- ADP Payrolls disappoints – stocks rejoice

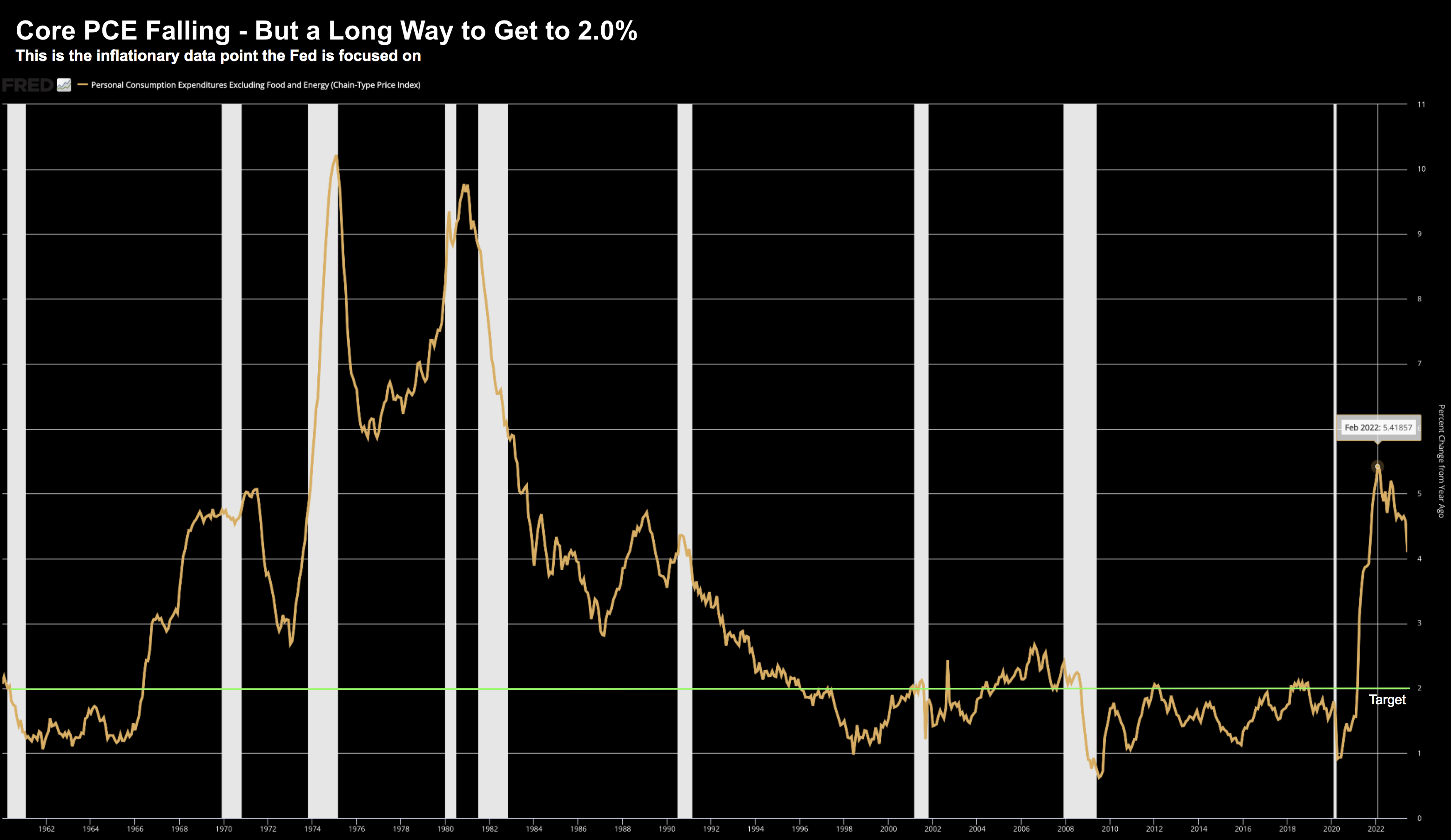

- Core PCE this week a far more important print

- Credit card delinquencies race higher

More “bad news is good news” hit the tape today…

The monthly ADP private jobs number came in far weaker than expected.

I say ‘good news’ as it potentially means less Fed (or at least that’s the assumption)

For context, yesterday I offered this:

If we learn that hiring (via ADP) continues to be robust – this could imply “more Fed”. More Fed will likely pressure stocks. On the flip side, a weaker than expected ADP monthly report could imply consumers’ spending power is diminishing.

Here’s CNBC:

Job creation in the United States slowed more than expected in August, according to ADP, a sign that the surprisingly resilient U.S. economy might be starting to ease under pressure from higher interest rates.

