- Tech rallies in 2023 – but not much else

- Without market breadth – rally is on tenterhooks

- Why earnings estimates could still be too high

This is a complex macro environment to navigate:

- Central banks keeping rates high to combat soaring inflation

- Open questions regarding the ‘health’ of the regional financial sector (with growing concerns of the sectors exposure to commercial real-estate)

- Escalating geopolitical tensions with China and Russia (among others); and

- Let’s not forget about earnings risks opposite the growing threat of recession.

Tonight I will talk about the latter – as we sneak up on Q1 earnings season.

But despite all of the above – equities are positive for the year.

The S&P 500 is up ~3.4% at the time of writing – with the tech-heavy Nasdaq 100 up over 16%.

Which raises an important question…

If big tech wasn’t up ~16% (arguably on the back of a flight to “safety”) – how would the market look?

The answer – not great.

Digging Below the Surface

If your portfolio was still overweight tech from last year – you have probably started 2023 in good fashion.

That said, you are also battered and bruised from 2022.

Consider Cathie Wood’s tech based ARKK ETF.

During the course of 2022 – it plunged 67%.

However, to start 2023, the ETF is up 22% (now “only 71%” off its 2021 high)

22% sounds good… until you remind yourself the fund still lost 67% last year.

Now with the S&P 500 up ~3.4% to start 2023 – on the surface – things look reasonable.

If you annualize this pace, it’s on track for a 12.4% year (which anyone would happily take if you offered that now)

However, what you will find is that 3.4% is not very deep.

Put another way, the market lacks breadth.

For example, smaller companies are negative to start 2023.

What’s more, economically sensitive sectors, such as financials, energy, materials, and real estate are all down by a range of 5% to 10% year-to-date.

