- Markets see three rate cuts before 2025

- Watch for the (coming) un-inversion of the yield curve

- Why investors should consider selling the ‘long-end’ and buying the ‘short-end’

Today Fed Chair Powell delivered precisely what the market wanted to hear…

Help is on the way.

As a perpetual dove – Powell did his best to stay balanced however the cat is out of the bag.

Rate cuts are coming.

Shortly after the Fed Chair spoke – markets were quick to revise probabilities of near-term rate cuts:

- 100% chance of a rate cut for September;

- 75% for a second cut in November; and a

- 74% chance of a third cut in December.

Equities love nothing more than cheaper funding…

I will update the technical charts at the end of the week (and after we get earnings from Amazon and Apple)

For now, let’s look at what’s coming down the pike… cheaper money.

This Won’t be “One and Done”

Consistent with other meetings – Powell said rate cuts are an option if economic data continues on its current path.

In other words, it was the (same) scripted “data dependent” Fed.

However, there were some important nuances.

In light of the ‘economic data continuing on its current path’ – Powell said:

“If that test is met, a reduction in our policy rate could be on the table as soon as the next meeting in September”

The key word Powell used here was “could”

It was a word he used more than once.

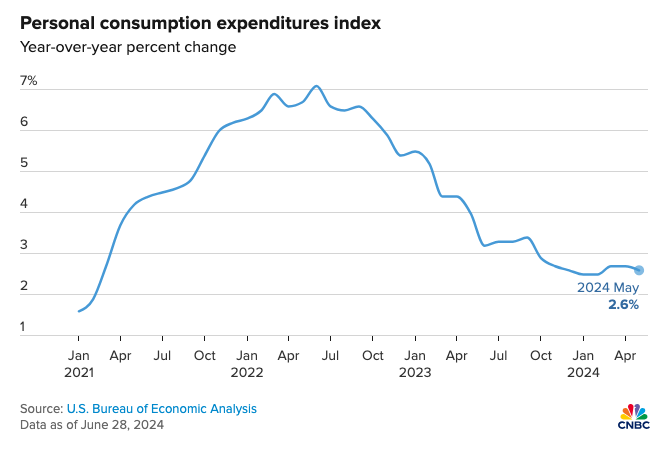

As we know, inflation has been trending lower in recent months.

Core PCE is trading with a 2-handle year-over-year and CPI is headed in the same direction (especially as we watch commodities and shelter prices come down)

And whilst both measures are still above the Fed’s desired 2.0% – they don’t need to wait until that level is achieved before they start easing.

