- Soft economic data has markets betting on a dovish Fed

- Bulls wage a high risk bet at ~4400 on the S&P 500

- Goldman sees “upside risks” to further hikes

The bear market bounce of 2022 now registers 18.4% (and counting).

The bulls have all the momentum.

However, it’s starting to feel like a very high risk / reward bet.

But that’s the game isn’t it?

Understanding risk.

Our job is to recognize when it’s excessive; and then we control it.

Put simply, that summarizes my approach this year.

As I’ve expressed often – 2022 has been a year not about making money; but specifically not losing it.

Quoting Howard Mark’s indispensable “The Most Important Thing” (Chapter 5)

Investing consists of exactly one thing: dealing with the future.

And because none of us can know the future with certainty, risk is inescapable. Thus, dealing with risk is an essential— I think the essential— element in investing.

It’s not hard to find investments that might go up. If you can find enough of these, you’ll have moved in the right direction. But you’re unlikely to succeed for long if you haven’t dealt explicitly with risk.

The first step consists of understanding it. The second step is recognizing when it’s high. The critical final step is controlling it.

If you don’t have a copy of this book – get it. I consider it mandatory reading for every investor.

But it comes with a caveat:

If you’re after some quick formula to identify winning stocks etc – you won’t find it in this book. However, it will help you develop ‘second order thinking’ to make better decisions.

That’s more important (financial or otherwise).

From mine, I don’t think the market is doing a lot of ‘second order thinking’ at present.

It’s trading on a sugar high.

Stocks represented better risk/reward between 3600 and 3700 (a time when I was adding to quality names).

But the risk equation looks far less attractive as we approach 4400.

S&P 500 – Too Far Too Fast

It’s not uncommon to experience 15-20% v-shaped rallies in bear markets (further to recent missives).

In fact, these types of rallies generally only happen in bear markets (e.g., fueled by short covering and systematic trades)

But looking at the weekly chart – this echoes the price action from late March 2020

However, as we entered the pandemic, it was with a Fed slashing rates to zero coupled with trillions in QE.

Aug 16 2022

Now we see the opposite.

Repeating last week’s post – my best guess is valuations will limit how far this market goes.

With forward earnings multiples now in the realm of 18.5x forward in a tightening environment (more on this below) — the upside reward is capped.

Let’s explore…

Betting Against the Fed

Typically it’s not a high probability bet to go against the Fed.

It may pay off… but that’s not what history shows.

Now over the past week or so — we have seen a batch of sobering economic data.

- New York Manufacturing plunges by second-most since 2001

- US Homebuilder Confidence worst since 2007

- Economists forecast Eurozone recession

- China issued surprise rate cut as data shows ‘alarming’ slowdown

However, as every negative report hit the tape – the bulls stepped on the gas.

Why?

