- Oil to fall in the short-term on demand concerns;

- Underinvestment in US hydrocarbons to result in more supply shocks;

- China’s H2 2023 re-opening to increase demand – where’s supply coming from?

In what is historically a positive week for stocks – all three major indices closed higher.

However, volumes were low as traders swapped their PC’s for the Hamptons.

Some useless stats:

- The Dow Jones Industrial Average (a basket of just 30 stocks) is just down 5.5% from its all time high; however

- The S&P 500 (comprising 500 stocks) needs to rally ~11% to 4469 to avoid being the worst year since 2008.

Sure it’s possible. But probable?

From mine, any catalyst to push the S&P 500 to ~4500 depends on:

- November monthly CPI (Dec 13th); and

- Fed policy statement that same week.

The market has already priced in 50 basis point (bps) for December and 25 bps for January… taking the effective rate to 450 bps (4.50%).

What’s more, it doesn’t see the Fed terminal rate exceeding 5.0%.

But as readers will have heard me say the past few months – focusing only on “how high” is just part of the equation.

A more holistic discussion consists of:

- How high?

- How fast? and

- For how long?

And it’s the latter which potentially has the market offside.

For example, if rates are held above 4.75% for a sustained period (e.g. more than 6 months) – that’s when you will see financial stress start to show (e.g., as credit spreads start to widen etc).

Moving on…

With respect to Nov monthly CPI – I think anything above 7.5% headline gives the Fed more ‘scope’ to continue their aggressive stance.

With that, let’s see how the S&P 500 ended the week

And following that, more on why I think oil is setting up for another supply shock in the second half of 2023.

For example, WTI Crude could easily find itself back above $100 per barrel.

Is the market ready for that? And how does that help bring down inflation?

S&P 500: Caution Ahead

The 15% rally from the October low was not unexpected.

I pencilled this in some 8+ weeks ago, looking for a move back to the 35-week EMA (or slightly higher).

For example, I talked about this outcome here (October 28).

Things have traded per the script (as they have done all year) — now wrestling with the zone of 4100

Question is can the bulls advance it higher? Or will it prove to be another bear trap?

I think we will have our answer before the end of the year…

Nov 25 2022

My focus is on the VIX over the next few weeks.

As I was saying the other day – most traders are now leaning to the same side of the boat.

And you know what usually happens then!

For example, if the VIX falls below 20, it could be a sign our boat is about to tip.

My best guess (and I could be wrong) is this 15% rally feels like a repeat of what we saw in June.

And in order for me to change my stance – I want to see a weekly close above 4325.

That will be a big win for the bulls.

However, at that point, investors are paying a 20-plus forward multiple for 2023.

That’s excessive. And it’s a poor risk/reward set up (especially if we see earnings decline or remain flat)

Okay… let’s look at oil.

Oil Sinks… But That Will Lead to Opportunity

When markets plunge – I start paying attention.

Now those markets could be currencies, commodities, metals, gold, equities, bonds… it doesn’t matter.