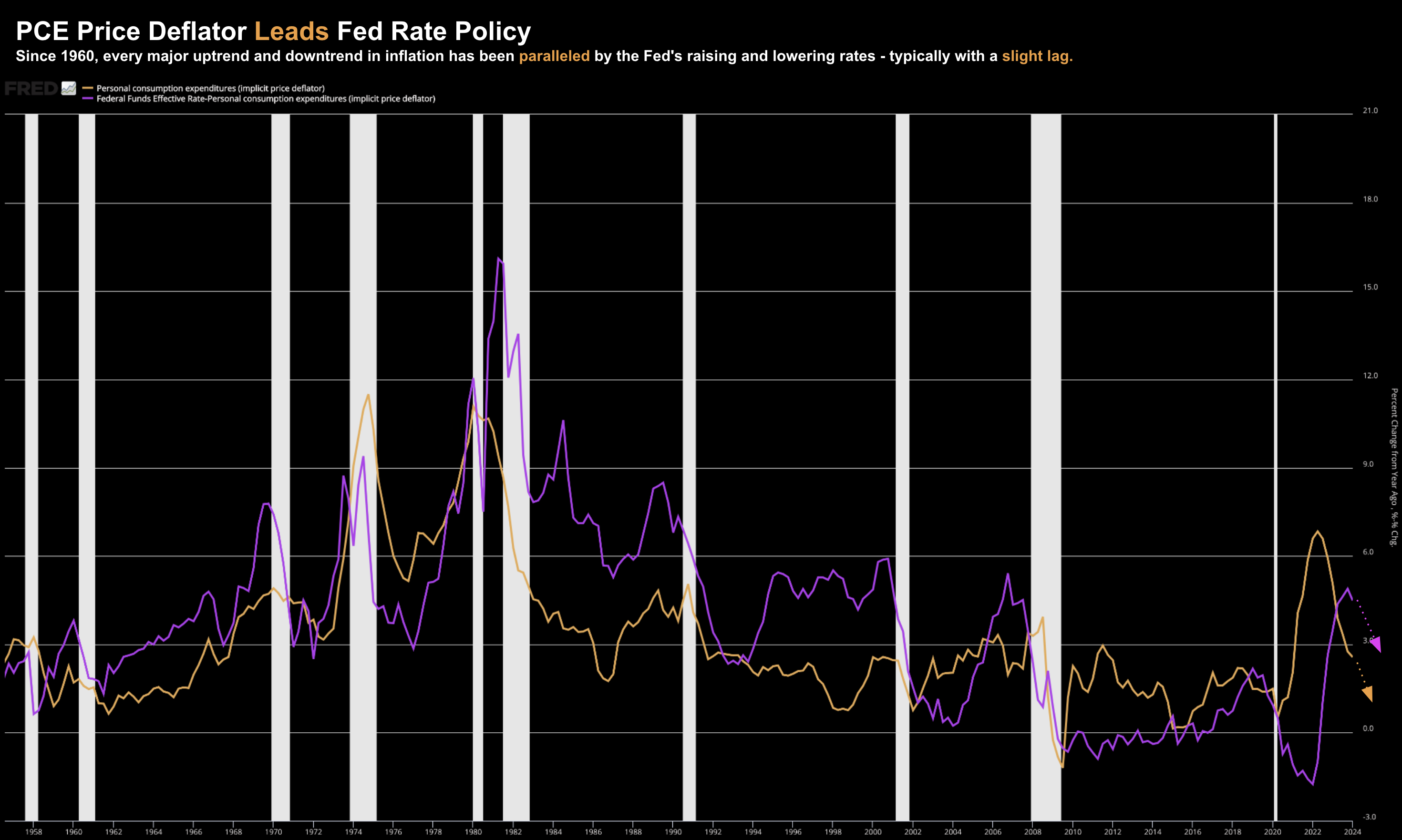

For example, as part of this post, I demonstrated why inflation is a leading indicator for Fed policy. And based on what we see – it’s now time for the Fed to go.

Repeating some of my language from that post:

Since 1960, every major uptrend and downtrend in inflation has been paralleled by the Fed’s raising and lowering of the fed funds rate, typically with a slight lag. This is very consistent.

And if we look at what we have seen with the PCE price deflator from early this year… it’s been trending lower sharply for ~6 months.

However, Fed policy has not moved. But at some point within the next few months – I believe their hand will be forced.

But are they moving too late? And will just one cut be the end of it?

On this, I think Steve Liesmann of CNBC asked a good question.

Essentially he asked the Chair whether rate cuts would be a process of normalizing or stimulus?

Powell responded by saying “… we can afford to begin to dialling back our policy rate and this will be a process”

Two things I took from this:

- Powell believes they have optionality (with inflation less of a risk); and more important

