- Never take the headline number at face value

- Rate hike probabilities rise slightly after jobs report

- All eyes turn to Sept CPI – will Core fall below 4.0% YoY?

Here’s a tip:

Never take a headline print at face value.

There’s always more to the story – where it pays to dive into the details.

Digging below the surface takes some work – however it’s worth doing.

Last week was a great example…

The BLS told us 336,000 jobs were added vs expectations of 160,000.

Now on the surface, you could be excused for thinking it was a ‘blowout’ jobs report… indicating a very strong economy.

Reality however suggests something else…

And based on what I am about to present – there’s enough weakness to suggest the Fed might still pause next month.

Let’s start with a few questions…

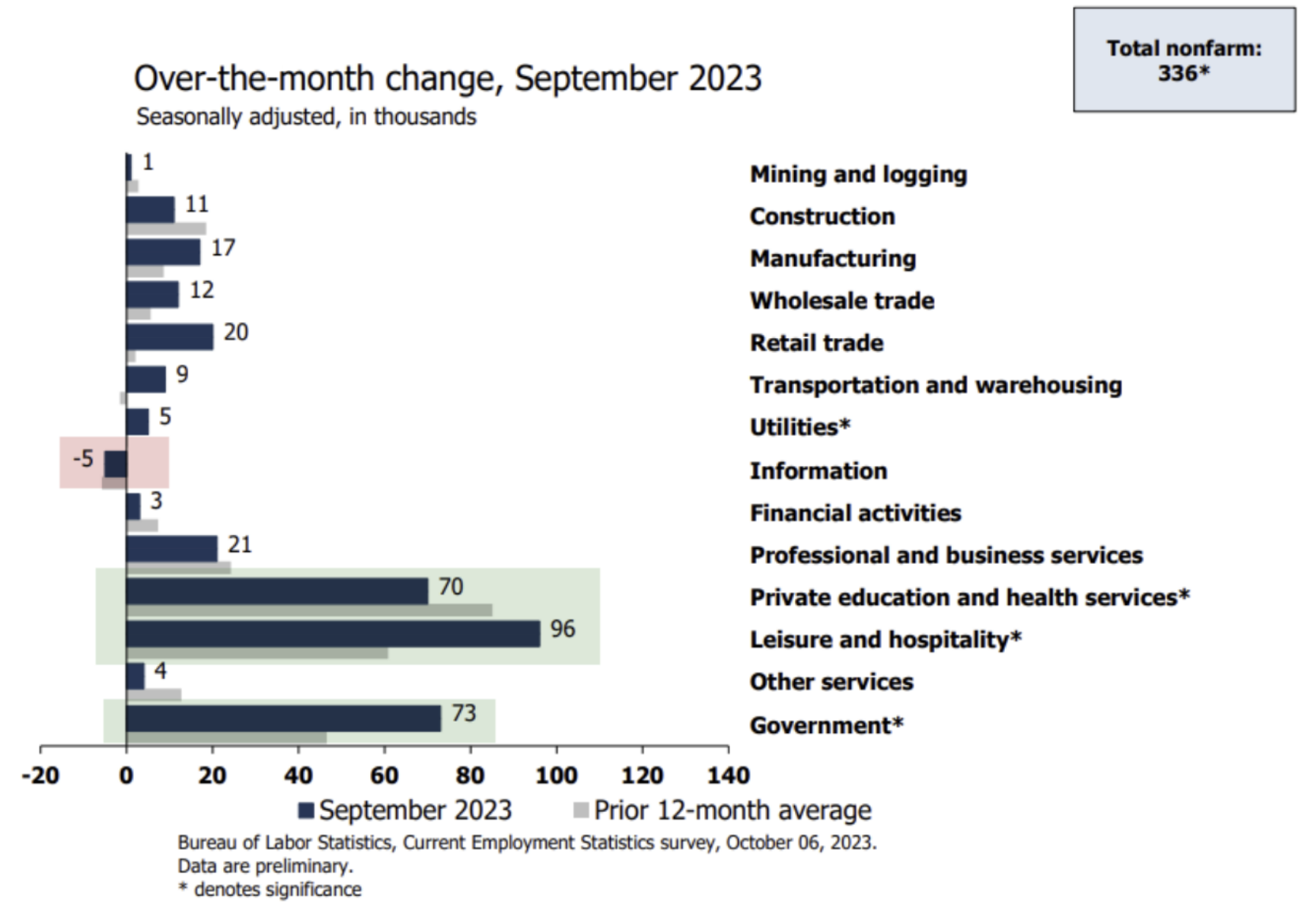

Where Were the “336K” Jobs Added?

