- Another bear market rally in the making – don’t trust it

- Earnings remain the market’s next major hurdle

- New Zealand’s economy is floundering opposite rate rises

Markets have a small spring in their step…

The S&P 500 chalked up four winning days in a row… its best effort so far this year.

Tech and higher-growth stocks the clear winners.

But don’t trust it…

This is a bear market rally. Nothing more.

It will suck a few people in (as they do) but what’s changed?

And whilst the rally could go further (4200 at a guess) – my bet is strength will be sold.

Repeating what I wrote last week – I want to see three things:

- The Fed to pivot on their aggressively hawkish language;

- Earnings revisions to come down; and

- The VIX to (ideally) trade above 40

So far we are zero for three.

Now we get CPI next week – with economists expecting a number north of 8% YoY.

Anything in that realm won’t do much to change the Fed’s stance.

We know the central bank will deliver another 75 basis points increase for July… that’s fully priced in.

Their commitment to “beating inflation into submission” is unlikely to deviate.

But from mine, we are yet to see earnings revisions come down.

They will.

And when they do – expect them to get ratcheted down again (e.g., not unlike the two revisions we saw back-to-back from Target and Restoration Hardware recently).

In summary, expect short sharp rallies where we make ‘lower lows and lower highs’.

I provided this detailed analysis for the bear markets of 2000 and 2008.

2000 saw no less than 7 bear market rallies of at least 8% (3 of which were 20%) on the way down.

The great recession of 2008 saw 4 bear market rallies – of which 2 were almost 20%.

My feeling is we are ~70% of the way to a market bottom…. but that’s just a guess.

It’s great progress…multiples have come down… but there’s more to come.

New Zealand Deserves Watching

Not only is New Zealand (NZ) one of my favourite places on the planet… it’s also one of the world’s most spectacular.

If you haven’t visited – it should be on your bucket list.

NZ is a small economy with GDP of ~$213B and a population of just ~5M.

