- S&P 500 gives back 4.9% for the month

- Stocks finally recognize ‘higher for longer’ rates

- Inverted yield curves don’t predict recessions… they cause them

Coming into September – I reminded readers it has the worst record of any calendar month.

The Trader’s Almanac tells us the S&P 500 has lost an average of 1% each September over the past 10 years.

And over the prior 25 years – the average monthly returns are -0.67%

Dismal.

This year, the S&P 500 gave back 4.9% for the month

September’s reputation remains in good stead.

But it wasn’t just September – stocks hit the pause button after June.

For the quarter, the Index surrendered 3.64%.

The Nasdaq fared far worse – losing 4.12%

None of this should come as a surprise…

But it did to some.

Stocks were very expensive coming into Q3 – as I will talk to below.

Priced to perfection you might say.

But stocks were not the story this quarter… the main event belonged to fixed income.

Stocks simply went along for the ride…

Bond prices plunged in September sending yields (and interest rates) sharply higher.

Higher yields have a knock on effect which impacts everything.

For example, from mortgage rates… to government debt… to business loans … to student debt… to credit cards… name your poison.

The rate will be determined by the 10-year yield.

For example, 30-year fixed home loan rates are now the highest they have been since 2001.

Now the US 10-year yield went from just 3.85% at the end of June to test 4.60% this week.

And given how much debt the government needs to issue – it’s likely to go higher.

Equities are officially on notice.

Recalibrating Valuations

Earlier this week I said stocks are in the process of recalibrating the prospect of rates remaining higher for longer.

Coming into September – this wasn’t part of the narrative.

Equities (falsely) assumed that rates had peaked and were on their way down.

I felt that was highly presumptuous given (but not limited to):

- Core PCE was more than twice the Fed’s target; and

- Unemployment was at a very strong 3.8% (i.e. full employment)

Ahead of the Fed’s meeting on Sept 20 – the December 2024 Fed Funds futures was 4.57%

However, that soon changed…

Powell delivered his (consistent) message that rates are likely to remain high – indicating they may not be done.

Equities didn’t like the Chair’s tone. Bond yields surged and equities plunged.

Here’s what matters:

For equities to justify their lofty “19x” forward multiple (where they traded prior to Powell’s address) – I felt we would need to see bond yields trade a lot lower.

Why?

Because the equity risk premium simply wasn’t there.

In fact, it was basically zero.

And as bond yields continued to rally – there was only going to be more pressure on stock valuations.

Something had to give (I will explain with a chart below)

So here’s a question:

With the S&P 500 recalibrating to the tune of ~8% from recent 4600 highs – are they now fairly valued?

My answer is ‘partially’.

But as an Index – they are not yet cheap.

For example, with the S&P 500 trading 4288 and 2024 earnings expected to be $235 per share (which assumes no recession next year) – that’s a forward PE of 18.2x

The inverse of 18.2 = 5.50% (i.e., the earnings yield)

By comparison, the 12-month Treasury yields 5.45% (which is risk free).

So where is the compensation (i.e. premium) if owning (risky) stocks?

There is none.

Let’s go one step further…

A lot of that 18.2x multiple is due to (overpriced) tech stocks – commanding forward multiples anywhere from 24x and above.

That’s high – especially given where yields are trading.

