- Powell admits the economic outlook is highly uncertain

- Suggests higher rates may be necessary (pending inflation and employment); and

- Rules out the possibility of rate cuts in the near-term

Today Fed Chair Jay Powell offered his latest sentiment on the economy and monetary policy from their annual Jackson Hole Summit.

Whilst he leant hawkish (my expectation) – he also admitted he doesn’t know what’s ahead.

Nothing wrong with that… better decision making starts by first recognizing what we don’t (or can’t) know.

In Powell’s words – the Fed are “navigating by the stars under cloudy skies”

“Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment. Doing too much could also do unnecessary harm to the economy. As is often the case, we are navigating by the stars under cloudy skies”

If only we had a Google Maps for where we are.

We don’t.

When was the last time we added in excess of $6+ Trillion to the balance sheet whilst keeping rates at zero?

You won’t find it.

Powell added:

“We are attentive to signs that the economy may not be cooling as expected. We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our (2.0%) objective.”

But I think it’s important to observe what he didn’t say.

The Chairman did not mention the possibility that the Fed is thinking about cutting rates.

This has been my thesis for at least 12+ months. However, that view has been at odds with the market.

For example, a few months ago Wall Street expected rate cuts later this year (or early next).

I didn’t see it.

Today most traders don’t see any cuts before mid-2024 (at the earliest)

That’s more realistic.

