- Selling in tech accelerates but closer to support

- Google down after hours after reporting 23% YoY Growth

- Microsoft rallies on 46% cloud revenue growth

My most recent missive warned the selling in tech could get ugly.

For example, the ETF QQQ (as a proxy) warned of downside:

April 22 2022

Today this ETF closed at $317 – which saw hundreds of billions shed in market cap.

Market cap haircuts included:

- Tesla – $126B

- Apple: $99B

- Microsoft: $78B

- Amazon: $64B

- Alphabet: $51B

Today we heard from two of the leading five: Google and Microsoft.

Both delivered solid quarters of growth… however one faired better than the other.

Let’s start with Google – my largest portfolio holding.

Google Grows Revenue 23% – Stock Drops

It was another solid quarter from the search advertising giant.

Total revenue came in at $68.01 billion – representing growth of 23% from the same period last year.

And on the surface, an excellent result.

However, it disappointed some investors who had set a very high bar.

Revenue had slowed from the white-hot 34% growth from Q1 2021 (were moderation was expected).

However, it was YouTube which alarmed investors – which showed only 14% growth.

CFO Ruth Porat said whilst YouTube is primarily an ad-supported model – its subscription business is growing. For example, both YouTube TV and Music Premium were up substantially in the last quarter.

Below are the key numbers:

- Earnings per share (EPS): $24.62 per share, vs. $25.91 expected

- Revenue: $68.01 billion, vs. $68.11 billion expected

- YouTube advertising revenue: $6.87 billion vs. $7.51 billion expected

- Google Cloud revenue: $5.82 billion vs. $5.76 billion expected; and

- Traffic acquisition costs (TAC): $11.99 billion vs. $11.69 billion expected

Cloud revenue was a bright spot – beating expectations on the top line – growing 44%. That said, the cloud business still reported an operating loss of $931 million.

(Note: Microsoft showed similar numbers – with growth in Azure at 46% – more on this below)

Bottom line:

It was a strong number across the board.

However, with shares lower after the close, we could see the stock trade at a modest forward PE of ~16x adjusted for cash per share – with further $70B in buybacks coming.

That’s not high for a company growing at 20%+ year on year (at their scale)

But the chart suggests taking caution – warning of more downside.

April 26 2022

Google finds itself in a weekly bearish trend.

The question is where will it find support?

Two levels I’m watching:

- Previous resistance around $2,150 (Feb and March of 2021); and

- The 50% retracement level at ~$2,000 – based on the rally from lows of March 2020 to the all-time high

This creates a zone between $2,000 and $2,150.

Now I’m not sure we get that low based on the fundamental value of the stock.

As I say, a forward PE of only ~16x growing at 20%+ (at Google’s margins) – with a $70B buyback in plan – is likely to lure long-term investors before long at current levels.

Microsoft Beats Expectations – Stock Rallies

Whilst Google disappointed – it wasn’t the same for Microsoft.

They beat on both the top and bottom line:

- Earnings: $2.22 per share vs. $2.19 expected

- Revenue: $49.36 billion vs. $49.05 billion expected.

The enterprise leader’s revenue increased by 18% year over year in the quarter compared with 20% in the previous quarter.

Amy Hood, Microsoft’s finance chief, said to expect fiscal fourth-quarter revenue of $52.4 billion to $53.2 billion. The middle of the range, at $52.8 billion, is just below the $52.95 billion consensus.

Revenue from Azure and other cloud services jumped 46% in the quarter, compared with 46% growth in the prior quarter.

And the number of Azure deals worth at least $100 million in the quarter more than doubled, CEO Satya Nadella told analysts on a conference call.

This is a stock you want to own for the long-term…

Now if you look at the respective charts for Google and Microsoft – they are similar:

MSFT: April 26 2022

Microsoft is ~18% off its highs at the time of writing (vs Google 21.4%)

Technically the stock looks very close to finding a long-term support level of around $260 (i.e., the highs of April 2021)

And with the stock up 4% after hours… this level looks intact.

MSFT is my second largest position and I think is long-term value around this level.

