- Smaller cap stocks catch a bid on expected rate cuts

- CPI softens (good news) however Core PPI jumps

- Consumer confidence plunges (again)

Has the market finally started to broaden beyond tech?

Maybe….

Whilst it’s still too early to answer – there were signs of life this week in sectors which have failed to work this year.

By way of example, the Russell 2000 and the Equal Weighted Index caught a bid – as the market started to price in at least one rate cut before the end of the year.

And that makes sense.

Companies that depend on leverage to supplement cash flows will stand to benefit more from rates cuts (vs their larger cap peers – who profit from higher rates due to cash hoards)

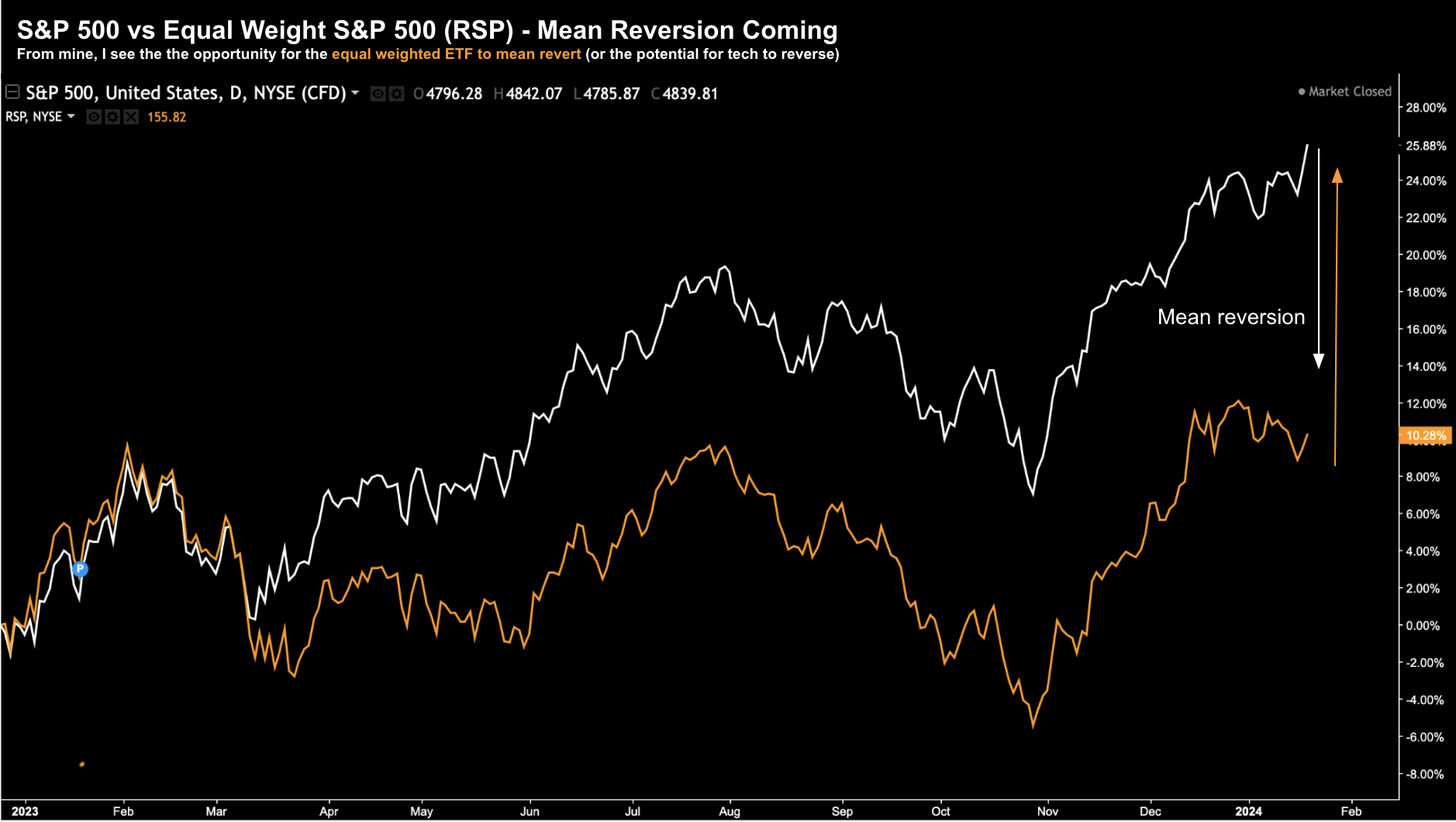

To set the scene – few months ago I drew reader’s attention to this chart:

The orange line is the Equal Weight Index (using the ETF ‘RSP’) vs the broader S&P 500 (white)

This shows that most sectors have not participated in the rally this year.

However, with the so-called ‘Mag 7‘ constituting~34% of the total S&P 500 market weight – this led to strong divergence.

My questions (at the time) were:

- Whether market divergence would continue?

- Or would the market eventually broaden (i.e., we get convergence – as the equal weight index starts to close the gap);

- Or whether tech stocks pulled back?

As it turns out – we’re yet to see any material convergence.

~6 months into the year and tech continues to dominate sector performance (led by the ‘Mag 7’ and AI).

However, sectors that have not worked this year (mostly due to higher rates) shot higher this week.

