- Markets sulk after Powell’s dose of reality

- Real rates are getting tight – second half cuts should not be ruled out

- Tech was priced to perfection (i.e., the bar was too high)

As we started this year – I felt the market was getting ahead of itself.

Not only was the tape approaching an overbought zone – it also assumed as many as six rate cuts (possibly seven) before the end of the year.

What’s more – it also priced in that earnings per share (EPS) would grow 12% year on year.

It felt like a contradiction.

How could we have both?

For example, either the economy was reeling and needed (emergency) rate cuts; or the economy is expanding strongly (supporting earnings growth)?

What was it?

Today Fed Chair Jay Powell pushed back on the former.

“I don’t think it’s likely that we’ll reach a level of confidence by the time of the March meeting . . . I don’t think that’s the base case”

For me, “likely” is a nebulous term (not helpful) – but my read is less than 25% we see a March rate cut.

And markets were quick to adjust…

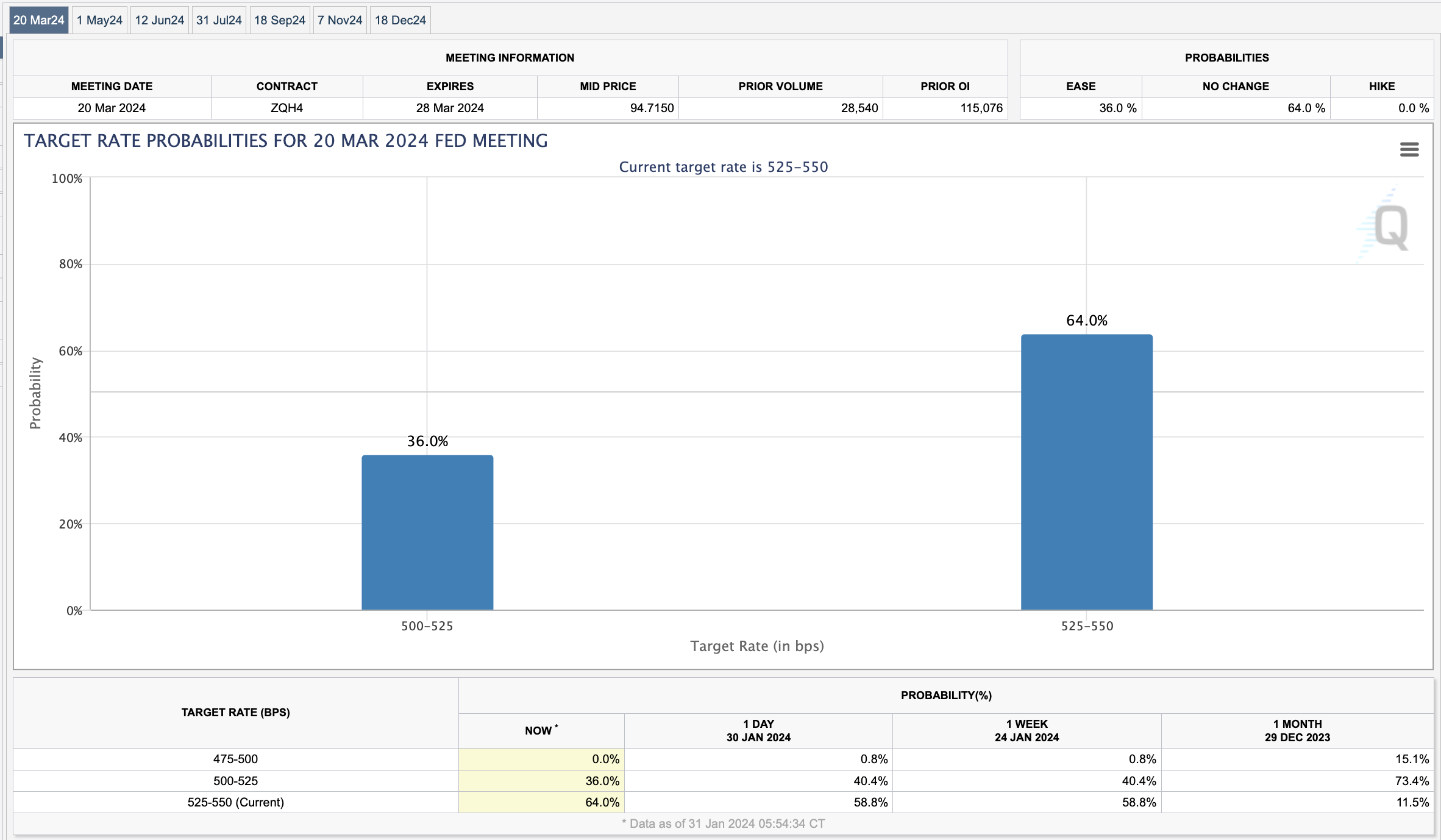

Odds for March Cuts Plunge

Coming into January – the market priced in a 73% chance of a rate cut in March.

With inflation falling – investors had convinced themselves the Fed ‘had’ to cut.

I wasn’t buying it…

Following Powell’s statement today – odds plunged to just 36%

To be clear, Powell did not say they won’t cut it March (they may) – but that’s not the Fed’s base case.

My view has been we’ll be talking about rate cuts in the second half.

However, rate cuts would not be because the “world is coming to an end”.

Far from it.

We have full employment and inflation is falling back to the desired level of around 2.0%

My guess is we will be there with Core and Headline by year’s end (or early 2025).

The Fed have suggested they’re essentially winning the fight – however they will not be bullied by the market.

But let me offer why three (maybe four) rate cuts could be justified in due course…

