- Why I challenge the soft landing narrative

- The three shifts in sentiment we’ve seen this year

- Why ‘late cycle’ investing is often difficult

2023 has been one of the more difficult years to navigate.

For example, if you chose the wrong stocks, sectors or simply decided to hide in cash – you didn’t fare well.

What’s also made it hard has been the various shifts in sentiment the past ~9 months.

These shifts have ‘whipped’ traders around.

Let me explain…

As we started 2023, markets were concerned about the possibility of imminent recession.

Rates were moving higher and the S&P 500 pulled back ~5% in December (after a strong run from October 2022).

Widespread uncertainty sent investors to the sidelines – fearing another “20% type” fall (e.g., back to ~3600)

Memories of September 2022 were fresh.

However, markets climbed the wall of worry in Q1, which saw many miss out.

Enter the second shift in sentiment…

With the Index up ~10% by the end of Q1 – investors felt a recession was now unlikely.

“Soft-landing” entered the vernacular – with employment strong and inflation trending lower.

This was a reason to buy stocks – which sent the S&P 500 up ~19% for the year.

And whilst some enjoyed the rally – others feared they were missing out.

Investors chased momentum – pushing valuations to ~20x forward earnings – on the basis growth was set to reaccelerate.

And as is often the case – things went too far.

Sentiment shifted again.

Stocks peaked in August and started to work their way lower.

Bond yields continued their ascent – calling into the question the narrative of a soft-landing.

The Fed repeatedly reminded participants their work may not be done – indicating rates will be “higher for longer”.

Yields continued to rise.

Before long, the prospect of a recession was back on the table.

Funny isn’t it…

When everyone expects a soft landing… perhaps the lesson is brace for impact.

But my point is these ‘pivots’ have made 2023 difficult for many to get right.

Personally, I’m up ~11% YTD – roughly inline with the S&P 500

Not a great year… but not a bad one either.

And I’ll happily take it after the 19% outperformance in 2022.

But this kind of chop is very typical of what you see when a market is late cycle.

And perhaps this point is lost on some investors.

Why Late Cycle is Hard

Typically there are just three:

- Early cycle;

- Mid cycle; and

- Late cycle

By knowing where we are – it will have a major bearing on how you approach risk.

For example, I remain 65% long equities for this reason (a very defensive position for me)

What’s more, where I have exposure is only in the highest quality names (whether it’s a bank, tech stock or energy company)

There is no room for dubious quality during a late cycle.

I say that because a rising tide today will not lift all boats.

That was 2021 (mid-cycle)

