- Will the yield curve flatten further on higher inflation?

- How white-hot CPI could derail Biden’s inflationary ‘

spendathon’? - US dollar to strengthen further… worrying emerging markets

Markets were largely flat today in anticipation of tomorrow’s eagerly awaited November CPI number.

The Labor Department on Friday morning will release November’s consumer price index, a gauge that measures the cost of dozens of items.

The index covers common goods including gasoline and ground beef, but extends into more detailed purchases such as frozen vegetables, indoor plants and flowers and pet supplies

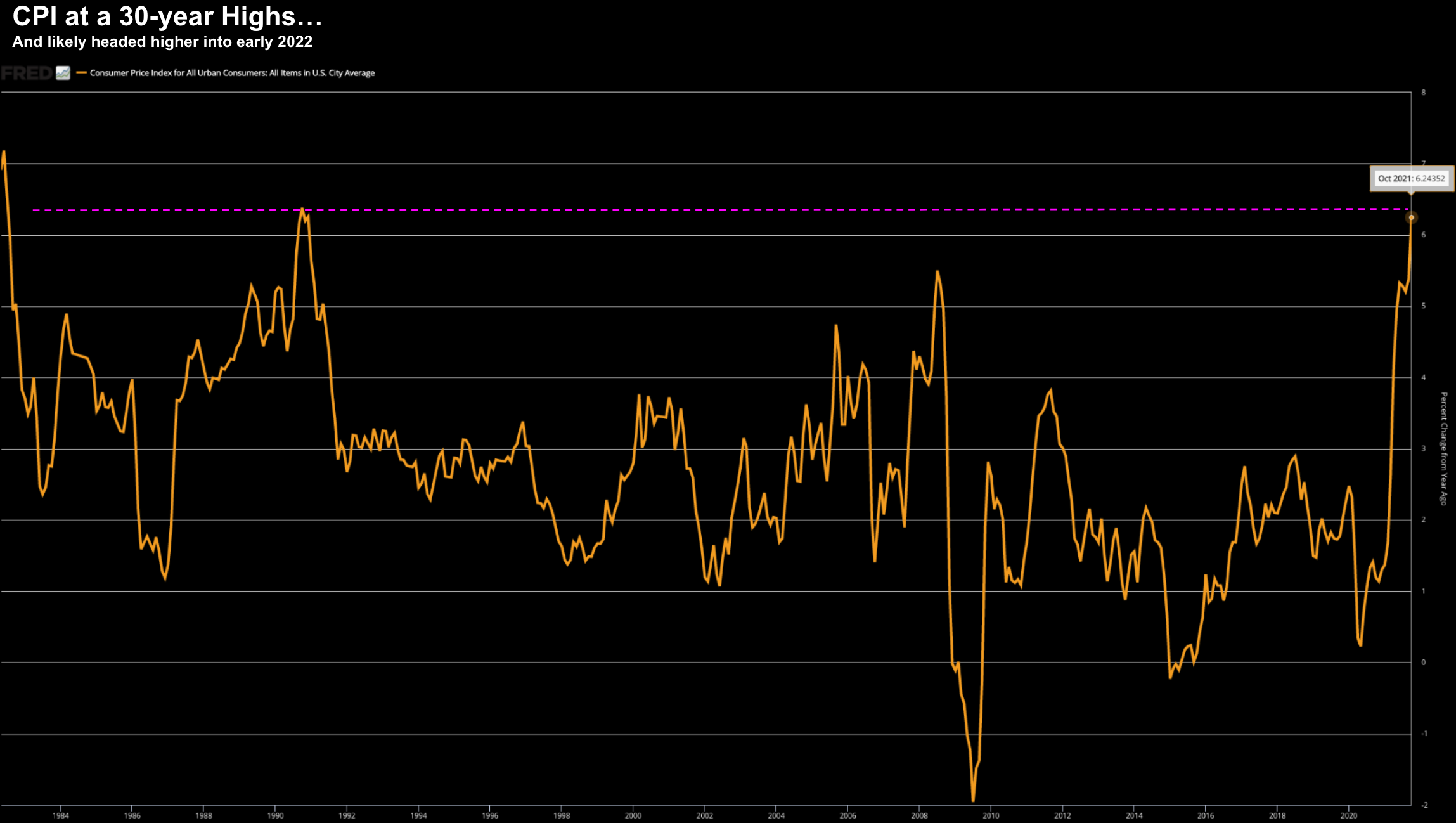

Will it be north of 6.2%?

If so, it will make it the largest increase since 1982.