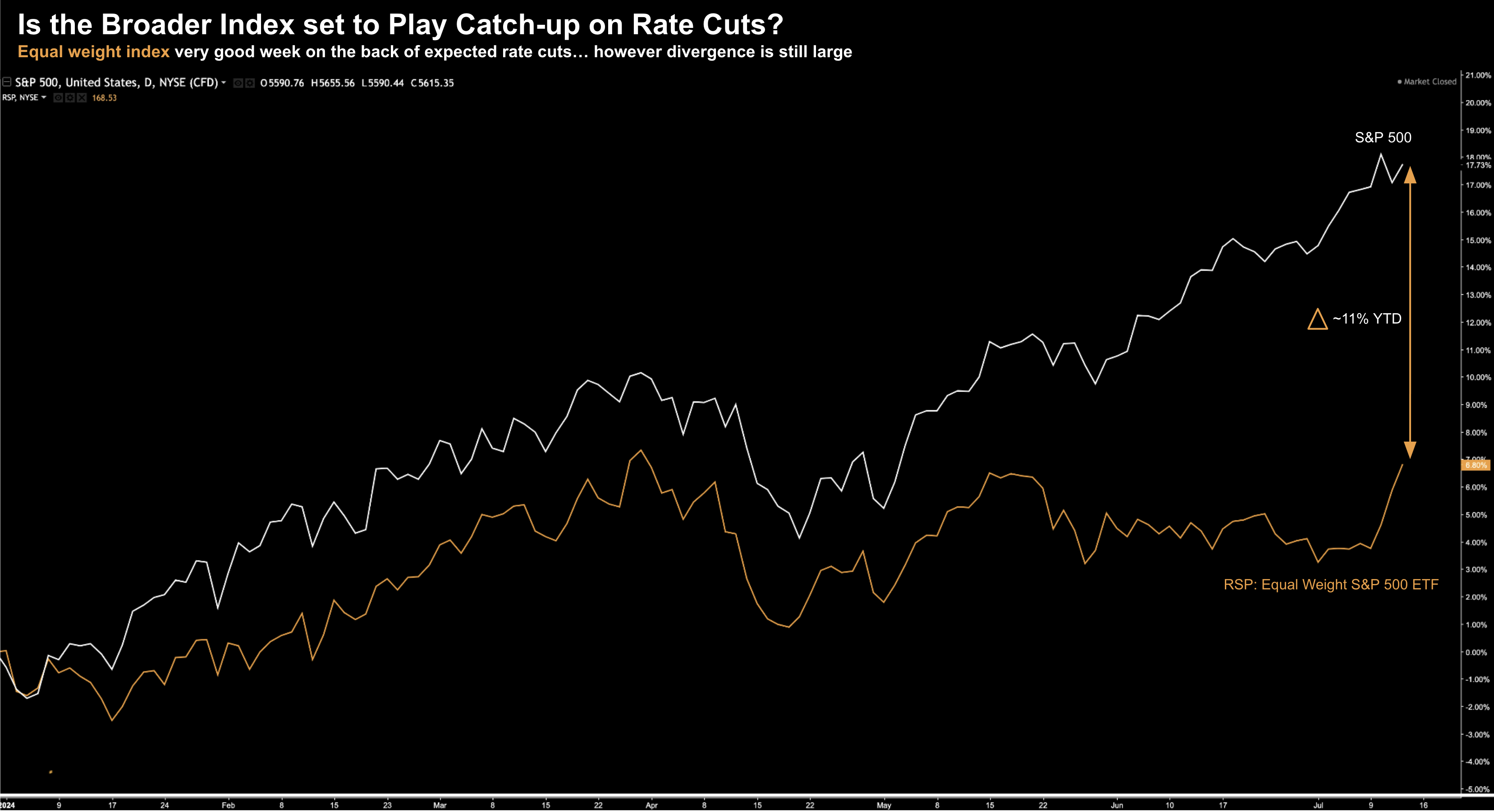

Below is the S&P 500 vs the Equal Weighted Index (using RSP) year-to-date:

July 13 2024

And whilst the gap is still ~11% year-to-date – its possible we see further convergence.

For example, should the probability of rate cuts increase – it’s likely more rate sensitive sectors start to catch a bid.

However, if you’re venturing into this space, I would continue to concentrate on quality (e.g. strong balance sheets, positive cash flow, growing revenue, low debt etc).

For example not all stocks are created equal (especially riskier smaller caps) – and many names still pose a risk should the economy materially weaken (irrespective of rates).

Let’s explore…

Inflation Eases (Partly)

- Consumer Price Inflation – declined 0.1% MoM / up 3.0% YoY (lowest in three years); and

- Producer Price Inflation (Wholesale Prices) – up 0.2% MoM / up 2.6% YoY

PPI was particularly disappointing as core saw a stunning 0.4% MoM rise – which was double consensus.

Put together, both equities and the bond market cheered the numbers.

In short, they see this as sufficient grounds for the Fed to commence rate cuts as early as September (something I suggested ahead of the print after listening to Powell address Congress).

What’s more, they see a strong probability of two rate cuts by year’s end.

Equity prices rallied (to record highs) and bond yields fell.

Below we see the price action with US 10-year yields – now at their lowest levels since March (great news for bond holders who will see capital appreciation)

July 13 2024

Whilst not the focus of this missive – I see these yields edging lower to ~4.0% on both softer inflation and growth concerns (but unlikely lower than 3.75%)

However, as I’ve been stressing of late, I don’t think inflation is the concern.

That was last year’s story….

