- Dimon warns of further ~20% downside for equities

- Brainard sees “signs of fragility'”in liquidity

- The exaggerated “boom and bust” central bank policy

That’s what I wrote last week.

Today the CEO of the world’s largest bank largely echoed that sentiment.

Jamie Dimon warned of cracks starting to surface – talking to the magnitude of a 40-year shift in monetary policy.

“It’s serious” he said.

And whilst markets can typically absorb a gradual period of higher rates (with less liquidity) – things are moving quickly.

And it’s the velocity which is causing much of the pain.

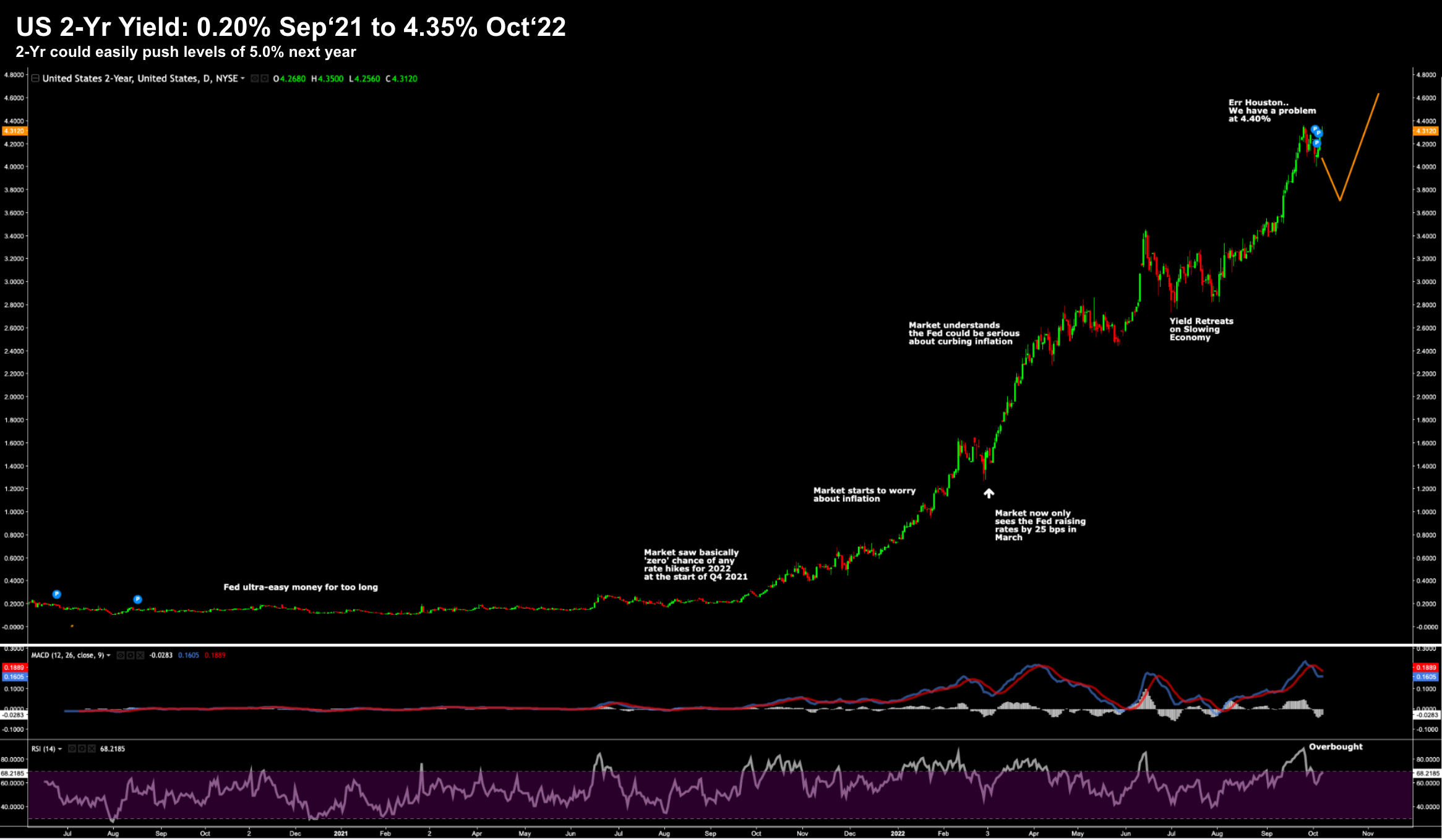

Consider the US 2-year yield – a proxy for the Fed funds rate.

