- Consumers continue to spend despite inflation

- Sticky inflation a problem for the Fed

- Defence remains the name of the game until we get the ‘all clear’

Markets received a small boost to finish the week following positive retail sales data.

Retail sales rebounded strongly in June as Americans were ‘forced’ to spend more on gasoline and other goods.

Good news? You tell me.

Echoing the sentiment from Jamie Dimon yesterday – US consumers remain in reasonably good shape – despite some of the highest levels of inflation we’ve seen in 40 years.

“The U.S. economy continues to grow and both the job market and consumer spending, and their ability to spend, remain healthy,”

Never underestimate the US consumer’s ability to spend…

The good news is the economy isn’t falling off a cliff anytime soon. Unemployment levels remain very low… there are over 11M job openings… and Americans have savings they are drawing upon.

That said, the Fed is not about to take their foot off the “interest rate gas” given what we find with inflation.

If anything, today’s stronger-than-expected retail sales print gives the Fed more scope to hike rates with confidence.

Remember:

The name of the game is demand destruction. That’s how you bring down inflation.

And the way you do this is by withdrawing money from people’s pockets.

Inflation Will Ease… But It’s Sticky

Yesterday I explained why inflation is likely to ease over the coming months and year.

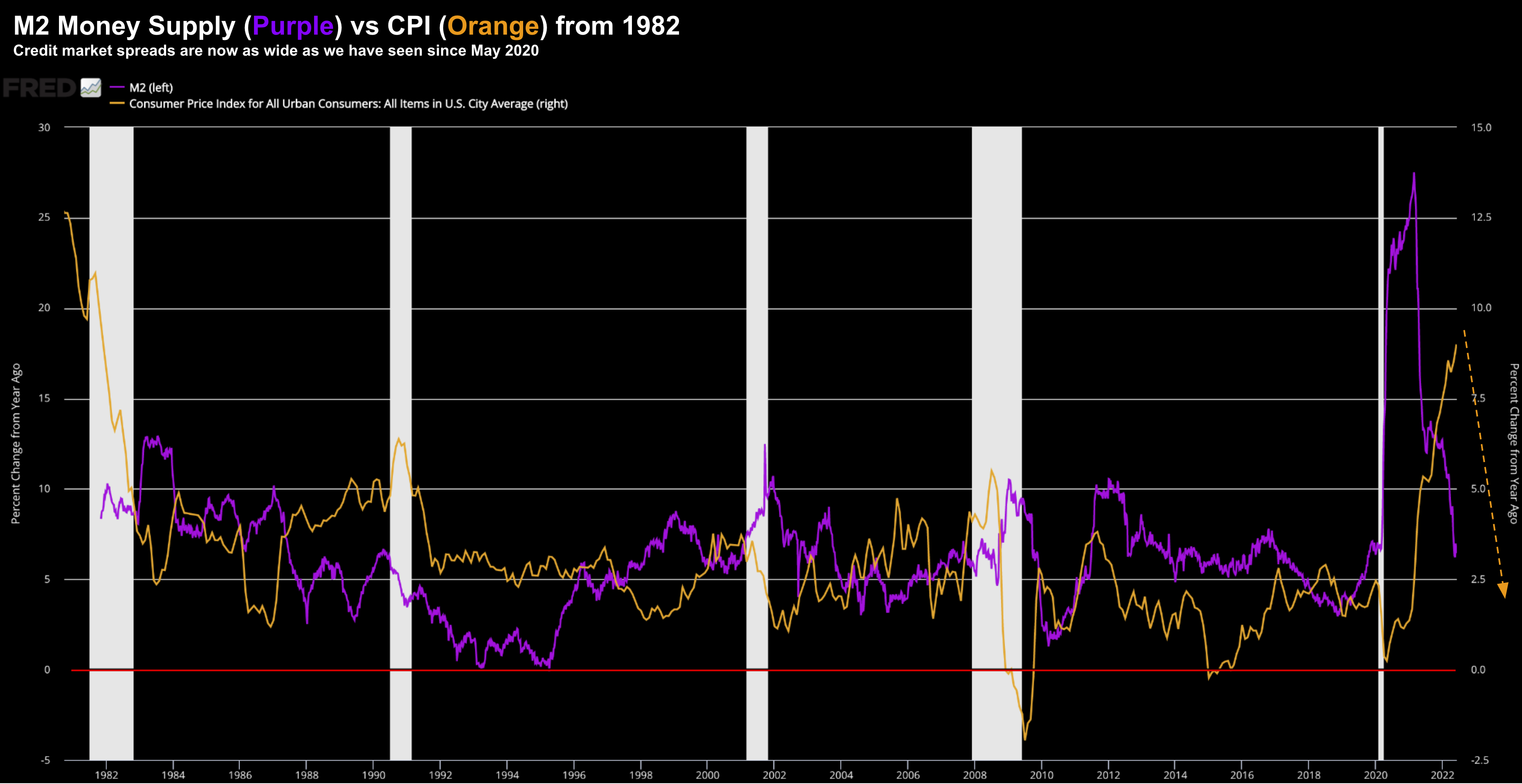

My logic: the dramatic slowdown in money supply (M2) growth.

This chart shows the 40-year trend for M2 growth vs CPI. Of late, the rate of growth for M2 has plummeted from an obscene 25% annualized to just 5.2%

What the Fed needed to do was take money out of the system.

This is now happening…

And if history is any guide (given the 12-month lag) – we should expect CPI to fall over the coming months (and what bond markets tell us with TIPS).

However, the expected lag effect means it won’t be anytime soon. And until the Fed sees continual (and meaningful) lower inflation prints – it will be pedal to the metal.

Perhaps the one thing likely to keep inflation unbearable high for at least 9-12 months (i.e. well above 5%) is what we see with wages and rents.

