- CPI and Core CPI both come in stronger than expected

- Market is correct to assume shelter prices will fall soon

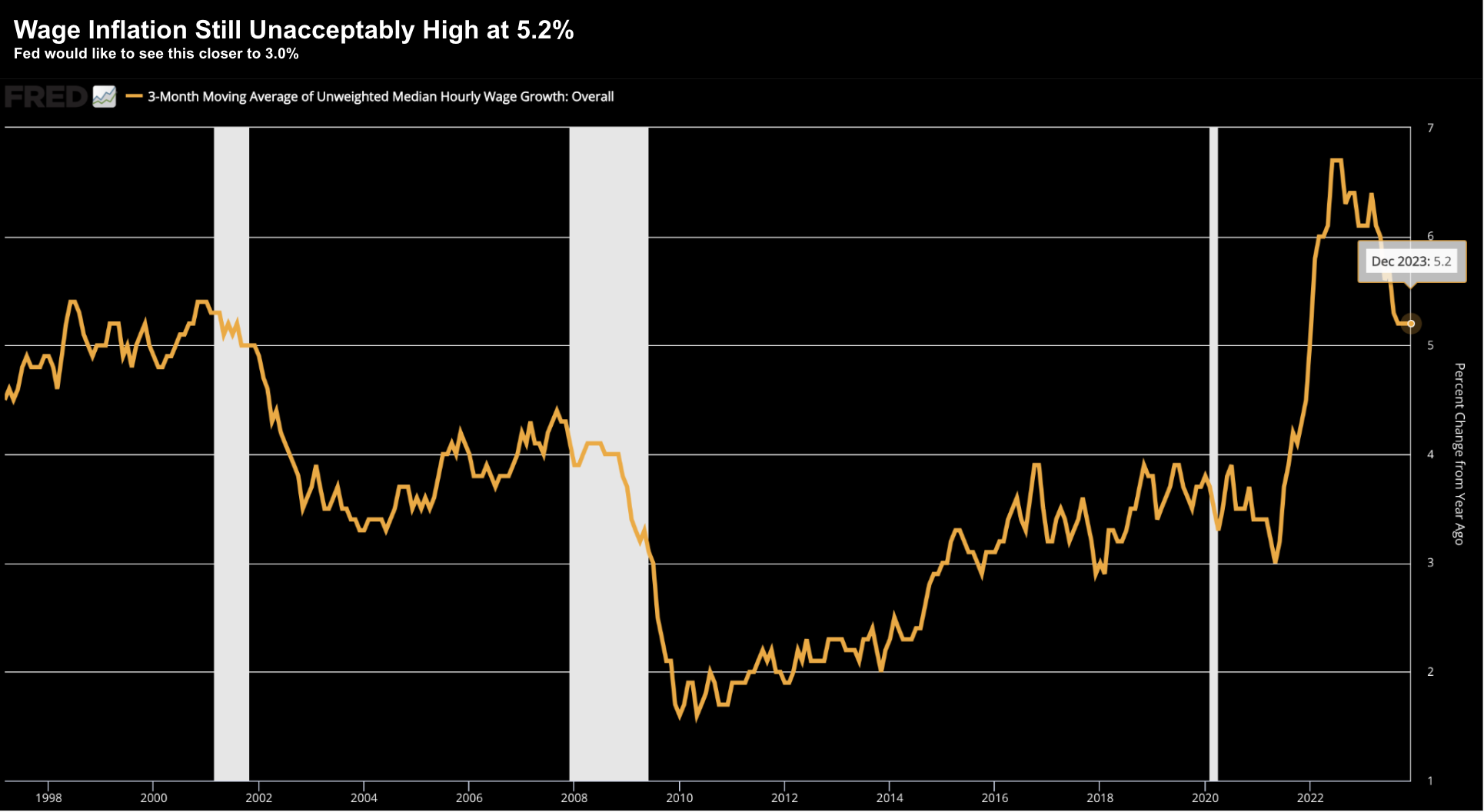

- 5.2% 3-mth avg wage growth is still a problem for the Fed

Markets were expecting very good news… but did they get it?