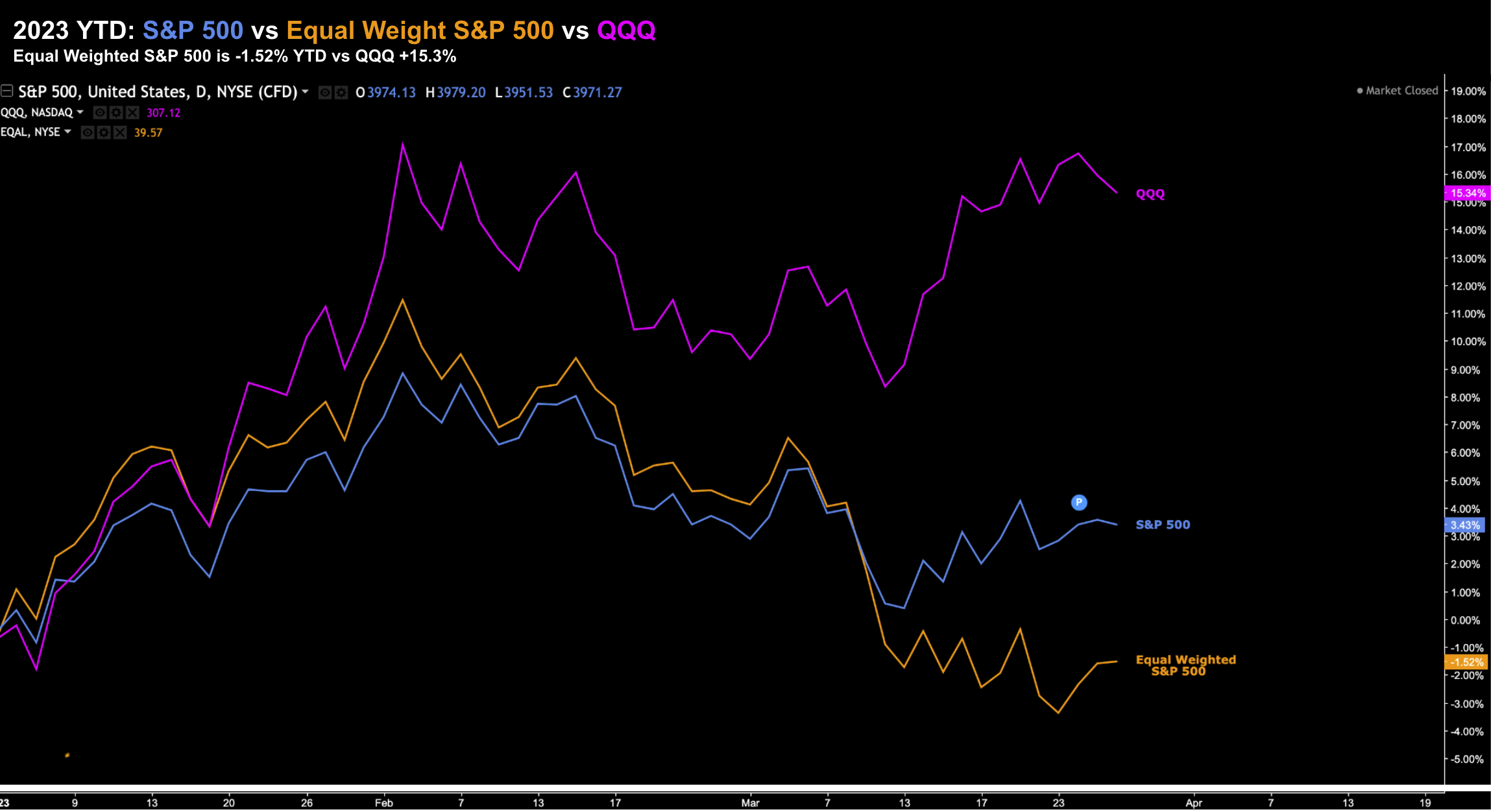

To demonstrate the divergence YTD (or lack of breadth) – took at look at this chart:

- S&P 500

- Equal Weight S&P 500 (‘EQAL’); and

- QQQ ETF (as a proxy for tech)

March 28 2023

The divergence really started to post the collapse of Silicon Valley Bank (March 10th).

Further to recent missives – large-cap tech has seen a flight to quality – where balance sheets are strong and cash flows reliable.

And with yields lower (and the Fed widely expected to cut rates) – it’s natural for tech to catch a bid.

On the other hand, money has fled small caps, banks and economically sensitive sectors like energy.

So what’s going on?

Let’s start with earnings.

Earnings Expectations

Further to my preface, if the risks were not already high enough on a macro level, we have earnings to worry about.

In just over 2 weeks – the banks lead things off.

It will be interesting to hear how they are now managing capital and provisions they are making.

