- We’re likely to see a sharp rally…

- But expect strength to be sold

- The next risk isn’t inflation – it’s earnings revisions

The past two days the market caught a bid.

However, as I’ve been saying recently, that’s to be expected.

We were slightly oversold technically in the short-term (using the weekly RSI – see below)

May 27 2022

But fundamentally – nothing has changed.

Speaking to the chart – last week I said expect a bear-market (2-4 week) bounce to the zone of 4200 to 4300. This week could be start..

The reason I nominated this zone is what we see with the 10 and 35-week EMAs. They trade ~4191 and 4336 respectively.

Any rally to that zone could see the S&P 500 trade as much as 9.7% to 17% off its near-term low.

However, that’s where I see overhead resistance.

Remember:

Bear market rallies are typically sharp (e.g. short covering of more speculative names). But don’t confuse days like this (or yesterday) with the market bottoming.

From mine, we may have made “a low”… but unlikely “the low“

Let’s explore my thinking…

Bigger Picture

I don’t get too excited about bear market rallies.

If anything, I expect them.

Markets never rise or fall in a straight line.

But sharp moves in either direction make for good mainstream fodder.

The right thing to do is zoom out and ask if anything material has changed from the ‘bigger picture’.

Short answer is it hasn’t. Not from my lens.

For example, consider the following:

- a persistent sticky inflation problem (specifically with wages and rents);

- meaningful amount of liquidity tightening from the Fed (i.e. $95B p/month being rolled off their balance sheet; combined with a normalization of short-term rates);

- a weaker consumer (notably middle-to-lower income households who are feeling first-hand the impacts of higher food and energy prices);

- growing uncertainty with both the Chinese and European economies; and last but not least

- corporate earnings which are still yet to be revised lower for the coming quarter (more on this shortly)…

As I say, I think the bounce we are seeing today is technical.

Bigger picture – the three primary factors

- Expectations for inflation;

- Resultant Fed monetary policy (QT and rates); and

- Corporate guidance and earnings

With respect to inflation – there has been some ‘good’ news – and perhaps why markets could be catching a bid. That said, it’s still far too early to call a coupe.

For example, longer-term (5-year) expectations for inflation are starting to come down.

By way of illustration – below is what we see with 5-Year Treasury Nominal (white) vs 5-Year Inflation Adjusted (orange)

May 27 2022

The inflation-indexed 5-Year yield has rallied to around 0%.

However, with the nominal 5-year yield now 3% – this tells us expectations for inflation 5-years hence are in the realm of 3%.

Not terrible.

But it puts a lot of faith in the Fed to get things under control.

Whatever the case, the narrative for inflation will continue to materially determine what we see for equity markets.

