- The war with unwanted inflation is over

- But will 150 bps of rate cuts the next 12 months avoid a (sharp) slowdown?

- All eyes now turn to PCE (Aug 30) and Nonfarm Payrolls (Sept 6)

“The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks”

— Jay Powell, Aug 23 2024

Fed Chair Powell didn’t disappoint at Jackson Hole – giving the market exactly what it wanted to hear… rate cuts are coming.

All that remains how many and by when?

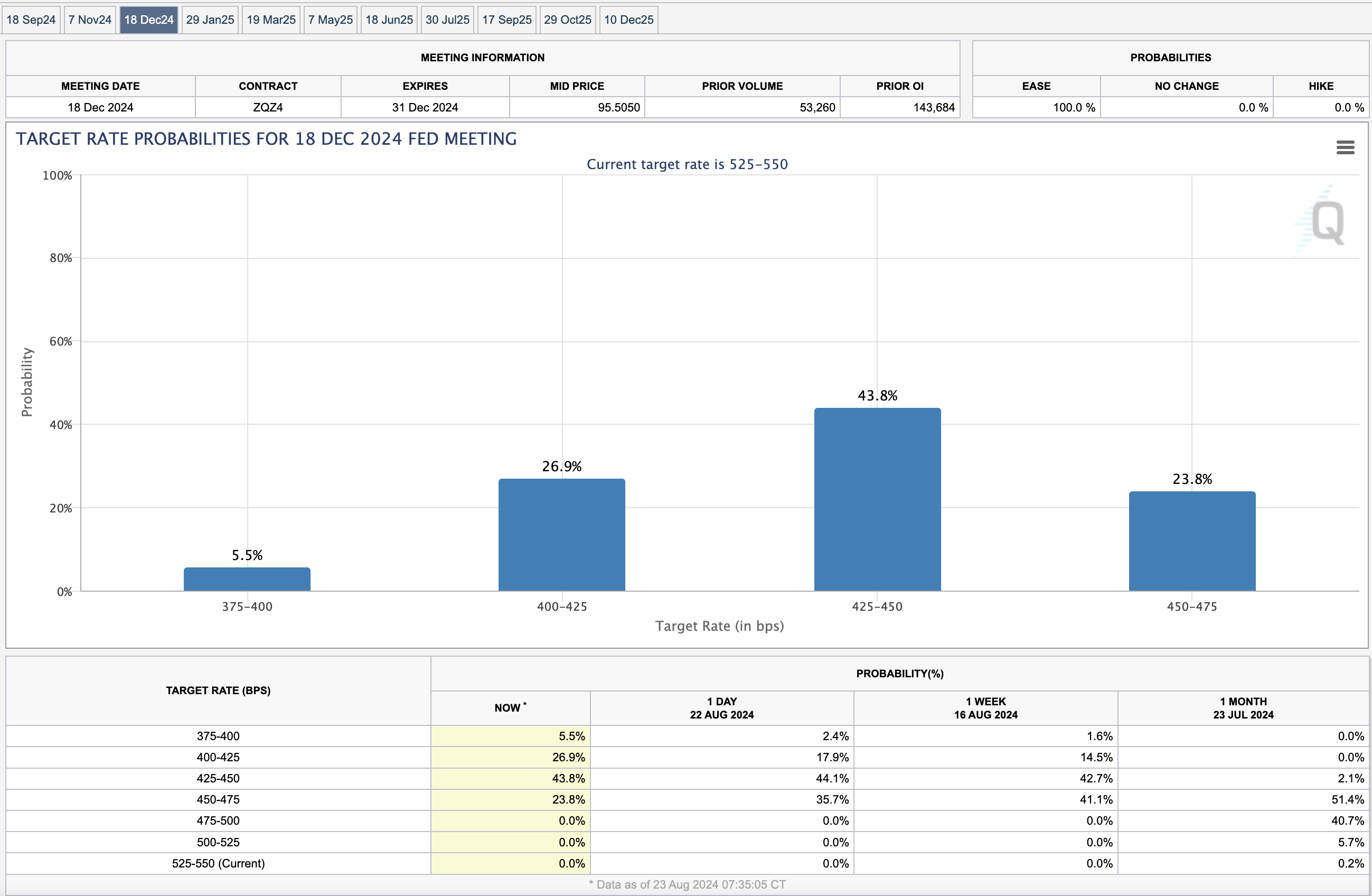

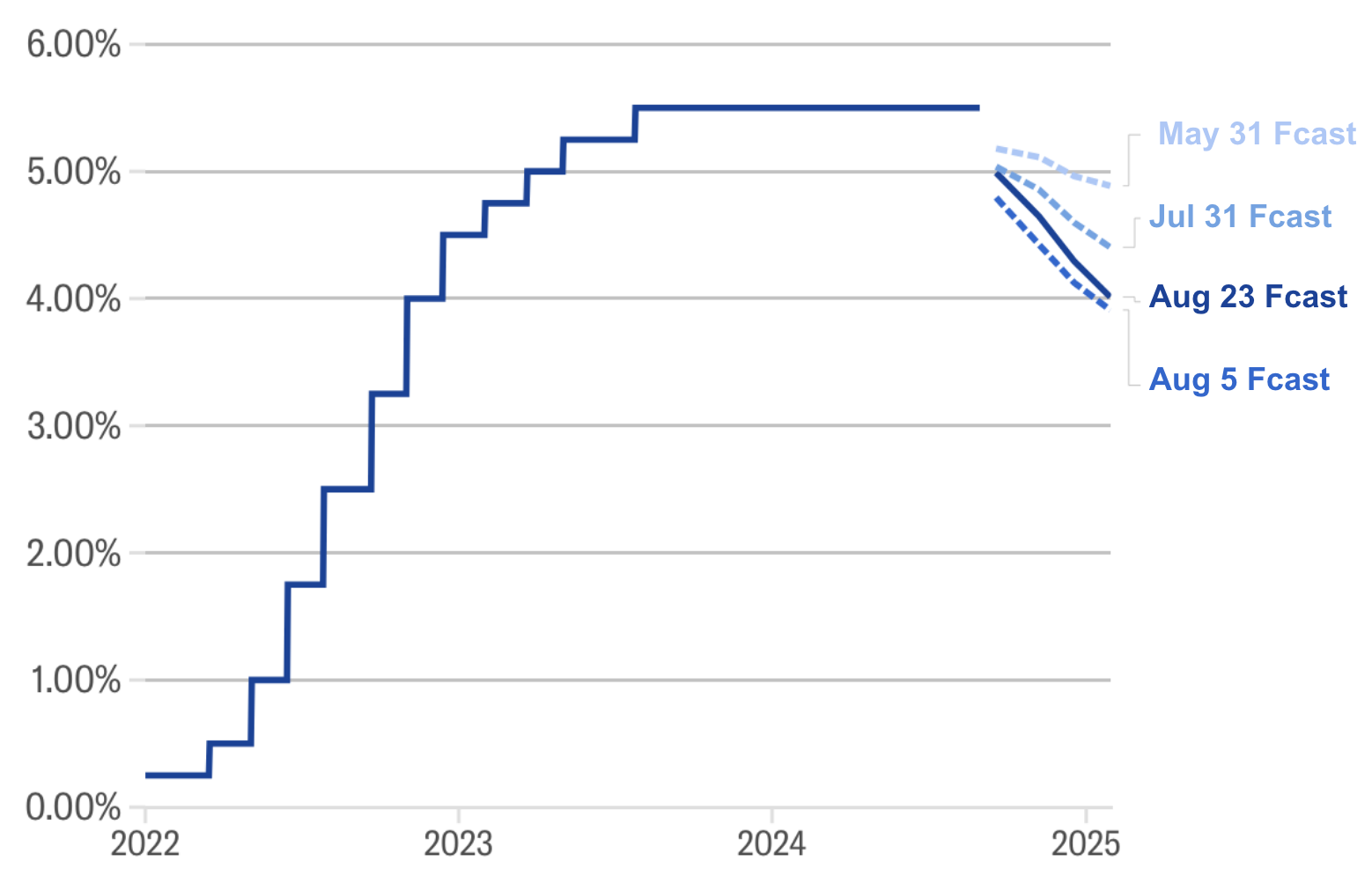

That’s not something Powell was ever going to offer (why remove optionality) – but the market is willing to bet we receive at least three (perhaps four) by year’s end.