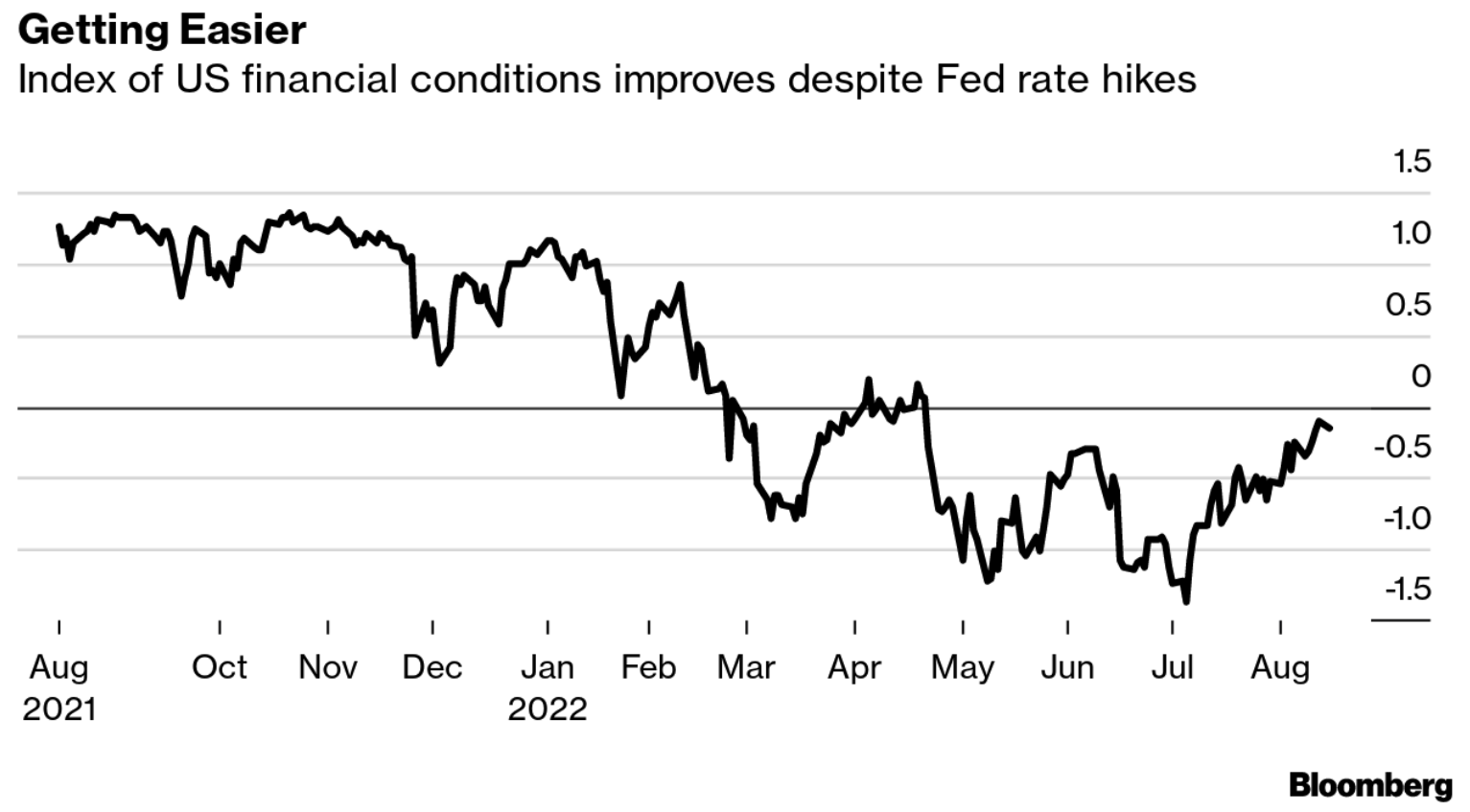

Simply put – the market sees financial conditions easing.

It’s calling the Fed’s bluff on aggressive rate hikes and QT.

Now if you recall, earlier this year Fed Chair Powell welcomed tightening in “financial conditions” — necessary to help tame inflation.

However, of late financial conditions have eased.

Not surprisingly as financial conditions have eased – risk assets rallied.

For example, look at v-shaped recovery with the ETF HYG (high-yield debt).

This ETF bottomed the week of June 13. Guess what, this was the same week the S&P 500 bottomed at 3636.

Aug 16 2022

From mine, the easing in financial conditions will not be a welcomed development by the central bank.

We know the Fed is committed to further hikes.

And if it wasn’t already clear – various Fed Presidents reminded us last week post the July CPI print.

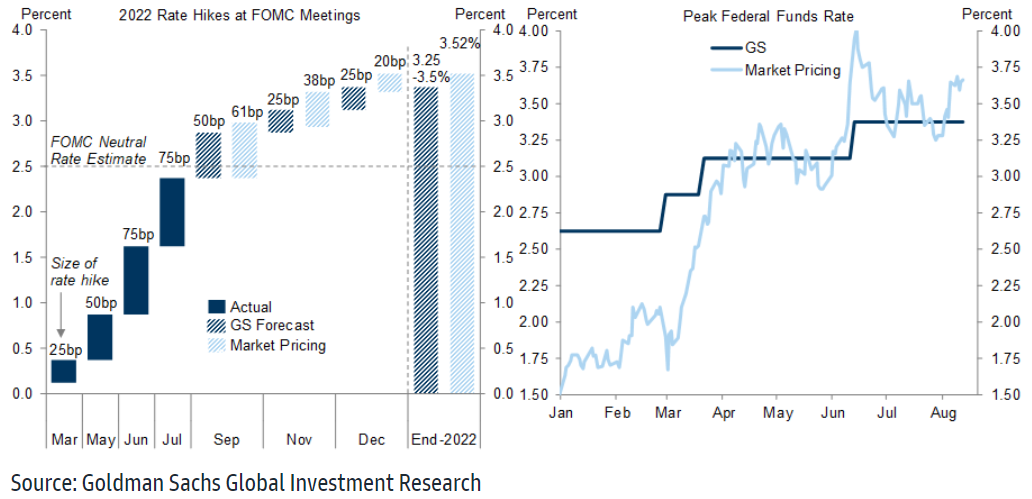

Now it’s widely expected the effective Fed funds rate will be 3.50% by year’s end.

What’s more, QT takes full effect from September (where $95B per month rolls off the Fed’s balance sheet).

My view is that when the Fed see that longer-term borrowing costs are now lower than where they were earlier in the year (e.g., 30-year fixed-rate mortgages, junk rated debt (HYG ETF); and 10-year Treasury yields) – this will only strengthen their resolve.

In short, this makes it harder to reduce inflation.

The objective here is to take money out of the system – not add to it with cheaper money.

Goldman Sees ‘Upside Risks’ to Further Hikes

Goldman Sachs’ lead economist – Jan Hatzius – echoed this sentiment recently commenting the easing of financial conditions potentially works against the Fed’s objective.

Hatzius see “upside risk” to rate forecasts, thanks to:

- “the recent easing in financial conditions that Fed officials have been unable to stop with warnings of additional hikes next year”; and

- the Fed looking “to regain better grip in the period ahead, including at Jackson Hole” (their annual summit later this month)

But here’s something else:

When faced with strong periods of unwanted (sustained) CPI in the past – the Fed has always continued to hike rates until the point it exceeds the CPI level.

