- My two strongest investing criteria for 2023

- VIX warns of investor complacency

- Wage inflation up 5.1% YoY – but lock in 50 bps for Dec

There are just 19 trading days left for 2022…

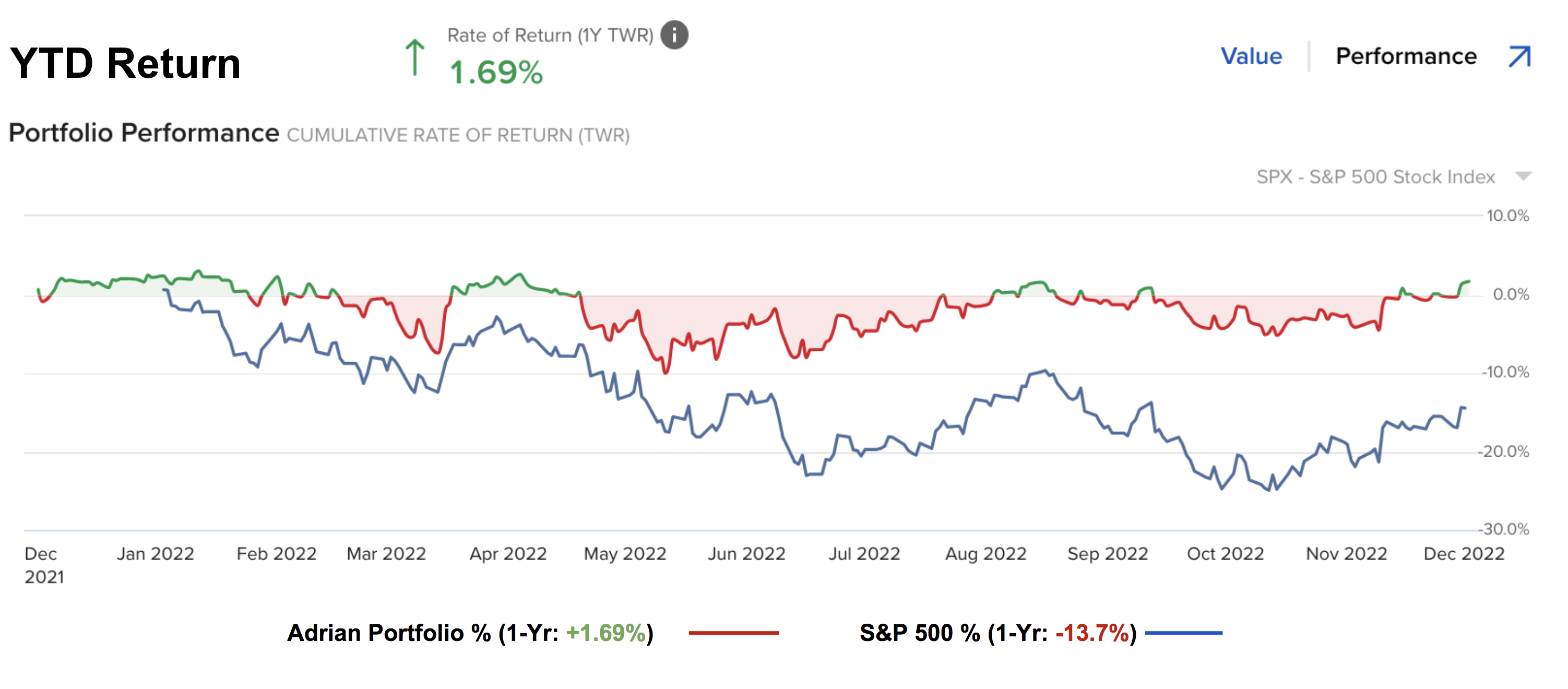

How has your portfolio performed?

For most, it’s been a very challenging environment.

For me personally, probably the toughest since 2008, with my portfolio basically flat.

I’m a chance to finish the year ‘in the green’… which I’ll happily take.

