- Prices could rally to 4200 (i.e. 16% from the lows)

- The litmus test(s) the market must pass

- Earnings revisions yet to come down… what this means for valuations

This week was a welcome relief – after the S&P 500 shed ~13% in the span of just two weeks.

Two questions you’re probably thinking:

- is this the start of something more? or

- is this your typical (bear market) dead cat bounce?

However, I will explore exactly what that means in a moment.

The Dow surged over 800 points to close the week – with the S&P 500 adding ~3%

It’s always hard to pin-point precisely why a market catches a bid… but four thoughts come to mind:

- close to oversold conditions in the near-term;

- short sellers locking in well-earned profits (i.e. short covering);

- index rebalancing (e.g., Netflix, Paypal and Facebook move into the “value” index from “growth”); and

- consumers expect inflationary pressures to ease slightly by year end (e.g. 5.3% vs 5.4% previously)

For investors who invest in value based ETFs (e.g. iShares Russell 1000 Value ETF) – they will effectively be buying these names. On the other hand, roughly $55 billion iShares Russell 1000 Growth ETF will likely reduce its holdings.

JP Morgan estimated that around $112 billion changed hands in these names — where Facebook and Netflix added 7% and 5% respectively.

With respect to the inflation – whilst sentiment only showed a 0.1% change – the market will take anything at this point.

That said, CPI north of 5% is still unbearably high and not going away anytime soon.

For example, it’s near impossible to eliminate ‘stickier’ inflation like rent and wages in the near-term. However, meaningfully lower house prices will help.

On the flip side, the consumer report indicated

The University of Michigan’s Surveys of Consumers said consumers expect inflation to rise at a 5.3% annualized rate as of the end of June.

That’s down from a preliminary reading released earlier this month, which showed inflation was expected by consumers to increase at a 5.4% clip. Still, Surveys of Consumers director Joanne Hsu said consumers “also expressed the highest level of uncertainty over long-run inflation since 1991, continuing a sharp increase that began in 2021.”

Overall consumer sentiment fell to a record low, hitting 50. That’s 14.4% below a May reading of 58.4 and 41.5% from a year-earlier period.

“Consumers across income, age, education, geographic region, political affiliation, stockholding and homeownership status all posted large declines,” Hsu said.

“About 79% of consumers expected bad times in the year ahead for business conditions, the highest since 2009.

47% of consumers blamed inflation for eroding their living standards, just one point shy of the all-time high last reached during the Great Recession,” Hsu added

