- JP Morgan Increases Loan Loss Provisions

- The primary reason inflation is likely to come down

- The shift from lowering PE’s to lowering the “E”

“Geopolitical tension, high inflation, waning consumer confidence, the uncertainty about how high rates have to go and the never-before-seen quantitative tightening and their effects on global liquidity, combined with the war in Ukraine and its harmful effect on global energy and food prices are very likely to have negative consequences on the global economy sometime down the road,”

JP Morgan CEO – Jamie Dimon

The last time we heard from Jamie Dimon he was warning about an ‘economic hurricanes’.

His language was a little more nuanced today — as America’s largest bank by assets saw second-quarter profits slump — building reserves for bad loans by $428 million and suspending share buybacks.

Sounds like a potential ‘Category 3′ storm to me!

The stock hit a fresh 52-week low (~$106) before closing down around 3.50%.

Here’s what they reported compared to expectations:

- Earnings per share: $2.76 vs. $2.88 expected

- Managed revenue: $31.63 billion vs. $31.95 billion expected

- Profit declined 28% from a year earlier to $8.65 billion — driven largely by the reserve build

On the surface it looks horrible.

However, it wasn’t that bad. For example, if you pair back the bad loan provisions of $428M – the result was inline.

That said, there will be losses.

JPM is one of the few major bellwethers I monitor (e.g., Amex, FedEx, Costo, Apple, Walmart others) – for the reason they gives us a good read on the consumer.

And to that end, Dimon was upbeat:

“The U.S. economy continues to grow and both the job market and consumer spending, and their ability to spend, remain healthy,”

As I like to say, never underestimate the US consumer’s ability to spend (whatever the means!)

Unemployment levels are near record lows (below 4%) which means consumers (and businesses) have little difficulty repaying loans.

And if you look at credit spreads – they are not blowing out.

What’s more, rising interest rates and loan growth mean that banks’ core lending activity is becoming more profitable.