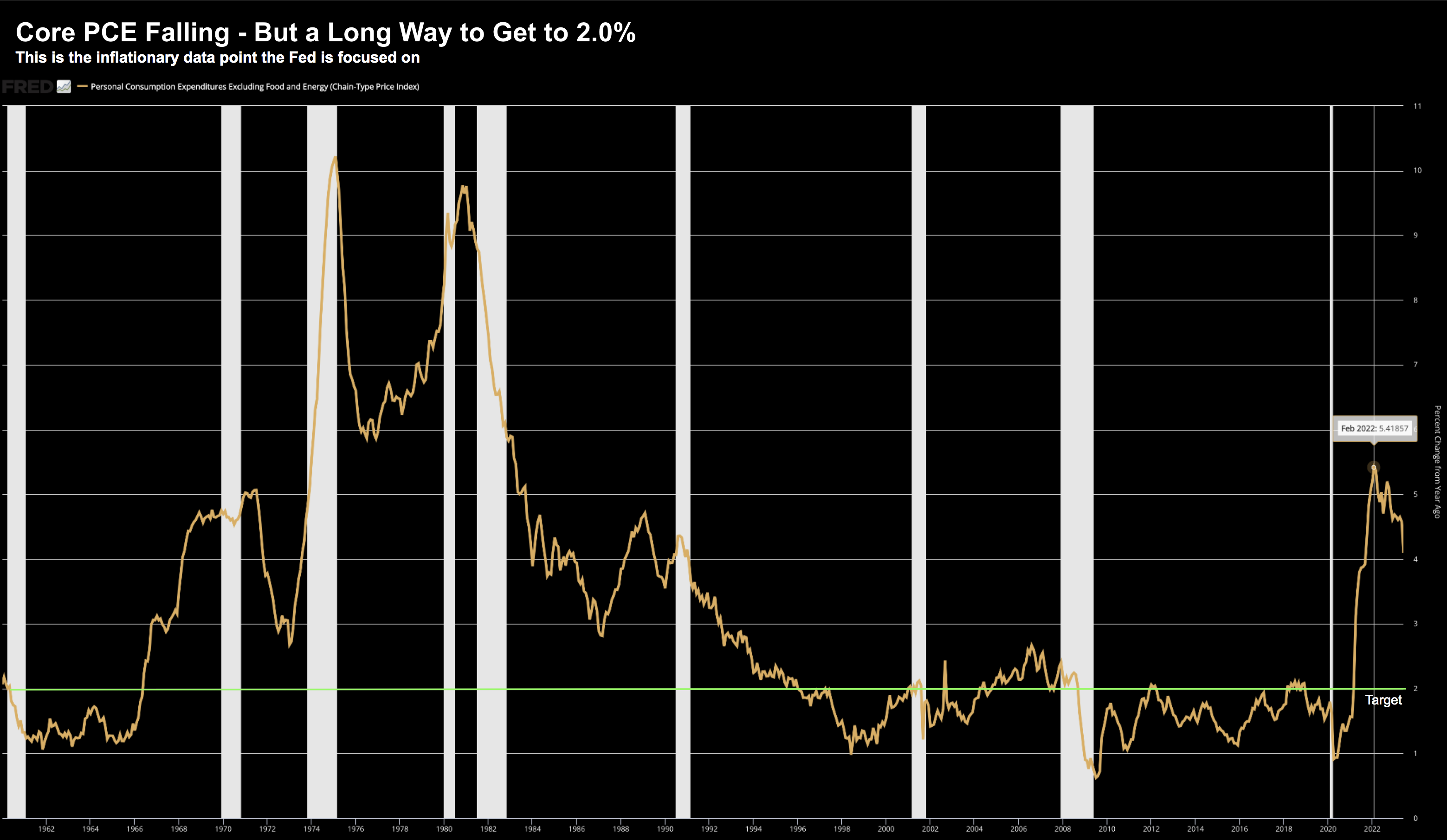

From mine, with Core CPE more than double the Fed’s objective, we should continue to expect a restrictive stance until we see definitive signs Core inflation is meaningfully trending lower.

For what it’s worth – pay less attention to headline inflation – and focus on core (that’s what Powell is watching)

Based on the last few prints – we cannot draw that conclusion. Not yet.

Powell reiterated that today.

Navigating a Difficult Path

Powell (and the FOMC) made a mistake well after the pandemic had passed.

We are paying for it now in the form of higher inflation.

In short, they kept rates far too low for too long.

Their (mistaken) view was inflation was going to be transient.

But I admire Powell for admitting they made a mistake.

The inflation genie broke out of the bottle and now they’re working hard to get him back in.

They ‘course corrected’ by raising rates 550 basis points over ~17 months.

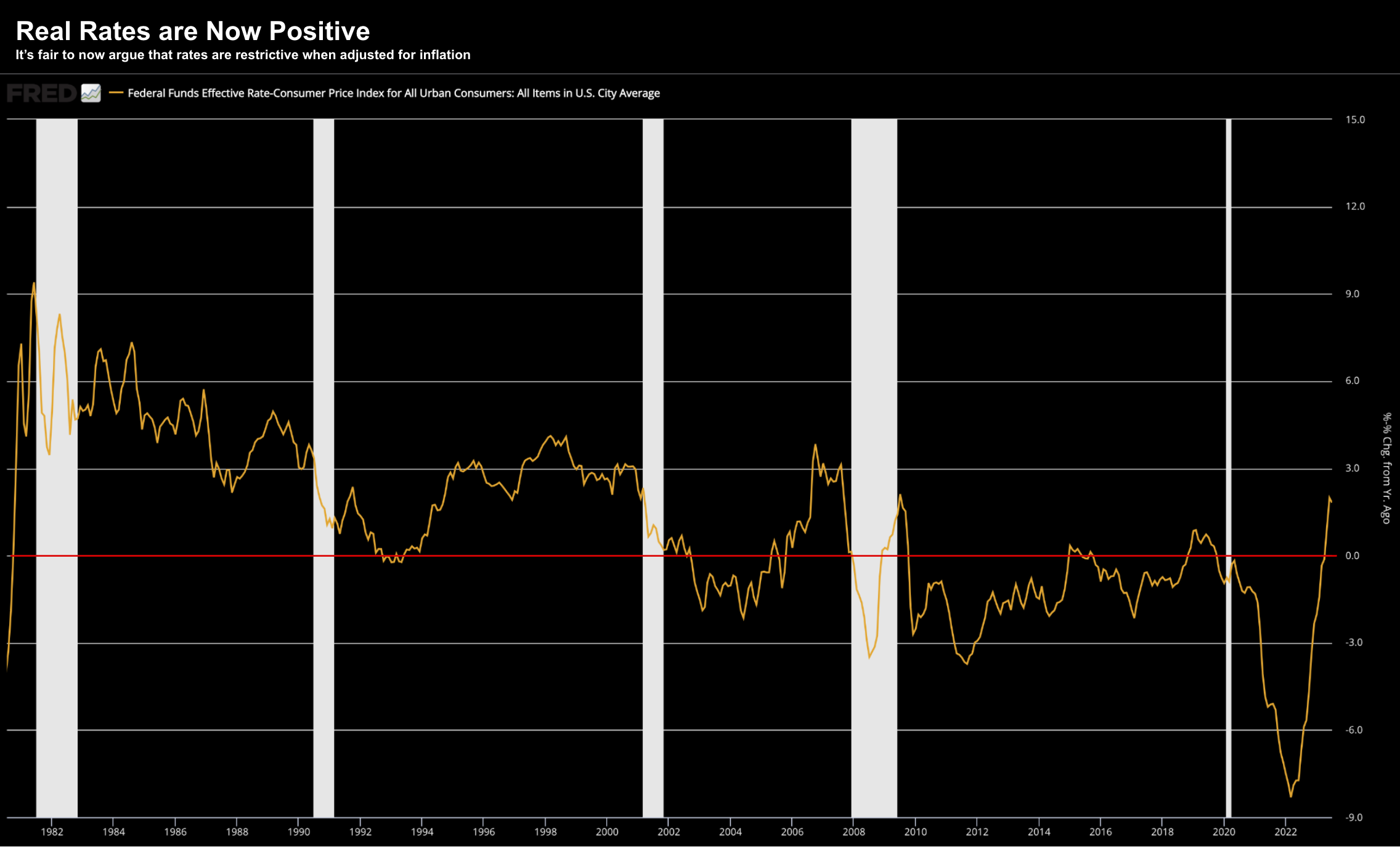

The result is real rates are now positive.