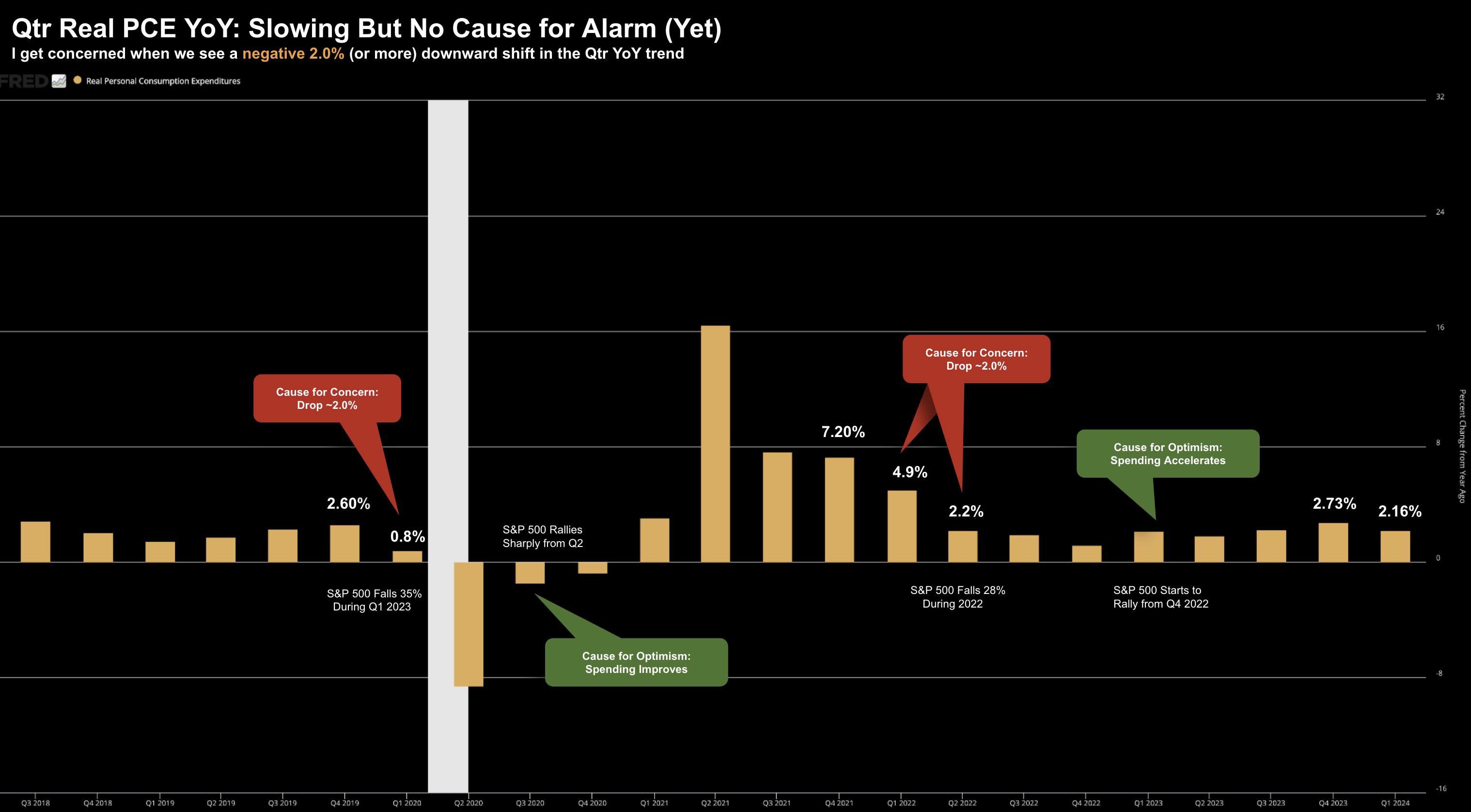

Real PCE is falling each quarter.

Consumer spending, growth and employment is where our focus should be.

That’s the larger risk to equities.

