- Commodity prices plunge on growth fears

- Bond market sees inflation averaging 2.50% p/yr the next 5 years

- A recession is the price we must pay… not a bad thing

The dreaded “R” word is the talk of the tape…

Recession.

And whilst a recession is now almost a certainty – it’s just a question of how deep any contraction will be?

But what’s most challenging with recessions is the precise timing.

How do we know the moment it strikes?

We don’t.

Recessions are always rear-view mirror.

That said, it appears this one might be coming sooner than initially expected (e.g. mid 2023).

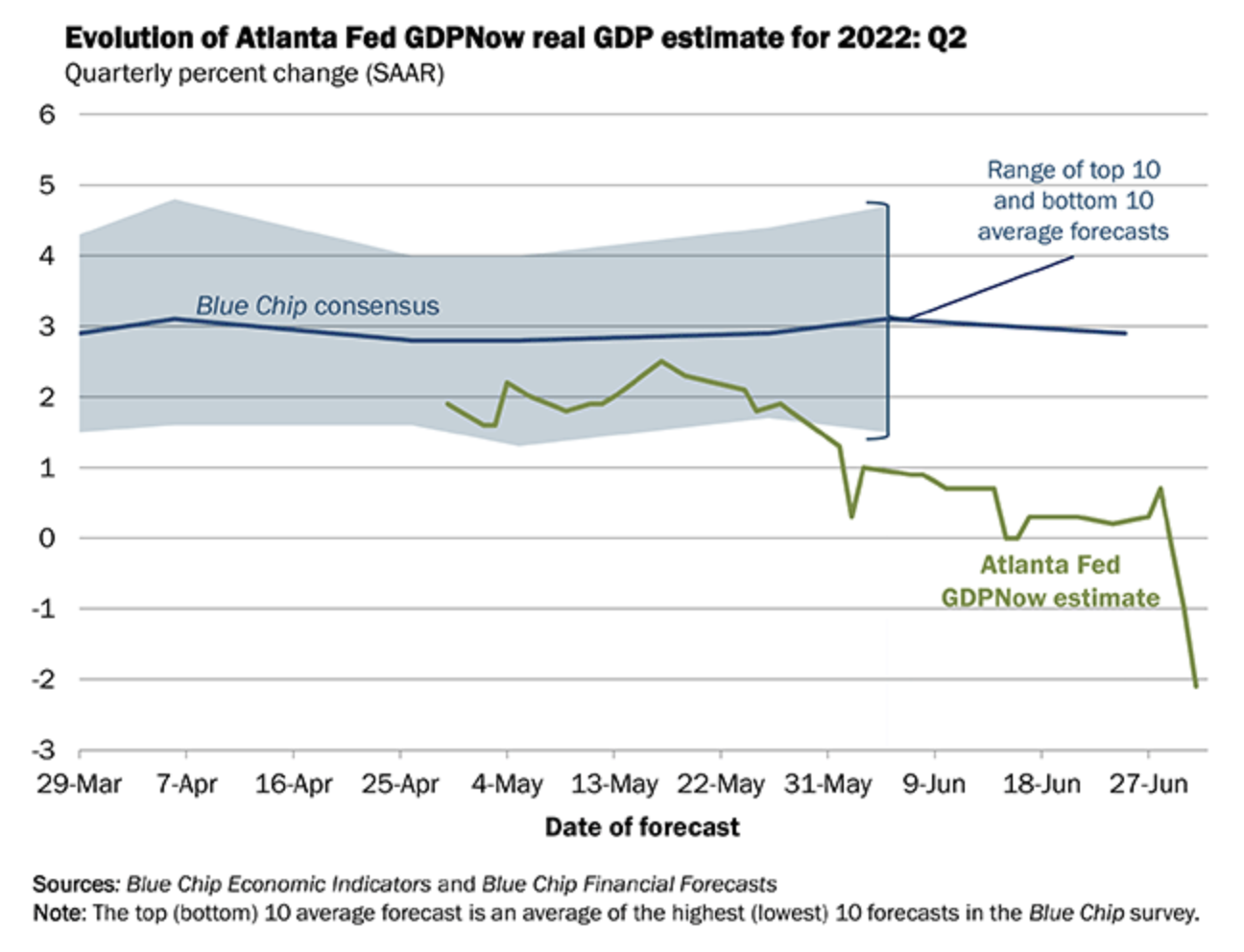

For example, based on the current GDP growth forecast from the Atlanta Fed – we could be in recession now.