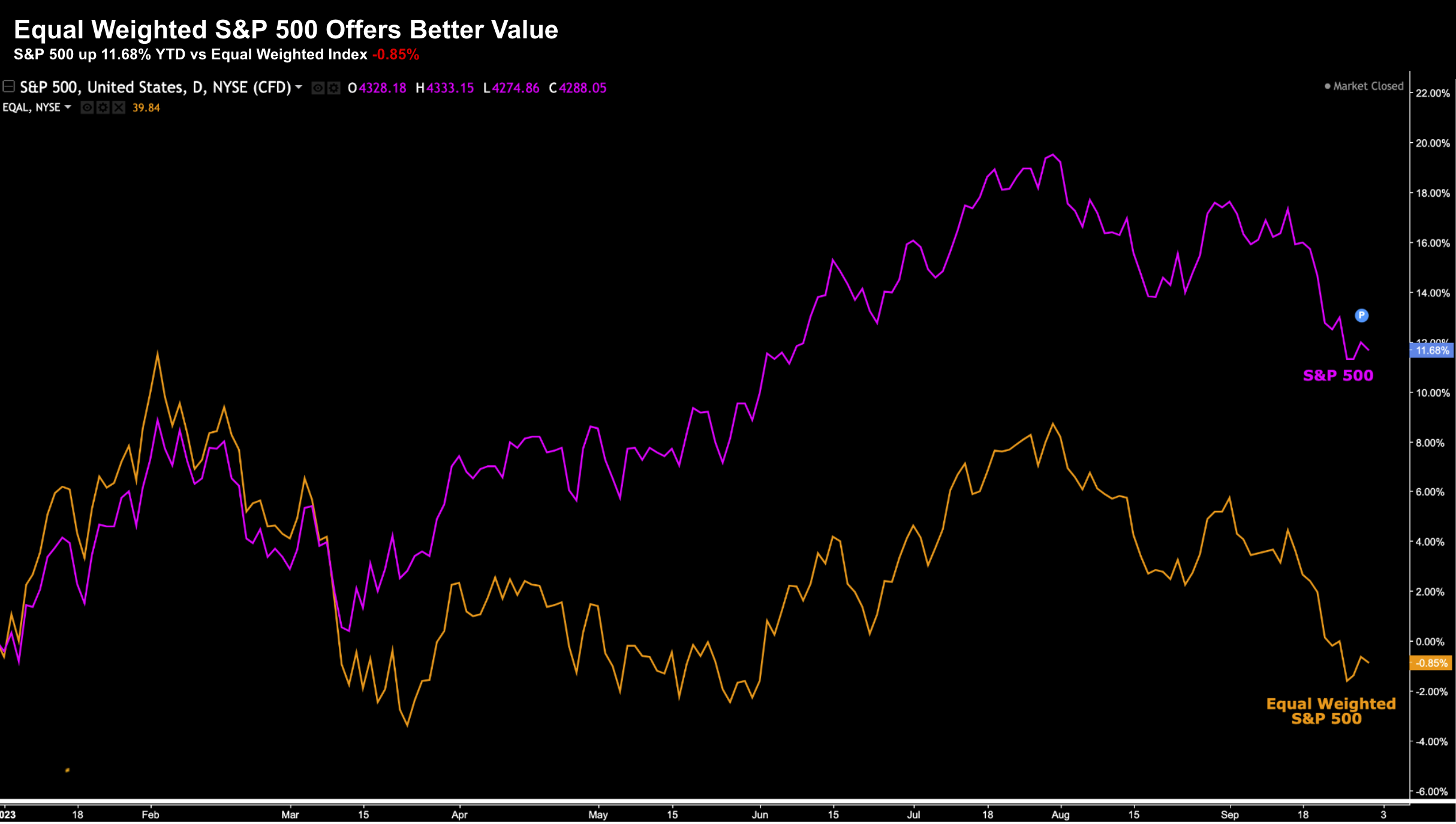

But if we only consider the equal weighted S&P 500 – it’s trading closer to 15x forward earnings.

1/15 = 6.67%

That’s better…

In other words, I think there could be value in the equal weighted portion of the market (less so in tech)

Sept 29 2023

The reason the S&P 500 shows such strong divergence from the equal weighted is what we find with large cap tech (and specifically around 7 stocks). Take those out and it’s a different story.

More on the S&P 500 weekly chart shortly… for now let’s revisit yields.

Yields to Determine the S&P 500’s Fate

Most of the price action in bonds last quarter was anchored at the longer end.

Not unlike the S&P 500, the US 10-Year Treasury has not recouped its levels from July 31st

For example, three months ago the yield on the 10-year was 3.96%.

We have not revisited that level since then… it’s only gone up.

Fast forward one month and they nudged their way to 4.11%.

At the time of writing, the 10-year rate is now 4.57% (after today’s slightly softer than expected Core PCE print of 3.9% YoY).

But what do we see at the short-end?

It’s stagnant.

