- State Coincident Indicators turn lower;

- Stocks run into (expected) overhead technical resistance;

- If there’s uncertainty – all we have are probabilities

Stocks finished 2023 at a blistering pace.

Investors tripped over themselves to add exposure – paying ‘any mutiple’ for stocks – culminating in the S&P 500 finishing 24.2% higher for the year.

It was the polar opposite to 2022.

However, 2024 has not started the same way.

From mine, late 2023 feels a lot like what we saw late 2021 (and early 2022)

At the time, investors chased momentum in fear of missing out (‘FOMO’) – pushing multiples into what I considered ‘higher risk’ territory (i.e., above 20x forward)

It was a time to lower exposure.

As we start the new year – stocks are taking a pause. And it’s not unexpected given the sharp run higher.

However it begs the question…

Could it be something more than a pause?

Of course we don’t know the answer (no-one does). Where there is uncertainty – all we have are probabilities.

With that – it’s worth asking more questions to try and ‘sharpen’ the zone of what’s probable – starting with the technical view.

S&P 500 Finds Resistance

Jan 4 2024

Here I extended the 61.8% to 76.4% Fibonacci retracement beyond the retracement labelled A-B (mid-last year).

We rallied to the top of the distribution (~4800) where we found resistance.

In addition, the weekly RSI (middle window) also suggested we were close to overbought.

Put together, it felt the probabilities of a pullback (or pause) were above 70%.

In other words, it was a higher risk bet adding exposure in this area.

From here, we should expect the S&P 500 to first test the 10-week EMA or ~4600.

That’s ~2% lower than today’s close.

However, if that level fails, we could see a quick trip to the 35-week EMA (blue line) which is ~4400

That would represent a pullback in the realm of 8.3% – and will likely attract buying support.

However, 4400 is not a strong enough long-term risk/reward to increase my equity exposure.

That’s the technical setup – but let’s look beyond that.

Did We Rally for the ‘Right’ Reasons?

A book I’ve been re-reading this week is Annie Duke’s “Thinking in Bets”

As an aside, this book was at the top of my recommended books for better decision making.

It’s an excellent read.

Duke’s book offers investors (and everyday decision makers) many lessons.

For example, we all know that markets go up and down for various reasons.

Sometimes a rise (or fall) is for the ‘right’ reasons; and other times for reasons which are ‘wrong’.

But how do you know the difference?

That’s the game of asset speculation… knowing the difference.

For example, was the v-shaped rally of 16.2% over 9 weeks last year for the right reasons?

If you can get that answer right – you have a chance of being rewarded.

Get it wrong – and it could be painful.

To try and answer this question – one method is to frame a series of derivative questions (a method recommended by Phil Tetlock in his book “Superforecasting – The Art and Science of Prediction”)

The “Right” Reasons

At the end of October- the Index had plunged to a level of ~4100.

If you refer to my weekly chart shared earlier – around 4100 was a zone which I said will likely act as support (i.e. 61.8% on the lower side of the distribution)

It was also the former zone of resistance from earlier in 2023 (which lends itself to the technical saying ‘previous resistance often becomes new support’)

Beyond the tape, we also saw the 10-year yield trading around 5.0% – where long-term debt could not catch the smallest bid.

From an equities perspective – markets were also worried about what the Fed might say at their Nov 1st FOMC meeting.

But investors were greeted with ‘soothing tones’ from Chair Powell – which were quickly followed by positive employment and lower inflation prints.

From there, this contributed to the 10-year easing sharply – giving investors hope financial conditions were easing.

Lower bond yields provided more reasons for investors to buy stocks (i.e., the “right” reasons)

Fast forward to the December FOMC meeting and stocks found another gear.

Powell effectively told markets they were finished with hikes (i.e., the inflation war was all but won) – suggesting as much as three rate cuts next year.

Investors now had a green light.

The “Powell Pivot” had arrived – giving more fund managers reason to pin their ears back (fearful they would miss the Fed cut rally).

I said the Fed Chair had effectively “rung the bell” and Pavlov’s Dogs came running.

What Could Go Wrong?

As I wrote here – investor behavior echoed what we saw late 2021 / early 2022.