The Atlanta Fed sees US GDP falling 2% this quarter…. resulting in two consecutive quarters of contraction (the technical definition of a recession).

And as their chart shows below – expectations are quickly being ratcheted lower.

And maybe this is the Fed’s intent?

For example, today we received the Fed’s latest minutes on monetary policy.

Whilst there were no surprises – the FOMC minutes reinforced the narrative of doing “whatever it takes” to bring inflation back to its target of ~2.0%.

In other words, expect sacrifices such as:

- Lower (recessionary) GDP growth;

- Falling prices (e.g., stocks, houses, bonds and commodities); and

- Tighter monetary conditions to reduce demand

The Fed is laser focused on one thing and one thing only: restoring price stability

Whatever it takes…

And none of this is lost on the bond market… as yields reverse sharply.

Yields Plunge on Growth Fears

Over the past few weeks, bond yields have turned on a dime.

Approximately four weeks ago yields indicated the Fed needed to do a lot more to get “in front of the inflation curve” – suggesting nominal rates at 4.00% by the end of 2023.

Not now.

These expectations have fallen ~100 bps (as I will demonstrate shortly).

Let’s start with the all important US 10-Year yield – which has tumbled from its recent 3.50% high to ~2.90% at the time of writing.

July 7 2022

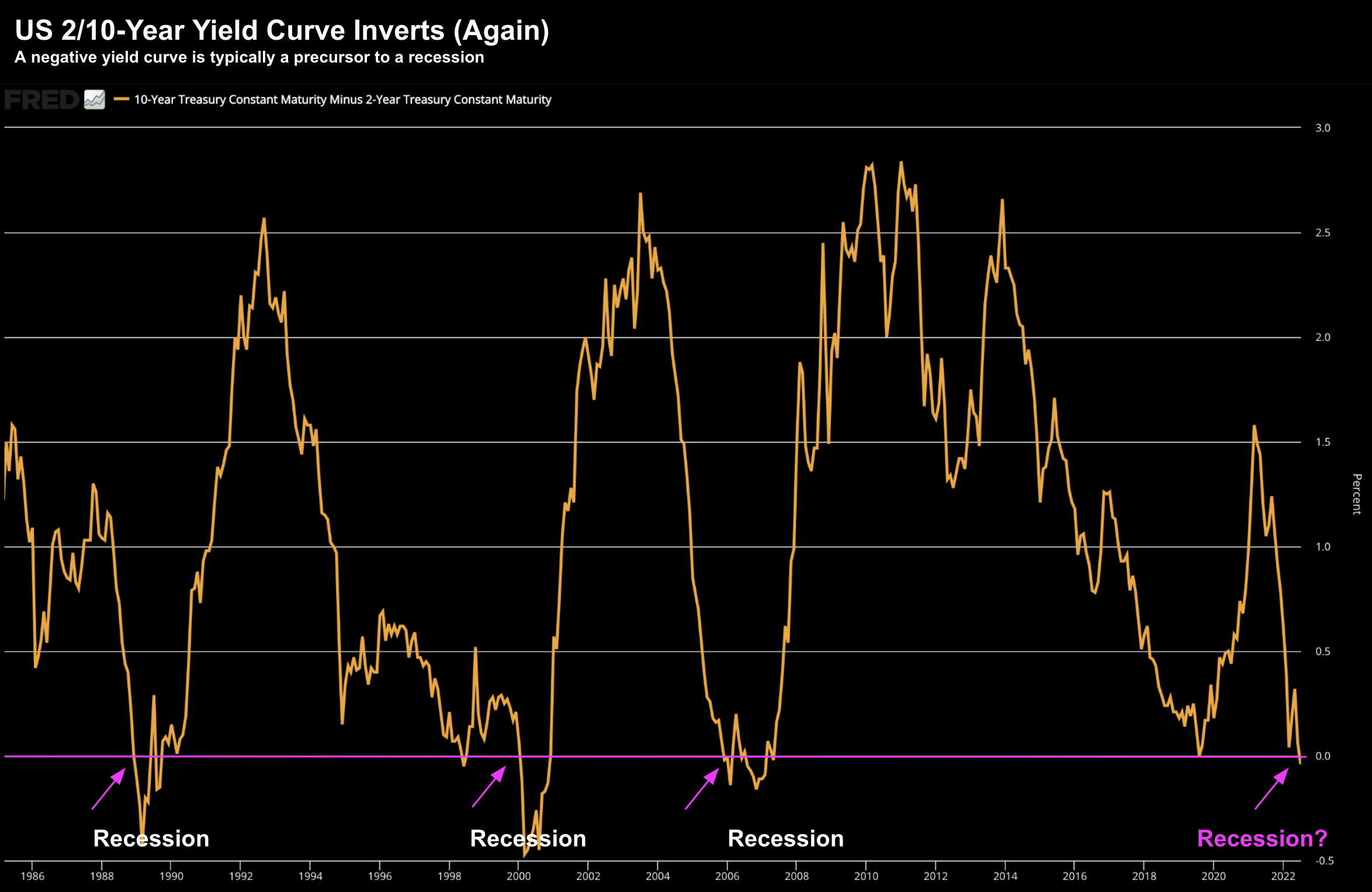

The ~60 basis point fall has also seen the closely watched 2/10 year yield curve invert by ~10 bps — suggesting sharply slower growth ahead.

July 7 2022

Again, none of this would be lost on the Fed.

In fact, it’s probably a welcomed development given their mission to restore price stability.

For example, what this (and other bond yield charts) suggests is fixed-income markets are looking beyond near-term inflationary risks (e.g., for 2022)… and see inflation falling as demand for goods falls.