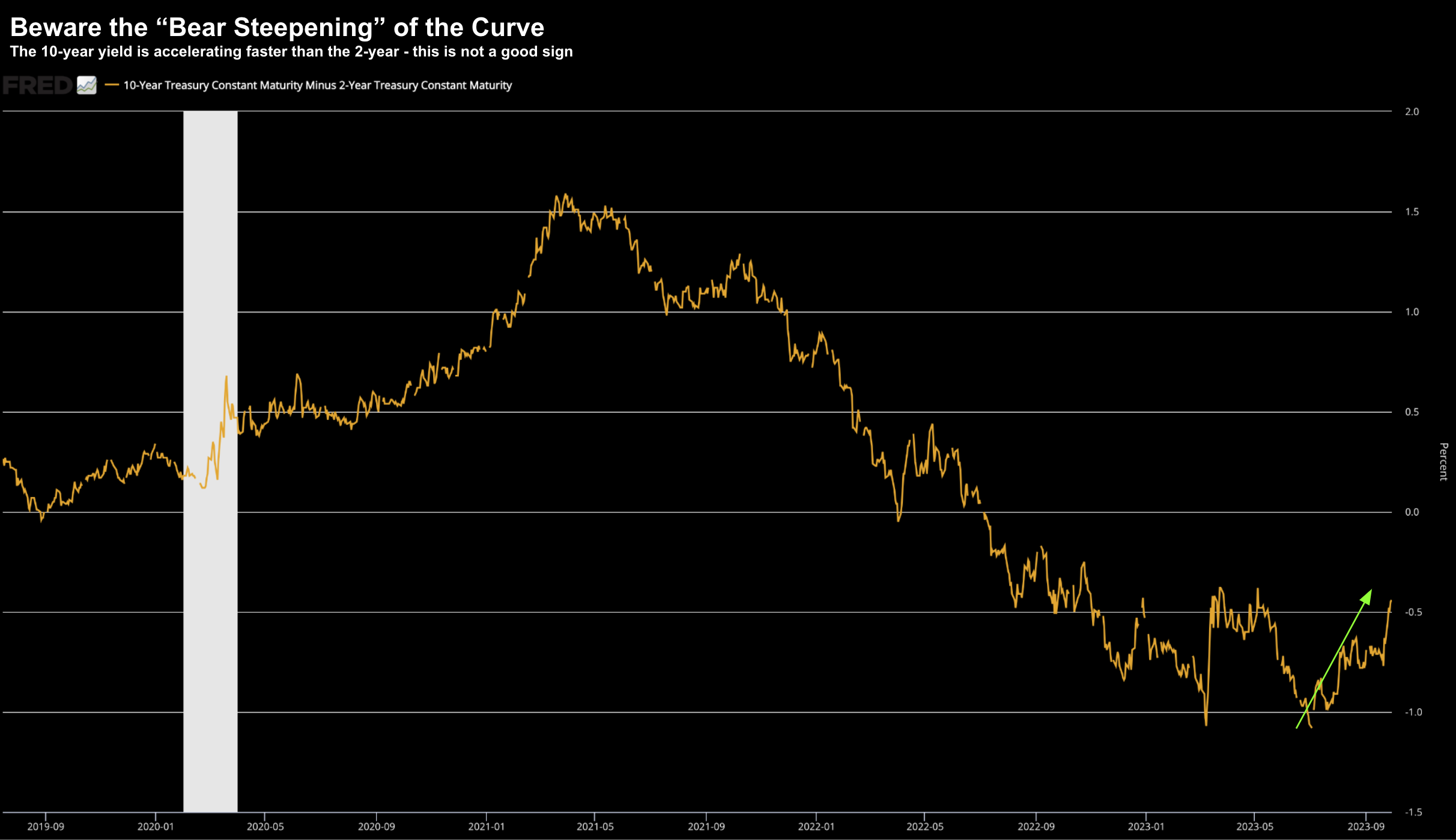

As a result, over that same period, the 2-10 inversion went from 92 basis points (bps) to around 44 bps today.

This is because the 10-year has been rising at a faster clip than the 2-year.