That’s a very good thing – as it’s the only way to get the ‘genie’ back in the bottle…

But that takes time…

Aug 25 2023

As this 40-year chart shows – real rates were largely negative for the better part of the past 15 years (i.e., below the 0% red line).

Yes, negative real rates are typically good for speculative risk assets (e.g., stocks and houses).

However you also mis-price risk – which can result in misallocated capital.

For example, poor businesses will attract capital that would otherwise not be deserving.

And only when ‘the tide goes out’ – bad businesses are exposed.

In the words of Warren Buffett – that’s when you see who was swimming naked.

Now real rates briefly turned positive when the Fed hiked in 2018 – however the equity market panicked.

The Fed caved.

Today the Fed doesn’t have the same optionality as it did 5 years ago.

Inflation remains far too high (as Powell mentioned) – where Core PCE still trades with a 4-handle.

But what I liked about Powell’s (honest) language is admitting the inflation fight is not done.

It’s premature to make that assumption.

Whilst encouraging, two good months of lower Core PCE doesn’t constitute a meaningful trend.

This has been the massive disconnect between the Fed and equities.

Equities felt the inflation fight was basically won.

Incorrectly, many assumed going from Core PCE of ~5.4% (Feb 2022) to ~4.1% (today) was good enough to warrant cuts may not be far away.

Aug 25 2023

Wrong.

Powell reminded participants there’s still a lot of work to do.

As an aside, here’s my post from February this year talking to this very point.

Expect the Fed to stay the course… even if that means holding rates higher for longer.

Market Wrestles with the Outlook

Coming into Jackson Hole – I wrote the Fed would most likely err on the side of being hawkish.

And if that was the case, long-term bond yields could actually fall.

Turns out, long-term yields fell slightly.

Short-term yields were mostly unchanged and equities rallied (perhaps fearing far worse from Powell)

With Powell not ruling out further hikes (e.g., higher for longer) – the market will see this as pressuring economic growth.

And should the economy stumble – yields will likely fall – as investors find shelter in bonds.

That’s bullish for bond investors.

But equities are not thrilled at the prospect of capital costing more. They will always want a lower cost of capital.

But it’s not coming… not soon.

A higher weighted cost of capital means pressure on earnings and growth.

That said, markets are still in excellent shape given where we are with bond yields.

