- Panic in the banking sector represent long-term opportunity

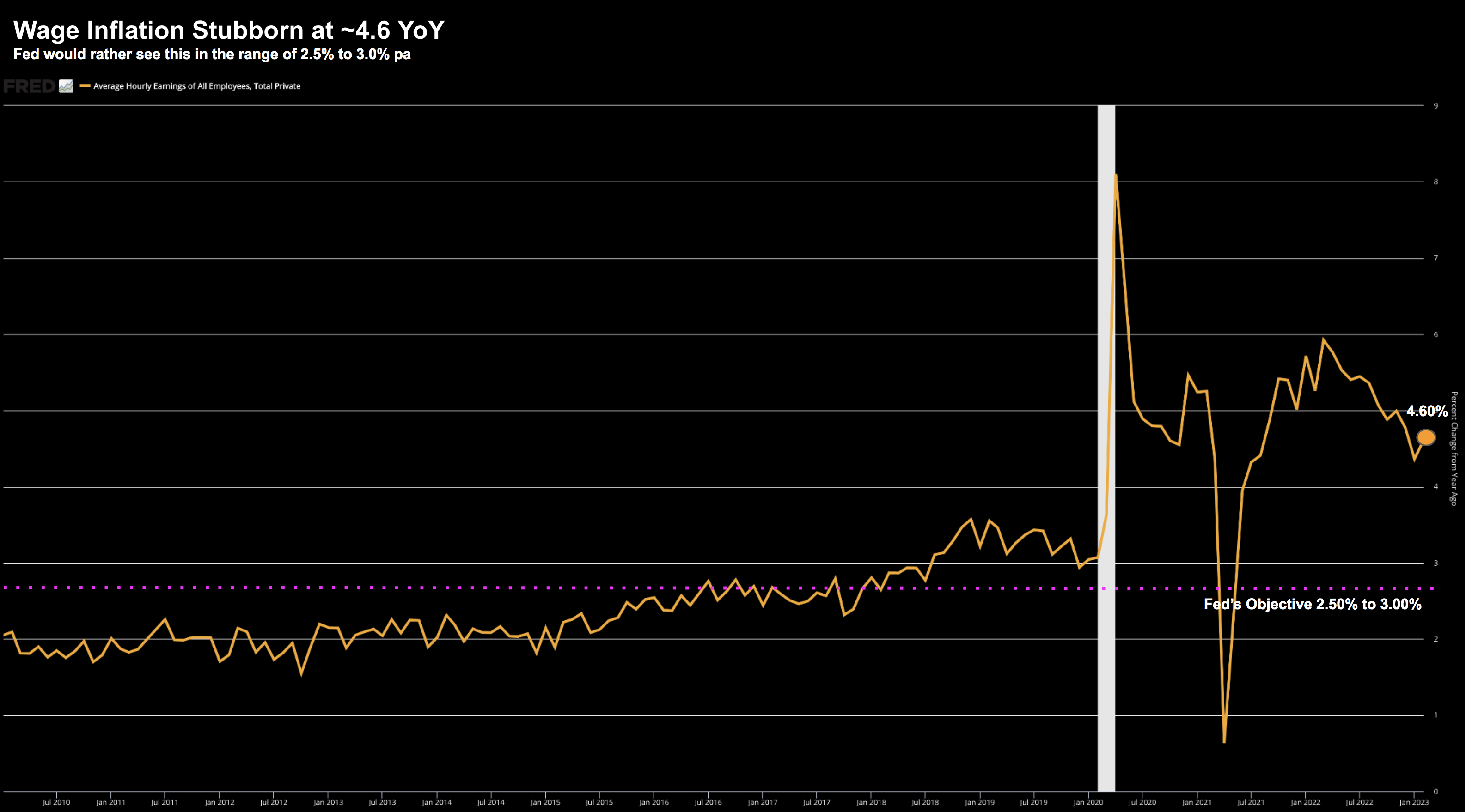

- Wage growth still remains far too high for the Fed

- SVB collapse cements ‘only’ a 25 bps rate rise later this month

At the end of the January this year – the S&P 500 was up 7.5% for the year

It was a red-hot start after a year where it lost almost 19%

February was not as kind – with the index dropping back to around 2.4% year-to-date gains. The bullish mood was starting to sour.

Fast forward to March 10th and the S&P 500 is barely in positive ground – up just 0.58%.