The firm reported Wednesday that private employers added 177,000 jobs in August, well below the revised total of 371,000 added in July. Economists surveyed by Dow Jones were expecting 200,000 jobs added in August.

ADP also reported that pay growth slowed for workers who changed jobs and those who stayed in their current positions.

“This month’s numbers are consistent with the pace of job creation before the pandemic,” Nela Richardson, chief economist at ADP, said in a press release. “After two years of exceptional gains tied to the recovery, we’re moving toward more sustainable growth in pay and employment as the economic effects of the pandemic recede.”

The theory is that a slower pace of hiring reduces the need for the Fed to keep hiking rates.

And that may be the case…

But if I listen to the tone of Powell’s recent Jackson Hole address – it was decidedly hawkish.

And to that end, tomorrow’s Core PCE and Friday’s non-farm payrolls reports will be key.

For example:

- Will we see another 4-handle with Core PCE (the Fed’s preferred inflation measure)? and

- Will non-farm payrolls align with the private sector ADP report (or will it show strength)?

On the first point, Core PCE is currently double the Fed’s 2.0% objective.

And whilst it’s off its Feb 5.4% high – that hard work will be getting it from “4 to 2”

But there’s another question less discussed…

How many more opportunities will Powell have to raise rates over the next 12 months?

My guess is one (maybe two).

Here’s the logic:

2024 is an election year.

It’s reasonable to assume Powell will try to avoid being seen to potentially influence the election by continuing with rate hikes next year.

The caveat to that of course is inflation spikes (which seems unlikely given how things are slowing)

However, if he were to raise rates next year, he will likely be accused of causing a recession (some feel he may have already) – handing the election to the Republicans.

I say that because in the event of a recession – the incumbent party always loses.

Therefore, if Core PCE still trades with a 4-handle – why not raise by 25 bps one more time and sit tight until the election is over?

From there, allow the long and variable lag effects to take their course.

I would not rule it out.

Can This Trend Continue?