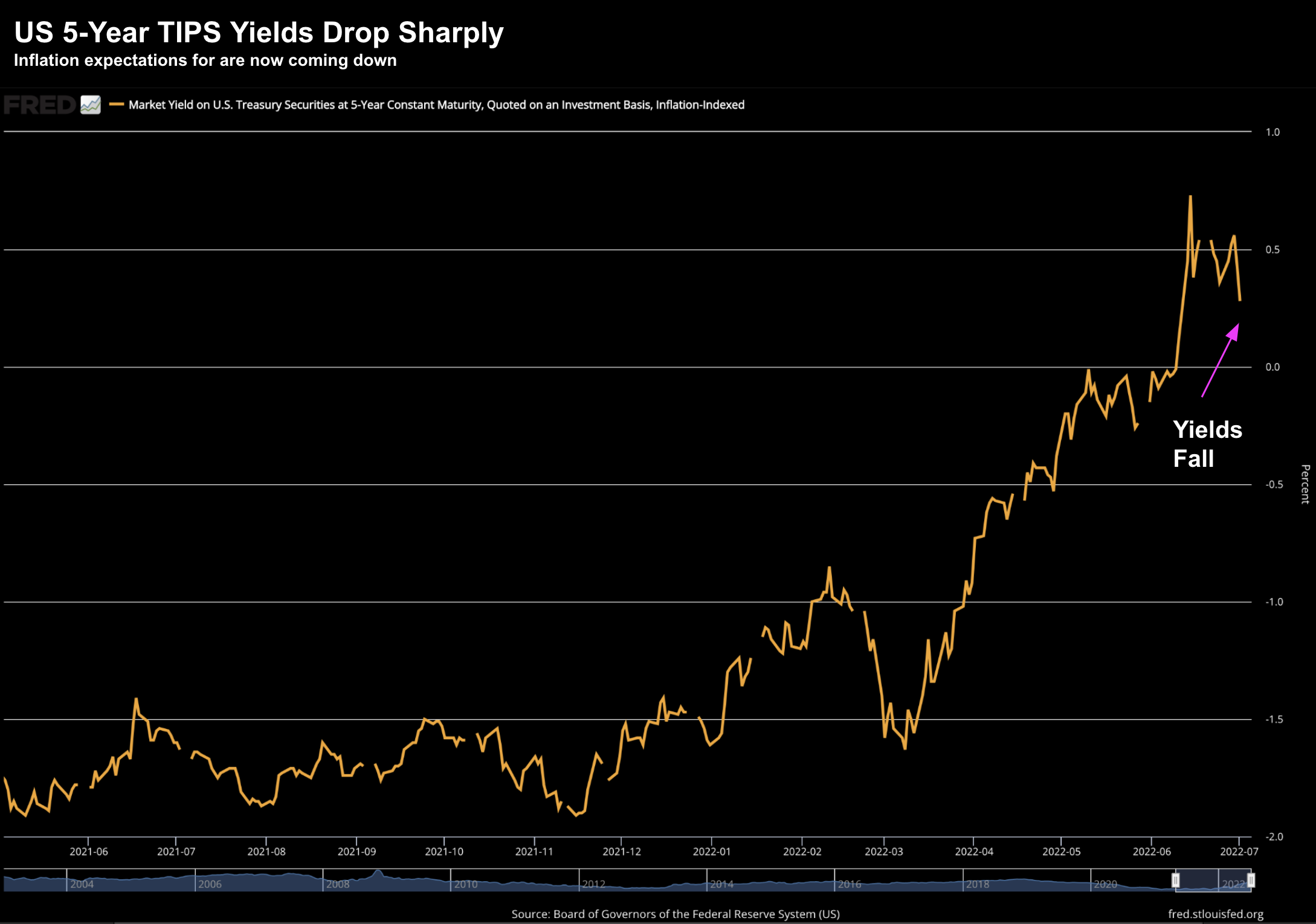

Now one of the best proxies for future inflation expectations (CPI) is 5-Year TIPS (Treasury Inflation Protected Securities)

July 7 2022

For four months, real yields (those adjusted for inflation) ripped higher opposite higher inflation expectations (and necessary Fed hikes)

Not now.

