- Bonds price in 100 bps of rate cuts this year

- Banks now doing the Fed’s “tightening” work

- Banks (and bonds) need to stabilize for stocks to rally

I don’t envy Fed Chair Jay Powell.

Caught firmly between a rock and hard place… there was no “obvious” decision to be made this week.

For example, many argued that hiking rates ran the risk of potentially causing further financial instability.

Why add to the pressure already on the system?

Alternatively, if the Fed elected to pause – how would that help with the fight against stubborn inflation?

I don’t think the Fed even know.

My best guess was the Fed would elect to hike for two reasons:

- A pause could suggest they were far more concerned about the banking crisis (potentially causing further panic); and

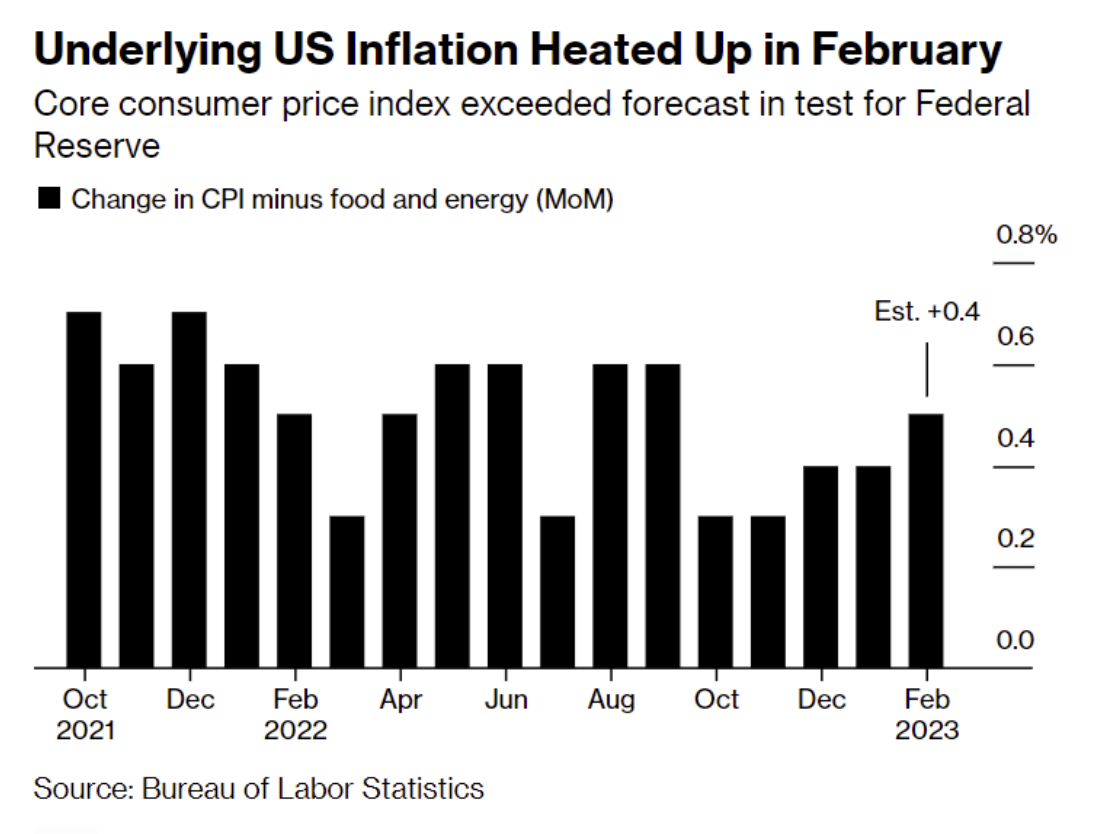

- The inflation problem is not getting better (as the chart shows above).

Now, if we didn’t have the current bank instability (which appears to be mostly limited to banks who lend to riskier small businesses) – the Fed may have considered a 50 bps hike.

However, with banks now set to tighten lending standards – focusing more on their balance sheets – they are helping with the inflation fight.

But…

That will come at a cost… far slower growth and likely recession.

Doing the Fed’s Work

Through February (not that long ago) – financial conditions remained ‘easy’ – despite some 450 bps of tightening from the Fed (with QT)

That’s changed.

