- Just how ‘strong’ is the labor market?

- Wage growth still at 4.4% – cementing the next rate hike (or two)

- More companies having to roll-over their debt… what that means

Jobs.

That’s what matters most if we are to avoid a recession (or land ‘softly’ as some believe)

If people have jobs – they will continue to spend. And if they spend – the economy will tick along.

70% of all US GDP is based on consumption.

Yes, consumers are “trading down”.

Amazon’s CEO – Andy Jassy – confirmed this yesterday in a CNBC interview.

We heard similar sentiment from retailers like Walmart and Target.

Consumers are being forced to choose cheaper items as their wages felt the full force of inflation.

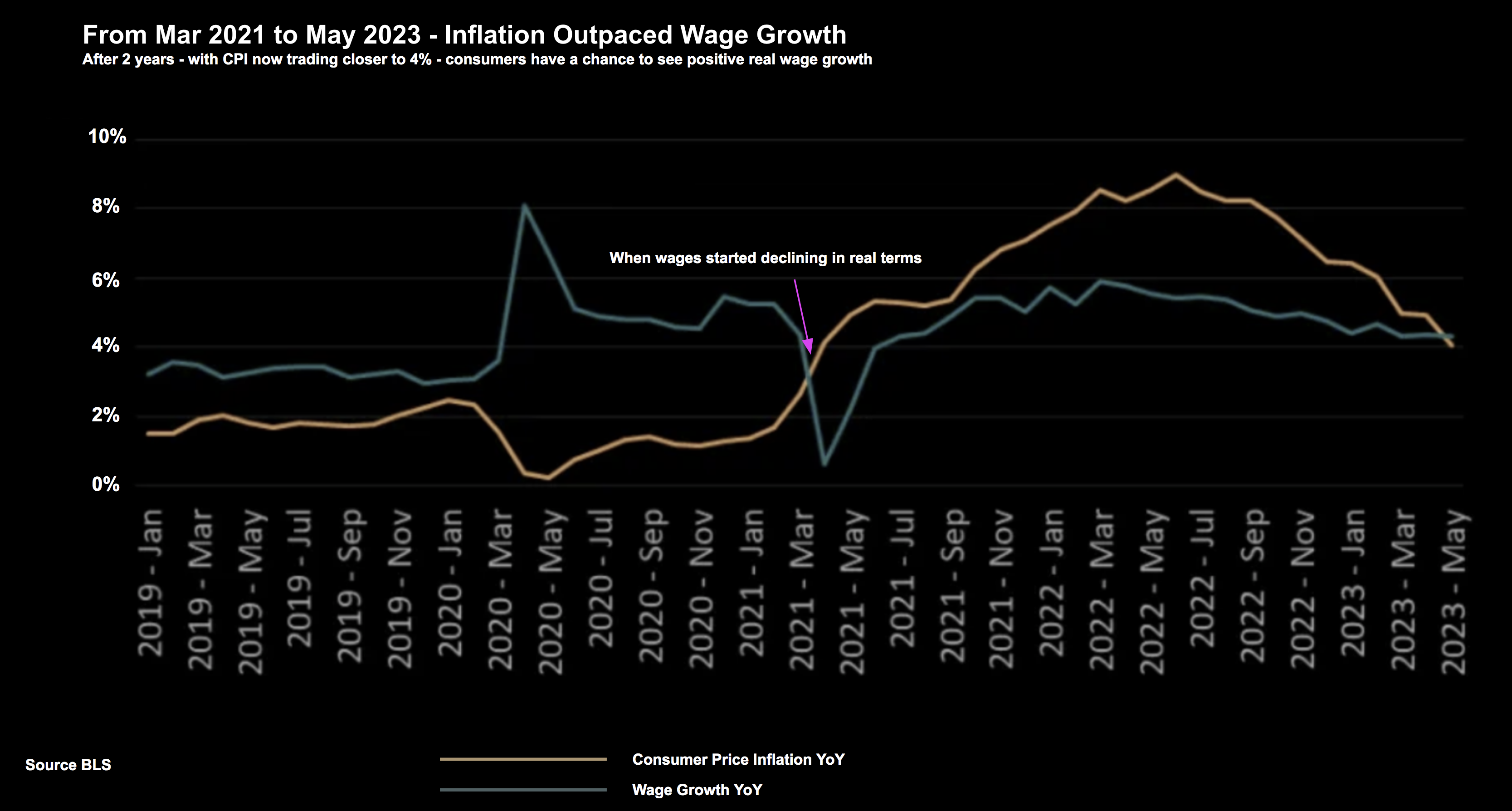

For example, in real terms (adjusted for inflation) – real wages have gone backwards since March 2021 (only turning positive very recently with CPI back around 4%)

Which begs the question – how robust is the jobs market?

