- What’s behind the rise in long-term bond yields?

- Traders are (very) long US treasuries

- S&P 500 pulls back as yields present an attractive option

In ~11 years writing this blog – I’ve never seen a move in bond markets like the past 24 months.

10-year yields traded below 0.5% not that long ago. Money was next to free.

Now that instrument will return 4.25%. The 12-month T-Bill is a very attractive 5.34%

Below is the 10-year yield chart from 2001.

So what does all this mean?

In short, if bonds fail to ‘calm down’ (for lack of a better term) – equities will face meaningful headwinds.

We got a small taste of that this week (more on this later when I look at the downturn in the S&P 500)

What’s more, if these yields continue to rise, they will place increasing pressure on the high multiples being asked of stocks.

In other words, the equity risk premium (i.e. the earnings yield above the risk-free treasury yield) becomes less.

And these two things create somewhat of a ‘feedback loop’…

So let’s take a look…. because this matters.

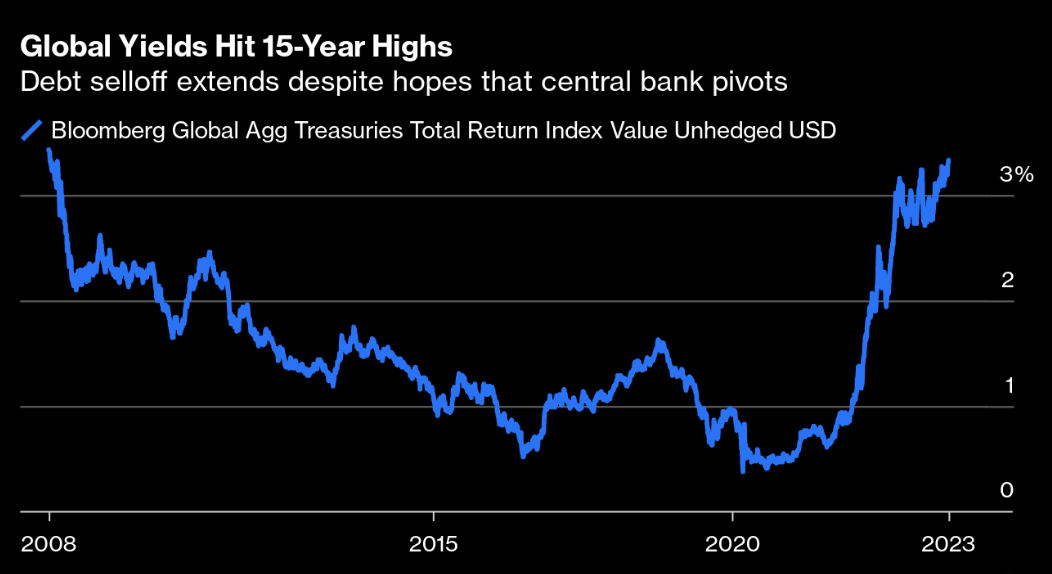

A Global Phenomenon

Whether it’s the US, Germany, Australia, Japan or the UK… yields on major fixed-income benchmarks are moving higher.

In the US – the 30-year hit its highest point since 2011 at 4.42%

In the UK, the 10-year gilt is yielding its most in 15 years.

And in Germany – hit its highest level since 2011.

Bloomberg’s global aggregate of government bonds has now reached its highest yield since the eve of the Global Financial Crisis at the end of 2007:

Sharply higher bond-yields deserve our attention…

During the week I cited calls from the likes of Bill Gross and Bill Ackman – both of the view yields have further to go.

They see inflation higher for longer.

Gross said the 10-year should typically trade about 135 basis points above the effective Fed Funds rate.

Ackman is putting his money where his mouth is – taking a bet against the popular view that yields are close to peaking.

He suggested the 10-year is likely to trade as high as 5.0% – shorting the bond market.

Former Treasury Secretary Larry Summers joined the bearish bond chorus – estimating 10-year yields should be 4.75%

From Bloomberg:

Inflation, which he predicts will rise faster than before, possibly at 2.5%. A real return of 1.5% to 2%, influenced by the government’s growing borrowing needs.

This includes factors like increased defense expenditures, potential extension of some tax cuts from the Trump era and rising interest costs on existing debt. A term premium, which compensates investors for choosing long-term securities over short-term ones. Summers estimates this to be between 0.75 to 1 percentage point.

Combining these factors, Summers suggests that investors might be eyeing a 4.75% yield or higher on the 10-year in the upcoming decade.

The thing is… none of these forecasts are crazy.

They are all quite reasonable.

For example, a 10-year yield between 4.50% and 5.50% is normal in historical terms.

If anything – 4.50% is well below the 100-year average.