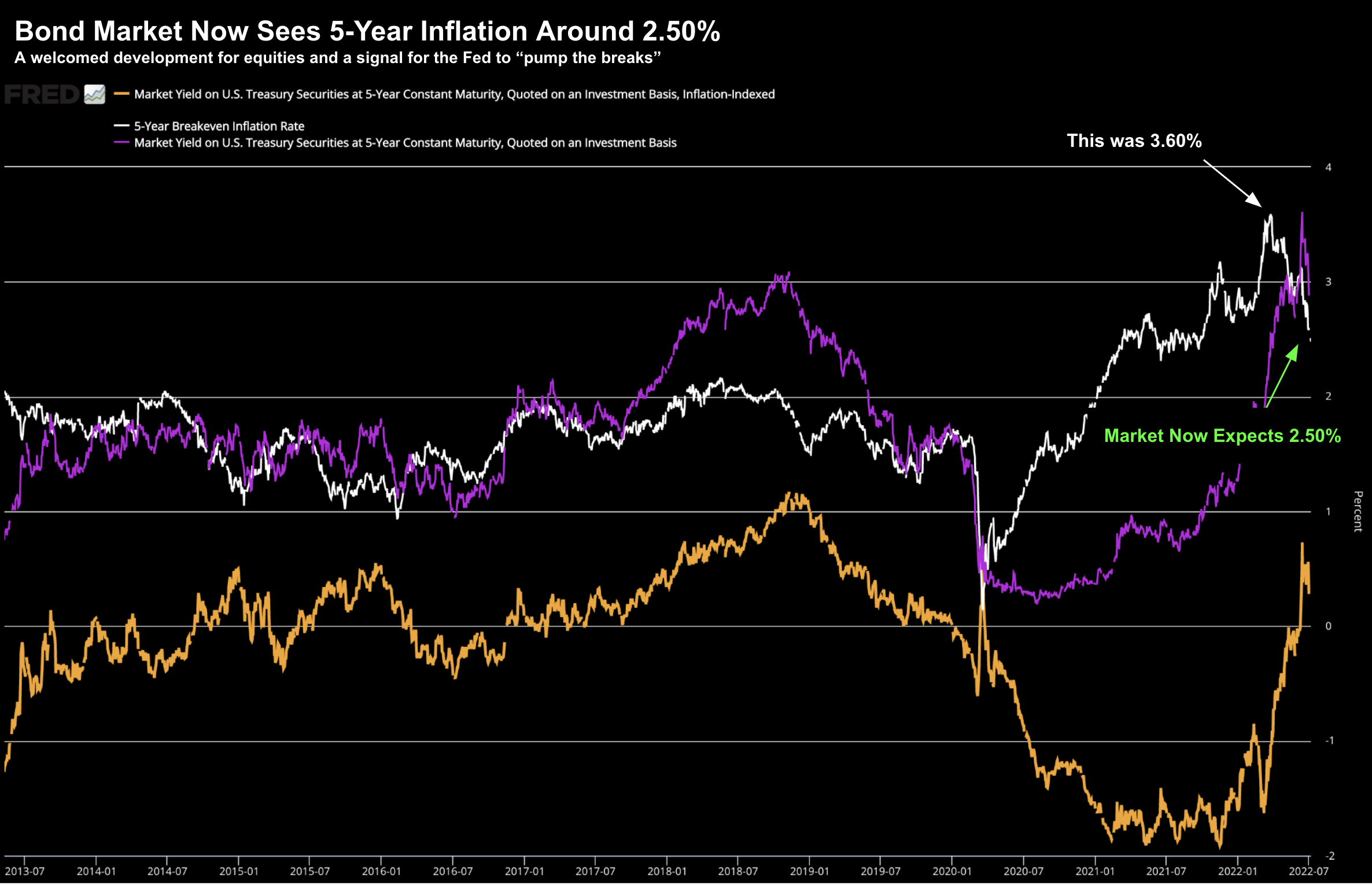

If we subtract the 5-Year TIPS yield from the nominal 5-Year Treasury rate of ~3.0% – we can estimate the market’s expectations of what CPI will average each year over the next 5 years (also known as the ‘breakeven rate‘)

This has now dropped to just 2.50% from ~3.60% a few weeks ago (white line below)

July 7 2022

The so-called “breakeven rate” is the rate which is indifferent to holding nominal treasury bonds.

A fall of over 110 basis points is a big shift in sentiment…

The bond market expects the Fed to be less aggressive in 2023… with Fed funds target rate closer to 3.00% vs 4.00%

In other words, look for the Fed to pivot in 2023 (on the assumption inflation is likely to fall)

Which leads us to what’s happening with commodities…

Falling Commodities: A ‘Good’ Sign

Up until recently, commodities were in a bull market.

However, some prices are coming down.

Let’s start with WTI Crude – arguably the most important input when it comes to CPI.

July 7 2022

WTI Crude was ~$122 per barrel three weeks ago – however has pulled back some 20% in the space of 3 weeks.

And whilst this is good news for inflation – it remains to be seen how far it’s likely to fall given what we see with the Russian invasion of Ukraine.

For example, I see technical support between $90 and $95 before another move higher.

However, should demand destruction continue at velocity – it’s plausible we see the price of WTI Crude all the way back to around $70 to $75 by year’s end.

I say this because various other (leading) commodities suggest a bearish lens…

Take copper.

This well known ‘economic predictor’ has plummeted from $4.93 March 4 (per 25,000 pound futures contract) to $3.41 today – a 31% drop in four months.

As an aside, I shared this forecast the other week for copper (calling for prices to fall below $3.00 in coming months).

