- Market doesn’t get the ‘dovish hike’ it expected

- Powell is non-committal on a pause

- When will we be talking about credit defaults?

The market wanted “one and done“… that was the expectation.

Powell spoiled the party.

Whilst the market expected a 25 bps Fed hike – what it did not know was whether any hike would be ‘dovish’ or ‘hawkish’?

For example, a dovish hike would be something like “we see the end of inflation… we’re winning the fight”

On the other hand, a hawkish tone would be sentiment to the effect of “it’s still premature to make that call”

For me, Powell delivered more of the latter… and less of the former.

And that makes sense.

Powell was resolute when he answered questions – not stepping away from their 2% inflation objective.

The audience asked whether the Fed would be ‘okay’ if we saw inflation settle in around 3% for a while?

Powell rejected that idea.

2% is the firm objective.

And given where we are with core services inflation – rate cuts are not on Powell’s radar.

That is not what the market has priced in.

‘Higher for Longer’

Whether the Fed raised 25 basis points or paused was neither here nor there.

I personally don’t think that over the course of a year – a raise of 25 basis points doesn’t make a great deal of difference.

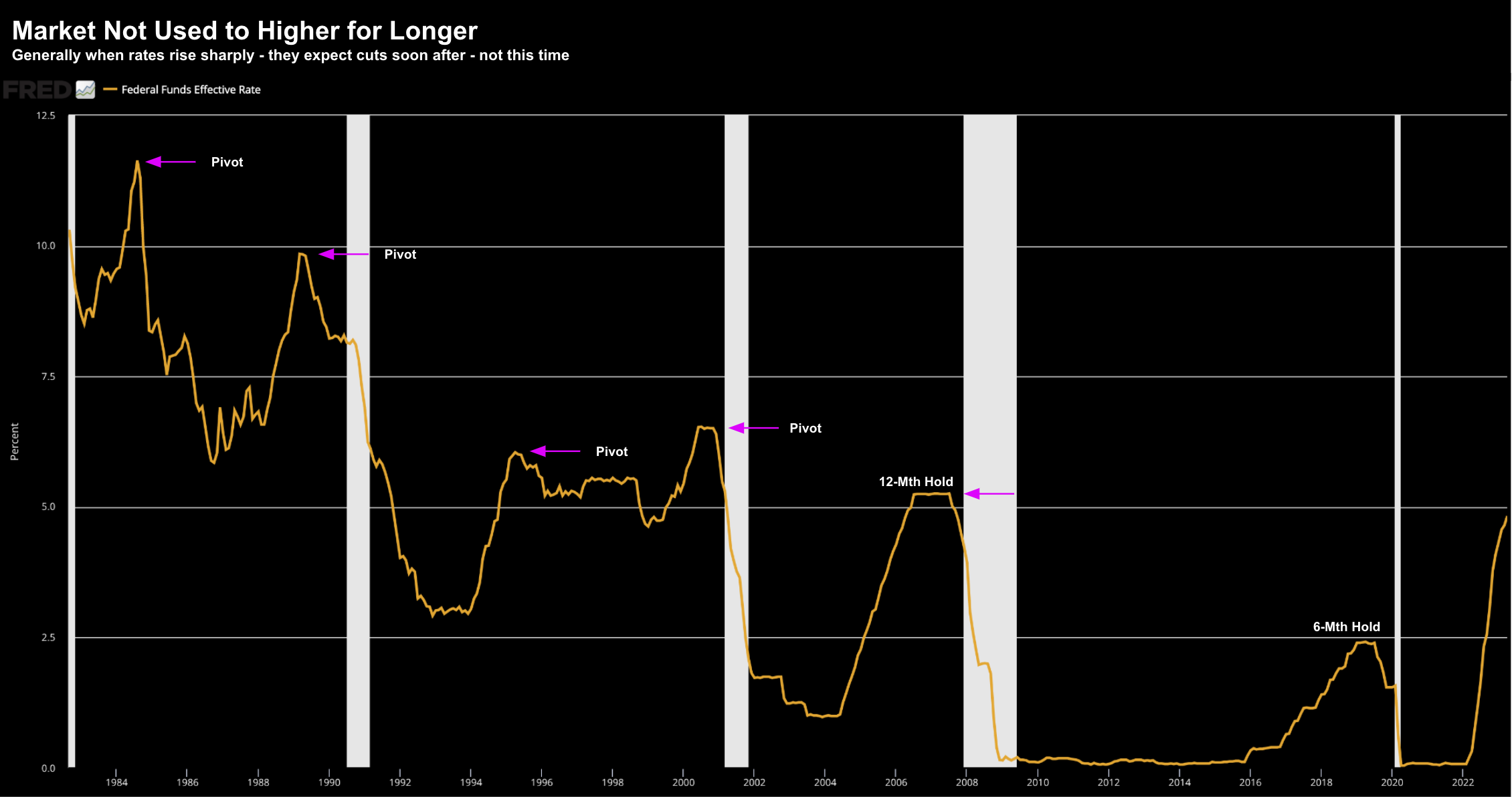

However, what matters is how long we stay at levels of 5.00% or above?

For example, I refer to this post from November 19th last year (6 months ago)

At the time, I offered a three-point framework when thinking about monetary policy (which has not changed):

- How fast the Fed raises rates;

- How high they raise them; and

- How long will they stay there?

We are finished with how fast; i.e., 500 basis points in 12 months.

We’re also closer to answering how high rates are likely to go (e.g. 5.00% to 5.25%)

I would be surprised if we get to 6.00% given the credit tightening we are seeing from banks.

But what we don’t know is how long they will stay there?

Market participants see the Fed cutting rates three times (i.e. 75 bps) between now and the end of the year.

Powell refused to entertain anything remotely like this.

For example, when prompted with questions in this direction – he simply pointed to the data:

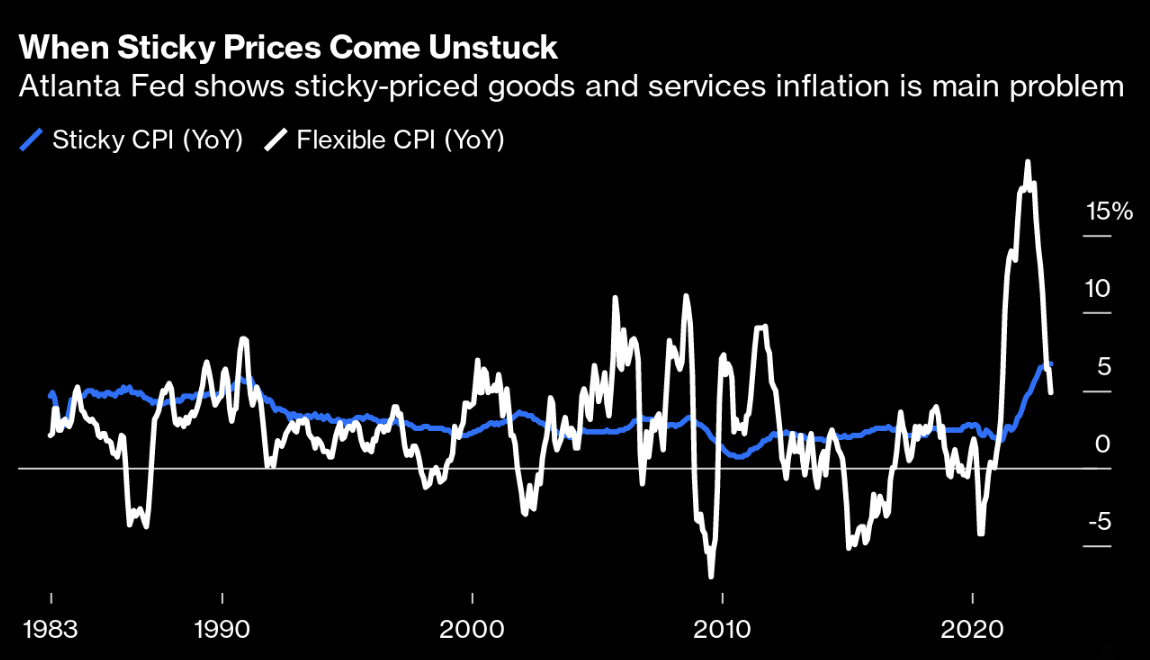

- First, the very high level of service sector inflation; and

- Second, needing to see several consecutive months of services inflation decline

So why would they consider cuts?