What isn’t normal is yields below 3.50% for an extended period.

The problem is of course – that’s what (almost) everyone became used to.

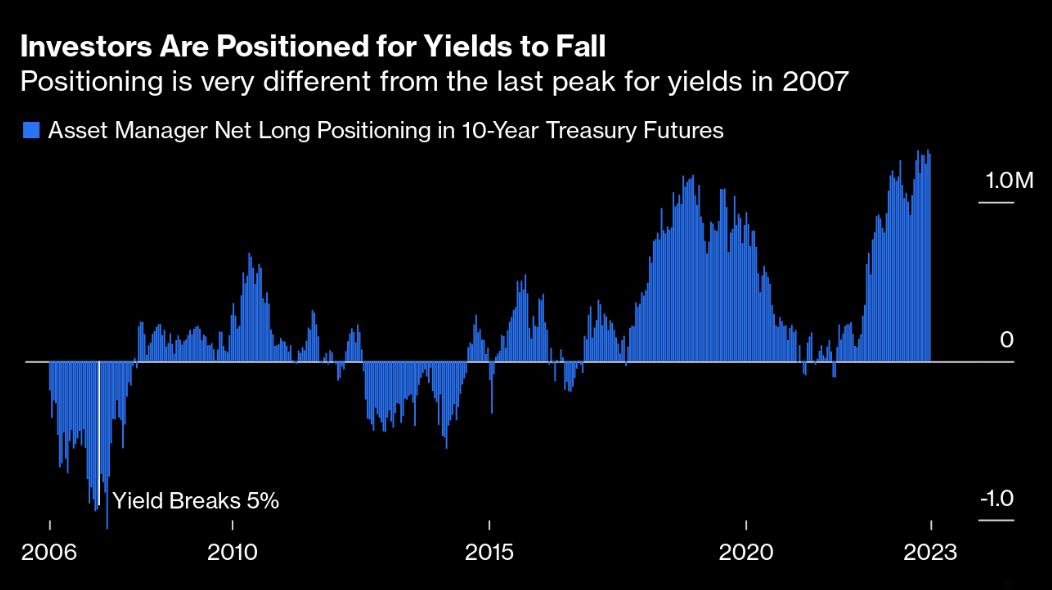

Traders are Long 10-Yr Treasuries

Most investors – including myself – are of the view that these instruments are now a buy.

However, I also recognize that yields could easily rise further.

Over the past two weeks I’ve been increasing my exposure to bonds via ETFs.

So far my trade is underwater (as yields continue to rise) – however I’m not taking a short-term ‘trading’ position.

But I’m not alone…

Asset managers, as tracked in commitment of traders data, are currently long 10-year Treasury futures to the greatest extent since 2008.

In other words, they see bond prices starting to rise as yields get closer to peaking.

Now if we look back at 2007 – investors were not positioned this way.

They expected yields to continue to rise (i.e. they were short bonds) however the opposite happened. Yields sank as the financial crisis took hold.

But here’s the worry…

If bond yields continue to rise – those with long exposure to bonds – will be in for some more pain.

That includes me – where bonds are now ~10% of my total portfolio.

That said – not only will bond prices fall – so too will stocks!

For stocks to do well – they will need to see yields fall (not rise)

Why is this Happening?

This is a difficult question to answer accurately.

Long-term bond yields are basically a function of market forces.

This is not the Fed intervening – as we have seen over the past decade or more (i.e., via Quantitative Easing – where they purchase bonds – driving down yields)

Three reasons (or market forces) come to mind:

1. Don’t Expect Rate Cuts Soon

With inflation continuing to be stubborn (specifically rents and wages) – traders are coming to the view not to expect rate cuts soon.

And if the script is “higher for longer” – this will put upward pressure on yields.

Now only a couple of months ago (or less) – the market was pricing in three rate cuts before the end of this year.

My view was this was optimistic.

For example, Powell has never given one hint they are thinking about cuts.

I’ve constantly maintained there’s no chance of a cut this year… especially given what we see with Core CPI and Core PCE.

The market has now shifted to rate cuts in the first half of next year.

Again, with inflation likely to remain sticky, that could be optimistic.

However, there’s a more important question to ask:

When the Fed eventually starts its easing cycle – how far do you think will they go?

For example, back below 3.0%?

I doubt it.

I think that era of artificially low rates is finished (which is a good thing)

Tom Garretson at RBC Wealth Management offered this:

[The rise in long-term yields] largely reflects a surprisingly strong domestic economy and fading inflation concerns, while looming Treasury supply, fading global demand for Treasuries along with outright selling, amid typically low August liquidity, may be ancillary factors that are also helping to drive yields higher.