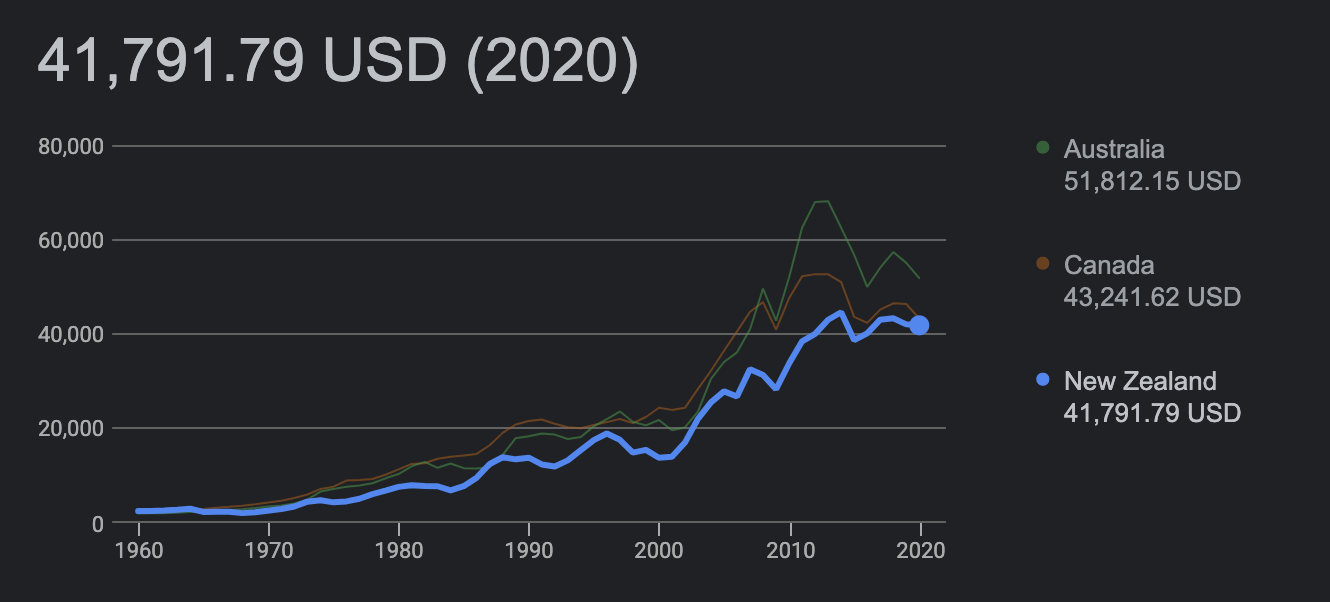

It’s GDP per capita is ~US$42K – very similar to Canada and slightly lower than Australia’s US$51K

By way of comparison – the US is ~$64K and China is ~$10.5K

Despite their size – they punch well above their weight.

But the actions of their policy makers deserves watching.

According to Bloomberg’s Matthew Brockett and Enda Curren – NZ has a knack for “leading the global policy cycle”.

For example, thirty years ago it pioneered inflation targeting. And 2022 has not been any exception….

Brockett and Curren state:

“Its status as a small, open, trade-reliant economy means it often reacts to growth trends quickly, making it the ‘canary in the coal mine’ for the global economy“