- Rate cuts will be a process

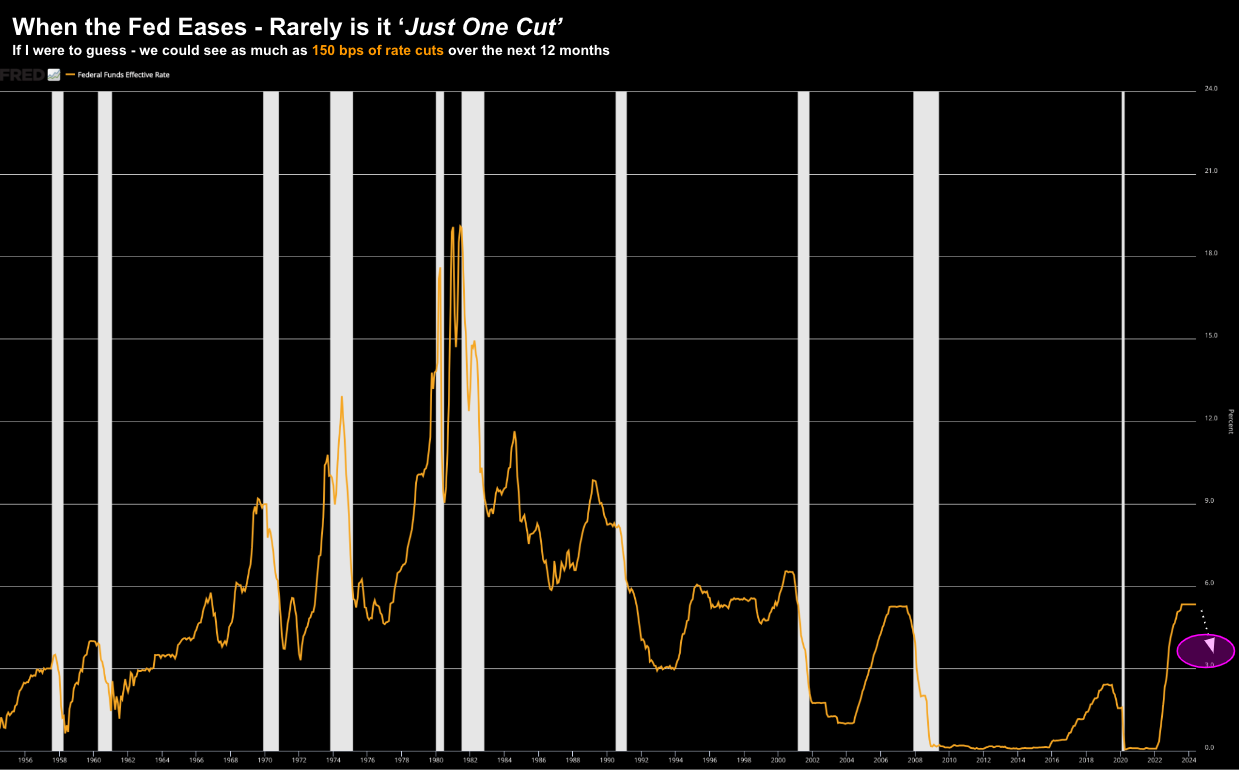

The use of the word “process” tells us this will likely be more than one cut. And whilst it’s impossible to guess – it would not be surprising to see:

- 50 to 75 basis points this year; and

- Pending employment and growth – potentially another 75 basis points next year (for a total of 150 bps)

If we look at the long-term chart below – whenever the Fed cut rates – not often is it simply ‘one rate cut’.

Not unlike cockroaches – rarely is there just one.

July 31 2024

So why as many as 6 rate cuts in the next 12 months?

Here Powell offered a small clue as to how they are thinking…

He said the economy today is not unlike what we saw pre-pandemic.

That’s interesting because today rates are 500 basis points higher…

Therefore, one could argue they could cut rates up to 6 times and still be well above what we saw 4-5 years ago.

In other words, Powell believes they have ample room to move.

Balancing the Risks

Powell continued to remind the audience the Fed is mindful of “balancing the risks” when setting policy.

The risks are two fold: (i) inflation; and (ii) employment.

This is the Fed’s dual mandate – price stability and full employment.

