- Fed stresses it’s premature to be even think about a ‘pause’

- “Rates have to go higher and stay higher for longer”

- At what interest rate level does the economy ‘cry uncle’?

Whilst a fourth consecutive 75 basis point hike was fully priced in – the market was hoping for dovish tones.

And for a brief moment – it was offered a glimmer of hope.

From the Fed’s prepared FOMC statement:

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

“As we come closer to that level and move further into restrictive territory, the question of speed becomes less important. … And that’s why I’ve said at the last two press conferences that at some point it will be important to slow the pace of increases. So that time is coming, and it may come as soon as the next meeting or the one after that. No decision has been made”

But the market will hear what it wants to hear.

What’s more, they will hear what they fear.

The ~12% bullish run in stocks over 3 weeks meant the market had ‘dovish ears’ coming into the print.

But Powell was quick to set the record straight.

Nothing has changed with the Fed’s steely resolve to squash inflation… regardless of the cost.

Put another way, the longer-term cost of not getting inflation far outweighs the risks of not doing enough.

Powell reiterated that sentiment.

And anyone trying to front-run the Fed on any ‘pause or pivot’ is acting in a highly premature manner.

Fed Has a “Ways” to Go

As soon as the Fed statement hit the market – the Dow was up something like 400 points.

It caught the snippet about the Fed noting the lag effect of its recent hikes and at ‘some point’ there would be a pause.

A “step down” is coming!!

But that’s not reason to get bullish.

As soon as Powell added color to the statement — the Dow reversed 700 points from its high.

All major indices closed at their low; whilst treasuries closed at the high yield.

The dollar also reversed its losses.

Three primary things I gleaned from Powell’s ‘Q&A’:

- The Fed funds rate will go higher than what most expect;

- The elevated rate will stay there longer than what most expect (e.g., 9-months to a year); and

- Nominal rates to hit 4.75%+ at the expense of a (probable) hard landing

With respect to the latter – Powell felt that the path to a ‘soft landing’ has now “narrowed”.

Put another way – it’s not happening.

But those who thought that was likely were overly hopeful.

You can’t raise rates over 400 basis points in the space of 12 months and expect the economy to take it in-stride.

Good luck!

Here’s Powell:

“We’ve always said it was going to be difficult, but to the extent rates have to go higher and stay higher for longer it becomes harder to see the path. It’s narrowed. I would say the path has narrowed over the course of the last year”.

But here the Chairman touches on what I think is one of the least discussed (more important) questions; i.e.,