The first thing I question is where were jobs added (or lost)?

For example, were they high paying ‘career’ type jobs?

Or were they government jobs (which isn’t good); or part-time temporary jobs (which are often seasonal)

Below is the breakdown from the BLS:

- Private education and health (70,000);

- Government (73,000); and

- Leisure and hospitality (96,000)

Government jobs are not what the economy needs for sustainable growth.

These jobs consume more public resources – adding to an already ballooning debt (which will be financed at far higher costs / taxes)

By contrast, the information sector (typically higher paying (essential) knowledge-based work) lost 5,000 jobs.

Ideally, we see growth in private sector long-term based jobs.

This isn’t the case…

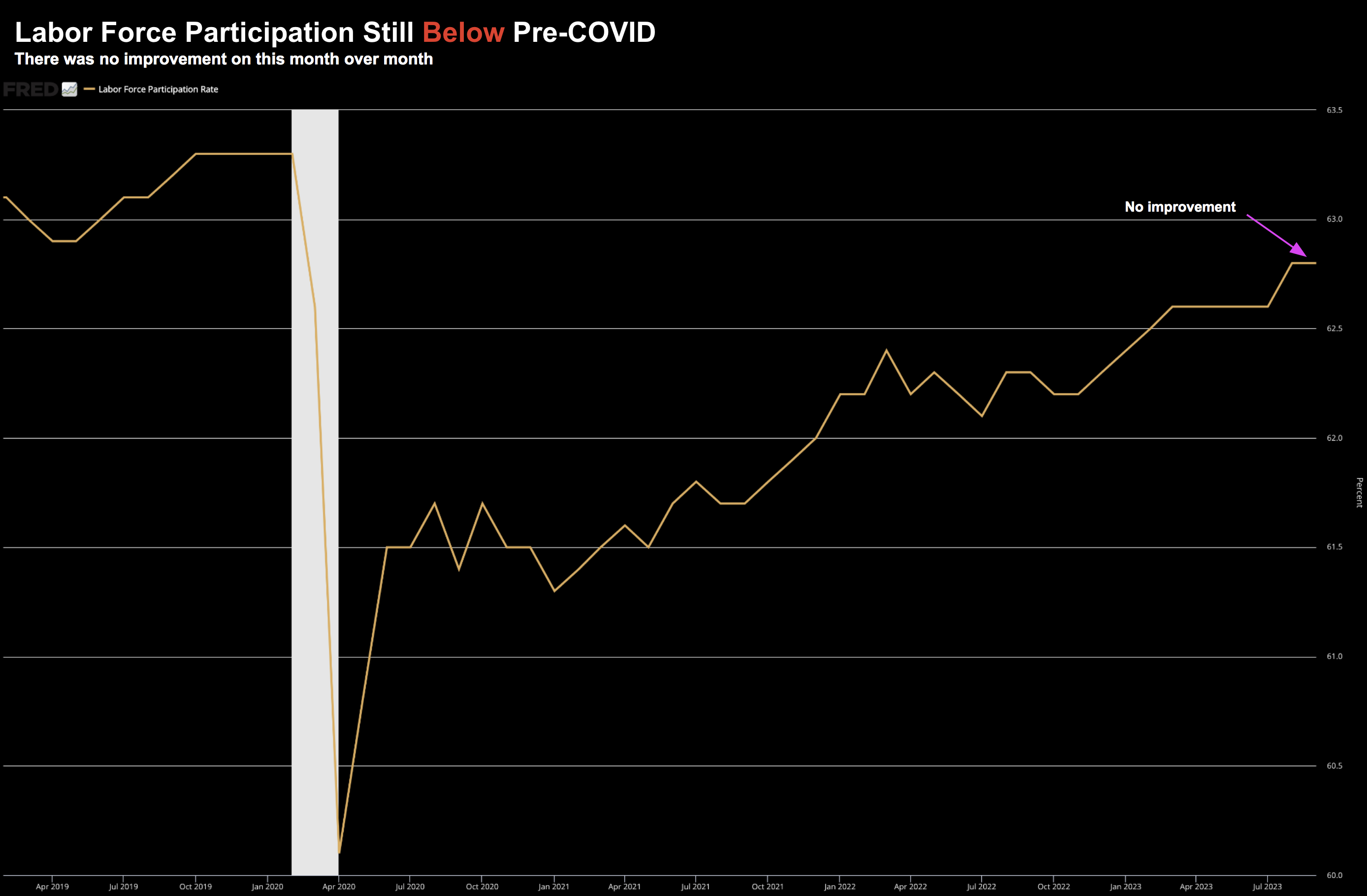

Did the Employment and Participation Rate Increase?

The second question to ask is whether both the employment and participation rate increased?

The answer was marginally.

Whilst there were said to be “336K” job additions – employment only rose by 86,000.

Why?

Because many people are still leaving the workforce (e.g. retiring, choosing not to come back to work etc)

For example, the participation rate (those looking for work or working) did not increase (see below). It was flat month over month.