Consumers Lack Confidence

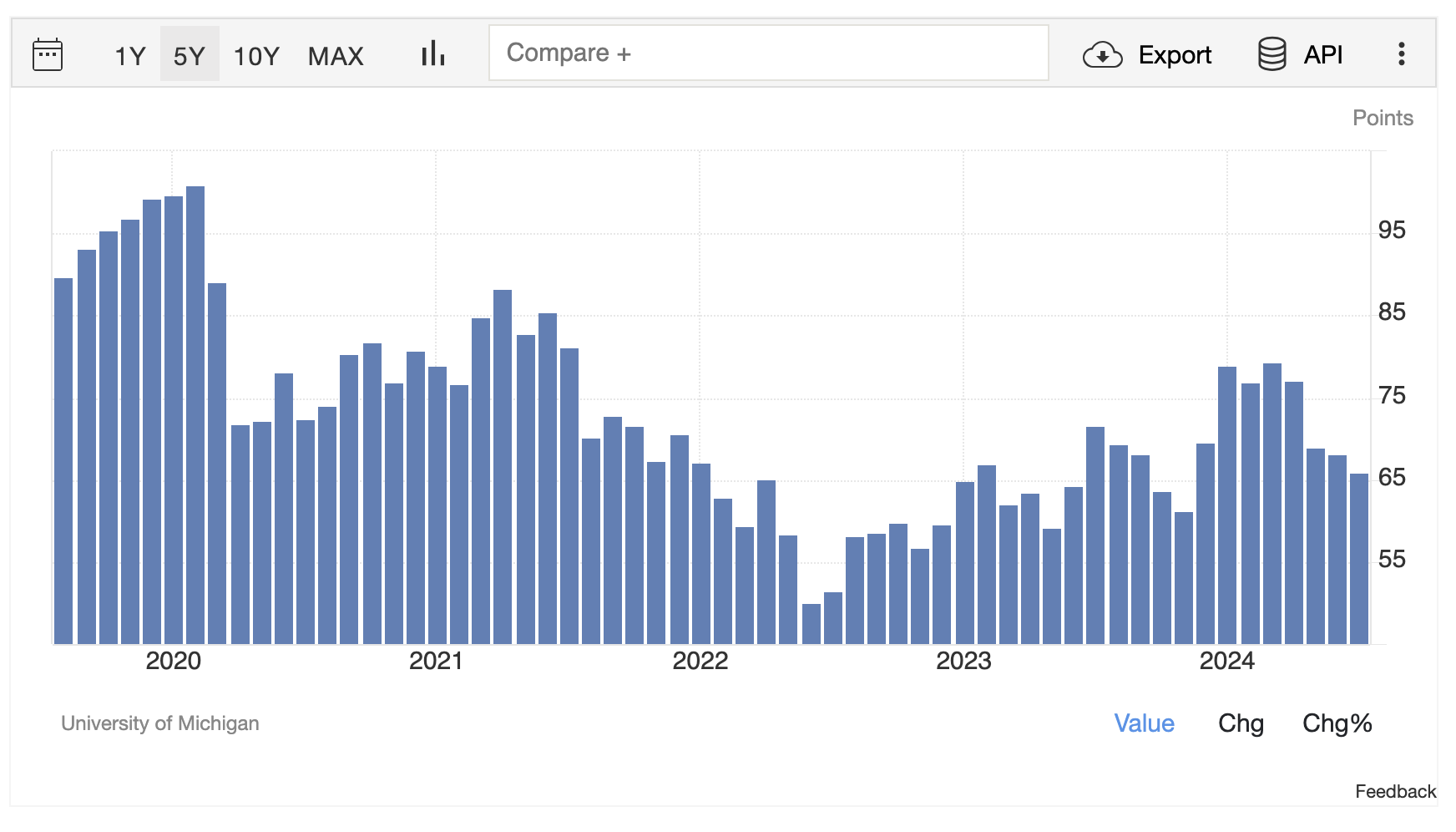

Friday we also received another important consumer data point – the University of Michigan’s consumer sentiment survey.

The negative trend of the past 6 months continues…

Consumer sentiment came in at 66.0 (down from 68.2 in June) vs. 68.5 consensus.

In addition, the Expectations Index slipped to 67.2 vs. 69.8 consensus.

What’s important here is the trend….

Sentiment peaked in the early part of the year and has progressively deteriorated.

However, it’s worth noting consumers have failed to regain the confidence they had in economy during 2016 and 2020.

Why?

Consumer sentiment remains stubbornly subdued.

And whilst prices may be rising at a slower pace year-over-year (3.0%) – they remain ~30% higher than what they were ~3 years ago.

That’s what they are feeling.

With growth slowing and unemployment rising – they’re not confident about the outlook.

Here’s University of Michigan’s Director Joanne Hsu:

“Although sentiment is more than 30% above the trough from June 2022, it remains stubbornly subdued. Nearly half of consumers still object to the impact of high prices, even as they expect inflation to continue moderating in the years ahead.

Consumers sense significant uncertainty regarding the economy’s direction, although there is little evidence to suggest the first presidential debate influenced their economic perspectives”

From mine, this echoes what we heard from leading retailers such as Walmart, Target, Nike and others.