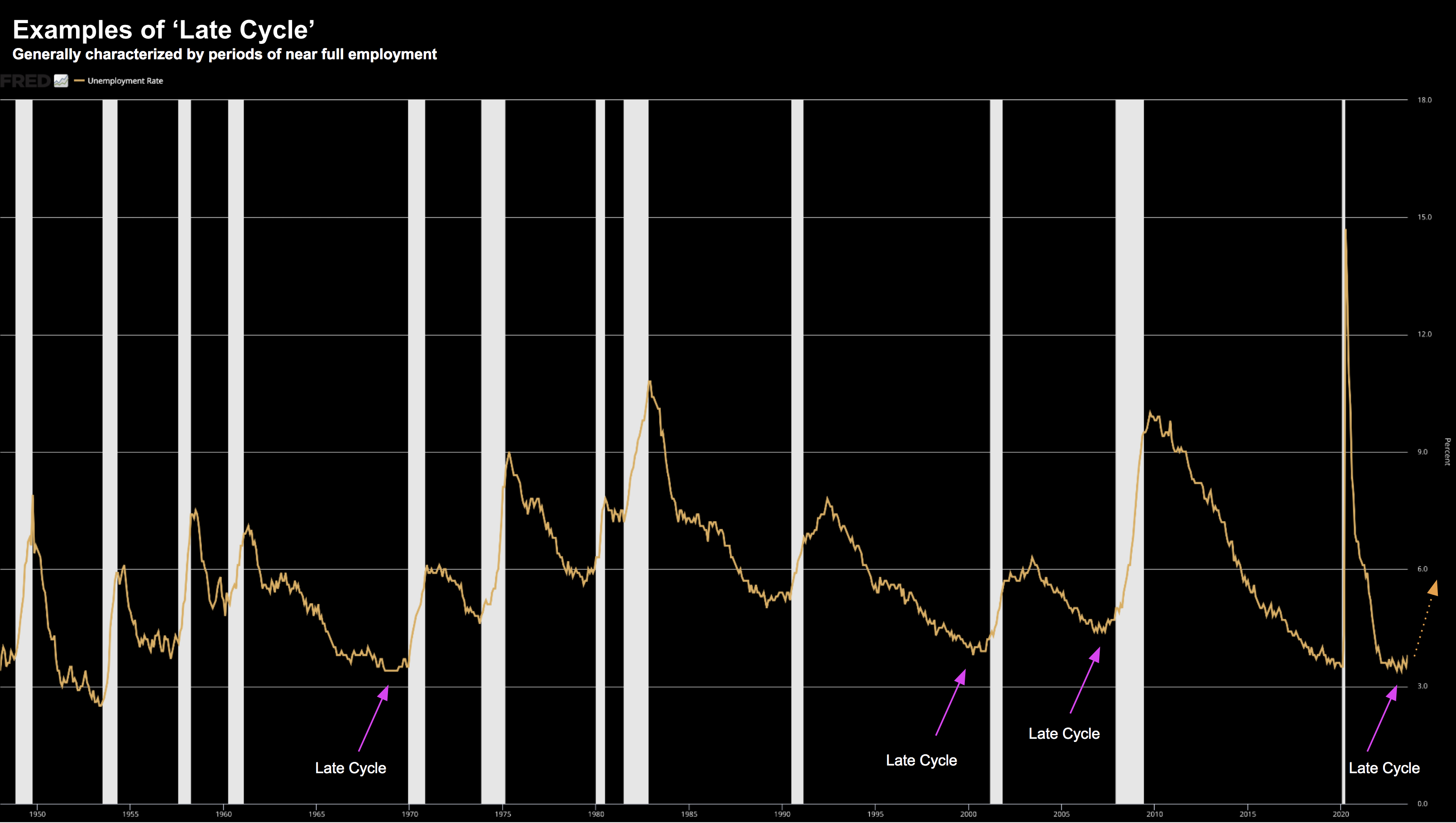

For those less familiar, a late cycle market is characterized by when we have close to full employment.

With full employment, economic activity is typically more robust however closer to its peak.

This implies that growth remains positive but there are signs of it slowing.

Case in point:

Today we learned that the Manufacturing Sector contracted for its 11th consecutive month in September. That’s very typical of something late in the cycle.

Rising inflation and a tight labor market will generally pressure profits and lead to higher interest rates.

Now one of the better (cyclical) metrics to monitor is where things stand with employment.

As this long term chart shows below – whenever we approach full employment – a recession is generally not too far away.

That’s how the cycle works.

The other characteristic of a late cycle economy are shifts in monetary policy.

For example, generally the Fed is closer to the end of its tightening cycle.

I’ve often said the Fed is perhaps in the 7th or 8th innings here (of 9).

Knowing this – markets will often try and front-run the central bank – by pre-empting rate cuts.

But as we know – markets got that wrong in 2023.

The nuance was stubbornly high (core) inflation – meaning the Fed didn’t have the optionality to cut.

This is what’s slightly different to other cycles the past 40 years.

The knock-on effect was that the cycle became extended.

And therein lies the rub…

These cycles can always last a lot longer than most assume.

Throw in consumer excess savings – greater intervention from the Fed (e.g., collapse of SVB) – massive government stimulus – and you get an elongated cycle.

Given this, what you find is there will be erroneous calls for things like an “imminent recession”.

That was the case this year.

The “R” Word is Back

Coming back to the sentiment shifts I characterized – the “R” word is starting to resurface.

To be clear, the base case for the stocks is no recession next year.

That is what’s priced in today.

A recession is not priced in with earnings expected to grow by 12% next year.

But from my lens, a recession is the base case.

I’m a contrarian here (just as I was when everyone was calling for the Fed to start cutting rates this year)

My expectations for a recession were in the realm of 18 to 24 months after the first rate hike (which was March 2022)

That is traditionally how long these Fed variable lags can take to work their way through.

Now as I’ve highlighted recently – think about what we see in the current cycle:

