- One plausible reasons stocks are ripping higher

- S&P 500 now at 21.7x forward earnings… not a bargain

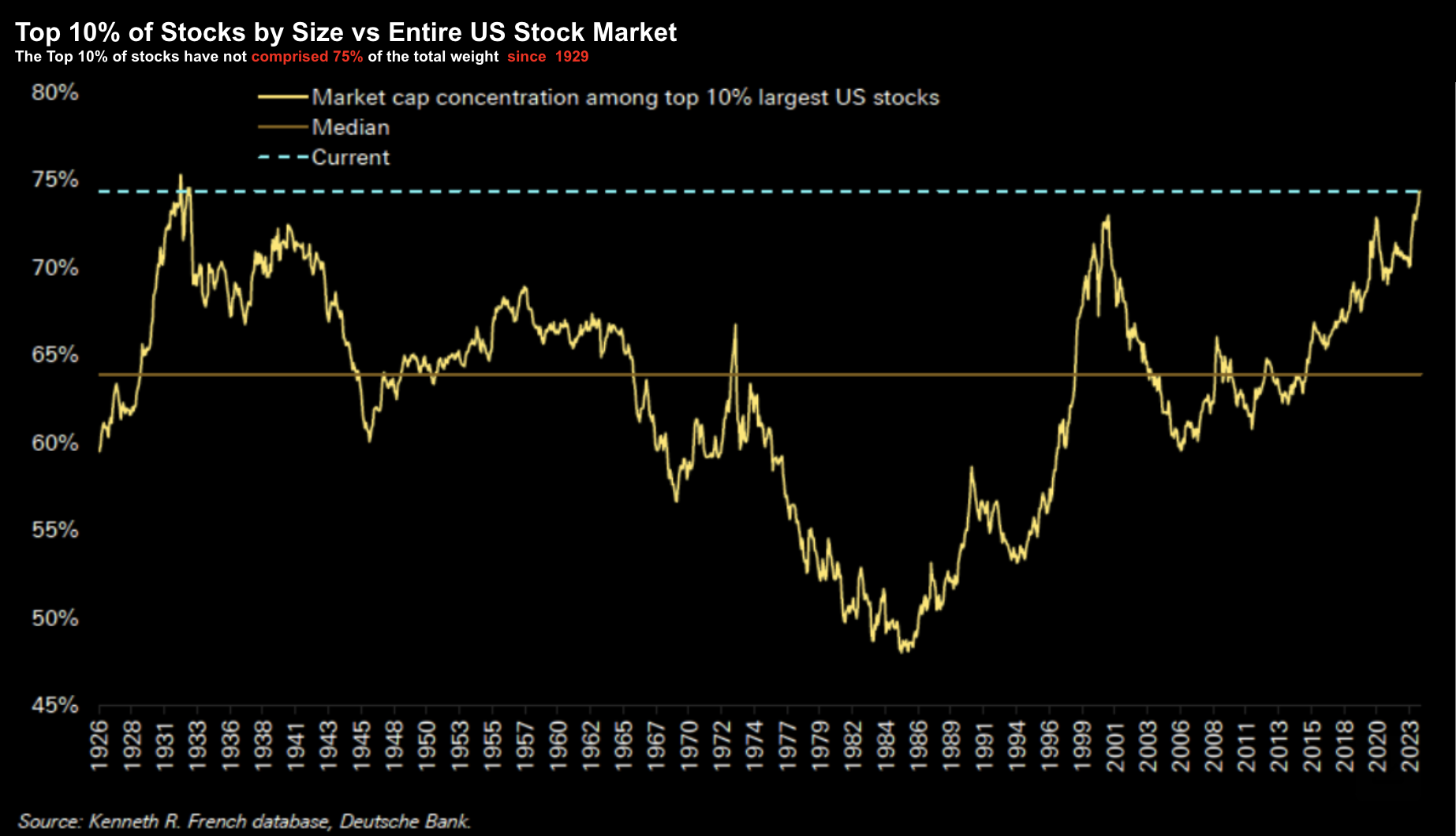

- We haven’t seen this metric since 1929!

It’s been about six days since my last missive…

As I watched the market shenanigans during the week (I will get to Nvidia in a moment) – I could not help but think very little has changed.

Each day I asked – ‘what could I offer readers that’s incremental to what I shared last week?’

The answer – not much.

Therefore, why waste pixels?

For example, this week we received earnings from Nvidia which easily beat expectations.