To that end, one of the more important data points next week will be retail spend (July 16)

Expectations are for a decline of 0.2% MoM in June.

If true – it will not bode well for the quarterly YoY change we see with Real PCE (trend below).

Further to my recent missives which explain why the consumer is key – the trend I’m most interested in is the change in real consumer spending (PCE)

It’s not inflation and nor is interest rate cuts (which will make little difference to the real economy) – it’s whether consumers are pulling back on spend.

July 13 2024

Here’s what matters:

If YoY quarterly % decline exceeds 2.0% – it typically does not bode well for equities.

Let me illustrate:

If we assume the Q2 (ending June) is to show a YoY change of 0.2% or less – the decline from 2.16% in Q1 could spell trouble.

For example, I’ve highlighted two other occasions over the past 10 years where this showed an ~2.0% decline YoY.

Both occasions saw meaningful pullbacks in equities.

On the other hand, if the change in Real PCE remains stable or accelerates (on a quarterly basis) – don’t expect a correction.

All Traders too Bullish?

Make that seven straight bullish weeks for the Index… establishing another new record high.

We are now up 37% since the October ’23 lows.

Very rarely will you see the market go “straight up” like this – and from mine – is completely disconnected from Main Street.

But that’s not unusual…

Technically, the S&P 500 is as stretched as I’ve seen it since Q4 2021.

July 13 2024

Warren Buffett is fond of saying “be fearful when others are greedy; and be greedy when they’re fearful”.

There’s very little fear in the market today (and a lot of optimism)

For example, consider the VIX (or ‘fear index’)

It trades at just 12.5 – which tells us traders do not fear any risks to the downside in the near-term.

In addition, consider the weekly RSI.

It closed at almost 78 this week – not something you typically see for a sustained period.

The market will undertake its next litmus over the next 2-3 weeks.

We head into the thick of earnings where growth for Q2 is expected to be above 8% YoY

Despite clear signs of a slowing consumer – it has not impacted analyst’s full year targets.

According to Factset – during the second quarter, analysts lowered EPS estimates for the quarter by a smaller margin than average.

They state “Q2 bottom-up EPS estimate (which is an aggregation of the median EPS estimates for Q2 for all the companies in the index) decreased by 0.5% (to $58.94 from $59.22) from March 31 to June 30″

In a separate report, they also tell us the market sees the S&P 500 growing earnings by ~11.3% this year; and over 14.4% next year:

Industry analysts in aggregate predict the S&P 500 will report year-over-year earnings growth of 11.3% in 2024 and 14.4% in 2025.

If these numbers are the actual earnings growth rates for these years, it will mark the third time in the past 15 years that the S&P 500 has reported two consecutive years of double-digit earnings growth.

The last two times the S&P 500 reported two straight years of double-digit earnings growth was in 2017 (11.5%) and 2018 (20.3%) and in 2010 (40.2%) and 2011 (12.8%).

An important observation here:

What we are seeing today is unusual and well above the longer-term mean. In other words – this should be treated as aberration. And whilst it’s positive – it’s also more reflective of peak cycle.

The other observation is earnings will be a function of whether the consumer continues to spend (and in turn, the absence of any recession).

And for that – I will continue to let spending growth be my barometer (vs a forecast for EPS).

Profit growth doesn’t happen without a strong (spending) consumer (see this post) for more detail).

Putting it All Together

Next week’s real (vs nominal) etail sales numbers will be an early preview of what we see with Real PCE.

I expect a decline in real sales month-over-month (and for the quarter) – despite nominal showing maybe a slight lift or flat.

However, I’m uncertain whether the decline change will be as much as 2% year-over-year (when measuring respective quarters – not months)

That’s what I’m targeting as trigger for a material slowdown in the economy (and it doesn’t need to be a recession to do damage to equities).

In addition, keep an eye on the (weakening) employment picture.

For example, anything near 4.5% by year’s end could trigger a recession.