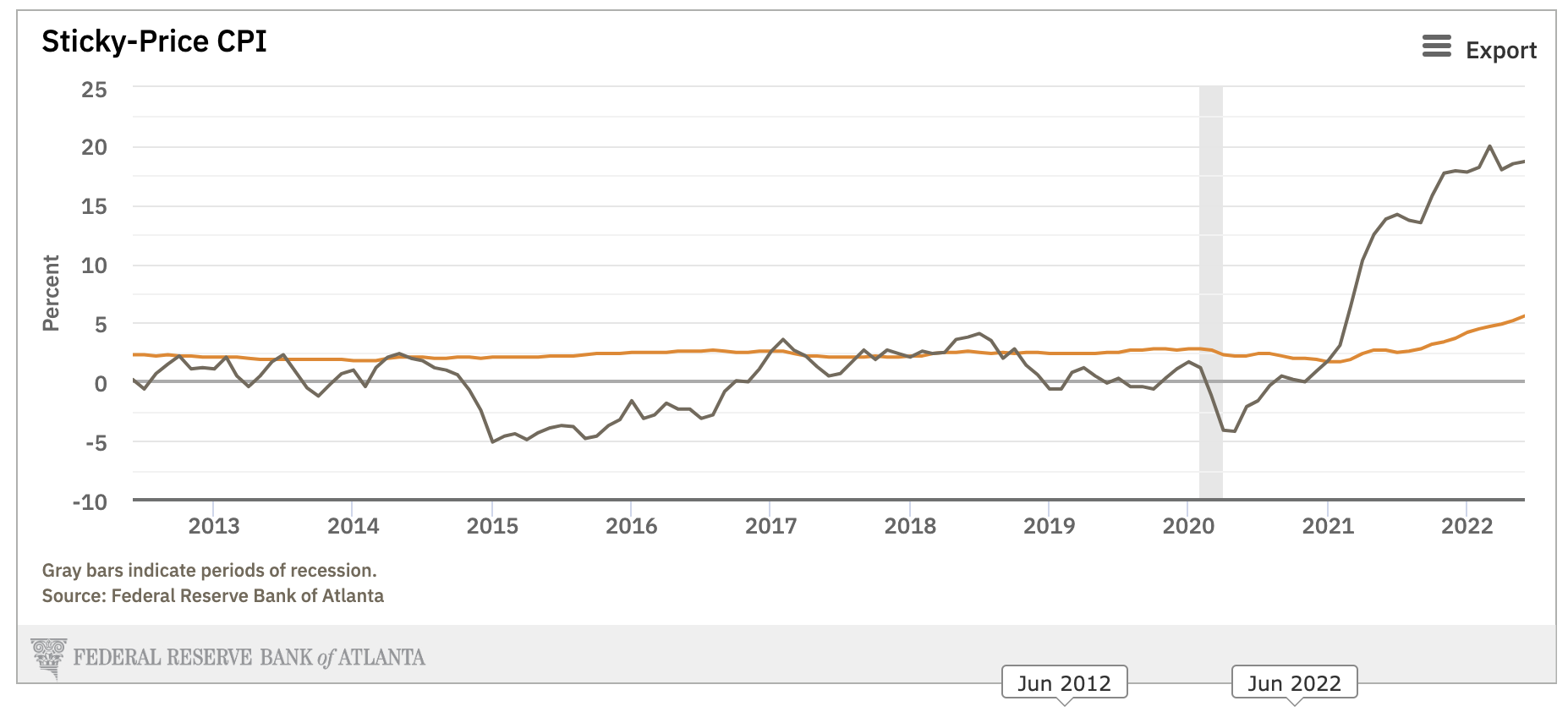

Consider the Atlanta Fed’s sticky CPI figure.

It hit a new high of 5.6% in June – with most of the increase led by shelter.

This differentiates components of CPI into flexible (grey) or sticky (orange) categories based on the frequency of their price adjustment. From the Atlanta Fed:

The Atlanta Fed’s sticky-price consumer price index (CPI)—a weighted basket of items that change price relatively slowly—increased 8.1 percent (on an annualized basis) in June, following a 7.5 percent increase in May.

On a year-over-year basis, the series is up 5.6 percent.

On a core basis (excluding food and energy), the sticky-price index increased 7.9 percent (annualized) in June, and its 12-month percent change was 5.4 percent.

The flexible cut of the CPI—a weighted basket of items that change price relatively frequently—increased 41.5 percent (annualized) in June and is up 18.7 percent on a year-over-year basis.

As I mentioned earlier, to bring this kind of unwanted inflation down is to crush demand (e.g., lower house prices in this case)

Hiking rates above the rate of inflation might do the trick (as we watch the demand for mortgages fall off a cliff).

S&P 500: Another Red Week

Whilst Friday’s price action helped paired back some of the weekly losses – it was not enough to finish in the green.

July 15 2022

Technically nothing has changed from last week’s analysis…

And I know I sound like a broken record (especially if you’re a regular reader) – but we remain in a bear market.

A bear market means lower highs and lower lows.

For clarity, bear markets do not mean we won’t see some bullish “rips” of 10% or more. However, I’m still expecting all new lows (especially post the Fed next two hikes of 75 bps plus)

But what’s driving the day-to-day whipsaw price action in equities?

Look no further than bond markets (and yields).

As I explained a few weeks back – until we see bond yields calm down (unlikely in the near-term) – equities will remain volatile.