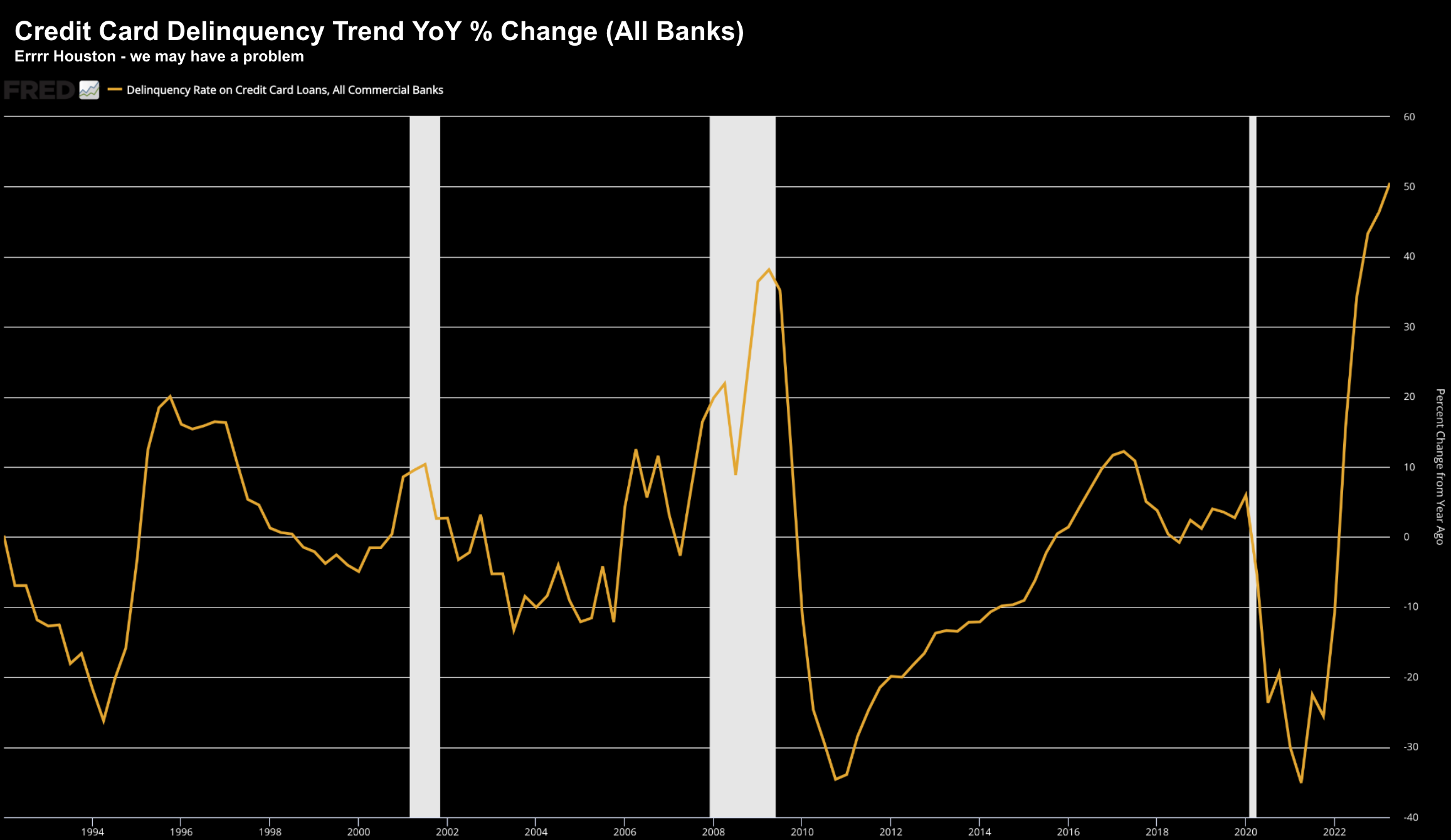

As part of yesterday’s missive – I touched on the record amount of credit card debt achieved by US consumers.

For the first time, this topped a level of $1 Trillion. From Reuters:

Credit card balances rose by $45 billion to $1.03 trillion in the second quarter, the regional Fed bank said in its latest quarterly household debt and credit report, reflecting robust consumer spending as well as higher prices due to inflation, researchers said.

Meanwhile, credit card delinquencies are at an 11-year high, as measured using a four-quarter average, the data showed.

Personally, I don’t this trend is sustainable (more on why below)

Two things some could be missing:

First, credit card debt is not simply expenditures – they’re balances.

This means consumers have spent the money – but for various reasons – cannot pay off the balance.

Now that’s not a problem if interest rates are closer to 0% (as we’ve seen the past 15+ years).