If the stock happens to dip tomorrow – I’m a buyer.

4,100 a Key Zone for the S&P 500

Still on deck this week are Meta, Apple and Amazon.

Any one of these three can move the market on a good or bad number.

From mine, I think Apple beats and the stock rises. Facebook already looks cheap with a lot of the bad news priced in.

However, Amazon could be risky.

That said, given the super strong results in Cloud from both Azure and Google – I expect Amazon’s cloud business – AWS – to show ~35% to 40% growth YoY.

Let’s take a quick look at the S&P 500 – as I think buying support is close:

April 26 2022

As I outlined in this post – the support zone of 4,100 will be critical.

We are not far away – closing at 4175.

Failure here will see a sharp move lower.

But as I was saying the other day – anything around the level of 4,000 represents a forward PE close to 17x… which is not expensive for the market.

As an aside, keep a close eye on the VIX.

We are now trading ~34… closer to a level where I get interested.

Note – the higher the VIX goes – the more traders are willing to pay for downside protection (i.e. put options)

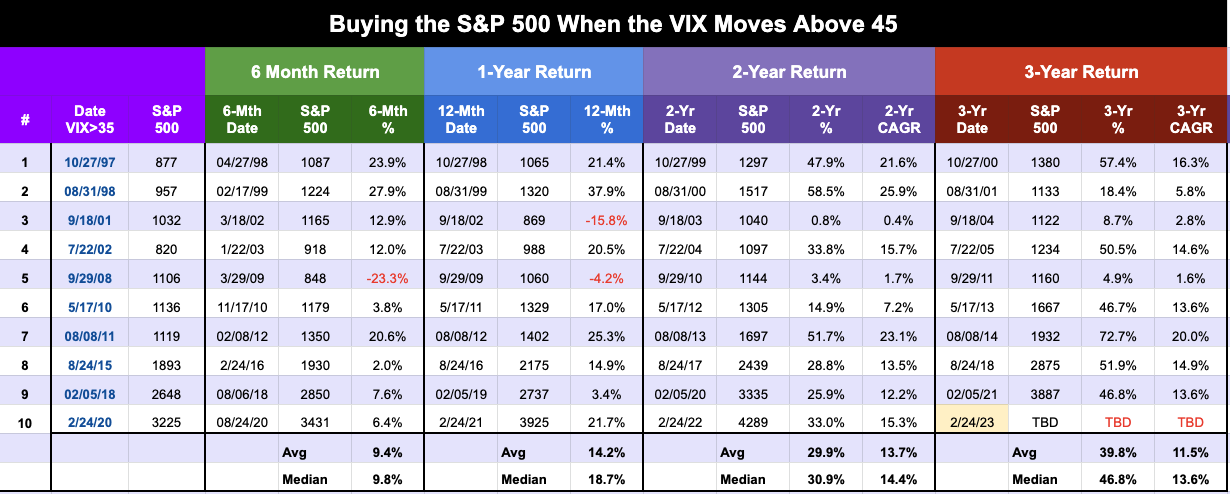

For those who missed a post I issued a few months ago – I will be buying the Index (with both hands) – should we see the VIX trade at 45

This will be getting closer to peak fear (which we have not seen yet).

In my experience, buying the market at peak fear often pays dividends over the long term. For example, below are average 6-month, 1-year, 2-year and 3-year returns when buying the VIX at a level of 45 or higher.

To be clear, a VIX at or above 45 is not common.

And we may not get there.

For example, if stocks bounce from this zone, the VIX will pull back sharply.

That said, if we see a breakdown – and the VIX spikes beyond 45 – I would look to add to Index positions.

Putting it All Together

Whilst investor fear is high – we are yet to see any panic selling.

And I don’t know if we will.

Things such as Covid in China, the war in Ukraine, the Federal Reserve’s monetary tightening and persistent inflation are all top of mind.

Throw in earnings that miss expectations and investors could throw in the towel.

To that end, what we hear from Meta, Apple and Amazon is massive.

If one of more of these fail to meet expectations – we might see one last ‘flush’ lower.