Below is the summary for headline and core (where core which excludes volatile food and energy prices)

- Headline CPI increased 0.3% MoM and 3.4% YoY vs est. of 0.2% and 3.2%; and

- Core CPI rose 0.3% MoM and 3.9% YoY vs est. of 0.3% and 3.8%

The Fed’s preferred inflation read is core.

On the surface, both prints were slightly higher than expected.

However, we saw a mostly muted reaction in both bond and equity markets.

In fact, bond yields fell – with the market maintaining its 68% expectation of a rate cut as early as March

Source: CME FedWatch Tool – Jan12 2024

The question is what does the market see beyond the (negative) headline?

My thinking – look no further than shelter and specifically how it’s measured.

CNBC reports much of the increase in CPI was said to come from rising shelter costs.

And this has been a pain-point for the market over the past few months.

Shelter was said to increase 0.5% MoM and accounted for more than half the core CPI increase (which I will talk to further below).

Fed officials largely expect shelter costs to decline through the year as renewed leases reflect lower rents.

And as I will explain – they have good reason to.

However, it’s not using the data provided from the government.

Shelter Costs Actually Falling

Whilst the government reported that shelter costs increased 0.5% MoM – two private sector reports suggest the opposite.

In fact, they report shelter declining the past 4-5 months on a month-over-month basis.

The discrepancy is the (outdated) way the government reports (and measures) shelter data (something that should be addressed)

BLS records shelter inflation as Owner’s Equivalent Rent – a combination of rent measures and survey-driven weighting that asks people about their housing costs. From the BLS:

“The data used as inputs in the construction of the index for shelter, as well as the indexes for rent and OER, are collected in two surveys. The Consumer Expenditure (CE) Survey asks households the share of their budget which goes towards different categories of goods and services, and is subsequently used by the CPI program to create weights for index estimation. The Housing Survey collects price observations of rental housing units across the United States.”

Unfortunately for the government – the data suffers an unacceptable lag.

And given rents can move quickly opposite market forces – the current methods are not equipped to capture the resultant change.

By contrast, near real-time indicators from property data company Zillow are more accurate reflection of what is happening (and maybe why Fed officials see it coming down)