It’s higher by over 400 basis points from Sept 2021. We have not seen a move that acute since WWII.

Oct 10 2022

And we are not finished yet… according to most policy makers.

Tonight I’ll offer a few charts that are the ‘enabling force’ behind Dimon’s warning.

Hopefully these charts will shed some light on why we’re experiencing this kind of volatility.

It doesn’t make it any less painful… but it offers useful context.

What goes up… typically comes down.

But first, let’s look at how Dimon managed to send more shockwaves through markets.

CEO of JP Morgan Warns

Jamie Dimon’s is never one to mince his words.

In June, he warned of an approaching economic “hurricane“… wishing the Fed “all the best”.

He said they’ll need it!

Sticking with his metaphor… you might his new language has rated the coming storm as possible “Cat 5“

When asked by CNBC where we sees a market “bottom” (an impossible question for any investor) – he offered this:

“It may have a way to go… I mean it really depends on this soft landing / hard landing thing… and since I don’t know the answer to that… for me it could easily be another 20%.

And I think like the next 20% would be much more painful.

For example, another hundred basis points will be a lot more painful than the first hundred because people aren’t used to it.

And you know… I think [the policy of] negative interest rates will end up being a complete failure”

Dimon also believes a recession is likely in the second half of 2023 (aligning with what the yield curve suggests).

But I will get to what the market thinks shortly… they don’t like what they see.

However, his forecast for a possible 20% further downside is not without reason – fundamentally and technically.

First, a brief comment regarding the ‘wisdom’ of negative interest rates.

He is right… they don’t work.

As I’ve written in the past – not only do negative rates grossly mis-price risk (giving rise to asset bubbles) – as those who are lending are not paid opposite the risks of making the loan.

In other words, they are not compensated for surrendering capital (and taking the risk)

As an investor (or someone who speculates in risk assets like stocks and houses) – let me ask you this question:

- Do you believe that it’s better to have “90 cents in 10 years time” than it is to have “$1 today”?

If you answered the former… you may not understand the time value of money.

That’s what Dimon is (indirectly) saying…

For example, if it were up to free market forces to set rates (and not central banks)- rates would never be negative.

Over the long run, negative rates lead to bankruptcy for creditors like banks, insurance companies, pension funds and pensioners themselves (i.e., those who are taking the risk of lending money)

This is not what you want to see if you are to have a sustained, healthy, functioning economy (where credit is allowed to flow).

Negative rates simply don’t work.

But it’s what central banks chose to implement for an extended period of time.

What could possibly go wrong?

Exaggerating the ‘Boom & Bust’

Over ~11 years writing this newsletter – you will have heard me say that “central banks will exaggerate both the boom and bust cycle”.

The key word is exaggerate.

Without central banks – we would inevitably have the regular ebbs and flows of the business cycle.

That’s normal.

Free markets will vary the price of lending money based on the relative levels of risk.

However, central bank interventionist policies have distorted these price signals.

Businesses are given capital that otherwise would not. And naive speculators invest in assets which are incorrectly seen as lower risk.

As a result, these cycles are exaggerated in both directions.

With that, let me offer three charts expanding on why Dimon’s warning to the downside…

1. QE: ‘Rocket Fuel’ for Stocks

Dimon said the next “hundred basis points will be more painful” than the first.

He’s right. It will be 10x more painful.

As an aside, only last week I was explaining to someone that rates don’t need to get to 18% again to cause pain.

In fact, nominal rates may only need to get to 5-6% to have the same impact

Why?

In 1980, people only needed to borrow between 3x and 4x a single person’s average income to own a house.

Today that number is as high as 8-10x (in over extended markets).

Consider Sydney, Australia – where the average price of a home is around $1.2M.

The painful part is the average income for an Australian is only $100K.

Quick math suggests that 12x one’s average income.

We’re far more extended than we were 40-years ago (and it’s not just Australia)

Therefore, it doesn’t take “18% interest rates” to cause real pain.

The problem is many investors were essentially “lured” (some might say forced) into risk assets mostly opposite the (perceived) low-cost of finance.

That’s changed.

And whilst higher rates will hurt those who have borrowed beyond their means… we should not be remiss of changes in liquidity.