From mine, their beat was expected given what we heard from large cap tech. The strong results saw the stock continue its dizzying ascent. It’s now closing in on the market cap of Apple… worth approx $2.0T at the time of writing (only Apple and Microsoft have larger market caps)

Who knew?

I’ve explained why I think Nvidia is over-bought… but that doesn’t mean it can’t go higher. Odds are it will.

Good luck if your’e willing to short it (that’s not me)

We also received a few other notable earnings reports, some of them good and others less so.

On the whole, earnings are okay but a long way short of the ‘11% to 12%’ growth markets expect for the full year.

And in other news – we also learned from the Fed’s January meeting minutes the majority of members are reluctant to cut.

No news there.

So what’s changed? Not much.

I will review the weekly chart for the S&P 500 shortly.

But first, I want to circle back on my missive from last week; i.e. the market is yet to calibrate for only three rate cuts this year.

Let’s take a closer look followed by what could be driving the market higher.

‘No Cuts for You’

One of my favourite Seinfeld episodes was the “Soup Nazi”

“No Soup For You” was the infamous line…

Well, swap out the soup chef for Jay Powell… “No Cuts for You”

The market was lining up – literally cup in hand – expecting at least six rate cuts this year.

For example, the day of the Fed’s meeting in January, it priced in an 89% probability of a rate cut in March.

I questioned it – failing to see a strong reason why the Fed would cut this early?

Turns out, that probability is now down to just 2%.

Sometimes markets are slow to connect the dots.

CME FedFunds Futures now see an 84% chance for cuts to begin in June.

From mine, that feels more likely.

Six cuts are now three.

And pending inflation – it might only be two?

That said, decent economic reports and hotter-than-expected CPI and PPI (inflation) data have led to markets dialling back easing expectations.

However, what’s interesting (to me) is a core thesis of the equity rally was the belief the Federal Reserve would slash rates at least six times.

Therefore, why is it that despite the shift in rate expectations – markets are still making new highs?

I will offer one possible reason: market concentration.

Top 10% = 75% of Total S&P 500 Weight

I’ve written about the risks of a narrow market extensively the past 12+ months – but it’s worth revisiting.

For example, when I thought the market could not get any more concentrated, along comes Nvidia’s surge.

It’s more fuel on the (risk) fire.

But there are many ways we can measure market imbalances (the “Mag 7” is widely referenced) – however they all draw a similar conclusion.

This remains an exceptionally narrow market.

And not unlike any structure – the narrower its foundation – the more vulnerable it is.

Below is a measure from Deutsche Bank’s Jim Reid.

Reid’s chart shows the Top 10% of stocks in the S&P 500 constitute ~75% of the total capitalization.

Source: Jim Reid – Deutsche Bank

Here’s the thing:

We’ve not seen this level of market concentration since 1929.

Now we saw a similar concentration risk in the year 2000… and we know how both of those “towers” ended.

Needless to say – both ‘structures’ were not on broad foundations.

TL;DR – the more tech rallies – the more vulnerable our tower becomes.