July 7 2022

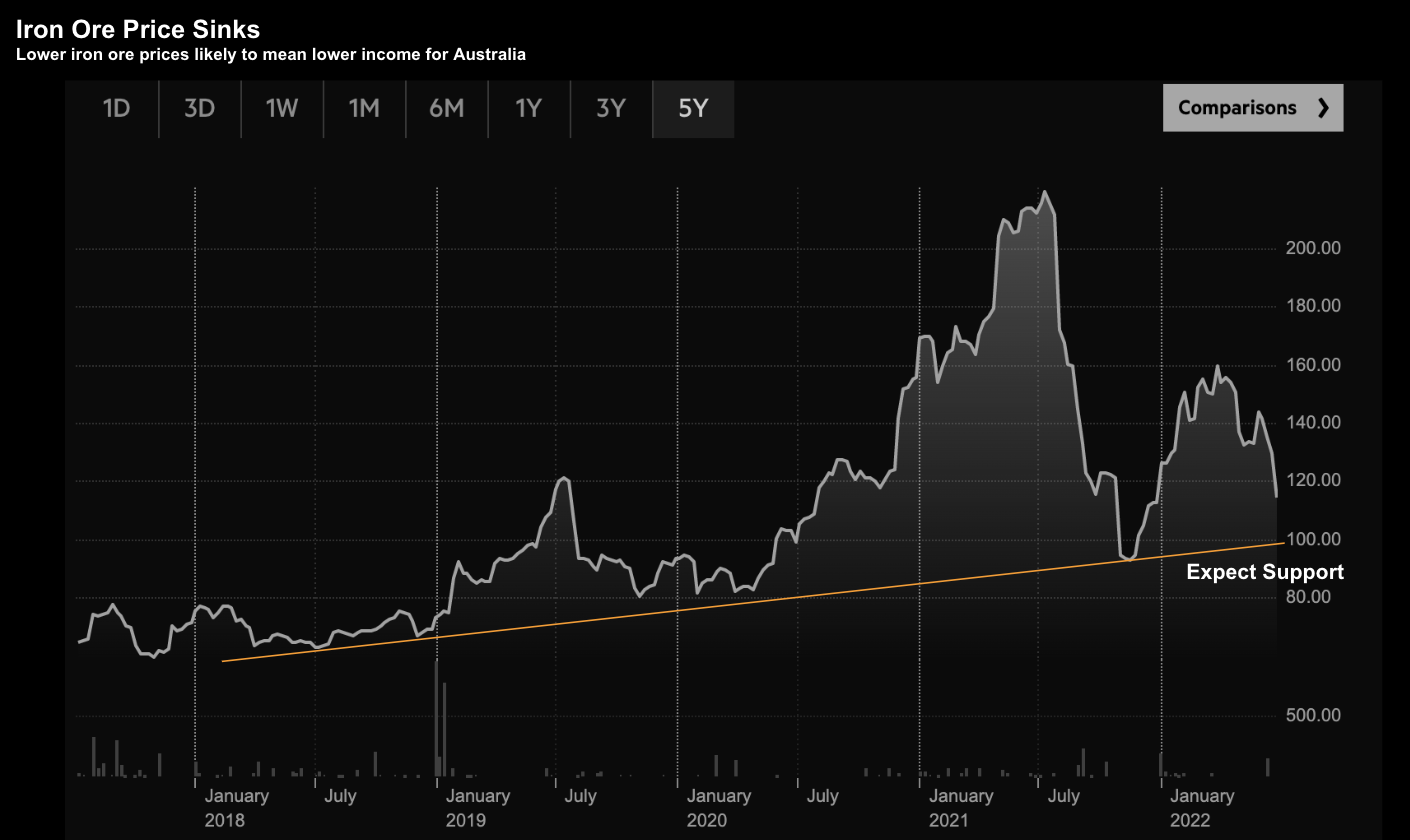

But it’s not limited to oil and copper – we have also seen price falls of more than 20% across iron ore, wheat, corn, lumber and natural gas.

Below is the 5-year chart for iron ore – trading ~$112 after being as high as $160 in April.