That’s not a good sign…

For example, a couple months back I described why this is a warning signal: “Beware the Bear Steepening of the Curve”

Sept 29 2023

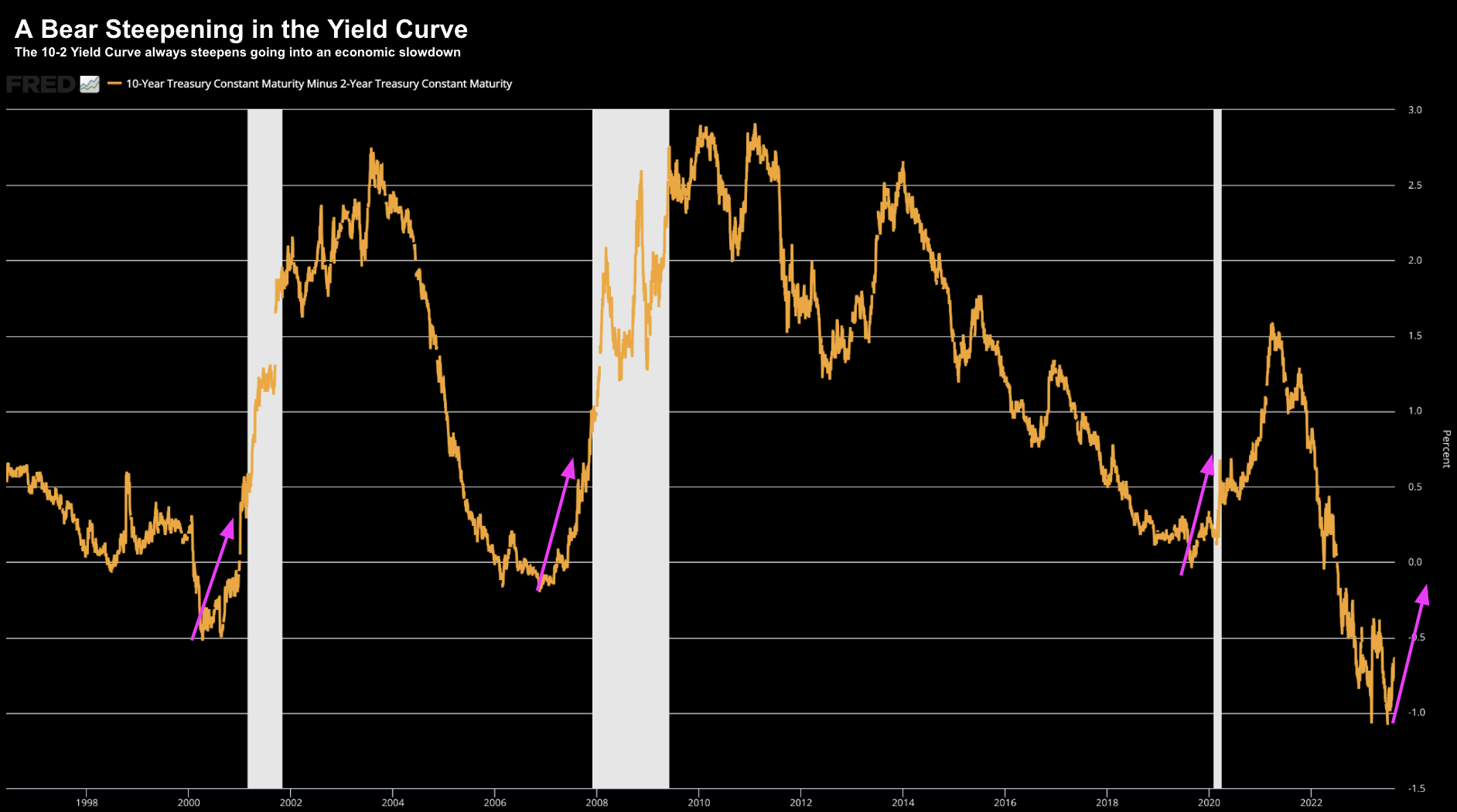

I often like to say that inverted yield curves don’t predict recessions (as many like to say) – they cause them.

However, the recession only begins after the curve normalizes.

And that “normalization” is the re-steepening of the curve.

Here’s the chart I offered August 22nd:

August 22 2023

The Great Divergence

Now this is the chart which shows the recalibration about to take place.

And it’s important…

Below is a comparison between the S&P 500 (purple) and EDV (Vanguard Long-Dated Treasury Bond Fund) for 2023

Sept 29 2023

Let me explain:

For the first two quarters – these assets traded roughly in lock-step (what you might expect)

However, from late May, we see the dramatic divergence between bonds and stocks.

From mine, this was stocks choosing to ignore what was happening in fixed income.