That is, markets were incredibly optimistic that very little (if anything) could go wrong. For example:

- Interest rates will come down with inflation;

- Consumers will continue to accelerate their spending;

- Jobs will not be lost (at large scale); and

- GDP will continue to expand as earnings grow.

But there was one unanswered question:

If the Fed is likely to cut rates (as much as three or four times next year) – what would cause that?

Put another way, it would not be because the economy was expanding.

I offered at least two plausible reasons:

- The Fed is concerned about the business cycle (i.e., risk of a recession from over-tightening); and

- There could be some kind of major credit event

If either of these are possible – why is the risk/reward attractive for stocks are current levels?

It’s not.

My assumption is the Fed are worried about the general slowing of the economy (mostly opposite the lag effects of 550 basis points of rate hikes and ~$1T in quantitative tightening)

For example, December 14th I issued a post titled “What Just Happened” – which theorized the Fed is now shifting from getting inflation back to 2.0% (supposedly at “any” cost) to one which is focused on the business cycle.

In other words, they want to “stick the landing” now it’s within reach.

However, it also suggested the Fed see the (potential) sharp contraction in the economy as a greater risk than inflation.

And this week, we learnt of a plausible reason why… things are slowing.

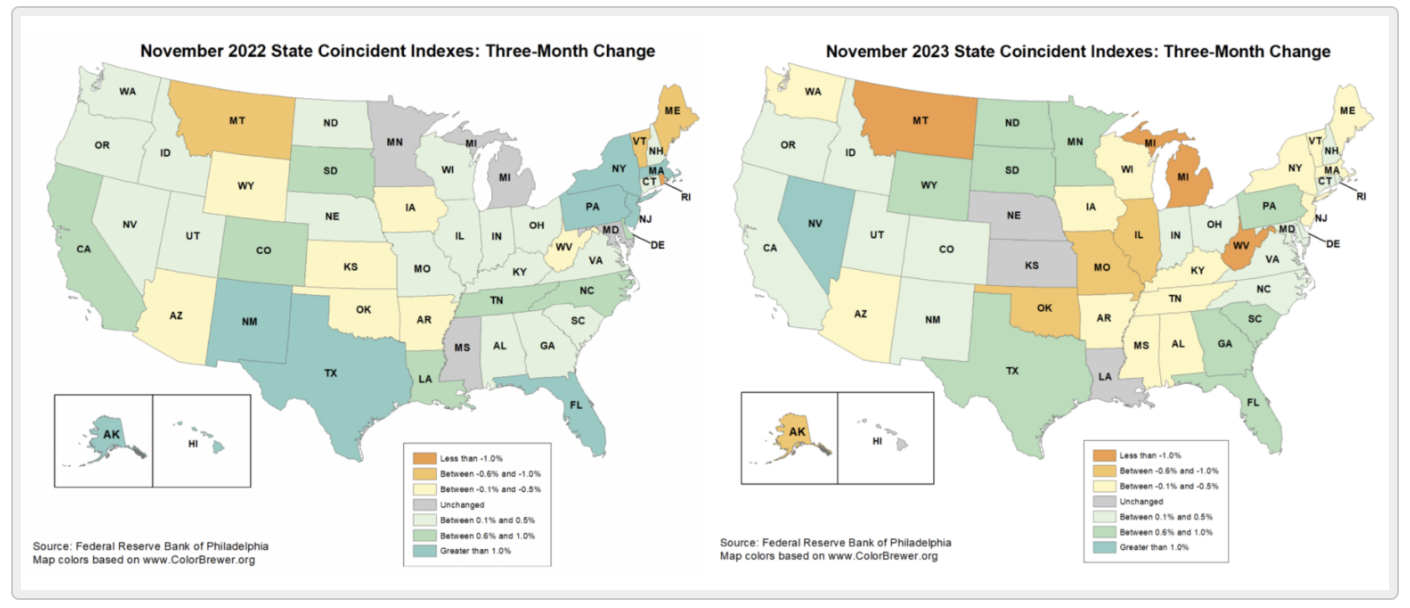

This is the Federal Reserve Bank of Philadelphia’s State Coincident Indicators for November 2023.

