- Headline 339,000 jobs added for May

- Wage growth falls – with jobs added in lower paying sectors

- Why the Fed is still more than likely to pause

Payrolls rose 339,000 for May.

That was well above the 190,000 expected – and what seems like a robust report.

Is the economy really that strong?

The devil is always in the details.

From mine, I think the Fed will likely pause on a rate hike this month despite the so-called ‘upside surprise’.

However, it would be remiss to rule out further hikes later in the year.

Let’s take a look at the ‘goldilocks’ report… and the pockets of weakness to watch.

Wage Growth Softens

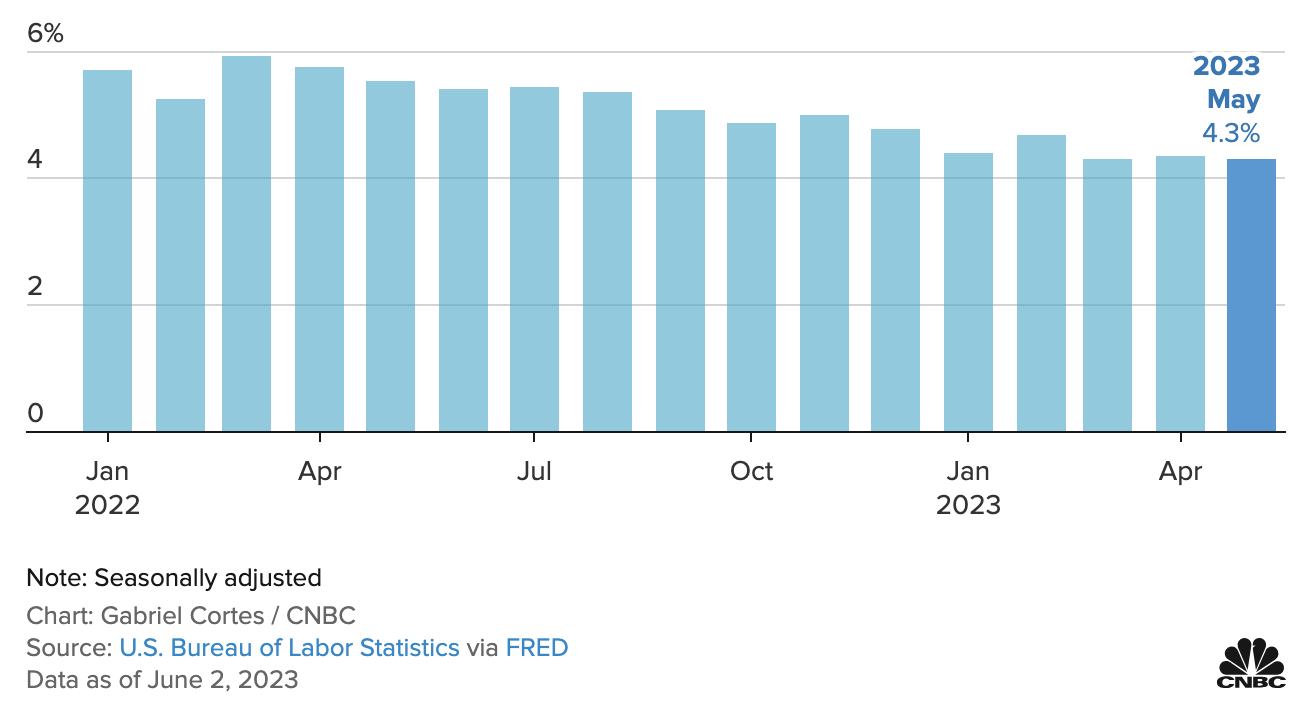

The first thing Fed watchers will note was the small slowdown in wage inflation.

Average hourly earnings, a key inflation indicator, rose 0.3% for the month, which was inline with expectations.

On an annual basis, wages increased 4.3%, which was 0.1 percentage point below the estimate.

What’s more, the average workweek fell by 0.1 hour to 34.3 hours (more on this shortly when I talk to the problem with productivity)

From CNBC:

So what may have caused the decline in wage gains?

Answer: more jobs in lower paid sectors.