Dec 9 2021

Or will it show signs of cooling… perhaps giving weight to Powell’s previous language of ‘transitory’?

Wall Street sees the former… with CPI coming in around 6.7% annualized… a frightening number by any measure.

Anything close to 6.7% to 7.0% is likely to support the Fed’s more aggressive stance with scaling back bond purchases.

Something hotter again could ignite fear of the Fed raising rates in the first half of next year… and perhaps 2 (maybe 3) 25 basis point rate rises in 2022?

Is that priced in?

I don’t think so.

But put equities aside for a moment… will a hot number potentially squash Joe Biden’s ambitions of several trillions in new spending?

For example, Democrat Senator Joe Manchin strongly opposes the (monstrous) spending bill for various reasons (inflation risks for one).

Here’s what Manchin had to say today:

“You want me to go back to West Virginia and say, ‘Boys, if you can just stay unemployed for a little longer, you’ll get a raise’?

None of this makes sense to me.”

He again called for “a strategic pause for spending and money creation,” adding that “if we get any of those wrong, we’re in trouble.”

“We’ve spent $5.4 trillion out the door, we have another $1.2 with the infrastructure bill…. I couldn’t get my head around $5.4.

So I said give me something to compare it to — World War II.

We saved the world, then you had the Marshall Plan rebuild Europe. In today’s dollars that would be $4.7 trillion.”

Mind blowing.

As I like to say – show me where the emergency is to spend more than what was required for WWII?

I digress….

But if inflation risks are rising (e.g., in the realm of 6.7%) — you would think it will only strengthen Manchin’s resolve to “kill the bill”.

Watch the Reaction in Bonds…

Last week, Powell’s recent hawkish pivot surprised markets.

Along with new COVID fears – it was the catalyst behind the recent 5% correction (the second for the year).

That said, markets have also time to digest what potentially ‘tighter’ monetary policy could mean.

A hot inflation read will not be “new news”…

But it’s not so much the number which matters… is the reaction from the Fed later this month.

For example, from the Fed’s perspective, they will be focused on the core side…

Dec 9 2021

If Core PCE (their preferred measure) is north of 4.2%… it’s difficult to see how this is positive for stocks.

From mine, we will get our cues from the bond market (and the dollar)… not equities.

For example, below is the 10-year Treasury Yield (white) vs the 2-Year Treasury Yield (orange)

Dec 9 2021

What we need to watch here is the move in 2-year yields.

They’ve moved sharply higher in recent weeks – which is the bond market suggesting the Fed is going to move.

However, the 10-year is moving lower (trading 1.50% at the time of writing) suggesting the bond market is concerned about growth.

Convergence of these two durations will worry the market.

For example, we saw this occur in early 2006… suggesting a recession wasn’t far away. The crash of 2008 was the result.

And we also saw a brief inversion in 2019… with a recession following in 2020 (albeit v-shaped thanks to ~$4 Trillion from the Fed).

The Only ‘Good’ Outcome…

For me, the Fed are “damned if they do and damned if they don’t”.

They are going regardless… having fallen behind the curve.

The only ‘acceptable’ outcome for equities will be a CPI number lower than 6.7%

I say that because a number between 6.2% and 6.7% is largely priced in.

But north of 6.7%?

What none of us know is how the Fed will react…

That said, if the number comes in hotter than expected, the bond market will start pricing in a more aggressive Fed.

In turn, this would imply a slower rate of liquidity growth – which will see equities lose momentum (supported by this chart)

Dec 9 2021

And this begs a question for another day…

What does 2022 look like with a much slower rate of liquidity growth?

I will talk about this towards the end of the month… but don’t expect a repeat of 2021.

Putting it All Together…

I think what could be interesting tomorrow is if inflation comes in much lower than expected.

For example, something in “low 6’s”?

It could have the market wondering if that would be enough for the Fed to re-think their (recent) hawkish language?

Personally I don’t see it… but it will be interesting to see how equities (and bonds) respond.

From mine, I think the Fed is committed.

As a minimum they will reduce all bond purchases to zero by next year and hike rates at least twice.

The question is what domestic growth environment will they be hiking into?

Will it be into strength or weakness?

And what will that do to the almighty US dollar?

Higher rates will equal a stronger dollar — which will pressure global markets and particularly emerging market debt.

For example, total emerging market debt edged up to $92.6 trillion, with China taking the “dragon’s” share.

In emerging markets excluding China, total debt hit a record high of $36.4 trillion, largely driven by increasing government debt.

These markets can not afford a stronger dollar… but will that be on the mind of Jay Powell & Co with monetary policy?

I doubt it.