- Jay Powell could not be clearer (again)

- “We’ve made less progress on inflation than anticipated – ongoing hikes are appropriate“

- But bonds and equities refuse to believe him?

- November’s CPI report; and

- The Fed’s statement on monetary policy

Both are now behind us and the market has barely moved.

CPI came in slightly lower than expected (thanks to lower energy prices) and the Fed did exactly what was expected – raised rates 50 basis points and reminded us their work is far from done.

For example, Chair Jay Powell (indirectly) said that we should expect another 25 to 50 bps Feb 1 and perhaps another 25 bps March 22.

This could take the short term rate between 4.50 and 4.75%

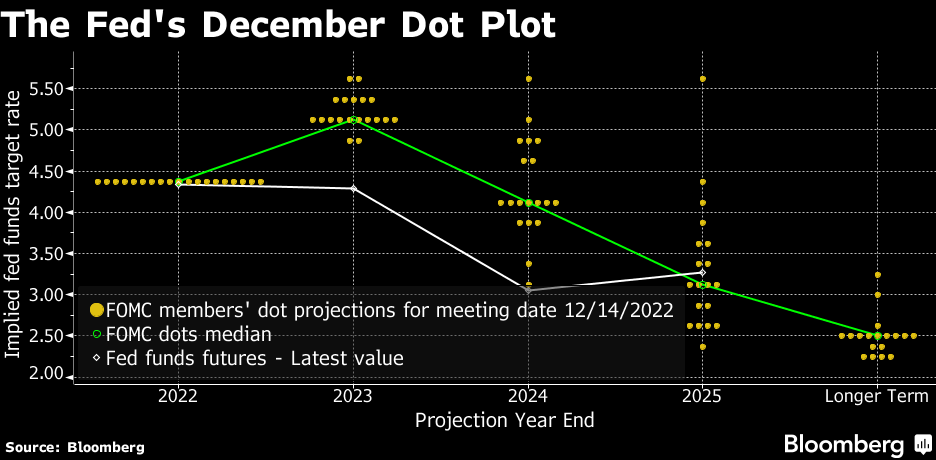

What’s more, if you look at the revised Fed “dot plot” (i.e., where Fed members see the short term rate next year) – this is now 5.10%

17 Fed officials now see 2023 rate projections at 5.00-5.25%; and 7 of which have it higher than 5.25%.

December 14 2022 – Bloomberg

That’s another 75 bps higher from where we are right now — a year from now.

For 2024, the Fed now averages out to rates of 4.00-4.25% — 25 bps lower than where we got to today, in two years. Then, 2025 moves to 3.00-3.25% — the same as where we were on the first day of autumn.

Translation: higher for longer.

You are kidding!! No chance. Good luck buddy.

Now echoing the sentiment I expressed yesterday – rate cuts are not projected to begin, according to Powell, until inflation metrics continue moving toward +2% “in a sustained way.”

When is that?

Who the hell knows!

Much of it will heavily depend on what we see with wages and rents (on the basis energy stays low).

With respect to wages – Powell said “we have made very little progress”

And that was not what that market wanted to hear.

Disconnect b/w the Fed and the Market

Jay Powell could not be clearer… we will be “tighter for longer”

He reinforced the commitment to bringing core inflation down to 2%.

He added they will continue using the balance sheet as appropriate (which meaningfully reduces liquidity)… with more work to do.

What’s more, he repeated those comments verbatim at the conclusion of his prepared remarks (just in case we didn’t get it)

What’s dovish here?

Nothing.