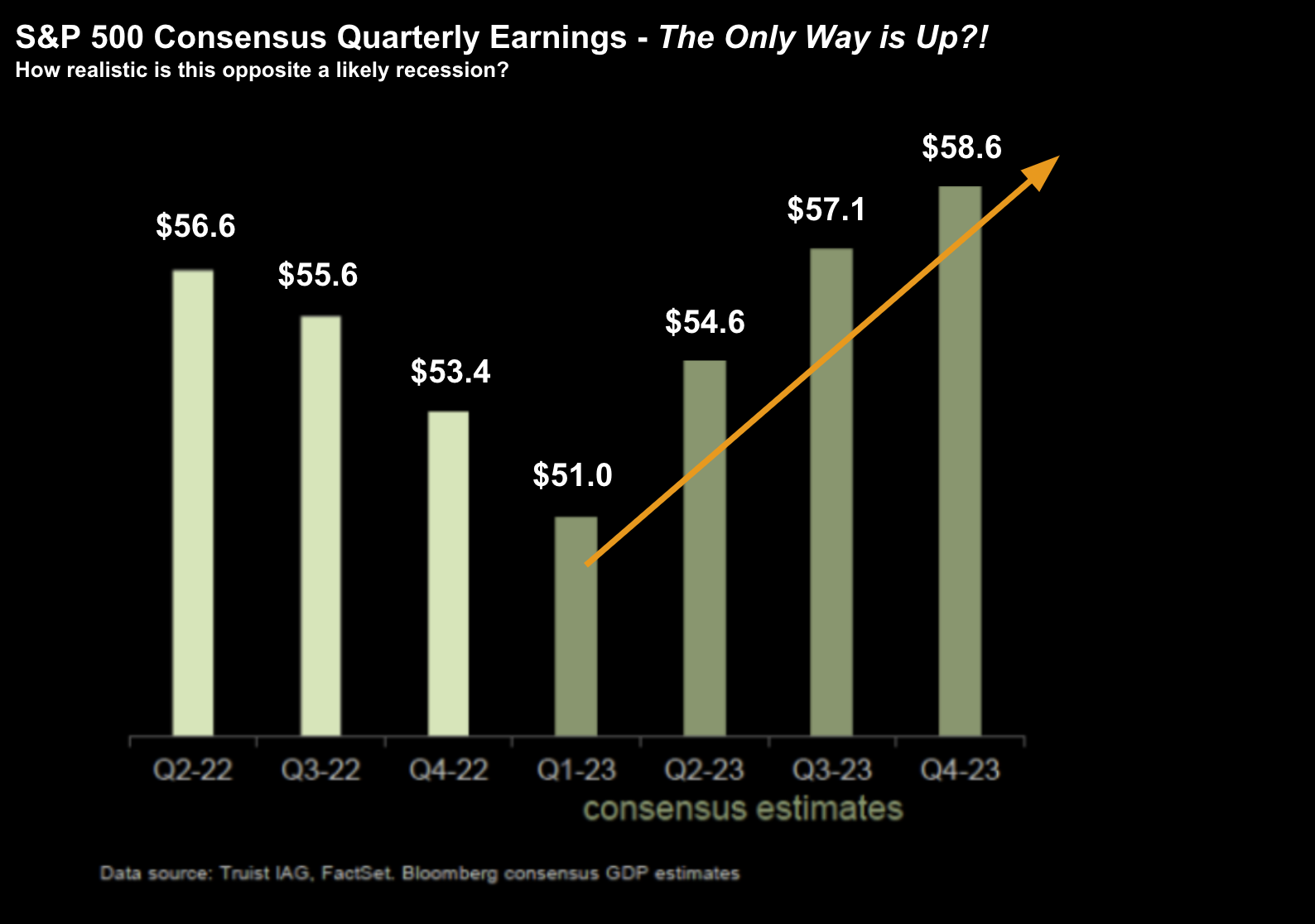

But beyond banks – what is potentially troubling (to me) is S&P 500 consensus quarterly earnings compiled by Bloomberg Intelligence show an increasing trend.

For example, this runs from $50.85 in the first quarter of 2023 to $54.64 in the next quarter, followed by $57.16 and $58.68 in the third and fourth respectively.

For the full year 2023, consensus shows $219.6 earnings per share forecast and $244.5 for 2024

The chart below shows Bloomberg’s own measuring of rolling earnings for the 12 months ahead for the coming year and for the year after have moved since the beginning of 2022.

With the S&P 500 currently trading 3971 – that puts the current PE multiple for 2023 at 18x.

For 2024, that multiple comes down to just 16.2x (which is very reasonable).

There’s just one catch:

How realistic are the EPS forecasts of ~$220 and ~$245 for 2023 and 2024 respectively?

To answer that, you need to have a thesis on the likelihood of a recession (and tighter credit conditions)

I will expand on this shortly…

But I said late 2022 – my own estimates for 2023 earnings are closer to $200 to $210 (vs the $220 projected by Bloomberg).

Now given the events of the past few weeks – with credit conditions tightening – $210 feels optimistic.

Again, the next 4-8 weeks will give us another insight into how corporate revenue, profits and margins are trending.

My guess is we will see margin contraction.

And I say that because of the focus we’ve seen on greater cost efficiencies (i.e. layoffs)

But What About Growth?

The second part of the equation is growth.

Some economists (not all) are coming around to the possibility that we might experience a recession later this year.

Do you think?!

They have been in denial for a while… but some are getting there.

However, the average FOMC participant still doesn’t see it.

From Bloomy:

The median FOMC participant barely marked down GDP growth for this year — meaning financial turmoil has essentially offset positive growth surprises before Silicon Valley Bank’s collapse.

Consumer confidence will likely support the view that households remain cautiously optimistic about the future and see bright employment prospects.

Interesting…

Labor is always the last domino to fall.

