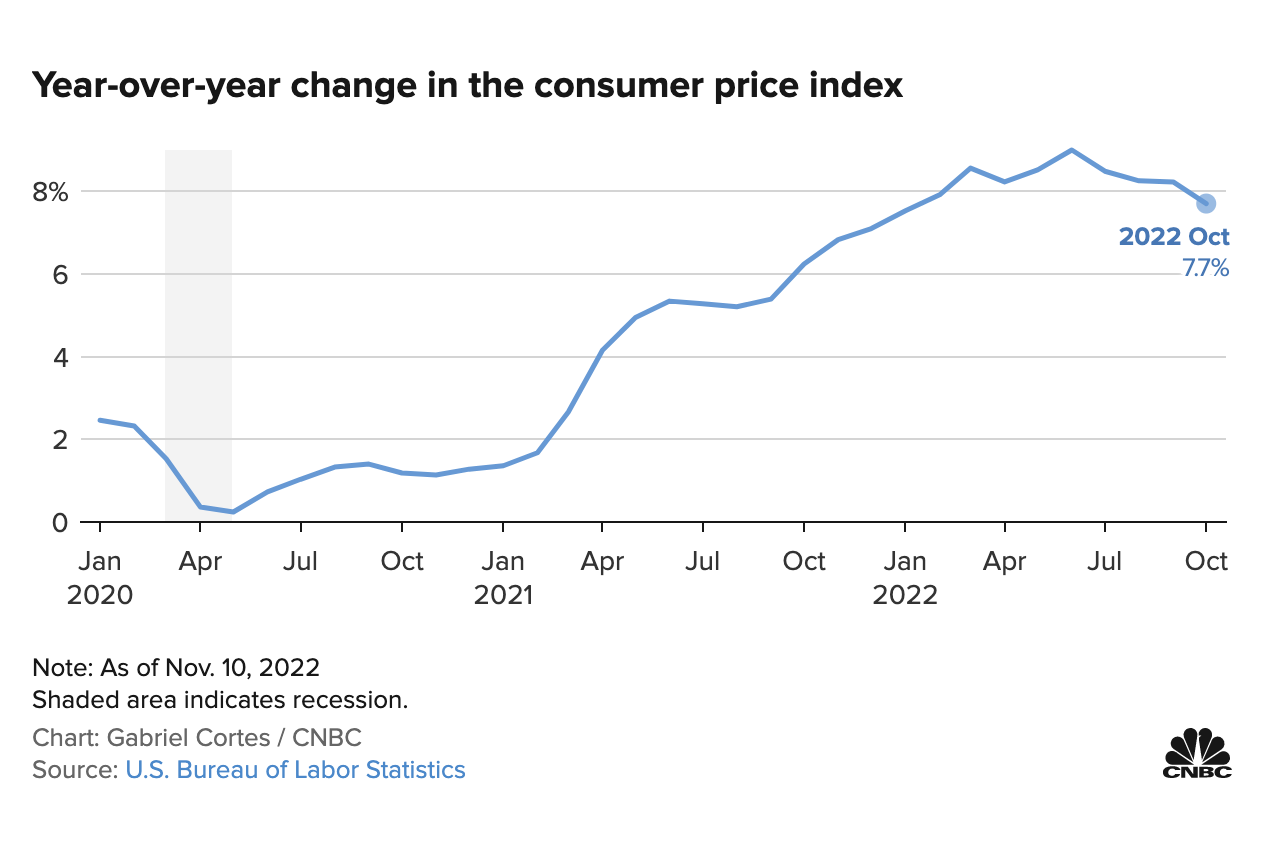

- CPI slightly softer at 7.7% YoY

- Fed fund futures see 50 bps for Dec (not 75)

- Rally could see S&P 500 at 4100… but I would fade it there

Sounds painful…

If you haven’t heard the term “rip your face off rally“… today was one of those days.

Equities had their best day since April 2020 — as bond yields and the dollar fell sharply.

The Nasdaq ripped higher by a whopping 7.4%

Now a rally of this magnitude can hurt if you are positioned on the wrong side.

For example, those betting on a higher inflation number were panic buying today.

That’s what it smelt of.

And if you were leveraged short… that’s when your ‘face gets ripped off’

Maybe it’s similar to what poor Sam Bankman-Fried is feeling about now… sounds like good old fashion theft (using client fades to trade and then getting it wrong – more to come on that I’m sure)

Getting your face ripped off happens when the market viciously turns higher in the other direction.

But it happens so quickly it is typically only noticed when you look up from your keyboard to ask your trading partner what happened, and he only sees a pair of lips and what used to resemble a face.

It’s not often you see the Nasdaq rally 7.4% in a session.

And trust me – it’s not a good thing.

Yes – the gains were nice and my portfolio did exceptionally well (given I am ~65% long).

My YTD position is now down ~3.5% (vs the S&P 500 down ~17.0%) – a small fighting chance to turn positive for the year.

