- Ka-Pow(ell)!! Fed Chair pulls no punches on hikes

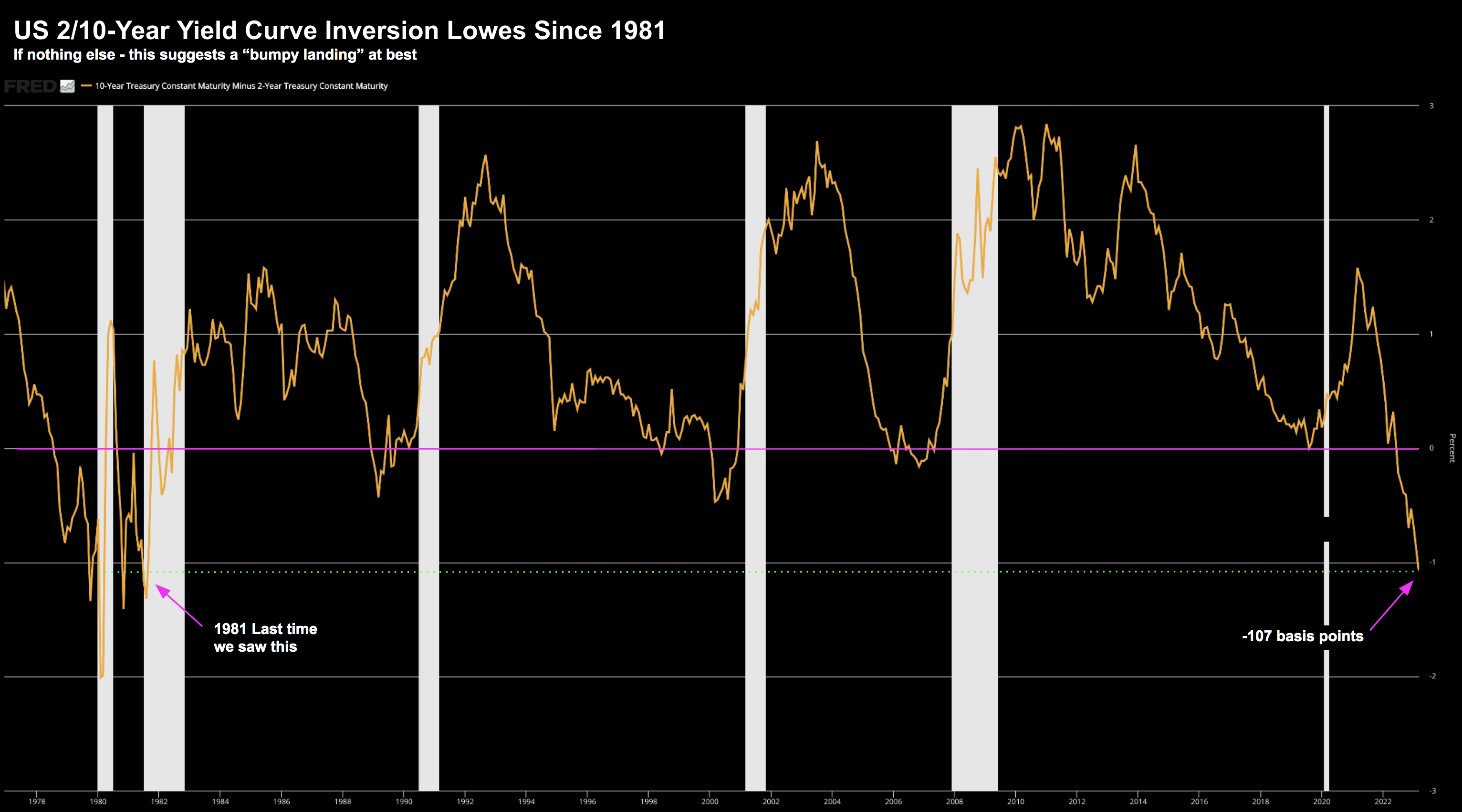

- 2-10 Yield Curve inverts to 107 bps – lowest since 1981

- Why Powell may not go 50 bps in March

People will always choose what they want to hear.

Period.

And in the case of the market – over the past 12 months – they have refused to listen to the Fed.

The Fed Chairman – Jay Powell – has consistently been a hawk.

About 9 months ago he made it crystal clear “there will be pain”

“There’s a long way to go”… “It’s far too premature to think our work is done” – he would say every single month.

But what did markets choose to hear?

They heard a dove.

