- 13F filings give us insight into the smart money

- Knowing when to sell more important than buying

- Q2 trades from Ackman, Buffett, Elliot Management and Tepper

Something I do four times a year is pore through something known as “13Fs”

A 13F is a quarterly report that institutional investment managers with over $100 million in assets must file with the US Securities and Exchange Commission.

The legal requirement is intended to increase transparency and public access to information about institutional investors’ securities holdings.

And whilst these filings are submitted around 45 days after the quarter ends (e.g. August 15 deadline for June 30 quarter end) – they offer us insight into how the “smart money” is allocating money risk capital.

Now I track about 50 of these funds – and have done for more than decade.

For example, some names I follow include (not limited to) Warren Buffett, Bill Ackman, David Tepper, Howard Marks, Stan Druckenmiller and Seth Klarman.

Not only do these investors manage hundreds of billions of dollars – they also boast proven track records over very long periods.

The latter is very important.

Put another way, I am not interested in some fund which managed “20%” gains the past ~3-5 years.

That can be luck.

I’m looking for track records where the manager has consistently beaten the annualized return of the S&P 500 (~10.5% inclusive of dividends) for more than 20 years.

Applying that razor will reduce your list considerably – as few fund managers are able to do this.

And if applied over 20+ years – it’s not luck – they’re doing something right.

Now last quarter I noticed two distinct trends:

- Money moving out of large cap tech; and

- Investing in value names (at cheaper multiples)

Sound familiar?

It’s the same strategy I was advocating last quarter.

Below I’ve highlighted a couple of names I track and specific transactions which caught my eye.

But I encourage you to research these filings for yourself – and take note of:

- What they’re buying and selling; and

- The amount of money (risk capital) they allocate to positions.

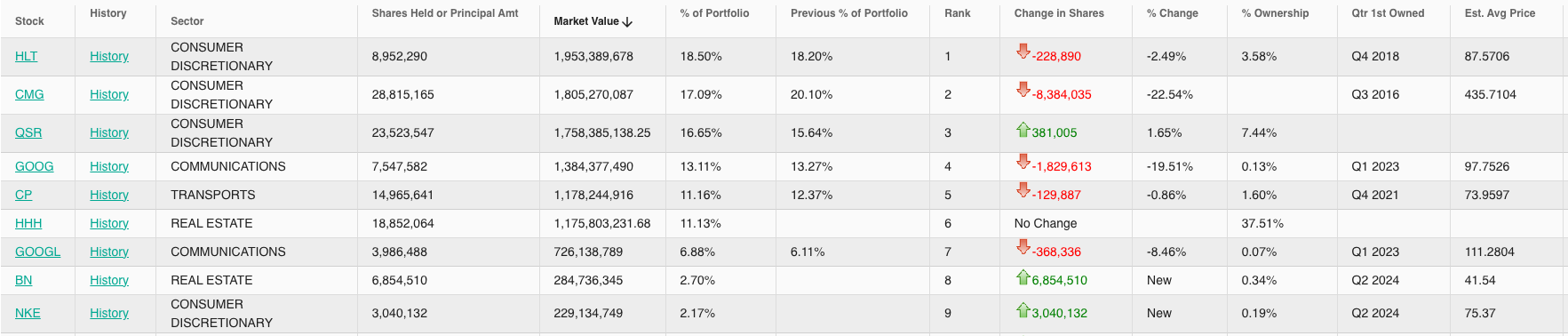

Bill Ackman – Reduces Google / Adds Nike

Ackman is a self-proclaimed mini Warren Buffett.

“I’ve been a kind of Warren Buffett devotee,” Ackman told CNBC. “He’s been my unofficial mentor for many years.”

“If you want to be a successful investor over time, and you find a handful of great businesses, doing nothing but owning them is an amazing strategy. It’s underappreciated as a successful way to make money.”

But Ackman didn’t start life this way.

About a decade ago he was a notable short-seller and activist investor.

But after experiencing some painful (and quite public) losses – he changed tact.

Below is a look at what he did last quarter:

- 20% reduction in Google – now 13.1% of his portfolio

- 22% reduction in Chipotle – now 17.1% of his portfolio; and

- A very small (new) position in Nike – ~2% of his total portfolio

There are some parallels to what I did last quarter.

I also reduced my stake in Google by about ~10% – where it’s now ~14% of my portfolio.

In addition, I established new half position (2%) in Nike at a price of ~$72 per share.

As an aside, I took a quick look at Chipotle (CMG) given the sharp drop from $68 to $48 – but with a forward PE of over 47x – I decided to pass.

It’s a fabulous business and should be bought at a far lower multiple (e.g., at most 25x).

One final observation…

Ackman typically takes large concentrated positions (not unlike Buffett).