We’ll see if those “bright employment prospects” sour over the next few months (more than happy to be wrong)

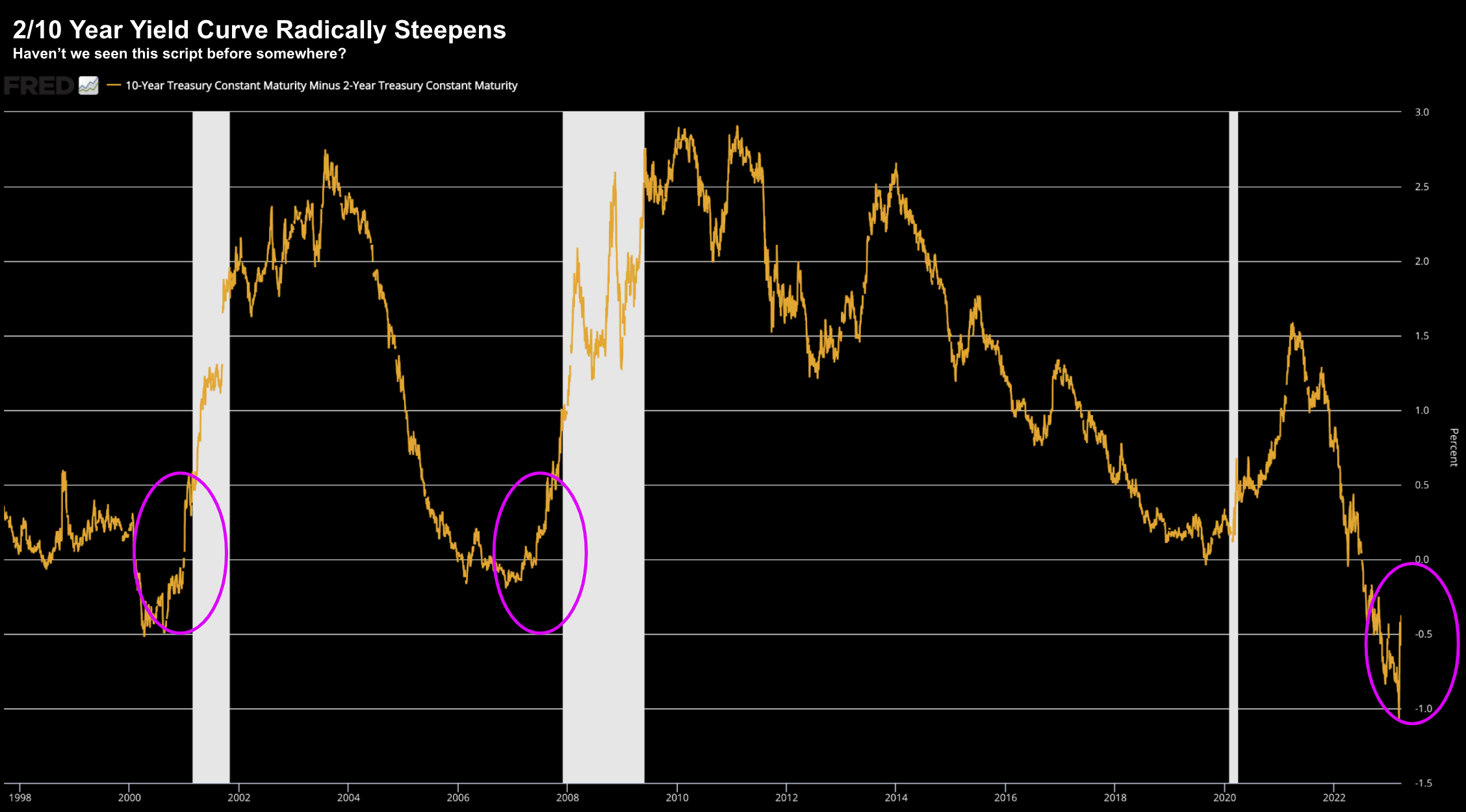

But here’s my preferred recession indicator (which I talked to as part of this post “Recession Dead Ahead”)

As I explained in my previous post – it’s not the initial inversion which is the worry.

That simply tells us it’s probably coming within 12 to 18 months.

However, the inevitable pivot in the other direction is reason to worry (i.e. where the short-term rate crashes).

Put another way – when the short term rates crashes (in this case more than 100 bps in just weeks) – it tells us the market is not confident on the outlook for growth.

So let’s bring this back to earnings….

If earnings are expected to increase this year (and next) – does that assume we will avoid recession?

Again, repeating the chart for consensus earnings:

Source: Bloomy

If that’s the case – I’m not buying it.

A recession – whether it’s mild or otherwise – means earnings will contract.