As an aside, if we still find a CPI headline above 4% YoY for any month — the Fed will not consider cutting rates.

Given how sticky we find wages and rents – I can’t see headline CPI with a 3-handle this year (despite what the dot-plot suggests).

But let’s play the game and assume we are to see inflation collapse below 3%.

If that happens, it will be either due to:

(a) a major credit event; and/or

(b a sharp recession (i.e. massive job layoffs).

Neither of these things are good for risk assets or earnings.

Market Yet to Adjust

So where are market’s with this?

For example, are they inline with how Powell is thinking?

Or are they attempting to front run the Fed?

My view is the latter.

As it stands today, with the market trading at a lofty ~19x forward earnings, they don’t think:

(i) 500 bps of rate increases in 12 months;

(ii) further credit tightening (from banks); and

(iii) quantitative tightening

… will have a meaningful impact on the economy and earnings.

I disagree.

I think the market grossly under-estimates how much credit tightening we will see (outside the Fed).

I say this because the market is simply not used to sustained tighter credit conditions (especially from the banks).

For example, the last time we saw the Fed hold rates higher for more than 12 months was 2007:

And that was without an inflation problem.

As I’ve been saying for many months – don’t expect rate cuts this year.

And if I’m right (and I may not be) — then the market is in for an adjustment.

19x forward is far too high.

Risk Needs to be Managed

Powell was asked if the committee considered a pause this meeting.

This was his response:

“Pausing was not so much considered at this meeting. There is a sense we are closer to the end than the beginning. And if you add up all the tightening across the various channels – we feel like we are getting closer”

Some may see that as dovish.

However, Powell reminded us that the Fed’s own forecast doesn’t see inflation to come down all that quickly

And in that world, Powell said he doesn’t see cuts.

Is that dovish?

But let’s look at the tape – it is screaming caution ahead:

May 3 2023

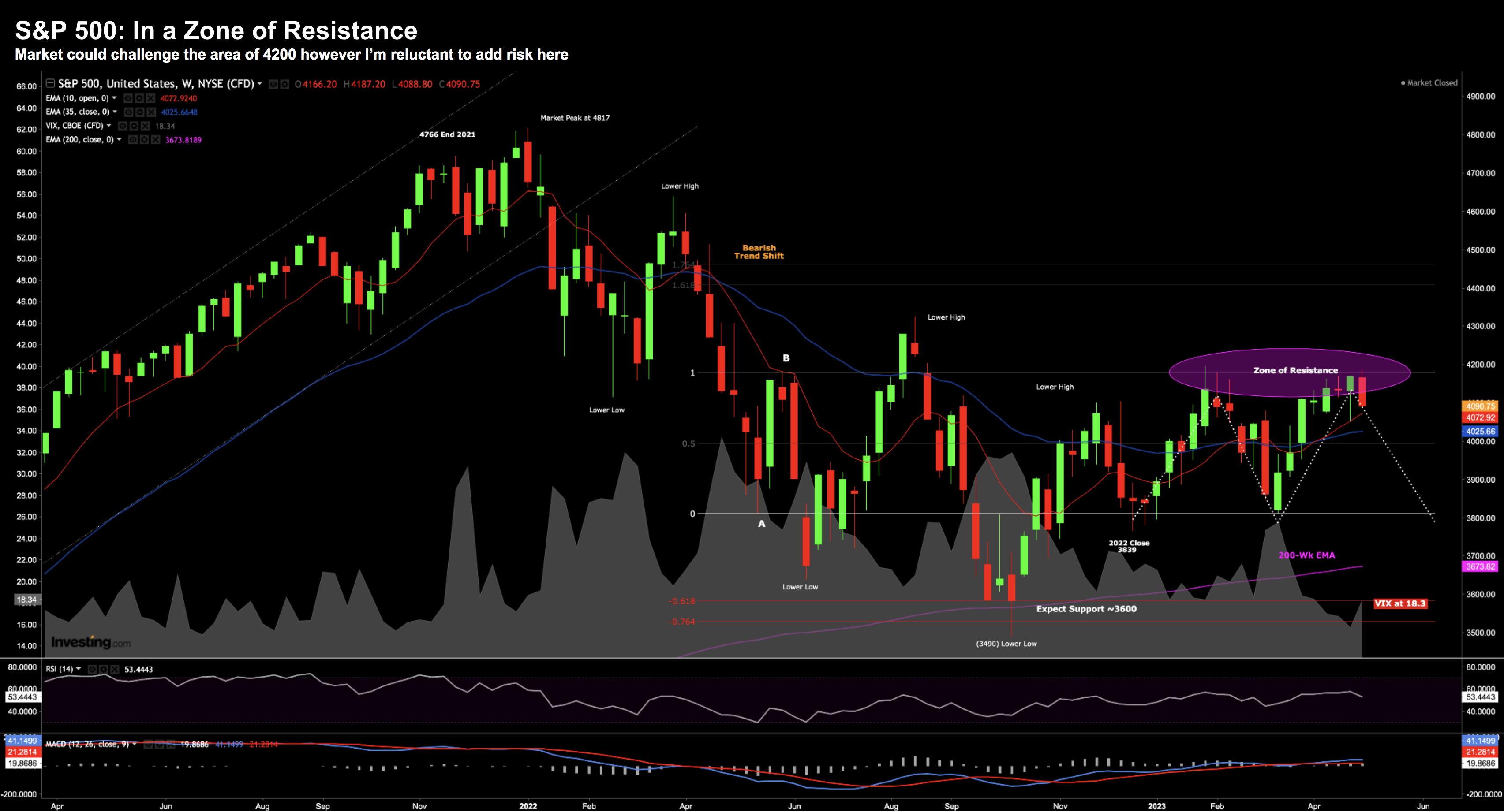

Fundamentally we know the market is very expensive.

But what about technically?

Every time the S&P 500 knocks on the door of 4200 – it’s rejected.

But what I want to point out is the complacency with the VIX.

Going into the Fed meeting – it traded at just 15x.

I made the comment that it under-appreciates the risks opposite such things as (not limited to): the Fed’s resolve to kill unwanted inflation; earnings outlook; debt ceiling; and other geopolitical risks.

Today the VIX surged back above 18.

My view is this will trade much higher in the coming weeks – which will likely see the market pull back further.

Putting it All Together

Powell delivered what I thought he would.

From mine, there were more hawkish tones to his statement.

That is, they are not even close to considering rate cuts.

And why would they?

Sure, they will likely pause in June.

But if they are to remain there for at least 6+ months – that’s not dovish.

Now the Fed dot-plot suggests headline CPI inflation falling to ~3% later this year.

That’s not what Powell suggested today.

He reminded us that services inflation continues to be stubborn.

Goods inflation on the other hand is back to (or even below) pre-pandemic levels.

But services inflation is what we need to pay attention to.

And that’s a function of labor.

Put together, Powell is trying to deal getting services inflation down in addition to uncertainties with ongoing banking problems.

For example, now Pacwest looks like the next regional bank in need of a lifeline.

The Fed’s tool kit is a combination of two (blunt) instruments:

(a) monetary policy (i.e. rates); along with

(b) supervisory and regulatory policy (to deal with further bank failures)

The question is can the Fed thread the (narrowing) needle?

I don’t think so… but that’s a contrarian call.

A recession appears to be a certainty; and it may not be long before we are talking about credit defaults.

That’s the next phase.

I will see it again…. I would not be adding to risk here.