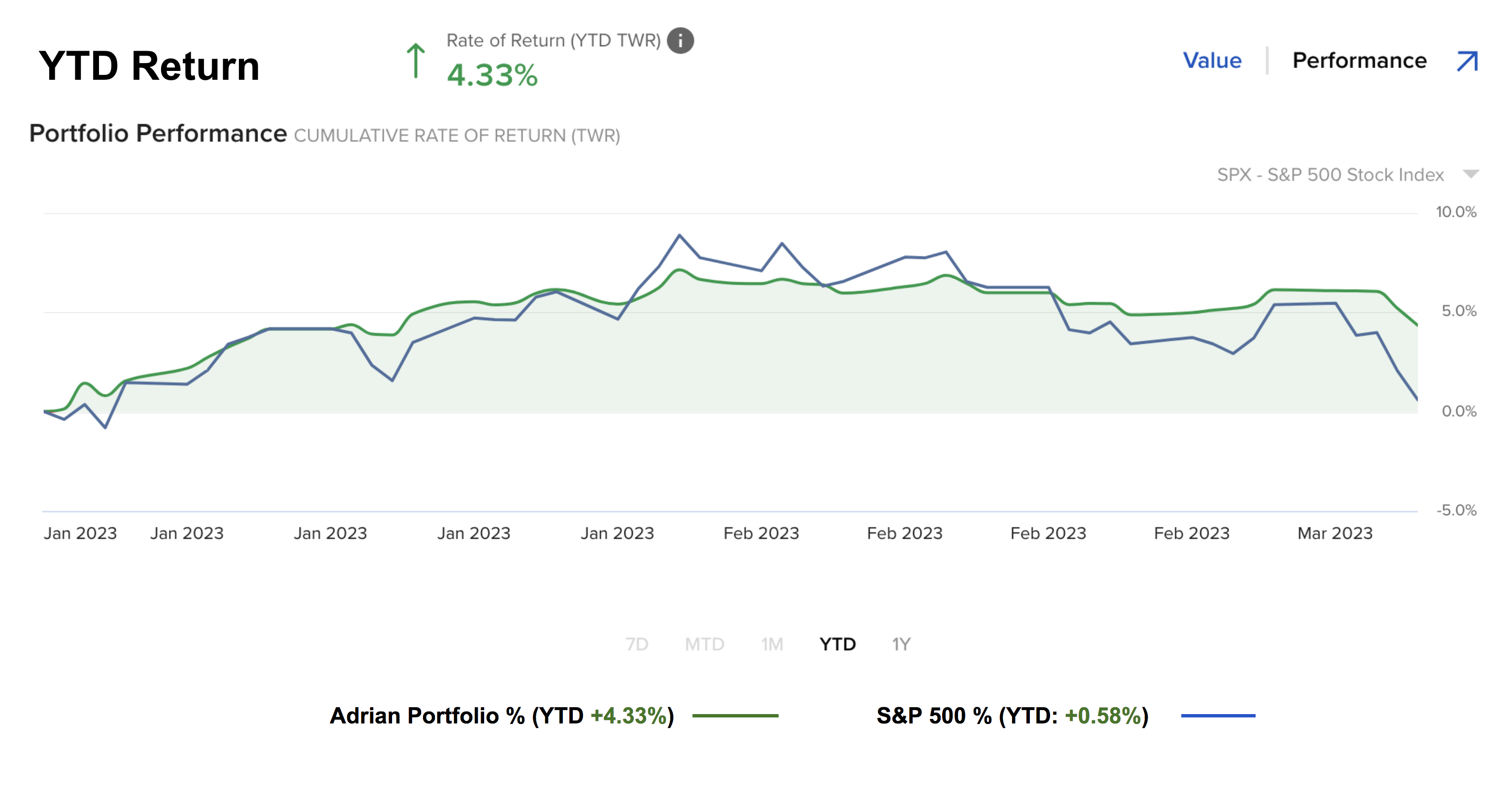

As I outlined yesterday – my portfolio also copped a hit (given I am 65% long)

The selling pressure in the market reduced my YTD gains to 4.33%

March 11 2023

Now, if you offered me this start two months ago (i.e. 3.75% ahead of the S&P 500) – I would have happily taken it.

So no complaints.

I also said I expect my portfolio to pull back a few weeks ago (as gains of ~6% every month are not sustainable)

The pain I felt was due to my exposure to banks – specifically in Bank of America (BAC)

I will talk more to this below but I took advantage of the Silicon Valley Bank panic to add to my BAC and WFC positions.