July 7 2022

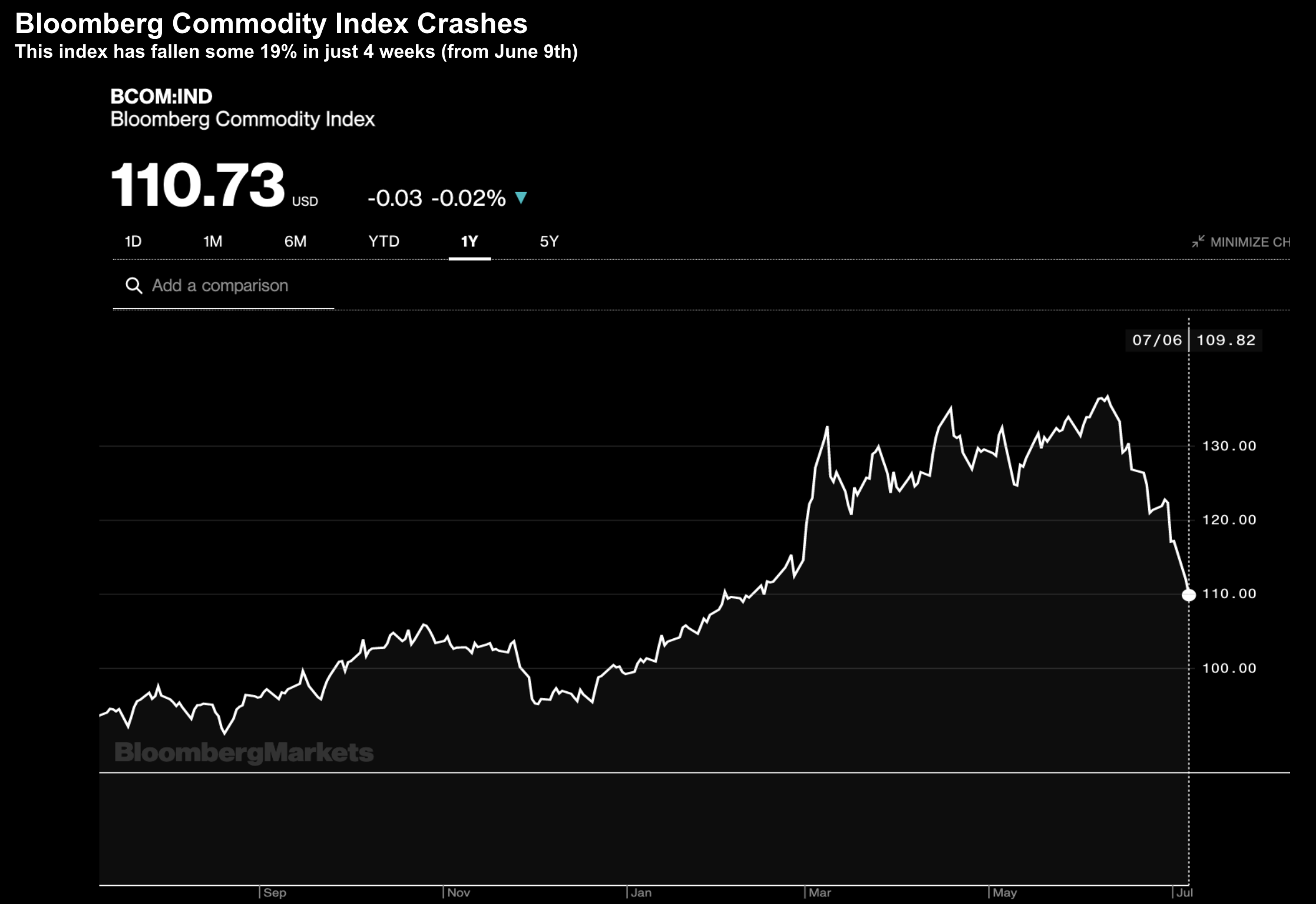

What’s more, the Bloomberg Commodity Index plunged from 136 on June 6 to 110 today – a 19% fall in less than 4 weeks.

July 7 2022

Put together, the price action in bond yields, commodities and the US dollar all point towards sharply lower growth.

Currencies also Warn on Growth

Recently I’ve been talking to the exceptional strength we find with the US dollar index…

And whilst it’s over-bought in the near-term (i.e., expect a pullback) – this has been a flight to safety.

For example, consider the Aussie.

It’s fallen to just 68.4c (despite 100 bps of rate rises from the RBA).

In April, it was trading as high as 75c

Look no further to the falling prices of commodities (notably iron ore and coal).

What’s more, consider the Euro.

For the first time in 20 years it’s set to trade at parity with the US dollar (and likely to fall below).

And then there’s the Yen – the most noteworthy of all currencies – which has plummeted from ¥113 Jan 24, 2022 to ~¥136 today – a ~16% loss in value in just over five months.

July 7 2022

Put together, global markets are braced for recession.

The Lagging Effect of Inflation

Despite the real-time corrections with commodities on recession fears (as central banks continue to hike rates) – it will do little to help inflation in the very-near term.

Long-term yes… but less so for the balance of this year.

Here’s why…

The inflation today opposite energy, food and other consumables is the lagging effect of three things:

- excessive monetary expansion (e.g. M2) for too long;

- overly aggressive fiscal spending from governments (mostly welfare); and

- various supply chain shocks.

We had far too much money chasing fewer goods (globally).