Today the Fed funds rate is just 2.50% (some 6% below CPI)

As I said above, the short-term rate is expected to reach 3.50% by year’s end – with CPI reducing to around 6.0% (all going well).

But don’t expect the Fed to pause next year…

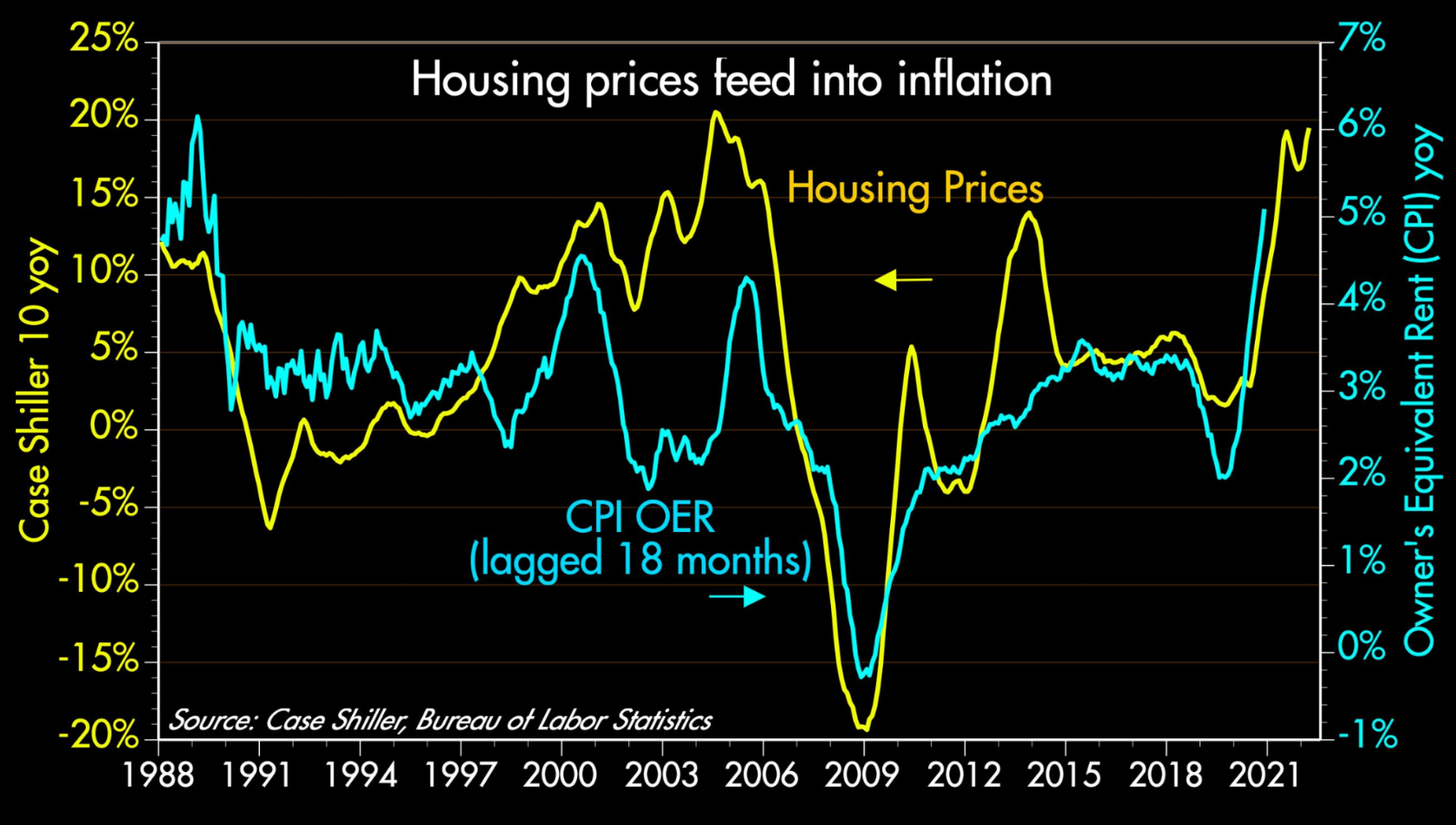

CPI will likely come down to 5% by mid-2023 – however from there it gets ‘stubborn’.

Consider shelter inflation…

Bloomberg reports it’s now four standard deviations above its norm for the last decade. Shelter accounts for a third of the CPI index and tends to come through with a 18-month lag to house prices.

Source: Scott Grannis

Question:

How does this bode well for headline inflation descending quickly to 2% in 2023?

It doesn’t.

What’s more, wage growth inflation is as hot as any point in history – more than 5% per year.

To be clear, the 20% plus decline in commodities is welcomed and a positive signal.

And markets are responding…

But from mine, what we should be laser focused on are wages, house prices and rents.

Today they are surging.

And if you think the Fed is largely done (as the market seems to) – it’s essentially wagering a high-risk bet.