- S&P 500 may catch a short-term bid around 4200

- However, I still don’t think it’s an attractive buy

- The other (troubling) chart which suggests a recession is on the way

July 28 2023

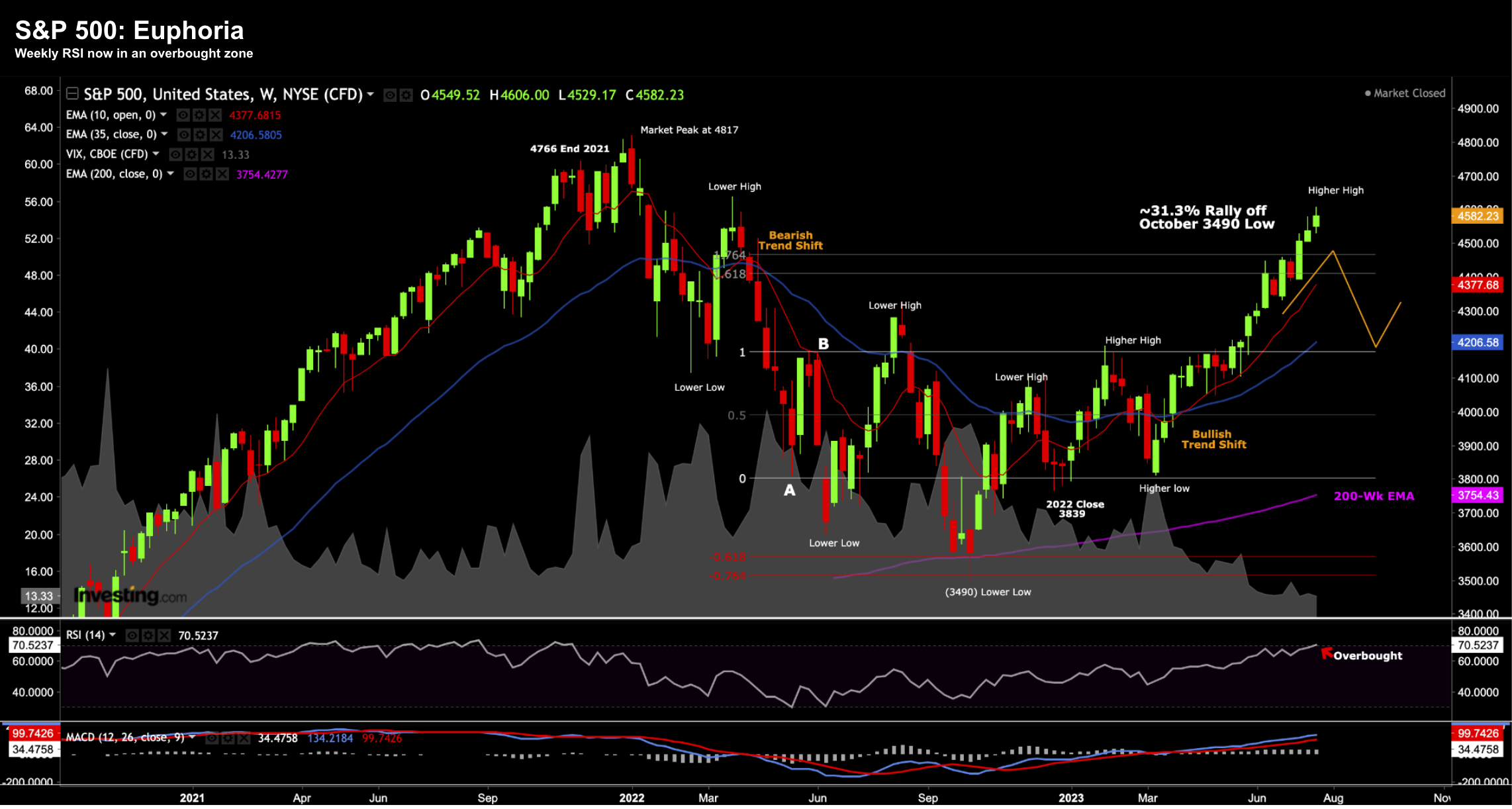

A little over 2 months ago – I described the market as “euphoric”

Valuations were in excess of 20x forward earnings – despite what we saw in bond markets.

Something was horribly wrong.

My simple advice was do not add to positions at those levels.