The odds of 100 bps of cuts by December increased by ~10% vs just 0% only four weeks ago.

Here’s how end-of-year expectations have shifted since May 31:

Focus Shifts to Employment

Powell’s said his “confidence has grown” that inflation is now on a sustainable path back to 2%

And I think that’s a reasonable assumption…

Demand destruction is driving prices lower (more on this below) – where retailers have completely exhausted the limits of price elasticity.

In short, there is now (far) less money in people’s pockets.

Savings levels are at decade lows; government handouts have expired; and wage growth is moderating (all reasons why inflation is falling).

And whether it’s Walmart, The Home Depot, Nike, McDonalds and more recently Williams Sonoma – they are all warning of a far more discerning consumer.

This makes the following two upcoming economic releases that much more important:

- August 30 – Personal Consumption and Expenditures; and

- September 6 – August employment report.

The July jobs report showed the second-weakest monthly job additions since 2020 and the highest unemployment rate, 4.3%, in nearly three years.

What’s more, during the week we saw the number of annual jobs additions revised lower by some 30% (or 818K fewer jobs)

That’s the largest annual downward revision since 2009.

Powell addressed these developments, noting the cooling seen in the labor market is “unmistakable” and that the downside risks to the central bank’s mandate for full employment have risen.

“It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon. We do not seek or welcome further cooling in labor market conditions.“

This elevates the importance of the September 6 monthly jobs print.

For example, if it’s similar to the paltry 114K jobs added in July (where most job additions continue to be in the public sector) – probabilities for a 50 bps cut will increase. Quoting Powell:

“We will do everything we can to support a strong labor market as we make further progress toward price stability.”

Be Careful What You Wish For

I want to come back to the question I raised prior to Powell’s address; i.e., why would the Fed aggressively cut rates?

For example, if the Fed are cutting into a weakening employment environment (which appears to be the case) – one should curb their enthusiasm.

I say that because the reaction on the stock market was one of elation – as stocks pushed recent all-time highs.

However, rate cuts are far from a panacea.