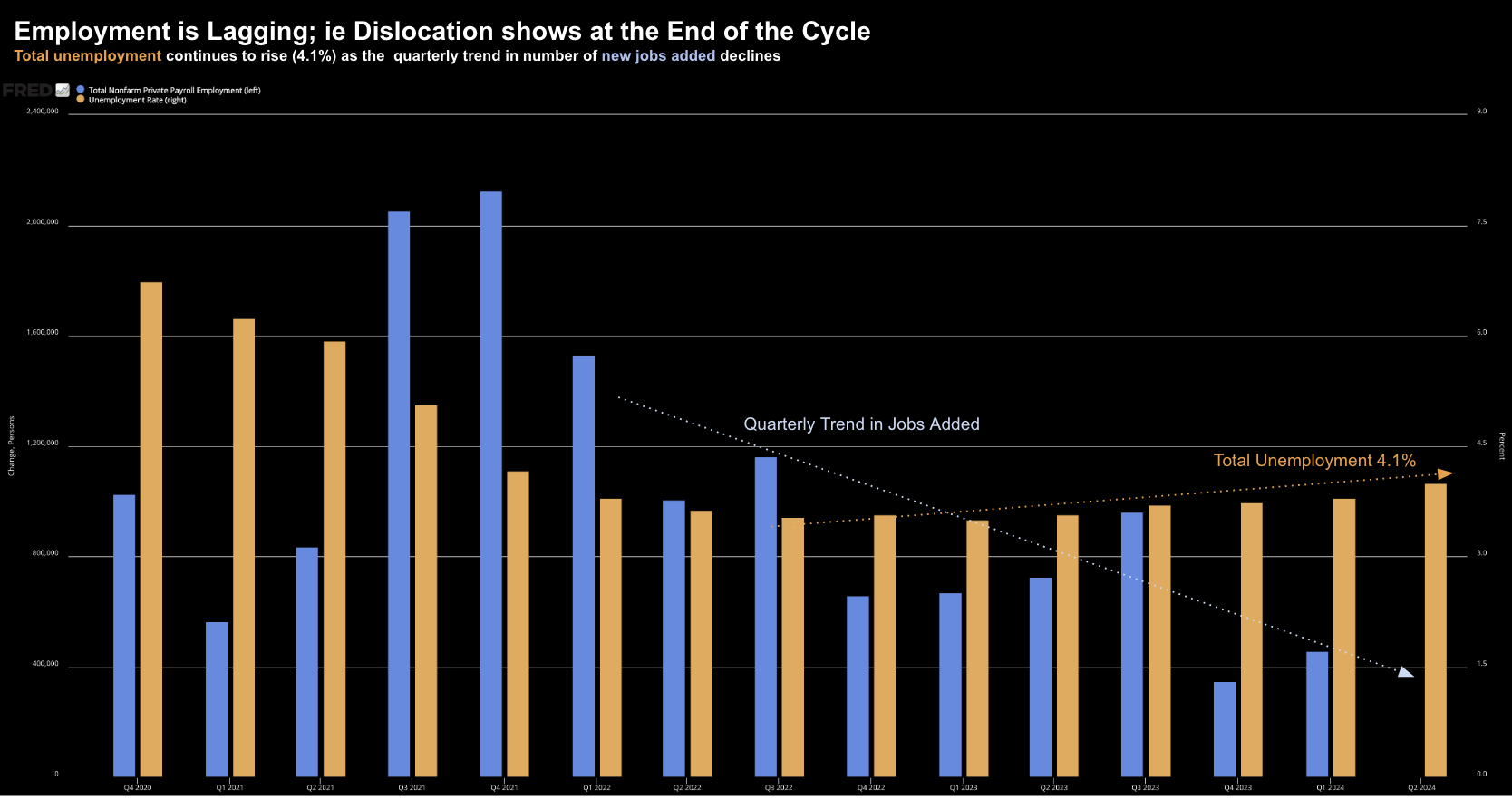

From mine, the clear slowdown we’re seeing in the labor market is where the Fed were going.

However, as we know, the unemployment rate is a lagging indicator.

Unemployment is now up from a low of 3.4% to 4.1% as of last month.

And given the wave of full-time layoffs we continue to hear (Intel one of the latest) – I would not be surprised to see this edging closer to 4.2% or 4.3% next month.

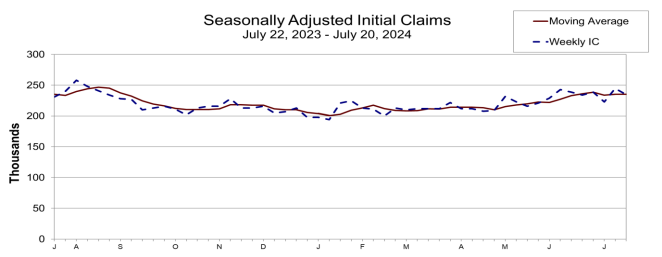

In addition, we’re seeing both continual and initial jobless claims rise.

I talked about why the latest (June) jobs report was not as strong as mainstream claim here. The market is yet to connect the dots.

Again, job losses happen after the damage is done.

For example, consumers are now exhausting what savings they have left (and leveraging credit) to maintain their pace of spending.