But unfortunately, the so-called lag effect from complex (global) supply chains takes time to work through.

The effects always start with the raw price of materials and commodities. It then moves through

However, this chain can take upwards of 6-12 months.

Consider your phone or the computer you’re using to read this blog.

Think about all the components which go into the hardware.

There are metals such as gold and lithium, gorilla glass, semiconductors, software, designers, resins and so on… all feeding into the end price of the product.

But that’s just raw inputs…

There is also the cost for every part of the supply chain involved. For example, there are trucks, cargo vessels, air transportation, distribution centers, warehouses all involved in putting the product together.

Every link in the chain has its own cost such as drivers, crews, fuel, insurance etc.

What’s more, every link requires energy to power it (and that’s mostly oil).

Unfortunately, eliminating inflation from complex supply chains is not a simple “3-6 month” fix. It can take 12 months (or more) to ripple through.

The 8%+ CPI we’re paying today is a direct function of:

- poor policies (monetary and fiscal); and

- supply chain snarls we’ve experienced the past 12+ months.

And whilst the 20%+ corrections in commodity prices of late will go a long way towards lowering prices for 2023… near-term inflation is with us for a while yet.

That said, demand destruction is a welcomed development for central bankers. It will reduce the need to hike rates in subsequent years… perhaps sooner.

And that’s what bond markets are pricing in…

Putting it All Together

It might sound perverse, but a recession is not all bad news.

Odds are we could be in one now.