Adrian vs S&P 500 – The Race to the Finish

With 40 calendar days left – who will win the title for 2022?

Place your bets.

But let’s dig into the source of the rally – a slightly softer CPI (and core) CPI print.

The market expected headline CPI of 7.9%… it came in at 7.7%

However, is that reason to think everything is now “sunshine and rainbows” – with the VIX plunging to just 23?

Hardly.

Trust me, we will see a much higher VIX in the coming months… it’s not far away.

So What’s Changed?

I will get to the “rip your face off rally” in a moment with the weekly chart … but first let’s check in with the inflation data.

What was ‘good’ about it (apart from used-car and apparel prices falling)?

As I wrote yesterday – the good news is inflation for October was slightly lower than expectations… and well down from its June 9.1% peak.

The bad news is it’s still a boiling 7.7%.

Maybe you could say we have gone from white hot (over 9%) to boiling (just below 8%).

But this is what you should ask yourself: does 7.7% materially change the Fed’s mindset?

Of course not.

Here’s the San Francisco Fed President Mary Daly post the inflation release:

“One month of data does not a victory make, and I think it’s really important to be thoughtful that this is just one piece of positive information, but we’re looking at a whole set of information,” San Francisco Fed President Mary Daly said in response to the CPI data.

“We have to be resolute to bring inflation down to 2% on average,” she added in a Q&A with the European Economics & Financial Centre.

“That’s our goal, that’s what Americans depend on, and that’s what we’re committed to doing. So we’re going to continue to adjust policy until that job is fully done.”

Or as I like to say “one hot month doesn’t make a summer”

Now if we see “7.4%” next month; say “7.0%’ in January; and perhaps “6.5%” in February… start to get excited.

Four data points like this and you can suggest we have a trend.

But until then, there’s a lot more to do.

As Daly suggests – there’s nothing in this print to suggest the Fed can either pause or pivot.

At best, the Fed may pump the breaks on 75 bps for December… perhaps only raising 50.

But if it were me… I would kill this sucker dead with another 75 bps.

And whilst the Fed may slow the pace of hikes (and they most likely in the first half of 2023) — they are not done hiking.

Are we closer to the end?

Yes. Of course.

Have we now done a lot of the heavy lifting?

Absolutely!

But we are headed to at least 4.75% next year…. and rates are likely to stay there for longer than most expect.

And that’s what markets are not pricing in… how long rates stay elevated.

Let’s Dig In to CPI

Here’s a selection of things that matter most to average households:

- Health insurance – up 20.6%

- Utilities – up 20%

- Gasoline – up 17.5%

- Food – up 10.9%; and

- Shelter – up 6.9%

These are all non-discretionary items. You can’t do without them.

Things like apparel, flights, used-cars, movie tickets etc… they are all nice to have. But we can defer those purchases if necessary.

But you are not deferring food, health, energy, utilities or rent.

Not if you can help it.

Shelter costs, which make up about one-third of the CPI, rose 0.8% for the month, the largest monthly gain since 1990, and up 6.9% from a year ago, their highest annual level since 1982.

As we know, rents (and wages) are sticky.

Also, fuel oil prices exploded 19.8% higher for the month and are up 68.5% on a 12-month basis.

What’s more, the food index rose 0.6% for the month and 10.9% annually.

Time to do cartwheels?

Not from my lens.