For example, approximately 200,000 of the jobs added were in the following sectors:

- Government (56K)

- Health care (52K)

- Leisure and hospitality (48K)

- Construction (25K); and

- Transportation and warehousing (24K)

Fed Chair Jay Powell has said he would like to see wage growth closer to 3.0% – therefore there is still work to do.

However, the trend appears to be lower (albeit slow).

Now whilst job additions are always a positive (people need jobs!) – what we also need to see are productivity gains.

Unfortunately, this is a very different story.

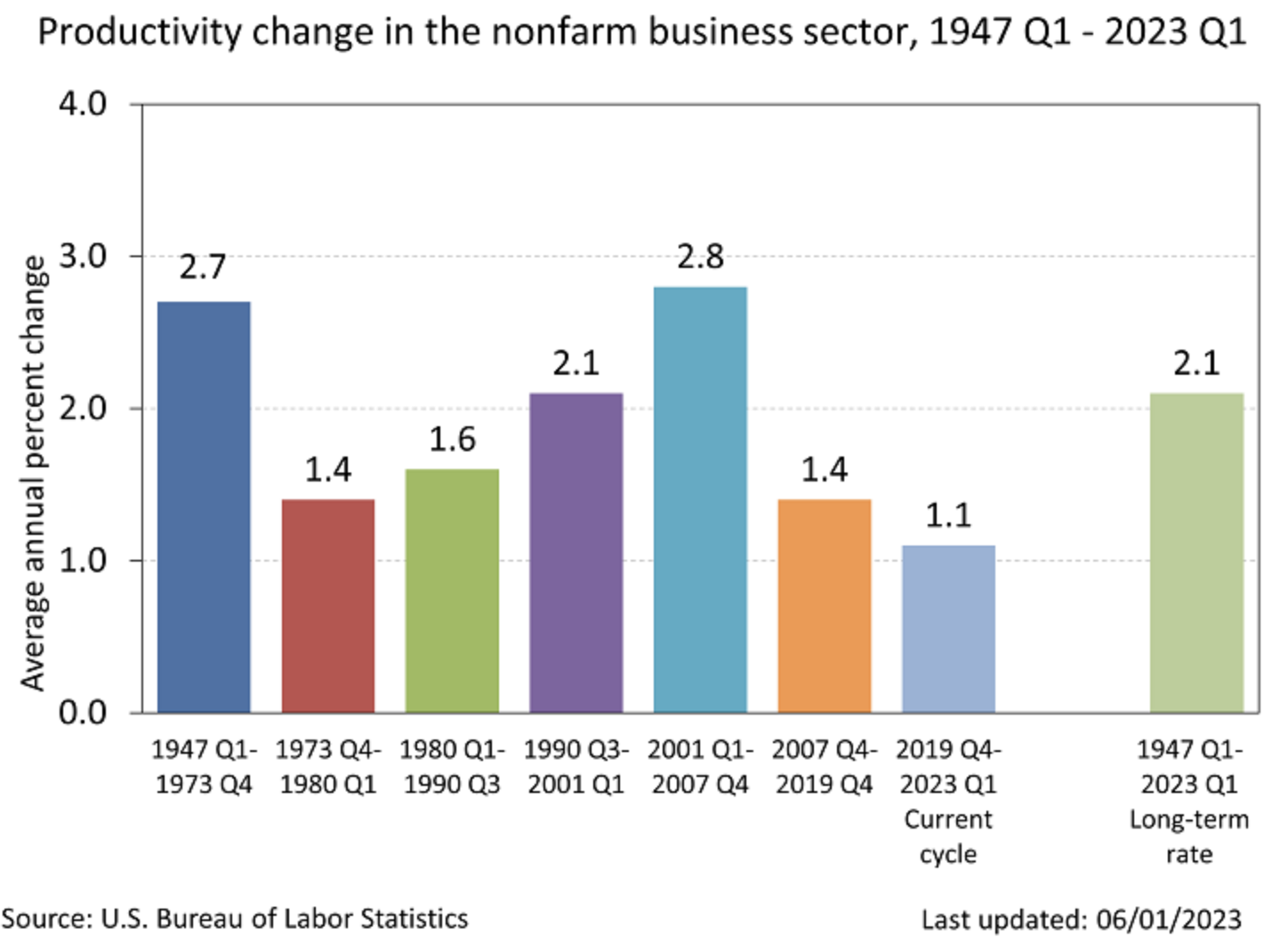

Lowest Productivity Growth Since 1980

Whilst we might have added 339K jobs – are we seeing greater output per capita?