That’s now just starting to change…

Equities have noticed the (bear) steepening of the curve and realize that the odds of a 2024 recession are now increasing.

As an aside, they were less worried about the inverted curve.

However, they’re not thrilled with the sharp rise in the 10-year yield against a stagnant 2-year.

These two lines will ultimately converge.

For example, if the market thinks a recession is more likely, then the white line (bond prices) will rise (i.e., bond yields will fall); and participants will sell stocks (i.e. the purple line falls).

Sure, this may not happen in the next few months (as we enter a seasonally strong part of the year) – but my bet is this closes.

And my way to play that is by adding exposure to long-term bonds.

Put it this way:

Stocks are still arguably expensive (at a forward PE of 18.2x).

However, with the 10-year trading around 4.50% (possibly going higher) – bond prices are not expensive.

Let’s close with how the S&P 500 finished September

Lousy Month for Stocks

The S&P 500 had a terrific start to 2023.

Just over half way through the year – the market was up close to 20%.

That helped offset some (not all) of the pain of losing almost 20% last year.

(Note: the market would need to rally 25% to recapture the 20% lost last year)

But if we look at the latest quarter – it’s been tough sledding.

Again, look no further than the headwinds such as interest rates, oil prices and stubborn inflation.

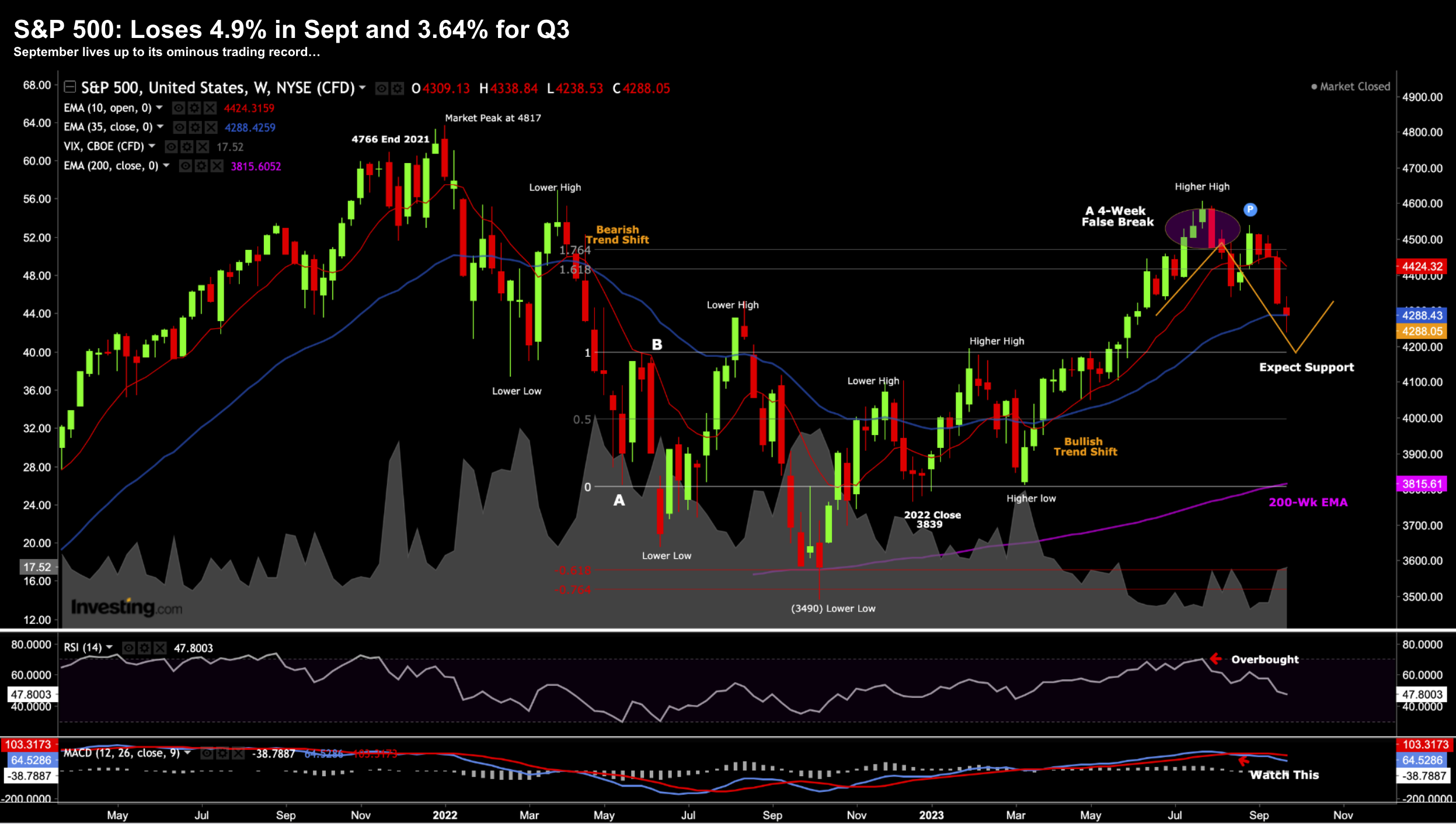

Let’s take a look using the weekly chart:

Sept 29 2023

Now if you’re a bull – there’s good news.

The S&P 500 remains in a strong bullish weekly trend.

Therefore, it’s likely prices will catch a bid and rally.