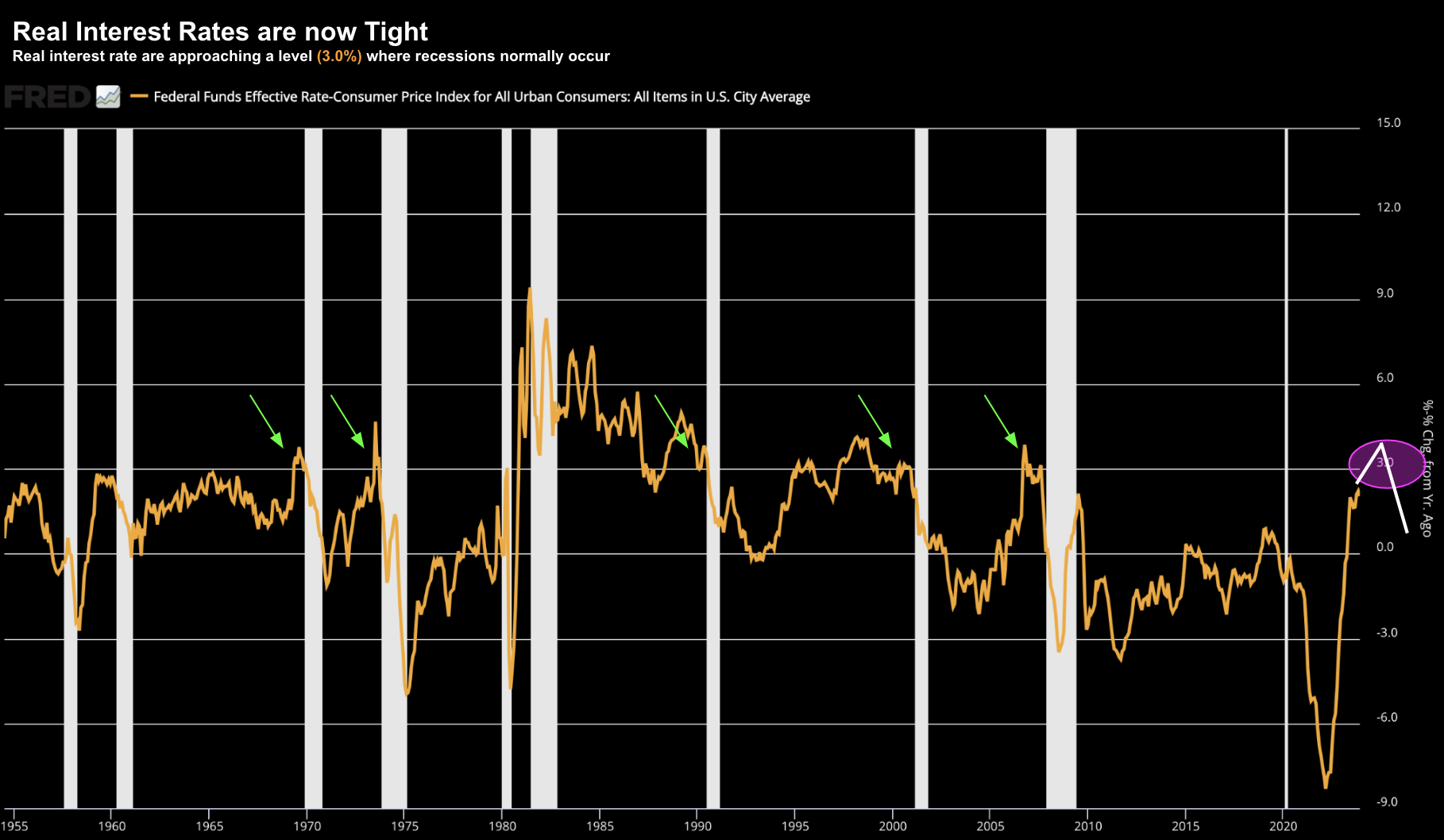

And it comes back to real rates…

Jan 31 2024

On the assumption inflation continues to head lower – and the Fed holds rates steady through March – it’s plausible real rates rise.

However, what’s interesting is recessions typically occur shortly after real rates hit ~3.0% (green arrows)

Today we are still below this level however falling inflation will cause this to rise.

Based on this – fixed income markets are doing exactly what they are supposed to.

But if we’re zoom out… this is all about the data (and it always has been).

The Fed will remain dependent on two prints:

- inflation; and

- employment.

This is what the Chairman reiterated and what other officials have been saying for months. The market however refuses to listen.

And from mine, it’s wise of the Fed to remain cautious.

Why declare victory prematurely?

The economy isn’t in trouble. GDP continues to expand; employment is full; and inflation is trending lower.

Now if something goes horribly wrong (which could happen) – they can cut if needed.

What’s more – they can also suspend Quantitative Tightening.

That’s the “Fed Put”

They have that in their pocket when or if needed.

But they are not forced to give up that option today.

Today Powell told a petulant market to be patient; i.e., you can’t get everything you want right now.

And the market sulked like any spoiled child.

Big Tech Disappoints (So Far)

In other news, we have had results from Alphabet (Google) and Microsoft.

We will get Apple, Amazon and Meta on Thursday.

I think their results were satisfactory but far from great.

But here’s the problem:

Technology stocks have been priced for perfection. Satisfactory results don’t cut it.

With forward earnings multiples for the Magnificent Seven averaging 35x… you need stellar results.

We got good results – not stellar.

Now I talked about the risks of over-exposure to large-cap tech here – suggesting there is better risk/reward with the equal weighted index.

I felt that earnings expectations were far too high – which implies these names could easily pull back in the realm of 10% to 20%.

