- Why mainstream’s read on retail sales is flawed

- Russell 2000 and non-tech stocks surge on likelihood of rate cuts

- Consumer spend trends will remain my focus in 2024

The rotation out of large cap tech into value names (and riskier smaller cap stocks) continued today.

Consider the Russell 2000…

The small cap index enjoyed its best two weeks since 2020.

Money is sensing rate cuts as soon as September (and likely more than one before the end of the year).

Add to that the possibility of a Trump Presidency in November – investors are now starting to price in more favorable business conditions (i.e., lower taxes and less regulation) next year.

And all of that makes perfect sense.

As I explained the other day, smaller cap stocks stand to benefit from lower rates (not to mentioned excessive government red tape – which is a huge cost)

However, be careful chasing the Russell 2000 after this surge.

And whilst I still believe there is opportunity in the equal weighted index (vs the S&P 500) – you can be patient with the Russell 2000.

The weekly chart for the Index is now close to overbought – where the risks of a sharp pullback are high.

For example, the weekly RSI for the Russell 2000 is trading close to 70.

When it trades above around this zone, pullbacks are likely within a few weeks or months.

In other words, overbought conditions can persist for a while. They are not an immediate indicator to sell.

For example, whilst the Index could easily push higher (the RSI hit 78 in early 2021) – it’s a zone where the negative convexity risks are highest (i.e., low upside with greater downside)

But let’s pivot to the focus of this post – monthly retail sales.

Once again, mainstream failed to read what’s going on beneath the surface.

Real Retail Sales are not Strong

When I caught the headline for month-over-month retail sales this morning – it said “retail sales hold up in June – better than expected”

Here’s the Wall Street Journal

What’s true is nominal sales were flat.

But the WSJ fail to use the word nominal when desribing sales.

That’s misleading.

As analysts and investors – nominal values are of very little use.

What helps us more when forecasting trends (and assessing risks) is real sales.

Real retail sales are those adjusted for inflation.

And with inflation stubbornly high around 3.0% year-over-year (approximately) – that makes a big difference.

Here’s the WSJ:

“Retail sales were flat in June, defying Wall Street’s prediction of a decline amid signs of slowing in the US economy. Economists had expected a 0.3% decline in spending, according to Bloomberg data. Meanwhile, retail sales in May were revised higher to an increase of 0.3%, from a prior reading of 0.1%, according to Census Bureau data. June sales, excluding auto and gas, increased by 0.8%, above consensus estimates for a 0.2% increase”

The other problem I have with most mainstream reporting is this tells us nothing of the longer-term trend.

That’s what we’re most interested in.

And from there – we want to look for any cause-and-effect – such as the trend in real wages.