For example, the 10-week EMA (red line) is above the 35-week EMA (blue) line. When we see this – dips are usually bought.

I expect we will see buying support around the 35-week EMA zone.

For example, if you look at this week’s candle, we dipped just below the 35-week EMA but closed right on it.

The candle’s ‘tail’ shows us there was good buying support around 4200 (what I suggested we might see)

What’s more, we are coming into what is traditionally a very strong time of year (November and December).

That’s the good news….

Now if you’re a bear – you also have a couple of things to keep you interested.

First, rising bond yields are your best friend.

Second, a government shut-down will be helpful (if nothing else will bring some volatility – but won’t impact stock prices that much)

Third, $90/b+ oil is not doing you any harm at all (it only increases the chances of further rate hikes)

And from a technical stance – the bulls have lost all momentum.

Their fading.

For example, if we look at the weekly-MACD (lower window) – it’s trending lower.

What’s more, when prices rallied to the 61.8% to 76.4% zone outside the distribution labelled A-B, they failed.

This tells me that stocks are most unlikely to mount another charge to 4800 this year.

They could – but I would be surprised to see the market make new highs.

However, whilst I’m not a bull – I’m not a raging bear either.

From mine, stocks will continue to muddle in this range bound market.

And their direction will be a function of bond yields.

Again, if we see the 10-year test 5.0%, equities could fall sharply.

To that end, if the S&P 500 tests the zone of 3800 to 4000 – don’t be afraid to add quality names to your long-term portfolio.

And if we see 3600 – add some more!