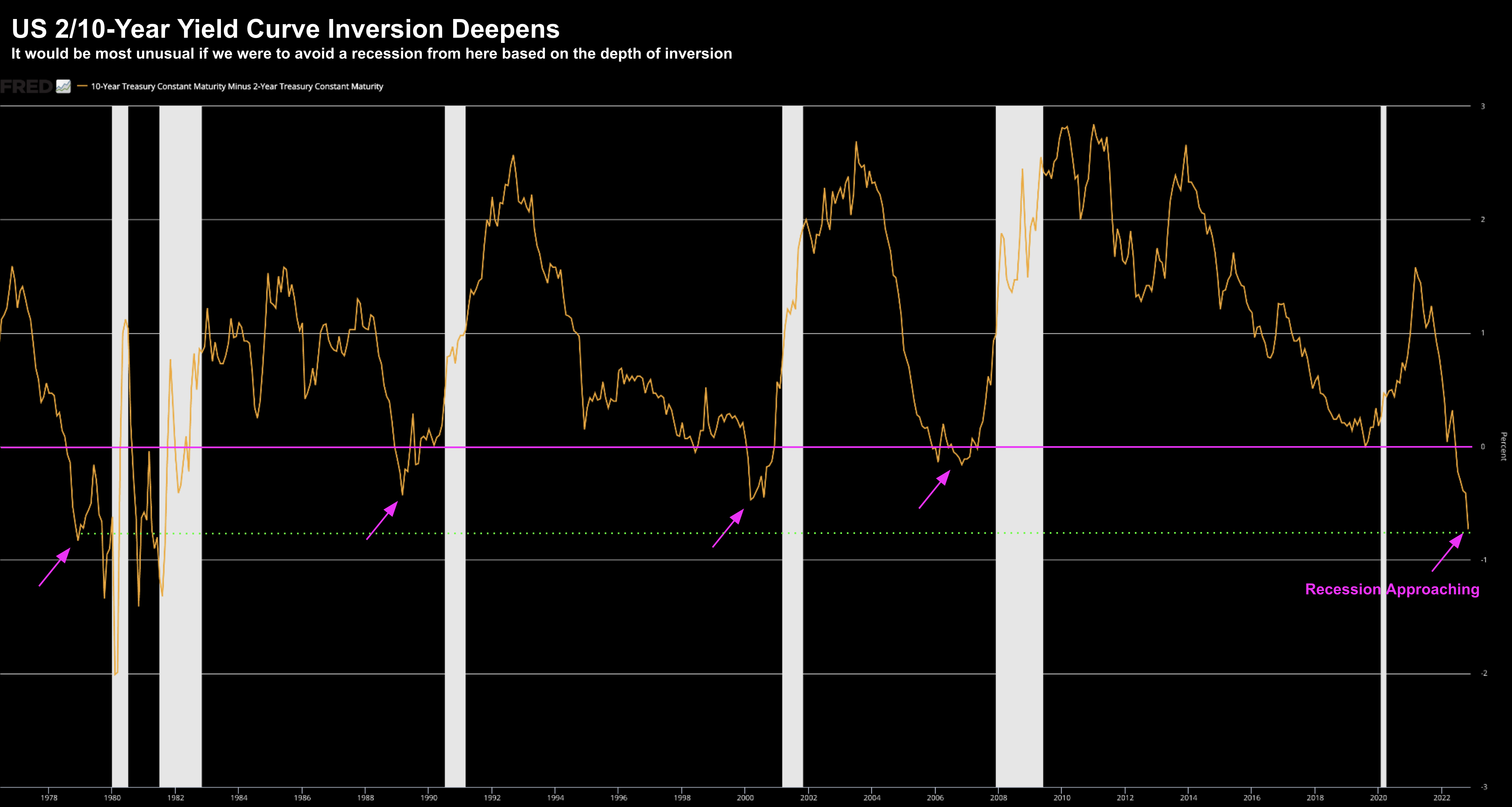

But what deserves attention is what we see with (a) the 2-year note; and (b) the yield curve.

For example, the US 2-year is trading at 4.24% at the time of writing.

However, we now have the Fed funds rate above the 2-year treasury.

That’s not something we have seen in a long time.

It’s a clear disconnect.

We have a situation where the bond market is telling the Fed “you don’t need to get to 5.0%”.

Or perhaps more accurately – you are not going to get to 5.0%

But for now, the Fed is not interested.