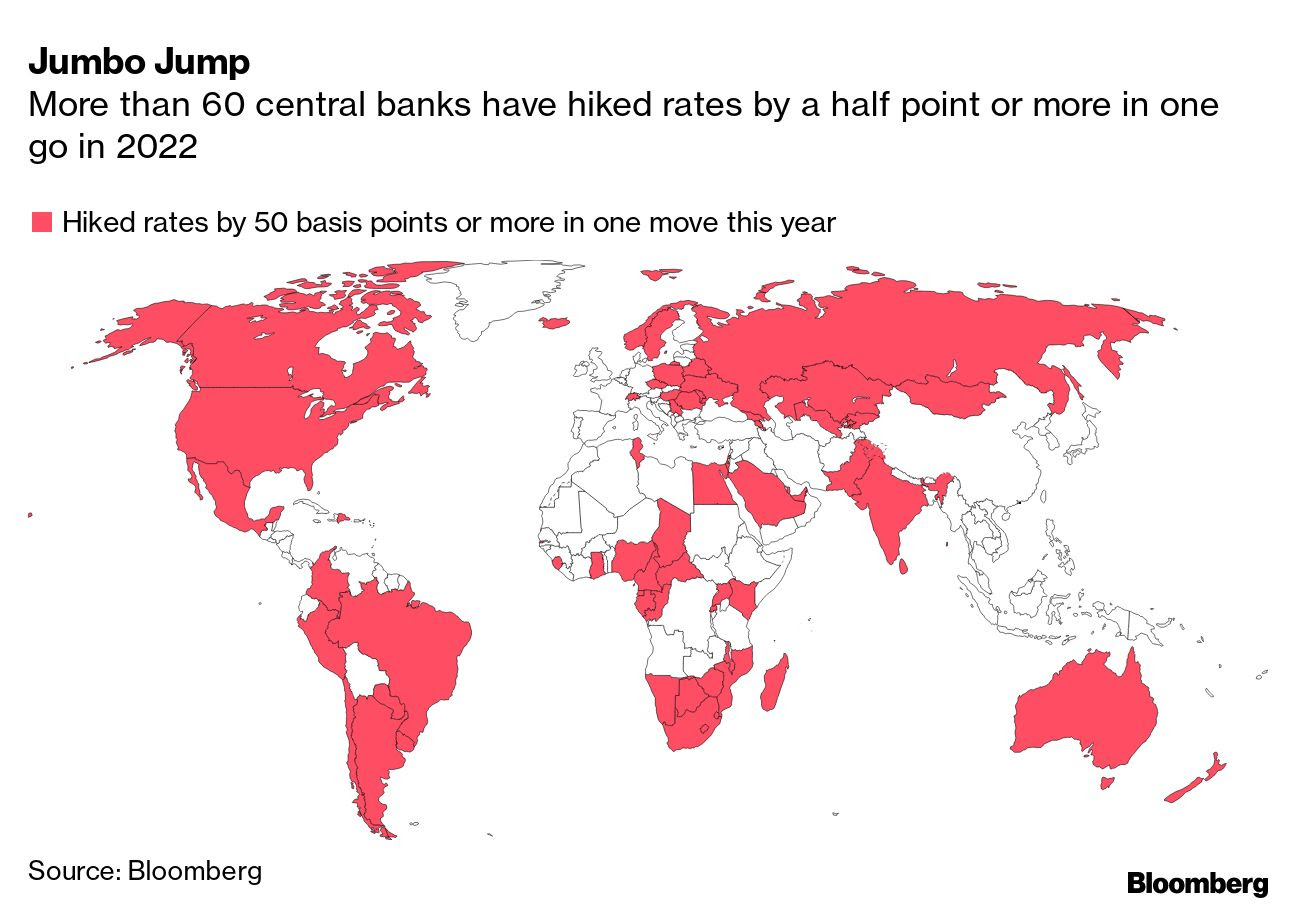

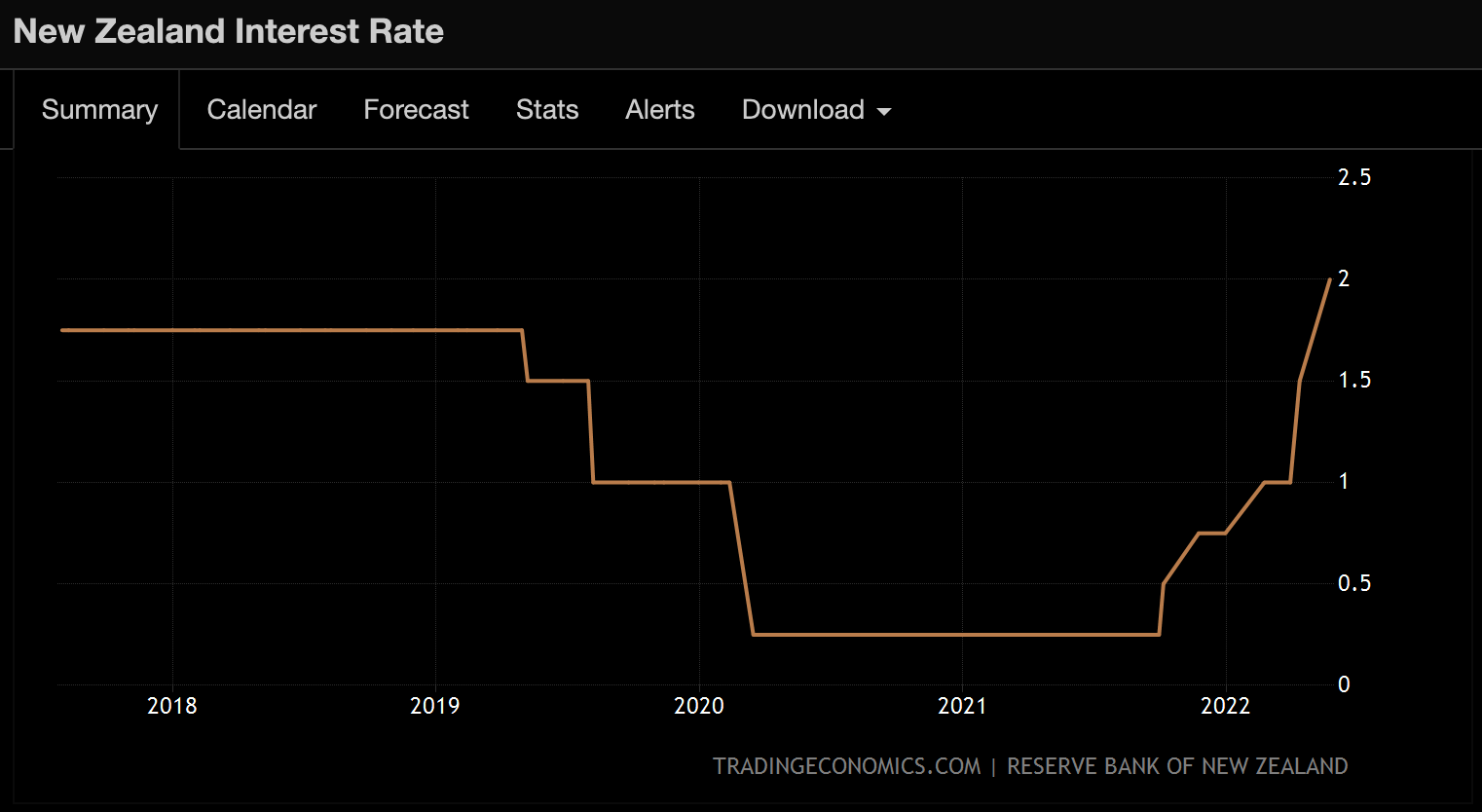

For example, their central bank were one of the first to start withdrawing pandemic stimulus last year; and their decision to hike rates was ahead of the US, Australia and Canada.

Given this, it pays to observe any advance lessons.

And in this case, the economic impact of rate hikes has been swift.

Business confidence has slumped and house prices are falling — suffering their biggest quarterly drop since 2009 in the three months through June.

Further to this post, I see a similar pathway for Australia’s housing market.

As it stands today, their central bank are committed to continuing to hike rates.

Here’s Reuters (July 8th):

The Reserve Bank of New Zealand (RBNZ) will deliver a third successive half-point interest rate hike on Wednesday and a fourth next month in its most aggressive policy tightening on record to control soaring inflation, a Reuters poll found.

A front-runner in withdrawing pandemic-era stimulus among its peers, the RBNZ will extend its hawkish stride to curb the highest inflation in three decades, at 6.9%, despite growing risks of an economic downturn

In May, the RBNZ projected that the Official Cash Rate (OCR) would climb to 3.95% in the third quarter of 2023, implying a 4% peak, with modest rate cuts beginning in mid-2024.

However, with house prices crashing and the economy going into reverse – it seems unlikely their central bank will be able to achieve their OCR objective.

Most local economists don’t see the OCR exceeding 3.5% – with their central bank pivoting as early as next year.

As an aside, I see the US Fed Reserve and Australia doing something very similar next year.

All economists in a Bloomberg survey expect the RBNZ to lift their cash rate to 2.5% from 2% on July 13.

“After the RBNZ slammed the brakes, the first skid marks have appeared on New Zealand’s economic road,” said Frederic Neumann, co-head of Asian economics research at HSBC Holdings.

“The contours of a shift in direction are becoming faintly visible in the distance. The signs are thus pointing towards a broader let-up in monetary tightening elsewhere.”

Putting it All Together

Yesterday I suggested that bond markets could be looking beyond the near-term inflationary risks of 2022/23.

For example, 5-Year inflation ‘breakevens’ are now some 100 basis points lower at just 2.50%

That’s a massive shift from a few weeks ago.

Expectations of the Fed’s effective funds rate have subsequently fallen from 4.00% at the end of 2023 to just 3.00%