Sadly the answer is no.

Productivity growth has slumped to a new 40-year low.

Put another way, today we require more people (and working hours) to produce less.

That’s not good.

As an aside, maybe “AI” will help change this equation in subsequent years (another conversation)

According to the US Bureau of Statistics – Non-farm business sector labor productivity decreased at an annual rate of 2.7% in the first quarter of 2023, as output increased 0.2 percent and hours worked increased 3.0 percent.

From the fourth quarter of 2019 to the first quarter of 2023, labor productivity rose at a 1.1% annual rate.

The average rate of productivity growth from 1947 through to Q1 2023 is 2.1%

The only time it was lower was in the six-quarter period from the first quarter of 1980 to the third quarter of 1981 (1.0 percent).

Labor productivity, or output per hour, is calculated by dividing an index of inflation-adjusted output by an index of hours worked for all persons, including employees, proprietors, and unpaid family workers. Unit labor costs are calculated as the ratio of hourly compensation to labor productivity.

Yes – job additions are good for the economy – but productivity gains are more important.

Here’s a silly analogy to make a point:

- Let’s say we hire a government employee to dig a hole in the road.

- That counts as one job and we have produced a hole.

- We then ask that person to fill the hole in again.

- That’s more hours worked (with 1 job added) – with zero output.

Job added with no productivity.

My point is it’s lazy thinking to conclude if we are adding “300K” monthly jobs it implies the economy is doing well.

The better question is what are those jobs producing?

What’s the output per capita?

Or are we simply hiring more people to ‘dig holes and fill them in again’?

Scratching below the surface – we see that GDP, gross domestic income and broad labor trends do not look good.

The Fed sees this…

Sure… ‘300K’ job additions makes for a positive headline.

And most of the mainstream have concluded the economy is in robust shape – which may help explain the enthusiasm with industrial and cyclical stocks today.

But how strong is the economy really?

What if the Fed Hikes?

