- One more headache for Powell (and the White House)

- Higher oil unlikely to help the inflation fight

- There is an answer… US to pump more oil!

November 25th 2022 – I offered this missive “Oil: 2023 Supply Shock Coming?”

My thesis was oil was likely to head higher in 2023.

The logic: insufficient supply.

Here’s the chart (and forecast) from just over 4 months ago – looking for WTI Crude to find support around $65

Nov 25 2022

Let’s see how we did…

Apr 04 2023

WTI traded down to a low of $65.17 – before catching a strong bid to trade $81.13 at the time of writing.

As regular readers will know, I increased my exposure to energy stocks (specifically OXY and SLB) over the past few months.

Oil (and energy stocks) were trading at solid discounts as investors fretted the prospect of a recession.

But here’s the thing:

An oil price above $70/b is all these companies need to produce windfalls of cash.

From mine, that’s a low bar, especially with the US basically reducing its supply.

But let’s talk more to the surprise OPEC+ news yesterday… where they agreed to cut 3.66M barrels of oil per day – or just under 4% of global supply.

Not Part of Powell’s Plan

Here’s Treasury Secretary Janet Yellen:

“I think it’s a regrettable action that OPEC decided to take. I’m not sure yet just what the price impact will be, I think we need to wait a little longer for, you know, to really assess that”

I think it’s a very unconstructive act at this time when it’s important to try to hold energy prices down.”

Econ 101: Produce less of something – expect it cost more.

What is the current policy of the Administration in terms of fossil fuels?

What’s regrettable?

From my lens, what’s regrettable is the US gifted OPEC the power to dictate prices.

That was a massive mistake.

The Administration’s decision to curb the production of fossil fuels has seen the US go from a “price maker” to a “price taker”.

The US can beg for the Saudi’s to produce more oil… but at the end of the day… they will do what’s most profitable for them.

Why wouldn’t they?

As I say, you make the bed you lie in.

Not only will $90 to $100 oil be a headache for the White House (let’s not even talk about the problem with strategic reserves – another mistake) – it’s also another (new) variable for Jay Powell & Co to consider.

And here’s why:

