- S&P 500 Caught in a Range

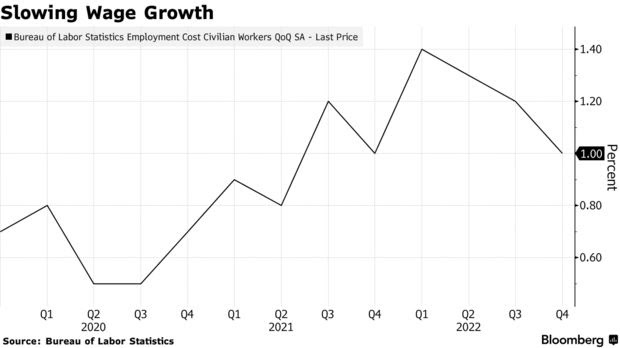

- Soft Landing Hopes with Lower Wage Growth

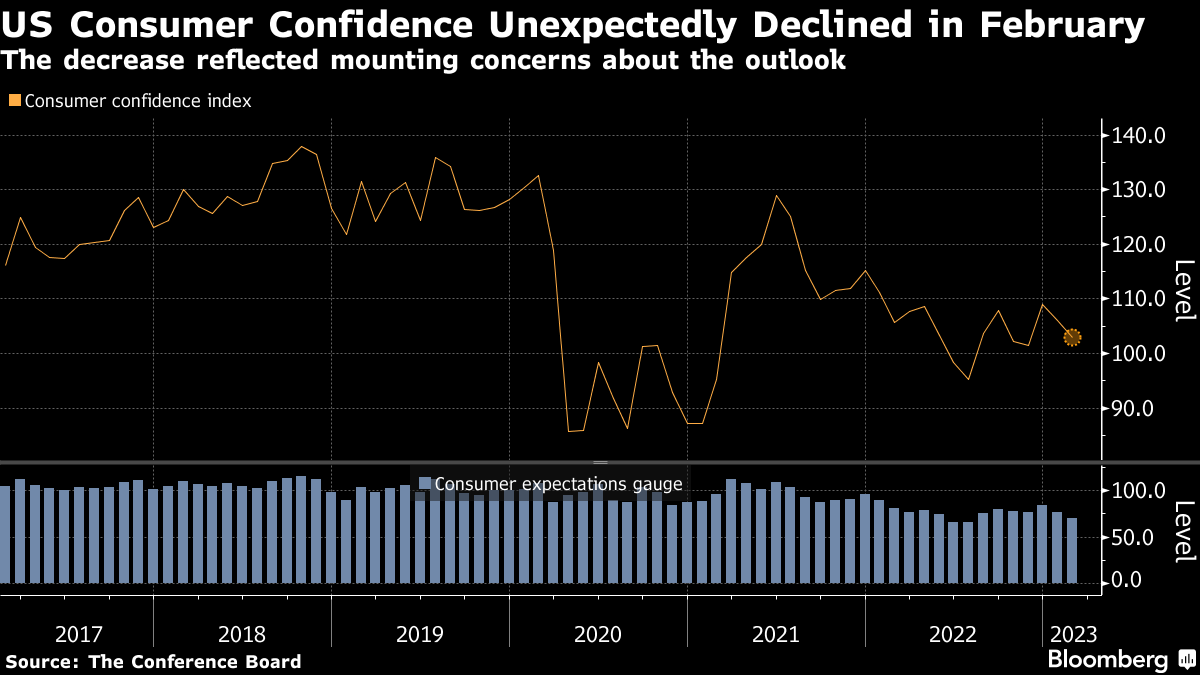

- Consumer confidence plummets

If you are an active trader – I can only imagine how difficult this market is.

One minute everything is headed lower – only for things to pivot the next.

As my Dad would say – the market doesn’t know if it’s ‘Arthur or Martha’.

For those who read the blog regularly – I don’t bother too much with the day-to-day movements.

That’s not my beat.

But if you are trying to time these moves consistently… good luck.

You are better than me.