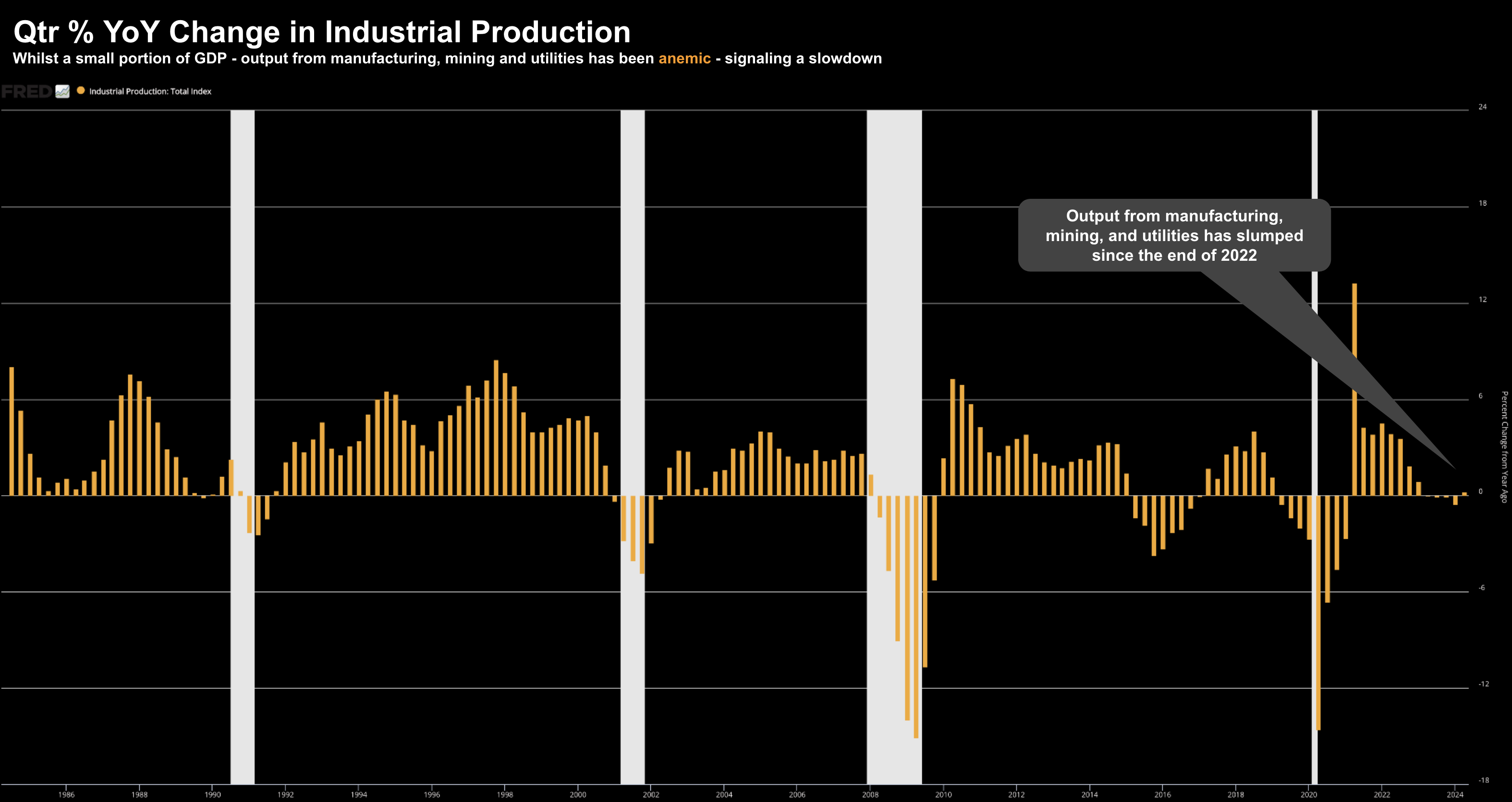

For example, the data during the month of August points to a clearly slowing economy.

Housing starts, building permits, industrial production were all well below expectations.

The slowdown in industrial production – which includes manufacturing, mining and utilities is notable – especially when viewed on a quarterly basis looking at the percentage change year-over-year:

And whilst industrial production is a smaller portion of GDP – it’s warning of a slowing economy.