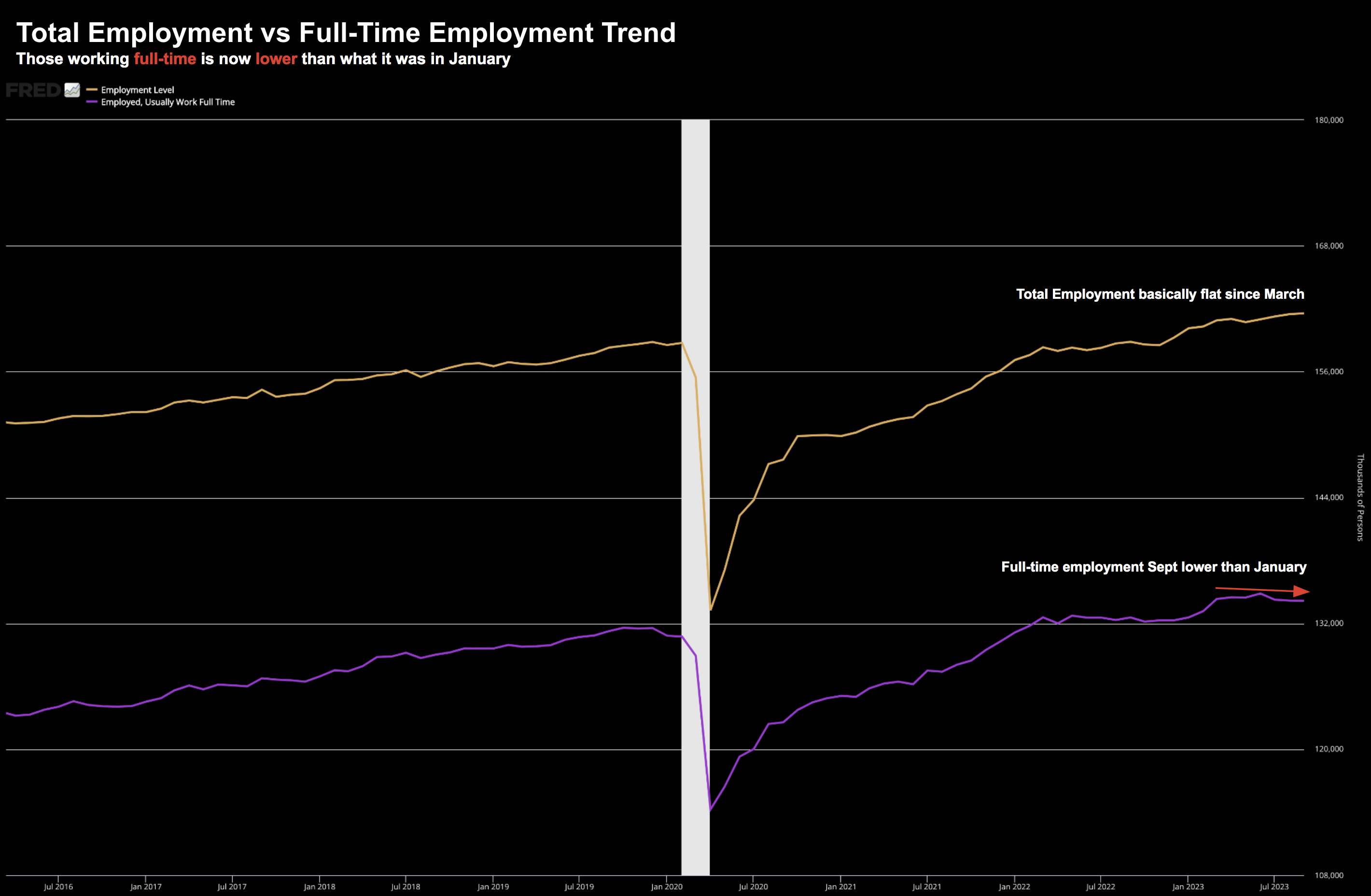

However, look at what we see with full-time employment (further to my earlier point about where jobs are being added)

October 8 2023

The orange line shows total employment.

The trend has essentially been flat since March.

However, full-time jobs are declining – now at a lower level than January.

In fact, since June 2023, full-time employment is lower by some 696,000 jobs

In addition, only 43.5% of the employment gains since May of 2022 were full-time.

From mine, this is very typical of a late cycle.

As an aside, the US civilian non-institutional population is 267.4M

Employment is 161.6M.

Put another way, there are ~106M over the age of 16 who are not working (around 40%)

Headline numbers won’t tell you that.

Hours Worked and Wage Growth

Wages and hours worked are also a very important part of the jobs story.

For example, if you worked a handful of hours per week (e.g., four), you are employed (i.e., a positive stat against the 336K)

However, “four hours” of work means you’re unlikely to pay rent.

Let’s start with hours work and then we will look at wages:

Here is what the BLS told us:

- Average weekly hours of all private employees was flat at 34.4 hours.

- A year ago average total private weekly hours were 34.6 hours.

You might now think that a change of just 12 minutes less per week (year over year) isn’t much.

But what if I told you that took some $56B of income out of the economy.

Some quick math:

- There are ~160M people working in the US

- The average wage is $33.88 per hour (which I will explore further below)

- ($33.88 x 34.4 hours) x 52 weeks = $60,604 income per year

- $60,604 x 160M people = $9.69 Trillion per year income

If we increase the time worked by 12 minutes per week – that number rises to $9.75 Trillion (or $56B more per year)

Not small.

