).

- The market is assuming 10.1% earnings growth in Q4 2023;

- It also assumes full year earnings growth of 2.5%; and

- A forward PE ratio of 18.0 based on these assumptions

My underlying thesis is we will encounter a recession later in 2023 (or early 2024) as a result of the Fed over-tightening.

And whilst this could be wrong – if I am correct – it will see earnings contract (not expand); implying a far higher multiple than 18x.

Anything greater than an 18x multiple with rates above 4.0% is excessive.

One final point to consider:

The stock market has never bottomed before a recession has begun.

Choosing Not to Fight the Fed

My thesis for a full-year earnings contraction in 2023 may prove incorrect.

And much of that will depend on what we see with employment and the consumer.

For example, today the economic data is holding up.

And despite US consumers blowing right through their savings – they’re more than willing to leverage their credit cards.

Never underestimate the American consumer’s desire to keep spending (even if they don’t have the money!)

What’s more, January’s blowout job number took everyone by surprise – including the Fed.

But does this work in the market’s favor (and its assumptions) or against (as it pertains to the outlook for rates)?

For example, consider the following hawkish sentiments from Fed officials this week:

- New York Fed President John Williams said they’ll need to get to a “sufficiently restrictive” stance and “maintain that for a few years to make sure we get inflation to 2%”

- Governor Lisa Cook: “We are not done yet with raising interest rates, and we will need to keep interest rates sufficiently restrictive”

- Governor Christopher Waller: “It might be a long fight, with interest rates higher for longer than some are currently expecting”

- Richmond President Thomas Barkin said the Fed needs to “stay the course” in its inflation fight

- Minneapolis President Neel Kashkari said the key rate still needs to go to “around 5.4%” from about 4.6% now

- Atlanta President Raphael Bostic said if a stronger-than-expected economy persists, “it’ll probably mean we have to do a little more work”

Bond markets seem to be paying some attention (as I shared yesterday) – with the 2-year yield moving above 4.50%

What’s more, the US 10-year moved back above 3.70%… pressuring growth stocks which were rallying on the promise of lower rates.

I’ve long maintained the Fed will get to at least 5.00% and hold rates there for sometime (e.g. at least through 2023)

Remember – there are three phases to the rate cycle:

- Rate increases;

- Rates pausing; and

- Rates being cut

We’re still working through the first phase (along with meaningful quantitative tightening – which some underestimate)

And we have not even started to pause!

Despite this, some market participants are acting as though we can already start assuming rate cuts.

Why? What’s the basis?

Goods prices falling?

I think that’s premature to make these assumptions… especially when you consider what we see with employment and wage inflation.

We are still early in this fight.

Putting it All Together

Markets have made a flying start to 2023.

And look, I am not unhappy with the ~6% gains YTD in my portfolio.

But I expect those gains to slip in the coming weeks…

To me, it feels like the market is overly optimistic on three things:

- Core service sector inflation rapidly declining (i.e., large falls in wages and rents);

- We will successfully avoid a recession in 2023; and

- Earnings will expand on last year (implying easier monetary conditions and a strong consumer)

Are these lazy assumptions?

They might be.

They are certainly possible but are they probable?

Not from my lens.

Based on what I’ve read – there is little evidence of services (core) inflation falling rapidly (especially wages and rents).

And the only reasonable disinflation we see is in goods and commodities.

Good.

But not great from the Fed’s lens.

That said, oil appears to be rallying again (as Russia cuts further supply).

With respect to a recession – leading financial indicators suggest this is unavoidable.

I talked to the depth of the inversion on 2/10’s only yesterday.

That’s not sustainable.

In closing, if we are to experience a recession (even if it’s ‘soft’) – earnings will most likely contract.

This implies the current forward PE of ~18x is likely ‘one or two turns’ higher (i.e. the “E” in PE needs to come down).

And if rates are remain around 4.0% – 18x plus isn’t attractive.

My best guess is we head lower in the near-term.

For what it’s worth, I’m still not willing to rule out a re-test of the 3600 lows at some point in 2023 (which now feels contrarian)