Putting it All Together

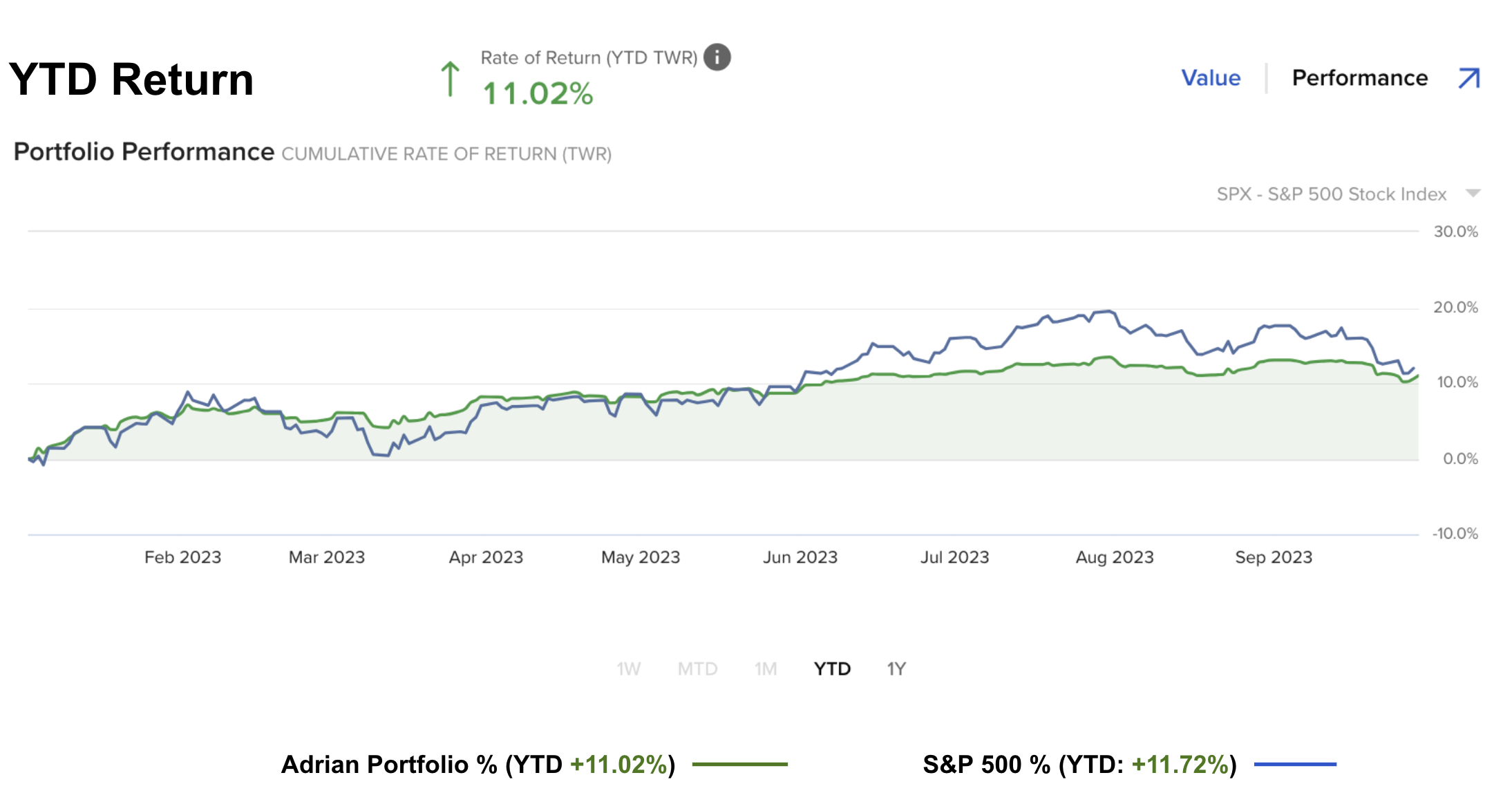

Given I didn’t increase my exposure to stocks the past few months – downside to my portfolio was limited.

I did fare better than the market (as I will show below)

For example, at the end of August, I trailed the S&P 500 by ~6%.

The index was up ~19% and I was up around 13% (given my exposure was only 65% to equities)

Fast forward to the end of September and the difference is now only 0.7%

We are basically “neck and neck” going into Q4.

3 Months to Go: Tight Race to the Finish

The downside to my portfolio was mostly in bonds and tech.

I increased my exposure to the ETF EDV – starting at a price of $76.

So far this position is under-water – but my view isn’t short term.

I hope to make money on this trade over the next 12-months (not the next 3 months) — where I expect the 10-year to trade back to a level of around 3.50%

If we refer back to the earlier chart showing the EDV vs S&P500 – I expect that gap to close.

Again, if we see a recession next year (which I expect) – yields will drop.

Now I mentioned I started my position in EDV around $76. I say that because if I see EDV trade down to ~$65 (e.g., if the 10-year pushes 5.0%) – I will add more.

I don’t pretend to be able to pick tops or bottoms.

That said, I’m also keeping a close eye on quality tech names.

For example, I would be happy picking up Apple around $160 to $165.

Amazon looks attractive between $100 and $110. And Google looks like a good long-term bet closer to $110.

Right now they are all too expensive given what we see with bond yields.

Their multiples are exceptionally high and they face major headwinds (e.g. meaningfully weaker consumer, high oil price, stronger dollar the past quarter etc)

And of course if I see the Index trade ~4,000 – I will likely add some SPY.

If we are lucky enough to see the S&P 500 trade 3,800 – I will add more – taking a 3-year view.

Finally, if bond yields continue to rally (especially given how much debt the government is trying to sell) – equities will remain under pressure and could offer more attractive long-term buying opportunities.