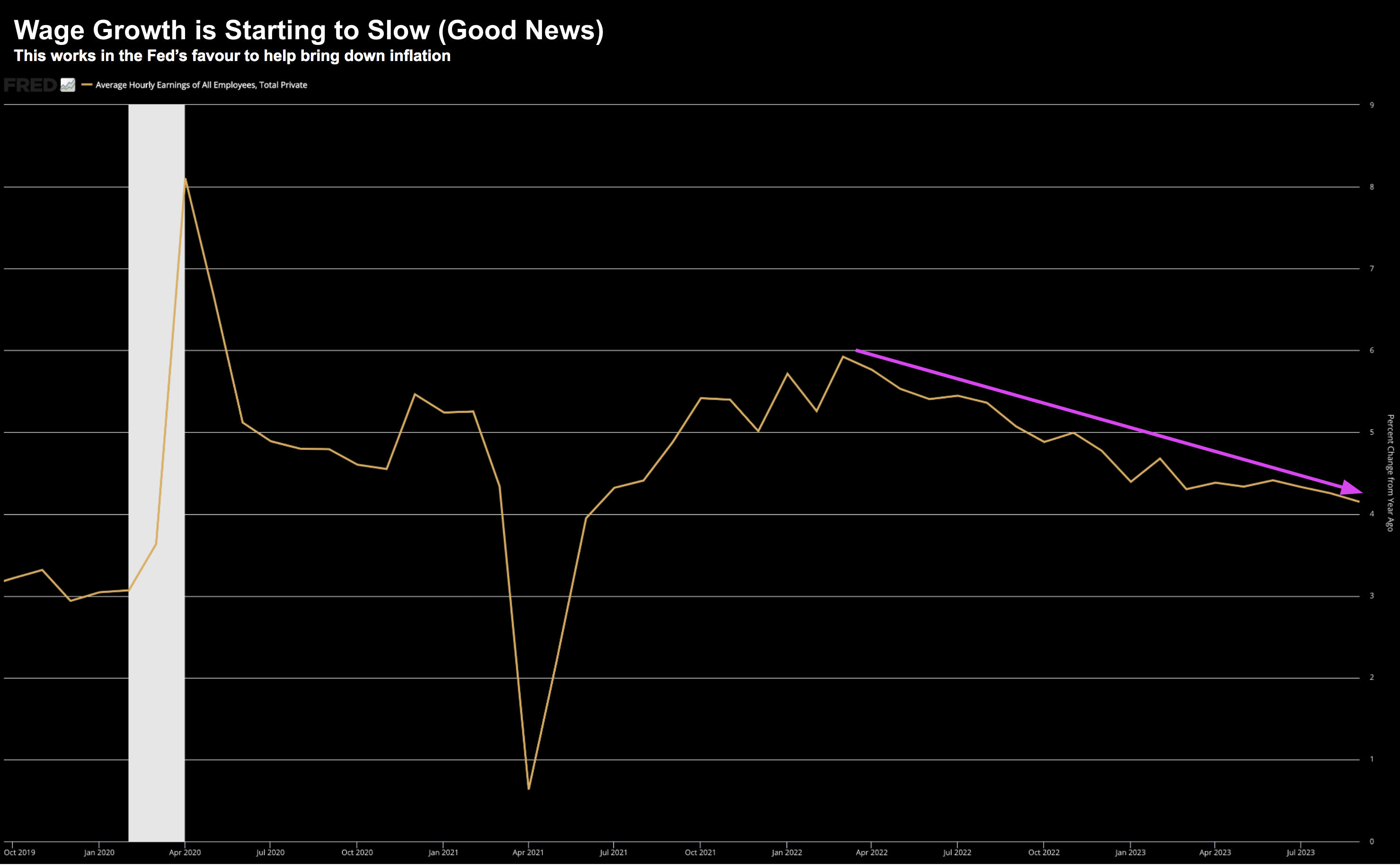

But let’s talk to hourly earnings… what’s the trend?

- Average hourly earnings of All Nonfarm Workers rose $0.07 to $33.88.

- A year ago the average wage was $32.53.

- That’s a gain of 4.2%.

- Average hourly earnings of Production and Nonsupervisory Workers rose $0.06 to $29.06.

- A year ago the average wage was $27.85.

- That’s a gain of 4.3%.

The “good news” is wages are now starting to keep up with inflation (after underperforming for most of the past year or more – where inflation exceeded 4.0%).

Workers are no longer going backwards!

However, the growth in wages is slowing.

That’s something which will please the Fed… less so workers.

For example, the monthly increase for production workers in September was 0.2 percent.

Below is the trend:

October 8 2023

Again, this a good sign for the Fed.

They have said they would like to see wage growth ~3.0% per year – just above their target for 2.0% inflation.