We saw this with the latest Real PCE report.

Now before we hear from the Fed again in seven weeks – we will get two more employment prints.

This will have on the impact on the rhetoric we hear from the Fed (and expectations for cuts)

And whilst inflation will likely soften (due to demand destruction) – unemployment could edge higher.

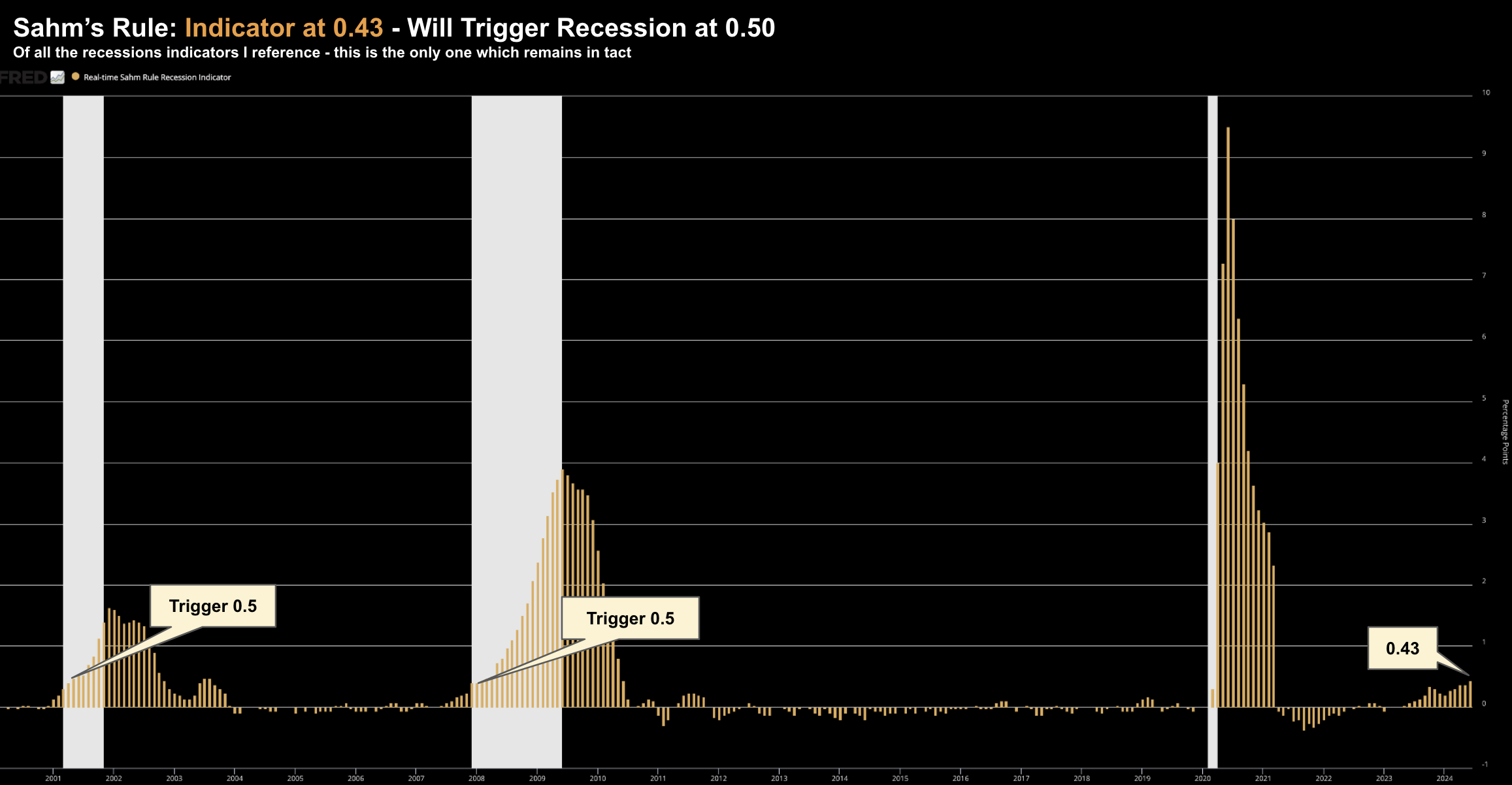

If this is correct – we should track what we see with Sahm’s Rule – warning us of a recession within 12 months.