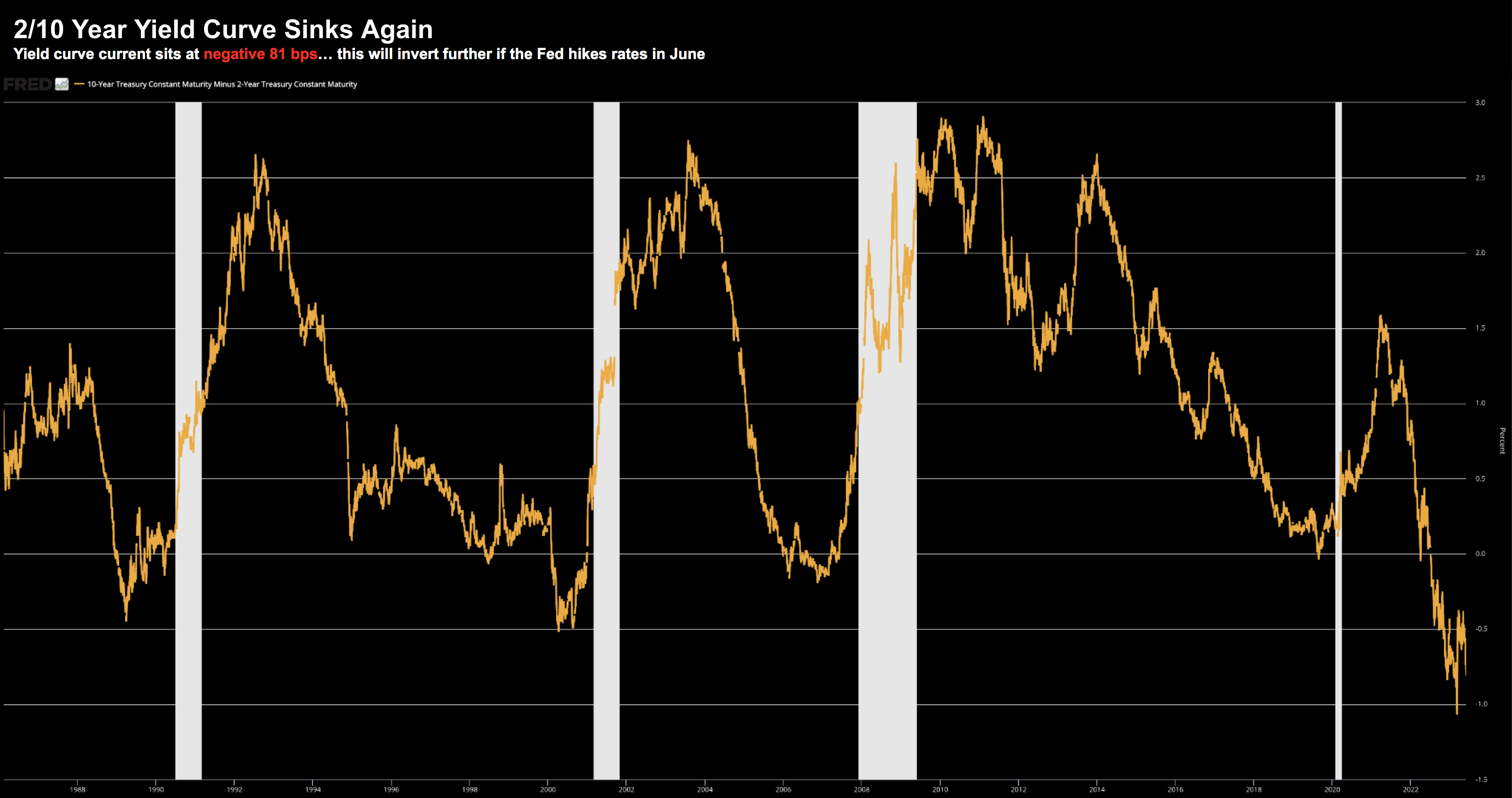

If the Fed does decide to raise 25 bps in June (I don’t think they will) – they’re going to further invert the yield curve.

June 2 2023

I haven’t talked about the 10/2 curve the past few weeks – as it looked as though it was trying to steepen.

However, this was on the back of expected rate cuts.

Why this is important is the banking system doesn’t work with a negative yield curve.

Banks make money when this is positive.

For example, a bank’s business model is to “buy short and lend long”.

This requires the short-term rate trade below that of the longer end.

At the time of writing – the short term rate is meaningfully higher.

That doesn’t work.

And with the regional banking ‘crisis’ not yet over – any further inversion isn’t helpful.

From mine, I think the Fed will be mindful of this.

Market Cheers the Result

Irrespective of what appears to be questionable underlying economy – the market cheered the ‘goldilocks’ number.

