- Will September bring opportunity?

- Investor enthusiasm starting to wane for NVDA

- Sept 6 Aug Payrolls… 4.4% unemployment could send signs of panic

September has started in a very typical September fashion.

Down!

It’s traditionally the worst month of the year in terms of returns.

But that’s not a bad thing…

As longer-term investors – it’s great when things go on sale.

That’s when we get to sharpen our pencils on higher quality businesses.

And for those who missed out four weeks ago (where you needed to act fast) – it’s possible you will get another chance this month.

As I wrote over the weekend – “Back to the Scene of the Crime” – the 10% surge in equities the past few weeks did not fill me with a lot of confidence. Repeating a portion of my post:

The question is whether the market: (a) breaks through previous resistance (the all-time high of 5669); or (b) performs what traders call a “back and fill”. My guess is we see the latter. The 10% surge over the past 4 weeks doesn’t make me feel any better.

Let’s explore..

Buckle Up

Last Friday the fear index (VIX) closed around 15.

I made the observation that whilst the market was challenging its all-time highs – investors were less complacent.

The aftershocks of four weeks ago were still present.

Today it closed back above 21.

This suggests the market remains in a braced position… perhaps prepared for bad news.

By way of example – take a look at what we’ve seen with former market darlings – semiconductors.

The AI chip stocks led the market higher the past 12 months… however the ‘fever’ broke early July.

Below is the Philadelphia Stock Exchange semiconductor index ‘SOX’.

Sept 4 2024

Led by AI poster child – Nvidia (NVDA) – it had its worst day since March 2020.

NVDA alone saw its market cap drop by $280 billion in a single day.

To put that into perspective – $280B is roughly the market capitalization of Chevron or Netflix.

Imagine losing the entire value of Netflix in a single day?

But it raises a question:

Is money simply coming out of higher multiple names (like the Mag 7) and rotating into other sectors? Or is it simply money coming out of the market all together (seeking safety)?

I ask because up until recently – we saw a shift into Small Caps (e.g. the Russell 2000).

However, that trade has also reversed sharply.

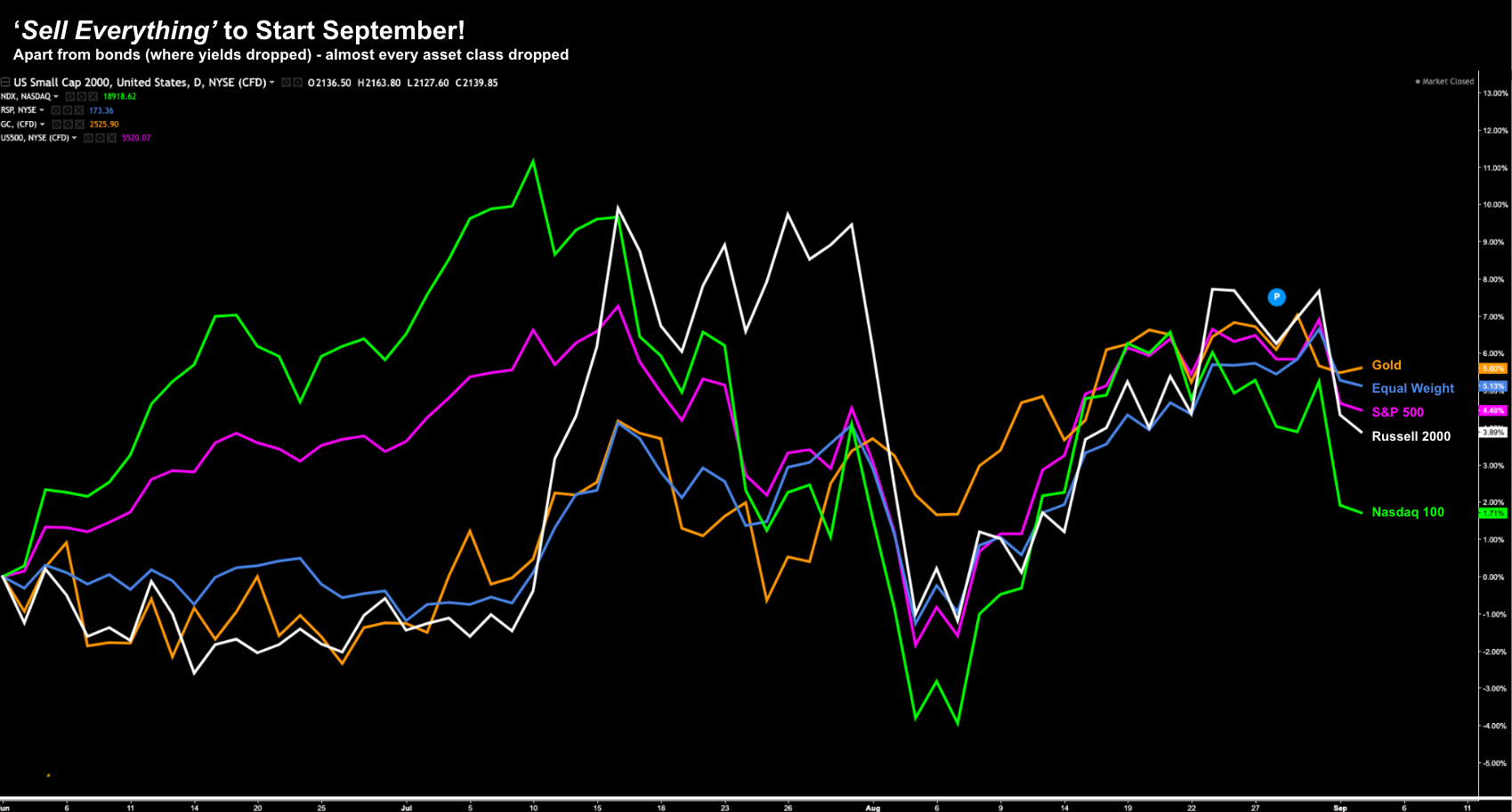

To demonstrate, below is a daily chart from June to Sept 4th comparing:

- S&P 500 – up 4.5%

- Gold – up 5.60%

- Nasdaq 100 – up 1.71%

- Russell 2000 (small caps) – up 3.90%; and

- Equal Weight S&P 500 – up 5.13%

Sept 4 2024

The poorest performing sector is clearly tech (green).