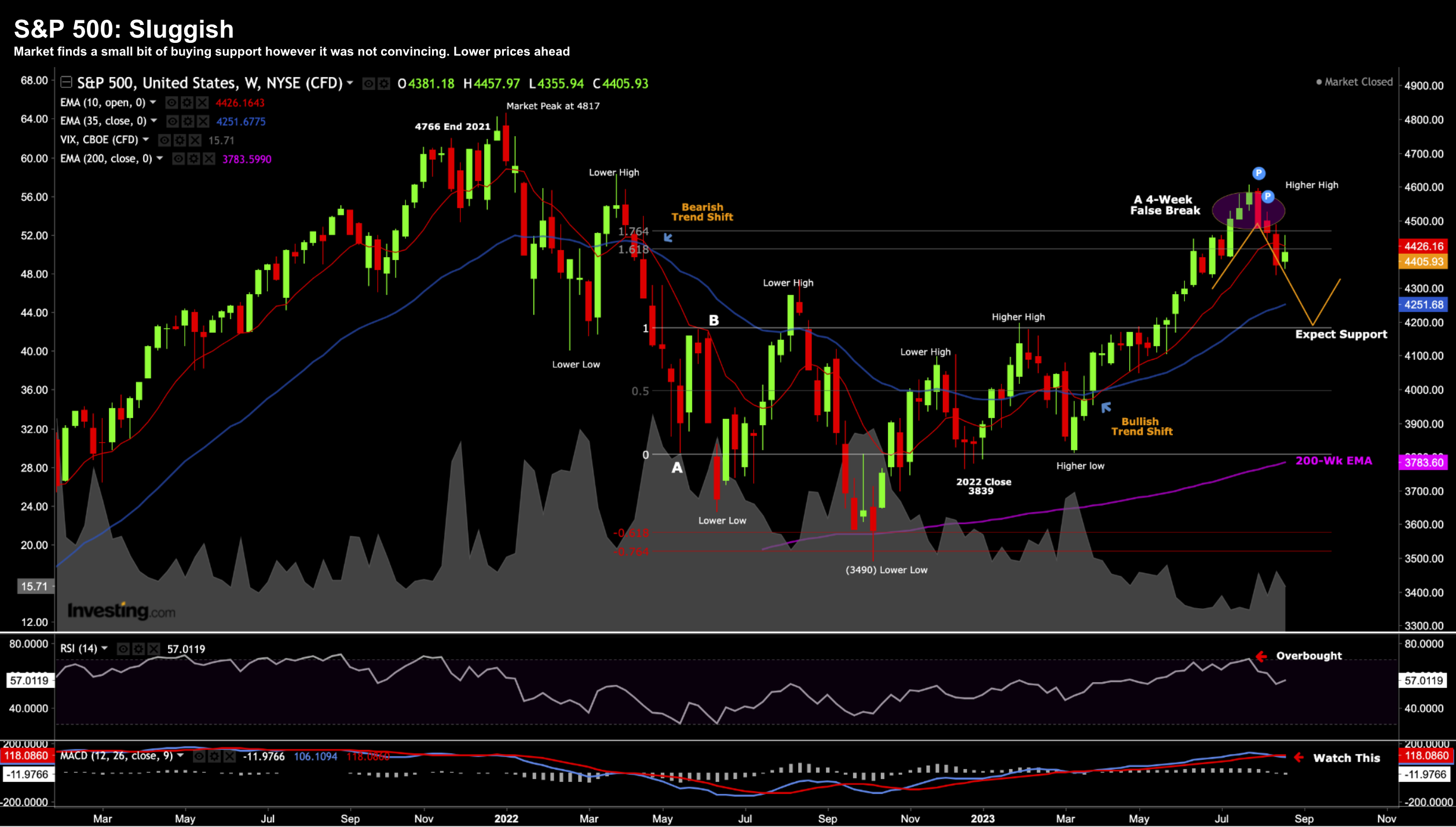

For example, the S&P 500 is only fractionally off its all-time highs… despite the recent drift lower.

Aug 25 2023

The past few weeks saw a small amount of (expected) profit taking.

And the RSI (middle window) suggested that could be the case.

But there is nothing overly bearish about this chart.

The bulls are in control.

For example, if the S&P 500 were to pull back to test the 35-week EMA zone (around 4250) – that’s a healthy bullish development.

My thesis is this dip will be bought.

Beyond the chart, fundamentally companies are still growing profits and earnings – which will take stocks higher over time.

The only question is what price you pay for those earnings?

22x? 20x? 18x? Less?

From mine, a figure closer to 16x (approximately) is better risk reward with short-term rates above 5.0%

Why?

1 / 16 = 6.25%

That’s higher than the risk free rate – however not much much.

Therefore, my view is the asking price for the Index is still very high in this context.

Put another way, the equity premiums are very low.

That said – beyond the asking price – companies are mostly in good shape.

The Q2 earnings season saw most companies beat low expectations… however earnings did decline for the third consecutive quarter.

And with Q3 guidance not terrible – strong earnings should see the S&P 500 create a “3800 to 4200” floor (at a guess)

Putting it All Together

Powell’s comments highlighted the uncertainties surrounding the economy and the complexity of the Fed’s response to it.

I think the description of navigating by the stars under cloudy skies is apt.

If only he had GPS.

If anything, it echoes what we heard from Home Depot’s CEO after their Q2 earnings:

“Uncertainties remain … and we don’t know how the monetary policy actions, which are specifically intended to dampen consumer demand, what that impact will ultimately have on consumer sentiment in the overall economy.”

If you were to take a dovish lens (I don’t) – the Chair did say the key rate is high enough to restrain the economy and cool growth, hiring and inflation.

Put another way, we are closer to the end of Fed tightening.

To some – that’s dovish.

That said, he pointed out that it’s hard to know how high borrowing costs have to be to restrain the economy, “and thus there is always uncertainty” about how effective the Fed’s policies are in reducing inflation.

And therein lies the rub…

The Fed is trying to thread the needle of cooling inflation (and economic growth) – but not doing too much to cause material damage to the economy.

So far so good… but there’s still a way to go.

But with rates likely to remain higher for longer (with the real rates positive) – consumers will find it increasingly more difficult to finance a “new home” or “a car”.

What’s more, small businesses will also find it tougher to finance expansion.

However, that’s precisely what the Fed is trying to do if they are to bring Core PCE down.