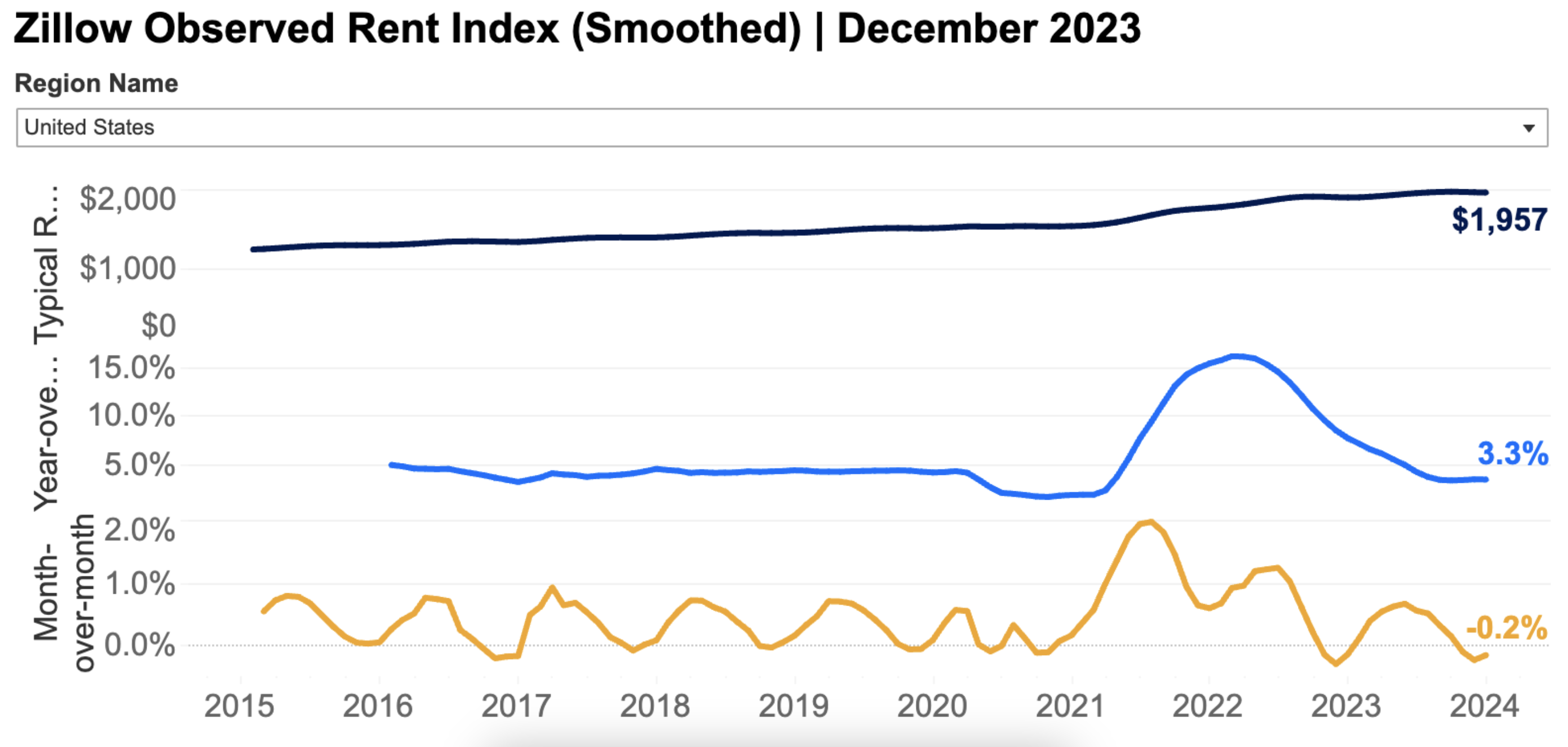

Zillow implement something they call the Zillow Observed Rent Index (ZORI)

“The Zillow Observed Rent Index (ZORI) measures changes in asking rents over time, controlling for changes in the quality of the available rental stock in ways that other measures of rental prices cannot.

What’s available to rent at any given time can change rapidly, and measures of median or average prices across time may not reflect actual market-based movements in rent prices, but instead simply reflect the fact that certain unit types are available at different times. ZORI solves this challenge by calculating price differences for the same rental unit over time, then aggregating those differences across all properties repeatedly listed for rent on Zillow.”

Based on this November 30 report – Zillow states:

- Renters are seeing more concessions now than they have in more than two years, with 30% of listings offering at least one concession.

- 43 of the 50 largest US markets have more rental concessions now than last year.

They add that renters are continuing to get ‘sweet deals’ – with far more rental listings featuring some sort of concession compared to last year.

Now, 30% of rentals on Zillow offer at least one concession – such as free months of rent or parking – to attract new tenants, compared to 24% at this time last year.

They’re one way to entice new tenants to a property without lowering rent.