Another “Strong” Jobs Report?

This week we received two important updates with respect to employment landscape.

What made things interesting is they painted different pictures.

The first was the private sector ADP jobs report.

According to CNBC:

- Private sector jobs surged by 497,000 in June, well ahead of the 267,000 gain in May and much better than the 220,000 estimate

Most of these new hires were in the (seasonal) part-time leisure and hospitality sector (around 232,000).

That said, the report was stronger than expected.

However, the more widely followed report came via the Bureau of Labor Statistics with the monthly payrolls change.

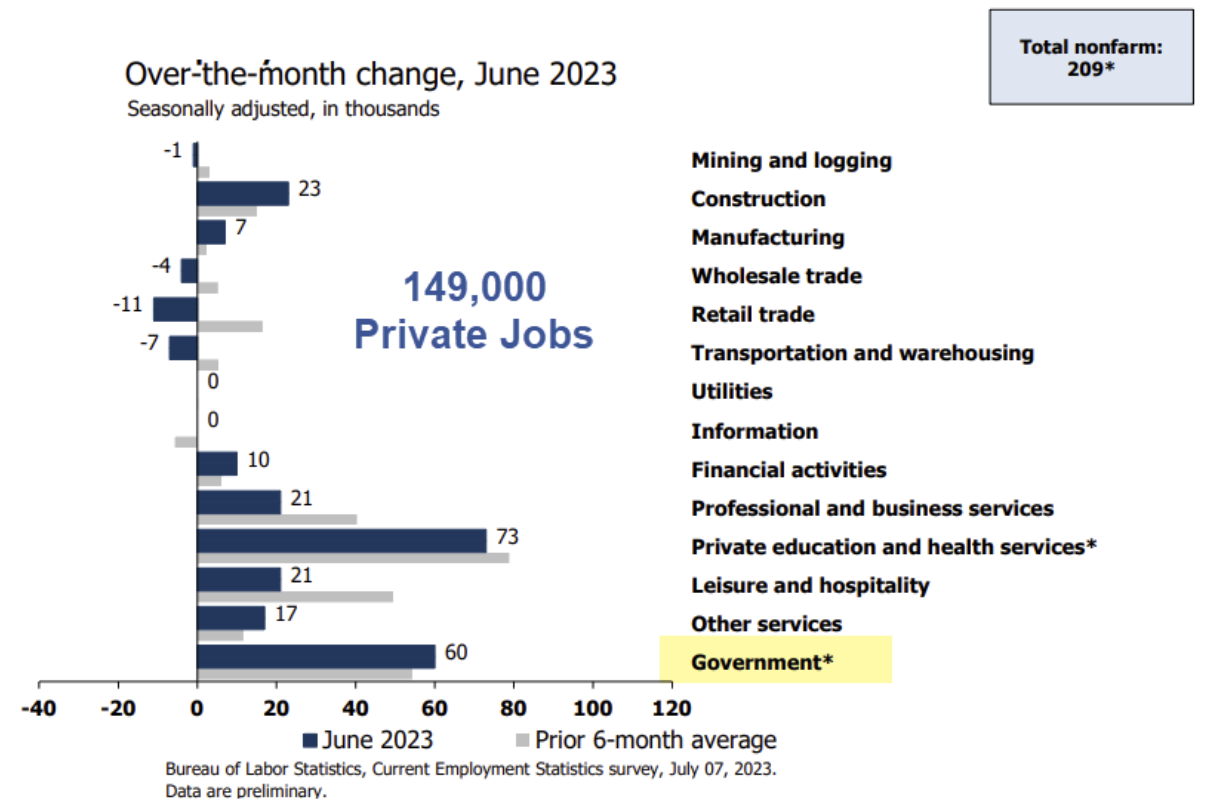

Expectations were high after the ADP number… however it proved to be more sobering. Only 209,000 jobs were added.