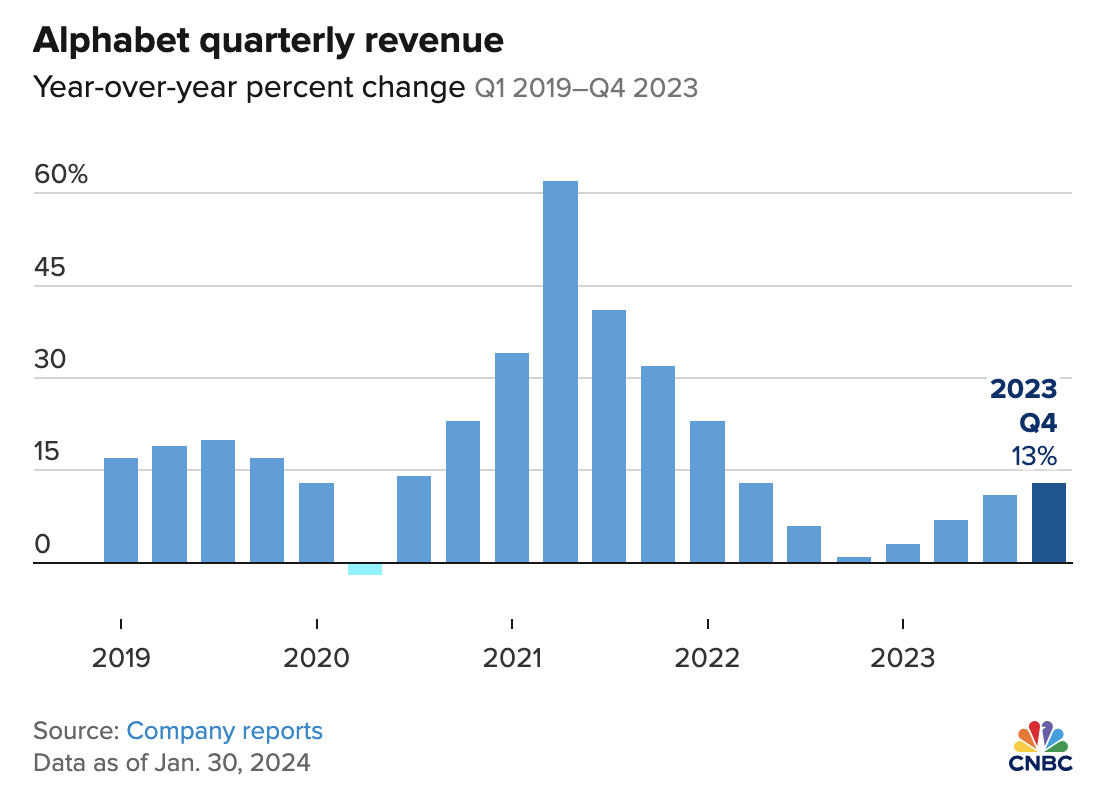

Alphabet (GOOG) for example gave back 7.35% today – after the Search giant reported disappointing ad revenue of $65.52 billion (missing the $65.94 billion the market expected). YouTube also missed top-line expectations. Total revenue was up 13% year on year.

However, at a (lofty) forward multiple of ~25x forward – 13% revenue growth is insufficient. Put another way, if the forward multiple was closer to 20x forward – it’s possible the stock would have gained after the result.

Source: CNBC – Jan 31 2024

With respect to Microsoft (MSFT) – they said its revenue increased 17.6% year over year (almost 5% better than Google) – although its outlook was a bit light.

Its Intelligent Cloud segment beat analysts’ expectations, and revenue from Azure and other cloud services grew 30%.

MSFT delivered a better result than GOOG – however at 35x forward earnings – it wasn’t surprising to see their shares fall less than 2%

Putting it All Together

Based on my missives of the past couple of months – I wasn’t surprised to see tech give back ground. A lot of very good news was already priced in (too much).

Yes, the earnings were decent – but not great.