But…

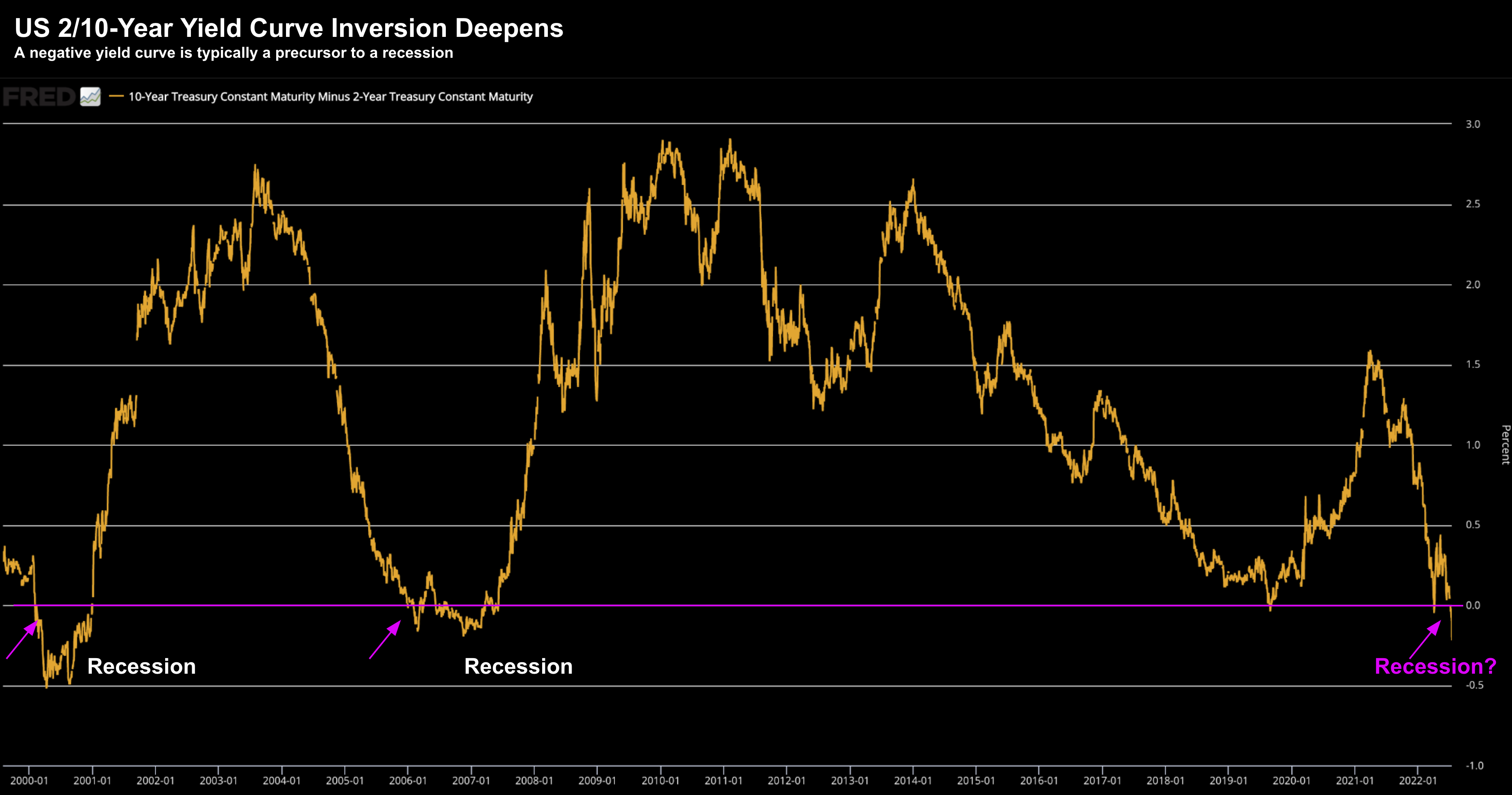

If there is a recession in the wings (which is what the yield curve suggests) – then it will be banks that feel it.

July 14 2023 – Source FRED

The model of “buying short and lending long” doesn’t work so well when the short-end is more expensive (i.e. the inverted curve)

From mine, it’s not surprising that most big bank stocks have sunk to 52-week lows in recent weeks.

The chart above doesn’t make for attractive reading if you are a bank.

For example, revenue from capital markets activities and mortgages has fallen sharply, and firms are disclosing write-downs amid the broad decline in financial assets.

The ‘good news‘ is this is exactly what the market needed to hear.

Further to my recent missives – earnings expectations need to come down and they are.

This is essential in terms of forming a market bottom.

We are not there yet – but we are at least on the right pathway.

However, when you see a quality stock like JPM trading at (or below) book value (currently 1.3x) – you buy it with both hands.

Tip: the best time to buy banks (for the long-term) is going into a recession.

Consider JPM – it traded ~2x book (~$173) September last year. Over the past 9 months it has given back 39%.

The way you trade quality banking stocks like JPM, GS, MS, WFC or BAC is two-fold:

- buy it closer to 1x book; and

- sell it at 2x book.

I deliberately use the word ‘quality’ – as there are plenty of bank stocks you do not want to own despite book value (e.g., Citi).

Why Inflation Will Come Down

Okay moving on…

Yesterday’s 9.1% YoY CPI number was shocking to many.

But it should not have been.

Simply fill up your car with gas or visit a supermarket and you might ask why it was “only” 9.1%…

If you ask me, the real number feels closer to 20% for essential items (not to mention rent!)