For me three things stood out:

- ~30% (60K) of the 209K were added in the public sector (a function of further deficit spending)

- There were major revisions lower for the previous months (33K lower for May; and 77K lower for April); and perhaps the most important from the Fed’s perspective;

- Wage inflation remains strong at 4.4% for all workers – which cements the next rate rise.

Here’s Mike Shedlock from Mish’s Blog with the June sector breakdown

Here’s my question…

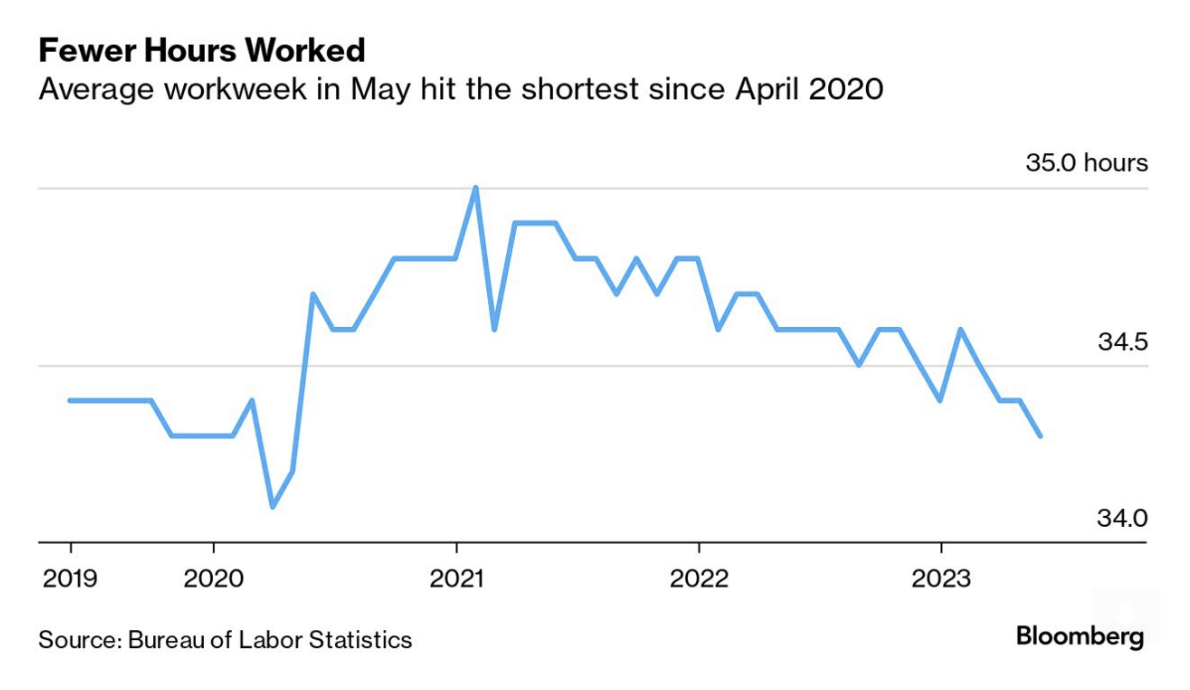

What does the working week look like?

For example, “a job” could be working “4 hours” per week or it might be “40 hours”?

The latter is a lot better than the former – especially if you have to pay things like rent and utilities?

And this deserves a closer look.

The Working Week

Again, any job is better than no job at all.

However, we are seeing a two year trend of fewer hours worked.

For example, the number of hours worked hit the lowest level since the initial Covid shock of spring 2020.

According to the most recent (June) report – the average weekly hours of all private employees was 34.4 hours (barely unchanged)

Now a move from say 35 hours (June 2021) down to 34.4 hours may not sound like a lot.

But if you consider there are 160 million people in the US workforce – that’s about 96 Million hours less a week.

With the average wage around $35 per hour – that’s $3.4 Billion per week in lost income

This tells me employers are cutting back the number of hours their staff work.

With economic conditions slowing (and the cost of debt rising) – businesses are likely to seek a number of different ways to reduce costs before laying off workers en masse.

Reducing working hours is often an early cautionary measure.

Reading the tea-leaves – the softening trend in work-week hours could be a precursor to what we see with future monthly payrolls.