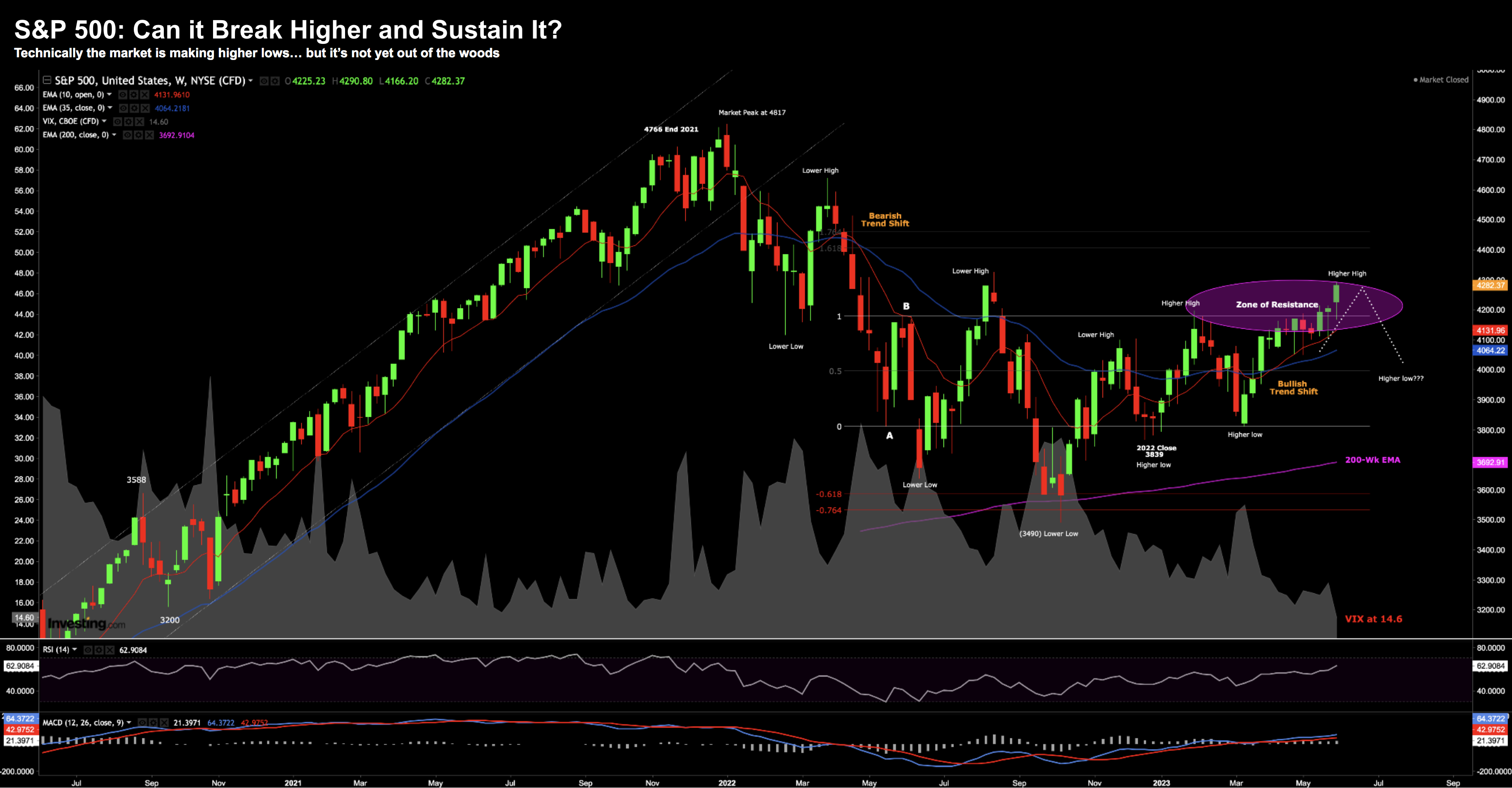

The S&P 500 pushed well above 4200 however still trades in what I think is a general zone of resistance.

Further to previous missives, I would like to see the market not only hold above 4200 – but do that for a number of weeks to give this trend weight.

On the other hand, if the S&P 500 falls back through 4200 it will be very bearish (i.e. a “false break”)

June 2 2023

- Two higher lows and higher highs since the low of October last year

- The weekly trend is bullish – turning in April.

- The MACD (momentum) indicator is positive.

All of these things suggest the direction is likely higher.

And as I said last week – we could easily see another 5% upside from here.

However, the meaningful break is only one week old.

Whilst positive, we need to give this a few weeks before we could give it weight.

For example, what I don’t want to see is a false break, where it reverses back below 4200.

We saw this in August last year after an incredible run high – and to a lesser extent January this year.