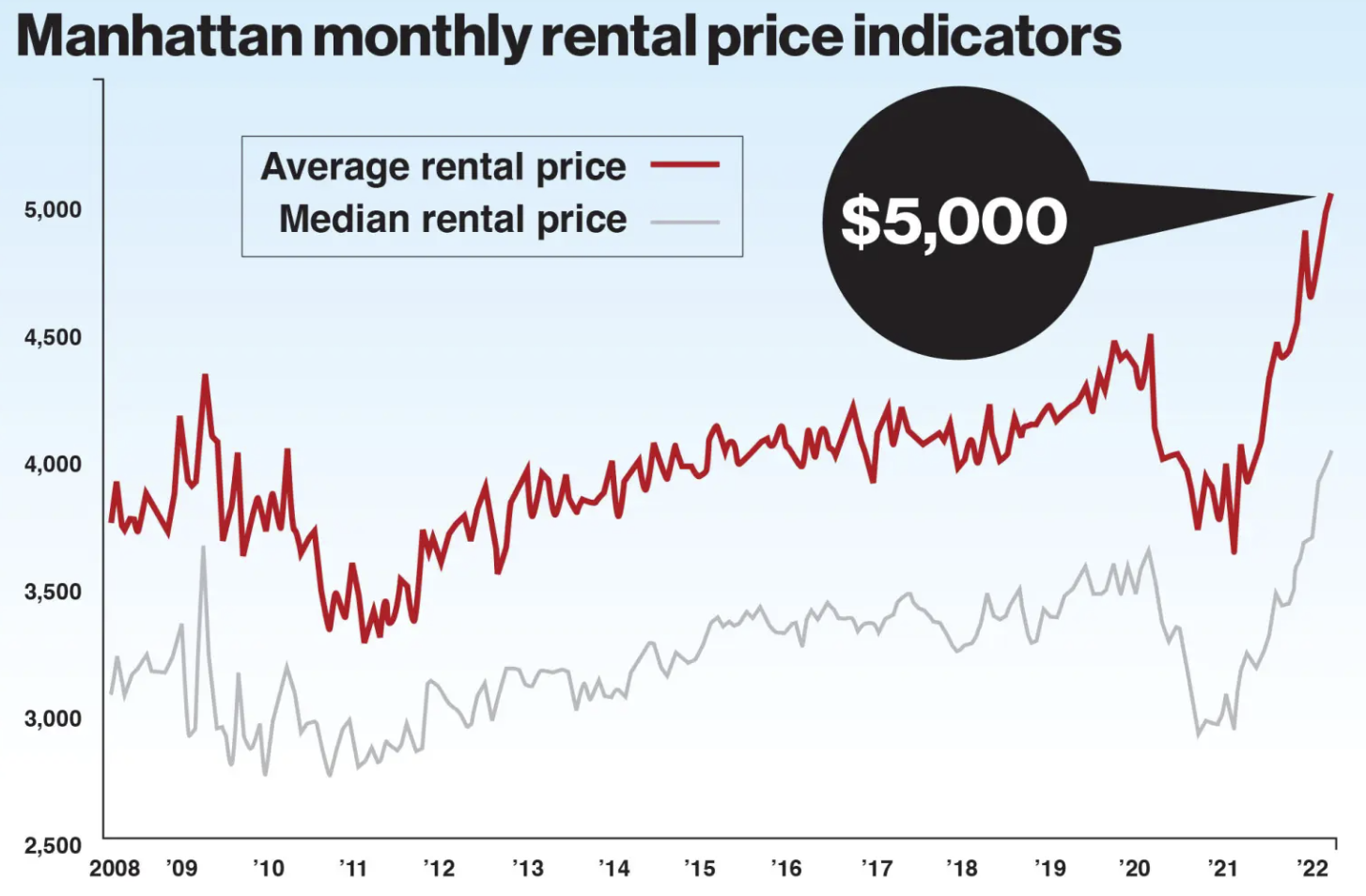

As an aside, I saw rent costs in Manhattan just broke US$5,000 per month (n.b., for Australian’s who prefer prices p/wk – that’s AU $1,722 p/wk on average or nearly AU $90K p/year).

San Francisco (where I live) is also not far behind New York City (I can tell you from personal experience!)

But there is good news on the way…

Now it’s very difficult (and bold) to say inflation has peaked.

That said, if you look ~6 months out… the number will almost certainly be lower.

That’s not to say it will be closer to the Fed’s target of 2% (not yet). But it could be in the realm of 5-6% and trending lower.

The reason?