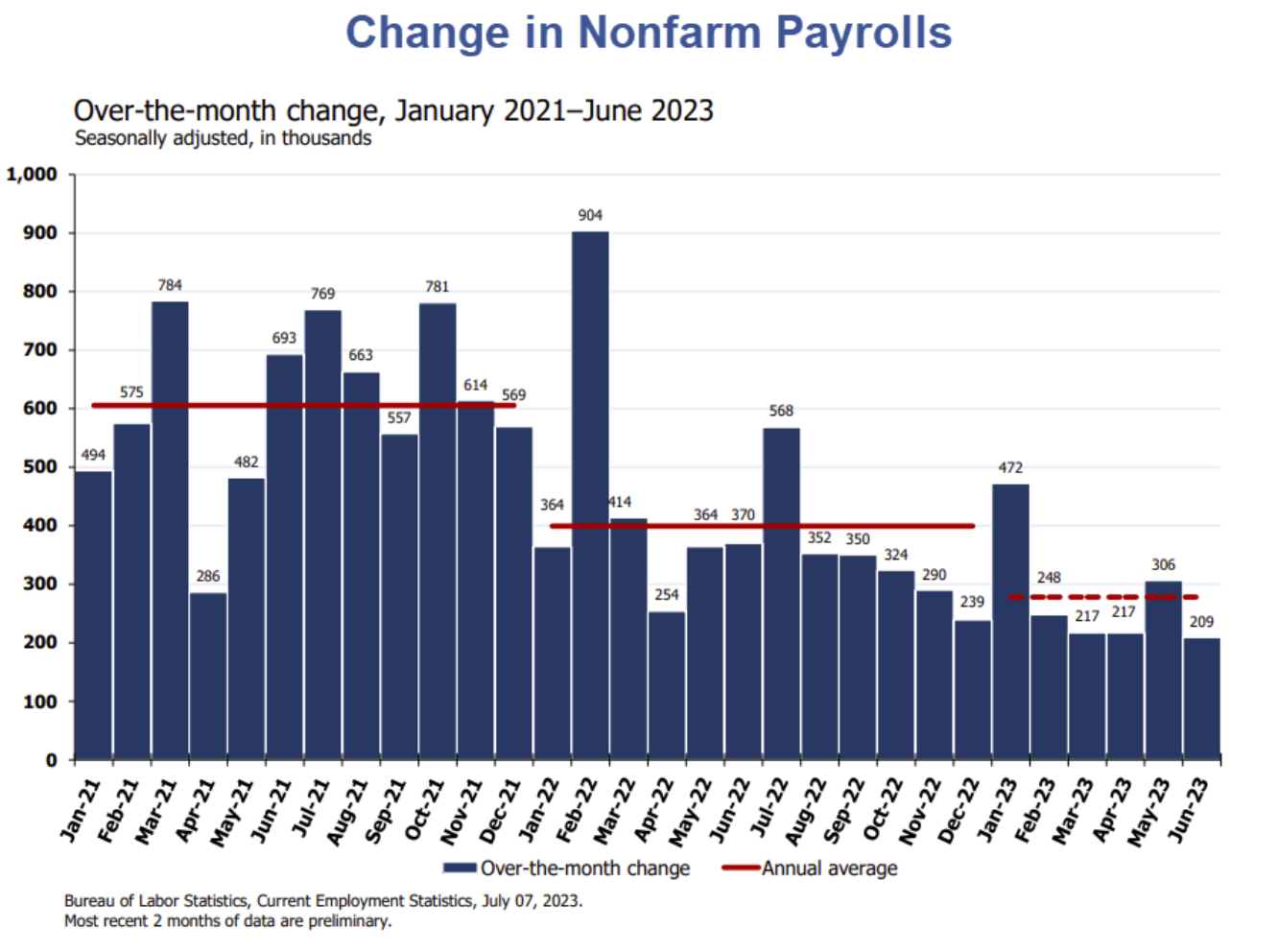

Below is the monthly payrolls trend (again from Mish’s Blog)

And whilst the employment market appears strong for now… for how long is the question.

As we saw in 2007 – it can turn quickly.

I suspect we will see this trend continue to move lower as the year goes on.

For example, my best guess is the 12 to 24 month lag effect of the Fed’s 500 bps of rate hikes (which are not finished) will tighten its vice like grip as time passes.