However, the ‘good news’ is we’re starting to collect a few of things we need to form a bottom; i.e.

- we have had multiple compressions;

- we have a firmer sense of how bad inflation is likely to be (with signs of it coming down); and

- we have priced in a 70%+ chance of a recession

All of that is helpful….

However, perhaps what’s most important is we are yet to see the earnings per share (EPS) downgrade cycle.

That’s what’s next…

We got some of that this week (JP Morgan) – but we’re yet to hear it from market leaders.

And specifically – I’m referring to the stocks which constitute more than 25% of the total S&P 500 market capitalization (mega-cap tech).

Whilst I’m less concerned about “Q2” earnings (they may still show single digit growth) – it’s the guidance which matters more. Markets are forward looking.

Now with rates sharply higher – discounted cash flows are going to come down (as you are dividing by a higher numerator).

And from mine, that is not yet priced in.

Putting it All Together

Next week we will hear from the likes of Tesla, Netflix, Goldman Sachs and Bank of America.

This might set the tone for what’s to follow.

I still don’t think you can afford to be aggressive here… it’s not the time to be playing offence. Not yet.

But these rips can suck people in…

The name of the game is defence, defence, defence; i.e. a time not to lose too much money.

For example, I’m down a little over 5.5% YTD – well ahead of the ~20% drawdown on the S&P 500.

However, recently I’ve added to core names at (what I believe) are very attractive long-term levels.

And there will be a time to attack this market with ‘both hands’ (e.g., the S&P 500 at 3500 or below). But it requires patience… grinding things out.

For example, the expected 2023 Fed pivot will be one of those signals…

But for the near-term – and until we get past earnings revisions – continue to be vigilant by playing great defence.