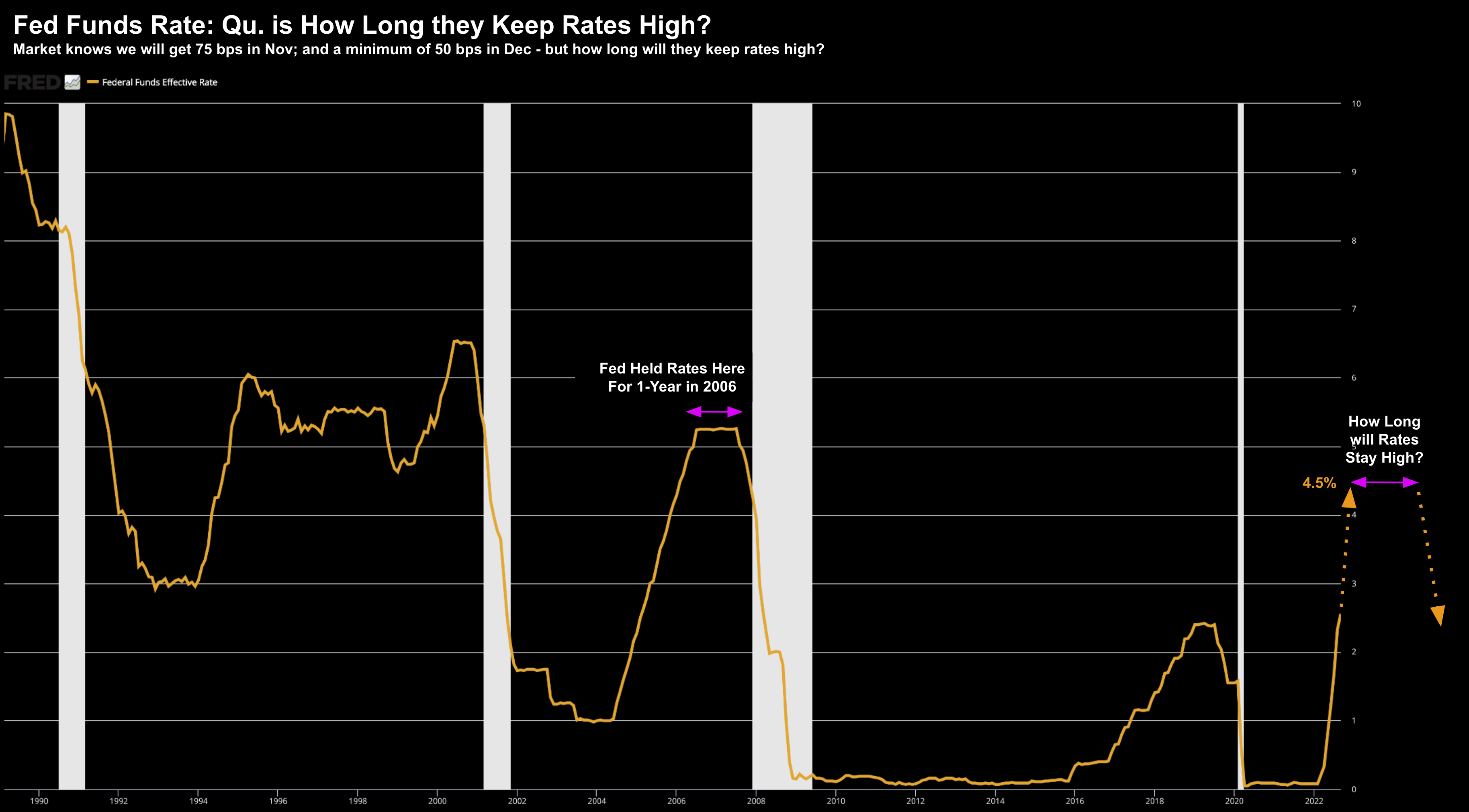

How long will rates remain elevated?

Obviously it’s an impossible question to answer.

But as regular readers will know, I’ve suggested (for weeks) that it doesn’t matter whether the Fed raises “50 or 75 bps” in December… that’s not the right question.

Nominal short-term rates are going to at least 4.50% (perhaps higher after today).

However, it’s becoming more apparent the Fed will likely keep them there for a long time (pending what we see with inflation)

And this could be 6, 9, 12 months or more?

What we can say is the inflation problem will not abate as fast as what many choose to believe (at least not to the Fed’s target of 2%)

And keeping rates at 4.50% (or above) is not what anyone should consider a “pivot”…

As I showed a few weeks ago – if we look back to 2006 to 2007 – the Fed held rates above 5.0% for over a year.

And whilst we may (or may not) get to 5.00% nominal rate – rates can stay elevated for a sustained time.

5.0% Nominal Rate will be Difficult

Post Powell’s conference, traders are betting the Fed could raise the fed funds rates to a high of 5.05%

Question I have is whether the Fed can pull that off?

My gut says no.

My thinking is rates will land somewhere between 4.50% and 5.00% before the Fed pauses.

As I believe it will very hard for the economy to swallow 5.0%

For example, there are many leading indicators that things are now rolling over (and sharply).