For example, today Vice Fed Chart Lael Brainard said:

- “We should recognize that liquidity is little fragile in core markets and so we’re carefully monitoring this”

What’s more, former Fed Chairman Ben Bernanke said there are some liquidity concerns starting to appear. What we’re seeing in Switzerland and the UK with the BoE) are clear signs of this type of stress.

I also talked to the significant selling we’re seeing in credit based ETFs HYG and LQD here.

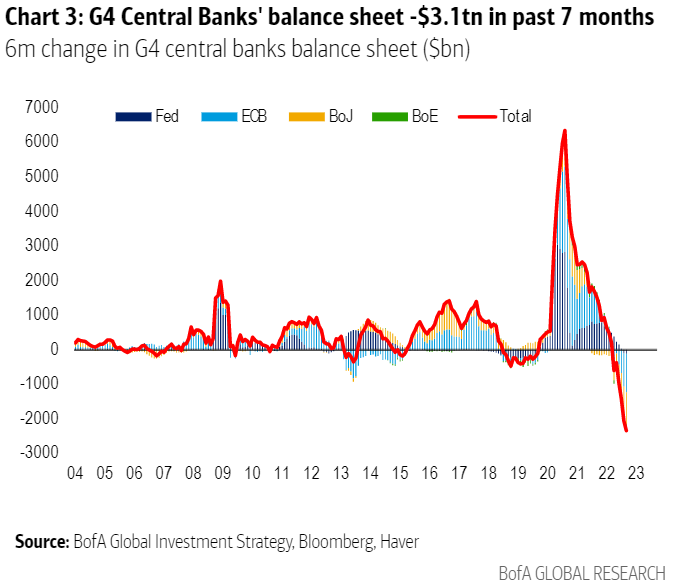

In short, it was sheer magnitude of liquidity which drove the boom in risk assets the past decade (e.g., bonds, stocks and houses).

It was far too much free money for too long.