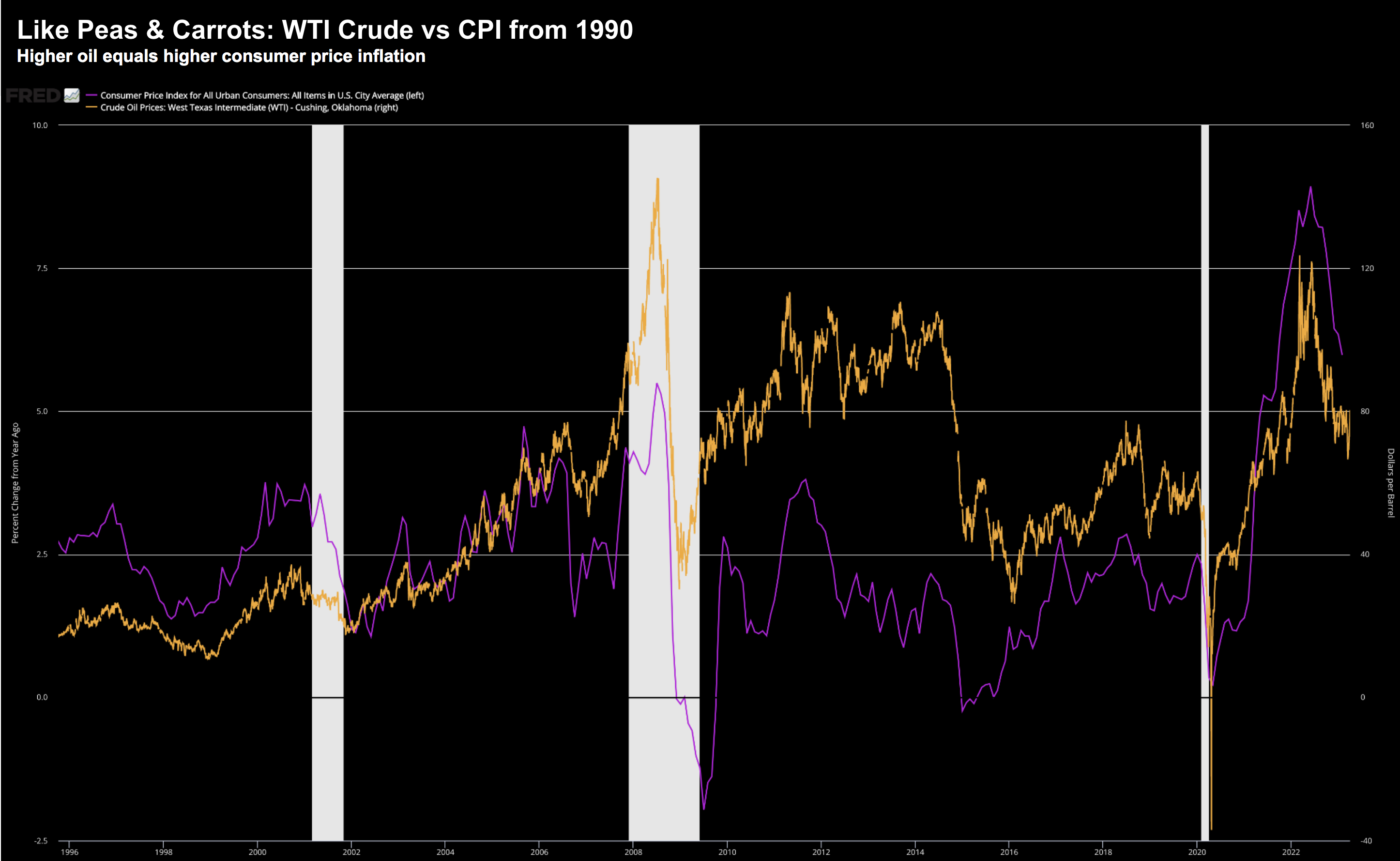

April 4 2023

Whilst the Fed chooses to exclude energy and food from its preferred measure of inflation (Core PCE) – the long-term relationship is clear.

If we are to see oil continue back towards $100, you can be sure the average prices of most goods will rise (not to mention the price at the pump!)

From mine, this just complicates Powell’s decision come May 2nd.

For example, St. Louis Fed chief James Bullard told Bloomberg Television that it’s an “open question” as to how much lasting impact the OPEC+ decision will have on inflation and interest rates, but that oil could make the Fed’s inflation fight harder.

My guess is Bullard is familiar with the chart above.