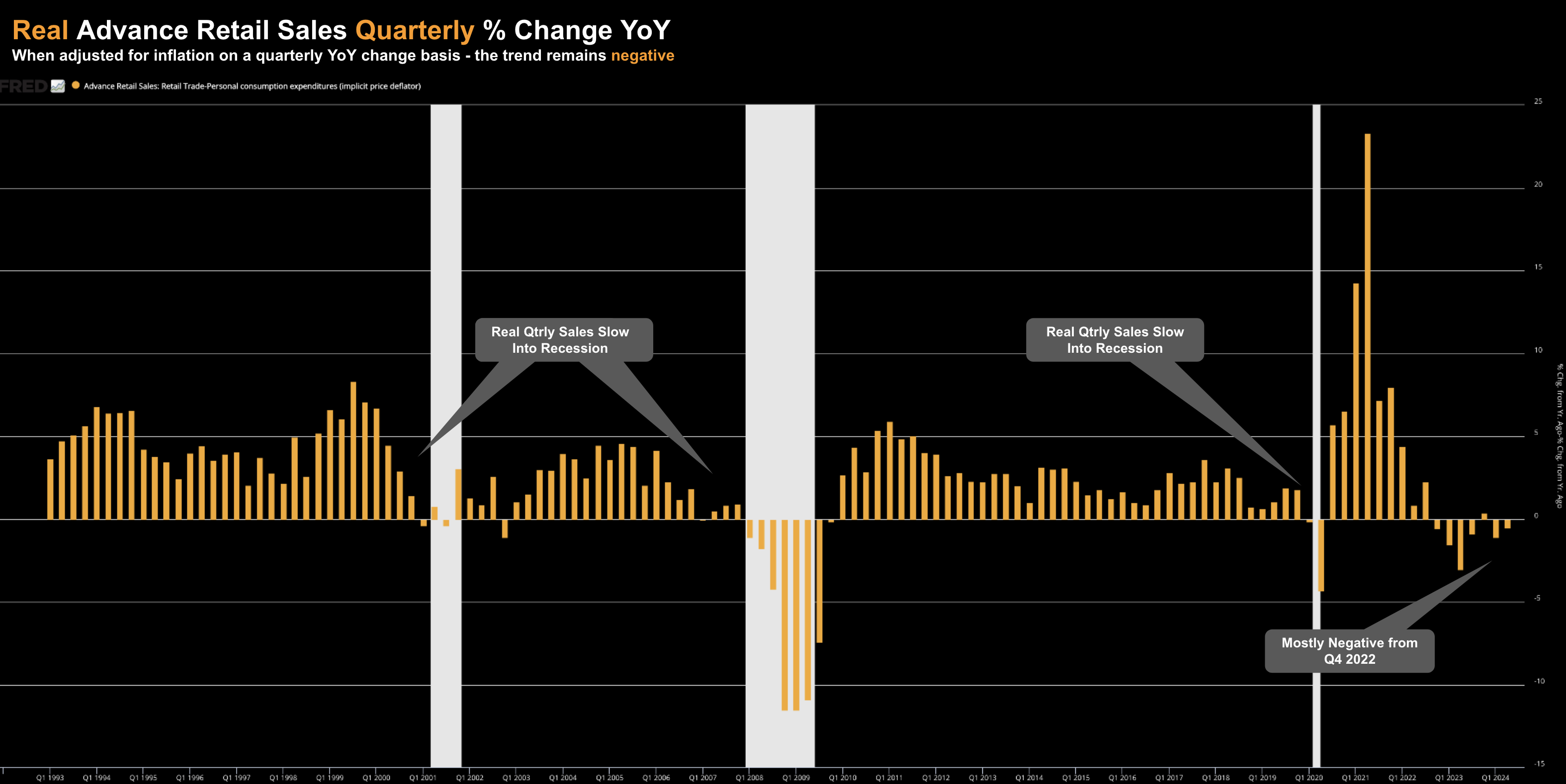

The only ‘surprise’ was retail sales – however as I explained in this post – they continue to be negative in real terms.

To that end, I will be very interested in what we see with Real PCE August 30.

It’s less about the change in prices (as I’m not concerned about excessive inflation) – it’s more what we see with real incomes and consumption trends.

So far the consumer is hanging in there… will it continue?