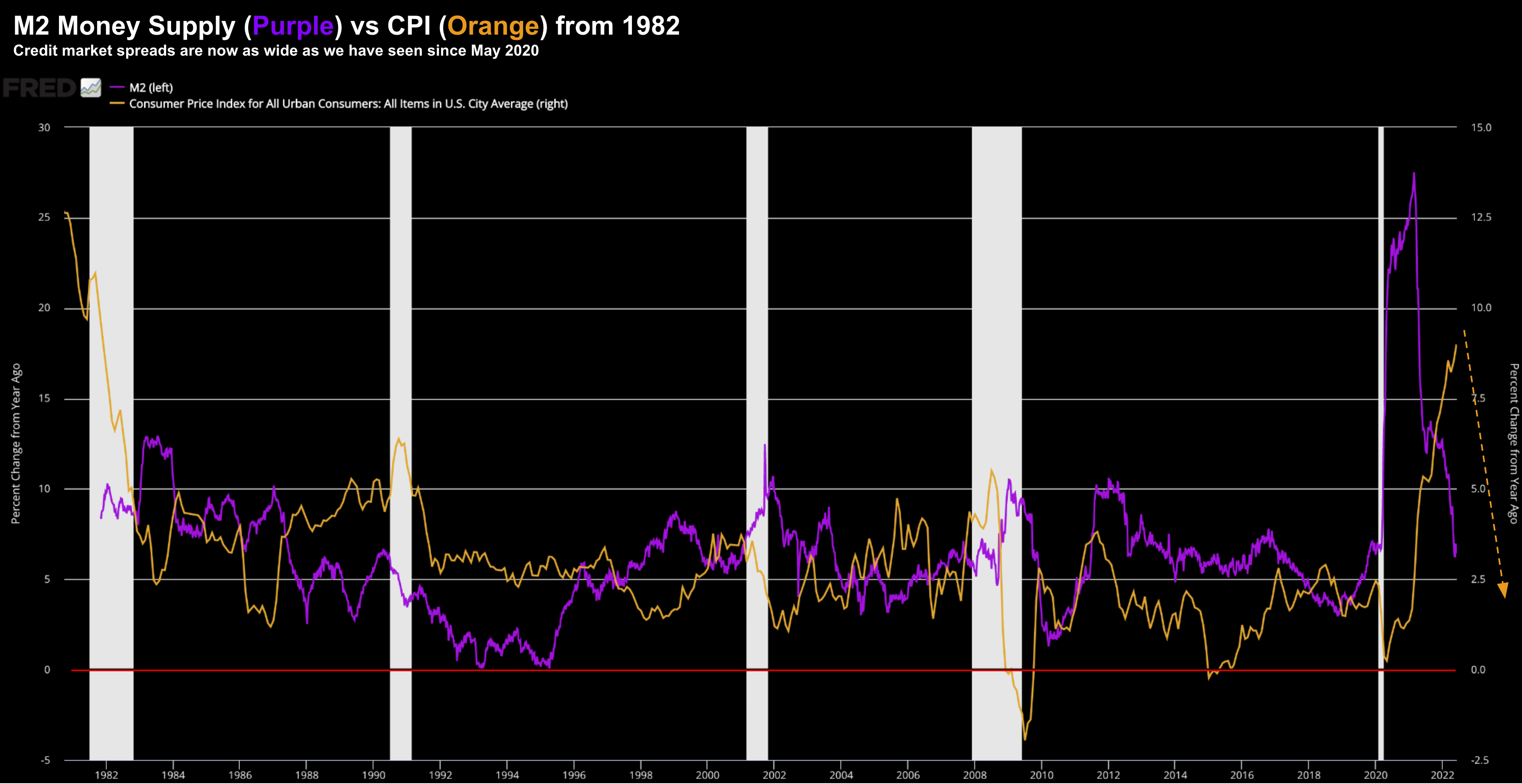

Look no further than the sharp decline in growth of M2 Money Supply

It was around this time last year I warned about the massive increase in money supply vs the (limited) increase in supply of goods.

Inflation results from having too much money chasing the same (or fewer) goods.

If nothing else – this chart demonstrates why we have an inflation problem.

But again, the good news is the Fed has finally realized the error of their ways (only ~12 months too late) and pivoted on money supply growth.

For example, the purple line (left hand axis) shows the rate of acceleration in M2 has fallen to just over 5%.

Over the past 20+ years, M2 growth has average around 6.1%

But look at the actions taken from March 2020…

The rate of growth accelerated to levels north of 25% – resulting in the Fed’s balance sheet growing by some $4.5 Trillion (as the central bank enabled government spend)

Now before we start calling for a peak… we should pay attention to the meaningful “lag” we see between these two variables.

We should expect a one-year lag before any material changes are going to show up.

With the Fed pivot on M2 growth being March 1st… we should see inflation really start to drop in Q1 2023

