It’s said that bonds investors are typically early… but often right.

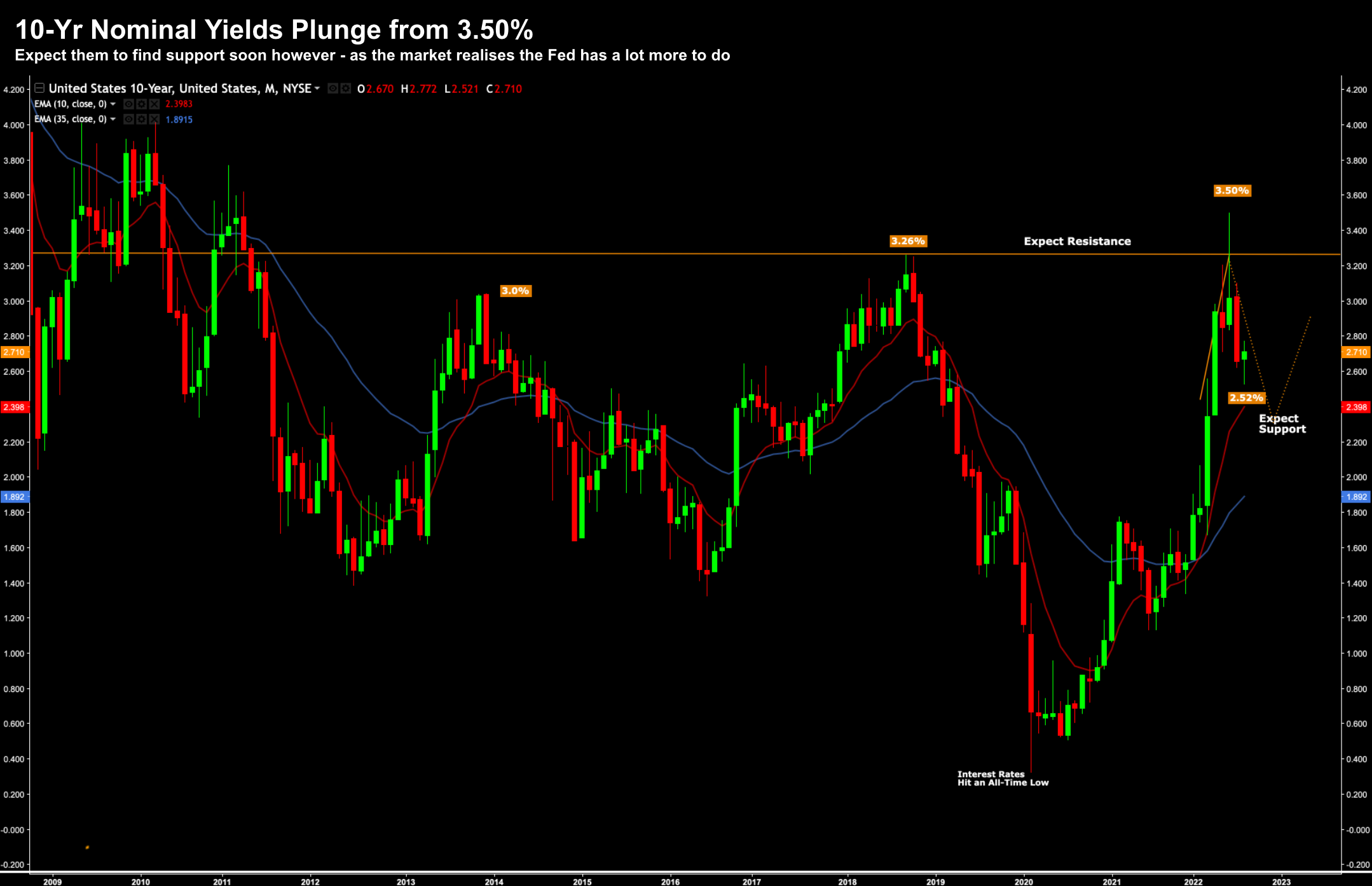

Below is the volatility we find with the US 10-year yields…

Aug 2 2022

This week bonds yields managed to stage a rally – perhaps spurred by Fed comments on interest rates.

They heard a dovish Fed saying they could be close to the neutral rate – in turn sending the market sharply higher.

Fed Hawks to Deliver the Message

Today that language was echoed by San Francisco Fed President Mary Daly.

“People are still struggling with the higher prices they’re paying and the rising prices. The number of people who can’t afford this week what they paid for with ease six months ago just means our work is far from done.”

What’s more, Chicago Fed President Charles Evans opened up the possibility of another large rate hike ahead, but said he hopes that can be avoided, with the Fed being able to bring down inflation without having to use harsh policy tightening.

“Nowhere near almost done. We have made a good start and I feel really pleased with where we’ve gotten to at this point.”

He expects policymakers to raise rates by half a percentage point at their next meeting in September, but left the door open to a bigger move.

“Fifty [basis points] is a reasonable assessment, but 75 could also be OK. I doubt that more would be called for.”

“We wanted to get to neutral expeditiously. We want to get a little restrictive expeditiously. We want to see if the real side effects are going to start coming back in line … or if we have a lot more ahead of us.”

Markets Wise to Listen

As these Fed members spoke – bonds moved in real-time.

And almost on cue – equities paused after their recent 14% rally from the lows:

Aug 2 2022

“With another 75-basis-point hike in the fed funds rate, inflation metrics rolling over and recession indicators flashing red, both stocks and bonds have rallied on the prospect of a policy pivot. Mission accomplished? Not!”

Put another way – what you are feeling here is a classic bear-market rally.

- First, policy operates with a lag. “The implications of tighter financial conditions, higher interest rates and balance sheet reduction are still ahead of us. They are also moving up on the premise that inflation is tamed and that real yields will fall, supporting rich valuations for stocks and credit.”

- Second, policy uncertainty rises with the Fed abandoning forward guidance. This demands higher risk premiums. “A data-dependent Fed suggests more market volatility and surprises in both directions. With the full impact of policy still ahead, and with unknowns on inflation, liquidity, jobs and geopolitics, we prefer to wait for wider risk premiums that more appropriately value the uncertainty.”

- Third, stocks are at best only fairly valued. Shalett estimates that the equity risk premium is some 300 basis points versus an average 350 basis points for the past 13 years. As such, she expects weak growth in the near term and “higher-for-longer inflation.”

For example, with respect to valuations, she said the forward PE is still 17.8. However, forward earnings are likely to be downgraded.

“During periods of aggressive Fed policy and going into recessions, history shows that the preferred entry point for stocks is when the ERP is above 450 basis points”

For example, we’re yet to see any meaningful earnings downgrades… which means the current market valuation (~4200) feels rich.

What’s more, the current rally has all the hallmarks of a classic bear market trap (not unlike 2000 and 2008 — which experienced multiple double-digit rallies on their way lower).

From mine, the market may be suffering a case of “rose colored glasses” in terms

- an earlier-than-expected Fed pivot (e.g. Q1 2023)

- stronger earnings growth for Q3

And yes, I think it’s likely to come down most opposite the slow-down in M2 money supply growth.

Irrespective, ‘stickier’ elements of inflation is most likely to see CPI north of a 5-handle as we head into 2023.

And if that’s the case, the Fed is unlikely to pivot.

Tread carefully… and pay attention to what we see with bonds. They are typically early and usually right.