- Chips lead the way to start the year

- S&P 500 trading at the average year-end analyst target

- Parallels b/w Cisco and Nvidia – lessons from 1999/2000

Momentum is a powerful force.

Bet against it at your peril.

John Maynard Keynes was believed to have said “… the market can remain irrational longer than you can remain solvent“

Sound advice.

Those expecting (or worse betting) the market would reverse to start 2024 are probably questioning their decision.

It’s been one record close after another. Higher highs beget higher highs.

The Nasdaq 100 notched gains for the fifth straight day, while the benchmark S&P 500 managed to scale its fourth record in a week.

Jan 24 2024

Year-to-date gains have been mostly come from the semiconductor sector – specifically stocks such as Nvidia (NVDA), Advanced Micro (AMD) and Taiwan Semi (TSM)

Consider the following year-to-date chart:

Jan 24 2024

NVDA and AMD are each up over 20% to start 2024.

ASML and TSM are also up double-digits.

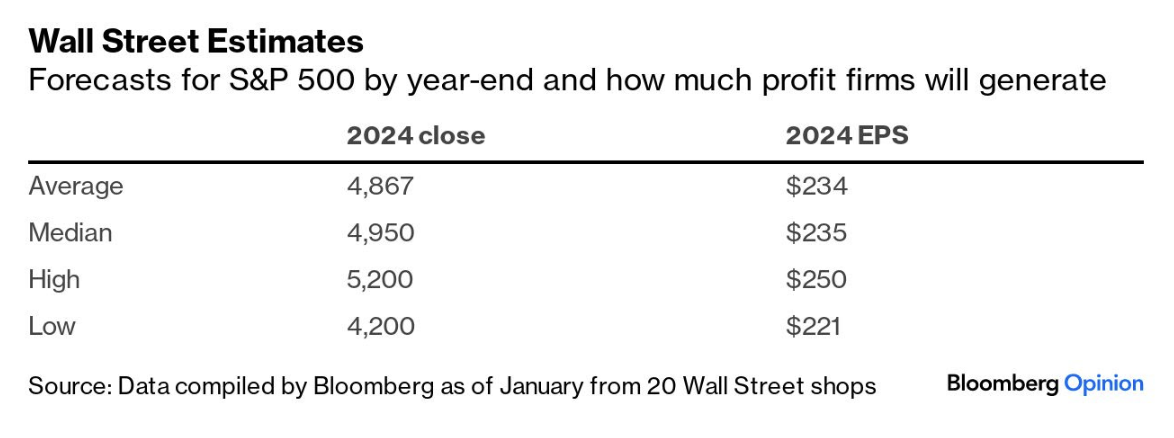

Given the gains in semis, specific AI related stocks and Netflix – the broader S&P 500 Index is now at (or above) the average year end targets.

According to Bloomberg Opinion – among the 20 estimates reviewed – the average EOY target is 4,867 with Earnings Per Share (EPS) estimated at $234.

At today’s close 4868 / $234 = 20.8x (which assumes ~12% EPS growth)

- Upside of 6.8% (at 5200); with potential

- Downside of 13.7% (at 4200)