The last time Powell spoke (before this week) he gave the doves a glimmer of hope by using the word “disinflation”

In fact, he mentioned it 11 times during his address.

The doves jumped on it.

Inflation is done. The Fed is about to cut.

That was a potential blunder from Powell.

Not a blunder in the sense the description is correct (i.e. inflation is coming down) – but it left things open to dovish interpretation.

Markets took off.

This week Powell addressed Congress.

First he testified to the Senate (yesterday) and today the House of Reps.

Markets were expecting a mildly hawkish Fed…. perhaps more use of the word “disinflation”

Wrong.

He mentioned the word just once.

This was full hawk Jay.

He recognized his blunder with the previous FOMC meeting and slammed the door shut on doves with “happy ears”.

Here’s the killer blow:

The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.

Could the language be any clearer?

Now if there are market participants who still think the Fed are dovish… maybe English isn’t your preferred language.

Take a course.

Powell was explicit that he might lift the Fed’s benchmark lending rate by a half percentage point at the March 22 meeting… pending the data.

Bring it I say.

Here’s a very loose analogy:

The patient has a life-threatening infection (e.g., unacceptably high stubborn inflation) – caused by a nasty bacteria (e.g., excessive money) and needs penicillin to kill it (higher interest rates).

Let’s say the penicillin is doing its job… the patient appears to be recovering… the infection is easing… but you are not through the full recommended dosage.

Do you start taking half measures? Maybe even pause whilst you still have the infection?

Or do you simply keep going until the infection is dead?

You keep going.

That’s what Powell told us this week… the economy is still suffering with this nasty bacteria… and we need to kill it dead.

Surprise surprise… markets were shocked.

It’s Going to Get “Bumpy”

I was not overly surprised to see the market’s reaction given I felt equities were fighting the Fed.

I’ve always felt the market was trying to call Powell’s bluff on rates…

Good luck with that.

Steven Blitz of TS Lombard described Powell’s language as a “tacit admission” that February’s downshift in hikes had been a mistake.

The Fed did this because the peak rate appeared to be close but…

“They are, in fact, no closer to understanding where the peak rate resides than they were a few months back, because they have no idea where disinflation will settle without a recession.”

Exactly.