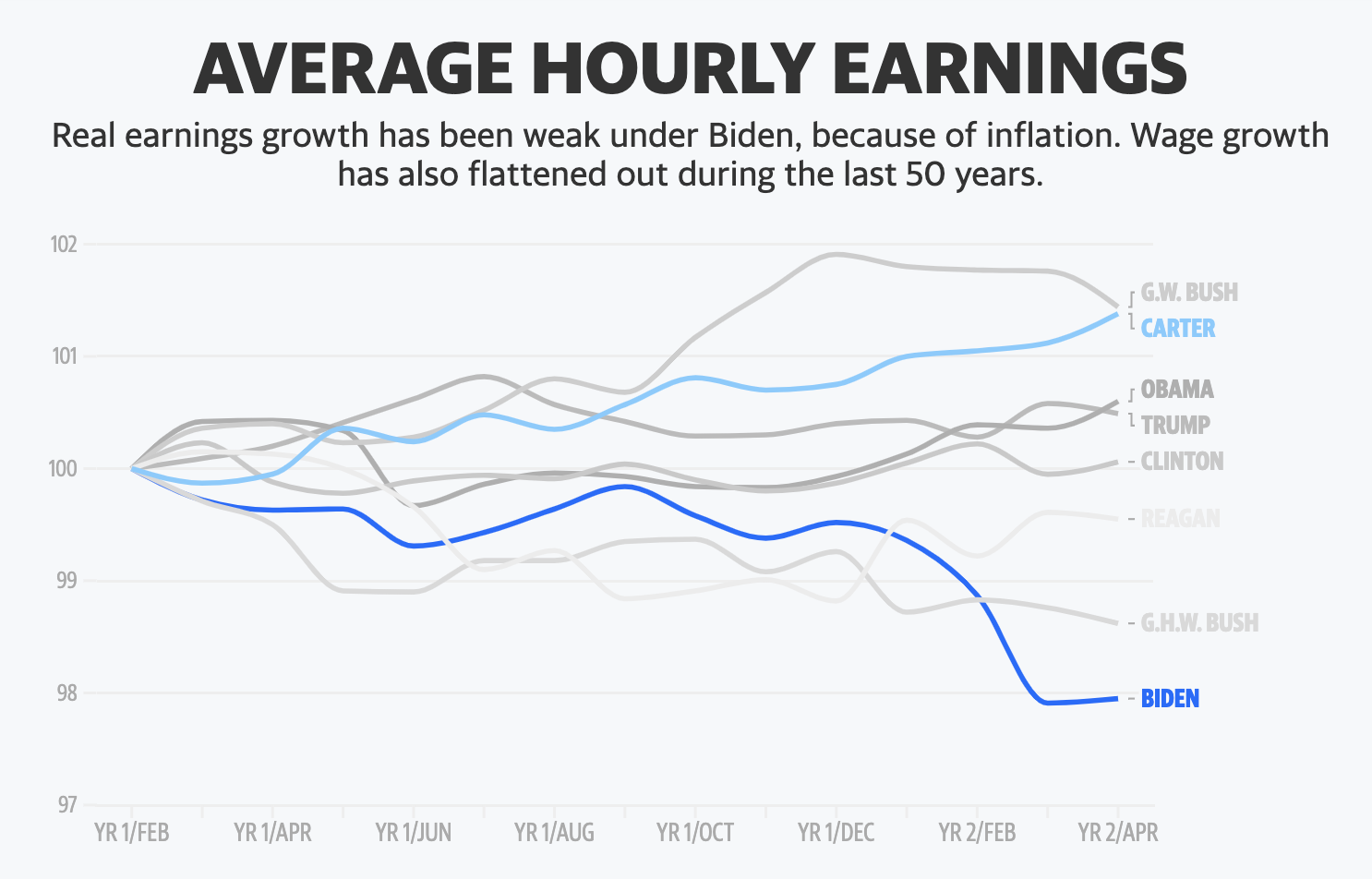

Maybe this has something to do with it… where the average wage growth in real terms is the lowest in 50 years…

If you ask me, the ‘one-two-punch‘ of unhinged monetary and fiscal policies has resulted in consumers feeling worse off now than before we entered the pandemic.

Funny how things turn out.

Gauging the Bear Market Rally of 2022…

My last missive shared investing lessons from 2000 and 2008.

Patience paid off during these times… striking when outright fear gripped the market (here’s a related post)

With the S&P 500 losing about half of its value during each of these recessions – we saw:

- Several sharp bear market rallies; and a series of

- ‘Lower lows‘ and ‘lower highs‘ before markets found their footing.

I had not traded through a market losing 50% previously…

But I was extremely fortunate… I was young (29) and the invaluable lessons lasted a lifetime. It’s a gift to make big mistakes earlier in life.

The market saw three rallies of 19.3%, 21.7% and 21.2% before making a new “lower low” each time.

The financial crisis of 2008 was not too dissimilar…

This time there were four sizable bear market rallies of 12.7%, 7.8%, 18.8% and 24%.

Again, each rally failed and we made a new lower low.

That’s the lesson and patience required…

So where does that leave us today – as we navigate the 9th largest correction post 1950)

June 25 2022

We’re up ~7.6% from the 3636 June 14th low. My expectation was support around the 3600 zone. This is both (a) 61.8% to 76.4% outside the retracement labelled A-B; and (b) the previous level of resistance from August 2020.