July 31 2024

Let’s see how the overly-complacent “soft landing” narrative holds up (which I don’t buy) – when (not if) this rule triggers….

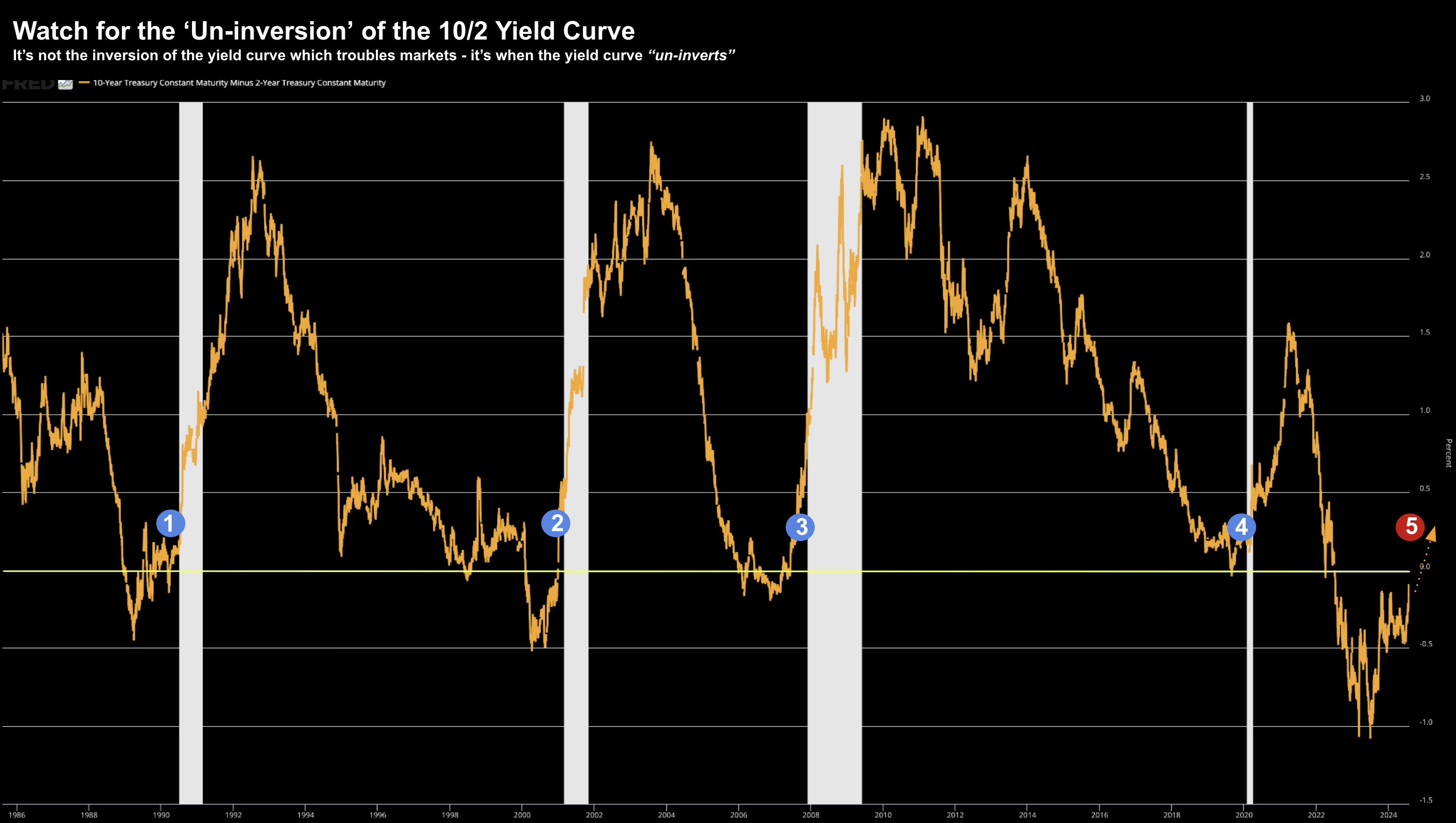

Watch the Un-inversion of the 10/2 Yield Curve

Whilst the market is cheering the prospect of at least three rate cuts this year – they might be less likely to cheer a yield curve which looks like “un-inverting”

For those less familiar, this will occur when the short-term yield (e.g., 2-year) is lower than the longer-term yield (e.g., 10-year)

And by the way – this is normal.