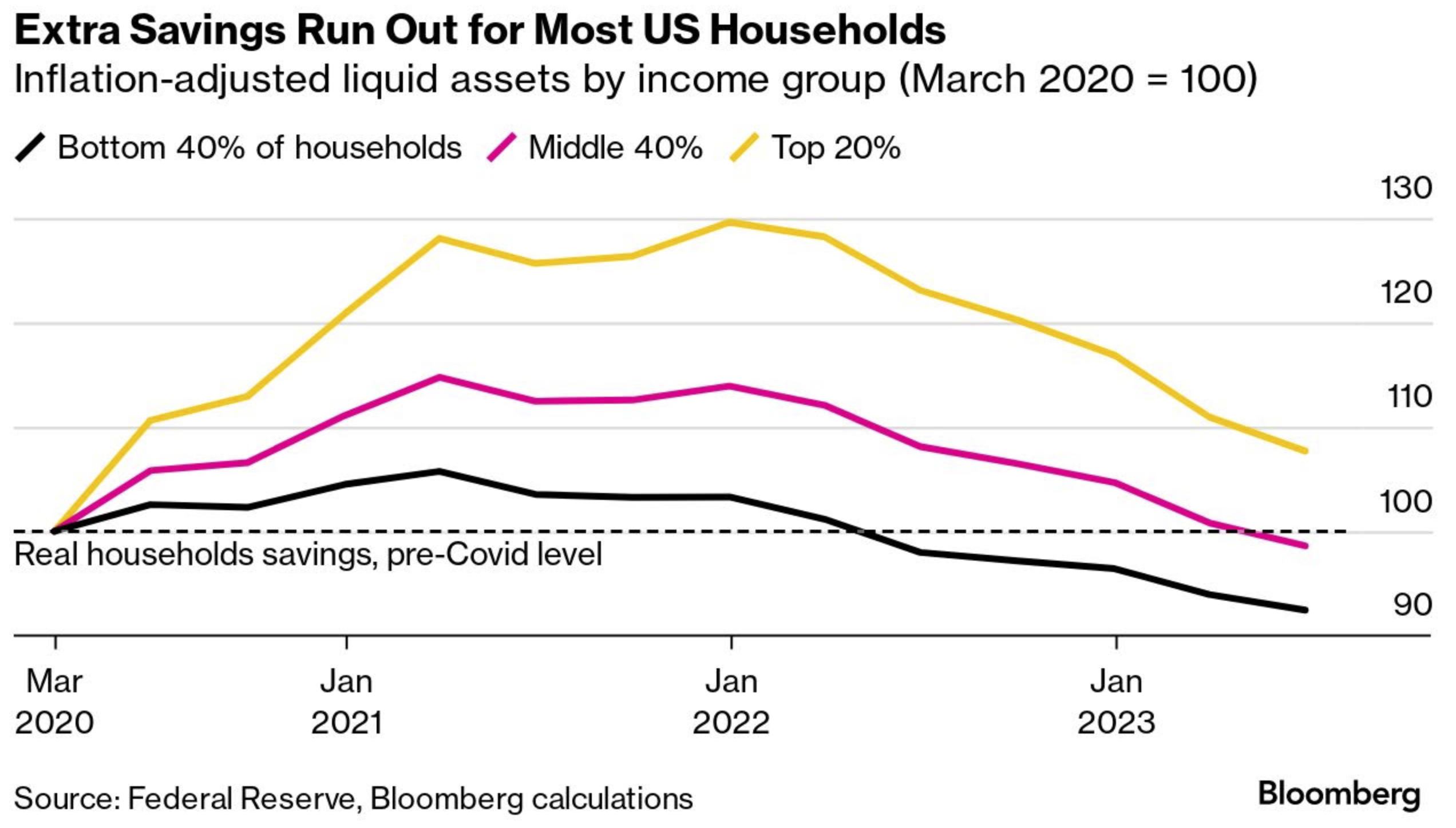

- Middle-to-lower consumers are out of excess savings (relying on credit)

- 45M student debt repayments re-commence Oct 1 (i.e., billions of dollars out of the economy);

- Oil prices well north of $80/b and likely to go higher (given the US’ decision to limit supply);

- Food and shelter prices continue to remain very high; and

We may not get any relief from the Fed for perhaps 6+ months.

That’s the risk to the “soft landing” narrative which is still priced into markets.

And from mine, those risks have always been in play.

All of them.

But let’s take it one step further…

It’s not enough that the consumer is expected to simply hang in there (and they could) – they need surprise on the upside.

I say that because it all hinges on household spend.

Drawing down on excess savings (courtesy of the government) is done.

Not only is it completely done – it’s now starting to weigh slightly on the Top 20%.

In addition, the government credit card is mostly tapped out (i.e. massive fiscal stimulus in the form of trillions).

That’s not coming back…

Although I hear the government still wishes to spend $2 Trillion more than it earns (not quite sure how the math still works at 5.5%+ interest rate?)

As an aside, if you want to know why bond yields are surging to 17-year highs… that’s why (continued reckless fiscal policy – both sides)

My thinking is growth in Q4 will need to come from (cashed up) households.

Because stocks are betting on a resurgent consumer.

Question for me is whether that’s a lock?