Banks are taking measures to fortify their balance sheets.

This is important as the Fed are betting these measures will likely slow the economy.

I think it’s a safe bet…

Credit conditions are going to get tighter.

And the bond market suggests as much.

Unfortunately for the US – the machine doesn’t run as “fast” without access to credit.

Whilst it’s near impossible to calibrate – the tightening credit conditions from bank lenders has probably accounted around “25 to 50” bps worth of hikes.

In fact, Powell was asked this question.

Powell said the tightening in financial conditions (from banks) from recent events could add up to the equivalent of a rate hike, “or perhaps more”

However, he repeatedly cautioned that the impact on the economic outlook was highly uncertain.

Translation:

Expect a bumpy landing – reminding us the Fed is not done until their inflation target of 2% is achieved.

The hymn sheet that Powell is singing to is akin to what we saw from Volcker in the 1980s.

He is on a mission to beat inflation at all costs… recognizing that comes with higher unemployment and a likely recession.

And potentially a little “financial instability” along the way.

However, the market is betting the Fed will fold.

Market vs the Fed

The FOMC yesterday affirmed its 5.1% Fed funds forecast for 2023.

If true, this would indicate one additional rate hike in 2023 followed by a hold of interest rates for the rest of the year.

From the Fed:

Now Powell admitted he sees the pace of rate rises will be slower than previously thought.

In that sense, Powell softened his language from previous meetings.

For example, in terms of forecasts – he offered:

- 2024 GDP growth expectations from 1.6% to 1.2%; and

- Unemployment rate of 4.5% the next 9 months.

If the latter is true – that would equal around 1.5M people becoming unemployed

Powell knows that to achieve his inflation objective of 2% – the only way that can be achieve is with unemployment closer to 5%

That’s how you bring down (endemic) wage inflation.

But as I said a few weeks ago – the Fed raising “25 basis points” this week was neither here nor there.

The bigger question is the end game.

For example, how long will the Fed continue with higher rates for longer (whether it’s 4.75%, 5.00% or 5.25%)?

I ask this as the (bond) market is not buying what Jay Powell was selling.

It thinks the Fed will be forced to cut rates by 100 basis points (1.0%) between now and the end of this year.

That’s what it is pricing in.