It’s worth paying close attention to for its broad and consistent trends – which do not operate with a large lag (unlike most other growth indicators)

Over the past three months, these indexes have:

- Increased in 25 states;

- Decreased in 21 states; and

- Remained stable in four.

Put together, this resulted in a three-month diffusion index of 8.

That’s a downward shift from a year ago…

For example, this time last year the coincident indexes increased in 30 states, decreased in 13 states, and remained stable in seven — for a one-month diffusion index of 34.

Today we find (on a YoY basis):

- 8 more states are now contracting (more orange/yellow); and

- 5 fewer states are expanding (less blue/green)

And whilst the change in state coincident indexes are arguably modest – there has been a notable contraction over the past three months.

The question is will it deteriorate?

And if so – to what extent would it cause the Fed to act?

Putting it All Together

The theory goes that significant falls in interest rates will result in higher stock prices and economic expansion.

And that ‘Goldilocks’ type thinking might prevail.

However, probabilities tell me conditions like that don’t happen often.

Sure, it’s possible. But from mine it’s not probable.

What’s more, when everyone expects a certain outcome, we should expect the opposite.

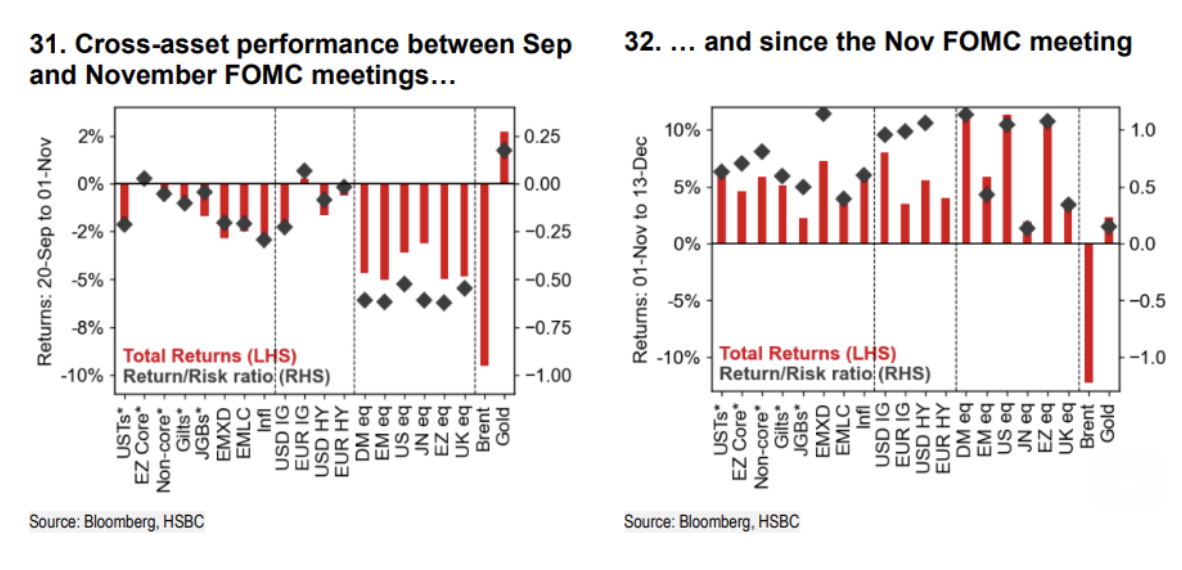

Just on this, Bloomberg cited some interesting research from Max Kettner, chief equity strategist at HSBC

Kettner came up with what he calls “Reverse Goldilocks”

For many years, markets traded in waves of “risk on” (stocks up and bonds down) and “risk off” (stocks down and bonds up).

For the last few months, Kettner shows, there’s been a straight oscillation between Reverse Goldilocks and what investors are pricing in (i.e., Goldilocks).

He says the last three FOMC meetings have provided the milestones.

For example, after Fed Chair Powell’s hawkish performance in September, several weeks of Reverse Goldilocks ensued.

Everything went down (apart from gold).

However, when there were hints of a U-turn at the next meeting, Goldilocks took over and most risk assets rallied (excluding oil):

So here’s the question:

Are we about to see another Fed induced “Reverse Goldilocks”?

If the last few days are any indication (i.e., stocks falling while bond yields rise) – I would not rule it out.