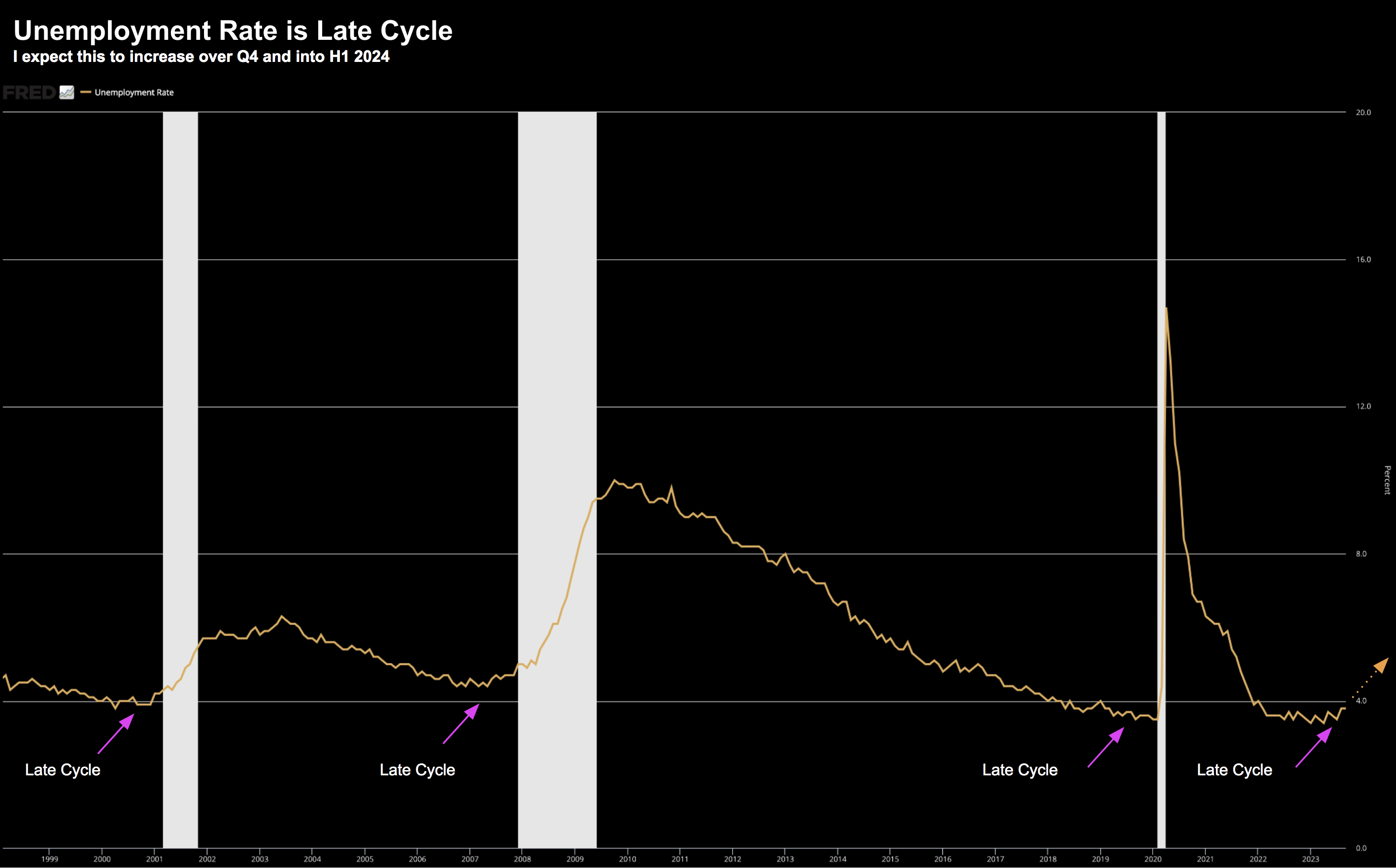

Trend with the Unemployment

The numbers above paint a different picture to the “white hot” jobs headline.

But what about the total unemployment rate?

My expectation is this will increase to levels closer to 5.0% by this time next year… but it will be a slow rise.

And if that’s true – expect a recession (which will accompany much lower inflation)

As I discussed here, we’re now at (or close to) peak employment with signs of slowing (i.e. typical of what you find when we are “late cycle“)

The challenge however is late cycle stages can be elongated.

Today the total unemployment rate has reverted to a level we saw in February 2022.

Slowly but surely this is increasing…. elongated the cycle.