Lessons from Two Decades Ago…

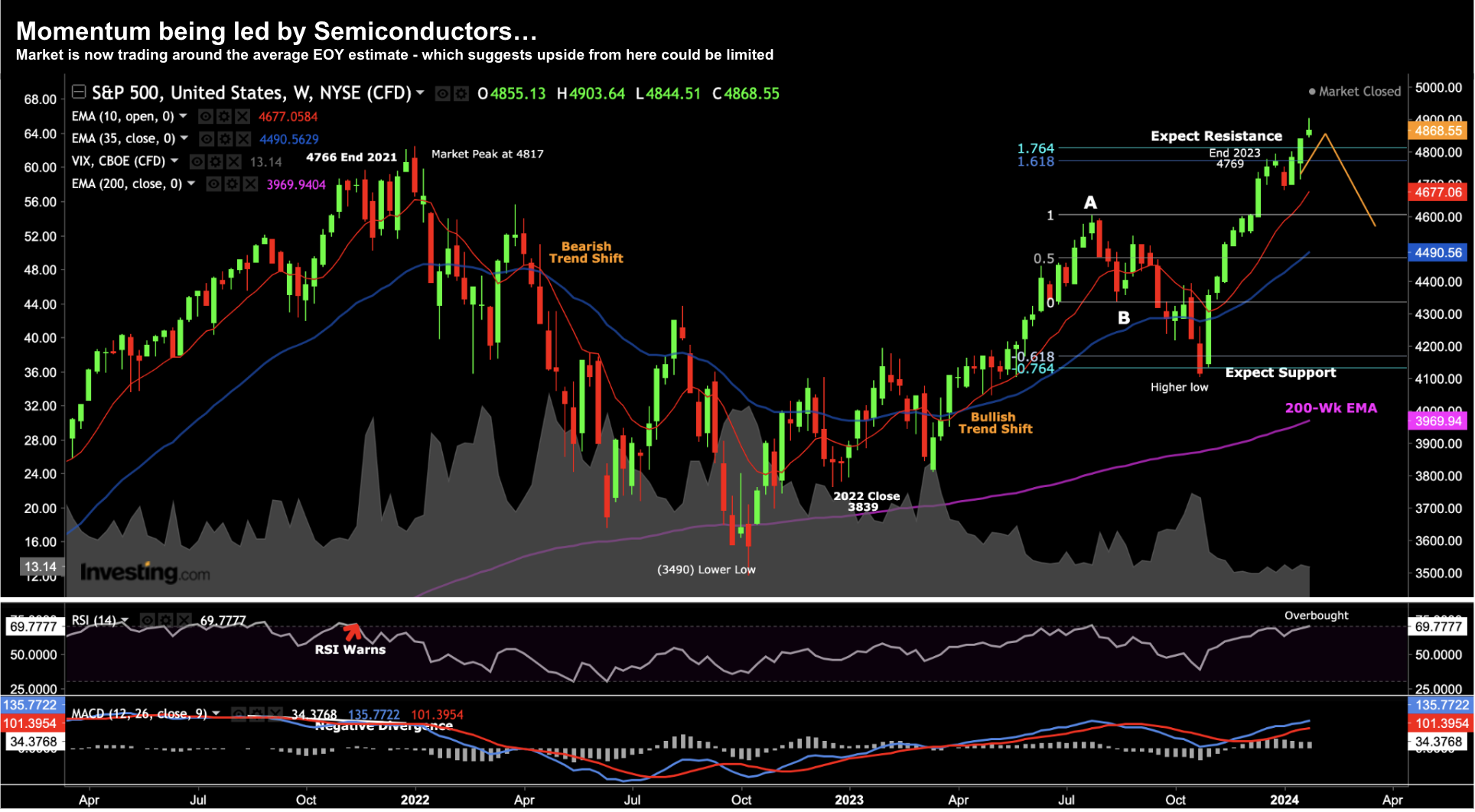

What’s worth paying attention to is the velocity of the move.

For example, we can observe both (i) the distance above the 35-week EMA; and (ii) the weekly RSI.

At the time of writing, the weekly RSI is 69.8 – very close to the overbought value of 70.

And whilst the RSI can remain extended for long periods (e.g. several weeks) – often corrections will occur from this zone.

Arguably the biggest bull on Wall Street – Ed Yardeni – who sees the S&P 500 trading 5,400 by year’s end – also warns of the rapid ascent higher.

Again, from Bloomberg Opinion:

“The S&P 500 may be starting a tech-led melt-up similar to what happened during the second half of the 1990s,” Yardeni wrote in a note.

“We’re wondering whether a bout of irrational exuberance might push the multiple higher, inflating a speculative bubble in the stock market as occurred during the late 1990s”