In the short term, real rates are a headwind as valuations adjust, but as long as real rates are rising for the right reasons, risk assets can still work over longer horizons

Put another way, if the economy is strong and we avoid a recession, then higher yields are likely.

However, the question is whether a recession is avoidable next year?

I don’t think so… but that’s a contrarian view.

Right now – I’m not seeing data which is convincing me otherwise.

2. BoJ’s Move to Let Rates Rise

The second factor potentially putting upward pressure on bond yields is what we saw out of the Bank of Japan (BoJ) two weeks ago.

The BoJ decided to loosen its yield curve control (YCC) policy.

In short, Japan’s central bank said they would tolerate bond yields between 0.5% to 1.0%

This was not expected (from a country perpetually battling with deflation)

As soon as this was announced (July 27) – yields rose globally.

One explanation is this means less cash flowing into world markets from the BoJ – which gave Japanese (bond) investors an incentive to bring their money back home.

In other words, an exodus from US bonds pushing up yields.

3. Fitch Downgrade

Perhaps the third factor at play is the decision from Fitch.

The downgrade to US credit may have caused some bond investors to head for the exits – driving up yields.

In addition, the more the government ramps its (reckless) spending – as deficits skyrocket – the more this becomes an issue.

This is a good reason for a bond investor to head for the exits.

From NPR (July)

The Treasury Department said Thursday that the budget gap from October through June was nearly $1.4 trillion — a 170% increase from the same period a year earlier. The federal government operates under a fiscal year that begins October 1.

The shortfall adds to an already large federal debt — estimated at more than $32 trillion. Financing that debt is increasingly expensive as a result of rising interest rates.

Interest payments over the last nine months reached $652 billion — 25% more than during the same period a year ago.

This is where Fitch were coming with the credit downgrade.

Bloomberg add that whilst the US debt is “manageable” – it’s not ideal – and will crowd out the private sector – hampering growth:

Even if average GDP growth slows to just over 5%, the ratio of external debt to GDP will be stable at approximately 1x GDP.

This level of debt and deficits is suboptimal for economic growth as government deficit spending crowds out private investment and, therefore, slows US economic growth.

However, given the strength and diversity of the US economy, including being the dominant source of most cutting-edge technology, this level of debt is manageable.

In short, the US government needs to get its “fiscal house” in order.

Not only to reduce the debt burden (and growing interest expense) – but to also help get the economy back on the pathway to long-term growth (which can only come from the private sector).