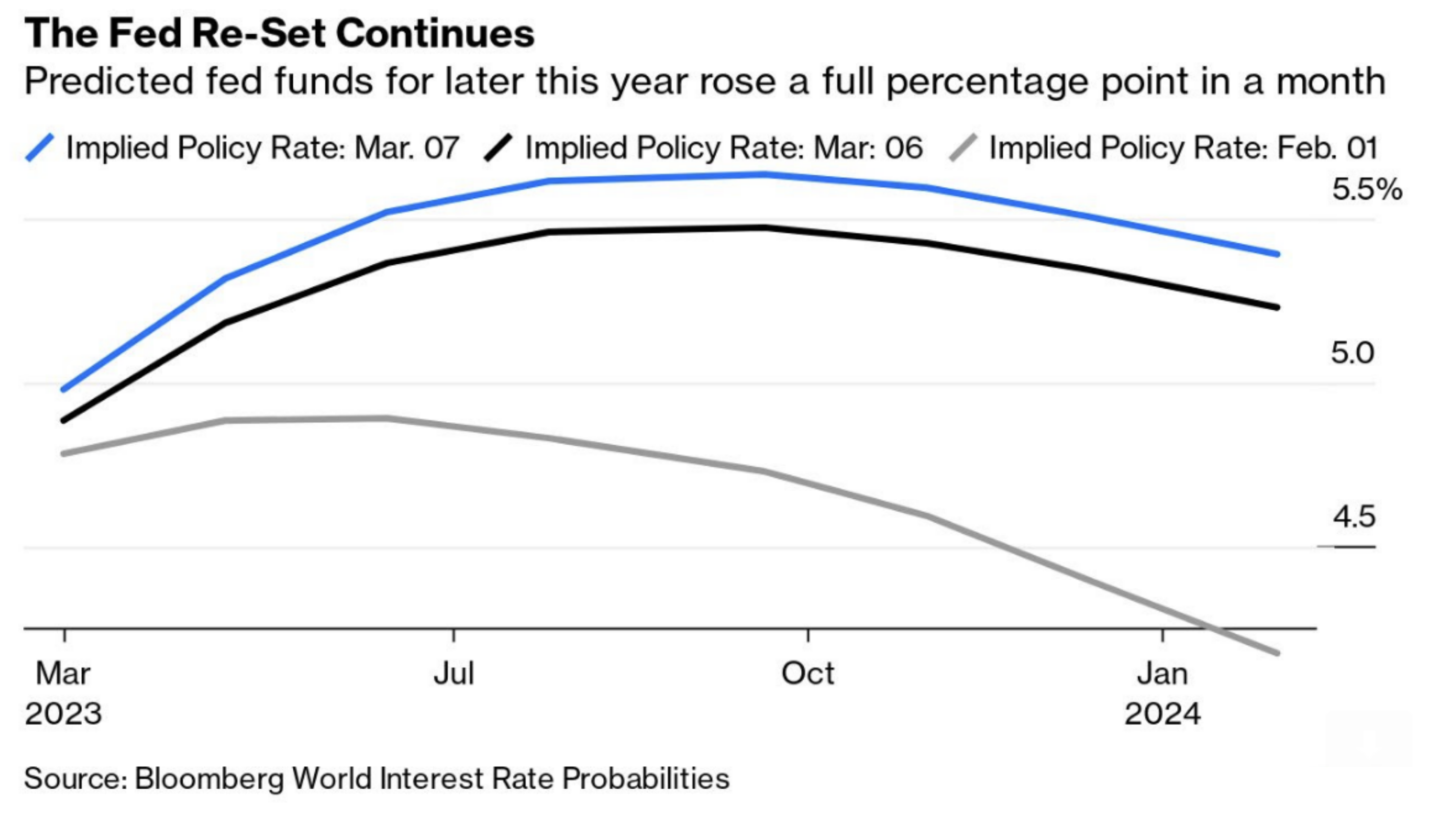

Treasuries yields found their mojo – with the US 2-year ripping above 5.0%.

Traders now expect the Fed to hike by 50 bps in two weeks.

This also raises the key borrowing costs by 107 basis points over the next four meetings to a peak of about 5.6%.

As I was saying just recently – it would be remiss of traders to rule out an terminal rate of 6.0%

March 8 2023

Question:

How’s that so-called “soft landing” looking with the effective Fed rate trading at 5.75% to 6.00%?

What’s more, that rate could be in play for at least 6 months.

Maybe we change the language to a “bumpy landing” (for those not willing to admit it could be “hard”)

After all, that was Powell’s choice of words.

He admitted that “the process of getting inflation back down to 2% has a long way to go and is likely to be bumpy.”

Yes… recessions are “bumpy”.

Earnings contract. Multiples will come down.

And sadly, millions of jobs will be lost as many businesses close their doors.

It’s bumpy.

And that’s what the 2/10 yield curve suggests – at its deepest inversion since 1981:

March 8 2023

And guess what – it’s going lower.

Soft landing?

I’m not convinced.

Equities Surprised

Stocks sold off post Powell’s “surprise” testimony.

Now I can only assume they expected a less hawkish Fed Chair.

Let’s take a look:

March 8 2023

For example:

- We rallied to the (expected) 4100 to 4200 zone;

- We found stiff resistance and failed; and now

- Look like heading lower.

The MACD in the lower window shows how bulls have lost all momentum… now without a strong catalyst to push things higher.

Technically I think we challenge the 3800 zone in the next few weeks.

And I am not willing to rule out a re-test of the October lows.

I will update the chart at the end of the week.

Putting it All Together

Goldman Sachs economists added 25 bps to their forecast for the peak rate to a range of 5.5% to 5.75% this week.

Golf clap for Goldies (it’s why they are paid the big bucks)

But as I have always said – whether the peak rate is “5.50% or 5.75% or 6.00%” – the more important question is how long we stay there?

3 months? 6 months? 12 months?

That’s entirely a function of the data.

We need to kill the infection.

How long rates stay elevated is going to have a greater impact on the economy (not simply whether they ‘touch’ 5.75%)

From mine, don’t expect any cuts until at least Q1 2024 (which until this week was a contrarian call… not now)

But let me add one more contrarian call…

I’m not willing to join the 50 bps club for March just yet (which is now consensus)

Yes, Powell was “full hawk” and needed to be.

He lost credit after the last address. He amended that error.

Doves got the memo (I hope).

However, Powell is not about to box himself into a corner.

For example, if we see 200,000 to 250,000 jobs added for February (or less) – Powell may be comfortable with 25 bps.

However, a number above 300,000 jobs and his hands are tied.

More needs to be done.

This all depends on jobs and the employment rate.

I say that because Powell will not be able to bring down service sector inflation without bringing down wages.

Reality is that will mean increasing the unemployment rate.

Bumpy.