We have never experienced a recession where earnings have expanded.

Not one.

Putting it All Together

- Are they borrowing (and at what cost)?

- Are they spending (and where?)

- Are they using (more) credit? Do they have savings?

- How confident do they feel in their prospects?

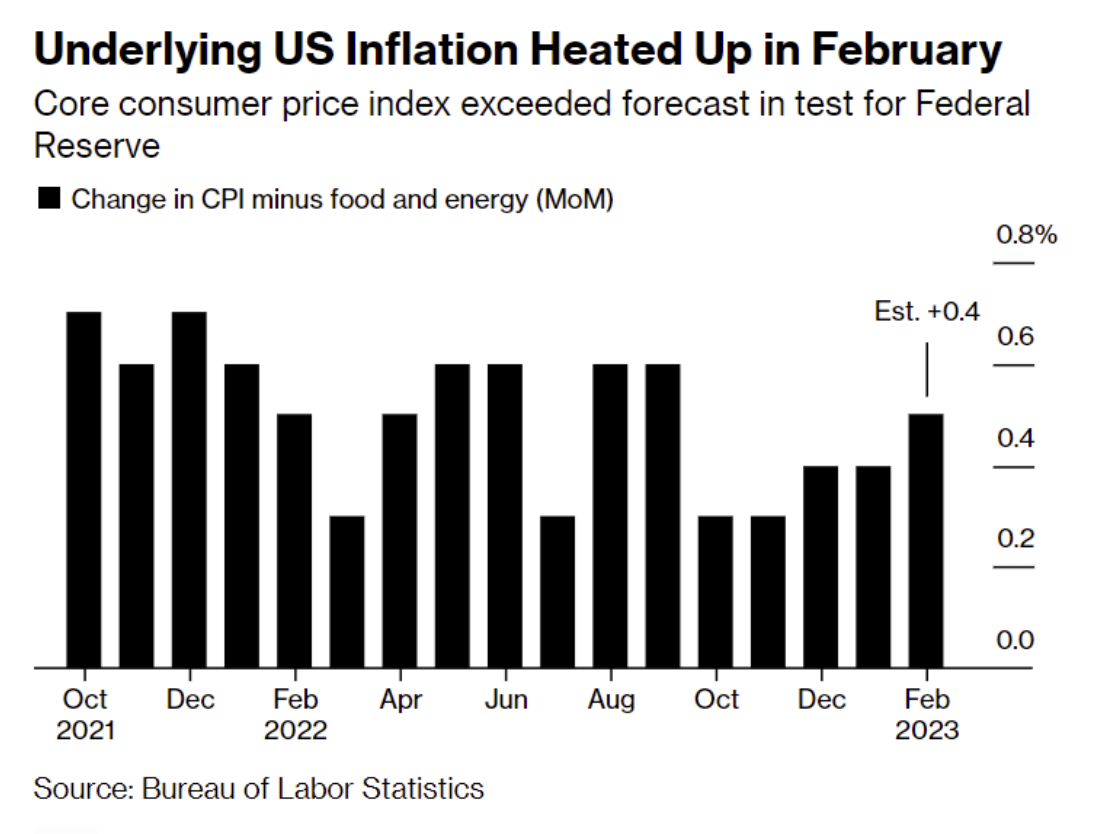

We will get the Personal Consumption Expenditures (PCE) price index, the Fed’s preferred measure of underlying price pressure this week.

This will be closely watched – as it will provide some further clarity as to what Powell might do at the next Fed meeting.

My guess is they will hike another 25 bps… barring some large negative surprise with Core PCE.

For example, anything above 4% with Core, and they will most likely raise (as the inflation problem is still at large)

I shared this chart last week:

One final comment on earnings….

Morgan Stanley’s Mike Wilson provided caution on CNBC last week.

Here’s the key takeaway:

- Stocks are still set to see earnings pressure, and investors shouldn’t be fooled by the tech rally

- Wilson said stocks now faced the highest downside risk in a year following the collapse of SVB.

- Previously, he predicted the worst earnings recession since 2008 to strike the market.

Wilson estimates earnings could be as low as $180 (worst case) but more likely in the realm of $200 for 2023.

Again, with the S&P 500 trading just below 4,000, that’s a current PE of 20x.

From my lens, that’s a sub-optimal risk reward.