For example, this year we’ve had to navigate:

- 35%+ decline in quality growth stocks (the worst since 2001);

- Almost 400 bps rise in interest rates (highest since 2006);

- Highest inflation in 40 years; and

- Mounting geopolitical risks in Europe and China.

It doesn’t get much more difficult.

All going well, I believe 2023 will be ‘somewhat’ easier to navigate…

But fear not – it will still offer its share of challenges.

For example, companies are not off the hook when it comes to growing revenue and profits. Unemployment is set to sharply rise and house prices will plunge.

To that end, I’m going to offer my best advice for filtering stocks next year (and it’s not overly complex)

Before I get to the charts – major indices have been mostly flat the past few weeks.

This has also resulted in the VIX dropping below 20 – which tells me investors are complacent.

My warning lights are flashing red.

I don’t mind the sideways chop… as I don’t get caught up in short-term tactical moves.

I leave that to day traders.

Stocks spend as much as ‘80%’ of their time grinding (and why most short-term traders lose money)

~20% of the time stocks will trend.

And over the past 100-years — 67% most of the time that trend is up.

With that, today I will:

- Share my thoughts on the latest monthly employment data;

- Review the S&P 500 weekly chart (and the warning signs); and

- Offer two (strong) recommendations for selecting stocks next year.

Fed’s Problem is w/Wage Inflation

This week we learned nonfarm payrolls increased 263,000 for the previous month while the unemployment rate was 3.7%.

That’s a strong result – no two ways about it.

However, perhaps one ‘pleasing’ bit of news was that total hours worked fell.

I use the word ‘pleasing’ because fewer hours worked reduces inflationary pressure (i.e., less money in people’s pockets to drive prices higher).

On the flip side, the Fed will not be happy with average hourly earnings jumping 0.6% for the month – which was double the estimate.

Wages were up 5.1% annually versus the 4.6% expectation.

That gives the Fed a green light to keep rates higher for longer. For example, only this week Jay Powell reminded us:

“To be clear, strong wage growth is a good thing. But for wage growth to be sustainable, it needs to be consistent with 2 percent inflation. That will require reducing demand for labor by slowing the economy”

5.1% is a long way from 2.0%

And whilst the employment data and wage growth was strong – it won’t change the Fed’s decision to increase 50 bps on Dec 14th.

That is locked in — irrespective of the CPI print we get on Dec 13th.

The Fed told us as much.

Remember:

If things continue to heat up (or simply remain stubbornly high around 5% wage growth) – they have the option of raising 50 again in January.

But for anyone who thinks the Fed will perform a v-shaped pivot (from rate hikes to rate cuts) next year… that’s premature.

S&P 500 – VIX Warns of Complacency

From mine, I think there’s a portion of people who feel the Fed will embark on rate cuts next year.

Maybe they will be right?

I don’t know.

And whilst these things are impossible for forecast (as they depend on a host of real-time data) – this is what’s driving the market higher.

They see a more dovish Fed over the next few months…

This week, I observed the VIX plunge to just 19.1

In short, it means traders are feeling very confident that very little can go wrong the next few months.

I think it’s exactly the opposite!

For example, the last time the VIX was this low was the all-time market high of 4817 at the start of the year.

Dec 2 2022

Yes, we are likely to see some seasonal strength into the year’s last 19 days.

That’s normal.

For example, I’ve mentioned I am looking for something in the realm of 3-4% (but not much more than that)

But as I look towards the first half of next year… how confident can investors be with respect to (and not limited to):

- Whether the Fed will be in a position to cut rates in the second half of 2023?

- The full extent / impact of the Fed’s hikes on real economy (i.e. is the worst really behind us)? and

- The negative impact on company revenues, margins and earnings?

For example, with respect to the second point, I don’t think we have seen a ‘big’ impact on the economy so far?

GDP is muddling along and we still have full employment (with very strong wage growth)

In turn, consumers are still purchasing (online spend for Black Friday was a new record!) – despite record amounts of inflation.