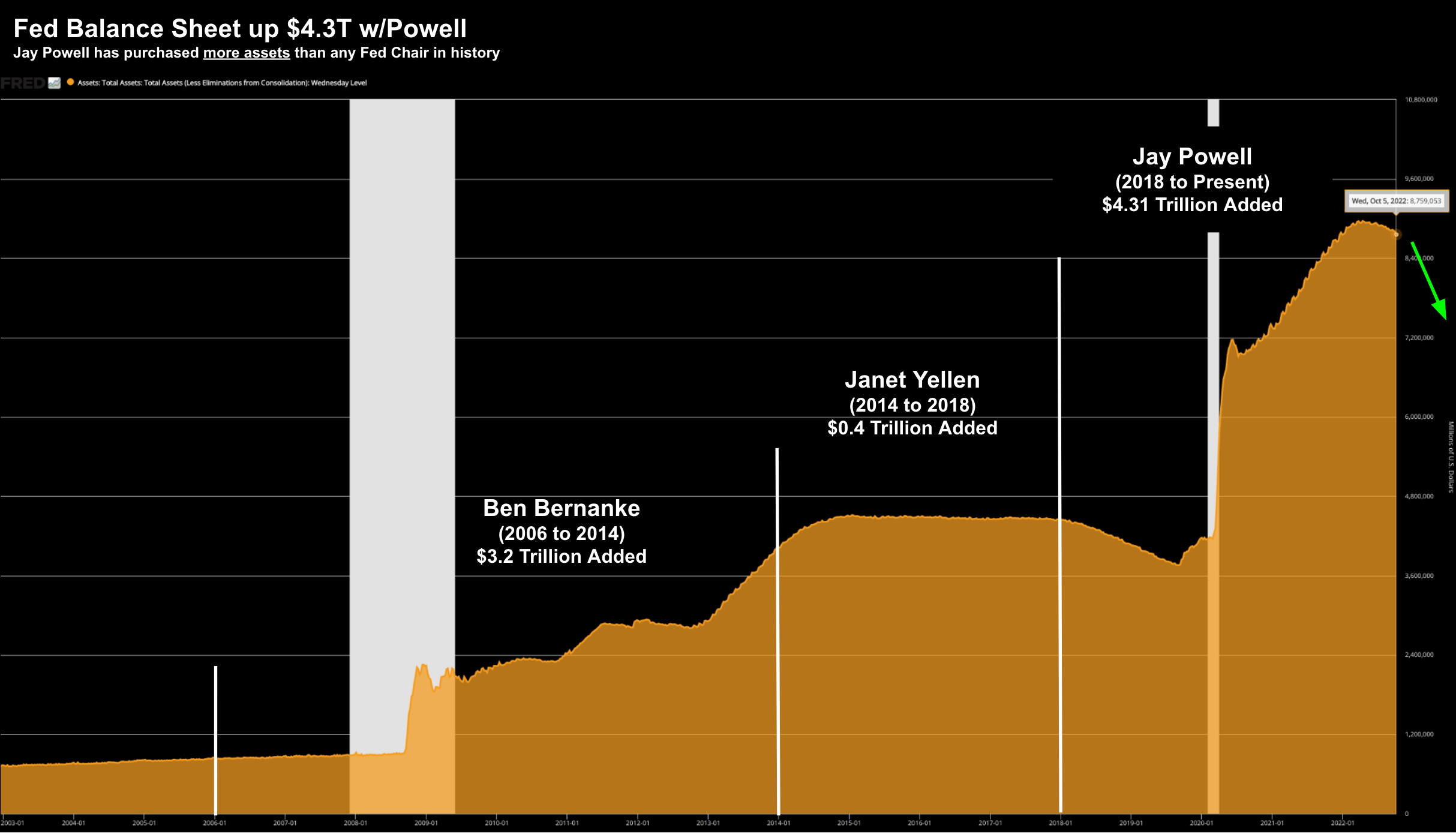

Below is the Fed’s balance sheet showing the $9 Trillion expansion from the early 2000’s

October 10 2022

For those less familiar – this shows how much money the Fed has printed to buy assets such as government and mortgage debt.

When the Fed buys US treasuries (such as the 10-year treasury) – it drives these yields (rates) lower. I will share that chart in a moment.

But more important, the reverse also holds true.

Today the Fed is no longer buying these assets – choosing to let them “roll off” their balance sheet as they mature (a process known as Quantitative Tightening (QT).

The last time the Fed attempted this (2018) — the S&P 500 lost ~22% in one quarter.

The Fed soon caved and stocks took off to the upside.

Today the Fed doesn’t have that option — not with inflation 3x their 2% target level.

And with the Fed actively reducing their balance sheet (at $95B per month) – this will likely have a meaningful impact on all risk assets.

Which is a great segue to our next chart – the relationship to the S&P 500

2. M2 Money Supply Growth

The expansion of the Fed’s balance sheet shows the acceleration in money supply at an unprecedented in scale.

It’s also unprecedented in terms of velocity.

For example, over the past 40+ years – money growth has averaged ~6% per year.

Even as we struggled with the steep recessions of 2001 and 2008 – the 6% growth rate barely changed.

Chairman Powell changed all that in 2020 and beyond:

October 10 2022

- S&P 500 (white);

- Growth in M2 ‘money supply’ (orange); and

- Long-term average growth rate in M2 (purple)

Post the pandemic the rate of growth for M2 surged to more than 20% versus the long-term average.

The orange line (money supply) is in the process of reversing – and over time will likely come back to its average.

However, the massive amounts of liquidity coming out of the system is causing stress and dislocation.

This is why we heard these comments today from both Brainard and Bernanke…

And whilst nothing has broken yet – it will likely show up first in credit markets.

