- Bringing “pain” to some households and businesses

- Direct and resolute message with no ambiguity

- Textbook technical pivot for the S&P 500

Powell could not be any clearer.

And perhaps unlike his address in July – the 8-minute Jackson Hole speech offered no ambiguity.

Tighter monetary conditions will continue until its Core PCE 2% inflation objective is met.

Period.

And if that means “pain ahead” – that’s the price we must pay to avoid much greater pain down the road.

Let’s start with some of the Chair’s language:

“Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely against loosening policy”

“Whilst the lower inflation readings for July are welcome, a single months improvement falls far short of what the committee will need to see before we are confident that inflation is moving down”

“So, we are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2%”

Nothing New – Just More Concise

From mine, there was nothing surprising (or new) about what we heard today.

I say that because you only have to look at the move in bond markets (the ‘smart money‘).

They didn’t budge.

What new news?

They heard this message a month ago – reinforced by various Fed officials.

Not only had bonds priced in a hawkish Fed for longer – they warned of a recession next year (i.e., “pain ahead”)

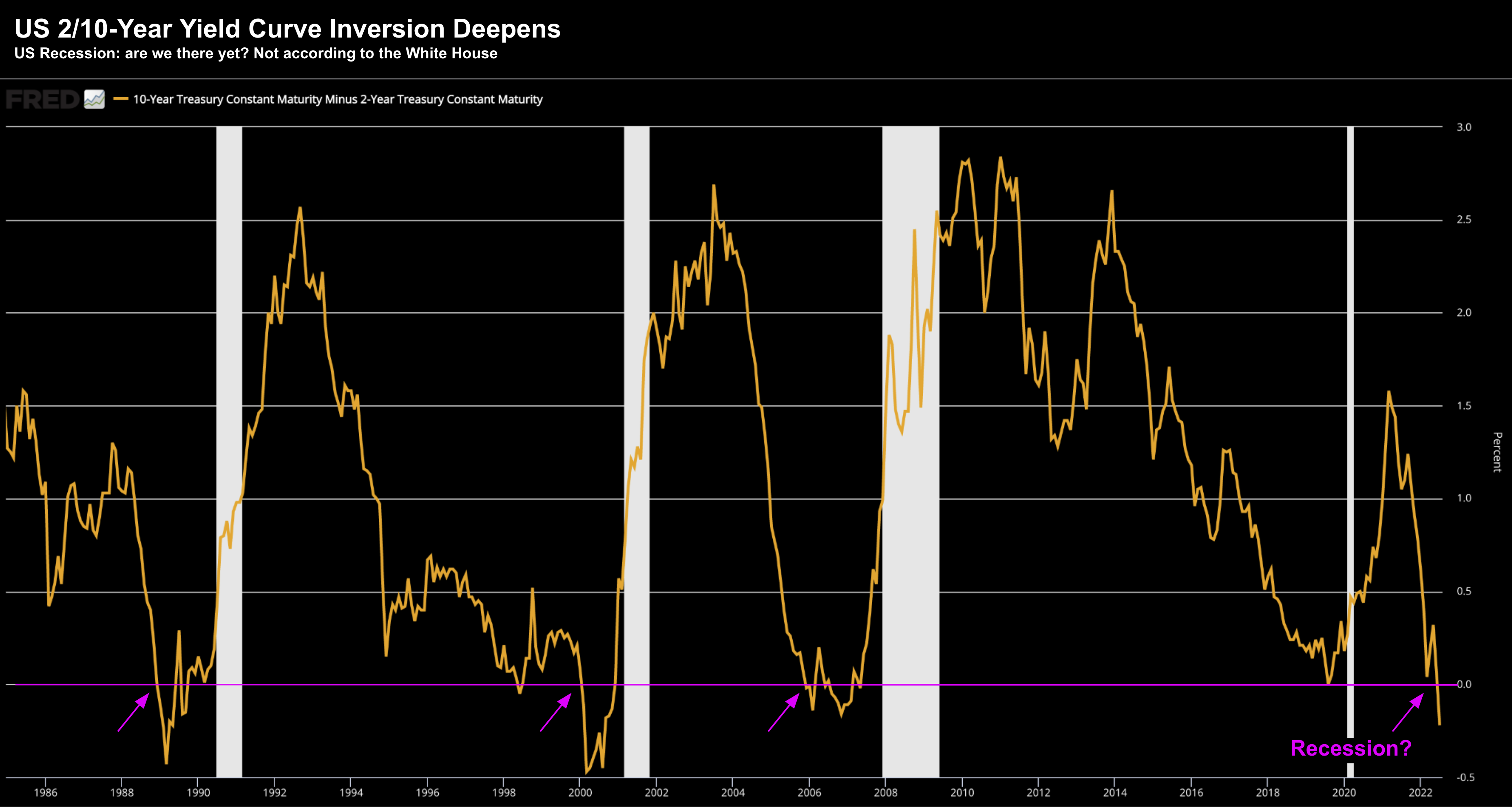

The 2-year yield trades ~3.40% – seen as a proxy for the average fed funds rate the next 2 years.