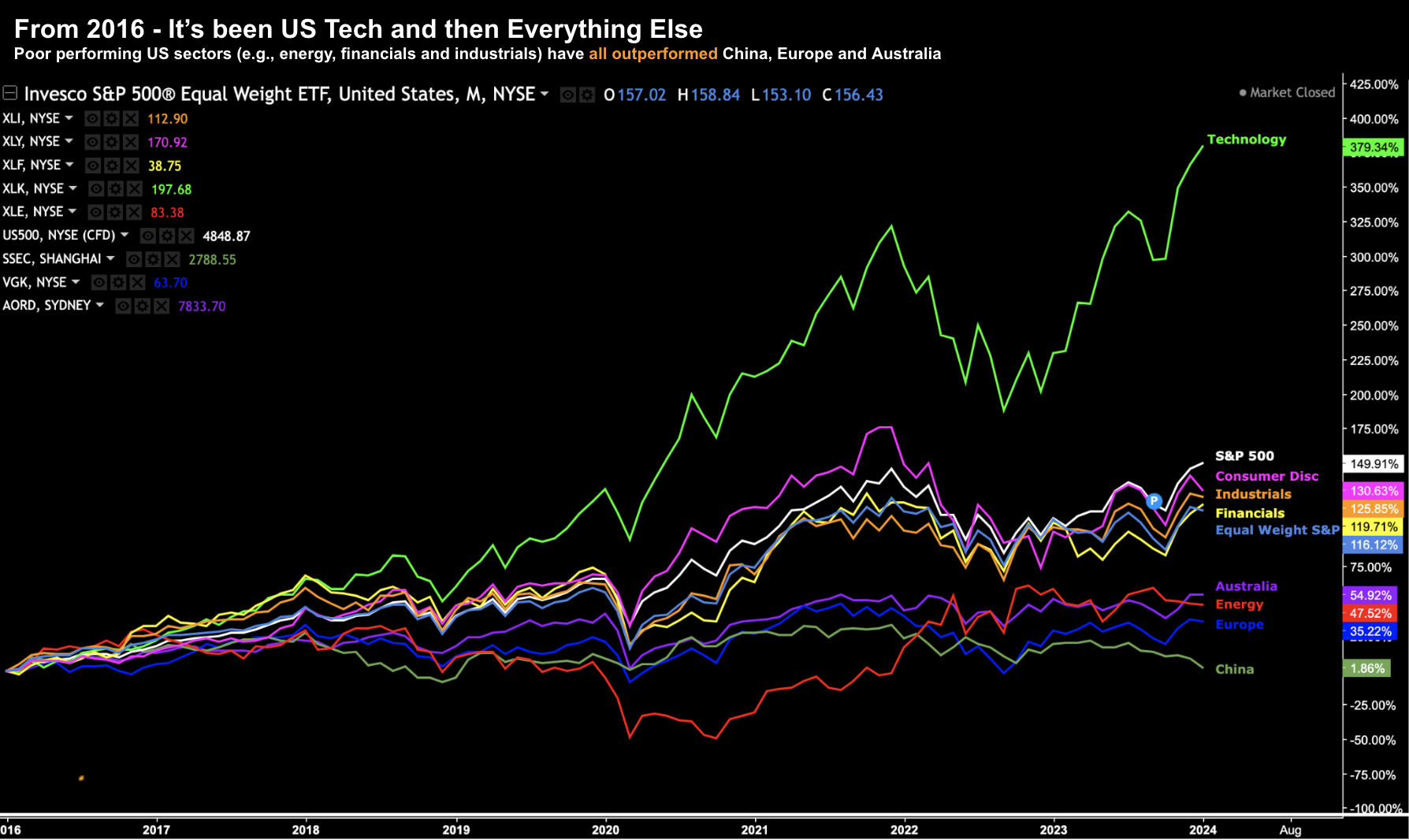

In addition, we should be mindful of how far tech has rallied over the past 12+ months.

But if we go back further – this is familiar territory.

For example, consider this 8-year chart where I compare the XLK ETF (technology) to:

- S&P 500 (white)

- Other US sectors (e.g., financials, consumer discretionary, industrials, energy)

- Equal Weighted S&P 500; and

- Markets such as Australia, Europe and China

Jan 31 2024

This performance chart overlaps with what I was saying recently about mean reversion.