As I wrote yesterday – I think SVB’s collapse is not systemic.

Not yet anyway.

That’s what credit spreads tell me.

I might be totally wrong – but that’s how I assess it.

Zooming out – from my lens things are largely “per the script”.

However, if you felt this market was poised to rip higher, you are probably feeling it.

Take Tom Lee from Fundstrat – a perpetual bull. Recently on CNBC he said:

“Historical data shows there is a high chance that the U.S. stock market may record a return of 20% or more this year after the three major indexes closed 2022 with their worst annual losses since 2008”

Tom could be right… but I think more accurate language is an “outside chance” rather than a “high” chance.

For example, this outcome would require:

- Earning expanding in the realm of 8-10%

- A forward PE in the range of 19x

- The Fed signalling they are closer to cutting rates;

- Core PCE Inflation closer to 2%; and

- US on a clear path to avoid a recession

Let’s start with the weekly tape.

Market Gives Up Its Gains

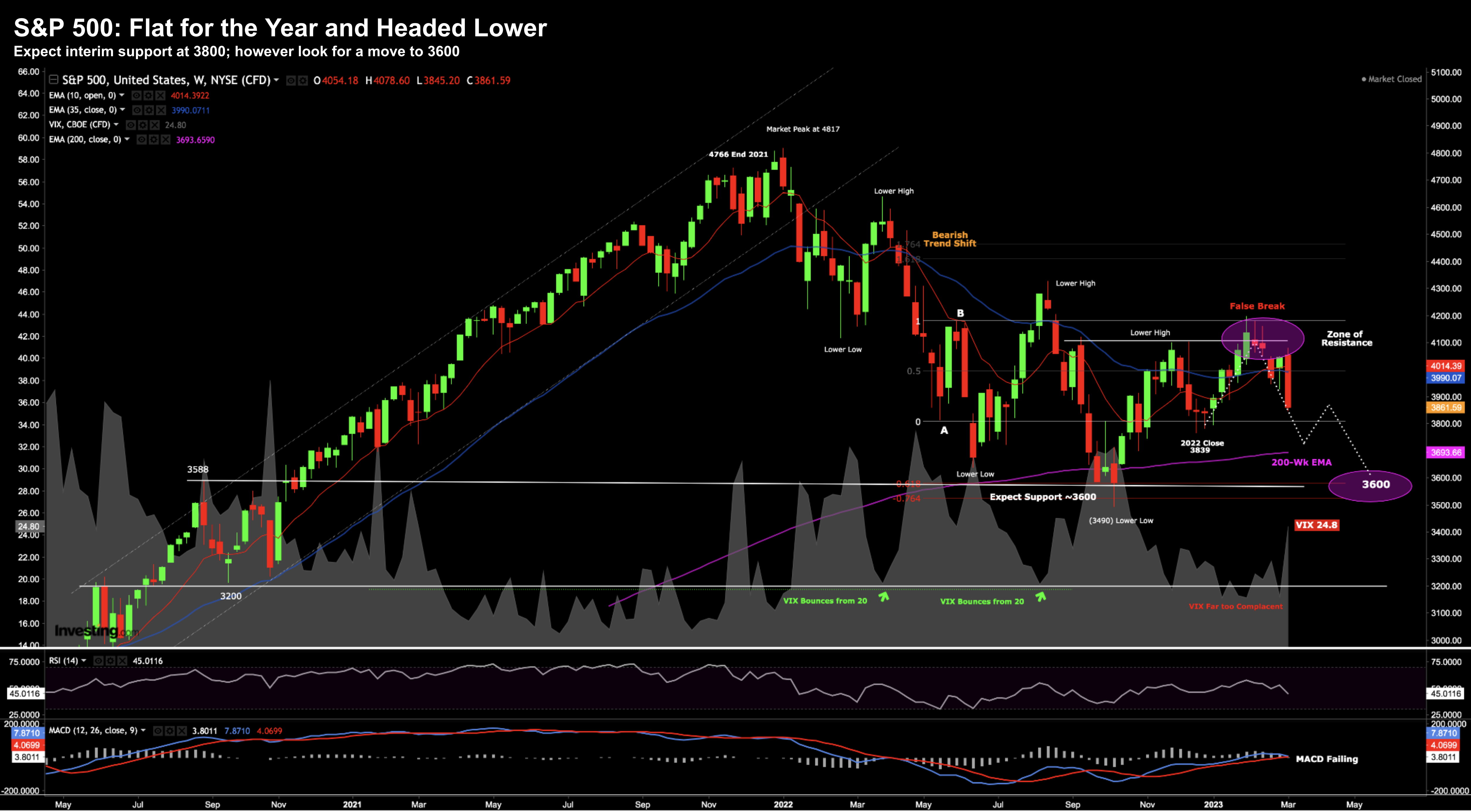

Regular readers will know I’ve been anticipating a solid pull back from the zone of ~4200 a few weeks ago.

First I was looking for stiff resistance (i.e. selling pressure) in this zone.

From there, I felt if we fell back below the 4100 close, it was likely to be a quick trip lower. For example, Feb 10 my post was titled “S&P 500: False Break Warns of Pullback”

Sure enough….

March 11 2023

- We’re likely to see interim support around the 3800 zone – consistent with the lows through December

- However, if that fails, expect a quick trip to the October lows around 3600

- The VIX has surged to ~25 – closer to where it deserves to be given the risks (it was far too complacent below 20)

- The weekly MACD has rolled over which is a sign the bulls have lost control

A combination of “Powell’s Punch” this week combined with the collapse of SVB has given the market reason to pause.

But from mine, I think the technical setup was already skewing the downside regardless.

These events made it easier for the bulls to roll over and hit the sell button.

Employment Remains Strong

Overshadowing the all-important monthly job report earlier in the week was Powell and the events of SVB.

However, the report deserves mention.