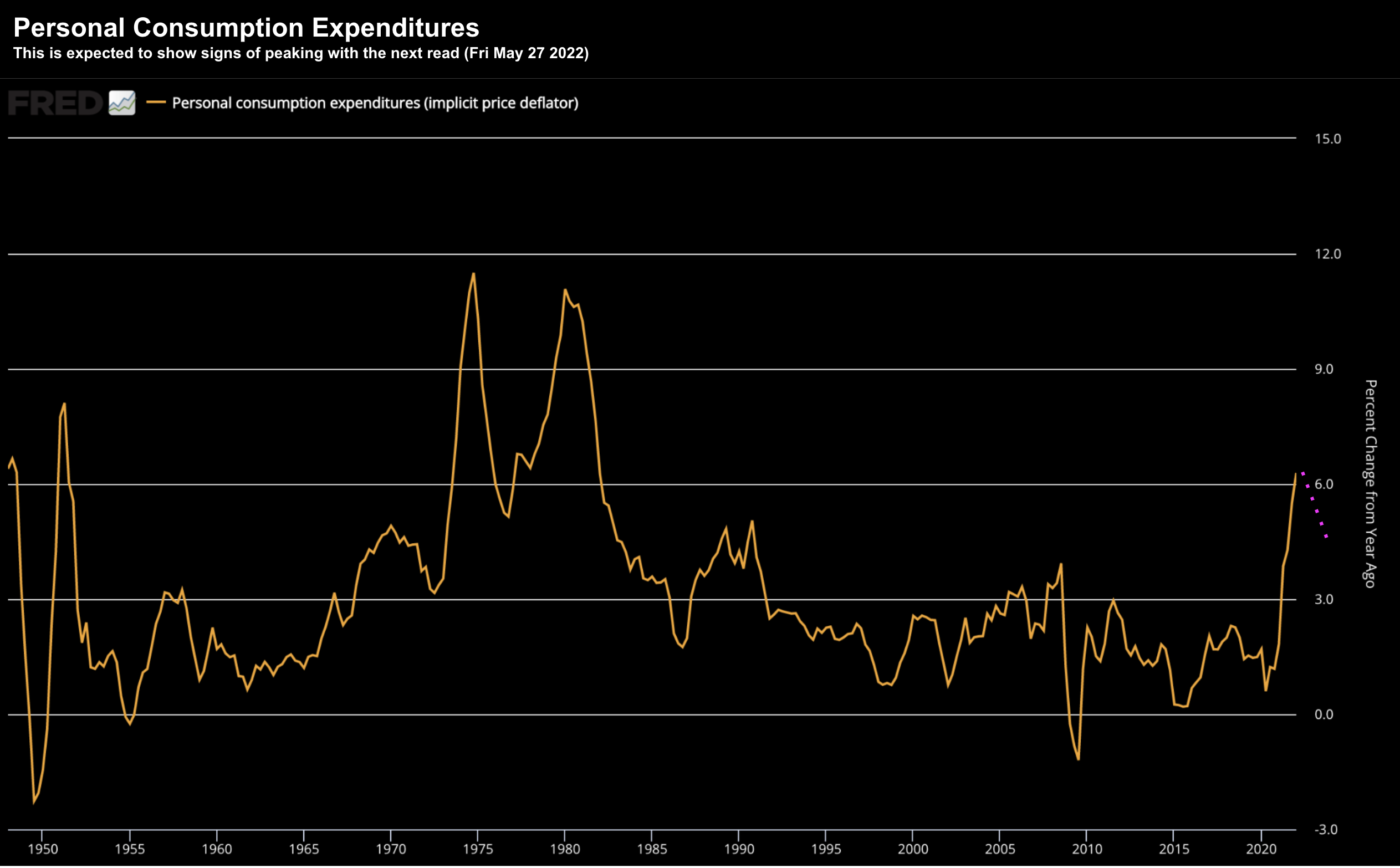

Just on this, tomorrow we get the latest inflation print on personal incomes and outlays.

This could be a market moving event…

Consensus is for a decline in the price deflator for Personal Consumption Expenditures’ (PCE) headline rate from 6.6% year-on-year for March to 6.3% in April.

May 27 2022

The Core PCE price index (something the Fed monitors closely) is also seen slipping from 5.2% to 4.9%.

Note: I personally don’t read too much into Core PCE as this removes food and energy. Unfortunately, most people tend to both eat and travel!!

Finally, we also get a final reading on US consumer confidence and expectations for inflation from the University of Michigan.

All readings will be closely watched.

And whilst I fully expect more ‘flexible’ prices on things like used cars, hotel rooms, airfares etc to fall… I don’t see the same rate of deceleration with ‘stickier’ costs like wages and/or rents (at least not until real rates are positive).

And only when we have more confidence that the Fed is ‘in front’ of the inflation curve – can we start to question whether the bottom might be in for stocks.

For example, I think we’re yet to see the lows for 2022.

Today the S&P 500 trades about ~17.2x forward (assuming earnings are ~$235 per share). My expectation for the S&P 500 is multiple closer to ~16x forward.

But the question remains… what is the “E” in PE?

Which brings me potential earnings revisions… are they about to drop?

Corporate Earnings

Over the past few years – markets were generally forgiving for any miss on either the top or bottom line.

Valuations also mattered far less – especially if there was growth.

Not now.

Any hint of lower than expected guidance; and/or a miss on either the top or bottom – has seen stocks sent to the woodshed.

Consider Target and Walmart last week.

They saw their worst trading days since 1987 – falling some 25% in a session.

May 27 2022

Target’s CEO said things have basically ‘turned on a dime’.

But it didn’t end there…

Some of you maybe familiar with SNAP Inc (aka Snapchat) – a smallish social media company.

Now if you have a 13-24 year old – you will know what it is.

Very rarely do I mention SNAP on the blog (I don’t use the app) – and it hasn’t been a stock to recommend (especially given the excessive multiples).

Now SNAP has around 500M Monthly Active Users (MAUs) and around 280M Daily Active Users (DAUs) — reaching 90% of 13-24-year-olds in the U.S., U.K., France and Australia.

By way of comparison – Meta (aka Facebook) enjoys around 3B MAUs.

This week their CEO – Evan Spiegel – surprised the market by saying the company would miss both revenue and earnings estimates for Q2.

“Today we filed an 8-K, sharing that the macro environment has deteriorated further and faster than we anticipated when we issued our quarterly guidance last month,” Spiegel wrote in the note. “As a result, while our revenue continues to grow year-over-year, it is growing more slowly than we expected at this time.”

As part of my missive earlier this week – I called this out as a broader market red-flag.

In other words, this wasn’t simply a “SNAP” execution problem… it was the read-through on the consumer.

Sure enough – the next day the market lost $400B in capitalization – with online advertising stocks feeling the brunt. SNAP’s share price collapsed – falling ~50% – at one point 85% lower than its $83 high last September:

SNAP: May 25 2022

My read on this is businesses are now looking to manage their costs by reducing discretionary (ad) budgets – as consumers spend less.

And it’s not hard to explain…

From mine, the impact of higher interest rates, higher energy and food costs are now rippling through into corporate bottom lines (not to mention margin compression opposite wage and other input costs)

For example, recently I shared how the average US consumer is spending an incremental ~$5,000 p/yr just on gas. And with respect to food – this is now costing ~$4,000 p/yr more.

That’s $9,000 in discretionary spend which has gone from consumer’s wallets (exclusive of higher interest payments on mortgages, car payments, credit cards etc)

Which begs the question:

Will we see similar episodes to SNAP? My guess is yes.

However, so far earnings revisions lower have not happened at scale.

For example, if earnings are to be revised by some 10-15% or more – we could see the S&P 500 at ~$215 EPS (or lower)

And if we assume a 16x forward multiple – we are just below 3500.

Don’t rule that out for 2022.

Putting it All Together

Technically, I can see the market rallying from near oversold levels.

However, any rally is more likely technical in nature.

From mine, this is an macro environment where:

- Profit growth is clear slowing;

- The average consumer is under immense (cost) pressure;

- Demand has been pulled forward;

- We’re likely to see (material) earnings revisions for Q2;

- Fed liquidity is tightening (QT); and

- Interest rates will need to normalize to combat inflation.

This is not conducive for the market to re-tests the highs of earlier this year.

And if I were to guess – the market has priced in a 70% probability of a 2023 recession.

Look for any market strength to be sold… at least until we get greater clarity (certainty) on all of the above.

This market has still has a lot of work to do…