I explained recently how the perceived “strong” June job report of 216K additions was anything but strong.

Jobs are getting harder to come by and full-time employment continues to decline.

The economy has shed (not added) 1.5M jobs in the past 12 months.

However, this is heavily obscured by an increase in part-time work and government jobs.

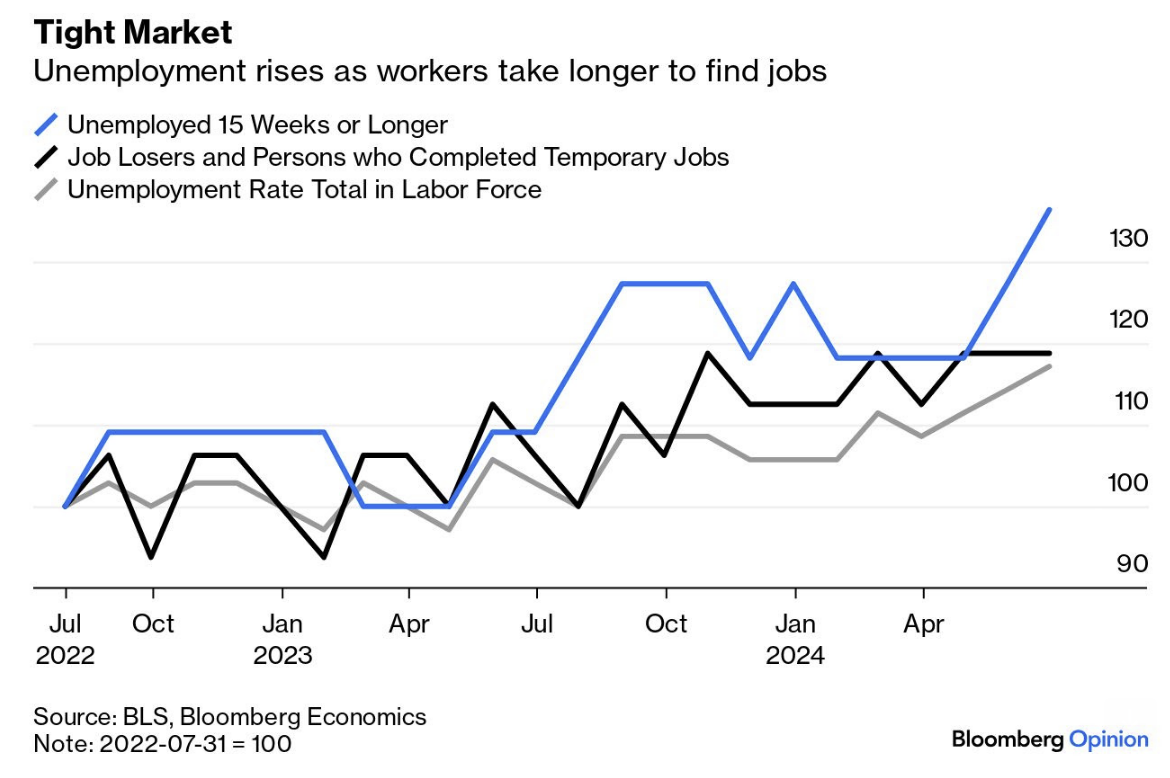

For example, below is the trend for those unemployed for more than 15 weeks – the highest point in more than two years

But as I like to remind readers: employment is a lagging indicator.

In other words, this will continue to tick higher.

However, the damage that is occurring (now) is not showing up in equity prices (or analyst’s forecasts).

Equities will be late to the game (as they usually are).

In closing, Charles Schwab Chief Investment Strategist – Liz Ann Sonders – described the jobs and inflation data as “goldilocks” in an interview with Barron’s

But that just echoes most of Wall Street… it’s the soft-landing narrative.

I see risks to consumer spending and employment over the coming quarters (irrespective of Fed cuts)

It won’t be long before the Fed talks less to inflation and more about risks to growth (and employment)

And if spending continues to decline – earnings revisions will follow.