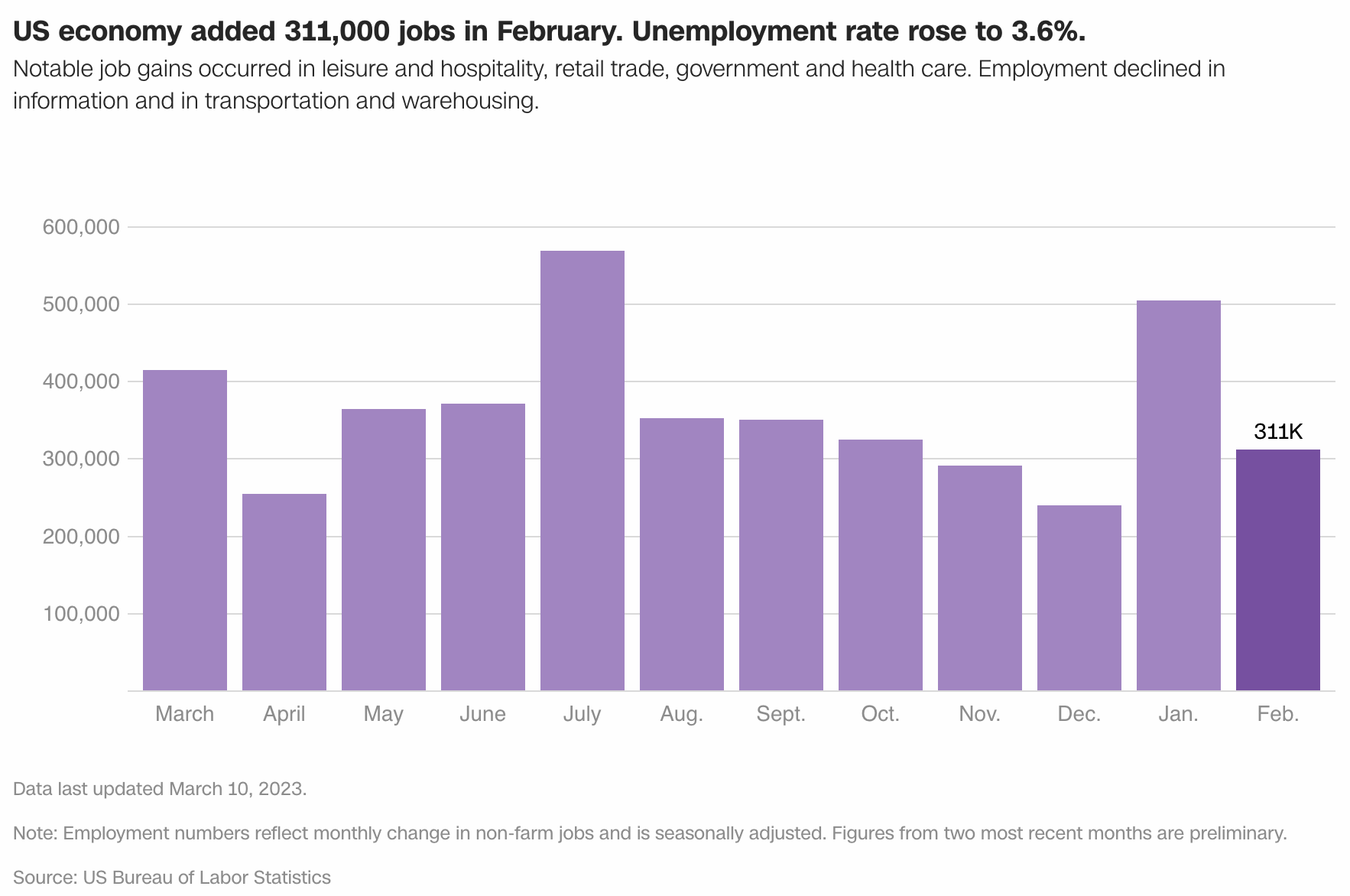

Whilst the US economy was said to add 311,000 jobs last month (well above expectations) – the one bit of “good news” was the unemployment ticked slightly higher to 3.6%

March 9 2023

The market was expecting a number between 200,000 and 250,000 jobs to be added.

Now I say “good news” as things are slowly heading where the Fed needs unemployment to be (much to the frustration of Senators like Elizabeth Warren)

As an aside, Elizabeth Warren doesn’t understand the significant risks of embedded (systemic) inflation and blasted Jay Powell for raising rates (another discussion)

However, from the Fed’s perspective, the concern is unacceptably high wage growth.

It remains stubbornly high – 4.6% over the year before.

March 11 2023

Due to the high number of open positions in the economy – employers are still being forced to pay up for employees.

Whilst the Fed don’t have a target per se for wage growth – Powell has stated a more sustainable rate is in the range of 2.50% to 3.00% per year.

The only way to see this come down is through a higher unemployment rate.

Now immediately after Powell’s testimony to Congress – the futures market had priced in an 80% probability of a 50 bps hike on March 22.

However, I was not buying it.

Not yet.

And now given the events of SVB’s surprise collapse – it’s more likely the Fed will continue with 25 bps.

Maybe Liz will be happier?

Adding to Bank of America

I added to my existing position in Bank of America (BAC) yesterday.

From a fundamental lens – this stock is now trading at:

- A forward PE of 9.6x; and

- A book value of just 1.1

It’s the latter I have been waiting for.

As a rough rule of thumb – the goal with banks is to buy quality (like BAC, JPM, WFC) – close to a book value of 1x.

And similarly, sell them above 2x book.