However, once we start to see things like:

- 5%+ unemployment;

- Wages only rising 2% YoY (not above 5%)

- GDP turning sharply negative; and

- House prices plunge 20%+

… when we start to see some of these metrics are approaching (especially employment) – it would fair to argue the “long and variable” impacts of the Fed’s policy are taking hold.

Fed Will Not Repeat their 2018 Mistake

The other discussion point I raise is whether you believe the Fed will be cutting (not just pausing) rates next year?

Obviously the answer will depend on the data (specifically employment, wages and inflation).

But I don’t believe the Fed will be too quick to repeat their 2018 mistake:

Dec 01 2022

For those less familiar, at the time the Fed were attempting to normalize rates whilst reducing their balance sheet.

The market threw a tantrum… stocks dropped 20% in the last quarter… and the Fed folded like a wet tram ticket.

Stocks rallied.

Not long after the pandemic struck (March 2020) and they were forced to prop up liquidity.

Fast forward to the start of 2022 – some 20 months after the pandemic began – the Fed maintained emergency level (zero) rates with QE.

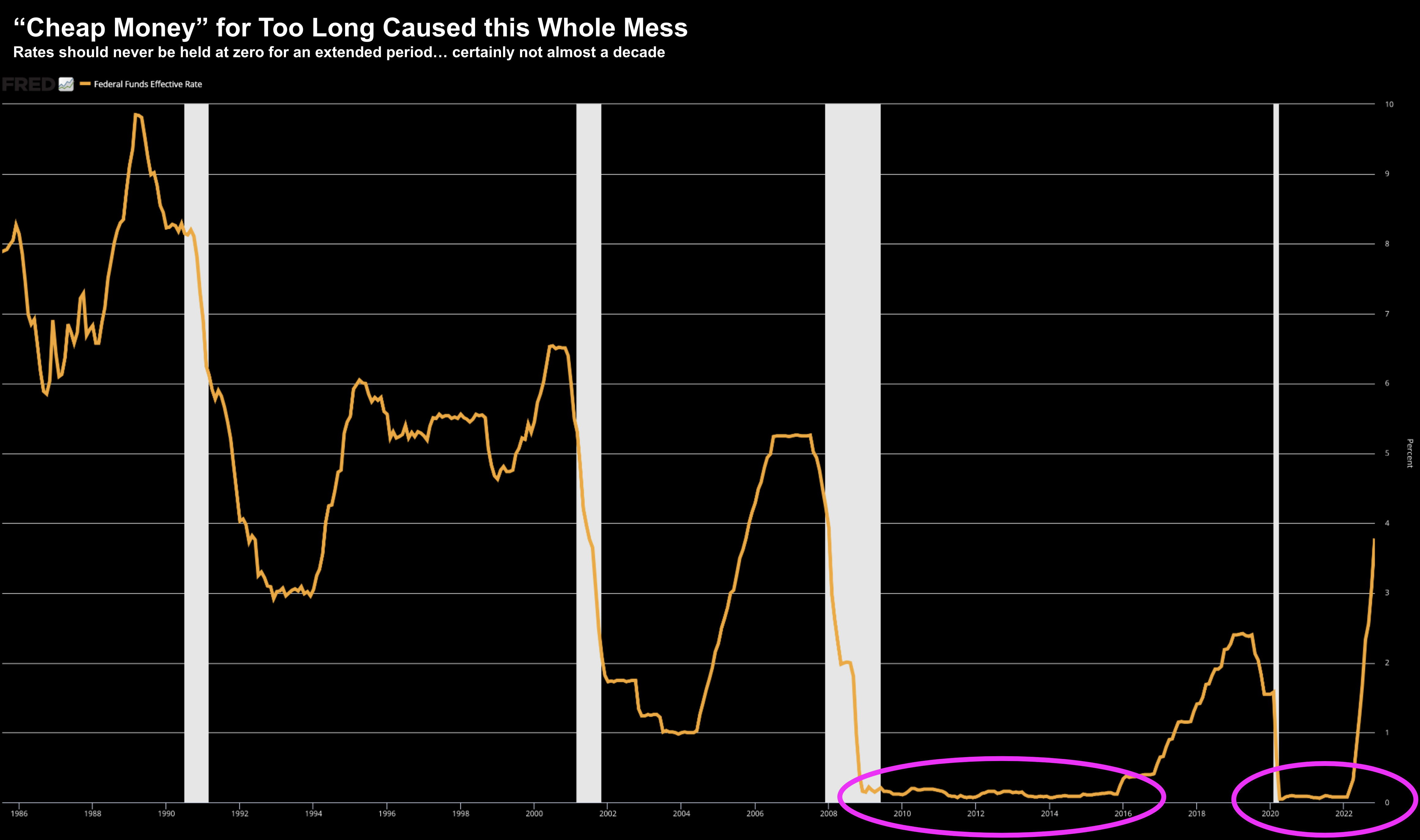

From mine, this will go down as one of the greatest financial errors in history (along with reckless government spending)

But more importantly, it won’t be a mistake the Fed will be keen to repeat.

If you want to know why we have an inflation problem – look no further than (a) zero interest policy; and (b) excessive money supply.

Inflation is nothing more than excess money chasing too few goods.

Central banks were the enablers… and government took full advantage.

But let me tell you, the days of rampant speculation are over.

What may have worked for you the past decade, will not work the next decade.

The Fed will be in no rush to repeat their mistake.

The ‘Rules’ Have Now Changed

2022 will go down as a year not to lose too much money.

And this is the case whenever central banks adopt a tightening policy.

If your portfolio is down “less than 5%” — well done — you are almost 10% better than the S&P 500.

That’s no mean feat to beat the index by double digits!

My thinking is 2023 will be a year we can be a little more aggressive…

But it will require just as much rigor and discipline.