There are two zones where I think the market faces the next level of selling: (i) zone of 4050 (10-wk EMA); and (ii) zone of 4250 (35-wk EMA). In other words, the market could easily rally ~16% from its lows before reversing

Over the next few weeks (and into earnings) we need to see two things: (i) meaningfully trade back above the previous high (labelled “B” or ~4200); and (ii) on any decline from expected resistance – form a new higher low.

Put another way, what we don’t want is rejection at “B”; only to fall below 3636 (a “lower low”). This would reinforce the bear market – and a quick trip to 3200.

This trend has been in effect for 11 weeks.

Probabilities suggest lower prices with a weekly bearish trend. What’s more, a bearish trend also indicates that strength is more likely to be sold.

For clarity, this does not mean you cannot enter long positions in bearish trends.

You can.

However, you should have the expectation that prices are more likely to continue falling (i.e., manage your position sizes accordingly).

Once we see the weekly trend pivot (as we eventually did with the crashes of 2000 and 2008) – probabilities suggest the prices are likely to trade higher (i.e., where dips are more likely to be bought).

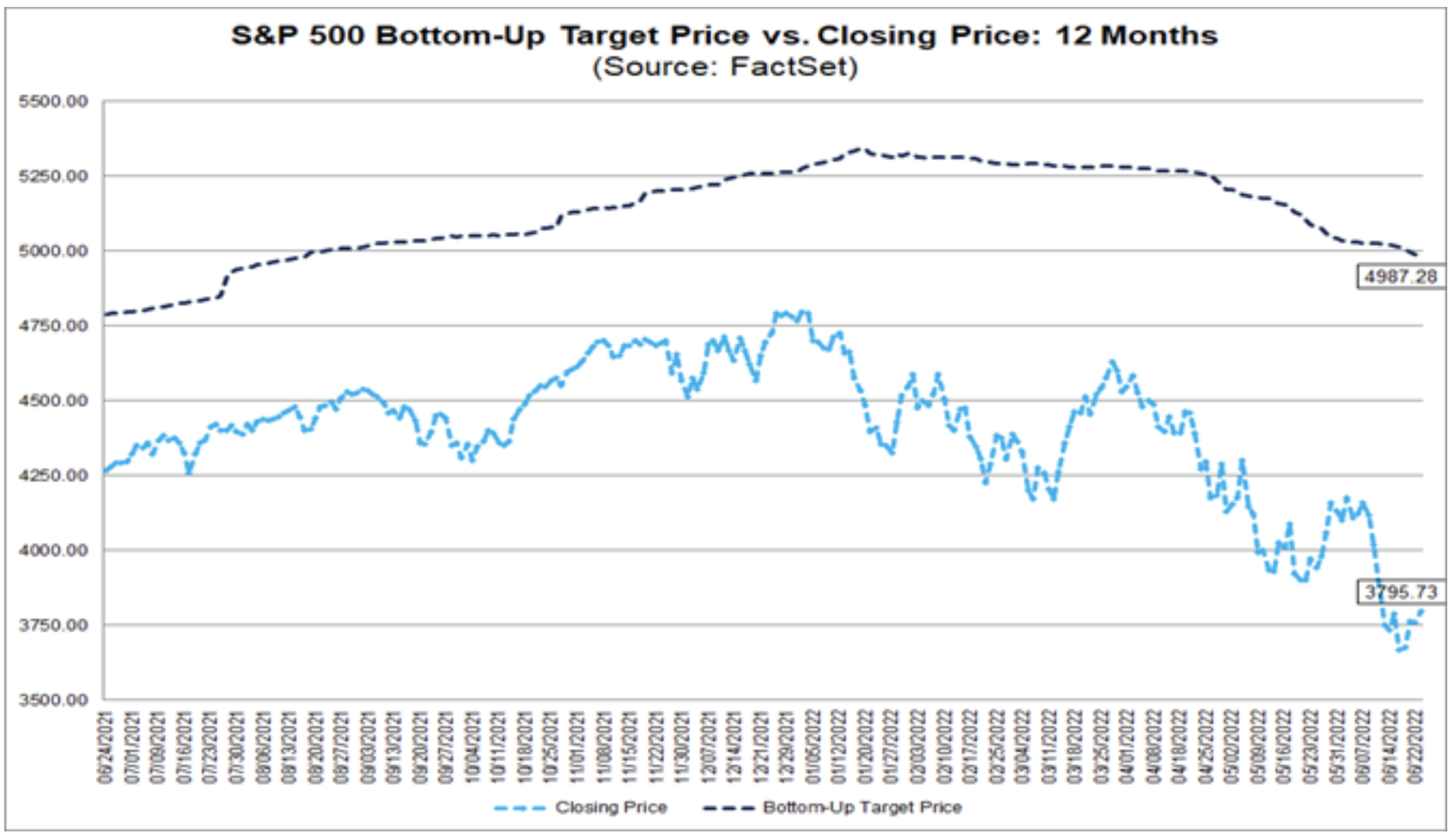

Bottom-Up Targets for S&P 500 Fall

It’s not surprising to read that analysts continue to ratchet down their expectations for 2022.

However, it is taking a lot longer than I expected!

For example, in January we saw forecasts as high as 5,344 for the S&P 500. My expectation was for something around 15% to 20% lower.

Today, the bottom-up target price has declined by 7% to 4,987 (still ambitious from my lens)

According to Factset, the price is calculated by aggregating the median target price estimates (based on company-level estimates submitted by industry analysts) for all the companies in the index.

Source: Factset

Industry analysts still (optimistically) believe the value of the index will increase by more than 30% in the next 12 months.

Question is – should we give analysts any weight?

Factset answers this by measuring analyst’s results.

In recent time periods, industry analysts have underestimated the closing price of the index 12 months later using month-end values. For example, over the past five years, industry analysts have underestimated the price of the index by 2.1% on average (using month-end values).

Over the past 10 years, industry analysts have underestimated the price of the index by 0.2% on average (using month-end values).

However, I think it’s also fair to say that analysts could not have forecast the extreme levels of monetary and fiscal intervention which has helped propel markets to such levels.

Over longer time periods, analysts have typically overestimated the closing price 12 months later. For example, over the past 15 years, industry analysts have overestimated the price of the index by 7.7% on average

For example, on June 30, 2021, the bottom-up target price was 4,795. Almost one year later, the S&P 500 closing price is 3911.In other words. the over-estimated the S&P 500 close by some 23%

Hmmm.