What’s more, take a look at the 2/10 yield curve… it continues to invert which is a very accurate indicator of recessions (as the chart suggests)

This chart simply says the economy is weakening and the Fed is getting towards the end of its tightening cycle (or as a minimum that cycle is maturing)

As I say, most leading financial indicators suggest recession ahead (or at least highly likely)

And Jay Powell’s response?

So what!

Powell’s approach here will be to overshoot.

And if that means overshooting into recession at the cost of getting inflation back to 2% — that’s a price he’s willing to pay.

But in terms of equities – they are making a big bet against the Fed.

It’s along the lines of the narrative I shared yesterday:

- Inflation is falling fast (e.g., expectations of CPI at ~4% mid 2023) – where a recession is likely;

- Fed will pause hiking rates by June; looking to cut rates H2 2023;

- That’s positive for earnings, economic growth and stock valuations

The market doesn’t see the Fed getting anywhere near the “dot plot” of 5.1% in 2023.

What’s more, they feel the Fed will be highly encouraged by a headline CPI of closer to 4-5% by mid-year…

This will allow them to at least pump the breaks.

And that’s the big bet being made today.

Market Anticipated Powell’s Comments

As I say, the market didn’t get any big surprises from Powell.

I think they were hoping for more dovish tones – but were not surprised with Powell’s commitment.

Here’s my read:

The Fed lost a lot of reputation credit over the past two years.

Powell is not attempting to restore their reputation.

He will not do that by wavering with policy.

He needs to stay the course. He needs to be committed.

“We’re going to get the job done” is what Powell often reminds us.

Now with CPI carrying a 7-handle (but falling fast); wage inflation at 5.1%; and unemployment only 3.7% — he has no room to move.

However, it’s the labor market causing Powell angst.

Yes, things like commodities, used cars, apparel, electronics etc are all falling sharply.

That’s not what Powell is focused on…

For example, as of 2-weeks ago there are something like 10.3M job openings in the economy.

That’s a lot of employers looking to people to fill roles.

It means they need to pay up. It means more money in people’s pockets.

That’s inflationary.

And whilst that kind of labor supply / demand pressure remains – it’s difficult to see how wage inflation falls.

But this is going to take “some work” in terms of unemployment getting closer to a level of around 5% – in turn bringing down wage pressure.

For example, the Fed does not see that happening until 2024.

However, at some point (and it’s not soon) the Fed will see the “long and variable” lags of rate hikes (with QT) will take effect.

That’s when the Fed will soften their stance

But not before.

Putting it All Together

The bond market knows inflation is coming down.

It also knows the effects of rate rises and QT suffer “long and variable” lags.

And we have done a lot of work…

That’s what the 2-year and 2/10 yield curve is telling us.

The economy is slowing (sharply) and a recession is likely.

What’s more difficult is the precise timing. For example, if it’s not 2023, it will be 2024.

That narrative is growing more loudly by the day.

However the Fed is not interested.

Powell is committed in his stance to restore inflation back to 2% and the Fed’s credibility.

That makes sense.

But this is a question of:

(a) whether you believe the market has this right (where Powell will likely need to pivot); or

(b) the Fed still has a lot of work to do (especially in terms of bringing down both wages and rents)

I don’t pretend to know… as forecasting these things is a fool’s errand.

Howard Marks said as much yesterday with his latest note.

What I can tell you is rates are staying higher for longer.

Yes, we might reach a so-called “terminal rate” (i.e., a rate that’s high enough to bring down inflation on its own) of somewhere between 4.75% and 5.00% (I don’t pretend to know).

But I can’t see the Fed hitting that rate without pausing for an extended period.

Is that priced in today?

I don’t think so.

I think it sees cuts in the second half of 2023.

Inflation back to 2% is not happening next year or the year after.

Before I close, getting to headline CPI at 5% will be pretty easy.

We could see that as early as June next year.

And I believe the Fed sees that.

But getting that rate from 5% to just 2% is not going to happen simply via goods moving lower… it will happen with major dislocation in the job market.

Who knows – maybe that’s the Fed’s intent?

Whatever it takes.