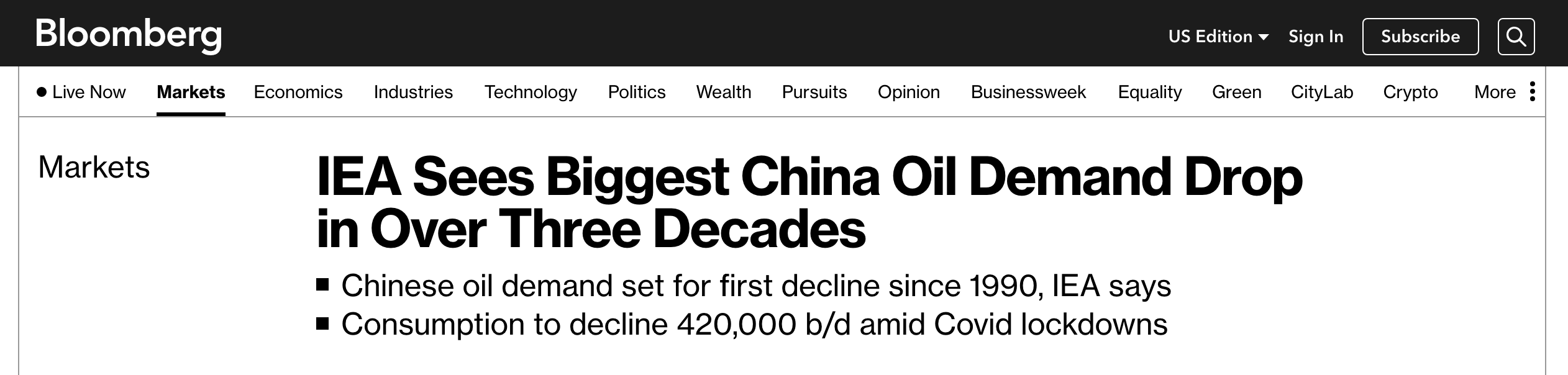

The price of WTI Crude crept on my radar this week – dropping $8 in 10 days – on fears of much slower global demand (specifically China).

Here’s Bloomberg today:

With the price of oil down about $8 in the past ten days, Ziad Daoud of Bloomberg Economics estimates much of the decline is down to falling demand.

Outbreaks of Covid-19 in China are sparking fears of broader restrictions in the world’s largest crude importer. Meanwhile, supply shortages have leant the other way as Saudi Arabia states a willingness to cut output further.

“The combination of weak demand and scarce supply is doubly bad for the global economy,” Daoud wrote in a report on the Bloomberg Terminal.

“The former signals a growth slowdown that’s already in motion. The latter will probably cause further activity weakness in the future.”

Nov 25 2022

Technically, crude remains in a weekly bearish trend (i.e., expect lower prices)

However, we can observe longer-term support around $76.

For example, this was a major low through 2011-12 – and then became resistance in 2018.

So we could see it catch a bid here.

However, if this level breaks, expect the commodity to drop down to levels of around $65.

What’s more, that will likely be very bullish for equities opposite lower inflation expectations.

However, I don’t expect the weakness to last much longer than Q2 of next year.

Here’s why… it’s Econ 101

A Bullish Thesis on Oil for 2023

As a preface, the near-term is extremely uncertain for oil and especially demand.

Consider the following:

- A raging war in Ukraine (unlikely to end soon);

- Widespread Chinese lockdowns; and

- Growing global recession fears as central banks hike rates into slowing economies