Generally the 10-year yield is significantly higher than shorter-term yields to compensate investors for taking duration risk.

What’s unusual is to have an inverted yield curve (which is what we have had for a record amount of time)

From mine, if the Fed is likely to ease – it follows the 2-year yield will likely come down.

What’s more, so too will the 3-year and 5-year yields.

However, I think there is an open question as to whether the 10-year yield comes down meaningfully (e.g., below say 3.50%)

Looking at the 40-year chart below – observe the previous four recessions (labelled in blue)

July 31 2024

In every instance, as the yield curve steepened from inversion (i.e., from below zero) – we saw the onset of a recession.

Markets typically rally during the process of inversion (and we have seen this the past two years) – however they react negatively to un-inversions.

Why does this happen?

This overlaps with my point above regarding the 10-year yield.

Investors tend to avoid the long-end of the curve (i.e. they sell longer duration bonds) – seeking more attractive returns at the shorter-end (less duration risk).

This has the effect of pushing longer-term yields higher.

And it’s for this reason – I’m very wary of being too long long-term bonds should we see the 10-year well below 4.0%

As I’ve said numerous times of late – I don’t see longer-term yields falling much below 3.50% over the next few years…

We are in a new-era of money.

Capital will cost more.

It’s very unlikely we are going to back to “zero rates” we saw the past two decades. That’s over.

In fact, I would not be surprised if the 10-year was significantly higher than 6.0% three (or more) years.