However…

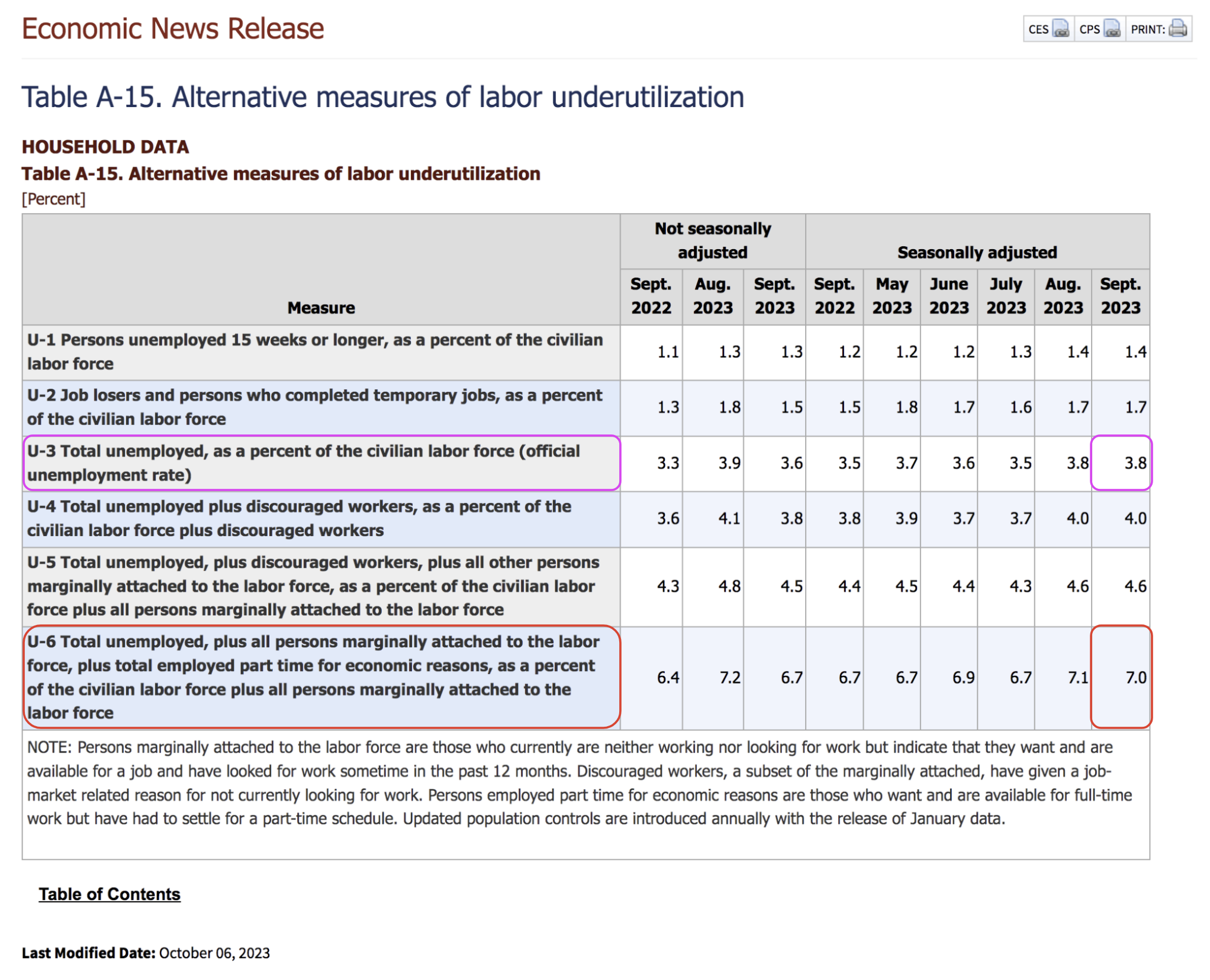

This is an alternative measure of the unemployment rate.

For example, the BLS report provides us an arguably better alternative called “U-6” as part of Table A-15

“U-3” is the number typically quoted in the media (i.e., 3.8%)

However, U-6 is higher at 7.0%.

What’s interesting is both of these prints are lower due to the millions dropping out of the labor force the past few years.

Keep an eye on this trend…

Putting it All Together

At first glance the 336K job additions sounded like very strong report.

For example, bond markets initially reacted by surging higher – only to reverse those gains by the end of the day.

From mine, the report is not as “hot” as mainstream claims.

There are many areas of weakness… which perhaps give reasons for the Fed to potentially pause.

Whilst wage inflation is still ‘hot’ ~4.2% YoY (for all workers) – the pace of growth is slowing.