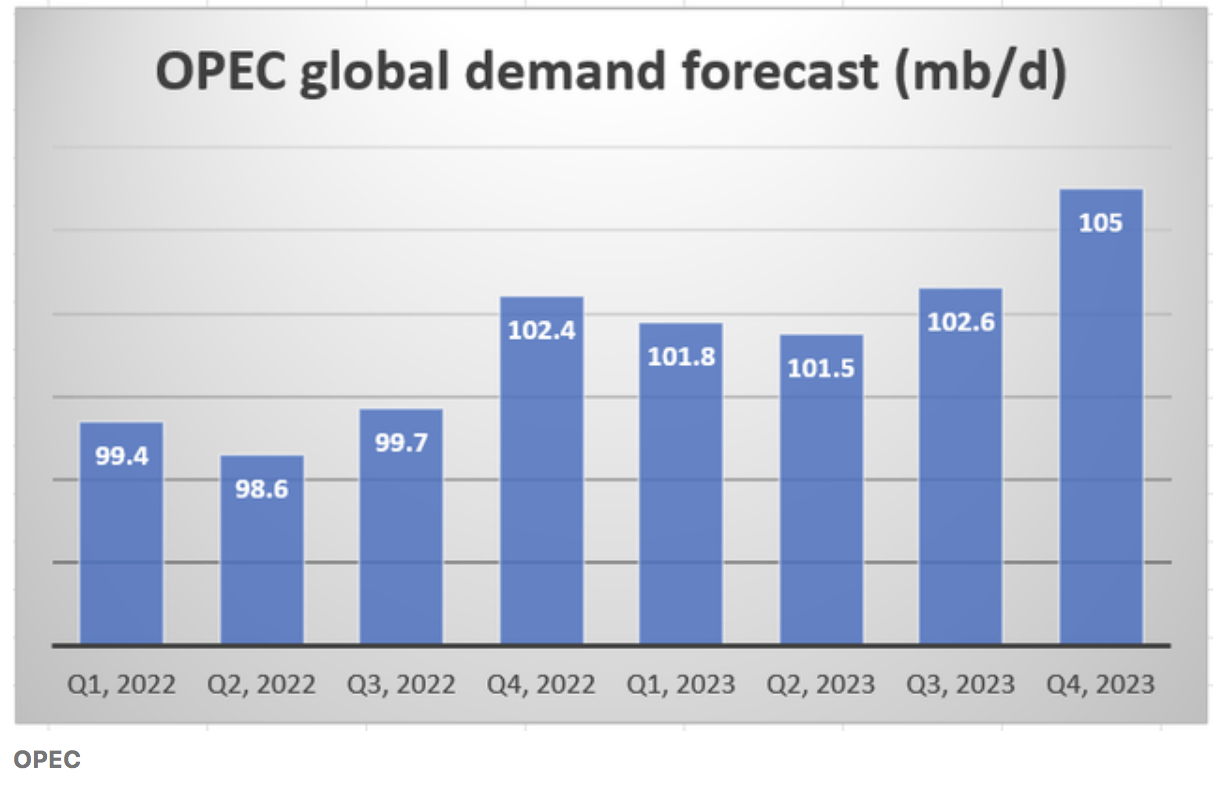

None of this bodes well for demand… where OPEC sees it falling in H1 2023.

But it’s China – as the world’s largest oil importer – causing the biggest worry.

Their regime is now imposing new forced Covid lockdowns – which could see demand fall by some 420K barrels of oil per day (bpd).

Now on the supply side, the market is coming to terms with:

- A 2M bpd OPEC cut (much to Washington’s angst); and more recently

- The new G7 price cap on Russian oil:

The Group of 7 nations are in talks to cap Russian oil at $65 and $70 a barrel — but analysts say it likely won’t have a significant impact on Moscow’s oil revenues even if it’s approved.

Prices at those levels are close to what Asian markets are currently paying Russia, which are at a “big discount,” said Wood Mackenzie’s vice president of gas and LNG research, Massimo Di Odoardo.

“Those levels of discounts are certainly in line with what the discounts already are in the market … It’s something that doesn’t seem, as it is placed, like it’s going to have any effect [on Moscow] whatsoever if the price is so high.”

The biggest risk to a potential oil shock is not Russian or OPEC supply… it’s the lack of output from the US.

At the time of writing, expectations for increased US shale output continue to be aggressively ratcheted down… as the ‘war on US drillers’ continues.

Bloomy this week citing the 5th monthly revision downward from the EIA:

US production is now down to just 12.3M barrels per day for 2023.

Unfortunately, this is woefully short of the gap required (some 6M bpd by some estimates) – and well short of US output achieved in 2019.

What’s more, we are also seeing decline rates from non-OPEC oil producers.

In summary, some analysts see a 6M bpd gap between recent production highs and the average daily demand that is being forecast Q4 2023.

OPEC and other entities could partially fill the gap, but the shortfall cannot be made without scale from the US.

And it’s most unlikely the world will meet the demand forecast 105M bpd by Q4 2023.

Put together, this is important as some may assume that 2022 was the last of any oil supply shock.

I think that’s short-sighted….

We should expect price shocks opposite inadequate investment in fossil fuels.

Russia’s invasion of Ukraine may have exacerbated this shortfall during 2022… however it won’t be the last of it without stronger investment.

And until we have enough green energy (e.g., solar, thermal, wind etc) to adequately offset the 80% of all energy we get from hydrocarbons – shocks will continue.

This is a long-term energy transition which requires trillions in investment.

And in the short-term, the 20% of global energy supply coming from green sources will not be enough to meet demand we expect of industry.

Green capex (for lack of a better term) to mine the necessary metals such as copper, nickel, lithium, cobalt, silver will be required to solve long-running carbonization issues.

However this will take decades.