Below is the technical set up for the bank:

March 11 2023

Whilst the bank is attractively valued from a long-term risk reward perspective – technically it looks set to trade lower.

For example, I think we could see BAC trade as low as $25.00 to $26.00 in the coming months.

On the one hand, that zone of $25.00 is ~61.8% outside the current price distribution.

And second, it’s close to the long term rising trend line.

For those who want to get ‘cute’ with the stock – feel free to wait for this zone.

And for those with a 3+ year time horizon – and are not concerned with an ~10% to 15% fall in the price in the near-term – anything around the current level feels like a good risk/reward.

My best guess is we see BAC back above $36 by the end of the year (and meaningfully higher (e.g. closer to $50 in 3 years)

Putting it All Together

These are the kind of weeks we should expect.

From mine, the complete lack of volatility the past two months is highly unusual.

My gut told me the VIX was far too complacent below 20 given the risks.

The market is slowly connecting some of the dots opposite the consequences of rates being “higher for longer”

That said, this kind of volatility (and panic) will offer opportunity if you have kept some power dry.

For example, I’ve been waiting for a sell-down in quality stocks like Bank of America.

And here you need to act like a “sniper”.

Sure, there’s a very high probability there will be more selling and that’s fine.

Paying ~$29 to $30 for the stock is a better long-term entry point than say ~$50.

In closing, SVB will not be the last shoe-to-drop with interest rates likely to remain well north of 5.0% for most of 2023.

And if we are fortunate – quality names can get caught up in the panic.

That’s what we saw this week.

That’s your opportunity to act if you have the available firepower and nerve.