That’s good news…

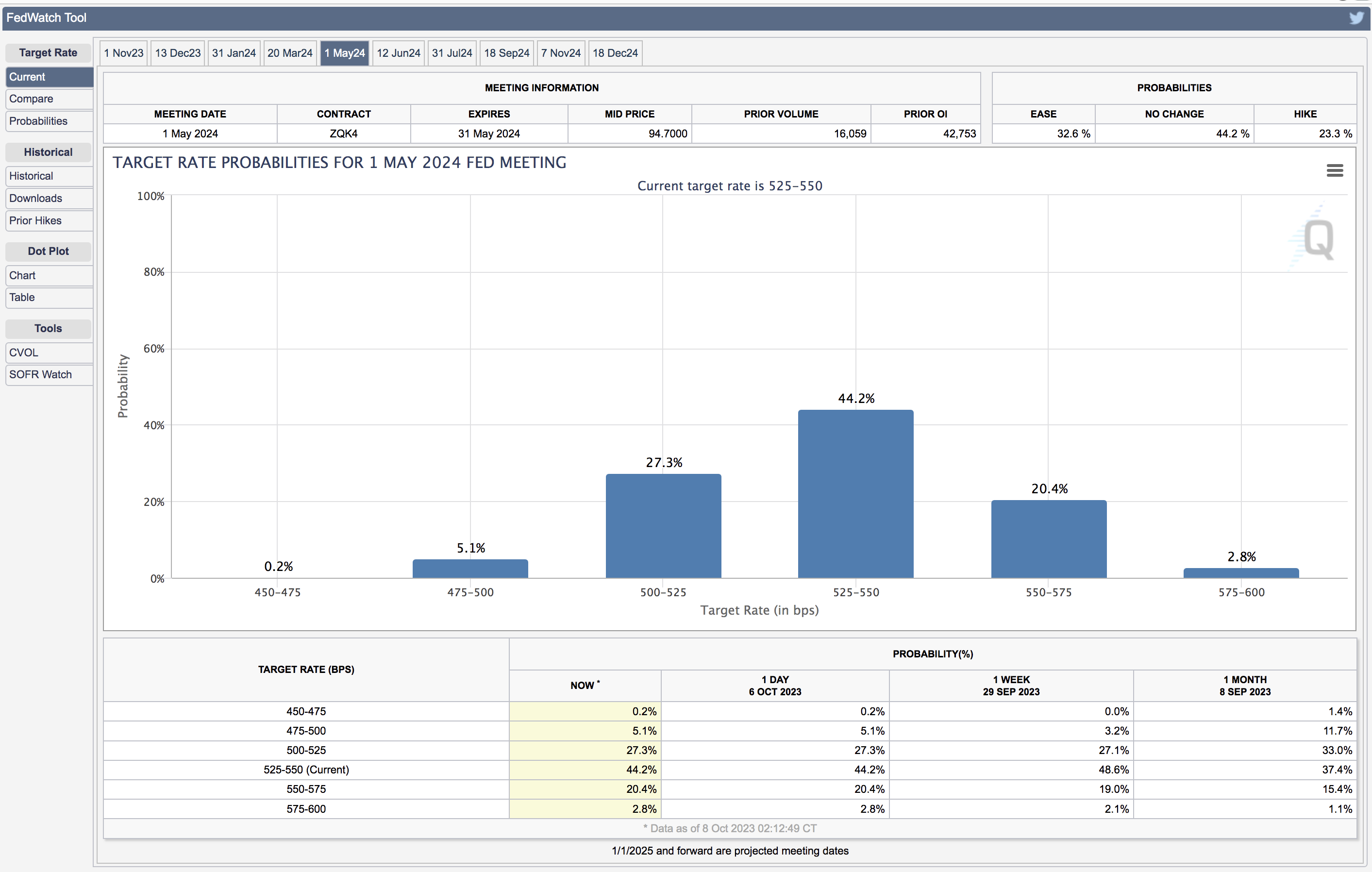

Before I close – below is what the Fed Fund Futures indicate for rates as at May 2024.

Following the jobs report – the market sees a 44.2% chance of the Fed funds rate being 525-550 bps by May next year.

For those less familiar — 525-550 is no change from where we are today.

However, we did see:

- The odds of at least one rate cut by May 2024 fall by 13.3%.

- The odds of at least one rate hike rose by 9.0%

For what it’s worth – the market increased the chance of a rate hike before the end of the year to 42.6% from 33.1%

However, the most likely outcome is no change to monetary policy this year.

Put another way, there was enough weakness in the jobs report for the market to believe the Fed is mostly likely done.

All eyes now turn to September 2023 CPI data – due to be released October 12

Expect headline to be ~3.6% YoY; however Core to still show a 4-handle