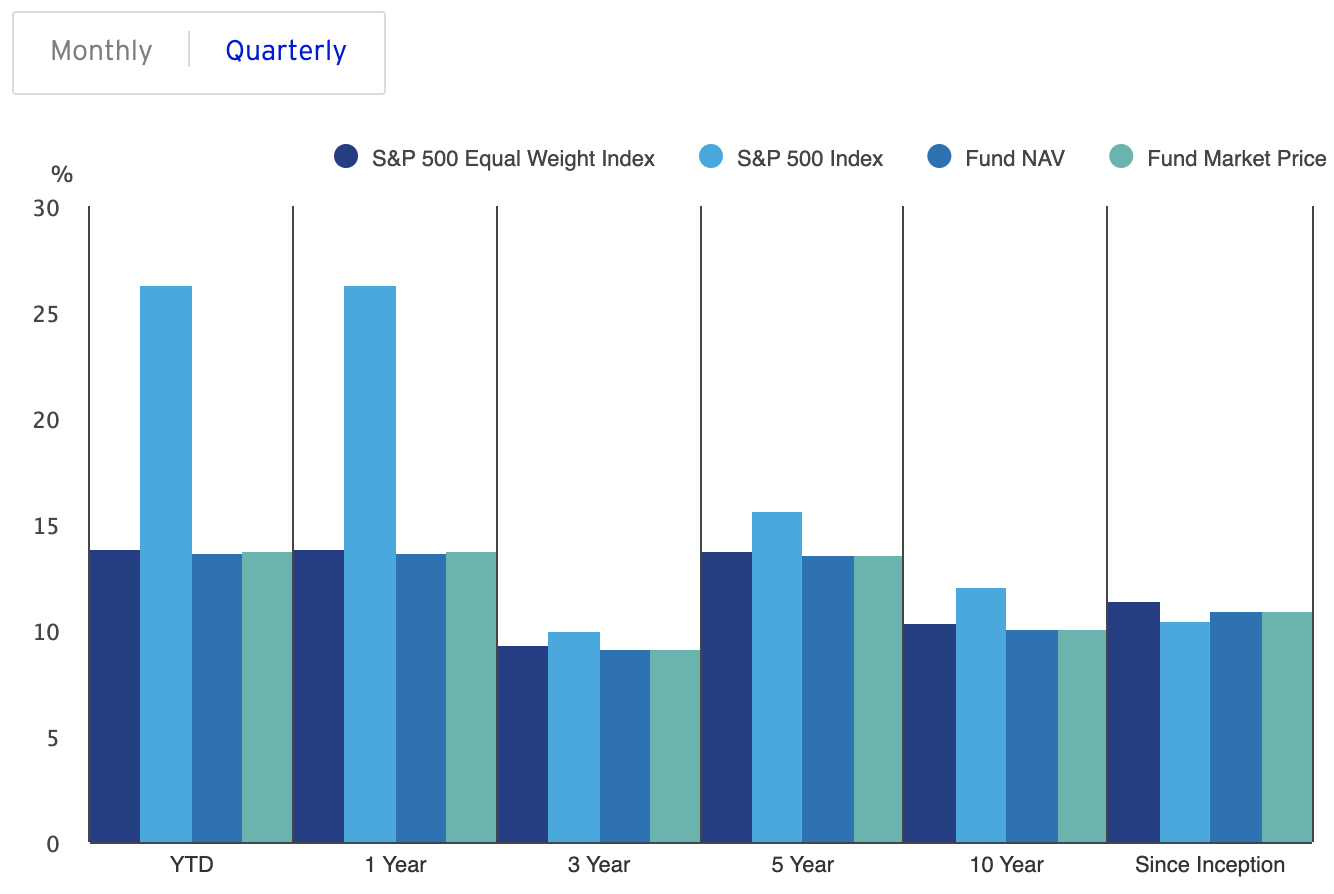

For example, over the long-run – the equal weighted S&P 500 index has outperformed the benchmark (see bar chart on right-hand side below).

Today, this ETF trades at a forward PE of ~16x (meaningfully below tech at 35x)

However, over the past year – it’s meaningfully underperformed (given the outperformance of a handful of tech stocks)

Therefore, investors would be wise to consider rebalancing (tech heavy) portfolios into either:

(a) the equal weighted index (RSP); and/or

(b) sectors such as financials (XLF), consumer discretionary (XLY) and/or industrials (XLI)

For those who are open to higher risk – modest exposure to either Europe (VGK), China (SSEC) and Australia (STW) – might also benefit by mean reversion in subsequent years.