As I mentioned recently – we are just 15 months in.

That’s what I think the market could be underestimating.

The Lag Effect

With ~200K jobs added over June (despite the 100K revisions lower the past two months) – the job market is ‘hanging in there’.

I’m reluctant to say it’s “strong” (unlike the media) – especially given the lower trend we see with working week hours.

What’s more, the jobs being added are more in the public sector, not the private sector.

We need to see the opposite.

But what has not happened yet is the full impact of the Fed’s rate hikes (and QE)

Some of that is opposite the ‘consumer cushion’ provided from trillions in fiscal stimulus.

That will fade over the coming months.

A lot of this money has found its way into higher prices (inflation)… and some helped offset any impact from rates.

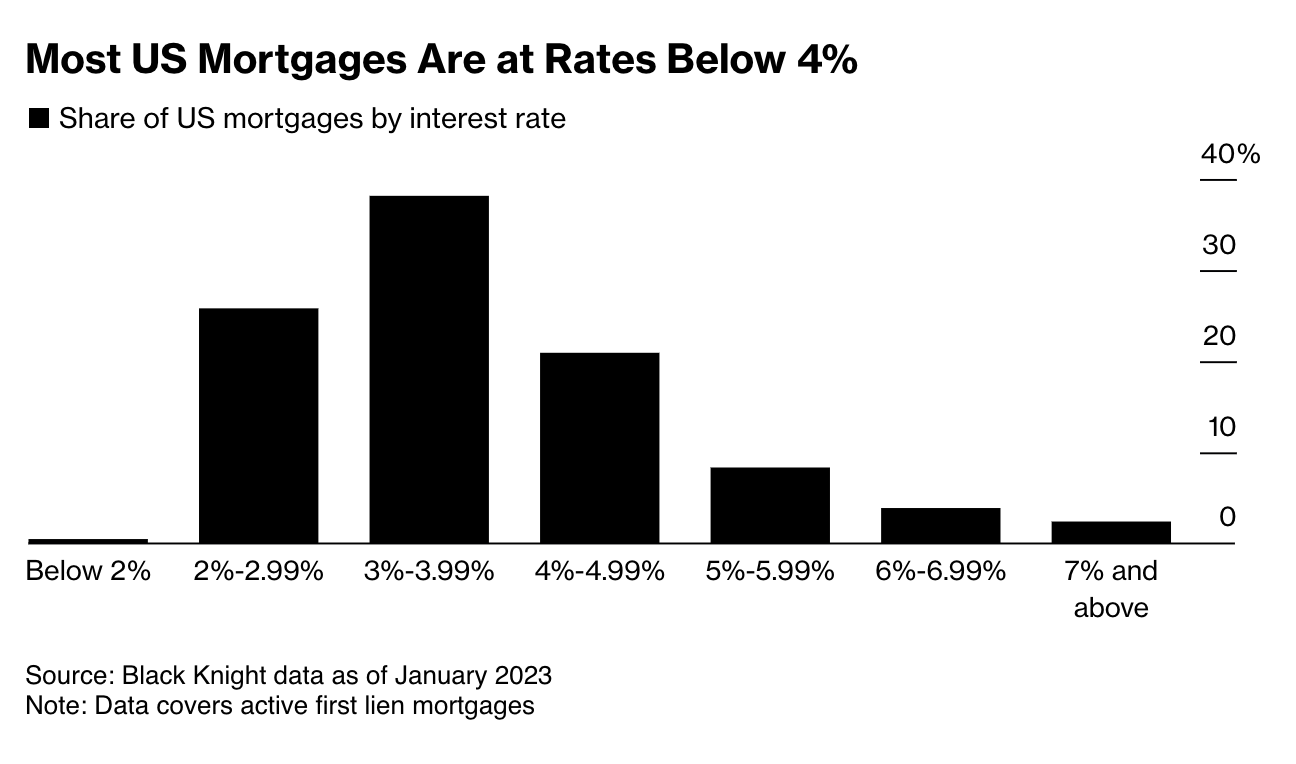

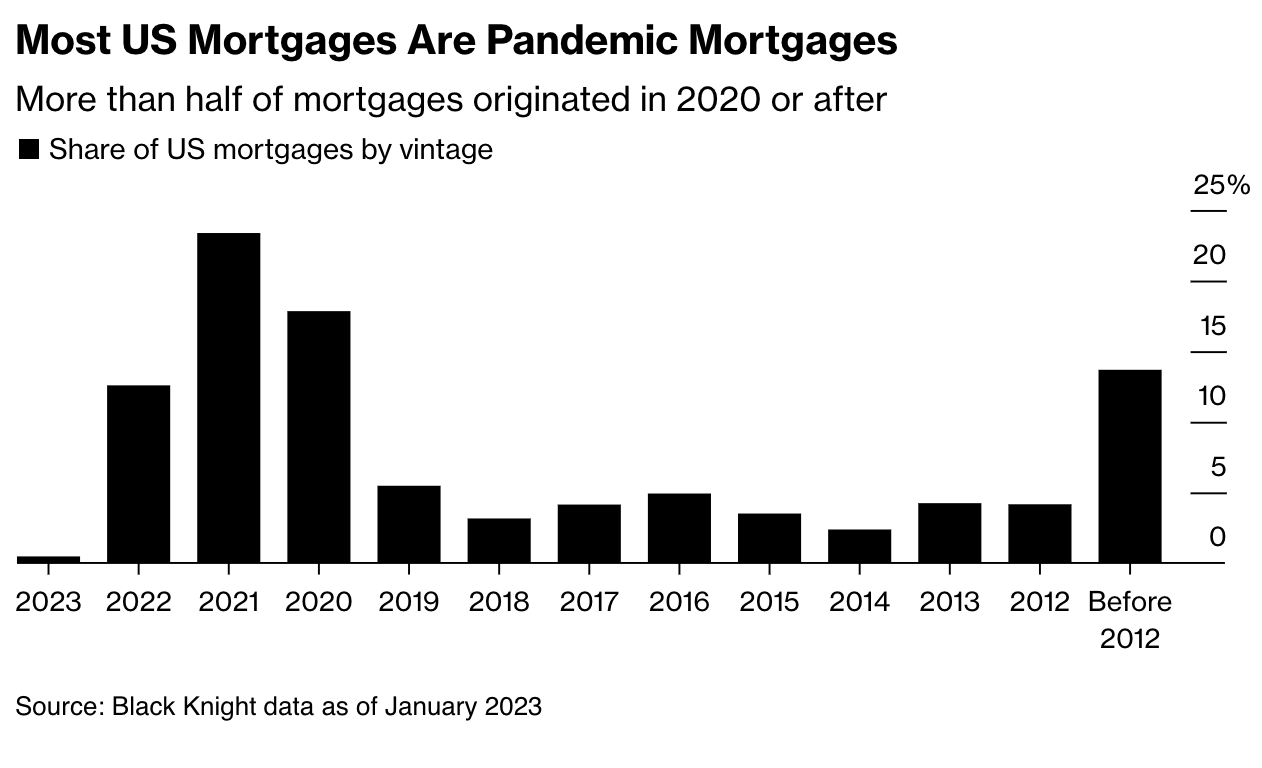

The other cushion many consumers are enjoying is with respect to fixed mortgage rates.

For those households who locked their borrowing in when rates were ultra-low (e.g., during 2020 and 2021) – they are in great shape.

For example, Bloomberg report that ~86% of existing home borrowers have 30-year fixed loans below 5.0%

And almost 70% are locked into a 30-year rate below 4.0%

What’s more, ~40% of all US mortgages originated in 2020 or 2021 – when rates were essentially zero.

UBS economists estimated that the share of floating-rate debt in the US mortgage pile has shrunk to about 5%

By comparison – that was closer to 40% in 2006.

This is another reason the Fed’s rate hikes have had a limited impact on many consumers (much to the Fed’s frustration to bring down inflation)

However, for those who took on debt at floating rates saw their world change more than a year ago.

But what about companies?

For those who sold bonds and raised loans during the pandemic, the impact is only now starting to hit.

It’s still very early… but we are seeing evidence of higher rates starting to bite (e.g., reduced work week hours as companies defend margins / lower costs).

From Bloomy:

“Most companies, especially those of lower quality, have been insulated from credit-related stress even as interest rates have risen dramatically over the last 15 months,” Morgan Stanley credit specialist Vishwanath Tirupattur wrote.