Which brings me to why there could be downside to come…

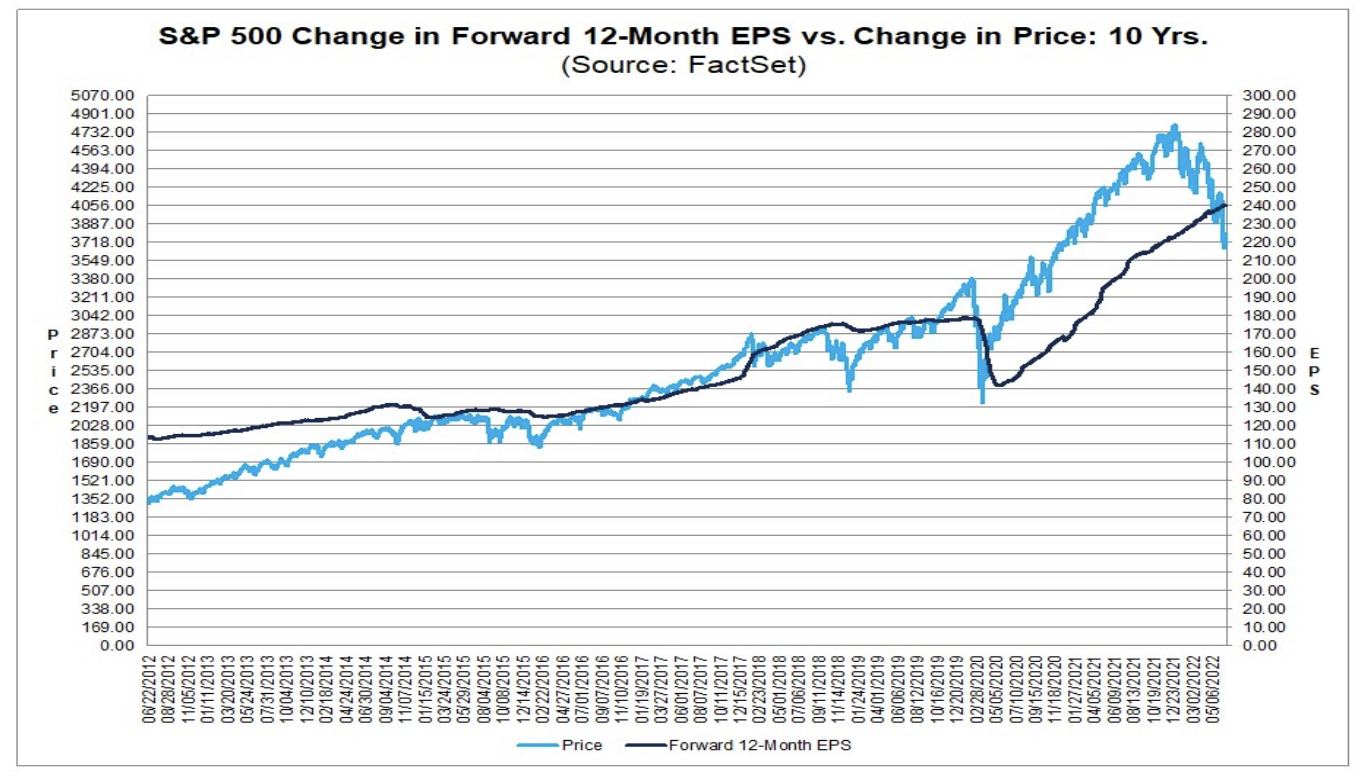

Estimates are Yet to Come Down

The other day I asked the following questions regarding Q2 earnings estimates:

- What will be the “E” (earnings) be in “PE” (price-to-earnings); and

- What is the appropriate multiple (e.g., opposite bond yields at ~3.1%)

Truth is no-one knows and we are all trying to guess where we think things land.

Regardless, one thing is for sure:

Analysts are yet to materially revise down estimates from around $235 forward EPS.

Here’s Factset on the latest forward estimates (dark blue) – overlain with the S&P 500

Personally I think there’s a strong possibility that earnings actually fall for Q2 (and not grow).

As Factset highlights – the estimated earnings growth rate for the S&P 500 Q2 2022 is 4.3% (i.e. $235).

However, I think it’s possible we could see a decline of 10% YoY – which would see EPS closer to $202.

That said, it’s also worth noting:

- It’s estimated we will see a staggering $1 Trillion in share buy backs this year (boosting EPS);

- Long-term average for S&P 500 earnings growth is between and 8% and 11% per year; and

- This coincides with the long-term S&P 500 capital appreciation (i.e., total CAGR of 10.5% inc dividends)

Now if the EPS number is anything close to 4% growth or above – the market could easily take off.

That said, if we see contraction, the look for prices to come down sharply.

Let’s now turn to the multiple (ie PE).. and the question of what’s value?

Historically the S&P 500 has traded at ~15.5x multiple.