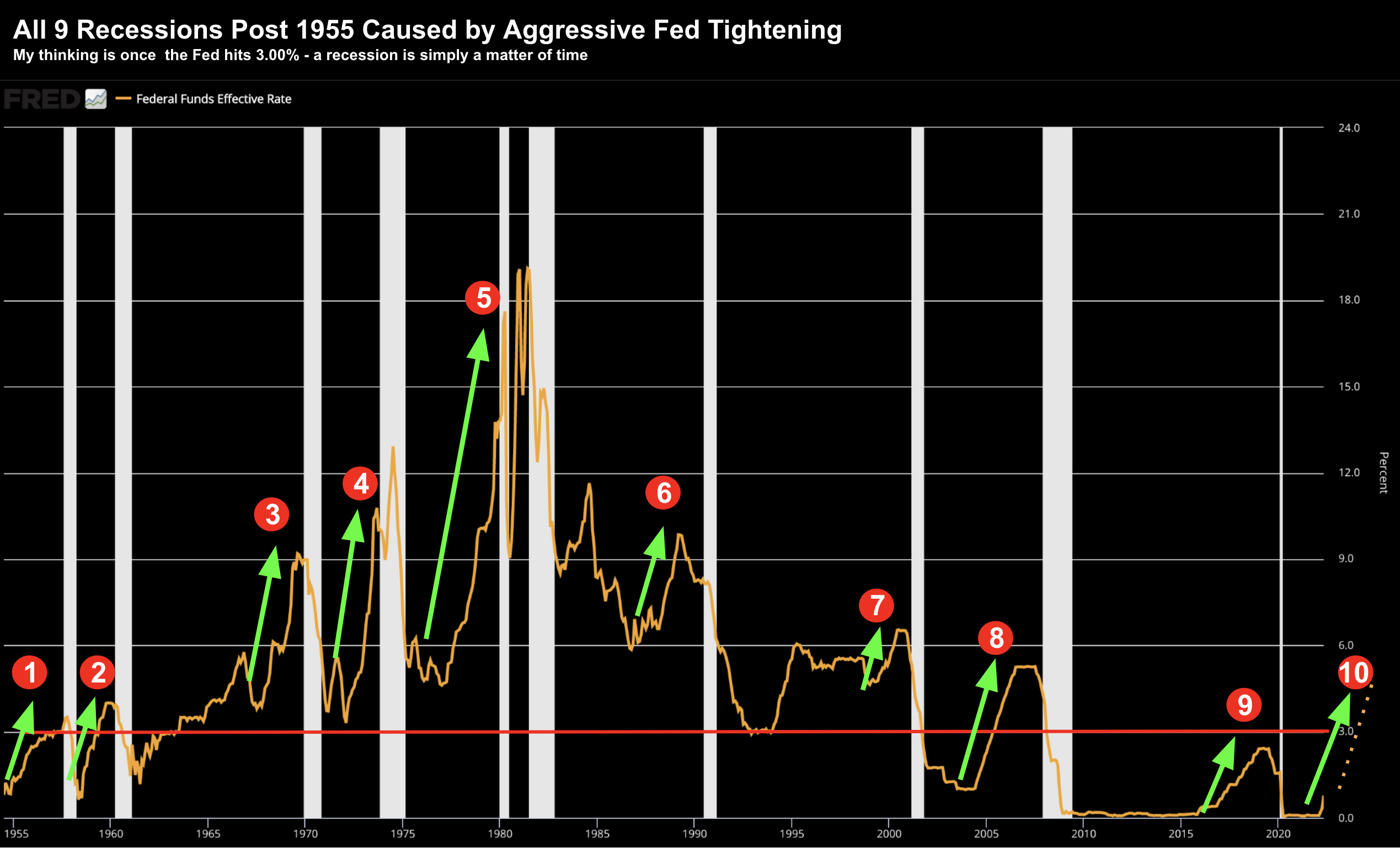

We should expect a recession every 7-8 years on average – where they are typically the result of aggressive monetary tightening from the Fed (as I showed recently with this chart)

Recessions help us flush out large amounts of misallocated capital (e.g., overpriced stocks, crypto, SPACS, houses etc etc)

And this is a big part of what the Fed had in mind.

What’s more, we’re now seeing commodity prices fall.… as global demand wanes (as we heard from Micron recently)

Fast forward ~12 months and lower commodity prices will start to feed their way through complex supply chains. As a result, inflation expectations are already starting to come down.

For example, 5-year “breakevens” falling from 3.60% to ~2.50% is a pleasing sign.

This suggests the Fed might be a position to be less aggressive with rate hikes heading into 2023 (possibly sooner).

And it’s this kind of shift which will help equities find their eventual bottom.