And that’s fine…

However, note his largest position is less than 20% of his total capital.

From mine, that’s prudent risk management.

For example, let’s assume you have a position with his 20%. If that stock happens to ‘blow up’ and lose say “30%” of its value – it’s only a 6% hit to your total portfolio.

That’s something you can easily recover from.

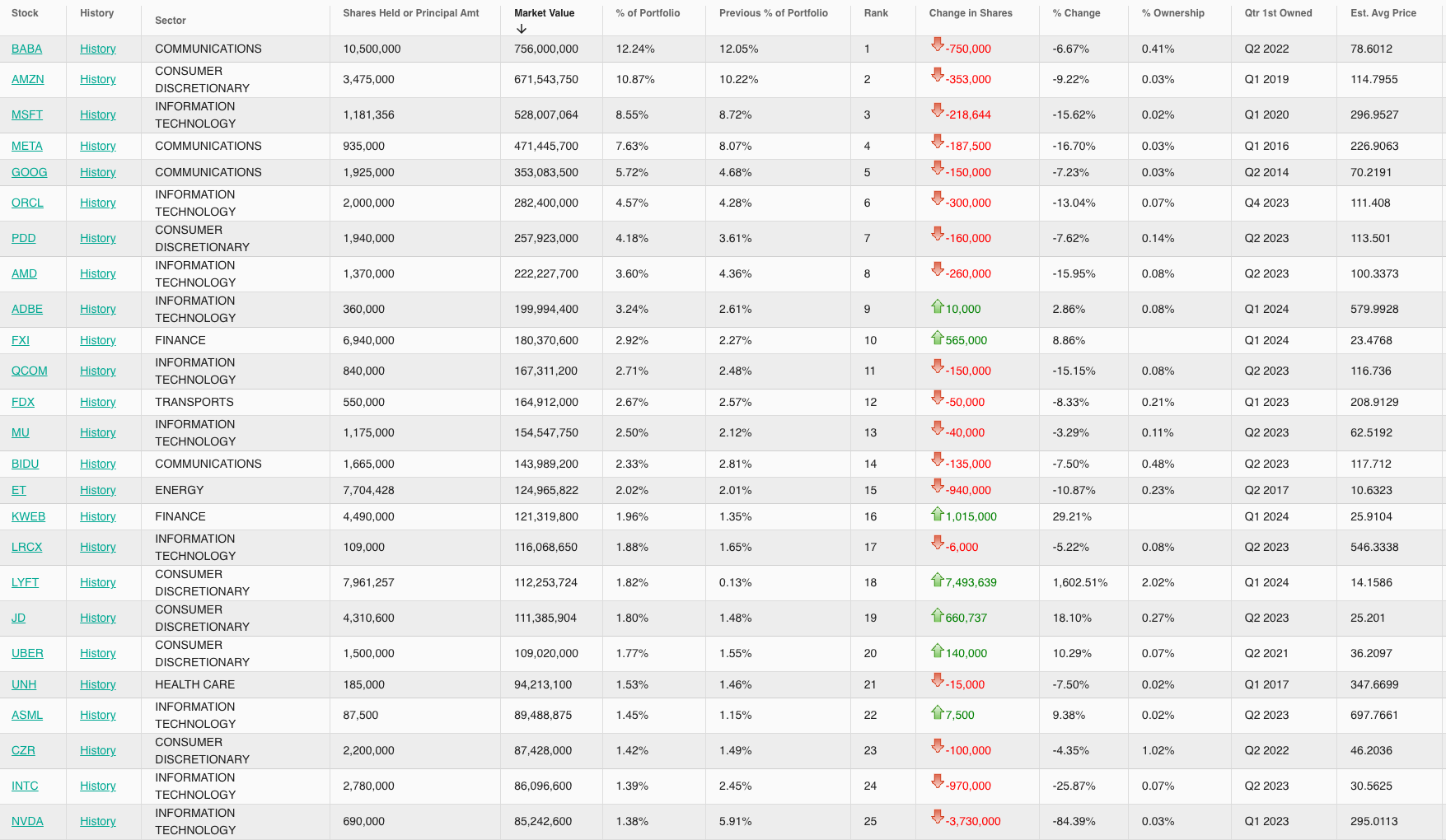

David Tepper – Reduces Tech and Buys Lyft

Tepper is someone I’ve followed for many years – before the financial crisis of 2008.

At the time he said something along the lines of “… when the Fed announces QE – buy the market with both hands”.

The rally in the market post 2008 was known as the “Tepper Rally”

He was right.

Let’s take a look at his Q2 2024 activity…

Tepper’s largest position is Alibaba (BABA) at ~12% and then Amazon (AMZN) at ~11%

However he reduced both these positions.

