- Market expects 4% earnings growth in 2023

- Mike Wilson from Morgan Stanley sees a possible 18% EPS decline

- Focus to be less on the Fed; but more on the economy (and jobs)

From mine, 2023 will be less about rates and inflation – it will shift to economic growth (or lack of) and earnings.

For example, are we headed into a recession? And if so, will it be mild or something darker?

And finally, given the widely expected slowdown (or possible economic contraction) – will companies post earnings growth on last year?

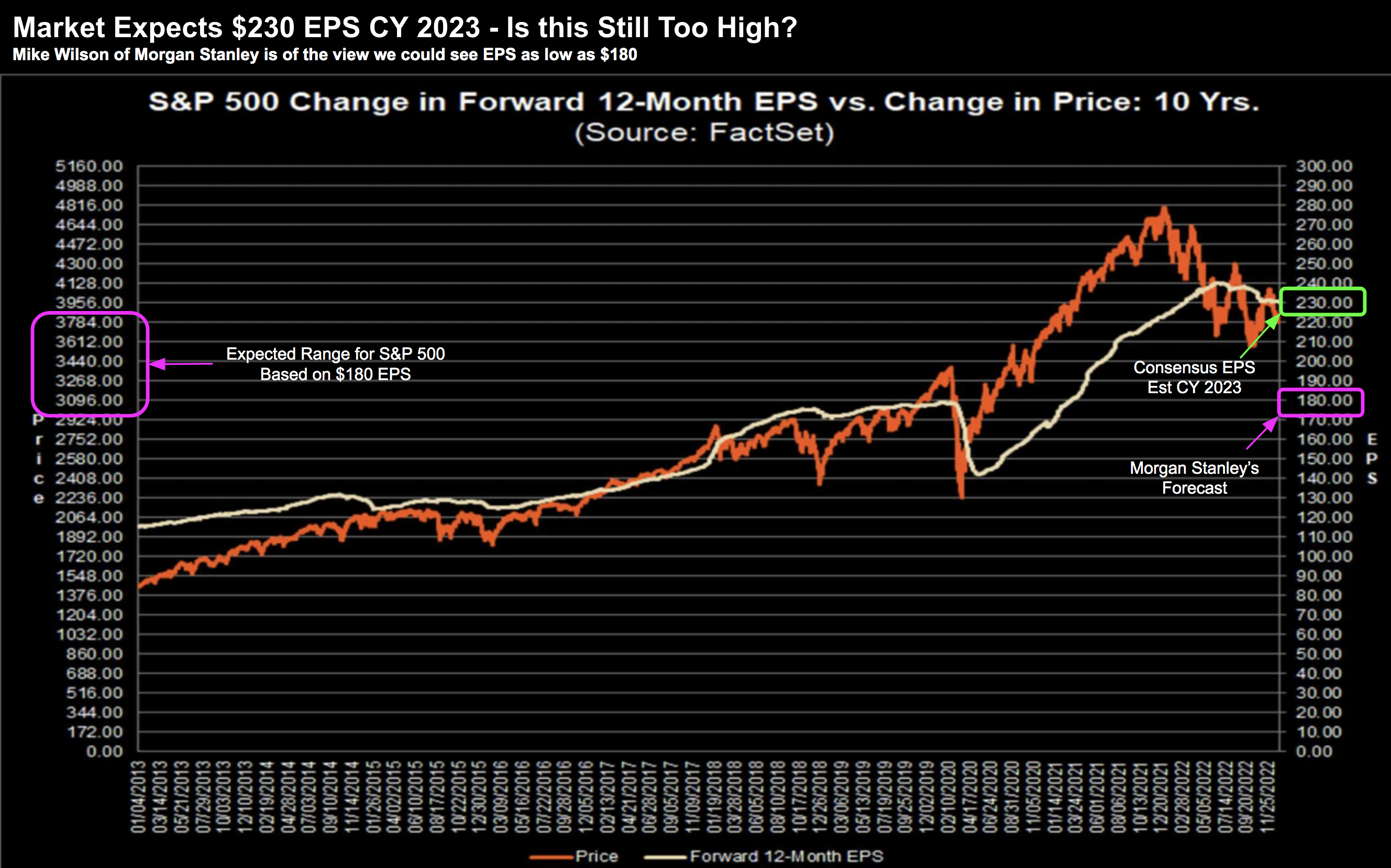

According to Factset – S&P 500 2023 earnings are expected to grow by 4% to $230 per share.

The good news is that’s ~$11 lower per share on previous expectations – however it still assumes expansion in a challenging environment.

So how realistic are those expectations?

That’s my question.

I ask because economic recessions have never resulted in earnings expansion.

No exceptions.

Again, do you think we are about to enter a recession later this year (or early next)?

What’s your base case? And why?

For example, if unemployment peaks at ~5% (the Fed’s unspoken goal) – then it’s possible any recession will be mild.

And this would likely mean earnings may only contract by single digits.

However, what if the Fed overshoots in its efforts to tame (wage) inflation and we get unemployment closer to 8%?