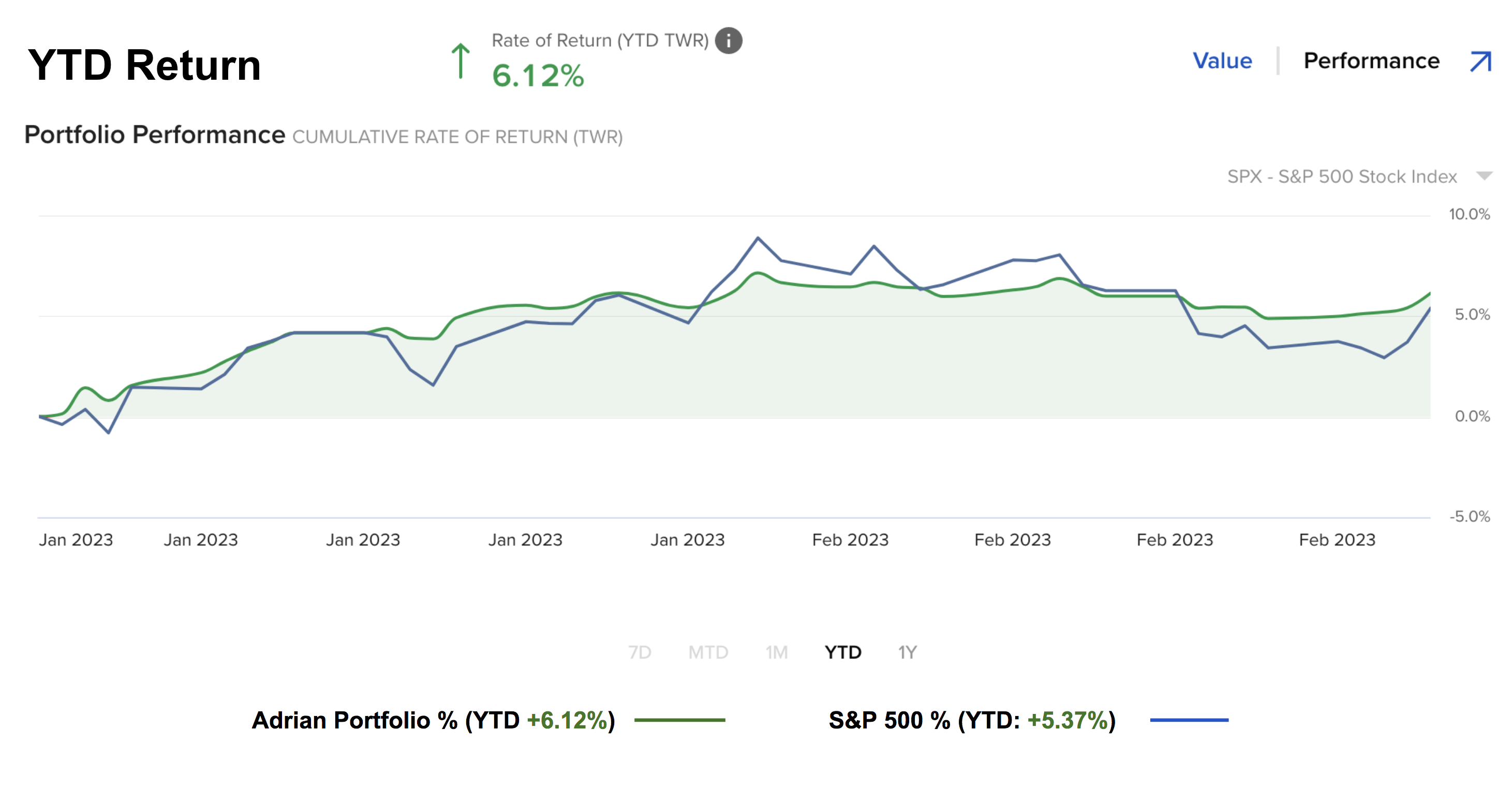

On the whole – markets have started 2023 very well – with the S&P 500 up 5.37%

March 4 2023

My own portfolio is up 6.12% YTD (which I will happily take) – slightly ahead of the index.

Here’s the thing:

You can’t afford to be either aggressively short or long this market.

I don’t think investors have a ‘green light’ for either outcome (more on why shortly)

For example, I can make reasonable arguments for both the bearish and bullish case (as I did here on Jan 21)

However, if I was to lean towards one direction, it would be lower.

That does not mean I see a ‘market crash’… but perhaps 10-20% lower than today.

That said, I have not sold any of my existing long positions from last year, which so far has led to a reasonable start.

If I had moved to largely cash… I would not be up over 6% YTD.

My long exposure remains around 65% (and I have no short positions).

You can track my performance week-to-week here.

As an aside, if you ask me, any newsletter or subscription market service (paid or otherwise) should share their performance.

For example, it’s one thing to post a “weekly trading tip” (any mug can occasionally get a few trades right) – but it’s another to consistently manage a portfolio that beats the S&P 500 (year after year).

With that, let’s start by checking with the weekly tape.

S&P 500: Not out of the Woods

It was strong close to the week – with the bulls gaining the upper hand.