Just a note on the former…

And whilst I think BABA is incredibly cheap – it comes with the risk of investing in China.

Given the Chinese government like to change the rules of the game at any time (seemingly intent on destroying their most promising growth companies) – this comes with a lot of risk.

For example, it’s hard enough to invest in great companies at good valuations – you don’t need an unpredictable government making it harder.

Again, I can’t question the valuation for Chinese tech stocks – they are insanely cheap. No debate.

But you just cannot trust the Chinese government.

Therefore, if you are going to invest in Chinese stocks, then I would refrain from making a large percentage of your capital (e.g. limit it to less than 5%)

Outside BABA – Tepper was also reducing his exposure to US large-cap tech.

- Reductions in each of AMZN, META, GOOG and MSFT – however all together – these stocks still represent ~30% of his total holdings (a testament to their quality)

- A massive 85% reduction in NVDA – now just 1.4% of his portfolio (which is the same weight as INTC)

- New ~2% positions in KWEB (Chinese internet ETF) and ride-share company LYFT

Outside BABA – I like what he has done – especially with respect to NVDA.

I personally think NVDA could go lower – as it suffers from Q3 capex “chip indigestion”

For example, when we hear from them Aug 28th, don’t be surprised to learn two things:

- A beat on both the top and bottom line; however

- Softer H2 guidance – with large cap tech customers reducing their capex

I saw that as we saw similar “capex digestive cycles” with Cisco (CSCO) through 1997 to 2000.

CSCO saw several drawdowns of more than 30% as it made its way higher – peaking in 2000.

Their customers needed to digest the massive amount of capex made – as they expanded network infrastructure.

AI Chips will be no different… there will be ebbs and flows of capex cycles.

With respect to NVDA, I’m currently short $75 Nov Puts for a 14% annualized return.

If I don’t get the stock NVDA at $75 – then I’m very happy walking away with 14% on my risk capital.

As aside, I’ve taken a ~2% (half) position in INTC at an average price of ~$21.

It’s a high risk / high reward long-term bet. But at just 2% of my total investable capital – the stock could fall to just “$10” (half its tangible book value) and I’ve only lost ~1% of my overall capital.

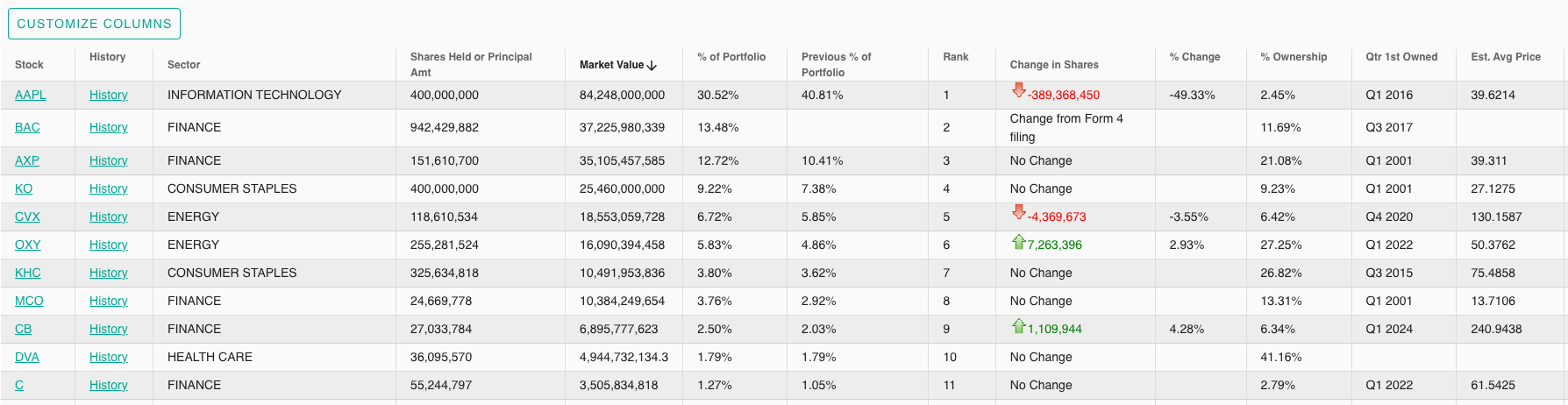

Buffett – Sells 50% of Apple and Cuts BoA

I mentioned Buffett’s 50% reduction in Apple last week.

Again, a prudent measure with the stock challenging a forward PE of 32x

This is the same reason I sold (before I learned of Buffett’s decision)

And whilst Buffett recently described Apple as one of the best businesses in the world and has said that he would own the company if he could — there is always a price he was willing to sell for.

That price is 32x its forward earnings.

The other notable move was selling 19.2 million BofA shares.