And that’s not hard to explain – valuations were rich.

However, if we look at activity over the past few days – it would appear that almost every segment (including gold) has traded lower.

This is money looking for safety elsewhere (e.g., bonds)

Bond prices have gone higher as yields come down.

Now compare this to where the Nasdaq 100 was the week of July 10.

Since that week, the (risk) script has been flipped.

If nothing else, this tells me the market is now more concerned about potential bad economic news.

We have moved from “bad news is good news” (where bad economic data potentially meant more rate cuts) to one where “bad news is bad news”

Speaking of which…

Manufacturing Recession

To set the scene – manufacturing is a very small component of GDP.

However, it’s an important sector (not to mention strategic reasons).

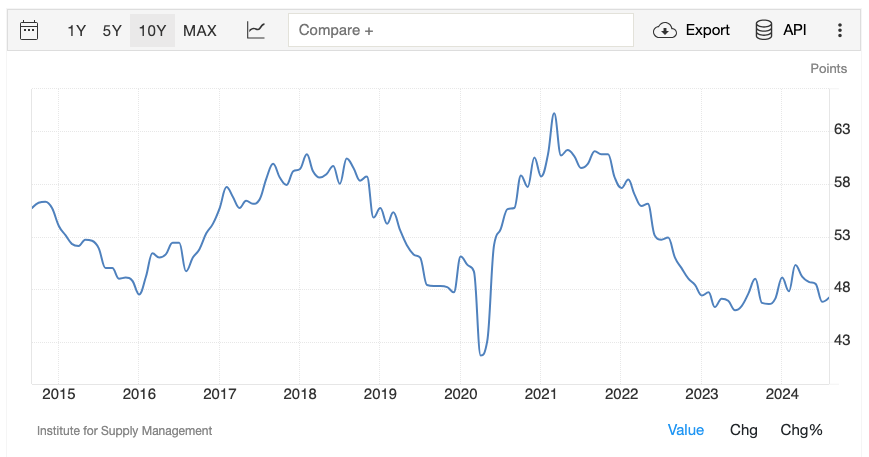

This week The Institute of Supply Management (ISM) reported activity in the manufacturing sector contracted in August for the fifth consecutive month and the 21st time in the last 22 months…

Not great.

There’s a possibility the market remains concerned the series of contractionary prints could spell signs of trouble with respect to the broader economy.

Below is the 10-year trend for ISM – where a number below 50 indicates contraction.

The U.S. manufacturing sector has been struggling for years.

The question is why? For example:

- Is it a lack of demand for U.S. made products?

- Are the (tax) incentives right?

- Is it product competitiveness?

- Has the industry not adapted (if so, why)? or

- Is it potentially a foreign trade issue?

I don’t pretend to know – but clearly something is broken.

(n.b., If it were me – I would look very hard at the incentive structure)

Brace for Payrolls

If there’s a catalyst to send the market higher or lower – it will be August payrolls on Sept 6th.

According to economists, the U.S. economy is projected to add 160K jobs in August following the 114K the month prior.

We remember the market panic which followed the 114K jobs print.

Now if we get a monthly print in the realm of 150K to 250K job additions – consider it a ‘goldilocks’ number.

“Not too hot” for the Fed to pause on cuts; and “not too cold” to imply the economy is contracting faster than expected.

The Unemployment Rate is seen narrowing 4.2% from 4.3% during the same period – which would be a welcomed result.

However, anything north of 4.3% could see the market sell-off continue (and perhaps prompting the Fed to cut 50 bps)

From mine, a 50 bps cut would not be a good sign for the market.

It’s a sign the Fed could be panicked.

Putting it All Together

A final word on Nvidia – given it remains a barometer for the market (and the AI trade)

I’m starting to question whether investor enthusiasm is starting to wane?

My guess is yes.

Don’t get me wrong…

I like its long-term story and the quality of its business… I just don’t love the price.

That’s why I’m short Nov $75 Puts… as that’s the price I’m willing to pay for a 3-year bet.

Now with institutional traders back at work (after their summer holiday) – I was wondering whether we would start to see (big) money come back into the name?

I say that because over the past ~2 months – it’s mostly retail money pushing the price around. And retail traders get very excited by names like Nvidia.

But the money has not returned…

And maybe it’s because of the declining trend we find with Nvidia’s earnings beats:

- Q3 2023 – 19.64%

- Q4 2023 – 11.69%

- Q1 2024 – 8.51%; and

- Q2 2024 – 5.43%

5.43% is a long way from almost a ~20% beat a year ago.

The bar is getting more difficult to clear.

Up until recently, some bold investors were still willing to pay close to 50x forward earnings.

I warned investors from taking the trade. That’s a big bet given this trend.

Once again, I think NVDA could easily double in price by 2027. But we should expect several 30% to 40% pullbacks along the way.

I still think you get it cheaper than where it closed today.