What’s more, it will require us to “fish where the fish are”

Put it this way:

For the most part (excluding 2022) – investing has been like shooting fish in a barrel.

Any idiot was able to post double-digit returns year after year (e.g. Cathie Wood) – especially with rates and zero and money printing on tap.

But the key was not to give those back this year!

Poor old Cathie gave back over 70% of her gains.

That’s bad execution (and she’s not alone)

In 2023 I would like you to think about where you fish…. as the model for investing has fundamentally changed.

The reason:

Interest rates are going to remain a lot higher for longer.

And they could remain well above 3% for years….

Now to help make my point (and frame this missive) — take a look at this 14-year chart (as it tells an important story):

Dec 1 2022

This shows the performance of the XLK (tech sector ETF) vs the S&P 500 (orange)

If you were investing in tech the past decade (as I did) – you have had a decent ~10+ years.

Long duration assets (like tech) – with strong revenue growth – works extremely well when rates are anchored at zero.

What’s more, they command a high earnings multiple (typically north of 20x).

However, over the past two years or so, some investors chased tech stocks on the basis:

- rates would stay at zero in perpetuity; and

- were willing to pay any multiple for revenue growth

From 2020, the XLK ETF went vertical – as the Fed slashed rates and handed out in excess of $4 Trillion incremental dollars.

But in the last quarter of 2021… they told us “the bar tab” was closed.

Cue the exits!

Poor old Cathie Wood and her followers never got the memo.

Here’s the thing:

Every 100 basis points rise we find with the US 10-year yield – this results in multiples dropping by ~20% (approx)

Valuations were crushed… as they are very much tied to yields.

That’s how assets are priced.

As the denominator went higher (i.e., rates) – their cash flows (and future valuations) were discounted.

No longer was only revenue growth enough… investors were seeking:

- balance sheet strength;

- positive (growing) cash flow; and ideally

- profits.

Where to “Fish” in 2023?

One argument I have heard recently is “xyz stock is now 70% off its highs… it’s cheap”

My response: why do you think it’s cheap?