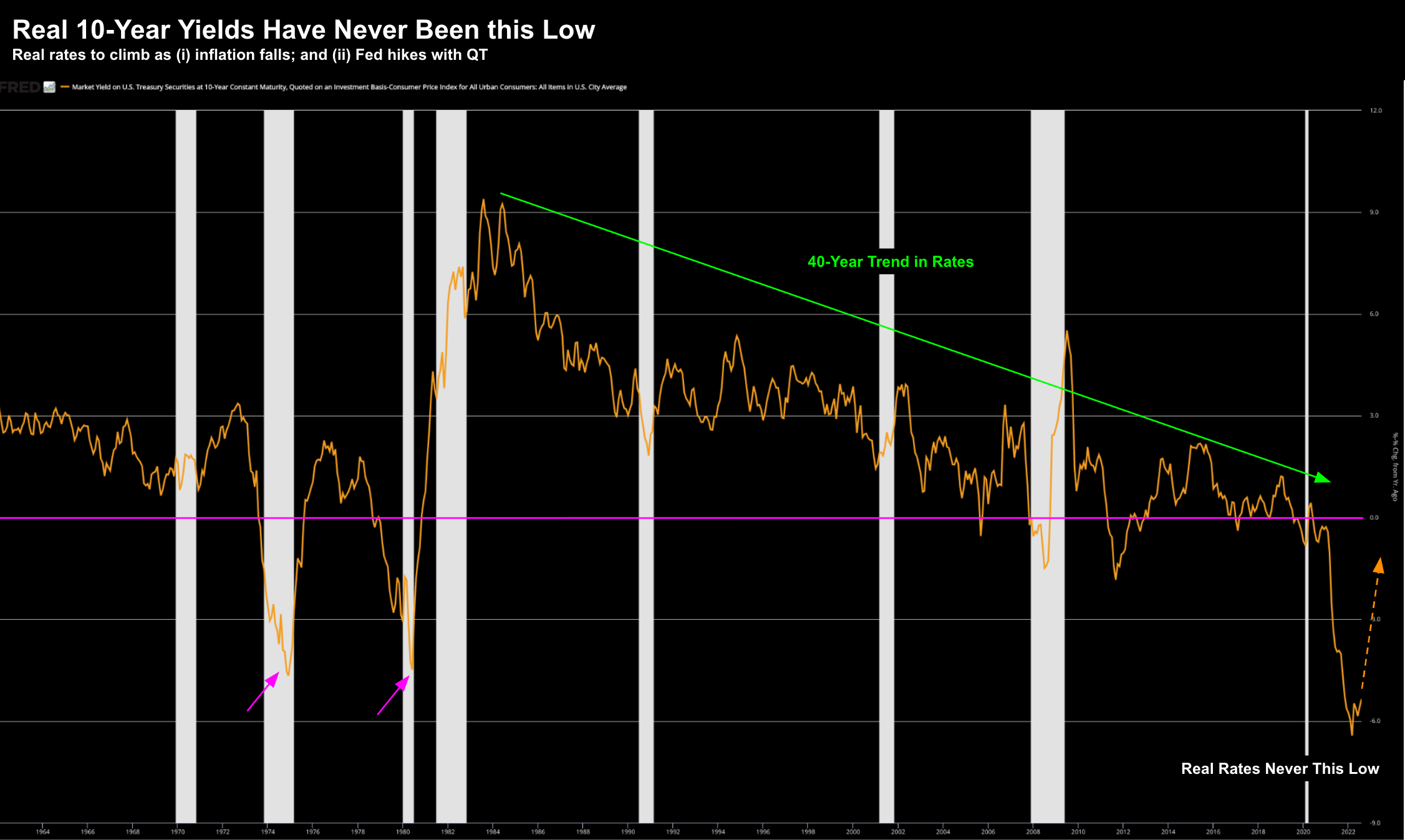

3. Long-Term Real Interest Rates

The third (and final) monetary chart to share is what we’ve seen with long-term (US 10-year) real interest rates.

We tend to always reference nominal rates (~3.88% on the 10-Year) but rarely talk to real rates (those adjusted for inflation).

The latter is far more important:

October 10 2022

Investors, consumers and business have only ever seen bond yields (and rates) head in one direction; i.e., down

Bond prices have continued to rally (enabled by the central banks asset buying) – driving yields lower.

However, if we look at what happened post the pandemic, real yields plunged to levels never seen.

My expectation is real yields are set to move higher through a combination of:

(a) inflation coming down over time; and

(b) the Fed continuing with rate hikes

For example, when former Fed Chair Ben Bernanke was asked about long-term rates today – he said he sees them coming down.

However, the process to get there will not be without pain.

Markets Don’t Like What They See

- being the most dovish in history (i.e. expanding the monetary base by trillions); to

- reducing money supply and raising rates at a clip not seen since the early 80s.

In parallel to reducing liquidity – we also find the interest rates are rising at velocity (as we see with the US 2-year yield)

And as I shared recently – on every occasion post WWII – this kind of move has resulted in a recession:

October 10 2022

This chart supports Dimon’s 2023 recession forecast.