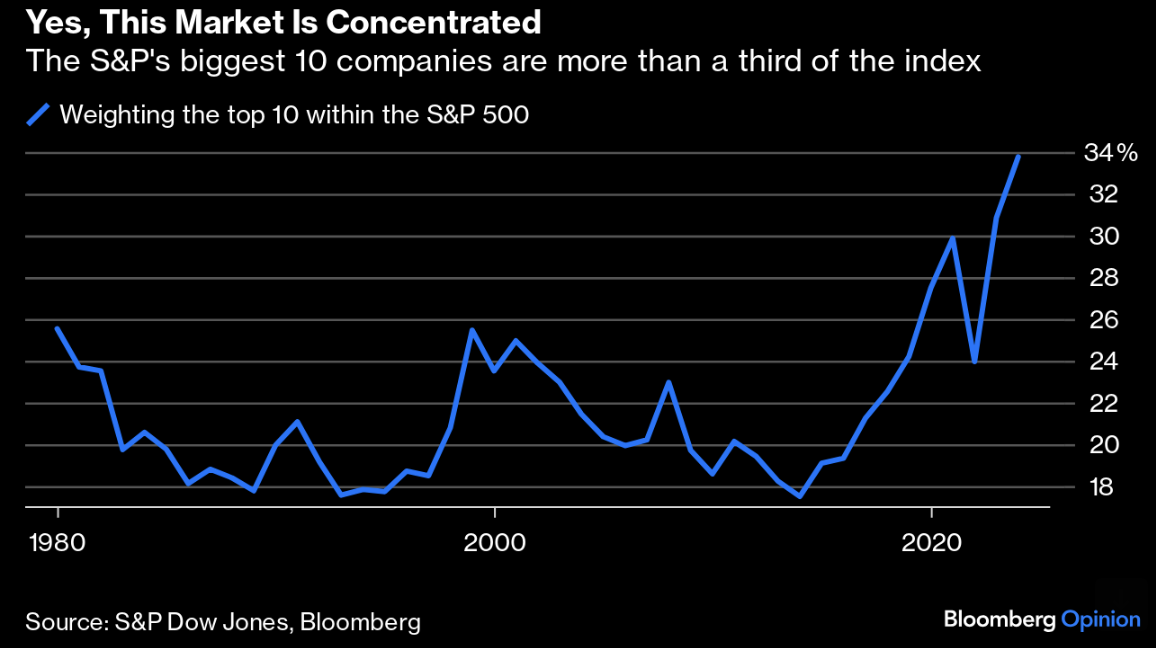

Bloomberg’s John Authers – in his regular opinion column “Points of Return” took this analysis one step further.

According to Authers, the Top 10 S&P 500 stocks make up ~34% of the market’s total capitalization.

But unlike Ried’s chart – this dwarfs what we saw in 2000/2001.

Investopia provides us with the Top 10 stocks by weight (as of Jan 25)

- MICROSOFT CORP (MSFT): 7.32%

- APPLE INC (AAPL): 6.95%

- NVIDIA CORP (NVDA): 3.71%

- AMAZON.COM, INC (AMZN): 3.49%

- META PLATFORMS INC, CLASS A (META): 2.12%

- ALPHABET INC CL C (GOOG): 1.83%

- BERKSHIRE HATHAWAY INC. CL B (BRK.B): 1.68%

- TESLA, INC (TSLA): 1.40%

- BROADCOM INC. (AVGO): 1.35%

- ELI LILLY AND COMPANY (LLY): 1.24%

Note:

(i) With half of Berkshire’s market cap comprising Apple stock – you might argue it’s just 9 names which constitute the ~34%

(ii) Given this table is from Jan 25th – when the price of Nvidia was 30% lower at ~$600 – the market weight of these stocks is now higher

But take a look at the 10 names… there’s only one name which sits outside tech… Eli Lilly.

I say that because Broadcom provides infrastructure for wireless LAN networks and WiFi routers – you might argue it too is in the ‘tech’ arena.

Authers’ adds another useful chart – highlighting tech’s dominance – exceeding what we saw during the dot.com bubble:

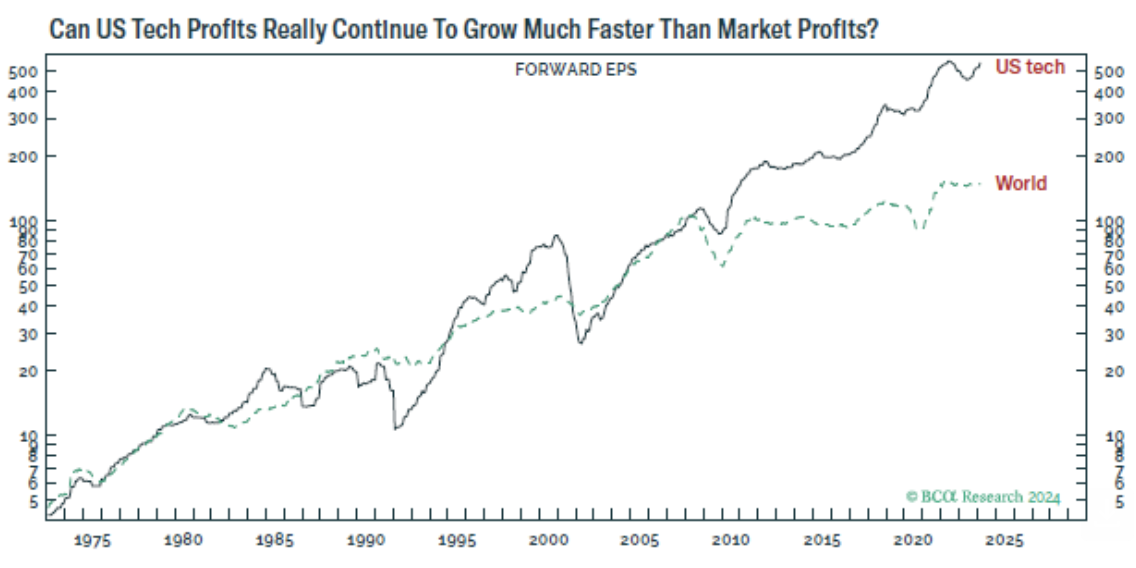

Now some people will say ‘so what Adrian – who cares if big companies (and tech) dominate?’