What then?

In any case, the market is less optimistic today than it was a month ago.

Factset reported that during the fourth quarter, analysts lowered EPS estimates by a larger margin than average.

The Q4 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q4 for all the companies in the index) decreased by 6.5% (to $54.01 from $57.78) from September 30 to December 31.

It’s noted that during Q4 – analysts usually reduce earnings estimates for the next fiscal year.

The largest sectors to be revised lower were Materials (-18.8%), Consumer Discretionary (-13.5%), and Communication Services (-11.8%).

However, on the other hand, Energy (+2.0%) and Utilities (+2.0%) were revised higher.

So will we see more downgrades post earnings season?

My guess is yes…

Contraction or Expansion

Much of your sentiment towards 2023 will hinge on whether we can avoid a recession.

And if we can’t avoid it – how ‘hard’ will the so-called landing be?

Hard? Soft?

Or something in between?

Further to recent missives I’ve shared — it’s not unusual for recessions to see earnings decline in the realm of 18%.

From D.A.Davidson:

It is important for investors to know during recessions that economic downturns create challenges for corporate profits, and S&P 500 earnings growth turned negative in each of the past ten recessions.

S&P 500 earnings per share (EPS) declines, from peak to trough, ranged from -4.6% in the 1980 recession, to -91.9% during the Global Financial Crisis (GFC) from 2007 to 2009.

The average earnings decline across all ten recessions was -29.5%.

That included two unusual events, as the GFC caused a collapse in the financial system and bank earnings, and the earnings decline in 2001 followed the bursting of the technology bubble, causing a massive earnings decline in that sector.

Excluding the recessions of 2001 and 2008 — the average earnings decline during the other eight recessions was -18.7%

Perhaps one of the more bearish forecasts in the market is from Mike Wilson at Morgan Stanley

Wilson believes we could see an ~18% EPS contraction – which would see earnings come in around $180 for the S&P 500.

However, that’s his bear case. A more likely case is closer to $200 EPS.

Either way, it’s some distance from the $230 expected (~21.7% lower at $180)

For example, if we adpot Wilson’s forecast… it represents an 18.2% drop on 2022 (consistent with Davidson’s research)

Wilson, who serves as the firm’s chief U.S. equity strategist and chief investment officer, believes $180 EPS could result in the S&P dropping as much as 24% in 2023.

And this makes sense – given the (strong) correlation between earnings and stock prices:

Source: Factset

Below is a portion of Wilson’s comments to CNBC at the end of Q4 last year:

“You should expect an S&P between 3,000 and 3,300 some time in probably the first four months of the year. That’s when we think the deceleration on the revisions on the earnings side will kind of reach its crescendo.”

“The bear market is not over,” he added. “We’ve got significantly lower lows if our earnings forecast is correct. Most of the damage will happen in these bigger companies — not just tech, by the way. It could be the consumer. It could be industrials.”

However, that could change this time next month.

The Fed to Play ‘Second Fiddle’ to Earnings

The investing narrative 2022 was overwhelmingly inflation and the Fed’s response.

But this year it will shift to the economy, jobs and earnings.

In other words, we are moving from ’cause’ to ‘effect’.

And specifically, the so-called ‘long and variable’ effects.

Some of these effects are showing up… but it’s early.

For example, last week we heard that Salesforce is cutting 10% of their staff and reducing its real-estate footprint; and Amazon is cutting 18,000 staff.

Tip: this won’t be the last round of cuts at either company.

From mine, this is reflective of an economy (and consumer) slowing. People are buying less stuff (mostly stuff they don’t really need); and enterprises need ‘less bums on seats’.

So what do you do when CEOs / CFOs start to ‘kitchen sink’ their earnings over the next 4+ weeks?

https://tradethetape.com.au/foolish-forecasts-and-questions-worth-asking/That’s what you need to be thinking about.

Personally, my approach will be to wait for the prices to come to me.

Patience and diligence.

For example, lower earnings revisions are also likely to drive valuations down to more attractive long-term levels.

Wilson’s S&P 500 targets are not unrealistic. For example, I outlined the three zones I am targeting for the S&P 500 here (from Dec 30).

S&P 500 (Chart from Dec 30 2022)