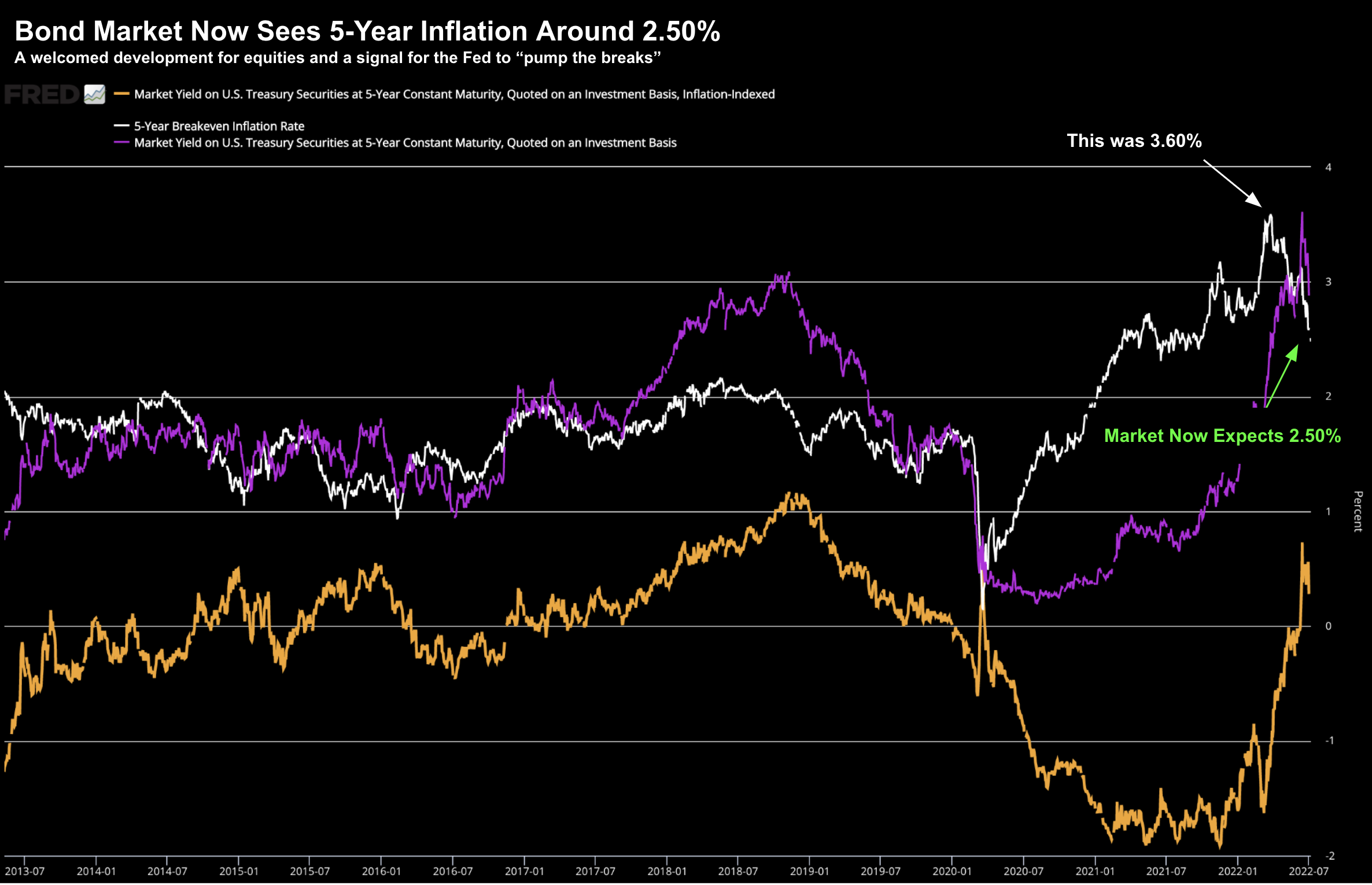

And this is precisely what the bond market has been suggesting…

For example, last week I highlighted how 5-Year TIPS now have inflation averaging just 2.5% the next 5 years (down from 3.60%).

Below is the chart I shared:

Now if you put all this together – it overlaps with what Dimon was saying today.

For example, he touched on the severity of Fed tightening.

What he didn’t say (but should have) is it will be unlike any other tightening we have ever seen.

Again, the reason?

We have never experienced such a dramatic (sudden) expansion in M2 Money Supply.

It’s simply unprecedented (as was COVID and the government’s actions).

But the Fed is now removing excess supply in a measured way – whilst raising rates.

This will almost certainly see inflation lower by Q1 next year.

And all going well, will also likely start to see Core CPI drop meaningfully from 5.9% over the next few months.

Putting it All Together

Uncomfortable levels of inflation are with us for a little while yet.

And that’s hurting a lot of working folks to make ends meet.

What’s more, there is still more “hot air” to come out of the speculative bubble in risk assets (i.e. stocks, houses, crypto etc)

That will hurt a far smaller (wealthier) percentage of people.

But it’s going to be painful for those who simply paid too much (largely opposite the lure of cheap money / quick gains)

However, there’s always light at the end of the tunnel.

We are closer to the bottom than the top with equities (less so with housing!)

And who knows, if a quality business like “JP Morgan” or “Bank of America” gets slammed on recession fears, then I would look to pick up stock for the long haul (e.g. 3+ years).

As these business will rip higher when we come out of recession (they always do)

With respect to this earnings season – investors will be narrowing in on the quality of earnings and their predictability, the quality of balance sheets, and of course the quality of their cash flows.

We’re also moving away from lowering PE’s (e.g., from expectations of “21x to 16x”) to lowering the “E“. We saw it today with JPM… and they won’t be the last.

Hopefully we are blessed enough to see the S&P 500 trading closer to levels of 3500 (or less) – and it will be time to accumulate quality names (if you have the means).