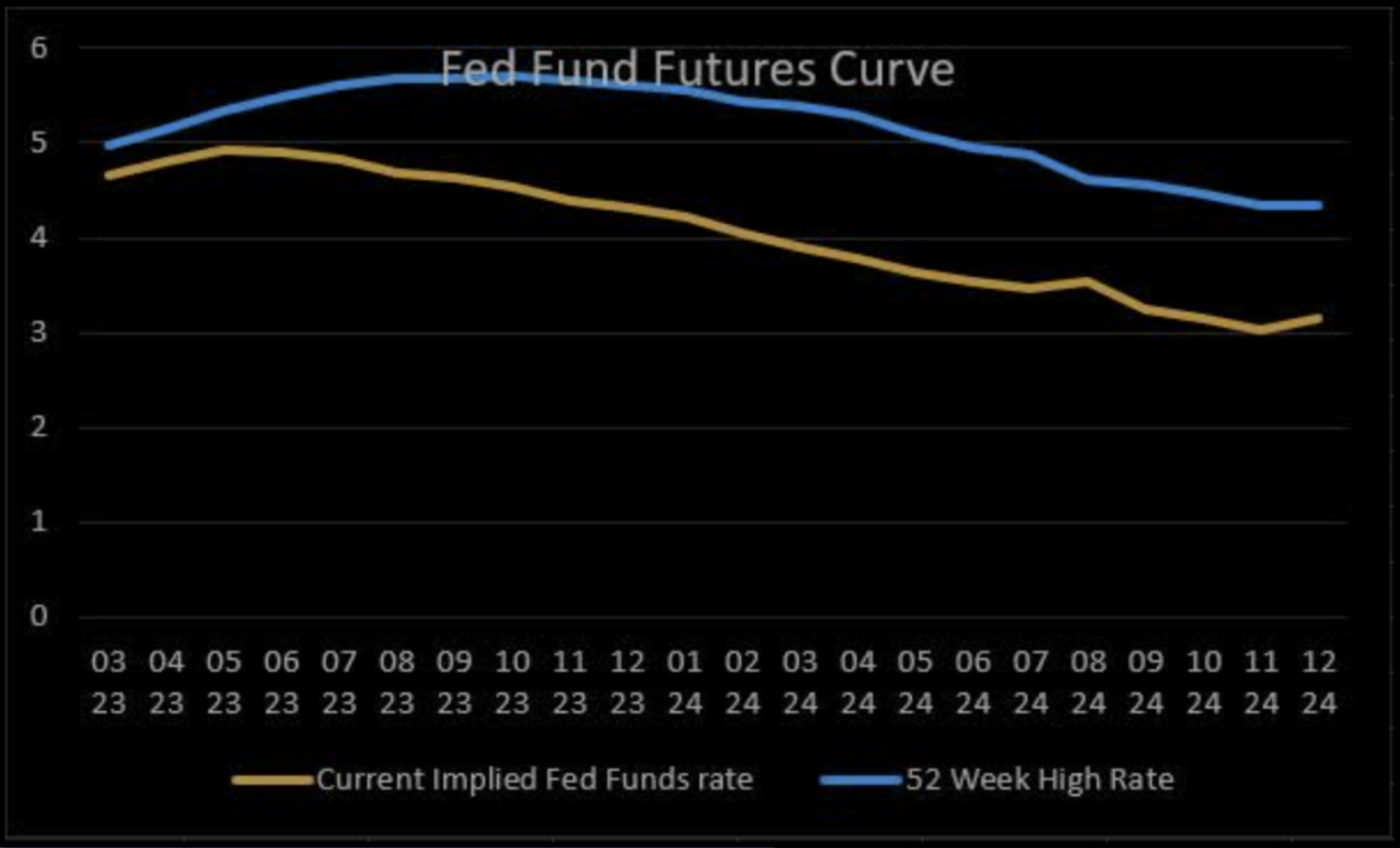

For example, Fed fund futures, which have already sold off since the start of the regional banking crisis, pushed lower after the Fed’s decision

The curve overall has dropped by 100-125 basis points for the period of fall 2023 through the end of 2024 in just the past couple of weeks.