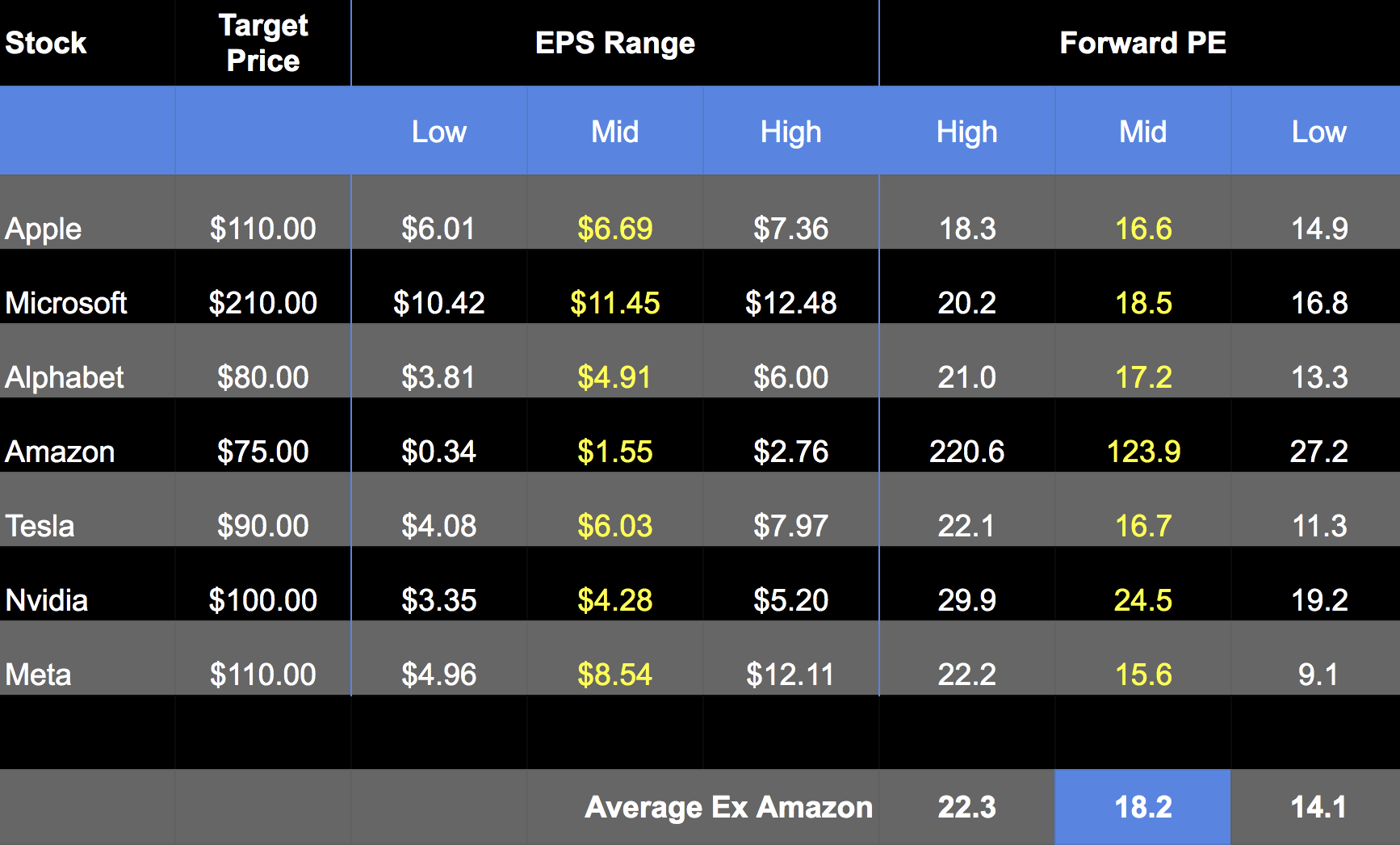

By way of example only, Apple and Microsoft at forward PE’s below 20x would represent an opportunity not seen in many years (maybe over a decade).

To me, this feels attractive for these names (irrespective of a recession).

In fact, it probably needs a recession to buy companies at these valuations.

For illustrative purposes only – if we were to take the mid-range of the expected EPS for big-cap tech – you can then play around with”target prices” and possible forward PEs

Consider Apple…

The range of EPS is between $6.01 at the low-end; and $7.36 at the high-end.

If we plug in a target price of $110 – take the mid-point of earnings at $6.69 – that gives us an approx fwd PE of 16.6x

That’s not unreasonable for a business of Apple’s quality.

And you can do the same thing for all of these companies.

But don’t just look at tech…

As I’ve stressed recently – tech still feels overpriced in this climate. I don’t think it will be tech which leads the market in a higher rate environment.

To be clear, the above names should be in your portfolio, but in aggregate I would recommend something less than market weight (which is currently 25%).

For example, we will find opportunities in defensive plays such as healthcare, energy and dividend paying stocks (I outlined some here that I own).

Names which include UNH, J&J, JPM, PG and MCD are some I own heading into 2023.

Putting it All Together

It’s often said that it’s not a stock market – it’s a ‘market of stocks’.

This will certainly be the case in 2023.

To get outperformance – you will need to be in quality.

Whilst we had a decade of zero rates with QE – the rising tide was said to lift all boats

Not now. The tide is going out.

Today we see who was swimming naked (to quote Warren Buffett)

If we are going to have a recession later this year (my base case) – it favours stock pickers.

Quality will rise.

Earnings season will not only reveal quality – it will tell us how corporate America is planning to navigate a new (far more difficult) environment.

For now, the market remains optimistic it will get $230 in 2023 in earnings.

And it might… but I would be surprised.

Be patient. Exercise diligence.