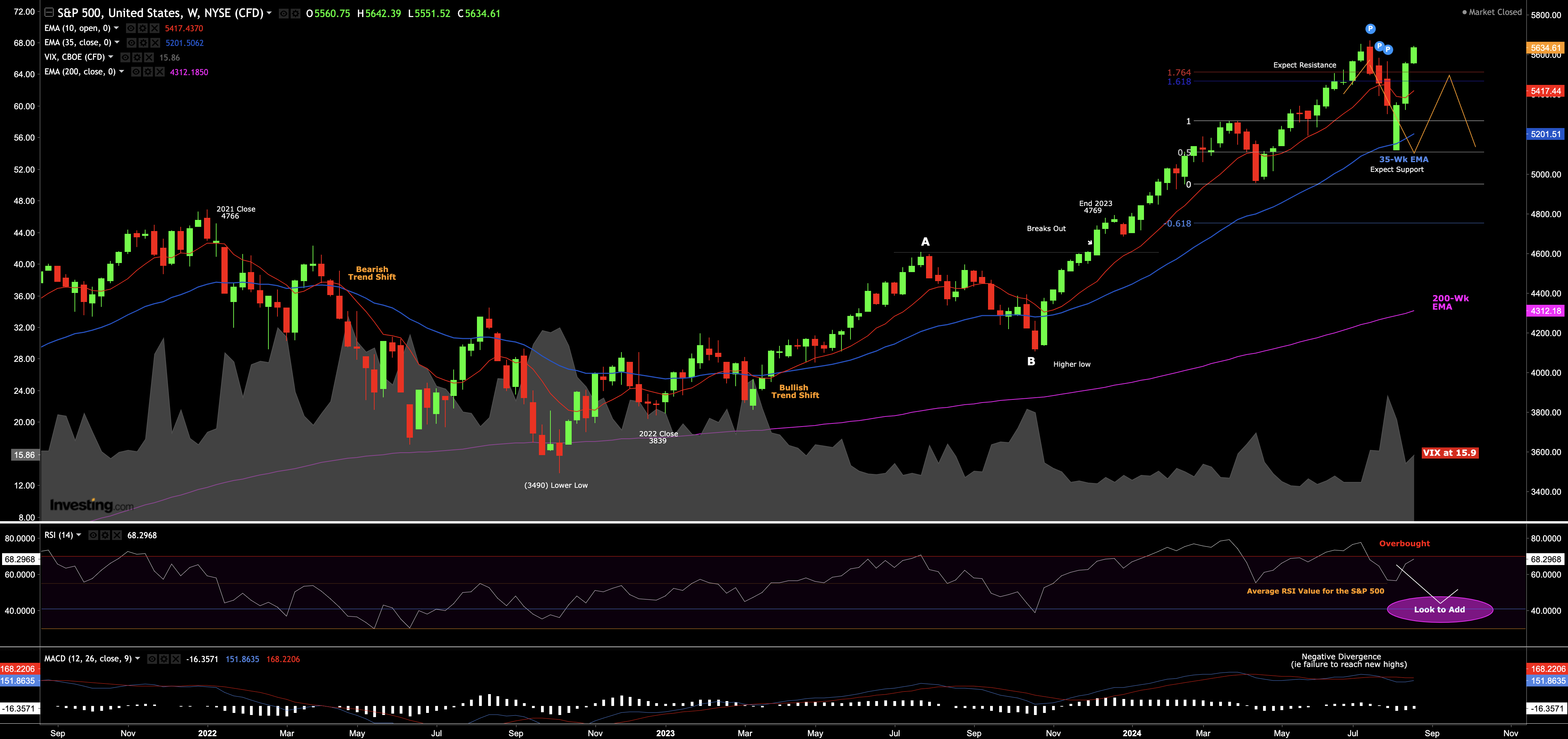

S&P 500 Cheer Rate Cuts

With the Fed giving the market a ‘green light’ on rate cuts – stocks celebrated with a victory lap of their own.

The S&P 500 has all but erased the ~10% correction through July – challenging its all-time high of 5669

However, the question is will rate cuts deliver the ‘silver bullet’ they expect?

August 24 2024

From mine, markets are pricing in the soft-landing scenario.

And there’s a possibility that is the outcome…

For example, if Real PCE does not change more than 2% lower on a quarterly basis year-over-year (e.g., from Q2 2.54% to 0.54% or less this quarter) – then I believe the chances of a recession are low.

However, if the current quarter (Q3) Real PCE drops more than 2% on a YoY change basis – the odds of ‘hard landing’ increase

For the purpose of clarity, we don’t need to experience a recession for stocks to correct 20%+

We saw this during 2022…

The change in Real PCE on a quarterly basis dropped from 7.20% during Q4 2021 – to 4.9% to 2.2% – which saw stocks correct 28%

If we see something similar during Q3 this year (which can’t be ruled out) – I will be preparing for a sharp correction.

Putting it All Together

As I said in my conclusion here – “expect a mostly dovish tone – indicating they’re in ‘solid’ position to start easing rates”

That’s what we got.

If anything – perhaps Powell was more dovish than anticipated.