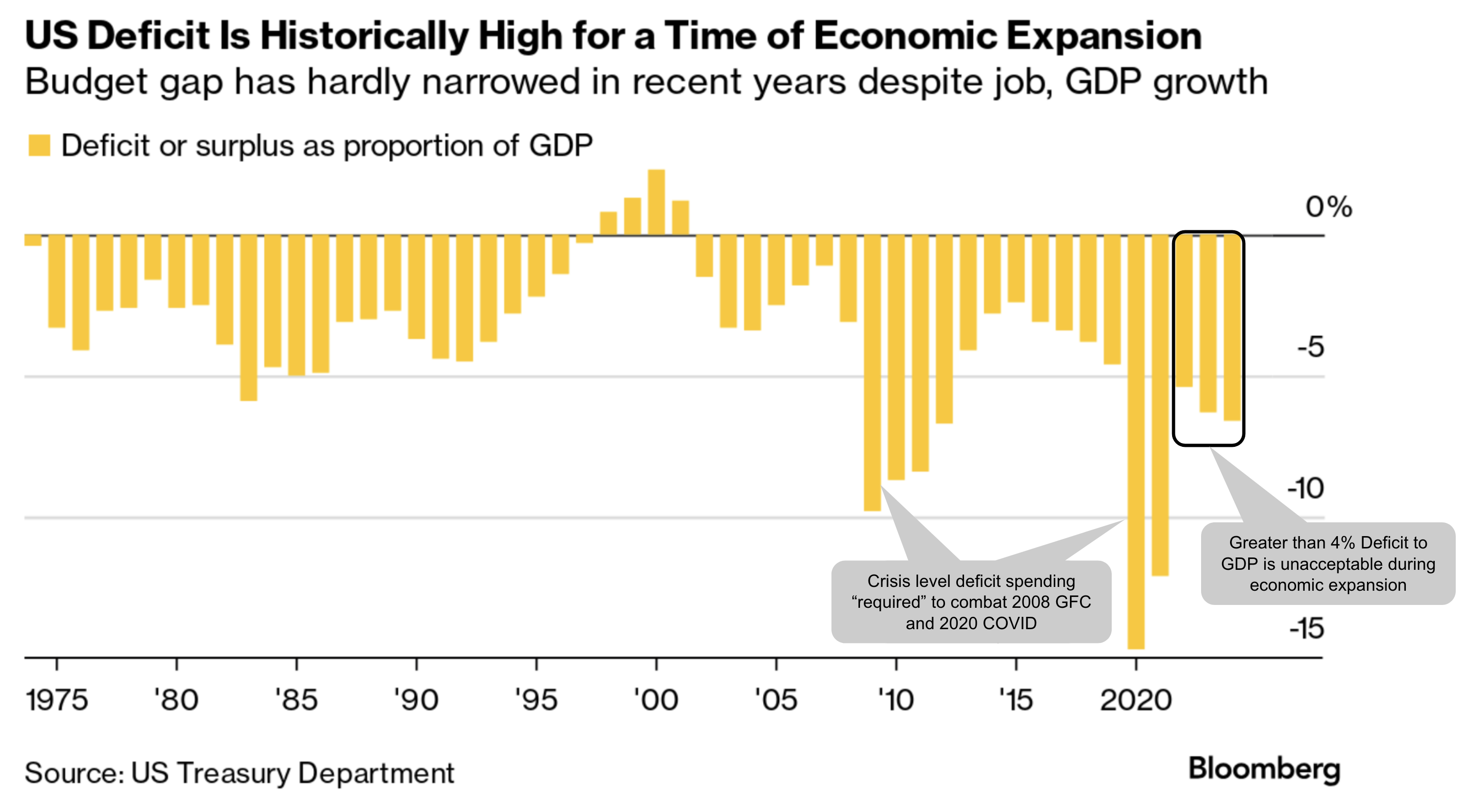

And it comes down to this troubling chart (from Bloomberg):

This is now a serious problem… which very few are talking about.

For example, in the first seven months of Fiscal Year (FY) 2024, spending on net interest has reached $514 billion, surpassing spending on both national defense ($498 billion) and Medicare ($465 billion).

Overall spending has totaled $3.9 trillion thus far.

Interest expense alone exceeds all the money spent on veterans, education, and transportation combined.

How is this acceptable?

How is it responsible?

February this year, Powell raised this issue in a rare interview with 60 Minutes.

He sent a not-so-subtle warning to members of Congress:

“It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path”

When asked if this was urgent – Powell said “…sooner is better than later. You could say that it was urgent, yes.”

So let me ask you…

Do you think either side – Republican or Democrat – is going to reign in fiscal spending?

My answer is no.

Not if they want to win votes. Politicans like to buy votes with spending.

Few people want austerity.

If you think that reckless government spending is likely to continue at the velocity we have seen the past three years – then I would not be a buyer of long-term bonds.

These yields are only likely to rise as the bond vigilantes strike. For clarity – that does not mean the 10-year yield may fall in the near-term (as the probabilities of recession and rate cuts increase)

They probable will – but I don’t see them staying there for long

From mine, you are better to reduce your exposure to the long-end; and look to increase exposure to the short-end (e.g., 2, 3 or 5 year)

Putting it All Together

Rate cuts are on their way… Powell made that clear today.

With two more CPI prints before the Fed meets again in seven weeks – it’s likely this will be in their favour.

But as I said a month or two ago – inflation risks are behind us.

All eyes will continue to be on employment, wages and spending risks.

Again, whilst employment is a lagging indicator – the softness in the economy is here.

Any further weakness in the employment data will force the Fed’s hand.

And whilst I see short-term rates coming down (sharply) – I can’t say the same for the long-end over the long run.

That’s a risk for the economy and the government at large.

Remember:

Every debt instrument is priced against the US 10-year yield.

That includes your mortgage, car loan, credit card, student loan – you name it.

Now let’s say we are in a deep slowdown next year – and the government needs to stimulate by issuing even more debt.

What yields will the bond vigilantes command?

If the government does not get its fiscal house in order very soon – I would not be surprised to see these yields resuming their ascent higher.

A 6.0% 10-year yield in three years (or more) is not without possibility.

Is the world ready for that?

If that’s the case, you don’t won’t exposure to the long-end.

For example, if we see the long-end (10-year) trading anywhere between 3.80% and 4.00% – I would be using that as an opportunity to reduce exposure.

Bond prices trade inversely to their yields.