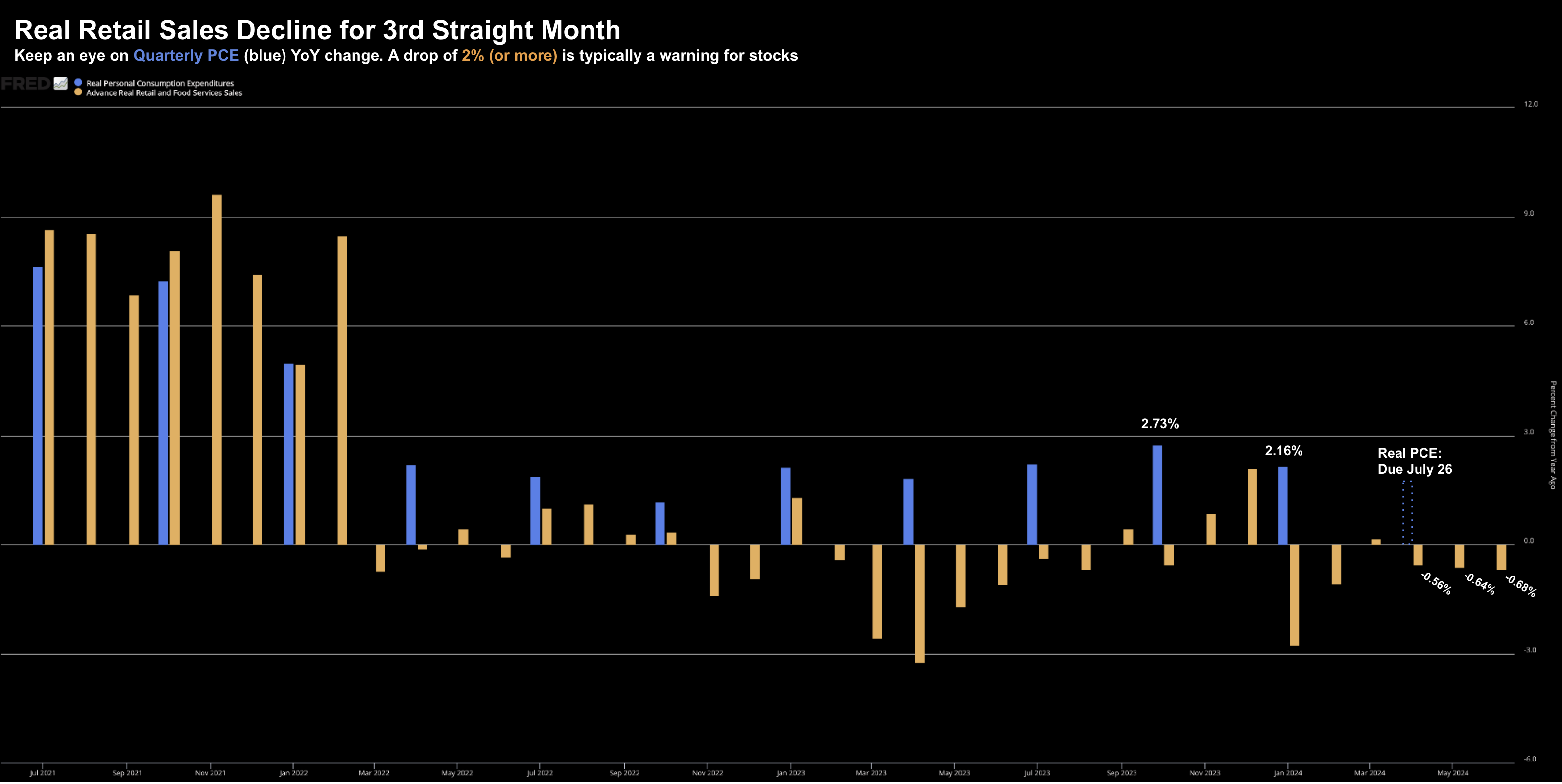

With that, below is the trend for monthly real retail sales (orange) – alongside the quarterly personal consumption expenditures (blue – which will be updated July 26)

July 16 2024

Here we can easily see how real retail sales have fallen YoY for three straight months.

In addition, they are lower for 5 of the past 6 months with a very small gain of 0.15% in March.

What is this important?

It says that discretionary retail continues to struggle.

This is why we are hearing dire warnings from most leading retailers (Walmart, Target, Nike, Lowes, McDonalds, Starbucks and the list continues)

Just on this – yesterday I was listening to British fashion retailer Burberry’s latest earnings.

Much like their discretionary peers – the results were awful – the stock lost 17% – scrapping its dividend and warning of lower profits.

From CNN:

“A global slowdown on spending on luxury goods has also forced Burberry to issue a profit warning, and it scrapped its dividend.

The stock slumped 17% in midday trading on the London Stock Exchange.

In a blunt assessment, Burberry chairman Gerry Murphy called the 168-year-old brand’s quarter “disappointing” and the luxury marketplace is “proving more challenging than expected.”

“We are taking decisive action to rebalance our offer to be more familiar to Burberry’s core customers whilst delivering relevant newness,” Murphy wrote. “We expect the actions we are taking, including cost savings, to start to deliver an improvement in our second half and to strengthen our competitive position and underpin long-term growth.”

Take another moment to examine the monthly trend above…

The downturn started in earnest January this year – where YoY sales declined almost 3% in real terms.

At the time, the market reported them as largely flat.

But scroll back to March 2022…

Over the past 28 months (almost 3 years) – this is what we’ve seen:

- 17 of 28 months (60%) saw real sales decline YoY

- The average is negative 0.42% YoY

- The sum of positive YoY months is 8.01%

- The sum of the negative YoY months is -19.9%

Question:

If you were presented this 3-year trend (and data above) – would your headline read: “retail sales are holding up”?

Unlikely.

This kind of analysis tells me there is pressure in areas of discretionary spend.

And if that’s correct – with consumer spend comprising more than two-thirds of GDP – this is something we need to be mindful of.

We get our next update on Real PCE on July 26.

And whilst I don’t expect a large decline from last quarter’s 2.16% year-over-year Real PCE quarterly figure — I will be watching the trend.

That’s what’s important.

My warning trigger is a decline of 2%+ YoY in any one quarter (similar to what we saw Q4 2021 – which saw stocks decline ~28% in 2022).

When Real PCE declines more than 2% in any one quarter – expect a meaningful (double-digit) decline in equities within 6-9 months.

Consumer spend is a consistently reliable leading indicator of earnings and stock market turning points.

Putting it All Together

From mine, this year is far less inflation risks (however this is still hurting middle and lower income cohorts – as prices are still up over 30% from 3 years ago).

It’s also less about whether the Fed will cut rates in September.

And whilst rate cuts will have some bearing on the consumer’s ability to spend – it will be minimal.

Yes, rate cuts will impact larger items (i.e. specifically homes and autos) over time.

But not immediately…

However, rate cuts are unlikely to impact essential items like food, insurance and energy.

And they’re most unlikely to impact smaller discretionary purchases (e.g., holidays, flights, clothing, eating out etc)

Why?

Because these things are generally not financed.

Smaller purchases (e.g., less than $5,000) are generally put on a credit card.

And credit card companies are not likely to lower their interest rate when the Fed cuts.

My concern is the damage to the consumer (and their spending) which is happening now (as we have seen the past 6 months).

That’s why I think the Fed is concerned.

They can see the weakness in the consumer – where Powell has stressed the importance of balancing the risks.

The trend in real retail monthly sales data shows us the weakness.

And with consumer spend comprising more than two-thirds of the economy – this deserves our full attention.

From here, let’s see how Real PCE comes in July 26.