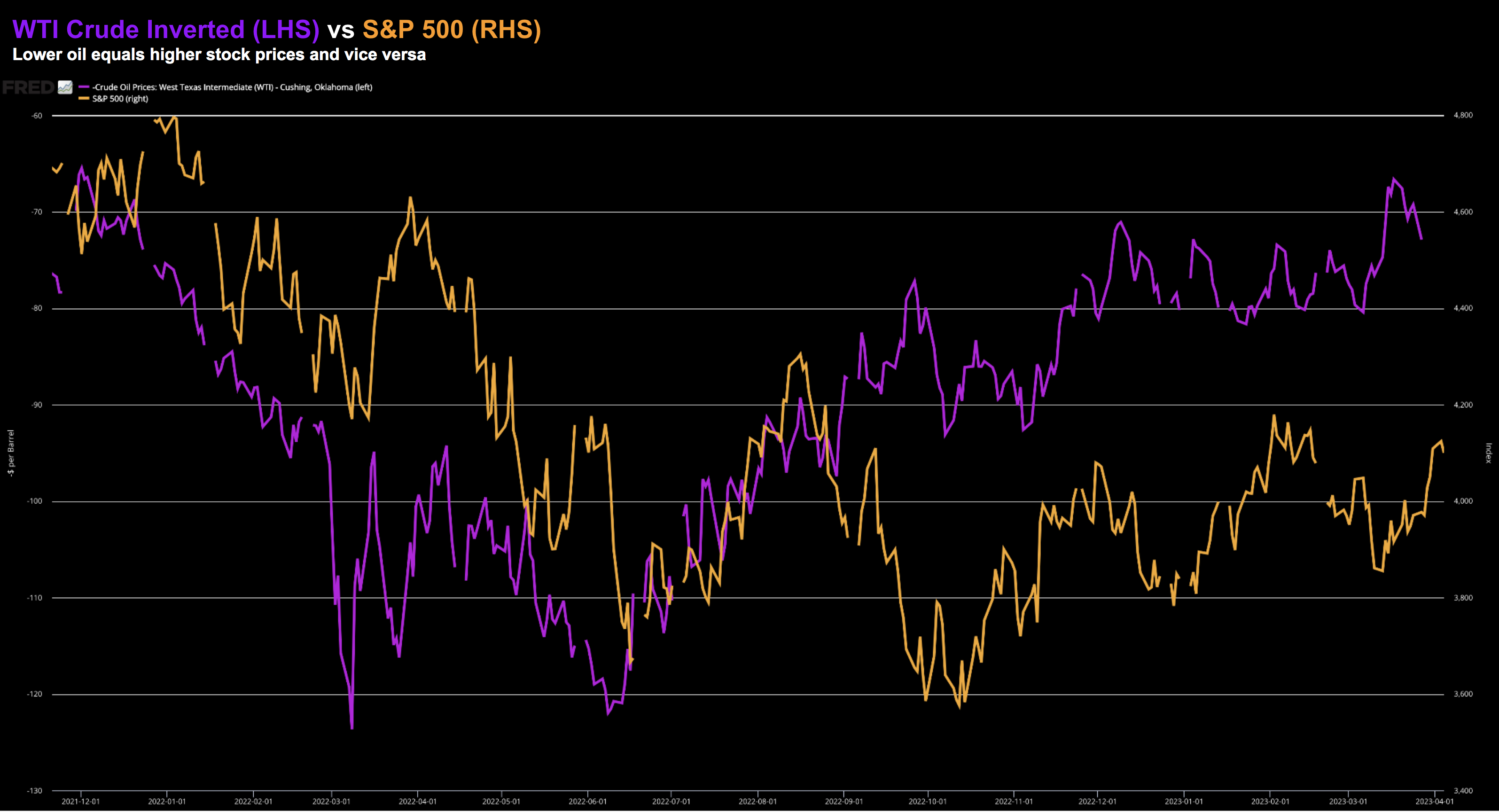

But here’s another curious relationship the market has with oil… equity prices:

April 4 2023

Here I have inverted the price of WTI Crude with the S&P 500

In short, the higher the oil price goes, the lower the S&P 500 (and vice versa).

Just look at the market’s immediate reaction when the OPEC+ news broke…

A ‘yellow flag’ was thrown on the track.

Caution drivers…. slippery conditions ahead.

Here’s Ken Shih on Bloomberg Television:

“The biggest risk for me is really looking at the gap between the expectation of what the market is expecting and what the Fed rhetoric is showing in terms of the Fed policy path,” with some still pricing in a cut later this year that runs against the Fed narrative.

A downturn from here could raise the risk of a cut at year-end, but “for the time being, rates stay higher for longer.”