And in the near-term – we remain underinvested in hydrocarbons.

Now when you combine that with China lifting their demand back to 15M bpd – expect oil back to be well above US$100/b

As context, this year China was ‘taken out’ of the oil market.

Going into 2021, China consumed roughly 15M bpd. However, as recently as October 2022, this plunged to just 10M barrels per day.

This will be the first annual Chinese decline since 1990.

In summary, if we see the price of oil trading between $65 and $70 a barrel – it represents a great 12-month risk reward opportunity.

Any number of oil supply shocks are likely to hit the market.

And in the absence of large sources of additional capacity (which don’t appear to be coming) – it’s likely to constrain the market.

Watching BP to Capitalize on Lower Oil

The stock I’m watching opposite a near-term dip in WTI Crude is BP PLC

Let’s start with the weekly chart followed by some fundamentals:

Nov 25 2022

Like most energy stocks, BP has had a terrific run of late.

However, unlike say Chevron and Exxon, it’s well off its all-time highs.

The weekly trend remains bullish (10-wk EMA above the 35-wk MEA) and has found strong support around $26

Today the stock trades around $35… however has the potential to challenge $48 over the next 12 months.

But my preferred entry is around $31.

And should WTI Crude fall from around $76 today to levels of ~$65 (due to concerns of weakening demand (e.g. Chinese lockdowns)) — BP’s stock will likely trade lower.

From the fundamental side, I think BP stacks up well for 4 reasons:

#1. Strong Production of Oil and Gas

BP currently produces about 1.1M bpd of oil and 6.5 billion cubic feet of natural gas p/day.

#2. Refiner for Europe

It’s the refinery story which I like more.

They can process 1.9 million barrels of oil per day.

And whilst they stand to benefit from higher oil prices next year… but they are pivotal to helping supply Europe with natural gas – as they earn money converting oil into gasoline, diesel and jet fuel.

#3. Assets in Reserve

The other part of the value equation is what they have under ground…

BP sits on a reported 7.9 billion barrels of underground reserves.

And should price of oil continue to go higher – these reserves will be re-priced.

#4. 4.0%+ Dividend

Next year investors will be hunting for reliable dividends.

Energy stocks will be high on that list… given their record of returning cash to shareholders.

At the current price of ~$35 — BP is paying a dividend of ~4%.

However, if you’re able to pick it up closer to $31 – that dividend improves to ~4.5%.

I expect the dividend to increase in 2023 (not decrease) as cash flows and profit margins continue to improve with oil closer to $100/b

Putting it All Together

The price of oil is determined by two things: (i) supply and (ii) demand.

It’s Econ 101.

In the near-term, both demand and supply remain under pressure.

There are growing concerns around China and the global economy falling into a recession.

Demand is likely to remain subdued for at least the next 6 months.

Obviously a deeper than expected global recession could materially impact the demand side of the equation. That’s a risk.

However, when China eventually emerges from its (pointless) ‘zero-COVID’ stance, they will demand 15M bpd.

What’s more, by Q4 2023, global demand is expected to be in the realm of 105M bpd

So where’s the supply going to come from?

It won’t be from OPEC. And don’t look at Russia.

Today, we remain horribly underinvested in hydrocarbons as many (western) governments scale back their investments.

Unfortunately, ~80% of our total energy requirements still come from fossil fuels.

That’s not changing quickly.

And the trillions required in ‘green capex’ opposite metals such as copper, nickel, lithium, cobalt, silver will take decades (assuming they exist!)

The ‘20%’ of all energy they supply today won’t carry the load.

As an aside, just look at California and its rolling “black-outs”.

(ps: I need someone to explain to me how the 5th largest economy in the world (California) continues to have rolling blackouts. Unacceptable.

Put “2 & 2” together and the price of hydrocarbons is likely to increase.

From mine, 2022 will not be the last of the oil shocks.

Oil will be greater than $100 next year and politicians will simply point fingers (failing to implement what is an obvious solution)

I would recommend having at least 5% of your portfolio weighted towards quality energy companies (especially if we see $65 to $70 oil in the coming weeks).