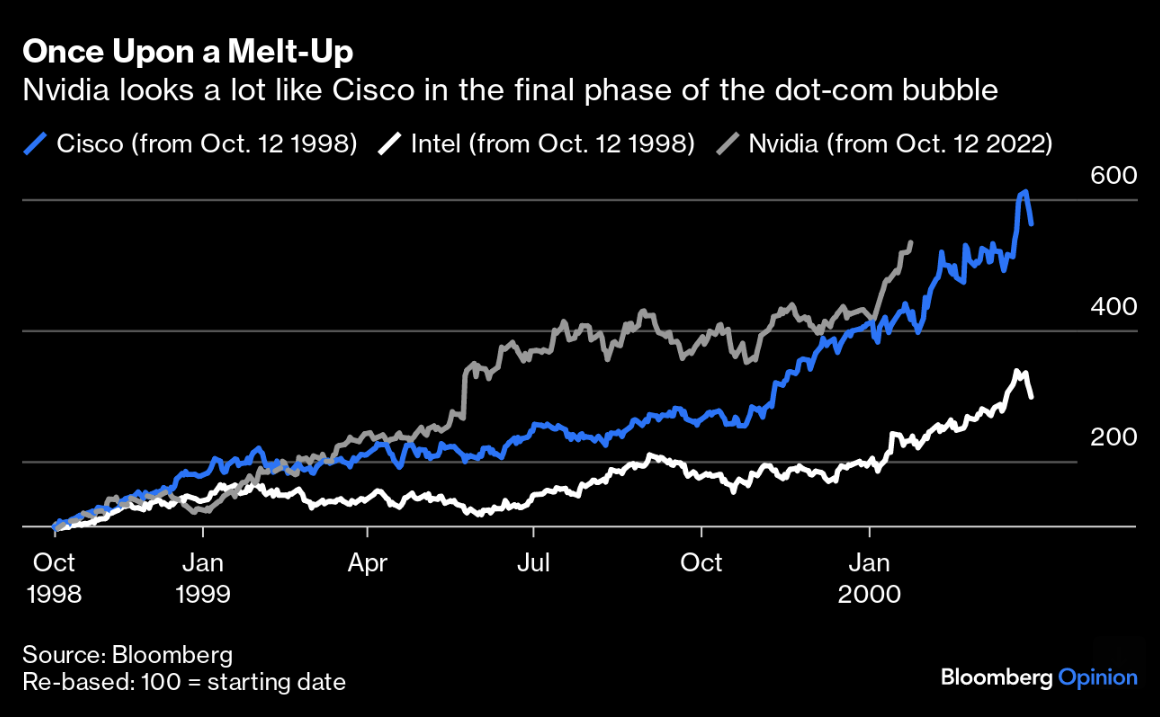

The parallels between the speed of this rally and the definitive melt-up that lasted from 1998 to early 2000 are eerily close.

It’s easiest to compare Nvidia, by far thought most likely to benefit the most from the new technology, to Cisco Systems Inc. back then.

The company that dominated the production of the routers necessary for the internet to function was, like Nvidia today, already well-established and not a start-up yet to make a profit like many dot-coms. Another more direct comparison would be Intel Corp., then the dominant maker of chips.

Not only does Authers cite parallels to tech stocks – he also cites the Fed pivot in 1998…

Handily, the earlier melt-up dated from a surprise pivot by the Federal Reserve in October 1998, and the current one got going on almost exactly the same day of 2022 — after a surprise pivot by the Fed.

Here is how Cisco’s and Intel’s performance to their peak in March 2000 compares to Nvidia’s rise to date:

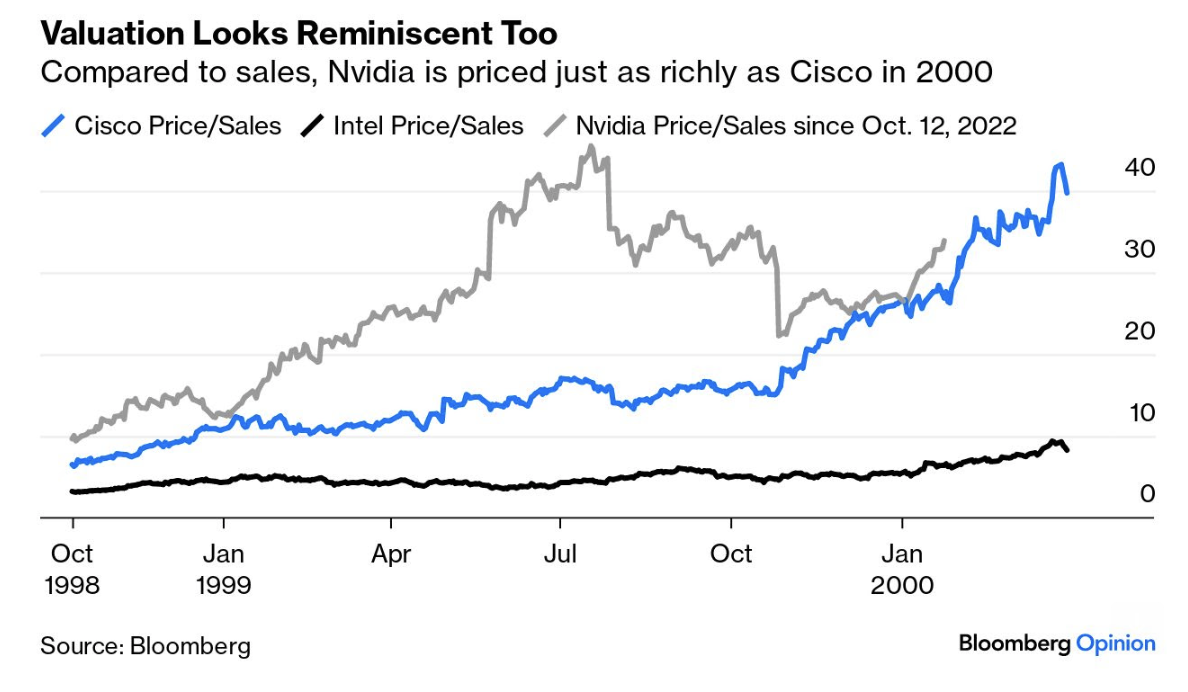

But it’s not just the ‘tape’ which is similar (i.e., the technical set up) – so too are lofty valuations:

For anyone who has high exposure to NVDA – I hope the stock doesn’t follow the same (longer-term) path of CSCO.

After the stock peaked in 2000 – its share price proceeded to plunge 89%

It took a 21 years to reclaim its previous high.

Below is the tape for the former (tech) market darling of 1999.

My best guess is there will be some AI stocks (not necessarily NVDA) that follow a similar script the next few years (i.e., not necessarily in the near-term)

Let’s Hope NVDA Doesn’t Repeat CSCO’s Long-Term Path post 2000

Proceed with Caution…

Auther’s points out that “…most of history’s great speculative excesses weren’t stupid“

That’s true.

And we could easily argue that the optimism surrounding AI is warranted.