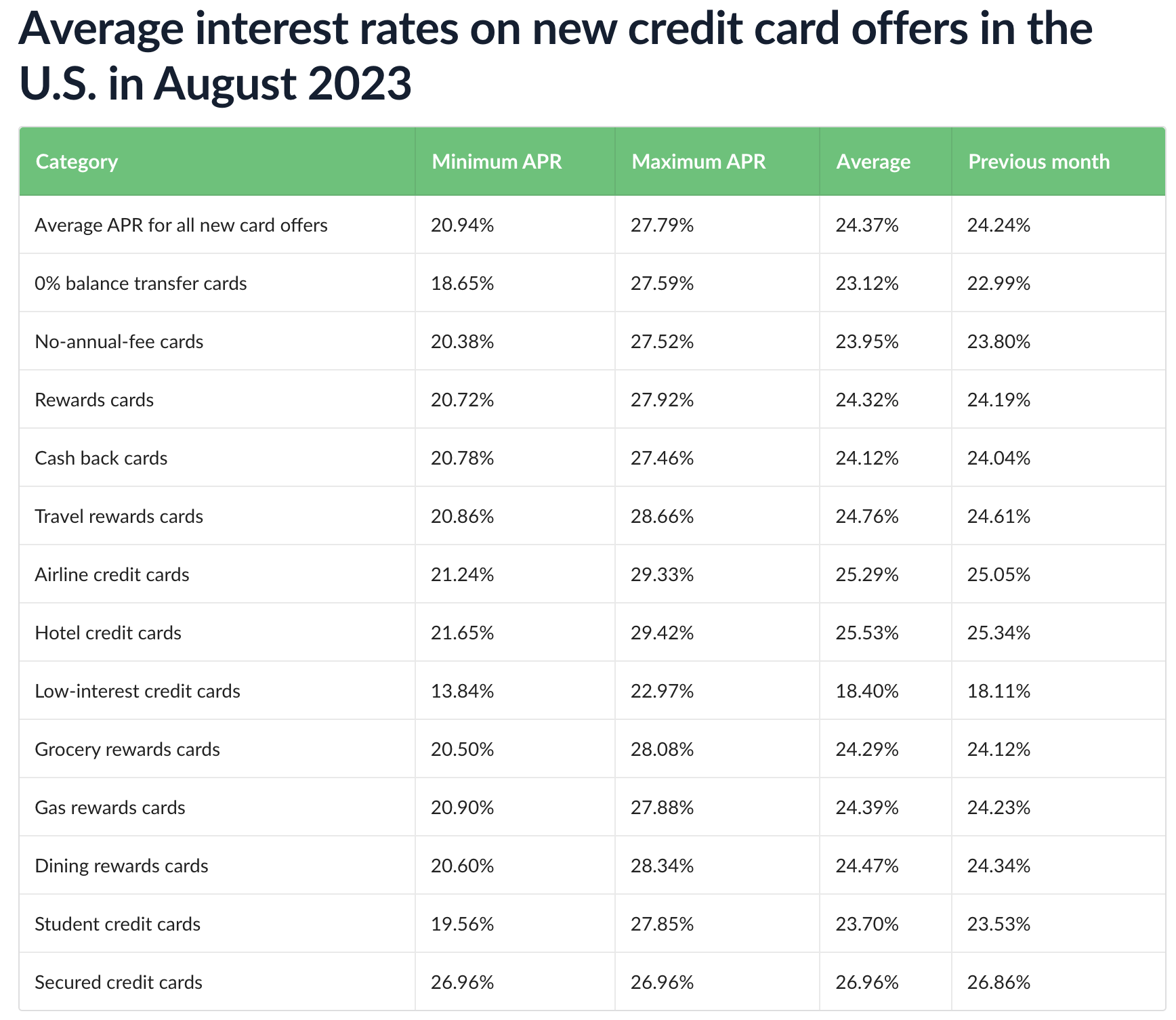

But it doesn’t work when folks are being charged “loan shark rates” of 24.4%+ for the outstanding loan.

From Lending Tree:

As an aside, the “low interest credit card” now averages 18.11%

But you see the problem(s)?

For starters, if you’re tapping your credit line to make ends meet, you’re basically at the end of your rope.

No-one voluntarily wants to be paying 24% on outstanding balances…

And if you’re not paying down the principle – the size of your loan will double in just over 2 years at these rates.

But let’s say you can’t pay… what then?

Then you default.

It’s no longer your problem (apart from suffering a hit to your credit rating) – it becomes the lender’s problem.

They made a bad loan and a loss is taken.

And as bad loans add up – lenders tighten their standards (which by the way is the Fed’s intent).

More Americans are failing to make payments on their credit cards and auto loans, another sign of rising financial pressure on consumers.

New credit card and auto loan delinquencies have now surpassed pre-Covid levels, according to a Wednesday report issued by Moody’s Investors Service

The rate of new credit card delinquencies hit 7.2% in the second quarter, up from 6.5% in the first quarter, according to the Moody’s report, which was based on household debt data published earlier this week by the New York Federal Reserve.

That closely watched rate measures the percentage of loans that became 30 or more days delinquent. This metric is now ahead of where it was in the second quarter of 2019, before the Covid-19 pandemic rocked the economy.

Delinquencies are accelerating at a faster clip than what we saw into the recession of 2008 and 2000.

But again, this is all seen as “good news” as far stocks are concerned.

More consumer pain means less Fed.

Now whilst growth is said to be “strong” the past few quarters (and why virtually no-one is calling for a recession next year) – you need to challenge where the so-called “growth” has come from.

I will offer to primary sources:

- Massive deficit spending from the government;

- Consumers using excess savings (which are gone) and credit lines.

A lot of the growth we’ve seen has been credit posing as growth.

It’s a great trick to prop up growth in the short-term (especially the public sector credit card).

This trick works whilst rates are ultra-low…

But with the Fed funds rate at 5.50% and APR’s on credit cards above 24%… is that model for growth sustainable?

Not from my lens. But some think so.

For now the market doesn’t care… we will see what it thinks in subsequent quarters.

Putting it All Together

Weaker jobs and downward growth revisions bode well for cooling prices.

From Yahoo Finance today:

US economic growth for the second quarter was revised downward on Wednesday as declines in business investment outweighed upward revisions to state, local, and consumer spending.

The Bureau of Economic Analysis’s revised estimate of second quarter US gross domestic product (GDP) showed the economy grew at an annualized pace of 2.1% during the period, lower than the initial estimate from July of 2.4% growth.

But it raises a question:

Will demand gradually slow or will it fall off a cliff?

Right now the market assumes the former; i.e. a soft landing.

However the latter is not priced in.

And that’s the game being played…

What are you prepared to pay opposite these (and other) risks?

Personally, I’m not comfortable paying above 17x forward for the Index.

- 17x implies an earnings yield of 5.80% (i.e., 1/17) vs the risk-free rate of 5.50%

- Assumed “E” of $235 p/share for 2024 (i.e., earnings growth of ~7% on this year)

$235 x 17 = 3995

However, if we’re to experience a recession in 2024 – forget about $235 EPS.

Earnings will not grow ~7% YoY.

Instead, they will contract from the expected ~$220 EPS for 2023.

That’s the bet you’re making buying the Index at the current level.