However, if we zoom out, there is nothing which suggests the S&P 500 is going materially higher anytime soon.

March 4 2023

From mine, the S&P 500 appears to be very much in a trading range between 3800 and 4200

The bulls are happy to step in and buy below 4,000 however struggle to push things much past 4200.

And this has been the case for 17 continual weeks.

For some people this is very a ‘tradable’ 10% range — but that’s not my game.

I’m far more likely to get the timing wrong – gifting my broker lots of commissions in the process!

What I am waiting for to put more cash to work is once we retest the 3600 zone.

The last time we visited that zone was October last year… and that’s what I did (in quality stocks)

And I think we will be given that opportunity again… however it will require some patience.

This week, there was some bullish optimism on two fronts:

- a chance of a soft landing; and

- yields on the 10-year treasury easing slightly.

Soft Landing Hopes

As we know, one of the keys to bringing down core service sector inflation will be wages.

However, with the labor market incredibly strong (where economists expect to see another 200,000+ jobs added for February), this has seen wages remain high.

But this week, despite the strength in hiring, there might be signs wage growth is easing.

If this is true, then it’s possible the Fed could restrain inflation without overly hurting the economy and employment.

Here’s Bloomberg:

Bloomy reported if pressure on pay keeps easing even as firms keep hiring, policymakers may feel less compelled to push interest rates ever deeper into restrictive territory in their drive to return inflation to their 2% goal.

But there’s another scenario starting to gain attention: call it a reverse wage-price spiral.

Moody’s Analytics chief economist Mark Zandi posits the wage deceleration is due to a downshift in inflation expectations held by workers, as well as their bosses.

Reduced expectations for living costs — reflecting lower gasoline prices and the anticipated impact of aggressive Fed rate increases — lead to tempered wage demands.

That, in turn, means less pressure on companies to raise prices.

We will keep an eye on this…

Because if there is to be a so-called “soft landing”… this is the scenario the Fed will be hoping for.

Possible? Yes.

Probable? I am less convinced.

Fatigued Consumers… or Not?

If we are to avoid a recession… or at least experience what some call a “mild recession”… it will all depend on the consumer.

Consumption is 70% of US GDP.

And if they are not participating… well say goodbye to your soft landing.

Now during the week, we learned that US consumer confidence unexpectedly fell in February.

I don’t think the result was surprising – as they contend with such things as:

— higher interest rates;

— high services prices (e.g. airline tickets, hotels, restaurants etc); and

— mounting recession risks.

The Conference Board’s index slipped for the second straight month to 102.9 from 106 in January

March 4 2023

“Both current confidence and expectations for the future — arguably more important in guiding behavior — fell noticeably”

And if you listen to recent reports from the likes of Walmart and The Home Depot – it supports this thesis.

However, economists at Goldman Sachs see things differently.

They believe the consumer has ‘plenty of gas in the tank’ and can keep driving the economy forward.

From CNBC:

Among Wall Street firms, Goldman Sachs’ economists take the view that the consumer strength can continue, saying household income growth bottomed out in 2022 as Covid-related income support programs ended, and will rebound this year, bolstering companies, including Walmart in particular.

Goldman economists expect disposable personal income to grow 6.1% this year, compared to a 0.4% decline in 2022, according to a recent report, driven by rising wages and higher profits for small business owners. That means consumers can spend more without dipping into savings and investment gains.

“The outlook for sustained consumer spending growth remains,” wrote consumer analyst Jason English. “Growth in [disposable income] and moderation in essential spending inflation mean that spending growth will no longer need to be funded from net savings, with [a] bounce back in the savings rate expected beginning in the first quarter of 2023.”

If Goldman are right… this also bodes well for the ‘soft landing’ thesis.

Putting it All Together

For every bearish thesis… there is something to counter it.

And pending which day of the week you decide to look at the market – you will have a different outcome.

My take is we can’t say with any certainty which way we are headed.

Therefore, it’s little wonder we find the S&P 500 chopping around between 3800 and 4200.

This week we will be treated to a swath of economic data and Fed speak:

- Tuesday (March 7) – Powell testifies to the Senate

- Wednesday (March 8) – ADP Employment and JOLTS (Job Openings)

- Thursday (March 9) – Jobless Claims and Fed Governor Waller speaks

- Friday (March 10) – February Employment Report

With employment and wages in focus – it could be a market moving week.

For example, anything more than say 250,000 jobs created in February coupled with strong wage inflation, and we could see a move lower.

The market will interpret this as giving the Fed are ‘green light’ to continue at pace.

The opposite also holds true.

Remain patient. Exercise diligence.

There will be better buying opportunities ahead.