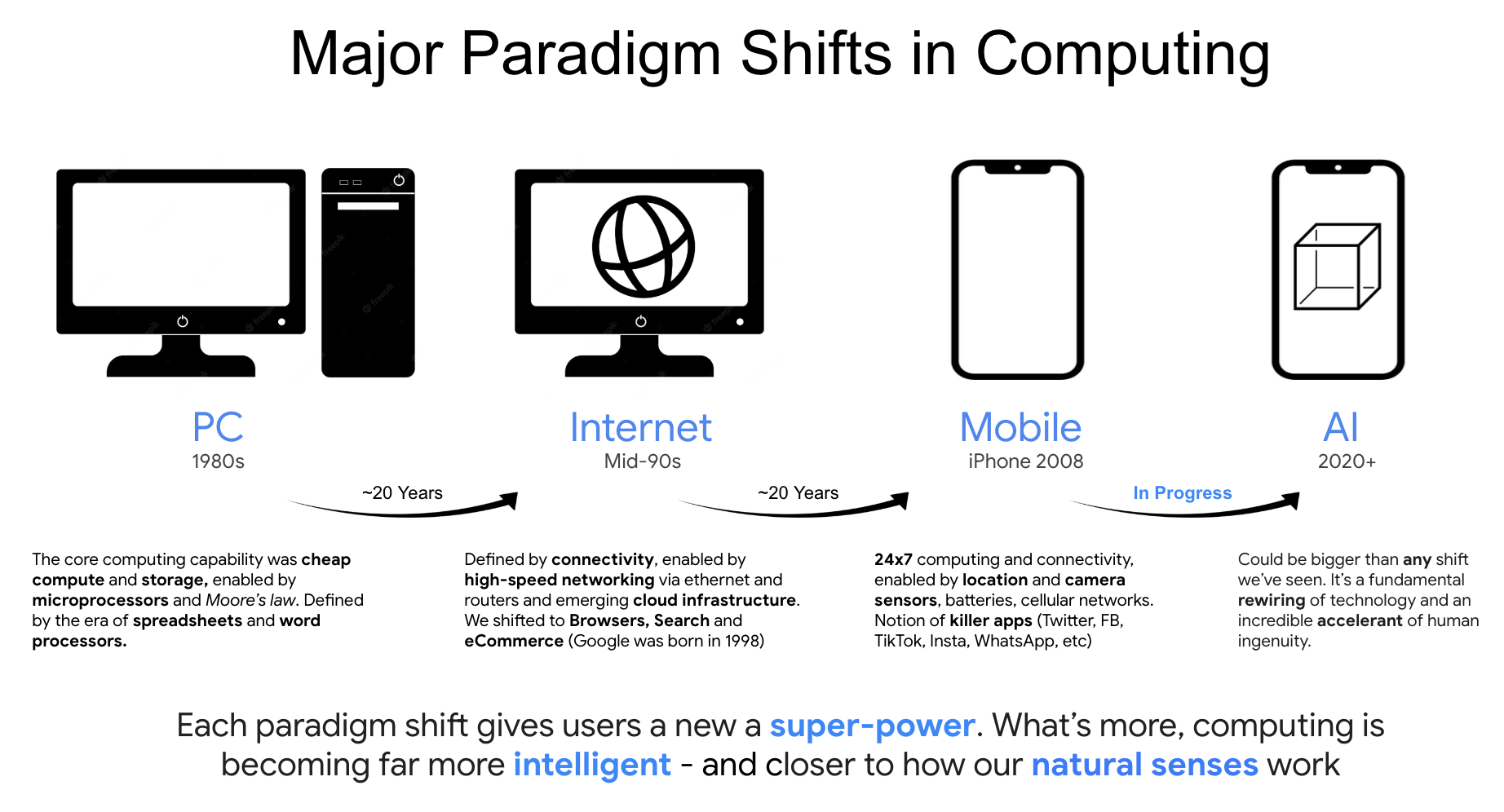

As an aside, as part of an ‘AI themed lecture’ I recently gave to a University – I described AI as potentially having greater impact than each of the three previous major ‘paradigm shifts’ in computing.

Think of it as a fundamental rewiring of technology – set to meaningfully accelerate human ingenuity.

I offered this 40-year framework – including examples of the various ‘super powers’ given to users with each shift.

What ‘super powers’ will AI give us?

Source: Adrian Tout

Cisco played a critical role with the internet – enabling routing technology and networking.

Companies such as Google and Amazon would not have been born without their innovation.

Nvidia is playing a similar role today – as companies depend on the power of their GPUs.

But from an investment perspective – there’s a challenge:

It’s very hard to value the future growth of such shifts.

Forecasting is not just hard… it’s near impossible.

For example, we still don’t know what the leading (monetizable) use-cases will be?

We didn’t know that Amazon would be the world’s largest retailer and cloud service provider (compute and storage) when Jeff Bezos starting selling books from his garage.

And just like we didn’t know the substantial role apps would play in the new mobile economy when Steve Jobs announced the Smartphone in 2008 (where personal computing would shift to being location-based 24×7)

The same innovation investment lessons apply to the advent of things such as electricity, cars, railroads and so on. All were transformative with seemingly endless possibilities.

However, each also created the potential to lose a lot of money in the short-term.

Putting it All Together

I work in the field of Artificial Intelligence (AI).

25-years ago I was part of talented team that developed maps for use-cases such as in-car navigation systems and web mapping (well before Google was born).

At the time (late 90s) – I didn’t see the incredible impact the smartphone (with GPS) would have some 10 years later.

About 10-years ago – I started working on applications with computer vision and neural networks (where the phone is enabled with the ability to understand its environment (not unlike how humans see).

Today, we label tech like (not limited to) computer vision and machine learning as “AI” (among other things such large language models (LLMs)

And that’s fine…

However, people who are arguably less familiar (who also may not be familiar with the many challenges) have become excited quickly.

In turn, this excitement has led to rampant speculation opposite the “promise” of the tech (which we see often)

We saw the same thing with CSCO and EMC in the late 90s.

I find this curious. For example, whilst I work directly in the field – I can’t put a value on it.

It’s simply far too early…

For example, I can’t tell you what the compelling use-cases will be in 2, 5 or 10 years time (we’re still figuring that out).

I can make a few educated guesses (as we’re testing many) – but I don’t pretend to know where this tech will go.

Just like I could not tell what innovations would result from the Internet in 1997.

For now, it’s not stopping investors making some aggressive bets on the promise of the tech.

Again, we saw similar speculative behavior with networking and storage in 1999.

The future of the tech is incredibly exciting.

No one questions that. But it’s not a straight line.

Don’t get caught on the wrong side of the tape in the near-term.