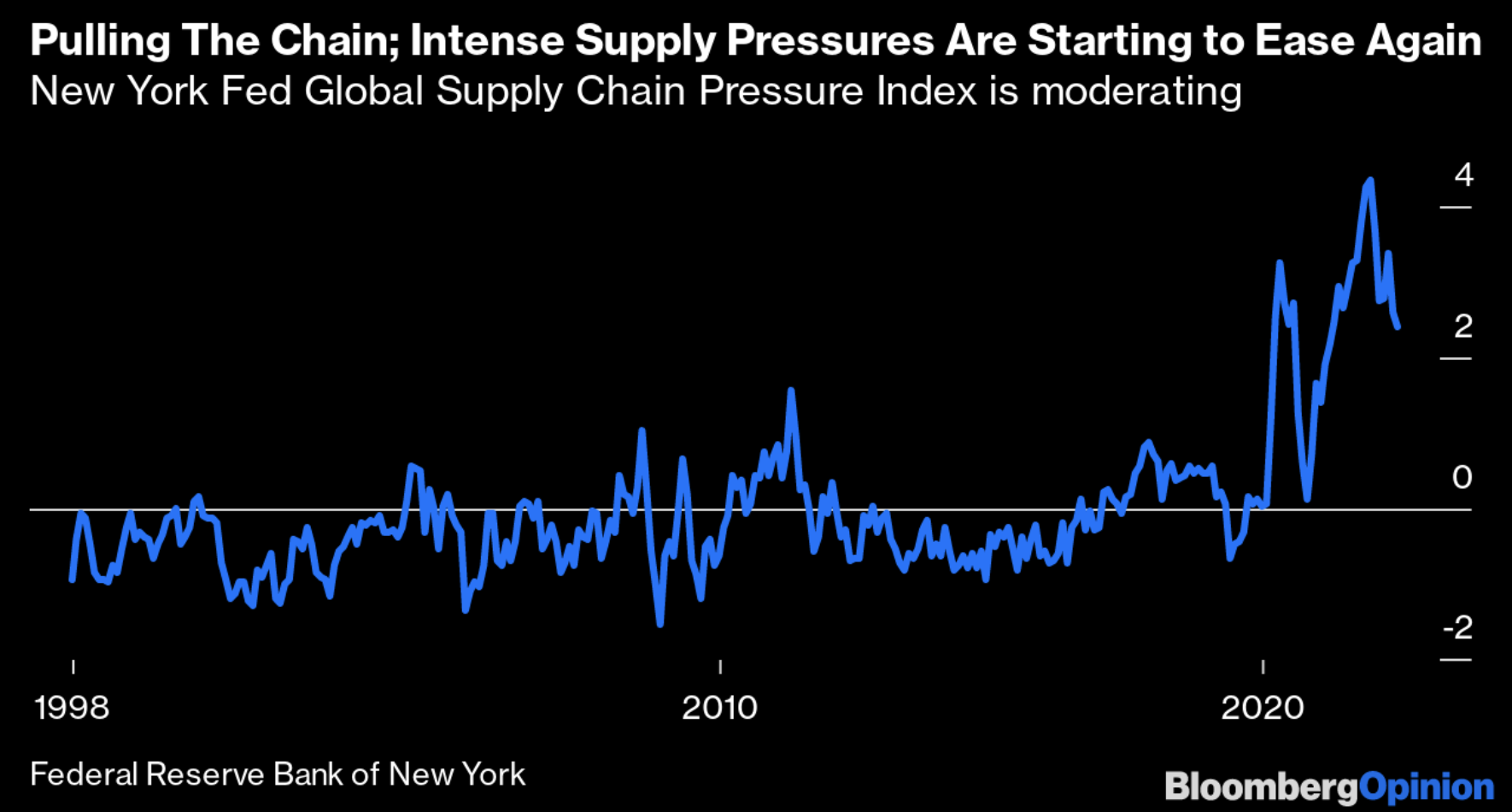

Adding to yesterday’s missive – the New York Fed’s index of global supply chain pressure, which blends shipping and freight costs and other measures of how swiftly supply chains are moving.

These rose sharply in 2020 – rapidly declined – then surged opposite a second wave of COVID lockdowns. However, the latest version of the index shows that pressure remains elevated, it is starting to work its way lower.

But the focus is quickly turning to what economic impacts are to follow (e.g., hence watching ‘advance’ countries like New Zealand)

Central banks are hiking aggressively into (global) slowing growth.

And from mine, that is not conducive to meaningfully higher stock prices in the near-term (quite the opposite)

But at some point, central banks will pivot on rates (as they do) and it will be “risk on”.

Unfortunately, there’s a lot more “wood to chop” between now and then.

Let’s see how US monthly CPI comes in next week… needless to say it will be closely watched.