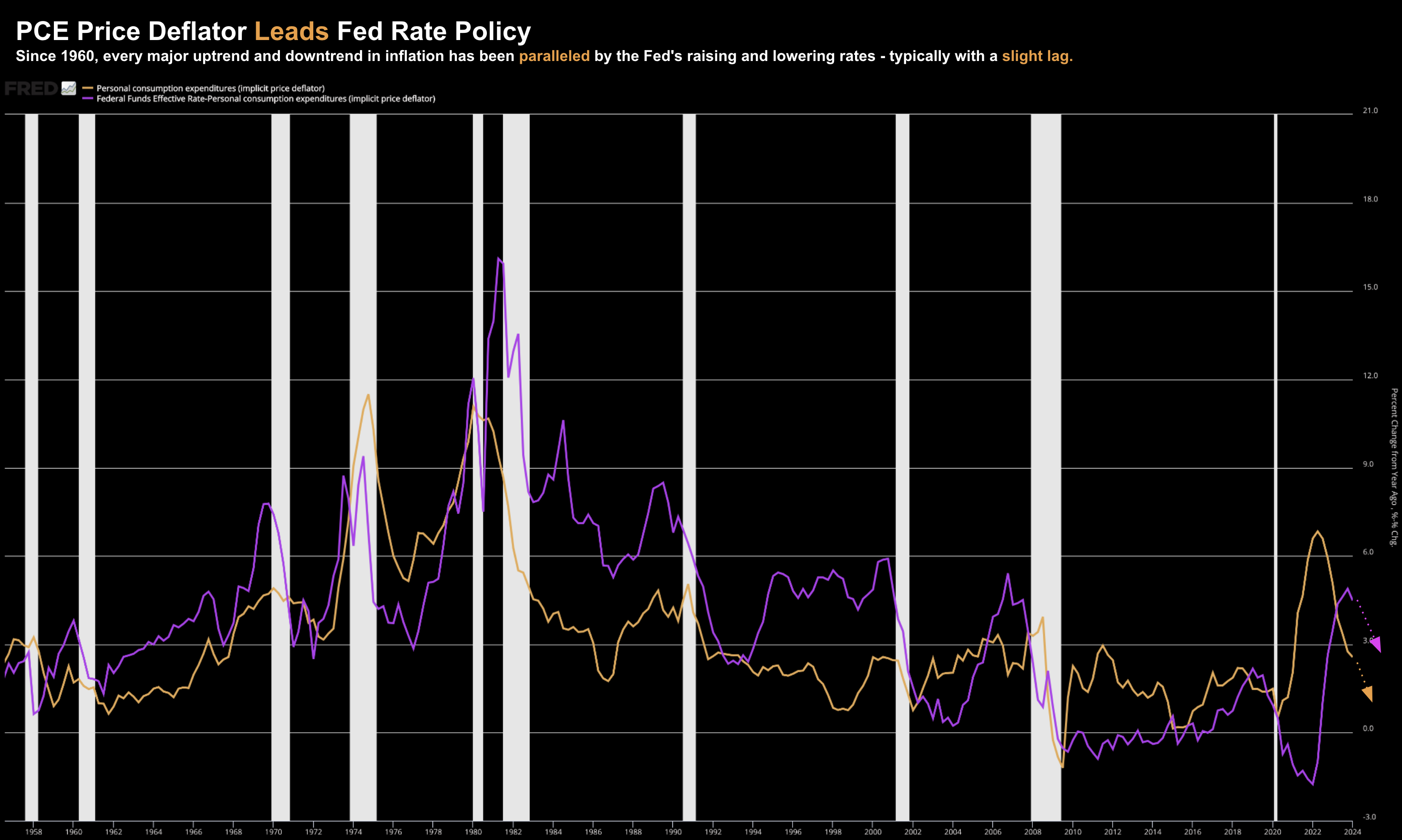

For me, given the strong (proven) causal relationships we see with both (a) inflation and (b) total aggregate debt – the decision was made for them.

For example, I offered this chart showing how the PCE Price Deflator leads Fed Policy (not the other way around)

This easing cycle will be no different to what we’ve seen since 1960.

From here, all that remains is how strong is the consumer?

Will they keep spending at the same pace as the past 12 months?

Spending is largely a function of real incomes (in the absence of government hand-outs) – will they rise or fall?

The PCE report scheduled for August 30 will give us an insight.

However, before we get those reports, all eyes turn to Nvidia (NVDA) earnings next week (Aug 28th)

They are the market barometer for the (much) hyped AI trade.

You can read more about what I expect (and risks) here.

In short, I expect they will handily beat Q2 revenue and earnings expectations.

However, what I’m more focused on is forward guidance.

For example, do NVDA expect the same pace of large-cap tech capex in the near-term?

That is what will likely determine the reaction in the share price (and perhaps the broader market).