For example, if we assume the “E” is $235 (high end) – at 15.5x that puts us around 3642 (a level we traded at last week). After this week’s close of 3911 – the forward PE ratio has inched up to 16.6x

However, if we assume a 10% decline (EPS $202) at 15.5x – the price of the Index drops to ~3,131 (just below the level of 3200 – where I felt the Index was a compelling long-term risk reward)

But in order to gauge “fair multiple” – we need to look at comparative returns from (risk free) bonds.

And this is where the US 10-Year yield is referenced.

The objective here to compare the earnings yields for stocks vs that of the risk-free rate (10-year yield).

I will start with the S&P 500 earnings yields…

Again, let’s assume the higher-end EPS of $235.

If this is accurate – it suggests an earnings yield of ~6.0% (i.e., $235 / 3911 = 6.0%)

However, if we lower our estimates to $202 (ie 10% decline in EPS) – that earnings yield drops to 5.2% ($202 / 3911).

Note – both earnings yields estimates are still much better than the (low) 4.7% yield at the start of the year (given prices are lower by ~ 20%)

By comparison, the risk-free US 10-Year yield has moved from just 1.50% at the start of the year to around 3.13% today.

In that sense, these yields are getting closer.

Now if stocks are yielding more than bonds (still the case today in either earnings scenario) – stocks are considered reasonably priced given that more value is being created.

Naturally as investors increase their demand for stocks, the prices increase, causing P/E ratios to increase. As P/E ratios increase, earnings yield decreases, bringing it more in line with bond yields

A commonly used ratio to gauge equity premium is known as the BEER ratio; i.e. Bond Equity Earnings Yield Ratio

This is simply the 10-Yr Bond Yield / Stocks Earnings Yield.

And if that ratio is less than 1 – stocks are considered fairly priced based on their earnings relative to risk-free bonds.

Let’s now use the two estimates for S&P 500 EPS (where the US 10-Yr Yield is currently 3.1%):

- Optimistic: 3.1% / 6.0% = 0.52 (where 6.0% earnings yield based on EPS $235)

- Conservative: 3.1% / 5.2% = 0.60 (where 5.2% earnings yield based on EPS $202)

But as you can see, as the 10-year yield increases (e.g. closer to 4%) this equation becomes more interesting.

In summary, if we see the Index around 3500, it’s arguably a good long-term bet to either add to (or establish) positions.

However, if we see panic selling on a sharp fall in earnings (or more aggressive Fed) — I’m a strong buyer around the 3200 level (for the long-term).

For example, with EPS as low as say $190 (which would be ~16% decline in EPS YoY) – and the S&P at 3200 – that implies a yield of 6.0%.

It’s my view that 6% earnings yield will remain competitive against US 10-year bond yield (which I expect to trade no higher than 5%)

Putting it All Together

We are in the early stages of what could be a double-digit percentage (bear market) rally.

For example, it would not surprise me to see the S&P 500 trade as high as 4200 in coming weeks.

However, its next litmus test will come in the form of earnings and guidance.

What can we expect?

Are Factset’s (analyst’s average) expectations of 4% YoY EPS growth too aggressive?

If earnings are to decline – and with the 10-year yield likely to trade north of 3% – what’s fair value?

Measuring things like earnings yields against that of the 10-year yield helps give us some guidance.

But it’s not perfect…

For example, the other metric I lean into is the market’s total cash flow yield.

As I outlined here, if we assume the S&P 500 falls ~13% – this represents an FCF Yield of ~5.0%.

By way of comparison, in 2008 when stocks fell over 50%, the market’s FCF Yield was ~5.9%

Therefore, I think there’s room to fall yet…

Put together, fundamentally and technically the area of ~3200 (if it presents) will offer investors long-term (3-year) value.

At that point, we will have seen stocks give back ~34% from their peak (typical for a recession – assuming that’s where we are headed).

3200 may not be “the” bottom… however I suspect perhaps “80%” of the downside will be priced in.