- Have we reached ‘peak greed‘ with the AI trade?

- Nvidia to experience some mild capex indigestion

- Watching Real PCE tomorrow for signs of slowing consumer

After Jay Powell took a victory lap last week – the next market hurdle was Nvidia’s (NVDA) earnings and its forward guide.

Rarely has a single stock been so ‘hyped’ – widely seen as the market barometer for the AI trade.

My expectation was the leading chip maker would handily beat Q2 revenue and earnings – however issue a softer-than-expected guide.

Nvidia shares fell about 6% Thursday, as the company’s fiscal second-quarter gross margin dipped slightly, and its revenue beat was eclipsed by a backdrop of increasingly lofty expectations.

Nvidia reported July quarter revenue on Wednesday of more than $30 billion, up 122% year on year.

It was the fourth straight quarter of triple-digit revenue growth.

But as Nvidia continues its rapid expansion, the annual comparisons are getting tougher. Nvidia issued market-beating revenue guidance for its fiscal third quarter of $32.5 billion. That would imply an 80% year-on-year increase, but a slowdown from the July quarter.

Make no mistake – this was another exceptionally strong quarter.

And despite the softer guide – “only” falling 6.4% should be considered a good result.

By way of example, NVDA’s stock – on average – has moved ~4% every day the past 12 months.

Therefore, a 6.4% move lower post earnings is nothing outside the ordinary.

However, those who were “long volatility” going into the trade (e.g., expecting a move 10%+ either way) – would have lost money.

Capex Indigestion

Coming into the print – I said recently investors should be braced for some near-term ‘capex indigestion’.

In other words, given how much companies have invested in chips the past few quarters (more than $600B) – it’s likely they take a pause.

With the stock lower today, investors were probably concerned about the guide.

In addition, they could also have unanswered questions regarding the timing of its much heralded next-generation Blackwell AI chip.

Here’s what their CFO told us on the call:

“In the fourth quarter, we expect to ship several billion dollars in Blackwell revenue”

Now with the company expected to do $32.5B in total revenue next quarter – the success of Blackwell will play a major role.

However, will Blackwell be “$3B” or “$20B”?

‘Several billion’ is suitably nebulous – and the market didn’t like it.

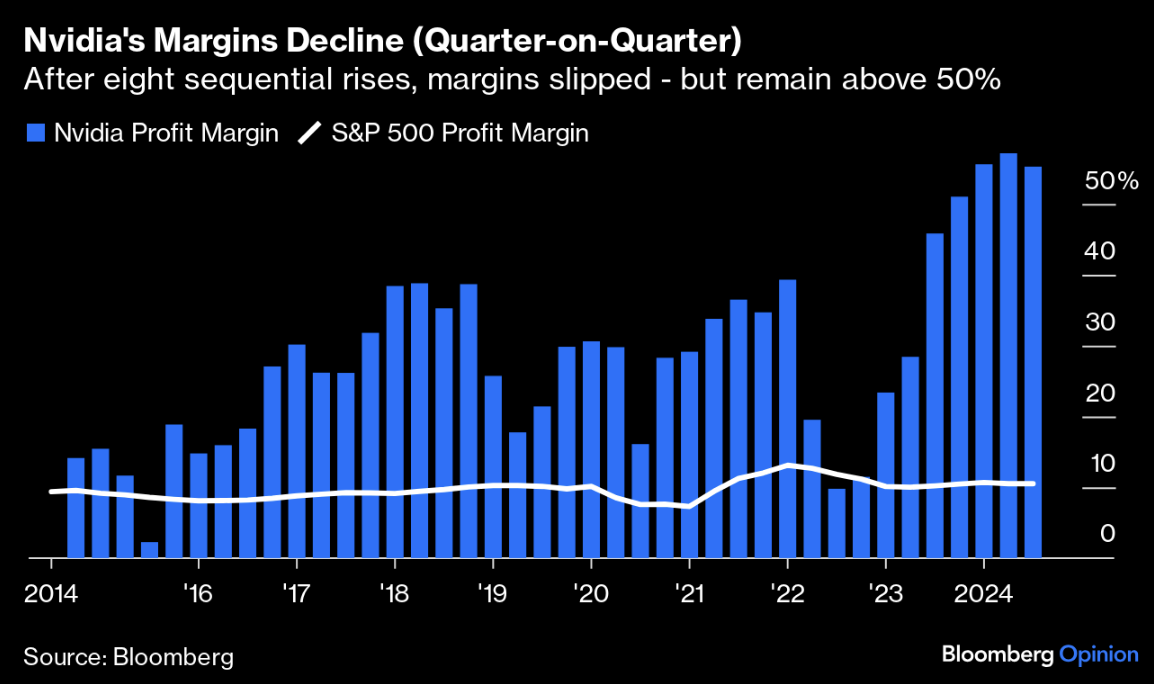

The other line item causing some analysts to ask questions is what they see with margins.

Now to be clear, it enjoys margins that its competitors could only dream of. It prints money.

For example, NVDA keeps more than 50% of sales as profit. That is a staggering 5x the average margin for the S&P 500.

Sustainable? Unlikely.

But it does suggest that 50% margins could be reaching a tipping point…

From Bloomberg:

Aug 30 2024

And from mine, this tipping point is not just with NVDA.

For example, take a look at the shares of Super Micro Computer (SMCI)

Supermicro develops server systems specifically designed to accommodate NVIDIA GPUs.

However, over the past few months, the stock has fallen some 64% (helped in part by a negative report by the short seller Hindenburg)

Aug 30 2024

As I wrote here, this is a great example of how quickly things can move from peak greed to peak fear.

Do You Buy NVDA Here?

With earnings and guidance behind us – and the stock well off its highs – do you buy the stock here?

Well that all depends on your timeframe.

For example, if you prepared to buy it here and simply sit on it for 3 years (and don’t try and trade around it) – I think you will do very well.

My best guess is the stock could easily double in value by 2027.

However, you should be prepared for numerous pullbacks in the realm of 30% to 40% along the way.

Let’s look at the weekly chart

Aug 30 2024

Using this time horizon – we can see how the stock has barely pulled back from its all time highs post Q2 earnings.

It remains in a very strong bullish trend – where it has found support around the 35-week EMA (blue line) on pullbacks.

My expectation is we will see this again at some point…

As regular readers know, I’m currently short NVDA Nov $75 Puts.

With earnings behind us – it seems likely keep the ~14% annualized yield on the trade.

Not terrible.

However, I would be very happy if I were exercised at $75… but I think it’s unlikely.

If you’re not in the stock, I would wait for more of a pullback before entering. I think you will get it lower.

But again, if you’re looking to simply invest over 3 years (and don’t mind the volatility) – I have every confidence the stock will continue to do well.

Putting it All Together

- NVDA earnings and guidance (tick); and

- Personal Consumption and Expenditures (PCE – due tomorrow)

With respect to PCE price inflation – I think that will come in as expected (2.7% YoY).

Anything higher could see the market pare back its expectations for 100 bps of rate cuts before the end of the year.

But that’s not what I will be watching…

I want to know if consumers are continuing to spend (in real terms) and what we see with real incomes (those adjusted for inflation)

With respect to real consumption – it’s expected to come in at +0.2% MoM (+2.40% annualized vs +2.60% last month).

Incomes are also expected to show a similar rise.

And whilst the monthly data gives us a snapshot – my primary focus will be the quarterly change year-over-year.

For example, a downward shift of more than 2.0% YoY in Real PCE will serve as a warning for an increasingly ‘cash strapped consumer’