The longer duration 10-year yield trades far lower at just 3.04%

If we subtract the yield of 2-year from the 10-year – the curve sits at negative 36 bps (deeper than 2008)

Aug 26 2022

Translation: caution ahead.

But equities were not listening…

They had surged to 18.5x forward earnings and figured inflation was almost ‘rear-view mirror’.

Therefore, Powell’s tone and choice of words was met with surprise and disbelief.

What do you mean no near-term pivot?

The Dow lost 1,000 points and the Nasdaq shed ~4%

Equities chose to hear what they wanted to hear from the Fed last month.

They incorrectly assumed a Fed pivot was sooner rather than later – based on inflation coming down fast.

It was a lower probability bet.

And I was having no part in it.

Jay’s ‘Volcker Moment’

A month ago (June 27) I offered this post: “Fed Speak: Doves or Hawks”

I argued the Fed’s language was more hawkish than dovish.

But as I mentioned – equities disagreed.

My feeling was the market had “happy ears” (which it does from time to time)

They chose to ignore anything hawkish – leaning into the Fed’s comment that “at some point monetary conditions will ease”.

Of course “at some point” the Fed will reverse course.

That could be the end of 2023… maybe even the end of 2024?

But if you were thinking that point was ‘early 2023’ (as many did) – that was an error in judgement.

Two things stood out to me today:

- Inclusion of the word “pain” as the price to be paid; and

- The absence of the expression “a soft landing”

“While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

The word “pain” is subject to interpretation.

My read is a loss of jobs, slower economic growth and a higher cost of capital for borrowers.

Put together: demand destruction.

That is, less demand for jobs; less borrowing; and far less consumption.

This is what the Fed must do if they are to tame inflation.

The need to reduce demand.

To that end, perhaps the most important data point over the coming weeks months won’t be CPI or PCE inflation – it could be employment data.

For example, today’s Core PCE print showed stronger wage inflation for July – despite the overall number easing slightly.

“The Commerce Department reported Friday that Americans’ after-tax personal income rose 0.3 percent from June to July after adjusting for inflation; it has fallen in June. Consumer spending rose 0.2 percent last month after accounting for higher prices.”

Again, this tell me this their objective of 2% will be a long fight… where wages are typically last to fall.

A Long Road to 2%

The volatility we’re experiencing today is a patient weening itself of easy money for too long.

The problem is rehab of tighter credit is just starting.

And some assets don’t want the party to end (like any good drug addict!)

For example, take a look around and ask yourself:

- Is credit contracting or expanding?

- Is demand for home loans increasing or decreasing?

- Are banks making loans easier to make or harder? and

- Are IPOs more plentiful now or scarce?

If you believe credit conditions are tightening (as I do) – then it doesn’t bode well for risk assets.