Watch Credit Conditions

From mine, the answer will come from what we see with trends in credit.

I say that because of what we see with the Bloomberg chart above – showing the depleted rates of household savings.

For this, it pays to keep a close eye on bank credit conditions.

That’s an excellent proxy for where the consumer is.

Now some might argue that ‘strength of spending’ is a better guide – but they are not typically reliable indicators.

For example, using this indicator alone didn’t help with the recessions of 2000 and 2008.

Things were ‘great’ heading into Q4 of 2007 – with GDP at 2.5% and full employment.

We know what happened next…

But we should also never underestimate the US consumers desire to spend. Even if they don’t have the money… they will try and buy something they don’t really need.

Now with respect to consumer credit – the latest Fed survey of loan officers show banks are tightening fast.

Personally I think that’s a good thing (but not so much for consumers and/or growth)

From Reuters:

July 31 – U.S. banks reported tighter credit standards and weaker loan demand from both businesses and consumers during the second quarter, Federal Reserve survey data released on Monday showed, evidence that the central bank’s interest-rate hike campaign is slowing the nation’s financial gears as intended. The Fed’s quarterly Senior Loan Officer Opinion Survey, or SLOOS, also showed that banks expect to further tighten standards over the rest of 2023

“The most cited reasons for expecting to tighten lending standards were a less favorable or more uncertain economic outlook, an expected deterioration in collateral values, and an expected deterioration in credit quality of CRE (commercial real estate) and other loans,” the Fed said.

- Oil prices were significantly higher over August and September; and

- 10-year bond yields also surged over this time – hitting 4.70% today

Are these not major headwinds?

If nothing else, the higher price at the pump will hit consumers in their hip pocket.

No-one is happy paying US$100+ to fill up their tank. $80/b+ oil only adds pressure to (already tight) household budgets.

However, it’s the latter which will hurt business investment.

And as we know – businesses need to scale investment if they are to grow.

That’s my bigger concern…

What I’m Watching this Earnings Season

This earnings season will be particularly interesting.

And I say that for a specific reason…

So far this year, investors have gravitated towards the safety of strong cash flows and balance sheets.

And that makes sense in a difficult climate.

You need to be idiosyncratic with your investing – as it’s the higher quality stocks which have performed.

However, the earnings recovery this year has mostly been cost savings and financial engineering (e.g., companies doing buy-backs)

That ‘magic trick’ works once in a while…

But what has not been there this year is revenue growth (excluding say Nvidia and Tesla)

As we know, the tech sector went too far with spending during COVID, on the assumption eCommerce trends would continue.

That was a misguided assumption.

These eCommerce trends are now back where they were before COVID (in terms of online spend)

This naturally led to some much needed belt-tightening – which helped improve their operating margins and earnings.

Earnings were better than feared and the stocks went up.

And that’s fine…

However, whilst cost discipline is always a healthy exercise – it won’t be enough to justify the 24x plus multiples investors are giving these names.

For example, none of Microsoft, Apple, Amazon and Google were able to post double-digit revenue growth.

None of them.

And yet the asking price is more than 20x next year’s earnings!

As an aside, Apple’s revenue growth was negative year on year – currently trading close to 27x earnings.

Too expensive.

It’s my view that these names will need to show strong top line acceleration to justify the next leg higher.

That’s what I am looking for in Q4 and into Q1.

Because if it’s not there – simply cutting costs or buying back stock to boost earnings won’t be enough.

You get a 20 to 30x plus multiple due to top-line growth (not whether you slashed head count by 20% or saved money on coffee)

But will that be forthcoming?

We don’t have too long to find out.

Putting it All Together

Let me be clear – a “soft landing” is certainly possible.

I just think it’s a lower probability outcome.

Unlike the market, a soft-landing is not my base case… but I hope I’m wrong.

Again, I have a 65% long exposure to the market in quality names.

If I’m wrong on my recession call – these names will likely move a lot higher.

For example, I can think of a couple of reasons I could be wrong with a recession forecast next year.

For example, we may see a big drop in job vacancies which would help cool the (hot) labor market.

That’s something the Fed would welcome over the coming weeks – and maybe enough for them to pause through the end of the year?

And maybe the Administration’s efforts to boost business investment through industrial policy may work.

For example, consider the semiconductor chips initiative below:

Maybe a large increase in business investment will help offset the expected weakness from consumers?

I hope it does!

But there are numerous headwinds blowing in the other direction (as I’ve been warning)

And I think investors are better served expecting a ‘firmer’ landing vs one which is ‘soft’.

It all depends on the consumer. Keep your eyes on credit.