People making that argument are implying that its previous value was fairly priced.

Newsflash:

The valuations of “90%” of all tech stocks in Q4 2021 were bullshit.

They should never have been that high…. artificially higher due to monetary policy and rampant greed.

Here’s something else:

Many of these companies never (a) turned a profit; and/or (b) were able to generate consistent positive free cash flow.

Investors bought them only based on revenue growth (and perhaps the promise of profits in years to come).

To some degree (although I wasn’t buying it!) – it made sense opposite a zero cost of capital.

But not now… that ship has long sailed.

With the Fed funds rate likely to be north of 4.75% next year… the market effectively bifurcated.

What we have is two categories of stocks:

- Those with positive free cash flow growth; and/or profits; and

- Those who don’t (i.e. cash furnaces)

For example, those that fall into the latter (e.g., Twilio, Roku, Robinhood, Peloton – and it’s a very long list) – are going to find it tough sledding.

Don’t be too surprised if they come begging for more capital.

The first thing I want you to do for 2023 is get rid of negative free cash flow stocks.

I don’t care if they are saying they will get to positive free cash flow later… doesn’t matter.

Shoot first. Ask questions later.

Sell them. Don’t look back. Admit you made a mistake. Move on.

Remember this basic rule:

You don’t have to recover losses from the stocks you previously held.

You would be surprised at how many people don’t subscribe to this simple philosophy.

The second rule I want you to do for next year is strictly invest in companies producing strong positive free cash flows (and ideally profits).

They are more likely to catch a bid.

For example, assuming you are looking for exposure to tech, you might consider names like:

- Mega-cap tech like Google (GOOG), Microsoft (MSFT), Apple (AAPL) and Amazon (AMZN); and for higher-growth

- Crowdstrike (CRWD), Snowflake (SNOW) and Palo Alto Networks (PANW).

The latter command very high multiples (given their 50%+ growth rates) – but have strong free cash flows.

They are businesses which are working.

And in terms of the large caps… their multiples are now lower… but still remain on the high-side.

I think they have further to fall (as Q4 earnings and forward guidance will likely disappoint)

But if you can buy these names around 18x to 20x forward multiple – it’s a good risk/reward bet for the longer-term (e.g. 3+ years).

Both their earnings and earnings multiples will continue to expand.

As an aside, Meta at 13x forward PE might be worth a small (e.g. ~2% of your portfolio) bet.

The social media company has applied some (long overdue) capex discipline to its “Metacurse” business; and appears to be focused on:

- monetizing Reels (it’s TikTok short-form video competitor); and

- what it can do with WhatsApp.

WithWith ~3B active monthly users (n.b., gladly I’m not one) – it has the potential to turn the sinking ship around.

Putting it All Together

I consider the past decade an age of excess.

A torrent of unprecedented free money (from central banks) resulted in rampant speculation.

But speculation was not only from investors (specifically tech and housing) — it was also from tech companies themselves.

There was a complete lack of capex discipline… and many became “overweight”.

What’s more, the market sent a clear message to every CEO.

Get your companies back in shape.

Get fit.

Some have received the message (e.g., Meta)

Now it takes courage to find the right balance between (a) growth; and (b) profitability.

But I can tell you the market is going to reward profitability during a time of 4%+ interest rates.

Put another way – you are not going to be rewarded for revenue growth at the expense of cash burn.

In closing, when you consider buying a stock in 2023, ask yourself two questions:

- what’s their free cash flow (as a function of their market cap)? and

- do they generate a profit?

If the answer is yes… then what multiple is the market asking?

As a very rough rule of thumb – be careful if that forward multiple is greater than 30x (they would want to have exceptionally high revenue growth)

If can do that – it will help you to sort some of the ‘wheat from the chaff’

Too many investors chased a lot of chaff this year… most of them severely burnt… caught holding a bag of rubbish.

Don’t repeat this mistake in 2023.

The rules have changed.

What worked well the last decade (with zero rates) – won’t work as well the next decade.