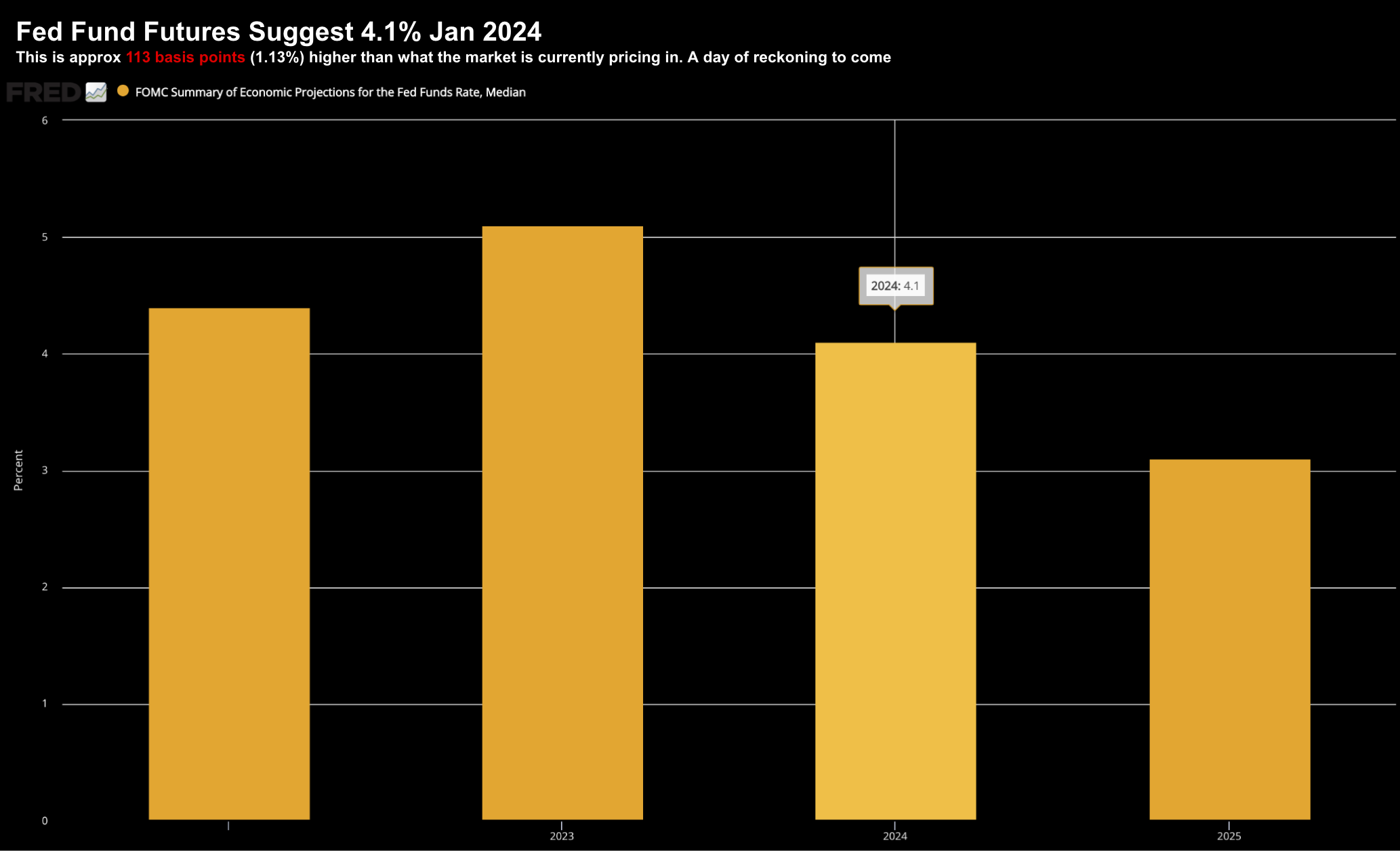

At the time of writing, fed fund futures for 2024 are trading at 113 basis points lower than the Fed’s own projections.

At the beginning of March – the market’s expectations were roughly inline with the Fed.

Not now.

The banking crisis changed all that.

As context, it’s extremely rare to see this kind of divergence.

The TL;DR here is there will be a reckoning to come.

For example, either the Fed caves to the market and is forced to cut rates sharply (e.g. opposite some kind of serious credit event)

Or the market has it wrong and the Fed will have the ability to hold rates where they are.

To be clear, they may not raise rates any further… but they will not cut either.

Again, Powell said rate cuts are not in his base case for this year.

Investors are placing their bets.

My money (as it always is) continues to be on the Fed.

Market’s Wobble Post Powell

Following both Powell’s decision and Janet Yellen’s testimony that they cannot guarantee all uninsured deposits – markets traded lower.

Arguably the sell-off was less about Powell – but more about Yellen

From CNBC:

In response to a direct question about whether the Treasury would circumvent Congress to insure all deposits, Yellen replied, “I have not considered or discussed anything having to do with blanket insurance or guarantees of all deposits.”

As soon as Yellen made that clear – banking stocks resumed their slide.

Let’s take a look:

March 23 2023

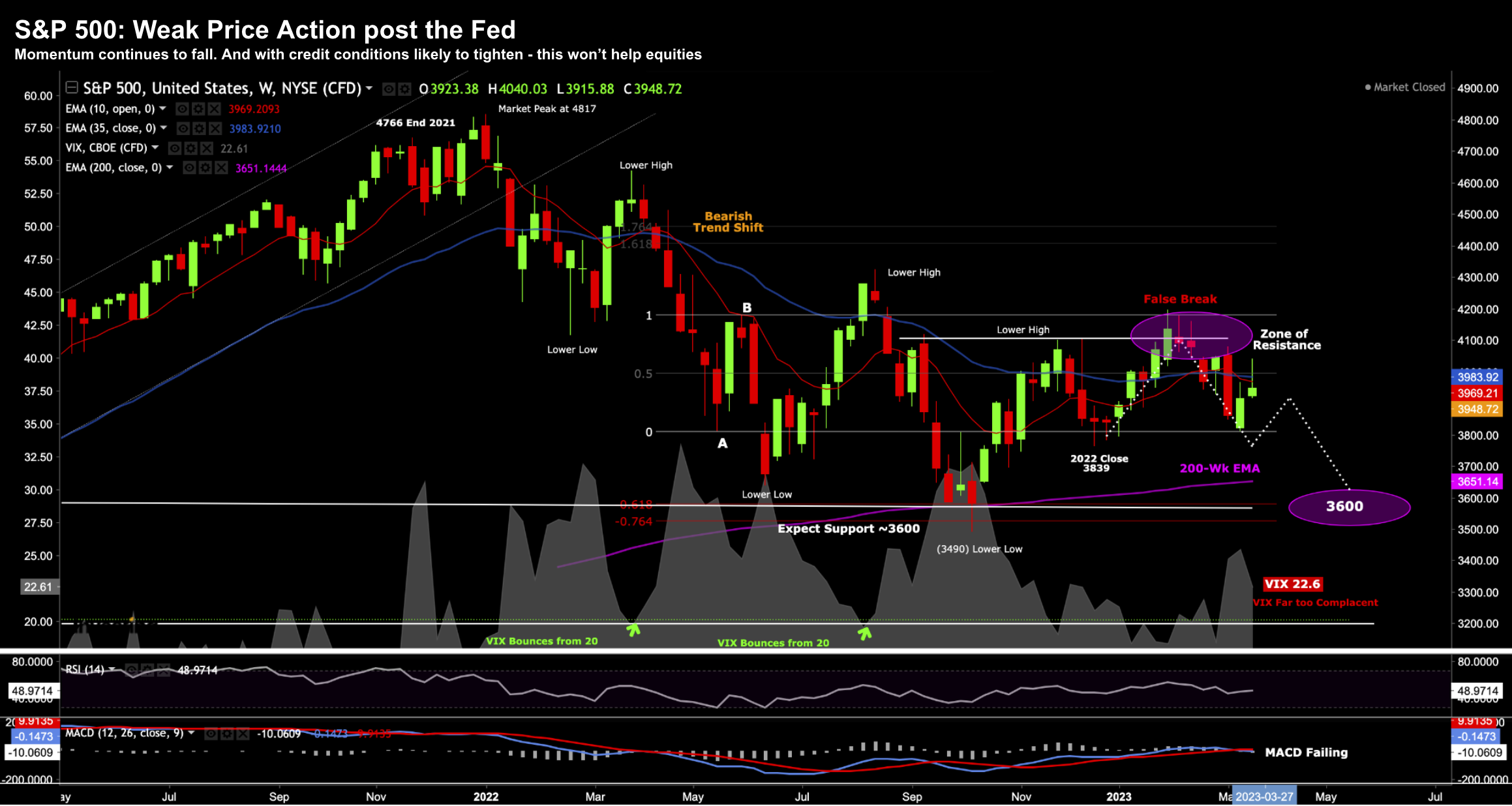

Not much has changed technically from my post last weekend.

We remain caught in a range.

That said, the setup here is not constructive.

For example, I think the market will continue to struggle to push above 4200 and faces more pressure to the downside.

Moreover, the inflation and growth problems have not gone away.

Credit is tightening which will crimp any economic expansion.

And the Fed is in no rush to cut rates.

However, it feels optimistic to expect 100 bps of cuts over the next 9 months.

And if we were to see that, it implies some kind of financial collapse (which I simply don’t see).

Putting it All Together

It didn’t matter what the Fed did this week – they were never going to please everyone.

Opinion was firmly divided on what was the “right” thing to do.

Personally, I don’t think 25 bps makes much of a difference.

But it signalled intent.

And similarly, if they didn’t raise rates, it potentially sent a different signal.

In terms of the market, perhaps the only sector “working” is big-tech.

And it makes sense…

Investors are buying these companies for similar reasons they buy Treasuries or gold.

Companies like Apple, Google and Microsoft don’t need banks.

They have more money than most banks!

Not only do they have bullet proof balance sheets – they are cash machines which operate at healthy (double-digit) margins with strong moats.

These companies will weather any downturn better than most.

But in times of great uncertainty – these stocks are seen as defensive plays (not growth)

However, be careful here if chasing this trade.

They’re now trading at very high multiples.

And whilst I’m happy to own them… I’m not adding at these prices.

Don’t be surprised for these names to retreat over the coming couple of months (or when there is more stability with banks)