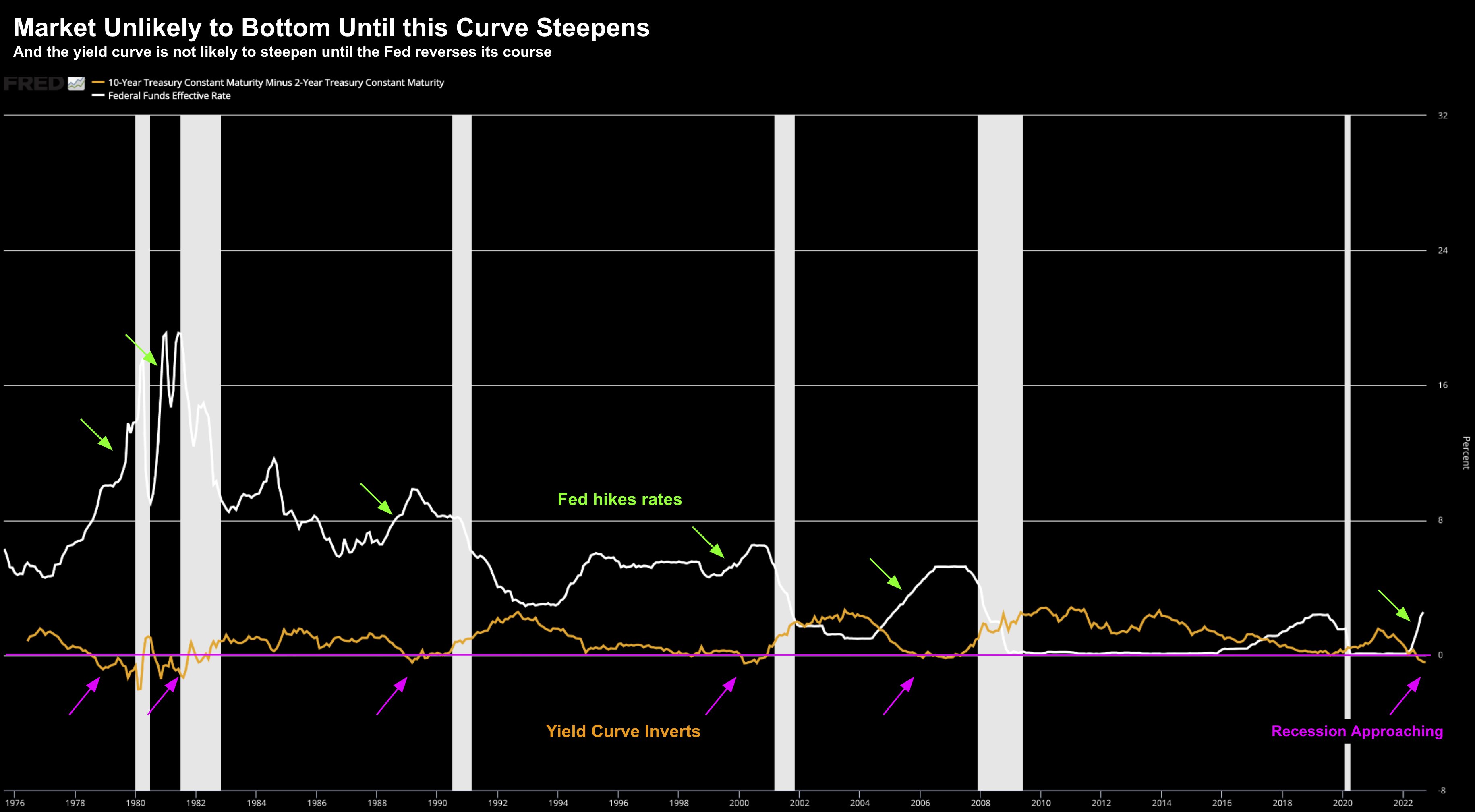

As readers know, my take on any possible market bottom will not be possible until:

(a) there are clear signs for the Fed to reverse course; and

(b) the yield curve begins to start sloping upward

We do not have either at present. And until then – expect more downside:

October 10 2022

For what it’s worth – I am not looking for ‘2900’ (Dimon’s very rough warning) – but something closer to 3200.

If we see that, I would be an aggressive buyer for the long-term.

And if market was to trade “10%” lower than this level — that’s neither ‘here nor there” if taking a 3+ year view.

Putting it All Together

Before I close, Lael Brainard said something today which may have gone unnoticed.

She said even though the Fed are committed to staying the course – they are monitoring the fragility in liquidity.

This is important.

For example, if we do see a major credit event – I think central banks will act.

We saw this last week when the Bank of England reversed their decision on QT – intervening to buy UK bonds – adding much needed stability for their bond market.

And whilst there are no causes for alarm just yet… they are watchful.

You might say the Fed will likely keep going until something breaks.

So far nothing has broken… but that’s not to say it won’t.

Brace for more downside… as my sense is the so-called “Fed Put” is a lot lower than 3600.

Who knows… something below 3,000 could force their hand?