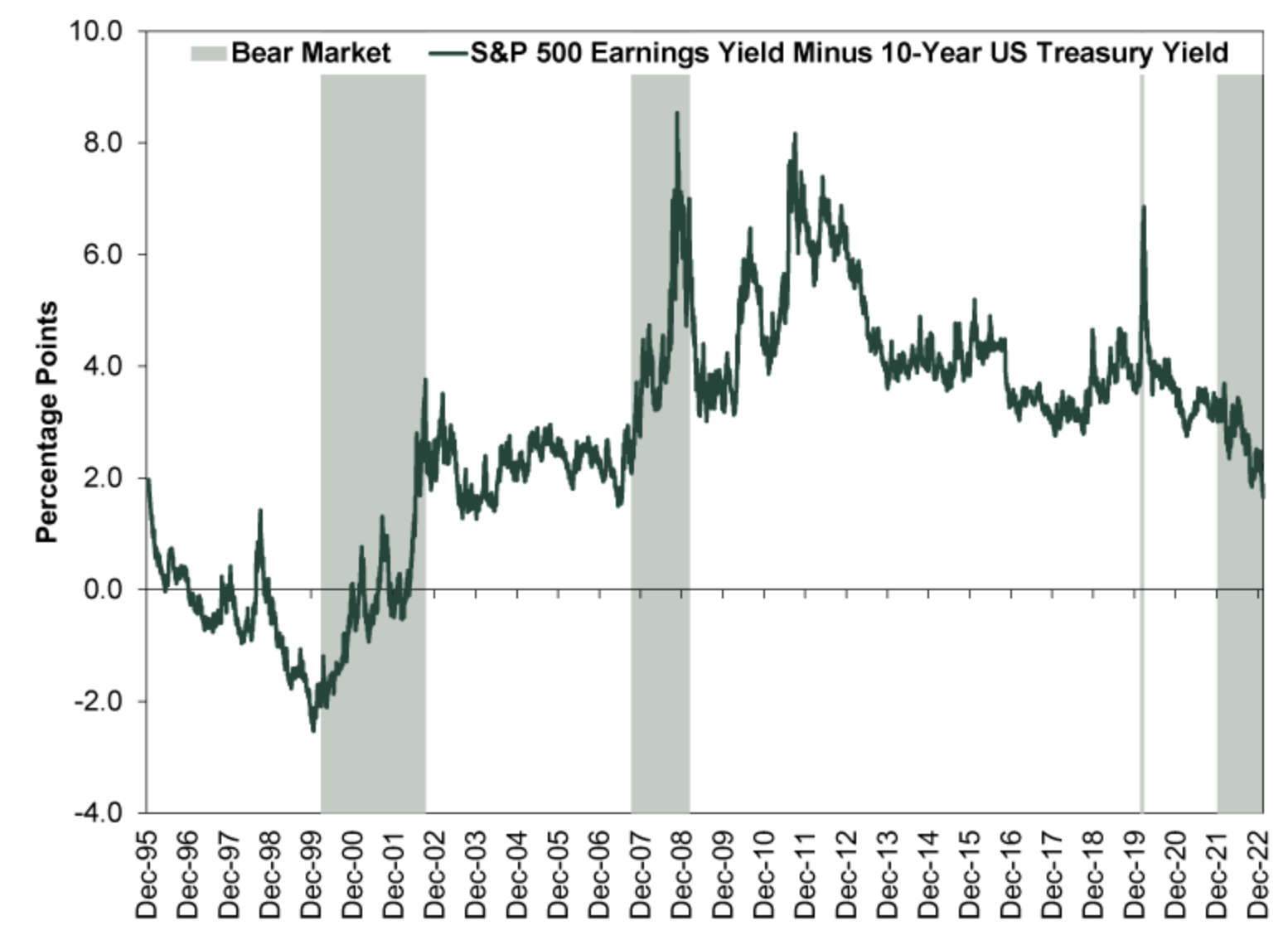

This Matters for Stocks

As I’ve written here – stocks will continue to compete against risk-free yields offered by Treasuries.

Given how high yields are – the equity risk premium offered is as low as we’ve seen in 2001 and 2008.

In other words, stock investors are not being compensated opposite the risk.

That’s not to say the events of 2001 and 2008 will repeat next year (they probably won’t) – but we’re in rarified air in terms of the (low) risk premium (note – I offer a historical chart of earnings premiums further below).

And should the 10-year continue to rise (e.g. above 4.50%) – treasuries get more attractive (and stocks less attractive).

What’s more, it also puts a lot of pressure on long-duration assets (like tech).

This is why large cap tech was sold this week… as excessive valuations were questioned opposite higher yields.

Let’s take a look at the weekly chart:

Aug 18 2023

The last time we saw the S&P 500 put in three consecutive losing weeks was Feb 6 to 20 this year.

One technical thing I was looking for this week was the 10-week EMA (red line) to hold.

It thought we might see some support – but the bulls didn’t put up much of a fight.

From here, my view is we test the zone (not the exact level) of the 35-week EMA (blue line)

At the time of writing that is 4242.

That zone could be up to ~2% either side of that level (roughly 4150 to 4350)

My best guess is bulls may come back around that zone – which is ~9% off the highs.

Readers will recall I was looking for something like a 7-10% pullback.

However, we need to be careful if 4200 does not hold.

That could see the market drop to the mid-point of the distribution or around 4,000.

Is that value?

In short, it’s better but not fantastic.

For example, consider the following:

- Analysts see S&P 500 2024 earnings per share at $235 (which assumes no recession)

- With the S&P 500 at 4,000 – that represents a forward PE of 17x

- S&P 500 earnings yield would be 5.8% (inverse of 17x)

The yield of 5.8% is higher than the 10-year risk free rate (4.2%) – but only by ~1.6%

However, with the market at 4369 and ’24 expected earnings of $235 – that’s a forward PE of 18.6x

1 / 18.6 = 5.4% (only 1.2% above the 10-year yield)

For context, below is the historical difference between stocks earnings yield and that of the 10-year yield:

In 2007 the difference was ~2.0%

And in the lead up to the dot.com bust of 2001 – the difference was essentially 0% (to negative)

Neither were ideal times to be overexposed to stocks.

Again, I think we get a better opportunity.

Putting it All Together

From mine, this is becoming far less about the Fed but more about the market forces with bond yields.

They need to calm down for equities to find their feet.

Could the Fed raise rates again this year?

Most definitely.

That will be determined by what we see with inflation.

However, if they do, that will only see yields rise further.

And the further bond yields go – the less attractive stocks will be.

My view is the 10-year will make its way back to around 3.5% before year’s end.

But a lot of this depends on inflation and whether we seem likely to avoid recession in 2024.

If your view is we don’t avoid a recession – bond yields will fall (i.e. bond prices rise). That’s good news for those who are long bonds.

However, if you think a recession is not a risk, then I would not be investing in bonds (as yields will push higher)