The downside risks were just too high.

My thesis was whilst stocks could easily rally to ~4500 — any further meaningful upside felt ‘limited’

Turns out we didn’t go too much higher.

I sketched in the orange lines – suggesting there was a high probability stocks could pull back to the 35-week EMA (or a zone around 4200)

Fast forward to today:

Oct 5 2023

Things ‘traded per the script’…

They don’t always – but they certainly did this time.

The S&P 500 is now facing it fifth losing week in a row (with one day remaining this week)

The last time we saw that was April / May 2022.

Question is do you buy here?

One Question to Ask Yourself

For example, if we see bonds catch a bid (from what are now deeply oversold levels) and yields ease – stocks will rally.

But I think any near-term upside will be limited.

And it’s certainly not something I will be buying with “both hands”

But here’s the one question you need to ask:

Does the upside reward meaningfully outweigh the downside risk?

My answer is no.

Let me offer my logic:

With 6-month T-Bills offering you more than 5.54% – you need to ask whether you think the market can rally well beyond 4500?

Why 4500?

Because you can get 5.54% risk free over this period.

Therefore, to reward you for taking the risk in equities, the upside needs to be greater than 4500.

Now with earnings next year still expected to be $235 (which assumes 12% growth) – that’s a forward PE of 19x

That’s not cheap.

Especially given what we see with bonds.

In short, the upside feels limited.

So what’s the other side of the equation?

With near-term yields unlikely to give back a lot of ground (barring something terrible) — I don’t think the S&P 500 at 3600 is unreasonable.

Again, here’s my logic:

3600 / $235 is a forward PE of 15.3x (inline with the 100-year average)

What’s more – the earnings yield on 15.3 is 6.5% (i.e. 1/15.3)

That’s an approx 1% premium to treasuries – which is still quite low.

But…

This also assumes that earnings will grow to $235 next year (i.e. no recession)

That’s a bold assumption given the multitude of growing headwinds (especially to the consumer)

I will offer more on recessions risks in a moment…

But overall, I don’t think we will see that kind of earnings growth – and would be more comfortable assuming earnings closer to $220.

3600 / $220 = 16.4x (still a modest PE)

If you put all that together – I see the possibility of maybe ~8% upside (at most) vs up to 20% downside.

I don’t like that equation.

What I would like to see is the higher probability of 20% upside vs possible 8% downside.

Therefore, if we are to see the market trade around 3800 – the long-term (3+ year) risk/reward is far more in investor’s favour.

But at ~4200 – risks still skew to the downside given what we see with rates. And obviously the higher stocks go (4300 to 4500) – the more unattractive the market looks with short-term rates above 5.50%

Again, this is all about rates.

Something Else ‘Trading per the Script’