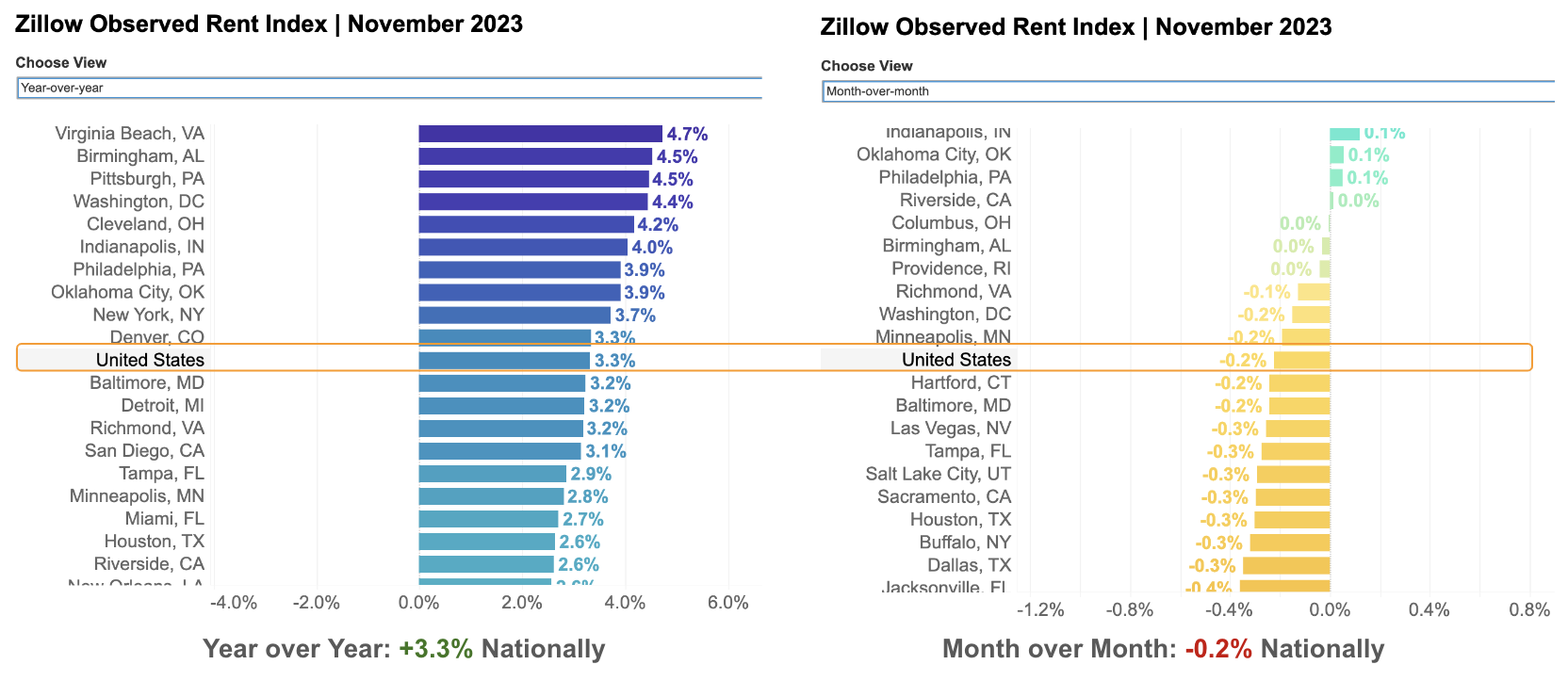

More important, they offer the following price trend data – where we find YoY (left hand side) and MoM (right hand side) from 2015 :

This is a stark contrast to the official data showing a 0.5% increase.