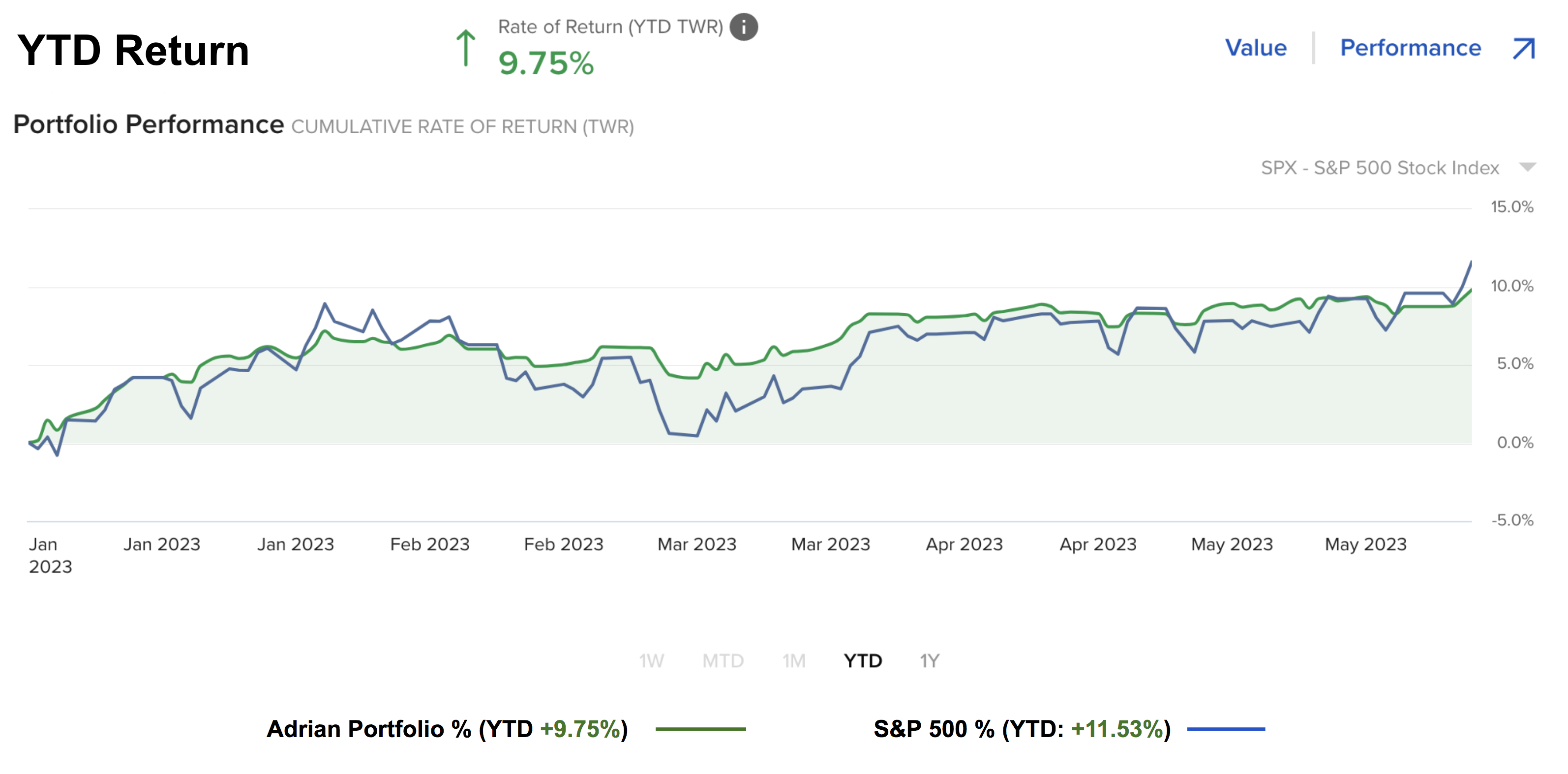

I’m happy to stay long the market (65% exposure) – with no short positions – where my portfolio is up ~10% YTD.

I am fractionally lower than the S&P 500 – however I am taking much less risk.

I remain extremely mindful of the downside potential.

June 2 2023

For clarity, I am not looking to add exposure at this level.

I think we will get a better opportunity in the next ~6 months.

Putting it All Together

Following today’s jobs report – the market has a probability of a Fed June hike at ~35%.

Put another way, a pause remains the likely outcome.

As an aside, it’s worth noting the jobs number saw a sharp decline in the number of people who were once self-employed.

There are now 8.73 million Americans who are self-employed without owning their own company.

That’s down from a peak of 9.51 million in August 2021, and it’s even lower than the 8.89 million registered in January 2020, before the pandemic hit.

This tells me people are being forced to go and find other work – taking what jobs are on offer.

For example, I’m sure a large part of the 339K increase is people working more than one job to make ends meet. Unfortately we don’t get that level of data in the report.

The headline today looked strong but the devil is always in the detail.

Will it be enough for the Fed to raise in June?

I don’t think so… not after looking through the composition of the report.

And with wage growth falling – and bank credit tightening – this will please the Fed.