To that I say this matters a great deal.

If for no other reason – should these companies stumble (and they can) – the entire market potentially comes down with it.

But there’s a less obvious reason which deserves scrutiny…

And that’s the size of the economic pie (and who gets what).

For example, whilst tech companies’ profits are growing much faster than everyone else’s (and hence why investors are suffer FOMO) — their money is also being made at the cost of others.

That’s a problem given big tech needs the balance of the economy to also do well.

For example, Apple needs consumers buying their hardware. Google and Meta needs small, medium and large businesses spending on ad dollars. Amazon and Microsoft need enterprises ramping up their investments in things like cloud infrastructure (among other things).

In other words, big tech needs both a thriving consumer and business investment to grow profits.

Therefore, if they are taking a larger portion of the overall “economic pie” (which is only growing at less than 2%) – is it possible at some point – tech potentially bites the very hand which feeds it?

Put another way, will these two lines below converge?

With that, let’s take a look at overall earnings landscape (which was given a boost thanks in part to the likes of say Nvidia)

Earnings Okay – But Not Great

As a preface, I highly recommend subscribing to Factset’s newsletter for all the latest news on company earnings and trends.

According to their latest report (Feb 20) – the blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings growth rate for the S&P 500 for Q4 2023 is 3.2%

Obviously that’s a far cry for the full year 11% to 12% YoY growth expected for calendar 2024… however at least it’s positive (unlike last year which saw contraction)

Okay… but it’s not great.

With respect to the top line – the blended (year-over-year) revenue growth rate for the S&P 500 for Q4 2023 is 4.0%.

This growth rate is below the 5-year average revenue growth rate of 6.9% and below the 10-year average revenue growth rate of 5.0%.

Again, okay… not great.

Now some will argue that 81% of stocks have either met or exceeded expectations (slightly lower than last quarter).

Pending your lens – you might suggest earnings are going well. And it’s a line I hear from much of mainstream analysts.

But ‘going well’ is a function of expectations…

From my lens, I’m focused on the full year target of 11% to 12% YoY.

That’s what the market is pricing in.

And if we fail to reach that bar – then it follows stock prices are likely to fall.

I say that because I think valuations are stretched at ~21.7x forward (if you assume an ~11% growth rate to $235 per share).

5088 / $235 = 21.7x

Disappointment will come if earnings fail to materialize.

For now, equities are not yet concerned (perhaps not as much as they should be).

But as they say – that is what creates a market.