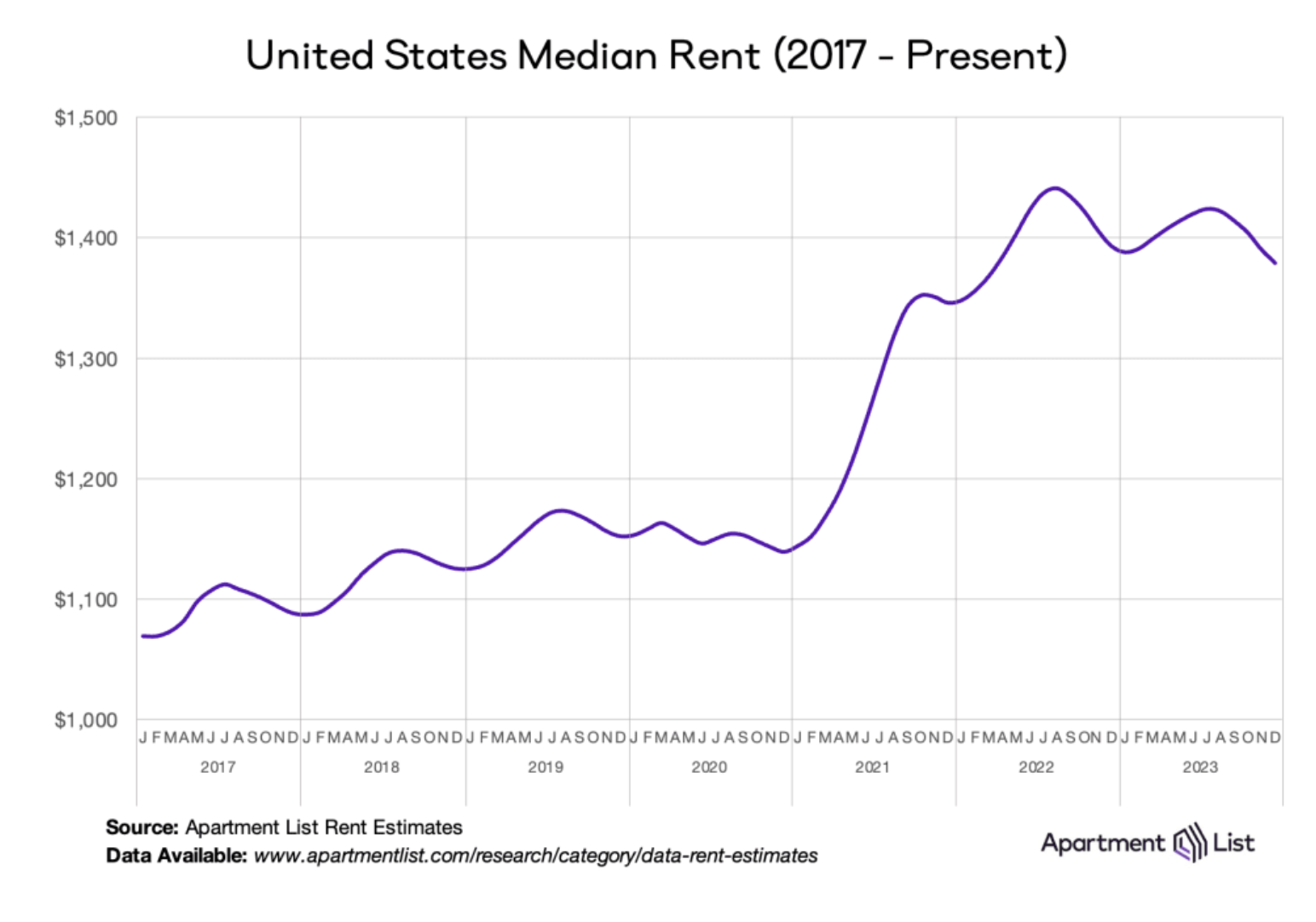

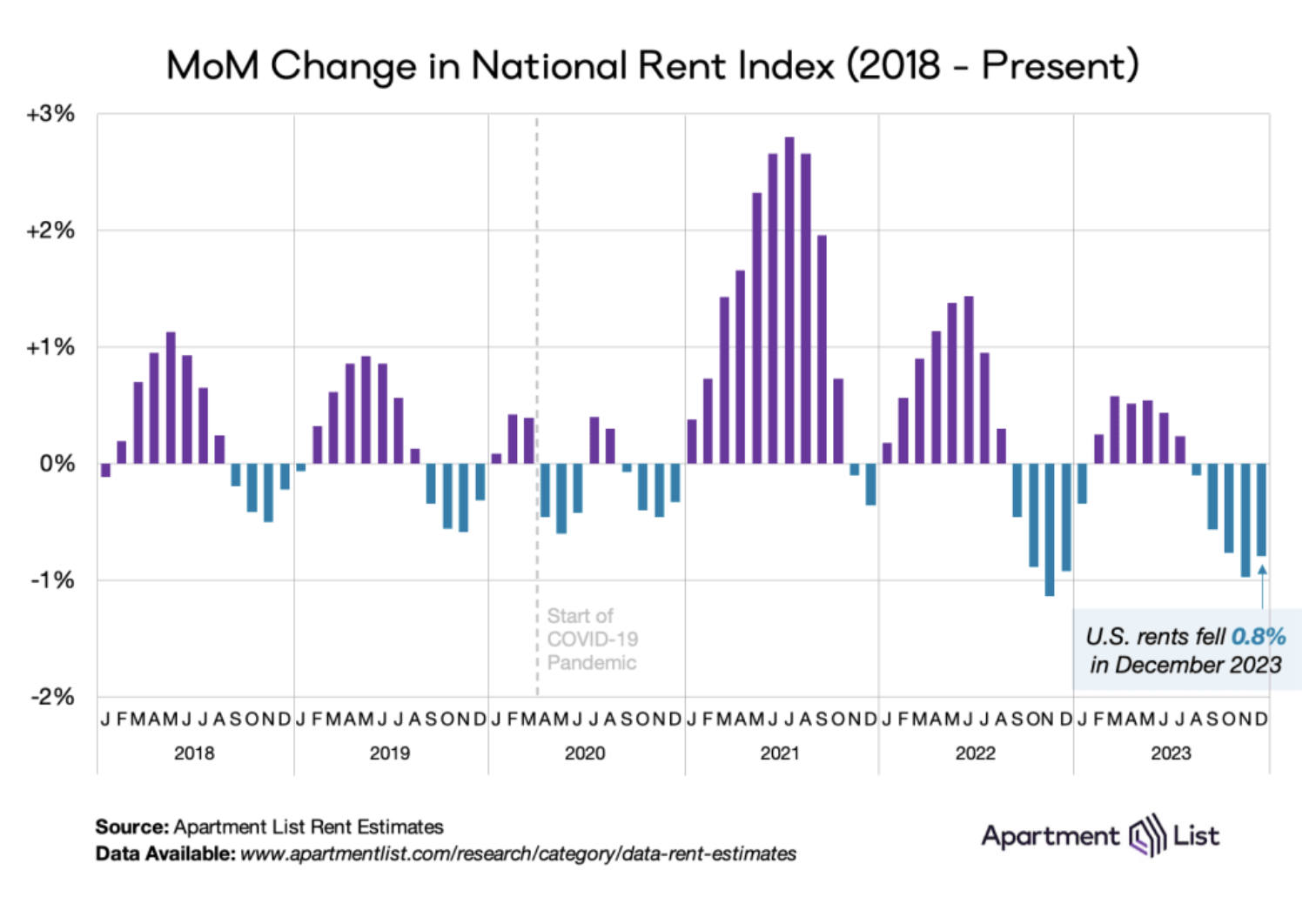

In addition to Zillow – the Apartment List National Rent Report supports the falling trend:

They report rents falling 0.8% over December – making the 5th straight month of declines.

This real-time (private sector) data highlights the significant lag with the official (BLS) data.

And with shelter constituting around half of CPI – it’s plausible the market looked straight through the higher-than-expected ‘official’ CPI figures.

Wage Growth the Focus

Whilst the Fed (and the market) have connected the dots of shelter inflation falling – wages deserve closer scrutiny.

The Fed is said to target annual wage growth in the realm of 3.0% (i.e. 1.0% higher than their inflation objective of 2.0%).

However, today the three month moving average shows a 5.2% gain YoY

Jan 12 2024

The “good news” from the Fed’s perspective is this is falling.

However, it’s still a very high 5.2%

December’s print showed further slowing (suggesting more weakness in the labor market) – however there’s a lot more to do.

From mine, until we see the unemployment rate tick higher, it’s hard to see how wage growth gets back to the 3.0% objective.

And whilst higher wages may be good news for workers (for now) – the Fed does not want to see higher inflation become systemic.

Putting it All Together

I’m having a hard time agreeing with the 68% probability priced in for a rate cut in March.

Yes, inflation is coming down. However, it’s slow.

And with wage growth well above that of inflation – it puts the Fed in a difficult position with respect to announcing any imminent cuts.

How do we explain the market’s conviction cuts are imminent?

Complacency? I don’t know.

Yes – shelter prices will almost certainly come down over the coming months. The data from Zillow and Apartment List National Rent Report confirms this.

But can we assume wage growth will be slow enough for the Fed to ease? Or does the Fed have another objective?

Either way – the market remains very confident rate cuts are coming and soon (whatever the reason may be).

However, if for any reason they don’t, we might see an adjustment in prices.