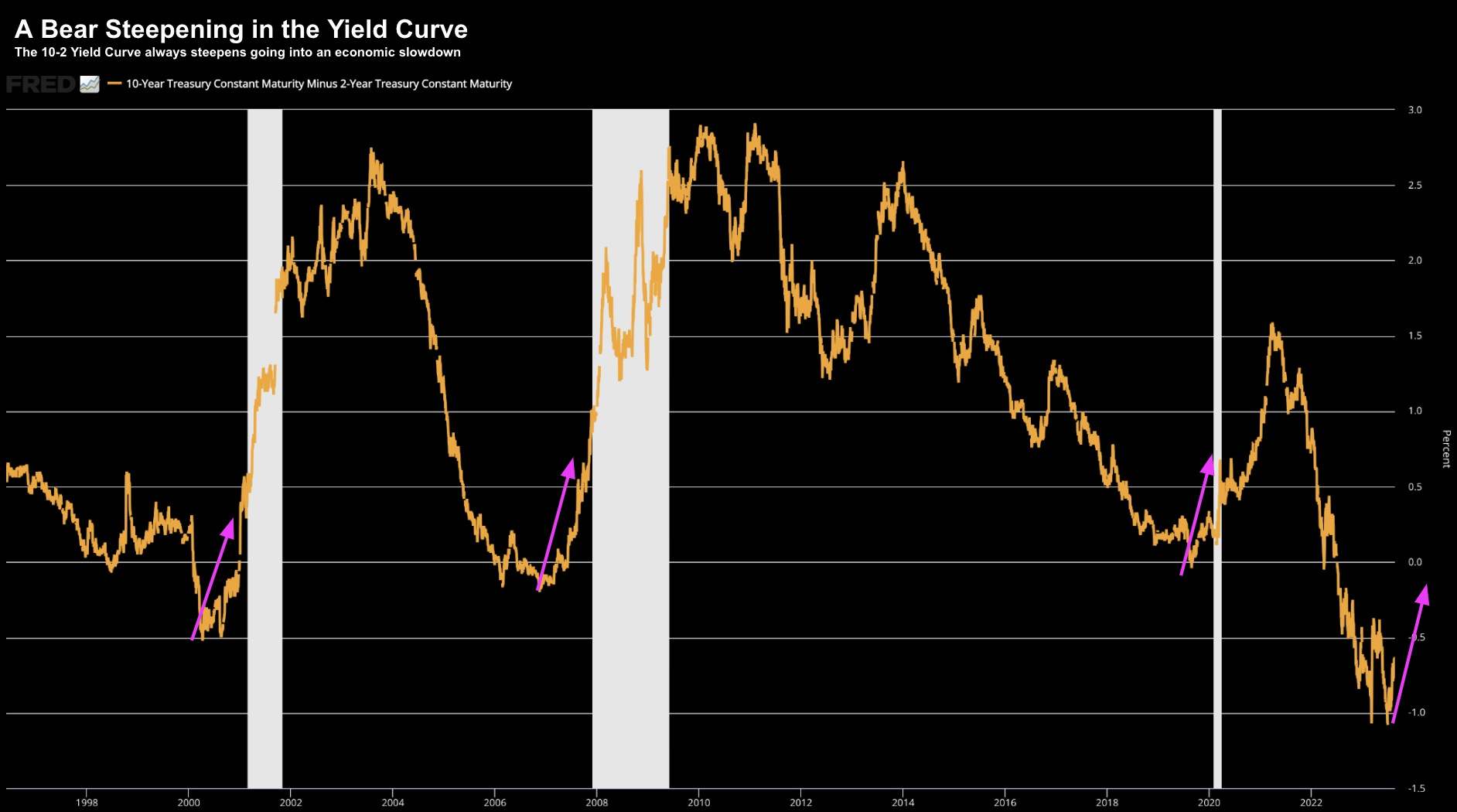

August 22 this year I issued this post “Beware the Bear Steepening of the Curve”

I offered this chart (and forecast):

August 22 2023

Let me repeat a portion of that post:

- First, the yield curve is negative for a sustained period; and

- Second, it’s followed by a (re)steepening of the curve

Generally this steepening (from inversion) doesn’t bode well for the economy.

The reason this happens is investors tend to avoid the long-end of the curve (ie., they sell longer duration bonds) – seeking more attractive returns at the shorter-end (which comes with less duration risk).

This has the effect of pushing long-term yields higher

To be clear, it’s not typical to see this. However, they do tend to occur prior to recessions.

Let’s update the 2-10 year yield chart:

Oct 5 2023

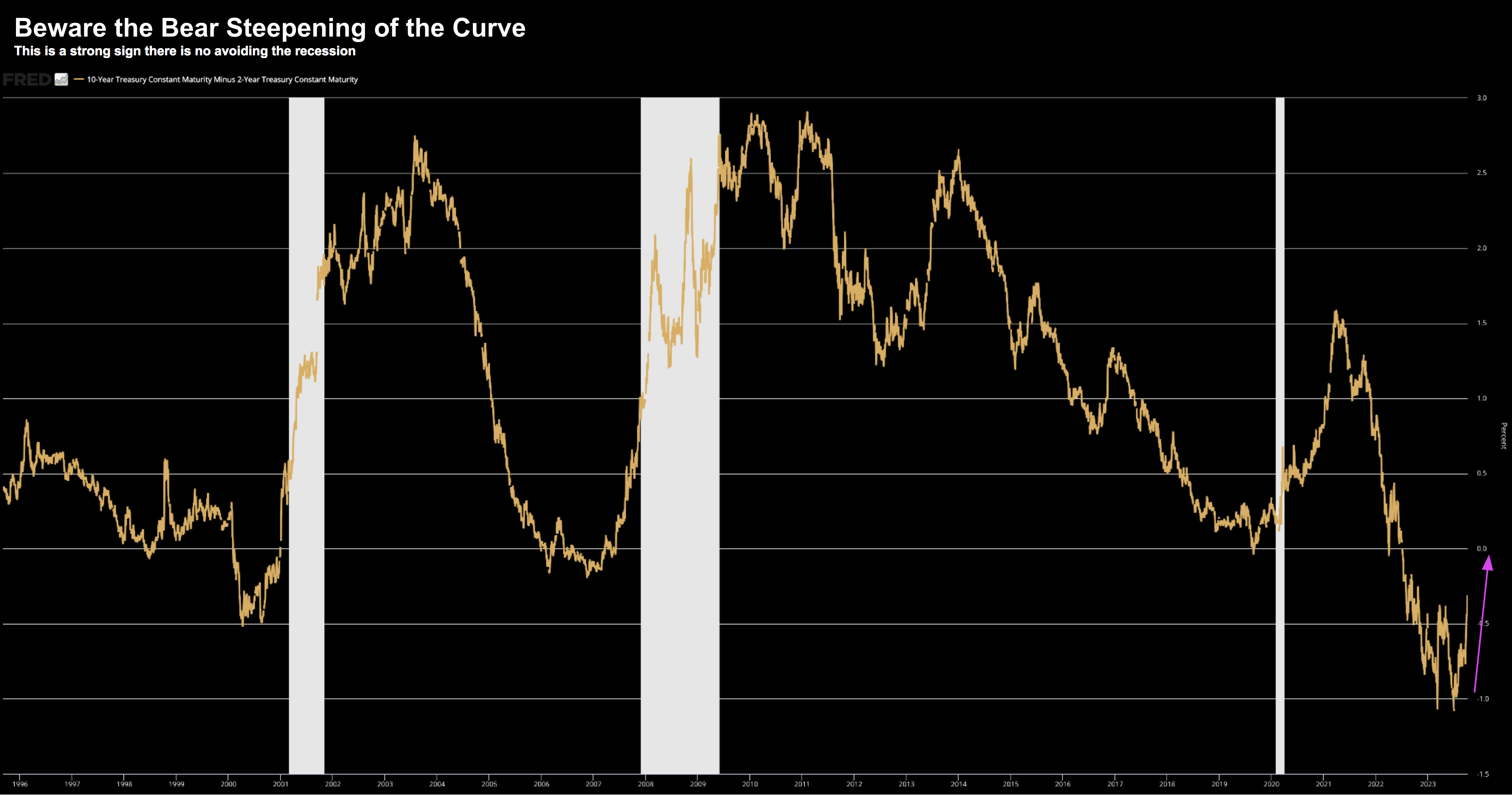

It was as deep as we have seen in decades.

Today the inversion is just 31 basis points.

What’s most troubling is the speed of the un-inversion.

That’s what bothers markets…

And I suspect much of the recent downside we’ve seen in equities is opposite this rapid steepening.

It’s also why I’m not shying away from my 2024 recession call.

But it’s not just me…

Jeff Gundlach (often known as the Bond King) is now advising investors to “buckle up”

Gundlach believes that bond-market turmoil could be a sign that a recession is on the way.

Yep… welcome to the club (better late than never)

Here is what he said this week:

“The US Treasury yield curve is de-inverting very rapidly,” Gundlach wrote

That “should put everyone on recession warning, not just recession watch,” he added. “If the unemployment rate ticks up just a couple of tenths it will be recession alert. Buckle up.”

Putting it All Together

Answer: a rapid re-steepening of the curve from inversion.

He says “... the yield curve tends to dis-invert when the recession is about to start”

This is the point I was making two months ago.

However, he adds something else…

He states the curve dis-inversions often happen because shorter yields come down.

But as we know – that’s not the case today.

The 2-year yield has been mostly stagnant or rising slowly.

In the jargon, that is a “bull steepening” because a rise in two-year prices (bullish if you hold them) leads to the flattening.

This one is different.

Today what we have is a bear steepening, meaning that the move has been driven by a fall in the price of long-dated bonds.

Further, this is a specific kind of bear steepening that starts with the curve already inverted.

That combination of conditions happens very rarely. However, when it does, a recession generally soon follows.

That’s been my thinking… but I could be wrong.

In summary, from mine the upside reward from 4250 fails to meaningfully outweigh the downside risks.

I think there will be better opportunities ahead.