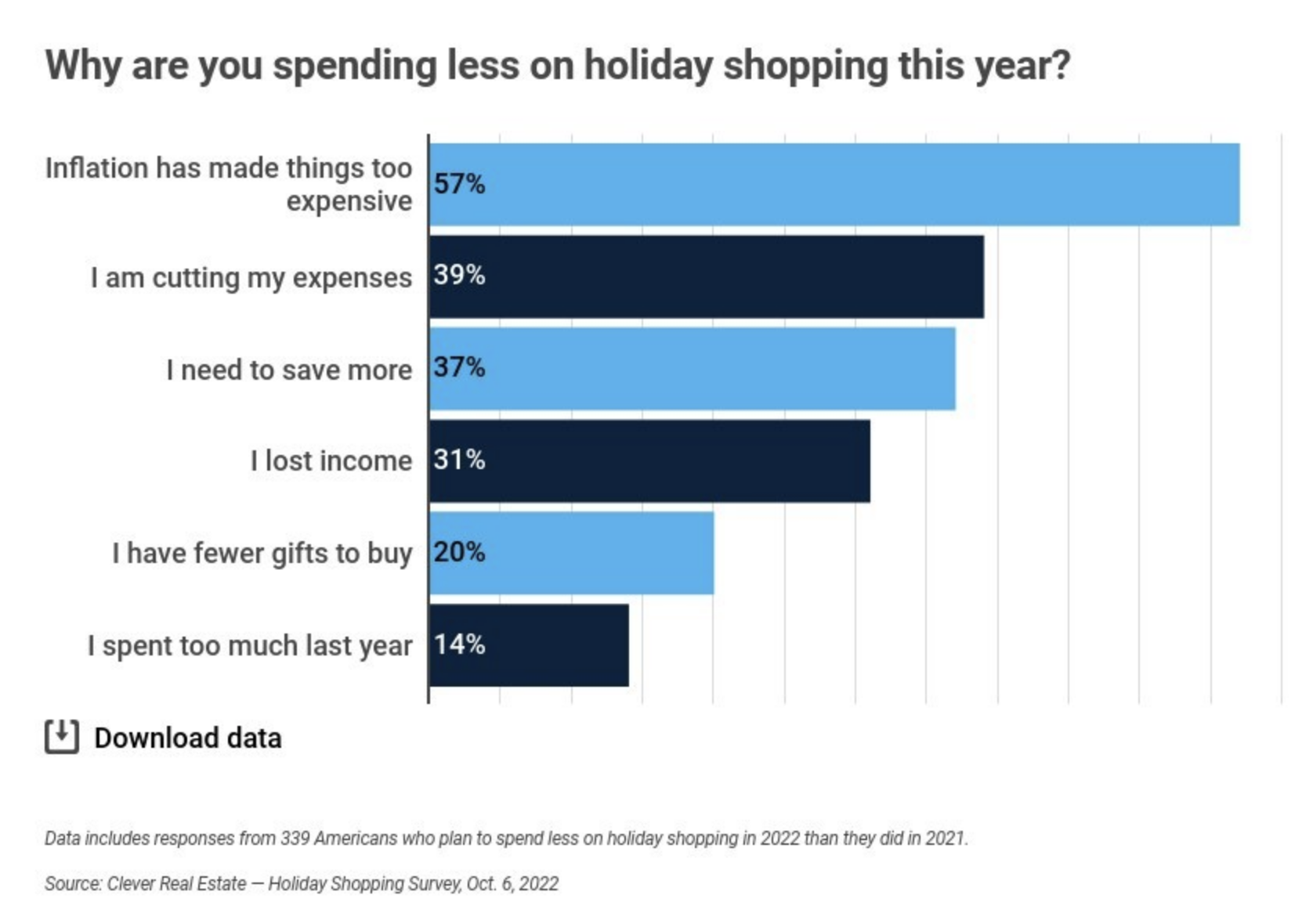

From example, a recent survey by Clever Real Estate found that about 1 in 3 Americans plan on cutting back spending this year due to higher prices.

Given the above survey – it goes without saying that getting inflation down is critical heading into the holiday shopping season.

But traders quickly changed their expectations regarding the Fed’s next move.

And I think it was a knee-jerk reaction – made with little (longer-term) thought.

Futures tied to the fed funds rate indicated an 80.6% probability of a 50 bps move in December, up from 56.8% a day ago, according to CME Group data.

But that’s the thing – markets are poised to respond to anything remotely positive.

Given how negative sentiment has been (especially in long-duration assets like tech) — it’s like a massive coiled spring.

The Coiled Spring

I’ve often said that the sharpest rallies will happen in bear markets.

Today was the perfect example.

With so many traders positioned short… today was a mad scramble to cover.

Look no further than the “Cathie Wood” names – her ARK Innovation Fund had its best day in 2 years.

Short covering.

But what I also know is these rallies are not to be trusted. We remain in a firm (strong) bearish trend.

And whilst there’s every chance this rally could push to 4100 (especially given the seasonality of the market) — that’s an opportunity to reposition your portfolio for a much tougher 2023.

Now yesterday I said “markets are likely to move sharply either way on the inflation read for October”

Here’s the (unchanged) heading from yesterday (Nov 09) – with today’s price action updated:

Nov 10 2022

A binary outcome was spot on…

My advice here is tread with caution as the S&P 500 once again tries to push up to the 4100 zone.

This is where I think we will see resistance.

And whilst there might be maybe 5% of upside post the mid-terms — the downside risks remain.

A 50 bps rate rise in December (vs 75 bps) changes absolutely nothing.

The 2-year yield still suggests we are headed to 4.75%.

And on the assumption that’s where we will stay for several months (i.e. until we see inflation move back to ~2%) – that does not bode well for equities and/or consumers.

Putting it All Together

With Q3 earnings behind us – the market will once again be moved by the macro.

For example, today was a great day for bonds, as yields plummeted.

Those tracking my recent TLT trade would have notice this shoot sharply higher.

What’s more, the US dollar gave up ~2% which is friendly for equities.

The lower the dollar – the more this will be a tailwind for stocks.

But with respect to earnings – I don’t think Q4 is going to be great.

What’s more, I think 2023 will see earnings contraction (not growth).

And if that’s the case, then 4100 on the S&P 500 represents a multiple of ~19.5x (i.e., $210 per share – a decline of ~5%)

That’s not attractive.

What’s more attractive is something in the realm of 15x to 16x (at most).