The selloff reduced the company’s holdings by about $1.5 billion, although it continues to own almost a 13% stake in the stock (about 1B shares)

This too was likely risk management.

I felt BoA was good value around $28 per share in March 2023 (read my justification to buy it here).

From my post at the time:

I think BAC will deliver an around 8% EPS CAGR going forward (taking into consideration further buybacks). Therefore, if we assume:

- PE Multiple expansion back to 11x (conservative)

- 2025 earnings at ~$3.97 (i.e., 8% CAGR)

- Estimate price of ~$44 in 2025

Based on the current price of $27.82 – that’s ~58%+ capital return plus 9% in expected dividends.

Things happened to turn out – it just happened a little faster.

However at the time – I had several (angry) readers telling me “... this banking crisis is worse than the GFC – banks are going broke – I would not be buying BofA”

My response “… and that’s what makes a market”

Note: it reminds me of what I was telling readers the other week. You buy quality when there is peak fear – and sell when there is peak greed. Reader feedback like this told me there was a lot of fear in the stock. This trade was a very good example.

I sold the position at ~$42.00 – as I felt the upside gains over the next 12 months did not handily outweigh the downside risks.

Here’s a tip:

Quality banks are a good buy at 1x book value – however look to sell them at 2x book. And for me – Bank of America is not worth near $50 per share.

Here’s Buffett’s trades the past quarter (for positions above 1% of his portfolio)

As an aside, the media was calling out “Buffett’s” new position in beauty retailer ULTA

This position is just 0.1% of his portfolio.

Whenever I see Berkshire taking less than 2% stake in any company, I don’t think it’s Warren buying.

Buffett allows a couple of his proteges to invest Berkshire money (at their full discretion) – and I think ULTA was an example (AMZN perhaps another).

Several Activists Buy Starbucks

Readers will also know the other stock I added to last quarter was Starbucks (SBUX).

Starbucks – not unlike Nike – had been sold heavily due to a host of business concerns (and some of them valid).

However, I believe it’s a good business – representing fair value below $75.

As such, I felt it was worth a 2% (half) position.

Recently I’ve read that no less than three prominant activist investors have been buying the stock.

- Elliott Investment Management

- Starboard Value; and

- Trian Fund Management (Nelson Pelz)

However, I believe that Trian was happy “trading” the stock on the near 25% stock surge following news of the CEO replacement.

I was happy seeing both Elliot and Starboard getting involved. Maybe they saw what I did. Here’s Elliot’s statement:

Elliott has become one of the largest investors in Starbucks because of our confidence in the long-term value-creation opportunity we see at one of the world’s most important brands.

Elliott has been engaged with Starbucks’ Board over the past two months regarding our perspectives on the Company’s key issues, and we view today’s announcement as a transformational step forward for the Company. We welcome the appointment of Brian Niccol, and we look forward to continuing our engagement with the Board as it works toward the realization of Starbucks’ full potential.

Not unlike Nike, I think it’s one of the world’s most important brands trading at a “fair” price.

Since I bought the stock – it’s up ~25% (which is just luck) – but it still has far more potential.

And perhaps Brian Niccol will be the right CEO to turn things around.

But it’s going to take him time…

Putting it All Together

13Fs are a terrific insight.

It gives you a glimpse into what leading fund managers are doing with investor money.

As I say, I favour those with very long successful track records (those who outperform the S&P 500)

I was not surprised to see the strong selling in large cap tech.

When I made the decision to do the same thing over the past few months – I felt the upside reward no longer handily offset the possible downside risk.

That’s when it’s time to sell (or at least reduce exposure)

As I wrote in June, selling is how I manage my risk.

I believe this is what the likes of Ackman, Tepper and Buffett (and many others) were doing last quarter.

They took advantage of excessive valuations in some of these names.

Equally they capitalized on value when it was presented.

For example, last quarter when I pulled the trigger on stocks such as (not limited to) McDonalds, AbbVie, Starbucks, Nike and Intel – I felt these were good businesses trading at fair value.

And just like Bank of America – some readers quick to tell me why they would not buy these stocks (it happens every time 🙂

But it’s thanks to negative reader / investor sentiment like this that I’m able to get the stock cheaper!

For example, if everyone loved the stock (and had the same idea – like we see with say Nvidia) – then they would be trading “40x earnings” – and the chance for upside would be minimal.

Now will these bets prove correct in 3+ years?

I don’t know…

Maybe one or two will lose 20-30% – that would not surprise me.

That’s why riskier bets only represent no more than 4-5% as a full position.

And maybe some could more than double?

For now it would appear businesses like Nike and Starbucks are attracting the eye of smart money for the same reasons I identified.

But we will see how things go… it’s still very early.

Just because a few of these trades are up in the realm of 10% to 25% – there’s a long way to go.