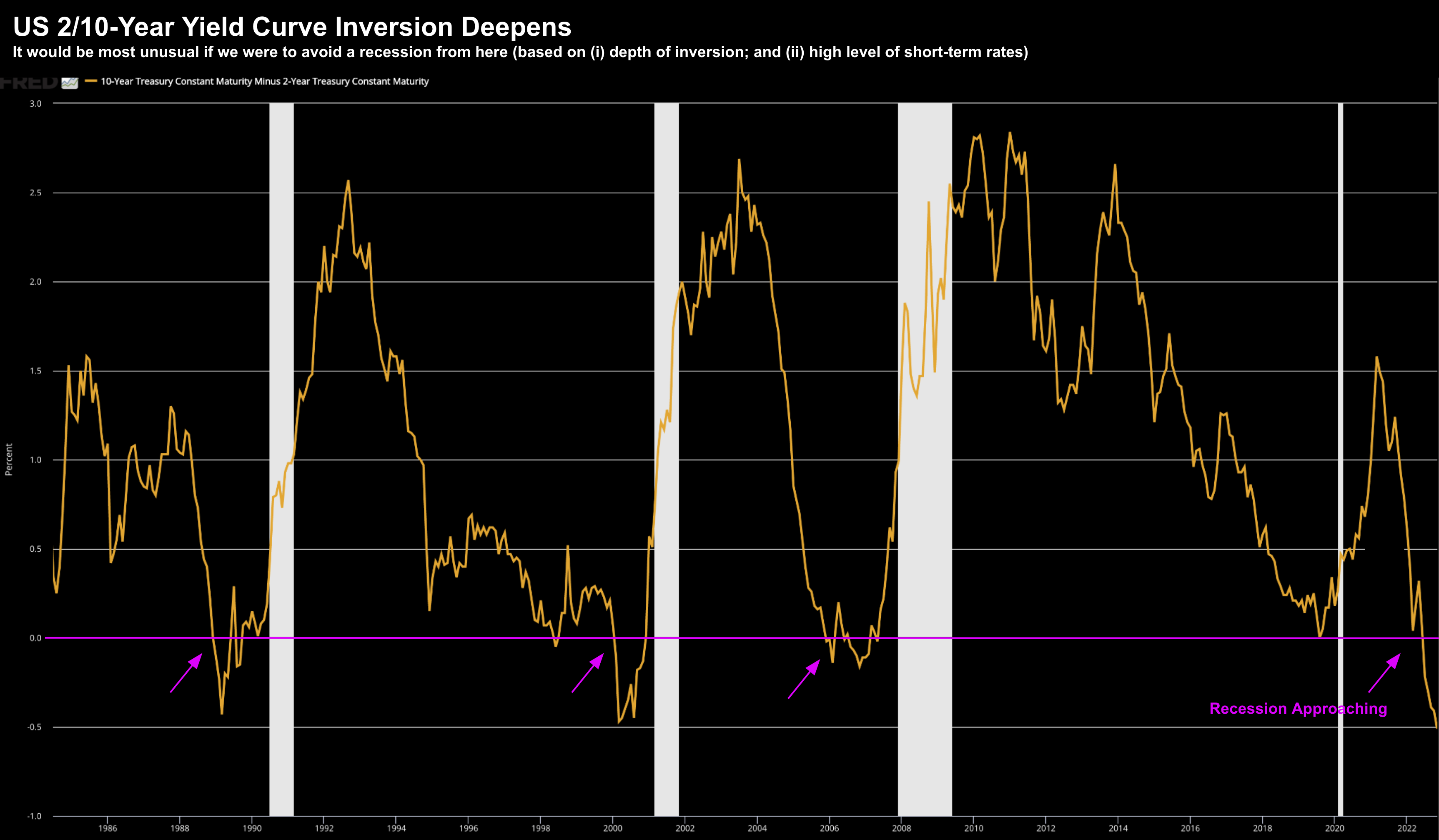

Take one of the most reliable real-time indicators – the yield curve (choose any duration).

The 2/10s are deeply negative at ~50 bps and have been anchored there for a while.

This is the deepest inversion we have seen in over 40 years…

Nov 02 2022

This is the bond market saying we are heading into a recession.

Now if the Fed were to continue to raise rates to 5.0% – it’s likely this curve will only deepen further.

The 2-year yield reached a high of 4.59% during his address today…

But the question is how much further can they go before the market “cries uncle”?

Nov 02 2022

Again, I don’t know the answer what the terminal rate will end up being – but Powell reiterated they are not thinking about pausing its rate hikes.

“It is very premature to be thinking about pausing. People when they hear ‘lags’ think about a pause. It is very premature, in my view, to think about or be talking about pausing our rate hikes. We have a ways to go,” he said.

We are getting closer to the point… but we have ample scope to go further.

Putting it All Together

Reckless Fed policy for over a decade has caused this pain.

They exaggerated the boom (i.e., average 16% CAGRs plus dividends for the past 6 years); and they will exaggerate the bust.

One mistake is being compounded by another.

So far this year – the Fed will have raised rates by 3.75%

25 + 50 + 75 + 75 + 75 + 75 (Nov) = 375 bps

Assuming we get another 50 bps for Dec – that will take the Fed’s short term rate to 4.25% (still well below that of inflation)

And as the 2-year yield indicates – we are heading to 4.75% at some point early in 2023.

That’s what the market is pricing in…

But what it has not priced in – is the Fed holding rates at that level for perhaps 9-12 months or more.

What surprised me today was how Powell set the table for a potential step-down in subsequent months (without committing to it).

That appeased the market for all of two seconds.

Short-term bulls bought it.

But as soon as Powell reiterated that rate hikes are a long way from finished – they were sent to the woodshed.

The final takeaway is the Fed is far from an easing cycle.

That’s when stocks will be closer to the bottom… when we get a sense the Fed can consider easing its policy.

That’s your Fed pivot. Not before.

Unfortunately it means a lot more pain for some.

The good news is I remain quietly confident the patient investor still has a chance to pick up the S&P 500 at 3400 and perhaps 3200.

And that’s a long-term gift for those with the means.