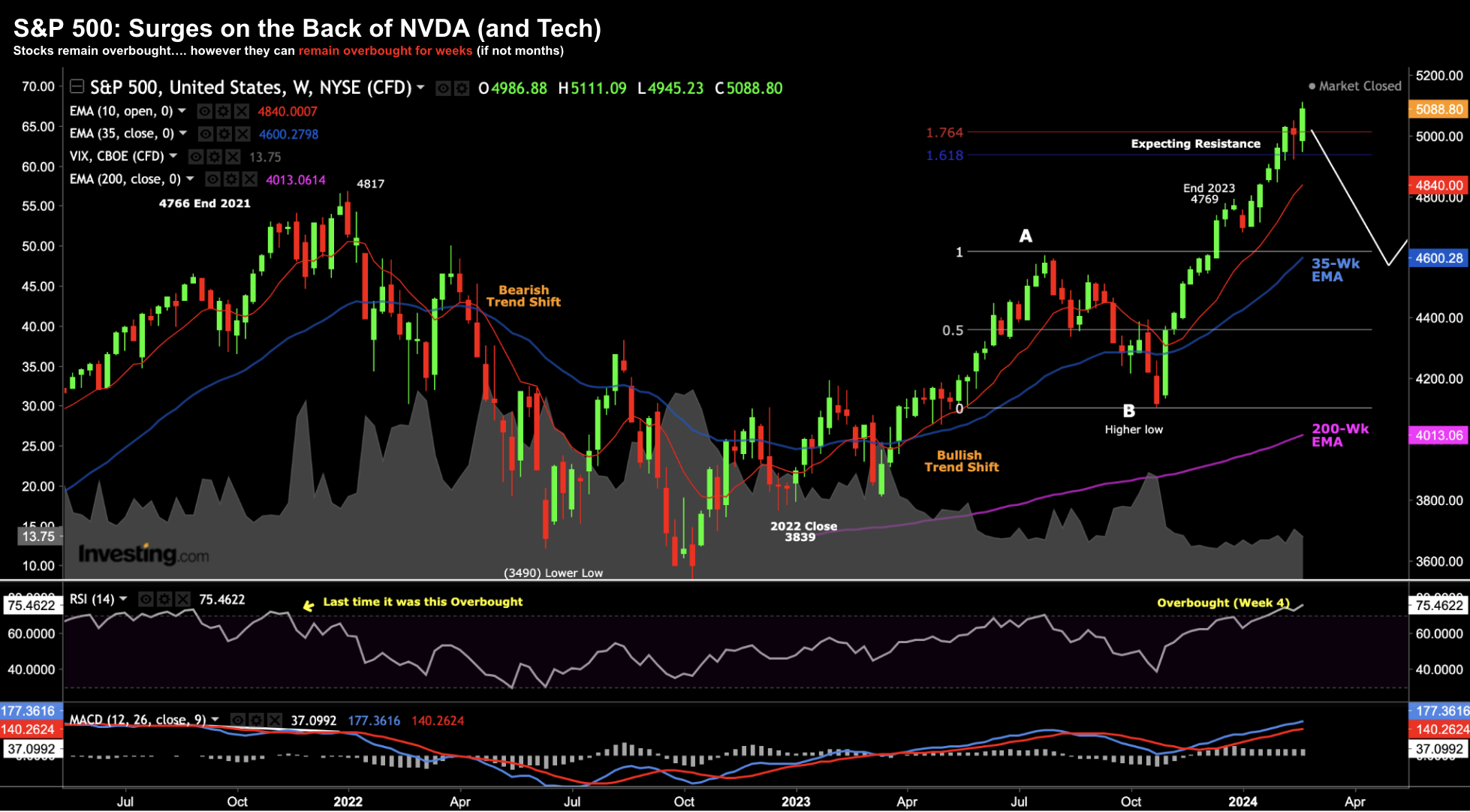

S&P 500 Rallies on Nvidia Beat

With all that said, from mine the market is rallying on the back of those “Top 10” stocks and specifically Nvidia.

But as I’ve said in the past – there’s nothing to say FOMO won’t continue.

That’s fine – but prices have reached a point where I don’t want to increase equity exposure.

In fact, I’ve been doing the opposite the past few weeks, reducing my long exposure to just 50%.

It’s the highest cash position I’ve had in a long time.

In the short-term, this is bound to see me underperform the market.

And that’s okay…

I’ve been in this situation many times before (with the last time being December 2021).

I recall in January 2022 I was something like 5% below market performance – only to finish the year ~20% in front.

I’m not saying that will repeat… and it probably won’t… but I’m always wary of paying too much.

And if the market is to correct from valuations of 21.7x forward, it’s likely to come from earnings disappointment.

Feb 23 2024

- Market remains in an overbought zone (not a sell signal in isolation)

- We’re trading slightly above the 61.8% to 76.4% outside the retracement labelled A-B (an area where we often see pullbacks); and

- the VIX remains very subdued at just 13.7… which suggests to me the market is overly complacent.

The 10-week EMA sits at ~4840… likely to be the first area of support on any pullback.

However, 4800 is still not a level I would be happy adding exposure.

4800 / $235 = 20.4x forward (not cheap)

Putting it All Together

I’m concerned about the widespread complacency across risk assets.

That applies to both bonds and equities (more so the latter)

For example, are stocks pricing in too much good news?

I think so.

Earnings have been okay – but I am not doing cartwheels over 3.2% year on year growth.

It’s mmweh.

What’s more, the Fed is likely to hold rates higher for longer unless they see meaningful progress. From mine, housing and wages are going to play a key part in that equation.

And let’s say rates stay higher for longer – how is that a tailwind for consumers and businesses alike?

“No soup for you”

In my experience, things can always go wrong (mostly when you least expect it). There will be disappointments – most likely on the earnings front. Consumers will need to accelerate their spending for this party to continue.

That’s the risk which lies in front of us (notwithstanding what we see geopolitically)

For my money – paying 21.7x forward with the 10-year trading above 4.20% is not that attractive.

I’m okay to sit this one out with ~50% in cash.

Time will tell if that proves to be prudent move… or an investment mistake.