However, as these loans and bonds come due and borrowers seek to roll over their funding, that fresh financing will occur at notably higher cost than a few years ago.

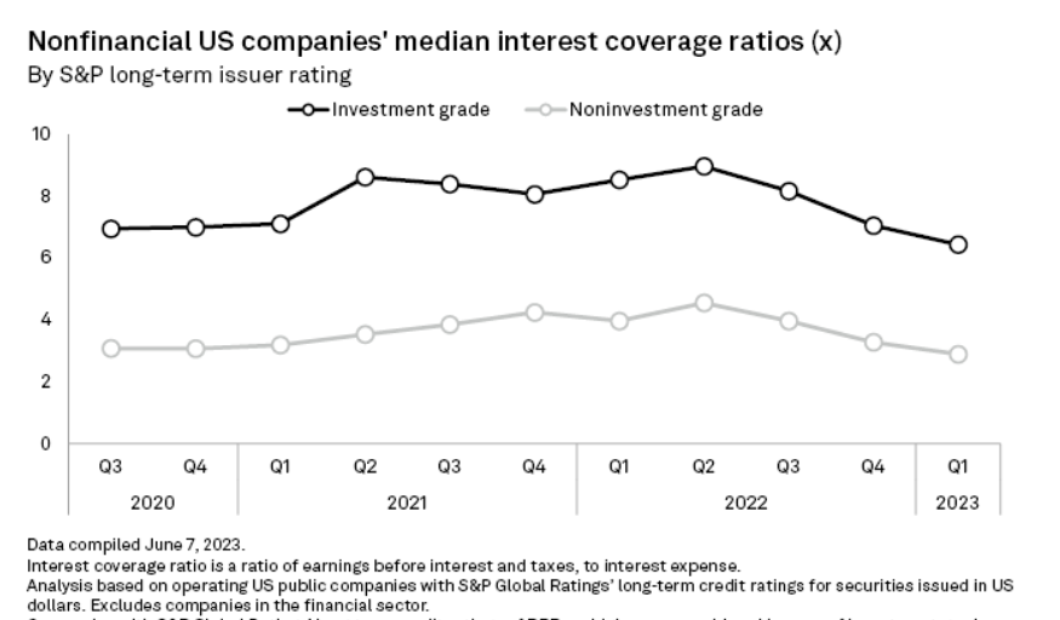

Bloomberg provided a key indicator to watch known as the interest-coverage ratio.

This measures how much corporate earnings can cover the interest expense of borrowing.

And that cover has been creeping lower as (a) earnings continue to soften; and (b) interest costs rise

Now if earnings expand – this gives companies greater ability to pay the higher costs of funding.

But therein lies the rub…

Are earnings going to expand if economic activity is weakening?

Your view will probably differ from mine.

I’ve talked to this subject at length over the past few months – where my view is earnings revisions will come down.

And if we are to see a recession (which I think is likely late 2023 or early next year) – earnings will contract.

In the event companies are unable to cover the debt – they can choose to retire debt or scale back their investments.

And I think that’s what they will do… until the outlook for the economy improves.

We’ve already seen that in the tech sector this year (with a hundreds of thousands of jobs shed)

However, with less investment, that will impact growth.

Bloomy add:

“Investment-grade companies are pulling back on growth plans and focusing on deleveraging, while their lower-rated peers face growing risks from soon-to-mature debt loads,” Peter Brennan and Umer Khan at S&P Global Ratings wrote.

And with the US 2-Year yield hitting its highest level in 16 years this week – this will only become more acute.

Jul 7 2023

And that will be the “Fed lag” at work.

Putting it All Together

Next week we will get all important CPI and Core CPI data.

It’s expected to show further weakness.

Headline CPI is expected to trade with a 3-handle; however the Core will be noticably higher (due to the higher costs of shelter)

However, I think the wage inflation we received today cements another rate hike.

Over the weekend I will check in with how the S&P 500 finished the week.

The index surrendered 3.3% this week.

It’s the largest pullback we’ve seen since early March (which demonstrates how strong the momentum has been).

My feeling is the market remains ripe for a 7-10% pullback around the 4400 to 4500 zone.

But I might be wrong…

However, if I’m right, ensure you have some cash on hand – as there will be a better buying opportunity ahead.