But we are early…

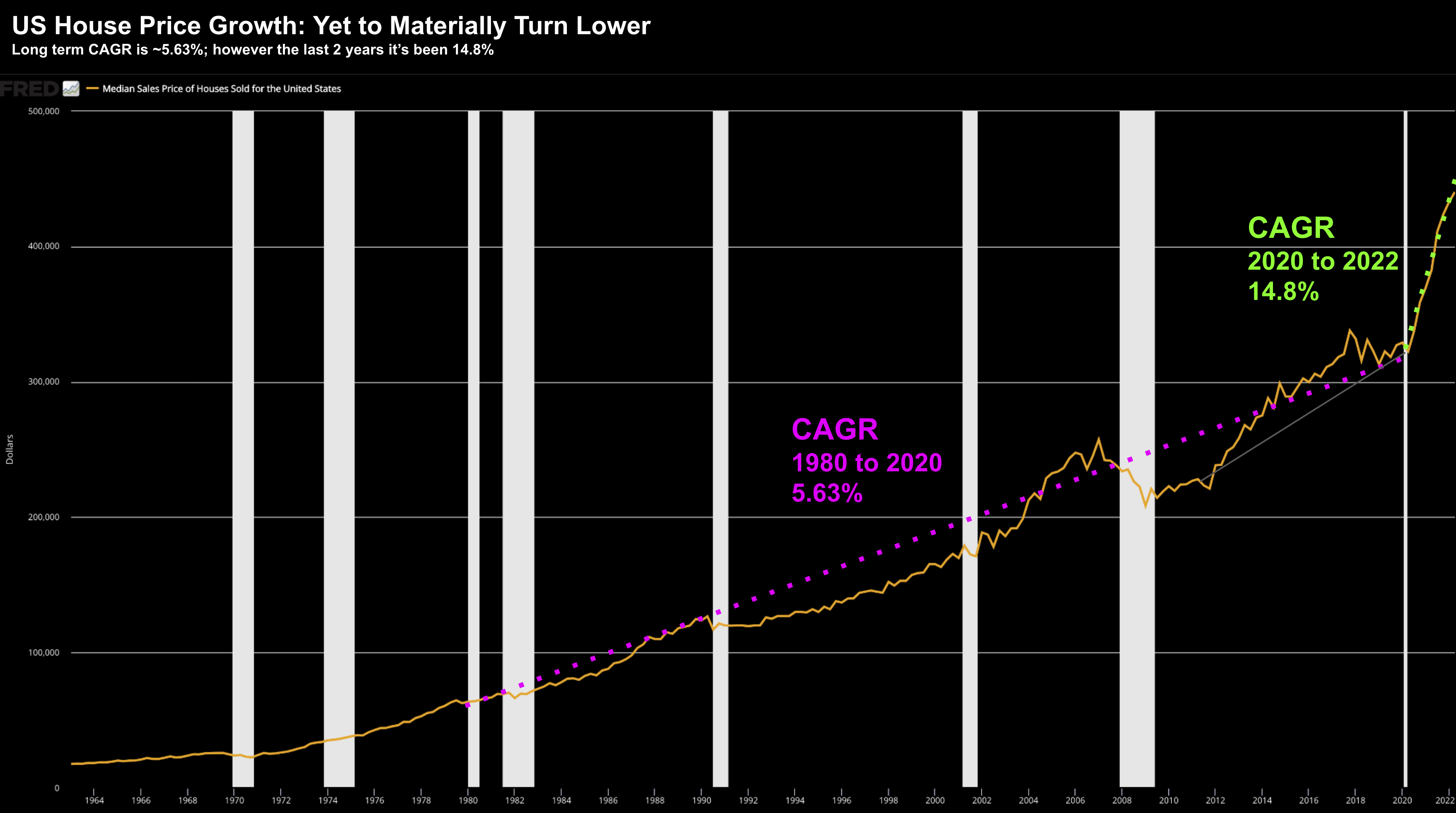

Consider the growth (dare I suggest speculation) in US house prices the past two years as a result of monetary policy:

Aug 26 2022

Now this trend is yet to reverse… however it needs to.

From 1980 to 2020 – the Compound Annual Growth Rate (CAGR) for average US house prices was 5.63%.

However, from 2020 to 2022, CAGR jumped to ~15% — fueled entirely excess liquidity (~$5 Trillion) chasing limited supply.

That’s how you get a 15% CAGR (not unlike stocks).

But I would argue this trend is about to reverse (should have the Fed have their way).

As I aside, the largest buyer of homes in the US – Blackstone Group – has stopped buying in 38 states.

Why?

Because they see lower prices ahead.

I digress…

Now from an inflation perspective — there’s an 18-month lag between house prices and rents.

In theory, it could be early 2024 before we see rents start to ease in certain places (n.b., they’re not easing in SF – where the average 1-bed 700 sq.ft. apartment is US $3,200 p/mth)

Why does this matter?

Rent constitutes almost one-third of CPI.

And whilst it’s easy to see CPI dropping from 9% to 5% next year – going from 5% to 2% could take more than 2-3 years.

And that’s why Powell firmly anchored expectations today on the tough fight they have ahead.

S&P 500: ‘Textbook’ Reversal

For regular blog readers – none of the above is new information.

I apologise for the redundancy.

In fact, I’ve been writing less of late because there is nothing much to add!

What haven’t I already said?

For example, not only were you expecting a hawkish Fed, you were also anticipating the pivot in stocks.

Below are 4 recent posts which carry the same narrative:

- August 4: Stay Patient – Pullback Coming

- August 6: Do the Upside Gains Easily Outweigh the Downside Risks?

- August 16: Markets Bet Big on a Dovish Fed

- August 22: Don’t Fight the Fed

Let’s update the weekly tape:

Aug 26 2022

For example:

- Weekly trend remains bearish — suggesting the probability of lower prices;

- Rejection from the 35-week EMA zone – typical of a bearish trend;

- False-break of the previous high at point “B” – a good reversal signal; and

- VIX at only 25.6 (still too low) – indicating traders remain too complacent

Now I don’t pretend to have a crystal ball on week-to-week stock movements.

But I can tell you the general trend is lower.

That said, it’s not low enough where I’m suggesting you pin your ears back and buy.

That’s still ahead.

But hopefully you were not wearing “happy ears” the past few weeks (and didn’t add to your risk exposure).

That’s what I wanted you to avoid.

There will be a better opportunity to add to quality stocks.

Stocks with strong (consistent) cash flows and balance sheets. Low debt. Wide moats. Strong margins.

And hopefully you used some of the recent~18% rally to clear out some of the “rubbish”… it was a gift.

Putting it All Together

Words like “pain” were carefully chosen.

But what Powell is trying to convey is the pain now will be far less than the pain ahead if they don’t act aggressively.

Let me conclude with three points:

- The Fed are responsible for inflation – it’s their mandate;

- A few consecutive months of lower inflation is not cause for complacency; and finally

- The central bank are willing to stick with it for as long as it takes.

And that will likely mean we’re about to have a lengthy period of sub-trend growth.

Bond markets have been telling us this for months.

The only surprise today was for equities who chose not to listen to what the Fed said in July.

Now they’re paying closer attention… but there’s more work to be done.