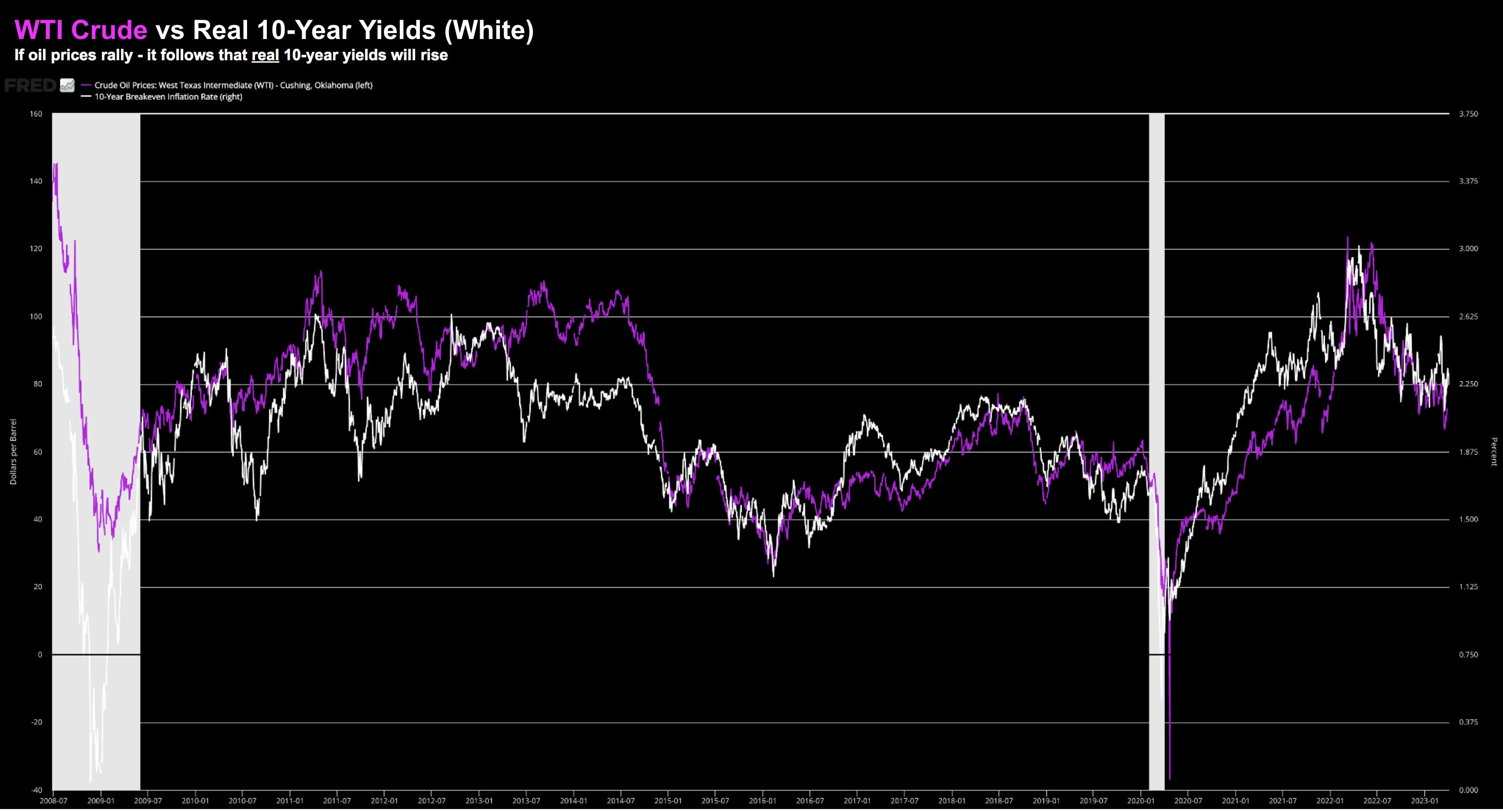

April 4 2023

Here we see how real 10-year yields have traded in lock-step with the change in oil prices over the past 15+ years.

This is very important…

One thing that had the market salivating lately was yields trending lower.

For example, long-duration assets (e.g. tech) ripped higher the past few weeks.

Why?

Yields were plummeting.

These are companies that ‘promise’ stronger cash flows in the future. Therefore, if rates are lower it means greater cash flows. The opposite is also true.

Now if oil is likely to move higher (and I think it is) – it follows that we will see real yields track WTI – putting further pressure on the market.

Putting it All Together

I remain bullish on WTI Crude despite the fact we are likely to experience a recession later this year (or early next).

Yes, this will result in far lower demand however the supply imbalance is not going away.

OPEC+ reminded us today it’s only going to get worse.

As an aside, news of weak factory orders yesterday reinforced my (recessionary) outlook.

Policy makers now have another variable to consider opposite their inflation fight.

Now if oil is to result in another spike in consumer inflation expectations – combined with a recessionary downturn – it’s hard to understand why that is bullish for equities.

But right now, the bulls are sticking with their optimistic thesis, trading around 4100 with a VIX only at 19x.

Whilst I’m not buying the Index here (it feels expensive) – I continue to like energy stocks (vs tech).

We will see how things go.